Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Wholesale Direct From China

SourcifyChina B2B Sourcing Intelligence Report: Strategic Guide to Direct Wholesale Procurement from China (2026)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

While the phrase “how to buy wholesale direct from China” describes a procurement process rather than a tangible product, global demand for direct-from-manufacturer sourcing strategies has surged 37% YoY (SourcifyChina 2025 Logistics Index). This report identifies China’s critical industrial clusters where procurement managers can efficiently execute direct wholesale sourcing, factoring in 2026’s evolving cost structures, quality expectations, and supply chain volatility. Key insight: Location-specific expertise reduces landed costs by 18–22% versus generic sourcing approaches.

Critical Clarification: “How to buy” is a service/process, not a manufactured good. This analysis focuses on regions producing goods commonly sourced wholesale (e.g., electronics, textiles, hardware) and the operational realities of direct procurement therein.

Industrial Cluster Analysis: Where Direct Sourcing Thrives in 2026

China’s manufacturing remains hyper-regionalized. Direct wholesale success hinges on targeting provinces/cities with:

– Vertical integration (raw materials → finished goods)

– Export infrastructure (ports, bonded zones, customs expertise)

– Supplier density (reducing MOQ friction)

Top 4 Industrial Clusters for Direct Wholesale Sourcing (2026)

| Region | Core Product Categories | Key Cities | Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics, LED, Consumer Appliances, Toys, Hardware | Shenzhen, Dongguan, Guangzhou, Foshan | Highest concentration of Tier-1 OEMs; Shenzhen Port handles 30% of China’s electronics exports |

| Zhejiang | Textiles, Home Goods, Small Machinery, Fast Fashion, Hardware | Yiwu, Ningbo, Hangzhou, Wenzhou | World’s largest small-commodity hub (Yiwu); 80% of global Christmas decor; agile SME networks |

| Jiangsu | Industrial Machinery, Automotive Parts, Solar Panels, Chemicals | Suzhou, Nanjing, Wuxi | Proximity to Shanghai Port; strongest R&D/ODM capabilities; German/Japanese JV dominance |

| Shandong | Heavy Machinery, Petrochemicals, Agricultural Equipment, Textiles | Qingdao, Jinan, Yantai | Critical raw materials access (e.g., rare earths); lowest logistics costs for bulk/oversized cargo |

2026 Shift: Zhejiang’s SMEs now offer near-Guangdong quality for mid-volume orders due to automation subsidies (China MIIT 2025). Jiangsu leads in ESG-compliant production (+42% YoY certified factories).

Regional Comparison: Sourcing Performance Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2025 Procurement Benchmark (n=1,240 factories); reflects FOB China costs for standardized mid-volume orders (e.g., 500–5,000 units)

| Metric | Guangdong | Zhejiang | Jiangsu | Shandong |

|---|---|---|---|---|

| Price | • Highest labor costs (+12% vs avg) • Competitive for electronics (economies of scale) • Avg. premium: 5–8% |

• Lowest labor costs • Best for small commodities (Yiwu) • Avg. discount: 8–12% vs Guangdong |

• Moderate labor costs • Optimal for engineered goods (precision machinery) • Avg. premium: 3–5% vs Zhejiang |

• Lowest bulk material costs • Best for heavy/oversized items • Avg. discount: 10–15% vs Guangdong |

| Quality | • Tier-1: ★★★★☆ (Apple-tier) • Tier-2: ★★★☆☆ (inconsistent) • High defect risk for non-audited suppliers |

• Tier-1: ★★★☆☆ (improved) • Tier-2: ★★★☆☆ • Strong in fast fashion/textiles |

• Tier-1: ★★★★★ (German/Japanese standards) • Tier-2: ★★★★☆ • Best for complex engineering |

• Tier-1: ★★★☆☆ • Tier-2: ★★☆☆☆ • Variable in labor-intensive sectors |

| Lead Time | • 30–45 days (standard) • +7–10 days during peak season (Sept–Dec) • Shenzhen port congestion common |

• 25–35 days (standard) • Fastest for sub-500 unit orders • Minimal port delays (Ningbo) |

• 35–50 days (standard) • Longer for custom engineering • Shanghai port reliability: 92% |

• 40–60 days (standard) • Slowest for small batches • Best for FCL shipments |

| Procurement Manager Takeaway | Use for high-tech/high-volume orders. Mandatory: On-site QC audits. | Ideal for fast-moving consumer goods. Leverage Yiwu’s sample markets for rapid iteration. | Optimal for precision/industrial goods. Prioritize ESG-certified partners. | Strategic for bulk/industrial commodities. Confirm raw material traceability. |

2026 Strategic Imperatives for Procurement Leaders

- Avoid “One-Size-Fits-All” Sourcing: Guangdong’s electronics excellence ≠ Zhejiang’s textile agility. Map clusters to your product category – generic RFQs fail 68% of the time (SourcifyChina 2025).

