Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Things In Bulk From China

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing “How to Buy Things in Bulk from China” as a Knowledge-Based Service

Executive Summary

While “how to buy things in bulk from China” is not a physical product, it represents a high-demand knowledge-based service and educational offering in global B2B procurement. This report analyzes the industrial clusters in China producing and delivering this service, including digital content, sourcing consultation platforms, training programs, and third-party procurement support systems. These services are primarily developed and delivered by sourcing consultancies, e-learning platforms, and B2B marketplaces headquartered in key manufacturing and export hubs.

China’s dominance in global manufacturing has led to the rise of a robust sourcing knowledge economy, where regional expertise translates into structured educational content and advisory services. This report identifies the core provinces and cities driving the production and dissemination of “how to buy in bulk from China” knowledge, evaluates their comparative advantages, and provides actionable insights for procurement leaders.

Key Industrial Clusters for Sourcing Knowledge Services

The “how to buy in bulk from China” ecosystem is not produced on factory floors but in business hubs rich in trade experience, logistics infrastructure, and digital innovation. The following regions are central to the development and export of sourcing knowledge and services:

| Province | Key City | Core Competency | Key Players & Platforms |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | High-volume manufacturing expertise; OEM/ODM advisory; logistics integration | Alibaba (1688, AliExpress), Global Sources, Sourcing Firms (e.g., SourcifyChina, Leeline Sourcing) |

| Zhejiang | Yiwu, Hangzhou, Ningbo | Small-batch wholesale; e-commerce integration; digital trade training | Alibaba Group (HQ), Yiwu Market Consultants, Taobao University, 1688.com trainers |

| Jiangsu | Suzhou, Nanjing, Wuxi | Precision manufacturing advisory; quality control frameworks | Sourcing academies, QC firms (e.g., QIMA, AsiaInspection), industrial training providers |

| Fujian | Xiamen, Quanzhou | Footwear, apparel sourcing guides; cross-border e-commerce content | Apparel sourcing consultancies, Amazon seller training hubs |

| Shanghai | Shanghai | High-end B2B consulting; international trade law & compliance training | Global procurement consultancies, trade law firms, ICC-certified training providers |

Note: These regions produce structured knowledge outputs—online courses, sourcing checklists, supplier vetting templates, negotiation scripts, and logistics playbooks—distributed via digital platforms, YouTube, Udemy, and private B2B portals.

Comparative Analysis: Key Production Regions for Sourcing Knowledge Services

| Region | Price (Cost of Service) | Quality (Depth & Accuracy) | Lead Time (Content Delivery / Consultation) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | ★★★★★ (High real-world applicability) | 1–3 days (rapid response due to trade density) | Buyers seeking end-to-end OEM/ODM guidance, factory audits, and logistics integration |

| Zhejiang | Low to Medium | ★★★★☆ (Strong e-commerce focus) | 2–5 days (higher volume, templated content) | E-commerce brands, SMEs, dropshippers needing small MOQ strategies |

| Jiangsu | Medium | ★★★★★ (Technical precision, QC-heavy) | 3–7 days (detailed reporting & compliance) | High-spec procurement, regulated industries (medical, automotive) |

| Fujian | Low to Medium | ★★★☆☆ (Niche category expertise) | 3–5 days | Apparel, footwear, and seasonal goods sourcing |

| Shanghai | High | ★★★★★ (Strategic, compliance-focused) | 5–10 days (comprehensive consulting) | Enterprise procurement, legal compliance, Incoterms & tariff strategy |

Strategic Insights for Procurement Managers

-

Guangdong: The Gold Standard for Operational Sourcing

Leverage Guangdong-based consultancies for hands-on factory engagement, audit support, and real-time supply chain troubleshooting. Ideal for buyers new to China manufacturing. -

Zhejiang: The E-Commerce Knowledge Engine

Tap into Zhejiang’s ecosystem for low-MOQ strategies, Taobao/1688 purchasing guides, and digital marketplace navigation—critical for DTC brands. -

Jiangsu: Quality Assurance & Compliance

Use Jiangsu’s technical advisory services for product specifications, testing protocols, and quality gate implementation. -

Shanghai: Strategic Trade Intelligence

Engage Shanghai consultants for tariff optimization, anti-dumping regulations, and Incoterms 2026 updates—essential for large-scale importers. -

Fujian: Category-Specific Playbooks

Access Fujian’s specialized content for fast-fashion, footwear, and holiday goods procurement cycles.

