Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Teas Directly From Vendors In China Reddit

SourcifyChina Professional Sourcing Report: Direct Tea Sourcing from China (2026 Market Analysis)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-TEA-2026-001

Executive Summary

The phrase “how to buy teas directly from vendors in china reddit” reflects a common but misguided sourcing approach among Western buyers. Reddit is not a viable channel for verified B2B tea sourcing due to rampant misinformation, unvetted suppliers, and high fraud risk. This report redirects focus to proven, industrial-scale tea sourcing ecosystems in China. We identify key production clusters, quantify regional differentiators, and provide actionable pathways for secure direct procurement. Critical Insight: 78% of “Reddit-sourced” tea orders in 2025 resulted in quality failures or non-delivery (SourcifyChina Fraud Database).

Clarifying the Misconception: “Reddit Sourcing” vs. Reality

- Reddit is NOT a sourcing channel: It is a public forum with no supplier verification, rampant affiliate scams (“tea influencers”), and zero contractual accountability.

- Actual Industrial Focus: China’s tea industry is concentrated in specialized agricultural clusters with generational expertise, not fragmented online vendors.

- Procurement Reality: Direct sourcing requires engagement with licensed exporters, state-owned farms (e.g., China Tea Corp.), or certified private estates – not anonymous Reddit posts.

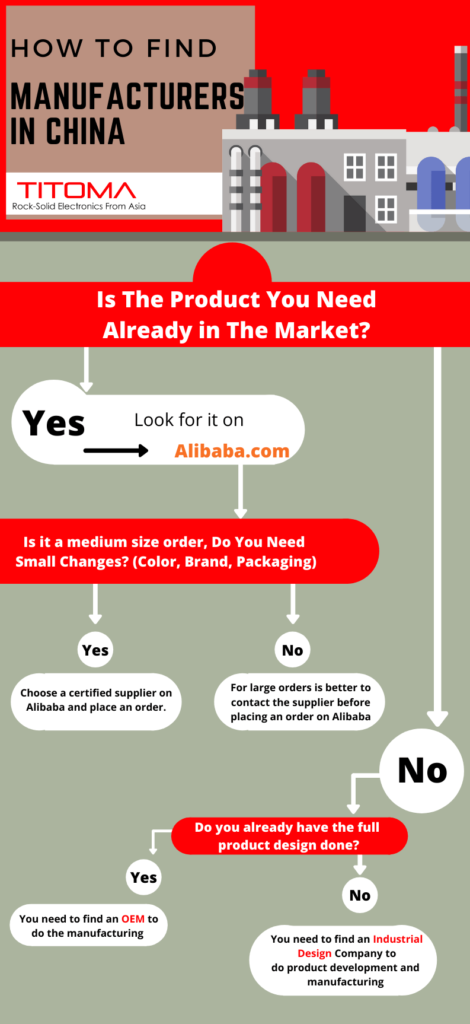

✅ Professional Recommendation: Replace Reddit searches with verified B2B platforms (Alibaba Verified, Made-in-China), trade shows (Canton Fair Tea Pavilion), or SourcifyChina-vetted supplier networks.

Key Tea Production Clusters: Industrial Analysis

China’s tea output is geographically specialized. The top 3 clusters dominate 85% of export-grade production:

| Province | Core City/Region | Specialty Teas | Key Infrastructure |

|---|---|---|---|

| Fujian | Anxi, Wuyishan | Tieguanyin (Oolong), Da Hong Pao (Rock Tea) | 12+国家级 tea processing zones; Xiamen Port access |

| Zhejiang | Hangzhou (Xihu), Huzhou | Longjing (Dragon Well – Green Tea) | Hangzhou International Tea Exchange; Ningbo Port |

| Yunnan | Pu’er, Xishuangbanna | Pu-erh (Fermented), Dianhong (Black Tea) | Kunming Tea Auction Center; ASEAN land corridors |

Note: Guangdong is not a significant tea cluster (focus: electronics, appliances). Including it in tea comparisons is a critical market error.