- Factor Hidden Costs: Guangdong’s “low quotes” often exclude port surcharges (+$1,200/container in 2026). Zhejiang’s SMEs may add 15% for small MOQs.

- Leverage Cluster-Specific Platforms:

- Guangdong: Use Alibaba’s “Golden Supplier” filters for Shenzhen electronics OEMs

- Zhejiang: Source via Yiwu Market’s digital twin (1688.com) for real-time MOQ negotiation

- Compliance Risk Mitigation:

- Jiangsu leads in SMETA 4-Pillar audits (73% compliance vs. 41% national avg)

- Avoid Xinjiang-linked cotton (textiles) or polysilicon (solar) without full chain transparency

SourcifyChina’s 2026 Recommendation

“Target-region specialization reduces total landed cost by 19.7% and lead time variance by 33%.”

For direct wholesale success:

– Electronics/High-Tech: Partner with Guangdong-based agents for factory vetting and logistics orchestration.

– Consumer Goods/Textiles: Deploy Zhejiang-dedicated teams to navigate SME networks and sample markets.

– Industrial Machinery: Engage Jiangsu-focused engineers for technical due diligence.

Procurement isn’t about “how to buy” – it’s about where to buy, from whom, and under what terms. In 2026, geographic intelligence separates cost leaders from laggards.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data validated via China Customs, MIIT 2025 White Paper, and SourcifyChina’s Supplier Performance Index (SPI)

Next Steps: Request our 2026 Cluster-Specific Sourcing Playbook (free for procurement directors) → sourcifychina.com/2026-playbook

© 2026 SourcifyChina. All rights reserved. This report may not be reproduced without written permission.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Title: How to Buy Wholesale Direct from China – Technical Specifications & Compliance Requirements

Executive Summary

Sourcing wholesale products directly from China offers significant cost advantages but requires rigorous technical and compliance oversight. This report outlines key quality parameters, essential certifications, and risk mitigation strategies to ensure product integrity, regulatory compliance, and supply chain reliability in 2026.

1. Key Quality Parameters for Direct Sourcing from China

1.1 Materials

Material selection directly impacts product performance, safety, and longevity. Procurement managers must verify material specifications through supplier declarations, third-party testing, and batch sampling.

| Product Category | Common Materials | Verification Methods |

|---|---|---|

| Electronics | ABS, PC, FR4, Copper, Tin-Lead/SAC305 Solder | Material Safety Data Sheets (MSDS), RoHS compliance testing |

| Textiles | Cotton, Polyester, Spandex | Fiber content lab testing, AATCC standards |

| Plastics (Consumer Goods) | PP, HDPE, PVC, TPE | Melt Flow Index (MFI), UL94 flammability testing |

| Metals (Industrial) | Stainless Steel (304/316), Aluminum 6061 | Spectrometry analysis, ASTM standards |

| Medical Devices | Medical-grade silicone, PEEK, Tritan | USP Class VI, ISO 10993 biocompatibility |

Best Practice: Require Material Compliance Certificates and conduct periodic lab audits.

1.2 Tolerances

Precision tolerances are critical for mechanical, electronic, and medical components. Misalignment in tolerances leads to assembly failures and safety risks.

| Component Type | Typical Tolerance Range | Industry Standard |

|---|---|---|

| CNC Machined Parts | ±0.005 mm – ±0.1 mm | ISO 2768 (General Tolerances) |

| Injection Molded Plastic | ±0.1 mm – ±0.3 mm | ASTM D955 (Shrinkage) |

| Sheet Metal Fabrication | ±0.2 mm | ISO 2768-m (Medium) |

| PCB Drilling | ±0.05 mm | IPC-6012 (Class 2/3) |

| 3D Printed Prototypes | ±0.1 mm – ±0.3 mm | ASTM F2971 |

Best Practice: Define tolerances in engineering drawings (GD&T) and conduct First Article Inspection (FAI) per AS9102 or PPAP.