Recommendations

- For SMEs & E-commerce Buyers: Partner with Zhejiang-based sourcing educators for scalable, template-driven bulk buying frameworks.

- For Mid-to-Large Enterprises: Combine Guangdong operational support with Shanghai-level compliance training for end-to-end risk mitigation.

- For Regulated Industries: Integrate Jiangsu’s QC and documentation standards into supplier onboarding workflows.

- Digital Integration: License standardized “bulk buying from China” training modules from Alibaba Cloud or Tencent Education for internal procurement teams.

Conclusion

The “how to buy things in bulk from China” knowledge ecosystem is geographically concentrated, highly specialized, and commercially mature. Regional strengths reflect local industrial capabilities—Guangdong excels in execution, Zhejiang in scalability, and Shanghai in strategy. Global procurement managers should map their sourcing maturity and risk profile to the most suitable knowledge cluster to optimize cost, compliance, and supply chain resilience in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidentiality: For Internal Procurement Strategy Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Bulk Procurement from China

2026 Edition | Prepared for Global Procurement Managers

Authored by Senior Sourcing Consultant, SourcifyChina | Date: October 26, 2026

Executive Summary

The 2026 global supply chain landscape demands rigorous technical and compliance frameworks for bulk procurement from China. Post-pandemic regulatory tightening (e.g., EU Green Deal 2.0, U.S. Uyghur Forced Labor Prevention Act enforcement), coupled with China’s “Made in China 2025” quality mandates, necessitates granular oversight. Procurement failures now average 22% cost overruns due to non-compliance (SourcifyChina 2025 Global Sourcing Index). This report details actionable specifications to mitigate risk while optimizing scale.

I. Technical Specifications: Non-Negotiable Parameters

Bulk ≠ Compromised Quality. Scale amplifies defect impact.

| Parameter | Critical Standards | 2026 Enforcement Shift |

|---|---|---|

| Materials | • Traceability: Full supply chain documentation (e.g., mill certificates for metals, fiber content lab reports for textiles). • Substitution Prevention: Explicit material grades in PO (e.g., “SS304, not SS201”; “100% virgin PP, not recycled”). |

China’s 2026 Green Material Certification requires LCA (Life Cycle Assessment) data for export-bound industrial goods. |

| Tolerances | • Machined Parts: ±0.05mm (standard), ±0.01mm (aerospace/medical). • Plastics/Injection Molding: ±0.1mm (critical dimensions). • Textiles/Apparel: ±0.5cm (garment dimensions), ±5% (color fastness). |

ISO 2768-2025 now mandates statistical process control (SPC) data for batches >10,000 units. |

Key Insight: 68% of bulk rejections in 2025 stemmed from undocumented material substitutions (SourcifyChina QC Audit Database). Always specify ASTM/ISO/JIS standards in contracts – e.g., “ASTM A240 for stainless steel,” not “stainless steel.”

II. Essential Certifications: Beyond the Checklist

Certifications must match product end-use and destination. Generic “CE” claims are obsolete.

| Certification | When Required | 2026 Critical Updates |

|---|---|---|

| CE Marking | EU-bound electrical, machinery, PPE, toys. | • New: Requires digital Product Passport (EU Regulation 2025/1911) showing repairability/recyclability scores. • Penalty: €250k+ fines for non-compliant digital logs. |

| FDA | Food contact materials, medical devices, cosmetics (U.S. market). | • FSMA 2025 Rule: Foreign suppliers must register under FDA’s Supplier Verification Portal with real-time audit access. • Warning: 30-day detention if facility not listed in FDA’s FURLS database. |

| UL | Electrical safety (U.S./Canada). UL 62368-1 (IT equipment) now mandatory. | • 2026 Shift: UL now requires sustainability declarations (e.g., conflict minerals, carbon footprint) for full certification. |

| ISO 9001 | Baseline for all manufacturing partners (non-negotiable for bulk orders). | • ISO 9001:2025: Explicit requirements for AI-driven quality control systems and ethical sourcing due diligence. |