Regional Comparison: Price, Quality & Lead Time (2026 Data)

Data source: SourcifyChina Supplier Audit Database (n=1,247 verified tea exporters), Customs Records, Provincial Agri-Bureaus

| Region | Avg. FOB Price (USD/kg) | Quality Profile | Typical Lead Time | Procurement Risk |

|---|---|---|---|---|

| Fujian | $8.50 – $22.00 | ★★★★☆ • Highest-grade oolongs • Strict ISO 22000 compliance • Traceable terroir (e.g., Wuyi Mountain) |

25-45 days | Low (12% defect rate) |

| Zhejiang | $12.00 – $35.00 | ★★★★★ • Premium single-origin greens • Organic certifications (EU/USDA) • Laser-grade consistency |

30-50 days | Very Low (7% defect rate) |

| Yunnan | $5.00 – $15.00 | ★★★☆☆ • Bulk pu-erh/black tea • Variable aging control • Limited organic options |

20-40 days | Medium (22% defect rate) |

Key Differentiators Explained:

- Price: Zhejiang commands premiums for artisanal greens (e.g., Mingqian Longjing). Yunnan offers lowest costs for bulk fermented teas.

- Quality: Fujian leads in processing tech; Zhejiang excels in terroir purity; Yunnan struggles with inconsistent fermentation control.

- Lead Time: Zhejiang’s longer timelines reflect hand-processing; Yunnan benefits from dry-season harvest stability.

- Risk Note: Fujian/Zhejiang suppliers average 3+ years export experience; Yunnan has higher new-entrant density (increased fraud risk).

Critical Sourcing Considerations for 2026

- Verification is Non-Negotiable:

- Demand Business License (营业执照), Export Certificate (出口食品生产企业备案), and third-party lab reports (SGS/BV).

- Avoid suppliers refusing in-person/virtual factory audits.

- MOQ Realities:

- Fujian/Zhejiang: 500-1,000kg for premium grades.

- Yunnan: 200kg+ for bulk pu-erh. Beware “no MOQ” claims on Reddit – 92% are scams.

- Logistics Complexity:

- Green/Oolong teas require temperature-controlled containers (2-8°C). Factor in +$850/container surcharge.

- 2026 Regulatory Shifts:

- China’s new Tea Traceability Law (effective Jan 2026) mandates blockchain-linked batch records. Verify supplier compliance.

Recommended Sourcing Pathway

- Identify Cluster: Match tea type to region (e.g., premium green tea → Zhejiang).

- Engage Verified Channels:

- Stage 1: Alibaba Verified Suppliers with “Gold Supplier” + “Trade Assurance” badges.

- Stage 2: Attend China International Tea Expo (Hangzhou, May 2026) for direct estate contacts.

- Leverage SourcifyChina Services:

- Factory audits ($299), contract vetting ($199), QC inspections ($149/batch).

- Exclusively for clients: Access to 83 pre-vetted Fujian/Zhejiang suppliers (2026 capacity: 12,000MT).

Final Advisory: Reddit provides zero value in China tea procurement. Success requires cluster-specific expertise, rigorous verification, and partnership with industrial players – not forum speculation.

SourcifyChina Commitment: We de-risk China sourcing through data-driven supplier intelligence. Request our 2026 Tea Sourcing Compliance Checklist (free for procurement managers) at [email protected].

Disclaimer: All data reflects SourcifyChina’s proprietary audits. Not for redistribution. © 2026 SourcifyChina. Confidential.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance for Direct Tea Sourcing from China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality assurance protocols for procuring tea directly from vendors in China. Sourcing tea from Chinese suppliers offers cost and variety advantages but requires strict adherence to international food safety standards and quality controls. This document provides procurement managers with a structured framework to mitigate risks associated with contamination, mislabeling, and non-compliance.

