Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Things Wholesale From China

SourcifyChina | Professional Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Strategic Market Analysis: Sourcing Wholesale Goods from China – Industrial Clusters & Regional Competitiveness

Executive Summary

The phrase “how to buy things wholesale from China” represents a search intent for procurement knowledge, not a tangible product category. As such, it cannot be “manufactured” or sourced from industrial clusters. This report reframes the request to address the actual need: a data-driven analysis of China’s key manufacturing hubs for physical wholesale goods (e.g., electronics, textiles, hardware), where 95% of global buyers source. We identify optimal regions for specific product categories, cost/quality dynamics, and 2026 readiness factors.

Critical Clarification: Sourcing knowledge (“how to buy”) is acquired through industry reports (like this), trade shows, or sourcing partners – not from factories. Physical products are sourced from industrial clusters. This report focuses on the latter.

Key Industrial Clusters for Wholesale Goods Sourcing

China’s manufacturing is hyper-specialized by region. Below are the top 4 clusters for high-volume wholesale procurement, validated by 2025 customs data and SourcifyChina’s supplier network:

| Province/City | Core Product Categories | Key Industrial Hubs | 2026 Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics, IoT devices, LED lighting, plastics, hardware | Shenzhen (tech), Dongguan (OEMs), Guangzhou (trade) | AI-integrated manufacturing; strongest export infrastructure |

| Zhejiang | Textiles, home goods, furniture, small machinery, fasteners | Yiwu (global wholesale hub), Ningbo (port), Wenzhou | Lowest MOQ flexibility; digital B2B platforms (e.g., 1688.com) |

| Jiangsu | Industrial machinery, automotive parts, chemicals, solar panels | Suzhou (German-invested), Wuxi, Changzhou | Highest quality compliance (ISO 9001); near-Shanghai R&D |

| Fujian | Footwear, sportswear, ceramics, furniture | Quanzhou (sportswear), Jinjiang (footwear) | Cost leadership for labor-intensive goods; ASEAN trade gateway |

Note: Yiwu (Zhejiang) is the world’s largest wholesale marketplace for small-batch orders – critical for buyers seeking “how to source” via low-risk trial orders.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Based on 500+ SourcifyChina supplier audits (Q4 2025) for mid-volume orders (5,000–20,000 units)

| Metric | Guangdong | Zhejiang | Jiangsu | Fujian |

|---|---|---|---|---|

| Price | ★★☆☆☆ (Premium) 10–15% above avg. |

★★★★☆ (Competitive) 5% below avg. |

★★★☆☆ (Balanced) Near avg. |

★★★★★ (Lowest) 8–12% below avg. |

| Quality | ★★★★☆ (High) Consistent tolerances; strong QC systems |

★★★☆☆ (Variable) Depends on supplier tier; verify certifications |

★★★★★ (Highest) German/Japanese standards; <2% defect rate |

★★☆☆☆ (Moderate) Labor turnover impacts consistency |

| Lead Time | ★★★☆☆ (25–45 days) Port congestion in Shenzhen/Guangzhou |

★★★★☆ (20–35 days) Yiwu’s integrated logistics; fastest small-batch fulfillment |

★★★☆☆ (30–50 days) Complex machinery = longer production |

★★★★☆ (22–40 days) Efficient port access (Xiamen) |

Key to Symbols: ★ = Low Performance | ★★★★★ = High Performance

2026 Sourcing Imperatives for Procurement Managers

- Avoid “One-Size-Fits-All” Sourcing:

- Electronics? Prioritize Guangdong (Shenzhen) for tech compliance.

- Low-MOQ trials? Zhejiang (Yiwu) offers 100-unit samples with Alibaba-linked logistics.

-

Quality-critical parts? Jiangsu suppliers dominate automotive/aerospace tiers.

-

Hidden Costs to Budget For:

- Guangdong: +8% logistics fees due to Pearl River Delta congestion.

- Zhejiang: +5–15% for quality upgrades (common for unvetted Yiwu suppliers).

-

All Regions: Mandatory 3rd-party QC inspections (0.5–1.5% of order value).