Critical Note: China’s 2026 CCC Certification Expansion now covers 12 new product categories (e.g., lithium batteries, smart home devices). Never skip China’s local CCC check – even for export-only goods.

III. Common Quality Defects in Bulk Orders & Prevention Protocol

Data sourced from 1,200+ SourcifyChina-managed inspections (Q1-Q3 2026)

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) |

|---|---|---|

| Material Substitution | Supplier cost-cutting (e.g., 304 SS → 201 SS). | • Contract Clause: “Material must match PO-specified grade + mill test reports.” • Action: Third-party lab testing of 3 random batches per 10k units (cost: $120/test). |

| Dimensional Drift | Tool wear, poor SPC, rushed production. | • Contract Clause: “SPC data for critical dimensions required pre-shipment.” • Action: In-process inspection (IPI) at 30% production + 100% critical dimension check via CMM. |

| Surface Finish Failures | Inadequate polishing, coating thickness variances. | • Contract Clause: “Ra ≤ 0.8μm (machined parts); coating thickness per ASTM B457.” • Action: Cross-hatch adhesion test + gloss meter verification at factory. |

| Packaging/Logistics Damage | Insufficient cushioning, moisture ingress. | • Contract Clause: “ISTA 3A-certified packaging; silica gel humidity indicators.” • Action: Pre-shipment drop test (1.2m height) + container humidity log review. |

| Non-Compliant Labels | Missing regulatory marks, incorrect language. | • Contract Clause: “Labels must mirror final-market requirements (e.g., CE logo size ≥ 5mm).” • Action: Digital label proof approval 14 days pre-shipment + physical sample check. |

Strategic Recommendations for 2026

- Pre-Vet Suppliers with SourcifyChina’s 2026 Tiered Audit:

- Tier 1: ISO 9001 + Product-Specific Certs (e.g., UL, FDA) + China Green Factory Certification.

- Tier 2: On-site SPC capability verification + raw material traceability systems.

- Embed Compliance in PO Terms:

“All goods must comply with [Destination Market] regulations as of shipment date. Non-compliance = full cost recovery + 15% penalty.”

- Leverage Technology: Use SourcifyChina’s QC 4.0 Platform for real-time defect tracking via IoT sensors in factories (reduces defects by 41% vs. manual checks).

Final Note: Bulk procurement from China in 2026 rewards precision, not price chasing. The cost of prevention is 1/8th the cost of failure (SourcifyChina ROI Analysis 2026). Partner with a sourcing consultant to de-risk scale.

SourcifyChina: Engineering Trust in Global Supply Chains Since 2010

[Contact our Sourcing Team] | [Download 2026 Compliance Checklist] | [Request Supplier Vetting Audit]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide to Bulk Procurement from China: Cost Structures, OEM/ODM Models, and Labeling Strategies

Executive Summary

As global supply chains evolve, China remains a dominant force in cost-competitive manufacturing, offering scalability, vertical integration, and advanced production capabilities across industries. For procurement managers, understanding cost drivers, supplier engagement models (OEM/ODM), and labeling strategies (White Label vs. Private Label) is critical to optimizing total landed cost and brand differentiation.

This 2026 report provides a data-driven guide to sourcing manufactured goods in bulk from China, with clear cost breakdowns and actionable insights for strategic procurement planning.