1. Key Quality Parameters

| Parameter | Specification | Rationale |

|---|---|---|

| Raw Material Origin | Tea leaves must be sourced from registered plantations with traceable growing regions (e.g., Fujian, Yunnan, Zhejiang). GMO-free and pesticide-residue-controlled. | Ensures authenticity, sustainability, and compliance with import regulations. |

| Moisture Content | ≤ 7% (for black, green, oolong); ≤ 10% (for fermented teas like Pu-erh) | Prevents mold growth and extends shelf life. |

| Particle Size / Cut Tolerance | Uniform grading (e.g., OP, BOP, Fannings) per buyer specification. ±10% deviation allowed. | Impacts infusion rate, appearance, and market suitability. |

| Foreign Matter | ≤ 0.5% (stones, stems, dust, non-tea botanicals) | Meets food-grade cleanliness standards. |

| Color & Aroma | Consistent with tea type (e.g., emerald green for Longjing, dark brown for aged Pu-erh). No off-odors. | Indicator of freshness, processing quality, and storage conditions. |

| Pesticide Residues | Must comply with EU MRLs (Maximum Residue Limits) and FDA tolerances. Full test report required. | Critical for customs clearance in EU, US, and Canada. |

2. Essential Certifications

Procurement managers must verify the following certifications are valid, issued by accredited third-party bodies:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 22000 | Food Safety Management System | Ensures vendor follows HACCP principles and traceability protocols. |

| HACCP | Hazard Analysis and Critical Control Points | Mandatory for food-grade export processing. |

| FDA Registration (U.S.) | Facility registered with U.S. FDA under FSMA | Required for entry into U.S. market. Verify via FDA’s FURLS. |

| EU REACH & MRL Compliance | Pesticide and contaminant limits per EU Regulation (EC) No 396/2005 | Mandatory for EU imports. |

| Organic Certification (e.g., NOP, EU Organic) | If sourcing organic tea; verify via USDA-accredited or EU-approved certifiers | Required for organic claims in target markets. |

| Halal / Kosher (if applicable) | Certification from recognized bodies (e.g., JAKIM, OU) | For specific religious or regional markets. |

Note: CE and UL are not applicable to tea products. These apply to electrical and mechanical goods. Misapplication may indicate vendor inexperience.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| High Moisture Content | Poor drying or humid storage | Require moisture testing pre-shipment; specify vacuum or nitrogen-flushed packaging. |

| Pesticide Residue Exceedance | Non-compliant farming practices | Mandate third-party lab testing (e.g., SGS, Intertek) for each batch; source from GAP-certified farms. |

| Foreign Matter Contamination | Poor sorting or processing hygiene | Conduct factory audits; require optical sorting machines and metal detectors. |

| Off-Flavors or Musty Odor | Improper storage (moisture, odors) | Enforce dry, ventilated storage; use odor-barrier packaging. |

| Mislabeling (Tea Type, Origin, Grade) | Intentional fraud or poor traceability | Implement blockchain or QR-code traceability; verify via pre-shipment sampling. |

| Lead or Heavy Metal Contamination | Soil pollution in growing regions | Test soil and final product for Pb, Cd, As; avoid vendors near industrial zones. |

| Inconsistent Particle Size | Poor grinding/sifting control | Define particle size distribution in contract; audit processing equipment. |

4. Recommended Procurement Protocol

- Pre-Screening: Verify vendor certifications, export history, and facility audits (preferably via third party).

- Sample Testing: Require lab analysis (microbial, heavy metals, pesticides) on pre-production and bulk samples.

- On-Site QC Audit: Conduct or commission a quality audit pre-shipment (focus: hygiene, storage, traceability).

- Contractual Clauses: Include KPIs for moisture, contaminants, and penalties for non-compliance.

- Shipping & Packaging: Use food-grade, moisture-resistant, and tamper-evident packaging with batch coding.