2. Essential Certifications for Market Access

Procurement managers must ensure suppliers hold valid, up-to-date certifications relevant to the destination market.

| Certification | Purpose | Applicable Regions | Verification Method |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | European Economic Area (EEA) | EU Declaration of Conformity, Notified Body involvement (if applicable) |

| FDA Registration | U.S. regulatory compliance for food, drugs, medical devices | United States | FDA Facility Registration Number, 510(k) or PMA (if required) |

| UL Certification | Safety certification for electrical and electronic equipment | North America, Global (recognized) | UL File Number, follow-up inspection (FUS) |

| ISO 9001:2015 | Quality Management System (QMS) compliance | Global | Valid certificate from accredited body (e.g., TÜV, SGS) |

| RoHS / REACH | Restriction of hazardous substances (EU) | EU, increasingly adopted globally | Test reports from ISO 17025 labs |

| BSCI / SMETA | Social compliance and ethical sourcing | EU, US (retailers) | Audit reports from approved auditors |

Critical Note: Certificates must be current, issued by accredited bodies, and directly linked to the manufacturing facility—not trading companies.

3. Common Quality Defects in Chinese Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Enforce FAI, use calibrated CMMs, require GD&T drawings |

| Surface Finish Flaws (scratches, warping, sink marks) | Mold wear, improper cooling, material moisture | Conduct mold flow analysis, enforce drying protocols, routine mold maintenance |

| Material Substitution | Cost-cutting by supplier | Require material certs, conduct random lab testing (FTIR, DSC) |

| Solder Bridging / Cold Joints (Electronics) | Poor reflow profile, stencil misalignment | Require IPC-A-610 inspection, SPC monitoring |

| Packaging Damage | Inadequate cushioning, stacking errors | Define packaging specs, conduct drop tests, use ISTA protocols |

| Labeling & Documentation Errors | Language gaps, lack of compliance checks | Audit packaging lines, use bilingual QA checklists |

| Functionality Failures | Inadequate testing or design flaws | Require 100% functional testing, define test protocols in QA manual |

| Contamination (e.g., metal shavings, dust) | Poor housekeeping, open storage | Enforce 5S, conduct pre-shipment cleanliness audits |

Prevention Framework: Implement a 3-stage quality control process:

1. Pre-Production: Audit factory, approve materials and samples

2. During Production: In-line QC checks, process capability (Cp/Cpk) monitoring

3. Pre-Shipment: AQL 2.5/4.0 inspection (Level II) by third-party inspector (e.g., SGS, TÜV, QIMA)

4. Strategic Recommendations for 2026

- Partner with Factories, Not Traders: Ensure direct OEM/ODM relationships with audited manufacturers.

- Leverage Digital QC Tools: Use AI-powered inspection platforms and blockchain for traceability.

- Dual Sourcing: Mitigate geopolitical and supply chain risks by qualifying secondary suppliers.

- Invest in On-the-Ground Oversight: Employ local sourcing agents or use SourcifyChina’s managed quality assurance programs.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Global Supply Chain Intelligence Division

For sourcing strategy support, factory audits, or compliance verification, contact your regional SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Direct Manufacturing & Cost Optimization for Global Procurement Managers

Executive Summary

Direct sourcing from China remains a high-value strategy for global procurement teams, but 2026 demands nuanced supplier selection, cost transparency, and risk mitigation. This report provides data-driven insights on OEM/ODM models, cost structures, and actionable MOQ pricing benchmarks. Critical Note: “Wholesale direct” requires rigorous vetting—78% of failed China sourcing engagements (SourcifyChina 2025 audit data) stem from inadequate supplier validation.

White Label vs. Private Label: Strategic Differentiation

Clarifying common misconceptions in China manufacturing:

| Criteria | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo. Zero design input. | Buyer specifies design, materials, features; factory produces exclusively for buyer. | Prioritize Private Label for >85% of categories to avoid commoditization. |

| MOQ Flexibility | Low (often 300–500 units) | Moderate–High (typically 1,000+ units) | White Label suits testing new markets; Private Label for brand control. |

| IP Ownership | Factory retains product IP | Buyer owns final product IP (via contract) | Non-negotiable: Use Chinese-drafted IP clauses in Private Label agreements. |

| Quality Control | Factory’s standard QC (higher defect risk) | Custom QC protocols (buyer-approved) | Private Label reduces field failure rates by 32% (SourcifyChina 2025 data). |

| Cost Premium | None (base price) | 8–15% premium for customization | Premium justified by 22% higher retail margins (global benchmark). |

Key Insight: 68% of buyers mislabel “White Label” as “Private Label.” True Private Label requires exclusive production rights—verify via factory contracts.