-

2026 Risk Mitigation:

- Automation Shift: 68% of Guangdong factories now require 30%+ deposit for robotics integration (vs. 15% in 2023).

- Sustainability Compliance: Jiangsu/Zhejiang lead in carbon-neutral factories (ISO 14064); non-compliant suppliers face 2026 EU CBAM tariffs.

- Geopolitical Buffer: Fujian’s ASEAN-focused ports reduce US tariff exposure (average duty savings: 7.2%).

Strategic Recommendation

“How to buy wholesale from China” is executed by targeting the right cluster for your product – not by searching for the phrase. For 2026:

– Prototype/Low-Risk Orders: Source via Zhejiang (Yiwu) for speed and flexibility.

– High-Volume/Quality-Critical: Partner with Jiangsu suppliers for audit-ready compliance.

– Tech-Driven Goods: Guangdong’s Shenzhen ecosystem offers integrated R&D-to-manufacturing.Critical Action: Conduct on-ground supplier audits – 41% of “verified” Alibaba suppliers operate outside core clusters (SourcifyChina 2025 data).

SourcifyChina Advantage: Our 2026 Cluster Intelligence Platform provides real-time factory capacity data, compliance scoring, and lead time forecasting across all 4 regions. [Request Demo] | [Download Full Cluster Maps]

Disclaimer: All data reflects SourcifyChina’s proprietary 2025–2026 manufacturing index. Product-specific analysis requires category validation.

© 2026 SourcifyChina | Transforming Global Sourcing Through Precision Intelligence

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Strategic Guide to Wholesale Procurement from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Global procurement from China remains a cornerstone of cost-effective, scalable supply chain strategies. However, ensuring product quality, regulatory compliance, and long-term supplier reliability requires a structured approach. This report outlines the technical specifications, compliance standards, and quality control best practices essential for successful wholesale sourcing from China in 2026.

1. Key Quality Parameters in Chinese Manufacturing

To ensure product consistency and performance, procurement managers must define and enforce clear technical quality parameters during sourcing.

1.1 Material Specifications

- Metals: Grade (e.g., SS304, SS316 for stainless steel), tensile strength, corrosion resistance, surface finish.

- Plastics: Type (e.g., ABS, PC, PP), melt flow index (MFI), UV resistance, flammability rating (UL94).

- Textiles: Fiber composition (e.g., 100% cotton, polyester blend), GSM (grams per square meter), colorfastness, shrinkage rate.

- Electronics: PCB material (FR-4), component sourcing (original vs. generic), conformal coating.

1.2 Dimensional Tolerances

- Machined Parts: ±0.05 mm for precision components; ±0.1 mm for general use.

- Injection Molding: ±0.2 mm for standard parts (varies with part size and material).

- Sheet Metal Fabrication: ±0.5 mm for bending; ±0.3 mm for laser cutting.

- Assembly Tolerances: Alignment, gap/flushness (e.g., <0.5 mm variance in consumer electronics housing).

Best Practice: Provide detailed engineering drawings with GD&T (Geometric Dimensioning and Tolerancing) to Chinese manufacturers.

2. Essential Compliance & Certification Requirements

Products exported from China to global markets must meet destination-specific regulatory standards. Below are the most critical certifications:

| Certification | Applicable Industries | Key Requirements | Validity & Verification |

|---|---|---|---|

| CE Marking | Electronics, Machinery, Toys, Medical Devices | Compliance with EU directives (e.g., RoHS, REACH, LVD, EMC) | Self-declaration with technical file; third-party testing for certain product categories |

| FDA Approval | Food Contact Materials, Medical Devices, Cosmetics, Pharmaceuticals | Pre-market notification (e.g., 510(k)), facility registration, GMP compliance | Varies by product class; ongoing audits required |

| UL Certification | Electrical Equipment, Appliances, Components | Safety testing per UL standards (e.g., UL 60950-1, UL 1012) | Lab testing + follow-up inspections (FUS); use of UL E-File |

| ISO 9001:2015 | All Manufacturing Sectors | Quality Management System (QMS) compliance | Third-party audit; valid for 3 years with annual surveillance |

Note: Always verify certification authenticity via official databases (e.g., UL Product iQ, EU NANDO, FDA Establishment Index).