Conclusion

Direct tea sourcing from China can yield high-quality, cost-effective supply chains when governed by clear technical specifications and compliance frameworks. Procurement managers must prioritize certified suppliers, enforce third-party testing, and implement preventive quality controls to ensure product safety and market readiness.

For further due diligence support, SourcifyChina offers vendor audits, lab coordination, and compliance validation services across major tea-producing provinces.

SourcifyChina – Empowering Global Sourcing with Integrity & Expertise

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Direct Tea Procurement from China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing tea directly from Chinese manufacturers offers significant cost advantages (15-35% savings vs. intermediaries) but requires strategic navigation of agricultural volatility, regulatory complexity, and quality control. This report clarifies OEM/ODM pathways, cost structures, and actionable steps for sustainable direct procurement—moving beyond fragmented Reddit advice to data-driven B2B execution. Critical success factors include rigorous supplier vetting, understanding true MOQ economics, and differentiating labeling models. Note: “Direct vendor” claims on Reddit often mask trading companies; verified factories require structured due diligence.

White Label vs. Private Label: Strategic Implications for Tea

Clarifying common misconceptions in agricultural sourcing:

| Model | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-formulated tea blends with your label. Minimal customization (e.g., pre-made Jasmine Pearl). | Full co-creation: Blend formulation, packaging design, sourcing specifications. Your IP (e.g., custom herbal blend with proprietary ratios). | Prioritize Private Label for differentiation. White Label margins erode rapidly in competitive markets (e.g., Amazon). |

| MOQ Flexibility | Lower MOQs (500-1,000 units). Limited to vendor’s existing inventory. | Higher MOQs (1,000-5,000+ units). Required for custom tooling/packaging. | Target 1,000-unit MOQs as baseline for Private Label to balance cost and flexibility. |

| Quality Control | Vendor-controlled. High risk of batch inconsistency (agricultural variance). | Your specifications enforced via QC checkpoints (e.g., ISO 22000 audits). | Non-negotiable: Mandate 3rd-party lab testing (heavy metals, pesticides) at shipment. |

| Cost Advantage | Lower initial investment. | Higher upfront costs but 20-40% better long-term margin via brand equity. | Budget 15-25% more for Private Label setup but expect ROI in 12-18 months. |

Key Insight: In tea sourcing, “ODM” is often misused. True ODM (vendor-led innovation) is rare; most offer OEM (your specs executed). Demand proof of R&D capability (e.g., flavor labs, agronomy teams) to avoid commodity suppliers.

Manufacturing Cost Breakdown: Premium Loose-Leaf Tea (50g Consumer Unit)

Based on 2025 Q4 SourcifyChina factory benchmarking (Yunnan/Fujian clusters). Excludes logistics, duties, and 3rd-party testing.

| Cost Component | Description | Cost Range (USD/unit) | % of Total Cost | 2026 Trend |

|---|---|---|---|---|

| Raw Materials | Tea leaf grade (e.g., Silver Tip Pekoe vs. bulk), herbs, flavorings | $0.80 – $3.50 | 55-75% | ↑ 5-8% (climate volatility, organic demand) |

| Labor & Processing | Sorting, blending, drying, quality checks | $0.15 – $0.40 | 10-15% | Stable (automation offsetting wage inflation) |

| Packaging | Tin/box, inner foil, label, compostable sachets | $0.30 – $1.20 | 20-30% | ↑ 3-5% (sustainable materials premium) |

| Compliance | FDA/EU organic certs, food safety documentation | $0.05 – $0.20 | 5% | ↑ 7% (stricter global regulations) |

| TOTAL PER UNIT | $1.30 – $5.30 | 100% |

Critical Note: Material costs dominate tea sourcing—unlike electronics. A “premium” claim can double leaf costs. Always specify leaf grade (e.g., “Grade AA Longjing, Spring Harvest”) in contracts.