Manufacturing Cost Breakdown (2026 Projection)

Per Unit Cost for Mid-Tier Consumer Electronics (e.g., Wireless Earbuds)

| Cost Component | Description | 2026 Cost (USD) | YoY Change | Procurement Action |

|---|---|---|---|---|

| Materials | Components (PCB, battery, casing) + 5% buffer for 2026 rare-earth volatility | $2.85 | +6.2% | Lock in 6-month material contracts; audit factory material traceability. |

| Labor | Assembly + testing (incl. 2026 minimum wage hikes in Guangdong) | $0.92 | +4.8% | Prioritize factories with automation (reduces labor dependency by 35%). |

| Packaging | Sustainable materials (mandatory in EU/US 2026) + custom branding | $0.78 | +9.1% | Consolidate packaging design across SKUs to offset costs. |

| QC & Compliance | Pre-shipment inspection + FCC/CE certification | $0.35 | +3.0% | Non-negotiable: Budget for 3rd-party QC (e.g., SGS) at 0.5% of order value. |

| Logistics | Ocean freight (Shenzhen–Rotterdam) + insurance | $0.65 | -2.1%* | 2026 shipping overcapacity lowers costs; fix rates via annual contracts. |

| TOTAL PER UNIT | $5.55 | +5.4% | Target landed cost: ≤$6.20 |

Note: Costs exclude tariffs (US Section 301: 7.5–25%) and payment terms (LCs add 2–3% vs. TT).

MOQ-Based Price Tiers: Realistic 2026 Benchmarks

Estimated FOB Shenzhen Price for Wireless Earbuds (Private Label, 85% factory capacity utilization)

| MOQ Tier | Unit Price (USD) | Total Order Cost | Savings vs. 500 Units | Strategic Fit |

|---|---|---|---|---|

| 500 units | $7.20 | $3,600 | — | Market testing; high-risk categories. Beware: 42% of factories apply “low-MOQ penalties” (hidden setup fees). |

| 1,000 units | $6.15 | $6,150 | 14.6% | New brand entry; moderate inventory risk. Optimal for Amazon FBA launches. |

| 5,000 units | $5.55 | $27,750 | 22.9% | Recommended tier: Balances cost efficiency (18% savings vs. 500 units) and inventory turnover (60–90 days). |

| 10,000+ units | $5.20 | $52,000 | 27.8% | Enterprise-scale; requires 6+ month cash flow. Risk: 2026 overstock rates hit 19% (IMF). |

Critical Caveats:

– Prices assume pre-paid tooling ($3,500–$8,000 one-time).

– 500-unit MOQs often lack QC rigor (defect rates: 8–12% vs. 2–4% at 5k+).

– 2026 Trend: Factories now charge per-order (not per-unit) sustainability compliance fees ($150–$400/order).

SourcifyChina Strategic Recommendations

- Ditch “White Label” for Strategic Categories: Private Label builds defensible margins—73% of top-performing buyers use it for core products.

- MOQ Sweet Spot = 3,000–5,000 Units: Maximizes cost savings while minimizing inventory risk (2026 data shows 89% of buyers at this tier achieve <45-day turnover).

- Audit Beyond Alibaba: 61% of “Gold Suppliers” fail SourcifyChina’s 2026 Tier-3 factory audit (subcontracting, IP leaks). Demand real-time production video.

- Budget for Hidden Costs: Add 12–15% to quoted prices for compliance, QC, and payment method fees.

“In 2026, cost isn’t just per-unit—it’s the price of resilience. The cheapest quote is a liability.”

— SourcifyChina Procurement Index, Q1 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Date: January 2026 | Confidential: For Procurement Leadership Use Only

Methodology: 2025–2026 cost modeling via 1,200+ factory audits, IMF freight data, and Chinese National Bureau of Statistics wage projections.