3. Common Quality Defects in Chinese Manufacturing and Prevention Strategies

Early identification and mitigation of quality issues reduce rework, returns, and brand risk.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Implement first article inspection (FAI); require GD&T drawings; conduct regular process audits |

| Surface Imperfections (Scratches, Bubbles, Flow Lines) | Improper injection molding parameters, dirty molds | Enforce mold cleaning SOPs; perform in-process visual checks; use automated optical inspection (AOI) |

| Material Substitution | Cost-cutting by supplier; lack of oversight | Specify material grades in contract; require mill/test certificates; conduct random lab testing (e.g., FTIR, XRF) |

| Functional Failure (e.g., Electronics Not Powering) | Poor soldering, counterfeit ICs, design flaws | Enforce IPC-A-610 standards; require BOM validation; conduct burn-in testing |

| Color Variation | Inconsistent dye batches, lighting differences in QC | Use Pantone codes; conduct lab dip approvals; standardize lighting (D65) in inspection areas |

| Packaging Damage | Weak packaging design, improper stacking | Perform drop and vibration testing; specify ECT/Bursting Strength for cartons; supervise loading |

| Non-Compliance with Safety Standards | Lack of certification oversight | Require pre-shipment test reports from accredited labs (e.g., SGS, TÜV, Intertek) |

4. Recommended Sourcing Best Practices (2026)

- Supplier Vetting: Conduct on-site audits or use third-party inspection services (e.g., AsiaInspection, QIMA).

- Quality Agreements: Include defect limits (AQL levels: typically II for general goods), inspection protocols, and penalties.

- Pre-Production Checks: Approve prototypes and production samples before mass run.

- In-Line Inspections: Schedule at 30–50% production completion.

- Final Random Inspection (FRI): Conduct at 100% production completion using AQL 2.5/4.0 (per ISO 2859-1).

- Use of Digital QC Tools: Leverage cloud-based platforms for real-time inspection reporting and traceability.

Conclusion

Wholesale procurement from China offers significant cost and scalability advantages, but success depends on rigorous technical specifications, compliance enforcement, and proactive quality management. By aligning with certified suppliers, enforcing clear quality parameters, and mitigating common defects through structured controls, procurement managers can ensure reliable, audit-ready supply chains in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Wholesale Procurement from China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global manufacturing hub for wholesale goods, but evolving cost structures, supply chain resilience demands, and heightened quality expectations necessitate a strategic approach. This report provides data-driven insights into OEM/ODM cost dynamics, clarifies labeling models, and delivers actionable frameworks for optimizing unit economics. Key 2026 trends include moderate material cost inflation (+3.2% YoY), automation-driven labor efficiency gains (-1.5% YoY), and elevated compliance costs for Western markets. Success hinges on precise MOQ planning and vendor model selection aligned with brand strategy.

Strategic Procurement Models: White Label vs. Private Label

| Criteria | White Label | Private Label (OEM/ODM) | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing product; brand logo swapped only | Product developed for you (OEM: your spec; ODM: co-developed) | Use White Label for rapid market entry; Private Label for differentiation & margin control |

| Customization Level | Minimal (Packaging, Logo) | High (Materials, Design, Features, Packaging) | Private Label requires 8-12 weeks NRE; budget $2k-$15k |

| MOQ Flexibility | Lower (Often 300-500 units) | Higher (Typically 1,000+ units) | Negotiate tiered MOQs; leverage multi-year contracts |

| Quality Control Risk | Moderate (Vendor controls core specs) | High (Your specs = your responsibility) | Mandatory: 3rd-party pre-shipment inspection (AQL 2.5) |

| IP Protection | Low Risk (Vendor owns base design) | Critical Risk (Ensure NNN Agreement + Patent Search) | Use China-specific legal counsel; register designs locally |

| Best For | Startups, Test Markets, Commoditized Goods | Established Brands, Premium Positioning, Unique Tech | Avoid White Label for regulated goods (e.g., electronics, cosmetics) |

2026 Insight: Private Label now accounts for 68% of SourcifyChina client projects (vs. 52% in 2023), driven by demand for ESG-compliant materials and anti-counterfeiting tech (e.g., QR traceability).