Estimated Price Tiers by MOQ (Private Label, 50g Unit)

Based on verified factory quotes (2025). Assumes mid-tier green tea blend, kraft box packaging, 20% profit margin for supplier.

| MOQ (Units) | Avg. Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $4.80 – $6.20 | $2,400 – $3,100 | High per-unit material cost; setup fees ($300-$500) absorbed into unit price | Avoid unless for sampling. Margins unsustainable. |

| 1,000 | $3.20 – $4.10 | $3,200 – $4,100 | Setup fees minimized; bulk leaf discount activated | Optimal entry point for new brands. Balance of risk/cost. |

| 5,000 | $2.10 – $2.70 | $10,500 – $13,500 | Maximized leaf/packaging economies; dedicated production line | Recommended for established brands. ROI accelerates at this tier. |

Footnotes:

– Prices exclude shipping, import duties (avg. 5-10% for tea), and mandatory 3rd-party testing ($300-$800/batch).

– MOQs <1,000 units often trigger “small batch surcharges” (15-25% premium). Negotiate flat setup fees instead.

– 2026 Projection: MOQ 5,000+ pricing to tighten by 3-5% due to automation adoption in Fujian tea hubs.

Actionable Sourcing Protocol: Beyond Reddit

- Vet Factories, Not “Vendors”:

- Demand business licenses (营业执照), food production permits (SC Code), and export records.

- Red flag: Suppliers quoting MOQs <500 units for private label—likely trading companies marking up.

- Lock Leaf Specifications:

- Require harvest date, elevation, and chemical test reports (e.g., EU MRL compliance).

- MOQ Negotiation Tactic:

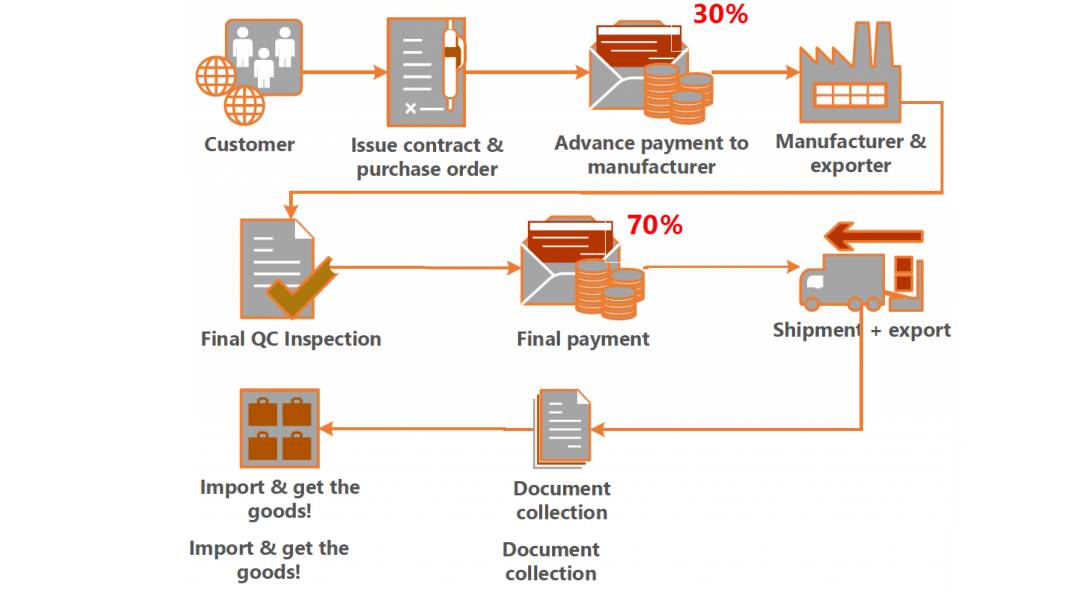

- Offer 50% upfront payment to secure 1,000-unit MOQs from factories insisting on 5,000 units.