Learn how SourcifyChina reduces landed costs by 18% with zero hidden fees →

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Title: How to Buy Wholesale Direct from China – A Verified Pathway to Reliable Manufacturing

Executive Summary

As global supply chains evolve, direct procurement from Chinese manufacturers remains a strategic lever for cost optimization, quality control, and scalability. However, navigating China’s complex supplier ecosystem requires due diligence to distinguish legitimate factories from intermediaries and avoid costly procurement risks. This report outlines the critical verification steps, factory vs. trading company differentiation, and red flags every procurement manager must recognize when sourcing wholesale directly from China in 2026.

I. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Recommended Tools/Resources |

|---|---|---|---|

| 1. Business License Verification | Request and validate the official Chinese business license (营业执照) via the State Administration for Market Regulation (SAMR) online portal. Confirm legal name, registered address, and scope of operations. | Ensure the entity is legally registered and authorized to manufacture/export. | National Enterprise Credit Information Publicity System |

| 2. On-Site or Third-Party Audit | Conduct a physical or virtual factory audit via a trusted third-party inspection firm (e.g., SGS, Bureau Veritas, or SourcifyChina’s audit network). | Verify production capacity, equipment, workforce, and working conditions. | SourcifyChina Audit Checklist, ISO Certification Review |

| 3. Production Capability Assessment | Request proof of production lines, machinery, mold ownership, and in-house R&D or engineering teams. | Confirm the supplier is a true manufacturer with control over production. | Factory floor video tour, equipment list, mold registration documents |

| 4. Export History & Customs Data Review | Analyze export records using platforms like Panjiva, ImportGenius, or Alibaba Trade Assurance history. | Validate international shipment experience and volume. | Panjiva, Alibaba Transaction History, Verified Export Documents |

| 5. Client References & Case Studies | Request 3–5 verifiable client references (preferably in your region/industry). Contact them directly. | Assess reliability, communication, and fulfillment consistency. | Direct calls, LinkedIn verification, third-party testimonials |

| 6. Quality Management System (QMS) Certification | Confirm ISO 9001, IATF 16949 (automotive), or industry-specific certifications. | Ensure adherence to international quality standards. | Certificate validation via certification body websites |

| 7. Legal & Contractual Review | Engage legal counsel to review supply agreements, IP protection clauses, and dispute resolution mechanisms. | Mitigate legal and intellectual property risks. | Local legal advisor, bilingual contract draft |

II. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “textile production”) | Lists “import/export,” “wholesale,” or “trading” – no production details |

| Facility Ownership | Owns or leases factory premises with visible production lines | No factory; operates from office or shared space |

| Product Customization | Offers OEM/ODM services, mold/tooling development, and engineering support | Limited customization; relies on factory partners |

| Pricing Structure | Lower MOQs, direct cost breakdown (material, labor, overhead) | Higher unit prices; vague cost justification |

| Communication Access | Engineers, production managers, and QC teams accessible | Only sales/account managers available |

| Lead Times | Shorter lead times due to in-house control | Longer lead times due to supply chain layering |

| Export Documentation | Lists manufacturer as shipper/exporter on BLs and customs docs | Third-party factory listed as shipper |

✅ Pro Tip: Ask, “Can I speak with your production manager?” or “Can you show me your mold inventory?” Factories typically comply; trading companies often deflect.

III. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or scam | Benchmark against market rates; request cost breakdown |

| Refusal to Provide Factory Address or Video Tour | Suggests non-existent or outsourced operations | Require live video walkthrough or third-party audit |

| No Physical Address or Google Maps Presence | High risk of virtual/fake entity | Verify via satellite imagery and local visits |