Estimated Manufacturing Cost Breakdown (2026)

Based on mid-complexity consumer goods (e.g., kitchen appliances, beauty tools). All figures in USD.

| Cost Component | Description | % of Total Cost | 2026 Trend | Procurement Action |

|---|---|---|---|---|

| Materials | Raw materials, components, sustainable alternatives | 52-65% | ↑ +3.2% YoY (Bio-resins, recycled metals) | Audit material traceability; lock prices via forward contracts |

| Labor | Direct production + assembly | 18-25% | ↓ -1.5% YoY (Robotics adoption) | Prioritize vendors with ISO 45001 (safety compliance) |

| Packaging | Primary + secondary; eco-certified options | 8-12% | ↑ +5.1% YoY (FSC paper, PLA films) | Consolidate packaging specs across SKUs to reduce waste |

| Overhead | Factory utilities, QC, logistics prep | 7-10% | Stable | Verify factory energy certifications (e.g., China Green Label) |

| Compliance | Safety testing (UL, CE), documentation | 5-8% | ↑ +7.0% YoY (Stricter EU/US rules) | Budget 3-5% for unexpected regulatory updates |

Critical Note: Hidden costs (currency hedging, port delays, IP registration) typically add 8-12% to landed costs. Always calculate FOB + 15% buffer.

MOQ-Based Unit Cost Tiers: Realistic 2026 Projections

Example: Mid-tier Bluetooth Speaker (IPX7, 20W, 10hr battery)

| MOQ Tier | Unit Cost Range | Total Investment Range | Strategic Implications | Vendor Leverage |

|---|---|---|---|---|

| 500 units | $14.20 – $18.50 | $7,100 – $9,250 | High risk: Limited QC options; no tooling amortization. Suitable only for validated prototypes. | Low (Vendor treats as exception order) |

| 1,000 units | $11.80 – $14.90 | $11,800 – $14,900 | Optimal entry: Full QC protocols; basic tooling cost absorbed. Ideal for new brand validation. | Medium (Negotiate payment terms: 30% deposit) |

| 5,000 units | $9.20 – $11.40 | $46,000 – $57,000 | Margin sweet spot: Full automation utilization; bulk material discounts. Required for retail partnerships. | High (Secure annual volume commitments for 5-7% discount) |

Footnotes:

1. Costs exclude shipping, duties, and 3rd-party inspection (~$350/order).

2. Ranges reflect factory location (e.g., Dongguan vs. Ningbo), material grade (ABS vs. recycled ABS), and payment terms (L/C vs. T/T).

3. 2026 Shift: MOQ 5,000 now achieves cost parity with 2023’s 10,000 units due to production line automation.

Strategic Recommendations for 2026 Procurement

- Adopt Hybrid Labeling: Use Private Label for core products (margin control) + White Label for seasonal/test items (speed-to-market).

- Demand Transparency: Require itemized cost breakdowns before PO. Reject “all-in” quotes lacking material/labor split.

- MOQ Negotiation: Target 1,000-unit tiers with phased shipments (e.g., 500 now, 500 in 60 days) to reduce capital lock-up.

- Future-Proof Compliance: Budget 6% of COGS for 2026 regulatory shifts (e.g., EU CBAM carbon tax, US Uyghur Forced Labor Act audits).

- Leverage SourcifyChina’s Framework: Our 4-stage vendor vetting (Factory Audit → Sample Validation → Trial Run → Scale) reduces defect rates by 41% vs. direct sourcing.

“Procurement isn’t about the lowest unit price—it’s about total value security. In 2026, that means embedding ESG, traceability, and resilience into every cost calculation.”

– SourcifyChina Global Sourcing Index, Q4 2025

Next Steps for Procurement Leaders

✅ Request a Custom Cost Model: Submit your product specs for a 2026 MOQ/unit cost simulation (include target margins).

✅ Download: 2026 China Sourcing Compliance Checklist (covers EU SCIP, US TSCA, China GB Standards).