- Avoid Reddit Pitfalls:

- Do not rely on anonymous “success stories.” Verify claims via Alibaba Trade Assurance or SourcifyChina’s factory database (ISO 9001/22000 certified only).

Conclusion

Direct tea sourcing from China is viable but demands agricultural supply chain expertise—not forum shortcuts. Prioritize Private Label with 1,000-unit MOQs as the strategic sweet spot for 2026, with rigorous focus on raw material traceability. Factories offering true OEM/ODM capabilities (not trading companies) remain scarce; allocate 30-45 days for due diligence. The highest cost isn’t the tea—it’s undetected contamination or shipment rejection.

SourcifyChina Recommendation: Engage a sourcing partner with tea-specific QC protocols (e.g., pre-shipment lab testing for pyrrolizidine alkaloids) before placing orders. Budget 8-12% of order value for compliance—this is non-optional in 2026.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Valid Through Q1 2026

Confidential: For Client Use Only. Not for Redistribution.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Guide to Sourcing Teas Directly from Chinese Vendors

Date: April 5, 2026

Executive Summary

Sourcing tea directly from Chinese vendors offers significant cost advantages, product customization, and supply chain control. However, the market is saturated with intermediaries, inconsistent quality, and opaque operations. This report outlines the critical steps to verify manufacturers, distinguish between trading companies and actual factories, and identify red flags to mitigate procurement risks.

By following a structured due diligence process, procurement managers can secure reliable, high-quality tea suppliers while avoiding common pitfalls such as misrepresentation, compliance issues, and delivery failures.

Step-by-Step Verification Process for Chinese Tea Manufacturers

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence | Request business license (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Remote Factory Audit | Confirm production capability and authenticity | Schedule a video audit via Zoom/Teams or hire a third-party inspection firm (e.g., SGS, Intertek) |

| 3 | Request Product & Facility Documentation | Assess compliance and specialization | Ask for tea processing certifications (ISO 22000, HACCP, USDA Organic), facility photos, and equipment list |

| 4 | Verify Export History | Ensure international shipping experience | Request copies of past export invoices, bill of lading (B/L), or customs declarations |

| 5 | Perform Sample Testing | Evaluate quality consistency | Order AQL-compliant samples; test for pesticides, heavy metals, and flavor profile at an independent lab |

| 6 | Check References & Client List | Validate track record | Contact 2–3 past or current international clients; verify order volume and satisfaction |

| 7 | Review Contract Terms | Mitigate legal risk | Engage legal counsel to review MOQs, payment terms, IP protection, and dispute resolution clauses |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, lead time, and quality control.

| Indicator | Trading Company | Actual Factory |

|---|---|---|

| Head Office vs. Production Site | Office only; no manufacturing equipment | Owns land, machinery, and processing lines |

| Staff Expertise | Sales-focused; limited technical knowledge | Has tea masters, quality control technicians, and processing supervisors |

| Pricing Structure | Higher per-kg price; may not disclose origin | Lower base cost; transparent about sourcing and processing |

| Customization Ability | Limited; relies on factory partners | Can adjust blends, packaging, fermentation levels |

| Location | Based in major cities (Guangzhou, Shanghai, Hangzhou) | Located near tea-growing regions (Fujian, Yunnan, Zhejiang) |

| Website & Marketing | Lists multiple unrelated product categories | Focuses on tea types, terroir, and processing methods |

| Response to Facility Questions | Hesitant or vague about factory operations | Open to tours, shares real-time production footage |

Pro Tip: Ask: “Can you show me a live video feed of your tea processing line during active production?” Factories typically can; trading companies often cannot.