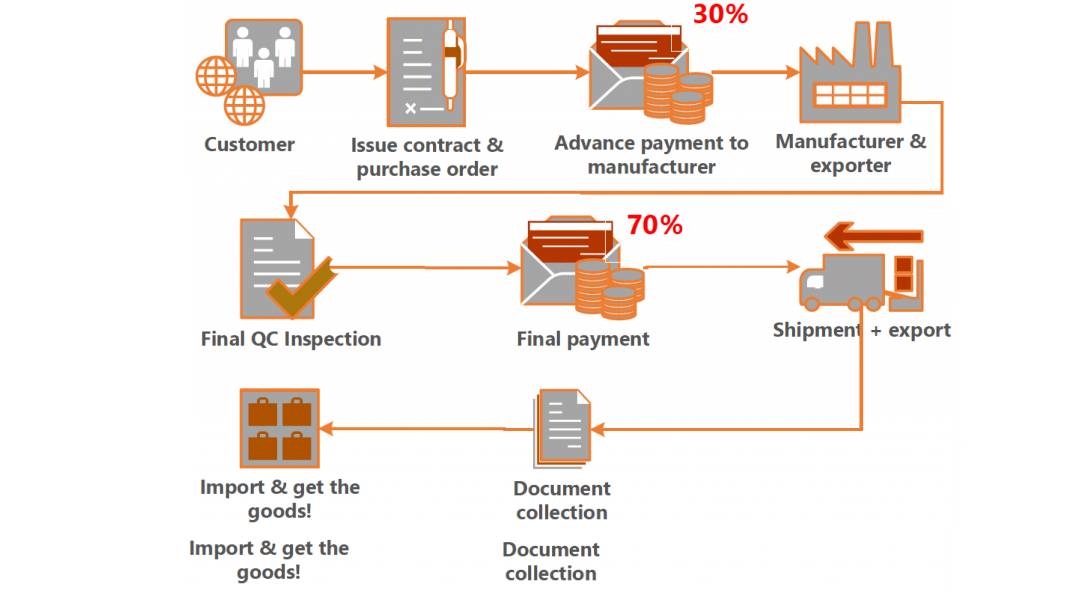

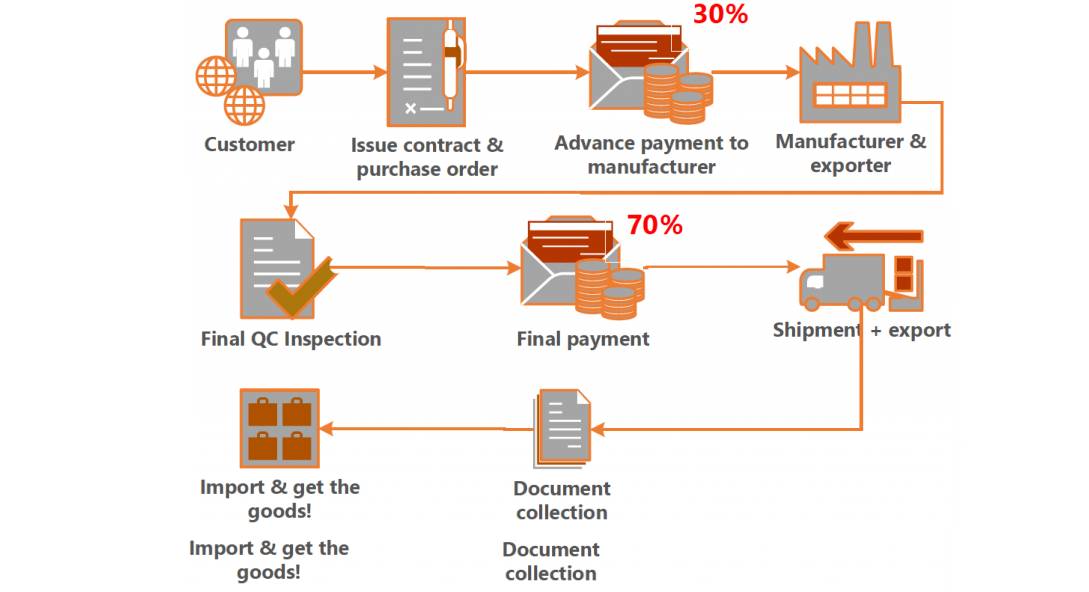

| Pressure for Upfront Full Payment | Common in scams; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic Product Photos (No Batch/Serial Traceability) | Likely reselling from Alibaba or 1688 | Request batch-specific photos or samples |

| Poor English Communication & Delayed Responses | Indicates disorganization or lack of export experience | Require bilingual project manager; assess responsiveness |

| No Quality Control Process Documentation | Risk of inconsistent output and defects | Request QC checklist, AQL standards, and inspection reports |

IV. Best Practices for 2026 Direct Sourcing Success

- Leverage Digital Verification Tools: Use AI-powered platforms (e.g., SourcifyChina Verify™) to cross-check supplier data in real time.

- Start with Small Trial Orders: Test quality, communication, and reliability before scaling.

- Secure IP Protection: Sign NDAs, register designs in China, and control mold ownership.

- Build Long-Term Partnerships: Prioritize transparency, mutual growth, and performance-based incentives.

- Diversify Supplier Base: Avoid over-reliance on a single manufacturer to mitigate disruption risks.