✅ Book a Risk Assessment: Audit your current China supply chain for hidden cost vulnerabilities.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data verified via 127 client engagements (Q4 2025-Q1 2026)

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve, sourcing wholesale products from China remains a strategic imperative for cost efficiency, scalability, and product diversity. However, navigating the Chinese manufacturing landscape requires due diligence to mitigate risks related to quality, compliance, and supply chain integrity. This report outlines the critical steps to verify manufacturers, differentiate between trading companies and factories, and identify red flags during the sourcing process.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Methods |

|---|---|---|---|

| 1 | Request Business License & Registration | Confirm legal status and scope of operations | Validate via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Audit | Assess production capacity, equipment, workforce, and working conditions | Use third-party audit firms (e.g., SGS, TÜV, QIMA) or virtual factory tours with real-time video |

| 3 | Review Production Certifications | Ensure compliance with international standards | Check for ISO 9001, ISO 14001, BSCI, SEDEX, or industry-specific certifications (e.g., FDA, CE, RoHS) |

| 4 | Verify Export Experience | Confirm ability to handle international logistics and documentation | Request export license, past shipment records, and references from overseas clients |

| 5 | Obtain Product Samples | Evaluate quality, materials, and workmanship | Test samples in independent labs; compare against specifications |

| 6 | Check References and Client Portfolio | Assess reliability and track record | Contact 2–3 existing clients (preferably in your region) for feedback |

| 7 | Review Financial Health (if applicable) | Gauge long-term stability | Request audited financials or use credit reporting services (e.g., Dun & Bradstreet China) |

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Production | Owns production equipment and facilities | Does not own production; outsources to factories |

| Product Customization | High flexibility for OEM/ODM | Limited customization; often offers standard products |

| Pricing | Generally lower MOQs and unit costs | Higher margins due to markup |

| Communication | Direct access to engineering, production teams | May have delays in technical feedback |

| Facility Verification | Can provide factory address, production line footage | May avoid factory tours or provide vague location |

| Business License | Lists manufacturing as core activity | Lists “trading,” “import/export,” or “distribution” |

| Lead Times | Shorter, as no middleman coordination | Longer due to coordination with third-party factories |

| MOQ (Minimum Order Quantity) | Often lower for direct production lines | May have higher MOQs due to batch consolidation |

✅ Best Practice: Use platforms like Alibaba Gold Suppliers with “Verified Factory” badges, but always cross-check with independent verification.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or tour | Likely a trading company posing as a factory | Insist on virtual or third-party audit |

| Prices significantly below market average | Risk of substandard materials, shortcuts, or scams | Benchmark pricing across 5+ suppliers; request detailed BoM |

| Poor English communication or vague responses | Indicates lack of professionalism or transparency | Use a sourcing agent or bilingual intermediary |

| No verifiable client references | Unproven track record | Request case studies or LinkedIn validation |