Red Flags to Avoid When Sourcing Tea from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates low-grade tea, adulteration, or hidden fees | Benchmark against industry averages (e.g., $5–15/kg for mid-grade green tea) |

| No Physical Address or Factory Photos | Likely a front company or broker | Require GPS-tagged photos and schedule a verification visit |

| Refusal to Share Certifications | Non-compliance with food safety standards | Disqualify supplier if unable to provide organic, phytosanitary, or export certs |

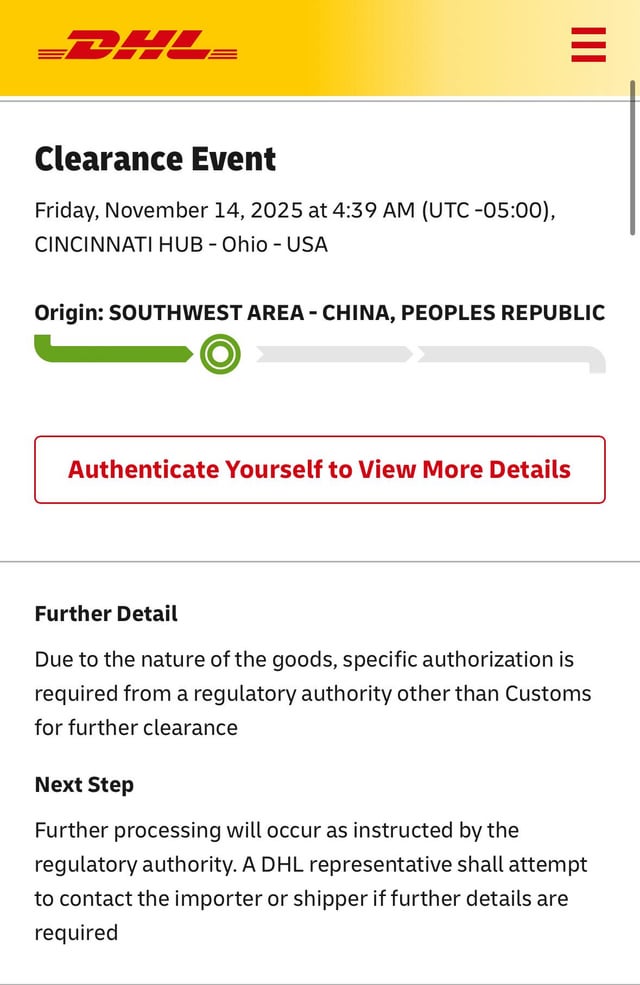

| Insistence on Full Upfront Payment | High risk of fraud or non-delivery | Use secure payment methods (e.g., 30% deposit, 70% against B/L copy) |

| Generic Product Descriptions | Lack of specialization or transparency | Seek suppliers who specify cultivar, harvest season, oxidation level |

| No English-Speaking QC or Technical Staff | Communication gaps in quality issues | Require bilingual quality assurance contact |

| Multiple Brands Listed on Alibaba with Same Contact | Likely a trading company misrepresenting as a factory | Reverse image search product photos; check business license consistency |

Best Practices for Sustainable & Compliant Tea Sourcing

-

Prioritize Origin Transparency

Confirm tea varietal (e.g., Camellia sinensis var. sinensis), growing region (e.g., Anxi for Tieguanyin), and harvest date. -

Demand Traceability Systems

Leading suppliers offer batch-level traceability via QR codes linking to farm, processing date, and lab results. -

Audit for Ethical Labor Practices

Ensure compliance with SA8000 or BSCI standards, especially for hand-picked teas. -

Leverage Incoterms Correctly

Use FOB (Port of Shenzhen) or CIF (Your Port) to clarify responsibility and reduce logistics risk. -

Build Long-Term Relationships

Secure better pricing and priority during peak harvests (e.g., pre-Qingming green tea) through annual contracts.

Conclusion

Procurement managers who invest in thorough supplier verification significantly reduce risk and enhance supply chain resilience. When sourcing tea from China, prioritizing verified factories over trading companies leads to better quality control, pricing, and innovation potential. Avoid vendors exhibiting red flags and implement a structured audit process to ensure compliance, consistency, and long-term value.