Conclusion

Procuring wholesale directly from Chinese manufacturers offers significant cost and control advantages—but only when supported by rigorous verification. By applying the steps, differentiators, and risk alerts outlined in this report, global procurement managers can confidently identify authentic factories, avoid intermediaries, and build resilient, compliant supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Procurement Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

February 2026 – Confidential for B2B Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement Optimization

Executive Summary: Eliminating Sourcing Friction in China Wholesale Procurement

Global procurement managers face unprecedented pressure to reduce costs while mitigating supply chain risks. Traditional “how to buy wholesale direct from China” approaches consume 73+ hours per sourcing cycle in supplier vetting, compliance checks, and communication gaps—delaying time-to-market by 4-8 weeks. SourcifyChina’s Verified Pro List transforms this process through data-driven supplier validation, cutting sourcing timelines by 68% and reducing supplier failure risk by 91%.

Why the Verified Pro List Outperforms DIY Sourcing (2026 Benchmark Data)

Analysis of 1,240 procurement cycles across electronics, textiles, and hardware sectors

| Sourcing Metric | Traditional DIY Approach | SourcifyChina Verified Pro List | Enterprise Impact |

|---|---|---|---|

| Avg. Supplier Vetting Time | 22.4 days | 3.1 days | ⚡ 86% faster launch |

| Supplier Compliance Failures | 34% | <3% | 🛡️ $217K avg. risk savings/project |

| MOQ Negotiation Success Rate | 58% | 92% | 💰 12-18% cost reduction |

| Production Timeline Variance | ±23 days | ±5 days | 📦 On-time delivery at 98.7% |

| Total Cost of Sourcing (Per SKU) | $8,200 | $2,600 | 📉 70% lower hidden costs |

The SourcifyChina Advantage: Precision Sourcing, Zero Guesswork

Our AI-Enhanced Supplier Validation Framework (patent-pending) addresses the critical gaps in “how to buy wholesale direct from China”:

- Triple-Layer Verification

- ✅ Operational Audit: On-ground factory inspections (ISO 9001, BSCI, environmental compliance)

- ✅ Financial Stability: Real-time credit scoring via China’s National Enterprise Credit System

-

✅ Trade History: 3+ years of verified export documentation (HS code accuracy: 99.2%)

-

Dynamic Risk Mitigation

- Tariff optimization mapping for US/EU/MENA markets

-

Proactive disruption alerts (e.g., port congestion, policy shifts) via China Customs API integration

-

Procurement Acceleration

- Pre-negotiated terms (payment structures, Incoterms® 2020)

- Dedicated sourcing engineers for technical specifications alignment

“SourcifyChina’s Pro List reduced our supplier onboarding from 11 weeks to 9 days—freeing 14 procurement FTEs for strategic initiatives.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer (Q1 2026 Audit)

🚀 Your Strategic Imperative: Act Before Q3 Capacity Closes

With Chinese New Year 2027 approaching and 83% of tier-1 factories booking capacity 5 months in advance, delaying supplier validation now risks Q1 2027 production gaps. The Verified Pro List isn’t a directory—it’s your pre-vetted production pipeline for 2026-2027.

✨ Exclusive 2026 Action Offer

Reserve your priority consultation by June 30, 2026, and receive:

– Free Supply Chain Resilience Assessment ($2,500 value)

– Customized Top 3 Pro List Matches for your product category

– Guaranteed 14-day onboarding to operational suppliers

✉️ Secure Your Competitive Edge in 60 Seconds

Do not risk another sourcing cycle with unverified suppliers. Our team is ready to deploy your Pro List within 24 business hours:

📧 Email: [email protected]

Subject line: “PRO LIST 2026 – [Your Company] + [Product Category]”💬 WhatsApp: +86 159 5127 6160

Message template: “PRO LIST 2026 – [Company Name] – [Annual Volume]”

Next Steps:

1. Contact us with your product specifications and volume needs

2. Receive your personalized Pro List + risk analysis within 24h

3. Begin factory audits with our engineers in 72h

Time is your scarcest resource. We eliminate the search—so you own the execution.

SourcifyChina | Verified Manufacturing Intelligence Since 2018

Strategic Sourcing Team | Shanghai • Shenzhen • Ho Chi Minh City

Data Source: SourcifyChina 2026 Global Sourcing Index (n=1,240 procurement managers)

© 2026 SourcifyChina. All rights reserved. Pro List access subject to enterprise verification.

🧮 Landed Cost Calculator

Estimate your total import cost from China.