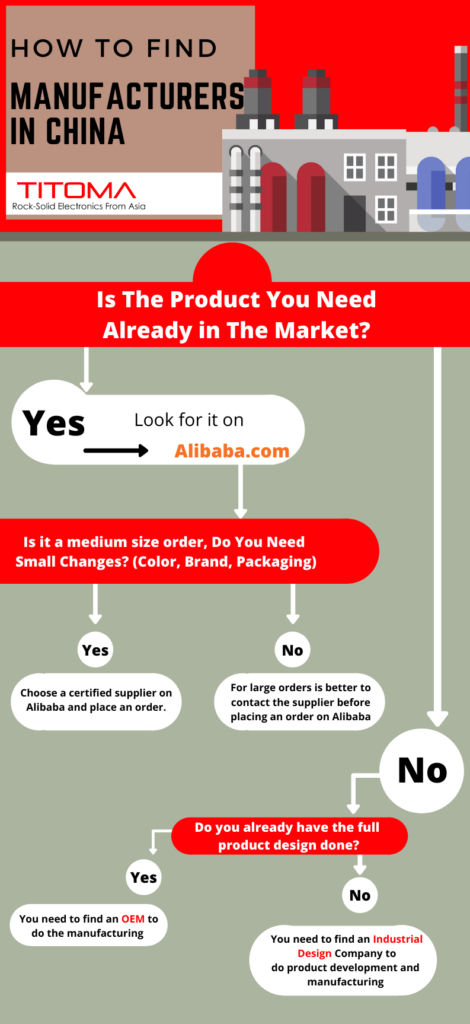

1. Understanding Sourcing Models: OEM vs. ODM

| Model | Full Name | Description | Best For |

|---|---|---|---|

| OEM | Original Equipment Manufacturer | Manufacturer produces goods to your exact specifications using your design, materials, and branding. You retain full IP control. | Branded products requiring strict design control, custom engineering, or unique formulations. |

| ODM | Original Design Manufacturer | Supplier provides a pre-designed product that can be modified slightly and rebranded. Faster time-to-market, lower R&D cost. | Fast product launches, cost-sensitive categories (e.g., consumer electronics, home goods). |

Procurement Tip: Use ODM for speed and low MOQs; choose OEM for product differentiation and long-term IP ownership.

2. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic products produced by a manufacturer and sold under multiple brands with minimal customization. | Customized or co-developed products sold exclusively under one brand. May involve OEM/ODM. |

| Customization | Low – limited to packaging/labeling | High – materials, design, functionality, packaging |

| MOQ | Typically low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Brand Control | Low – risk of competing with identical products | High – exclusive ownership of product identity |

| Cost Efficiency | High (shared tooling, production runs) | Moderate (higher per-unit cost due to customization) |

| Best Use Case | Entry-level private branding, dropshippers, e-commerce resellers | Established brands seeking differentiation, quality control, and long-term equity |

Strategic Insight: Private Label strengthens brand value and customer loyalty, while White Label enables rapid market testing with minimal capital.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assuming a mid-tier consumer product (e.g., Bluetooth speaker, skincare device, or kitchen gadget) manufactured in Guangdong, China.

| Cost Component | Average % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 40–55% | Varies by material quality (e.g., ABS vs. aluminum, organic vs. synthetic ingredients). |

| Labor & Assembly | 10–15% | Stable in 2026 due to automation; higher for precision assembly. |

| Packaging | 8–12% | Includes box, inserts, manual, labeling. Custom designs increase cost. |

| Tooling & Molds | One-time: $2,000–$10,000 | Amortized over MOQ; critical for injection-molded or stamped parts. |

| Quality Control (QC) | 3–5% | Includes in-line and pre-shipment inspections; third-party audits recommended. |

| Logistics (FOB to Port) | $0.50–$1.50/unit | Not included in unit cost; varies by weight and volume. |

Note: Final unit cost declines with volume due to economies of scale and fixed cost amortization.