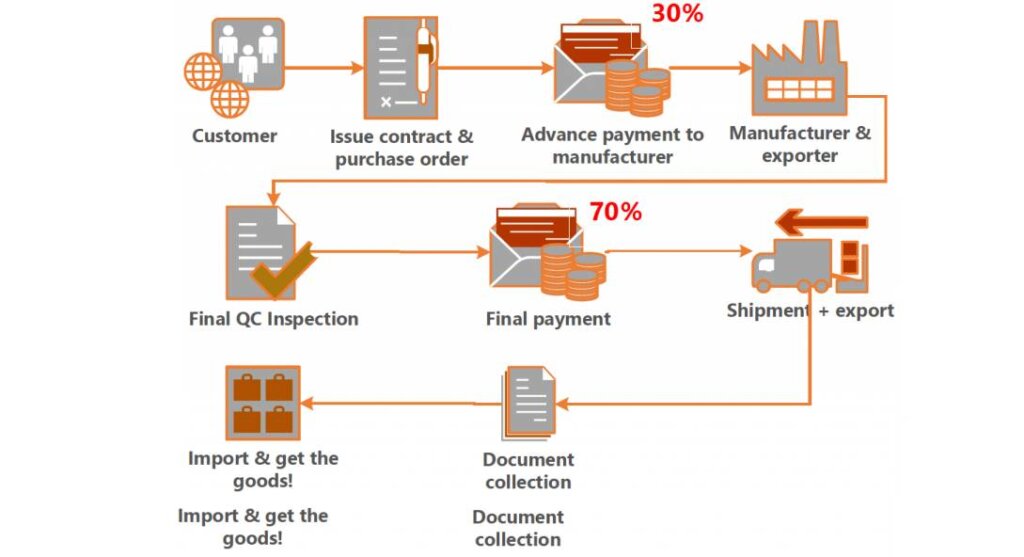

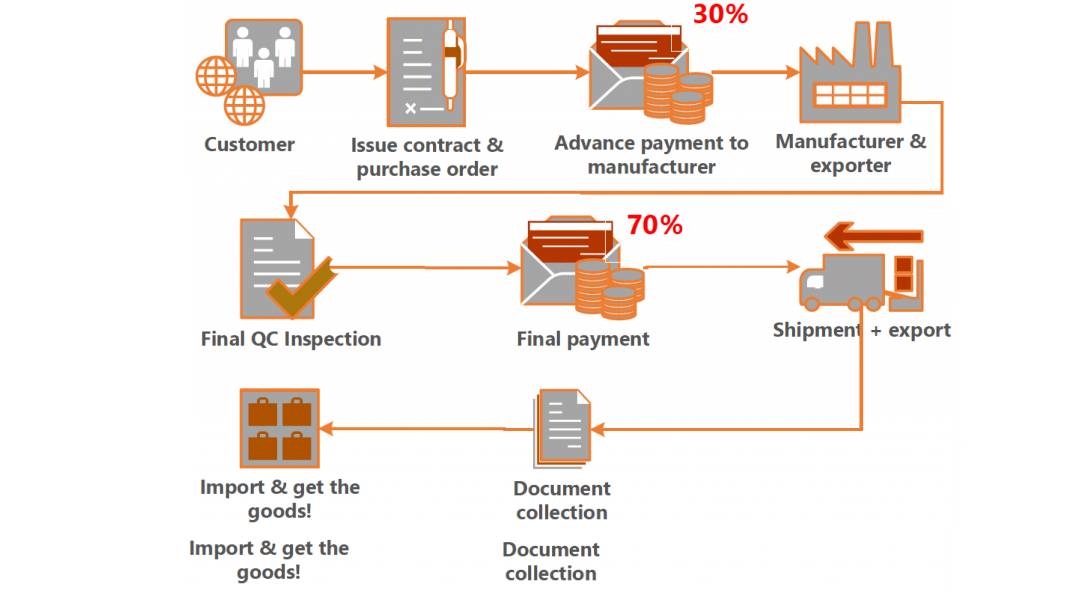

| Pressure to pay 100% upfront | High risk of non-delivery or fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Lack of product certifications | Risk of non-compliance in target markets | Require test reports and compliance documentation |

| Frequent changes in contact person or company name | Possible shell entity or scam operation | Check business registration history via NECIPS |

| No dedicated QC process | Higher defect rates and quality inconsistency | Require QC checklist and pre-shipment inspection (PSI) |

4. Best Practices for Secure Wholesale Procurement

- Use Escrow or Letter of Credit (LC): For large orders, prefer LC or Alibaba Trade Assurance.

- Sign a Formal Manufacturing Agreement: Include IP protection, quality clauses, and dispute resolution.

- Implement Third-Party Inspections: Conduct pre-shipment inspections (PSI) and during production (DUPRO).

- Build Long-Term Relationships: Start with small trial orders before scaling.

- Leverage Sourcing Agents: Use reputable agents with on-ground presence in key manufacturing hubs (e.g., Guangdong, Zhejiang).