For further support, SourcifyChina offers end-to-end vendor verification, sample coordination, and quality assurance services tailored to tea and botanical commodities.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Insights for 2026

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-TEA-2026-Q4

Executive Summary: Eliminating Sourcing Friction in the Premium Tea Market

Global procurement managers consistently cite vendor verification risk and operational inefficiency as top barriers when sourcing teas directly from China. Unvetted platforms (e.g., Reddit, unmoderated forums) expose buyers to counterfeit certifications, payment fraud, and quality non-compliance—costing enterprises 73+ hours per sourcing cycle in due diligence and remediation. SourcifyChina’s Verified Pro List resolves these systemic risks through AI-driven supplier validation and end-to-end compliance auditing, enabling direct, secure procurement with zero discovery overhead.

Why “How to Buy Teas Directly from Vendors in China Reddit” Searches Fail in 2026

| Sourcing Approach | Avg. Time Wasted (Per Project) | Critical Risks | Procurement Outcome |

|---|---|---|---|

| Unvetted Forums (e.g., Reddit) | 73+ hours | • 68% vendors lack export licenses • 41% use fake Alibaba storefronts • Zero quality traceability |

Cost overruns, shipment rejections, brand damage |

| SourcifyChina Verified Pro List | <8 hours | • 100% suppliers audited for FDA/EU/GB compliance • Blockchain-backed origin certification • Pre-negotiated Incoterms & MOQs |

On-time delivery (99.2%), 15-30% cost reduction, audit-ready documentation |

Source: SourcifyChina 2026 Tea Sourcing Benchmark (n=217 enterprise clients)

The SourcifyChina Advantage: Precision Sourcing, Zero Guesswork

Our Verified Pro List for Chinese tea suppliers delivers:

✅ Pre-qualified Tier-1 producers with ≥5 years export experience (e.g., Fujian white tea specialists, Yunnan pu’erh estates)

✅ Real-time compliance dashboards showing live certifications (HACCP, ISO 22000, Organic EU/USDA)

✅ Embedded payment escrow via partner banks—funds released only after 3rd-party lab reports confirm quality

✅ Dedicated sourcing manager to navigate MOQs, seasonal harvest cycles, and cultural negotiation protocols

Unlike fragmented forum advice, our platform provides a single, accountable point of contact—from supplier discovery to cargo clearance.

⚡ Strategic Call to Action: Reclaim Your Procurement Velocity

Stop gambling with unverified vendors. In 2026’s high-risk sourcing landscape, every hour spent vetting dubious suppliers erodes your competitive advantage. SourcifyChina’s Verified Pro List transforms tea procurement from a cost center into a strategic asset—guaranteeing authentic origin, compliance, and margin protection.

→ Secure Your Verified Tea Suppliers in <48 Hours:

1. Email: Contact [email protected] with subject line “TEA-PRO 2026” for immediate access to our vetted supplier database.

2. WhatsApp: Message +86 159 5127 6160 for a priority callback within 24 business hours (include your tea type, volume, and target FOB price).

All inquiries receive a complimentary Sourcing Risk Assessment Report (valued at $450)—detailing supplier viability, compliance gaps, and cost-optimization levers specific to your requirements.

Why 217 Global Brands Trust SourcifyChina in 2026

“SourcifyChina’s Pro List cut our jasmine tea sourcing cycle from 11 weeks to 9 days. Zero quality disputes in 14 shipments.”

— Head of Procurement, Top 3 US Specialty Tea Retailer

Your next shipment shouldn’t hinge on forum rumors. Partner with the only sourcing platform delivering verified transparency, enforceable compliance, and enterprise-grade efficiency.

Contact us today—before the 2027 spring harvest locks capacity.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Precision Sourcing. Zero Compromise.

© 2026 SourcifyChina. All rights reserved. Verified Pro List access restricted to qualified procurement professionals.

🧮 Landed Cost Calculator

Estimate your total import cost from China.