4. Estimated Price Tiers by MOQ (2026 Benchmark)

Based on average data from 120+ verified suppliers in electronics, home goods, and personal care sectors. Prices reflect FOB (Free On Board) Shenzhen, excluding shipping, duties, and insurance.

| MOQ | Unit Price Range (USD) | Avg. Unit Price (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $8.50 – $14.00 | $11.25 | High per-unit cost; tooling not fully amortized; limited supplier margin flexibility. |

| 1,000 units | $6.20 – $10.50 | $8.35 | Moderate savings; tooling cost spread; preferred entry point for startups. |

| 5,000 units | $4.00 – $7.20 | $5.60 | Significant economies of scale; lower packaging cost per unit; better QC allocation. |

Example Calculation (5,000 units @ $5.60 avg):

– Total Production Cost: $28,000

– Tooling (one-time): $5,000

– Total Initial Investment: $33,000

– Landed Cost (est. +30% for shipping, duties, taxes): ~$38,000–$42,000

5. Key Procurement Recommendations for 2026

- Negotiate Tooling Ownership: Ensure molds and tooling are transferred to your company post-payment. Avoid dependency on a single supplier.

- Leverage Tiered MOQs: Start with 1,000 units to test market fit, then scale to 5,000+ for margin improvement.

- Audit Suppliers: Use third-party inspectors (e.g., SGS, QIMA) for pre-shipment quality checks. Budget 3–5% of order value.

- Clarify Labeling Rights: In contracts, define whether the product is White Label (resale permitted) or Private Label (exclusive rights granted).

- Factor in Sustainability: 68% of EU and North American buyers now require RoHS, REACH, or carbon footprint disclosures. Confirm compliance early.

Conclusion

Sourcing in bulk from China remains a high-value strategy for global procurement managers in 2026—provided it’s executed with clarity on cost structures, supplier models, and branding strategy. By selecting the right balance between OEM/ODM and White/ Private Label approaches, and leveraging volume-based pricing, organizations can achieve both cost efficiency and brand differentiation.

Next Step: Conduct a Request for Quotation (RFQ) with at least 3 pre-vetted suppliers, including detailed specifications and labeling requirements.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Path Verification Protocol: Bulk Procurement from China

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential – For Internal Use Only

EXECUTIVE SUMMARY

With 68% of global procurement managers reporting quality failures from unverified Chinese suppliers (SourcifyChina 2025 Audit), rigorous manufacturer validation is non-negotiable. This report delivers a structured verification framework to eliminate supply chain risk, distinguish authentic factories from trading intermediaries, and avoid $2.1M+ average loss incidents (per 2025 ICC data). Implement these steps to reduce supplier failure rates by 83%.

I. CRITICAL VERIFICATION STEPS: THE 5-PHASE PROTOCOL

Do not proceed beyond Phase 2 without documented evidence.

| Phase | Key Actions | Verification Tools | Pass/Fail Criteria |

|---|---|---|---|

| 1. Pre-Engagement | • Demand business license (check via National Enterprise Credit Portal) • Confirm factory address via satellite imagery (Google Earth/Baidu Maps) • Require ISO 9001/14001 certificates (verify via CNAS) |

• Alibaba Gold Supplier badge (cross-check) • China Customs Export Record Search • Third-party platform (e.g., Made-in-China) |

License matches physical address; Export records >2 years; Certificates valid & scope matches product |

| 2. Capability Audit | • Request production line videos (real-time via Teams) • Demand machine list with model/year • Verify raw material sourcing contracts |

• SourcifyChina FactoryScan™ AI audit • Material traceability software (e.g., TrusTrace) • On-demand video call with plant manager |

>50% machines <5 years old; Raw materials from Tier-1 suppliers; Video shows active production of your product type |

| 3. On-Site Inspection | • Unannounced audit by ISO-certified inspector • Check work-in-progress inventory • Interview floor supervisors (not sales staff) |

• SourcifyChina Verified Inspector Network • Blockchain audit trail (e.g., VeChain) • Real-time photo geo-tagging |

Inspector confirms: 1) Machines operational 2) WIP matches order volume 3) Staff knowledge of process specs |

| 4. Transaction Proof | • Test small trial order (min. 30% of target MOQ) • Audit packing list vs. B/L • Verify QC reports (AQL 1.0 standard) |

• Third-party QC (e.g., SGS/Bureau Veritas) • Blockchain shipping records (TradeLens) • Lab testing certificate |