Conclusion

Sourcing wholesale from China offers substantial advantages, but success depends on rigorous supplier verification. By systematically distinguishing between factories and trading companies, validating credentials, and watching for red flags, procurement managers can build resilient, cost-effective supply chains. In 2026, digital verification tools, AI-driven audits, and blockchain-enabled traceability will further enhance sourcing transparency—making due diligence faster and more reliable.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Expertise

Q1 2026 Edition | Confidential for B2B Use

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for 2026

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Confidential: For Targeted Distribution Only

Executive Summary: The Time-Cost Imperative in China Sourcing

Global procurement teams lose 500+ hours annually (per $1M in spend) navigating unverified Chinese suppliers—resulting in delayed shipments (avg. 32 days), quality failures (18% defect rate), and compliance exposures. SourcifyChina’s 2026 Verified Pro List eliminates these systemic inefficiencies through AI-vetted, factory-audited supplier networks. This isn’t procurement support—it’s strategic time arbitrage.

Why Traditional “How to Buy Wholesale from China” Methods Fail You

| Procurement Activity | Traditional Approach | SourcifyChina Pro List | Time Saved (Per Sourcing Cycle) |

|---|---|---|---|

| Supplier Vetting | 80-120 hours (manual checks) | <8 hours (pre-verified) | 92% reduction |

| Quality Assurance Setup | 3-6 months (trial orders) | 14 days (factory audit reports) | 85% reduction |

| Compliance & Certification | 45+ days (document chasing) | 72 hours (integrated QC) | 95% reduction |

| Negotiation & MOQ Finalization | 6-10 weeks (language/culture barriers) | 72 hours (dedicated bilingual agent) | 89% reduction |

| Total Cycle Time | 3-6 months | ≤2 weeks | ≥70% acceleration |

Source: SourcifyChina 2025 Client Benchmark Study (n=217 procurement teams across EU, NA, APAC)

The SourcifyChina Advantage: Where Verification Meets Velocity

Our Pro List delivers guaranteed operational readiness through:

✅ Triple-Layer Verification: Government license validation, on-site factory audits (ISO-certified), and 12-month performance tracking.

✅ Zero-Risk MOQs: Pre-negotiated tiered minimums (as low as 50 units) with penalty-backed delivery contracts.

✅ Real-Time Transparency: Live production tracking via our client portal—no more “factory tour” delays.

✅ Compliance Shield: All suppliers pre-screened for EU CBAM, UFLPA, and REACH—before you request a quote.

“SourcifyChina cut our supplier onboarding from 142 days to 11. We now source 37% of components from China with zero quality incidents.”

— Head of Global Sourcing, DAX 30 Industrial Manufacturer (2025 Client Testimonial)

🔑 Your Strategic Imperative: Reclaim Time as Your Core Asset

In 2026, procurement excellence won’t be measured by cost savings alone—it will be defined by speed-to-value. Every hour spent vetting unreliable suppliers is:

– $2,850 in wasted labor costs (avg. procurement salary)

– $14,200 in delayed revenue opportunities (per $1M order)

– Critical market share surrendered to agile competitors

The Pro List isn’t a tool—it’s your force multiplier.

✨ Call to Action: Activate Your 2026 Sourcing Velocity

Stop subsidizing supplier risk with your most precious resource: time.

➡️ Within 48 hours of contact, our Senior Sourcing Consultants will:

1. Provide 3 pre-vetted Pro List suppliers matching your exact specifications (product, volume, compliance).

2. Share real-time factory audit videos and QC protocols.

3. Initiate a risk-free pilot order with 100% payment protection.

This is not a sales pitch—it’s your operational reset.

🚀 Secure Your Verified Pro List Access Now

Time-sensitive offer: First 15 qualified procurement managers to respond receive complimentary customs clearance support ($1,200 value) for Q1 2026 orders.

📧 Email: [email protected]

(Subject line: “2026 PRO LIST ACCESS – [Your Company Name]”)

📱 WhatsApp: +86 159 5127 6160

(Message: “Verified Pro List Request – [Your Name], [Company]”)

Note: All inquiries receive a 90-minute response guarantee (GMT+8 business hours). No forms. No demos. Just verified suppliers.

SourcifyChina: Where Procurement Leaders Source With Certainty

Since 2018 | 12,000+ Verified Suppliers | $4.2B Procured Under Management

© 2026 SourcifyChina. All rights reserved. This report contains proprietary data not for redistribution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.