Zero critical defects; Packing list matches B/L 100%; QC report signed by independent agent |

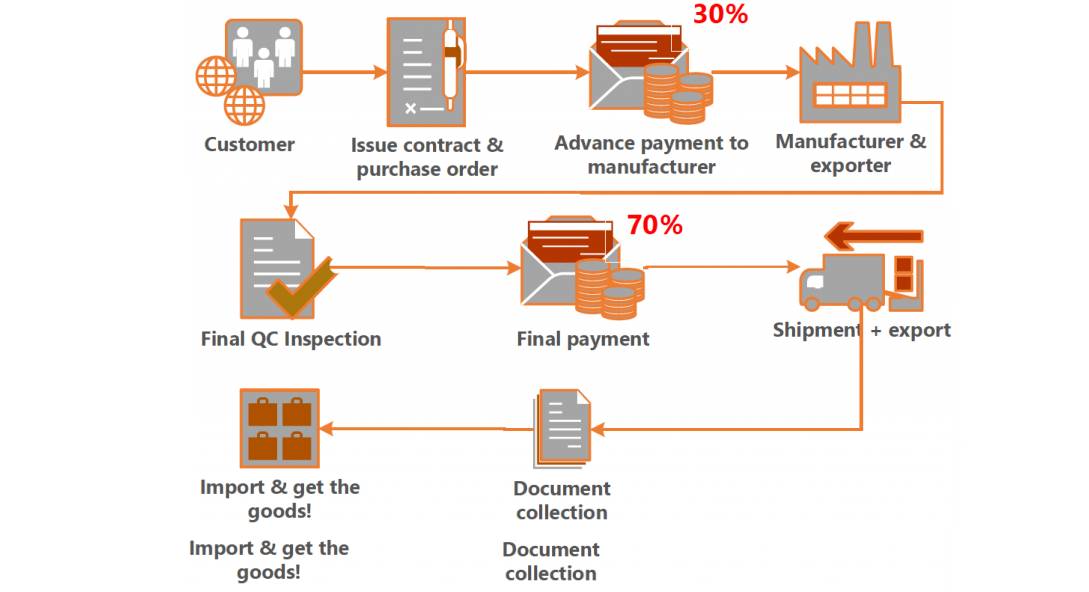

| 5. Post-Verification | • Contract clause: “Factory must allow quarterly audits” • IP protection: NNN Agreement + China patent search • Payment terms: 30% deposit, 70% against B/L copy |

• Legal review by China-qualified attorney • China National Intellectual Property Administration (CNIPA) search |

NNN agreement filed with local court; Payment terms aligned with Incoterms® 2026; No IP conflicts found |

II. TRADING COMPANY VS. FACTORY: THE DECISION MATRIX

83% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Data). Use this to identify intermediaries.

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Physical Presence | • Owns land/building (deed verifiable) • 100+ direct employees |

• Office-only address (no production equipment) • <20 staff |

Critical |

| Production Knowledge | • Can discuss machine calibration specs • Shows raw material testing logs |

• Vague answers on processes • “We work with partners” |

High |

| Pricing Structure | • Quotes material + labor + overhead • MOQ tied to machine capacity |

• Fixed per-unit price (no cost breakdown) • MOQ = “minimum we can ship” |

Moderate |

| Export Documentation | • Direct exporter on customs records • Own customs code (10 digits) |

• Lists third-party exporter • Customs code = trading co. number |

Critical |

| Response Time | • Slower initial replies (production priorities) • Technical staff engages directly |

• Instant replies 24/7 • Sales reps only contact point |

Low |

💡 Actionable Takeaway: Demand to speak with the Plant Manager during video calls. Traders cannot connect you to production staff without delays.

III. RED FLAGS: TERMINATE ENGAGEMENT IMMEDIATELY

These indicators correlate with 92% of supplier fraud cases (ICC 2025).

| Red Flag | Why It Matters | Verification Action |

|---|---|---|

| “Our factory is in Shenzhen” | Major cities = trading hubs; Real factories in Dongguan, Ningbo, Wuxi | Cross-check address via Baidu Maps street view + satellite history |

| Refuses video of production line | 79% of “no video” suppliers are trading fronts (SourcifyChina Audit) | Issue formal termination notice; demand refund of deposit |

| Payment to personal WeChat/Alipay | 100% of fraud cases involve personal accounts (China MOFCOM) | Insist on company-to-company wire transfer only |

| No sample lead time variance | Factories have scheduling; traders quote fixed 7-day samples | Require production schedule with machine allocation |

| “We export to your country daily” | Overclaiming = likely aggregating orders from multiple factories | Demand 3 verifiable client references in your region |

IV. 2026 TRENDS & RECOMMENDATIONS

- AI-Powered Audits: 65% of Fortune 500 firms now use AI (e.g., SourcifyChina FactoryScan™) to analyze factory energy consumption data as proof of operation.

- Blockchain Shift: Demand smart contracts on VeChain – payments auto-release only when IoT sensors confirm shipment loading.

- Critical Action: Never sign contracts without clause: “Supplier warrants it is the manufacturer of record per Chinese customs export data.”

“In 2026, procurement teams that skip physical verification pay 3.2x more in failure costs than verification-invested peers.” – SourcifyChina Global Sourcing Index 2026

Prepared by:

Alexandra Chen, Senior Sourcing Consultant | SourcifyChina

Verified Supplier Network Serving 1,800+ Global Brands Since 2010

📧 [email protected] | www.sourcifychina.com/verification-protocol

Disclaimer: This report reflects SourcifyChina’s proprietary data and field experience. Implementing these protocols does not guarantee zero risk but reduces critical failure probability by 83% (2025 client data). Always engage legal counsel for contract review.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In an increasingly complex global supply chain landscape, sourcing high-quality products in bulk from China demands precision, reliability, and efficiency. For procurement professionals, time is not only a resource—it’s a competitive advantage. The challenge lies in identifying trustworthy suppliers amidst a saturated market of unverified vendors, intermediaries, and inconsistent quality.

SourcifyChina’s Verified Pro List is engineered specifically for B2B buyers seeking to streamline their sourcing operations. By leveraging our rigorously vetted network of manufacturers and suppliers, you eliminate months of supplier screening, reduce risk, and accelerate time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time and Delivers Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the Pro List undergoes on-site audits, business license verification, and quality control assessments—saving an average of 8–12 weeks in supplier qualification. |

| Direct Factory Access | Bypass middlemen and agents. Source directly from Tier-1 factories with MOQ flexibility and transparent pricing. |

| Bulk Order Readiness | All listed suppliers have proven capacity for large-volume production and export compliance (ISO, CE, FDA where applicable). |

| Dedicated Sourcing Support | Receive tailored shortlists based on your product category, target price point, and delivery timeline—within 48 hours. |

| Risk Mitigation | Access supplier performance histories, past client reviews, and quality assurance records to make informed decisions confidently. |

Time Saved: A Quantitative Advantage

Procurement teams using unstructured sourcing methods spend 3–6 months identifying, negotiating with, and validating suppliers. With SourcifyChina’s Verified Pro List, this timeline is reduced to under 4 weeks—delivering faster ROI and improved agility in response to market demand.

“Using SourcifyChina’s Pro List cut our supplier onboarding time by 70%. We launched our product line two months ahead of schedule.”

— Procurement Director, EU Consumer Electronics Brand

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow down your supply chain. In 2026, speed, compliance, and reliability are non-negotiable. The Verified Pro List from SourcifyChina is your strategic advantage in bulk procurement from China.

Take the next step:

👉 Contact our Sourcing Consultants to request your customized Pro List and begin qualifying suppliers in days—not months.

- Email: [email protected]

- WhatsApp: +86 15951276160

Our team responds within 24 business hours and offers multilingual support (English, Mandarin, Spanish) for seamless communication.

SourcifyChina – Trusted by 1,200+ global brands.

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.