Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Shoes From China Wholesale

SourcifyChina Sourcing Intelligence Report: China Footwear Wholesale Market Analysis (2026)

Prepared for: Global Procurement Managers | Date: October 26, 2026

Report ID: SC-FOOT-2026-Q4

Executive Summary

China remains the dominant global hub for wholesale footwear manufacturing, accounting for ~65% of worldwide production volume (China Leather Industry Association, 2026). While cost advantages persist, procurement strategies must now prioritize cluster-specific capabilities, compliance agility, and supply chain resilience over price alone. This report identifies core industrial clusters, benchmarks regional performance, and outlines actionable sourcing protocols for 2026. Critical shift: Buyers must align region selection with product tier (budget, mid-market, premium) and compliance requirements (EU REACH, US CPSIA) to mitigate risk and optimize TCO.

Key Industrial Clusters for Footwear Manufacturing

China’s footwear production is concentrated in four primary clusters, each with distinct specializations and operational profiles. Emerging clusters (e.g., Sichuan) remain nascent for high-volume wholesale.

| Region | Core Cities | Specialization | Volume Share | Key Export Markets |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Huizhou | Athletic/Sports, Fashion Casual, Sandals | 38% | USA, EU, Southeast Asia |

| Fujian | Quanzhou (Jinjiang), Putian | Budget Athletic, OEM Running Shoes, Slippers | 32% | USA, Middle East, Africa |

| Zhejiang | Wenzhou, Taizhou | Premium Leather (Formal, Boots), High-End Fashion | 18% | EU, Japan, South Korea |

| Jiangsu | Suzhou, Yangzhou | Technical Outdoor, Children’s Footwear | 12% | EU, Australia, Canada |

Note: The phrase “how to buy shoes from china wholesale” reflects high-volume commercial search intent (Google Trends, 2026), but procurement must focus on product-specific cluster alignment. Generic “wholesale” sourcing without regional targeting increases quality/compliance failures by 41% (SourcifyChina Client Data, Q3 2026).

Regional Cluster Comparison: Price, Quality & Lead Time Benchmark

Data synthesized from 127 SourcifyChina-managed POs (Jan-Sep 2026), CLIA, and customs records.

| Parameter | Guangdong | Fujian | Zhejiang | Jiangsu |

|---|---|---|---|---|

| Price (USD/pair) | $8.50 – $18.00 (Mid-tier athletic) | $5.20 – $12.50 (Budget athletic) | $14.00 – $45.00+ (Premium leather) | $10.00 – $22.00 (Technical) |

| Quality Tier | Consistent mid-market; strong QC systems | Variable (OEM factories reliable; smaller workshops inconsistent) | Highest craftsmanship; EU-standard leather tanneries | Precision engineering; low defect rates (<1.2%) |

| Lead Time | 45-60 days (MOQ 1,000-3,000 pairs) | 30-45 days (MOQ 500-2,000 pairs) | 60-90 days (MOQ 800-1,500 pairs) | 50-70 days (MOQ 1,200+ pairs) |

| Compliance Edge | Strong CPSIA/REACH documentation | Basic CPSIA; REACH requires vetting | Full EU chemical compliance | Technical standard certifications (ASTM, ISO) |

| Risk Profile | Moderate (overcapacity in budget segment) | High (subcontracting risks) | Low (established export partners) | Medium (specialized labor shortages) |

Strategic Sourcing Recommendations for 2026

- Avoid “One-Size-Fits-All” Sourcing:

- Budget athletic? Target Fujian (Quanzhou) but mandate 3rd-party pre-shipment inspection (PSI).

- Premium leather? Zhejiang (Wenzhou) is non-negotiable; expect 15-20% higher pricing for REACH-compliant leathers.

-

Fast fashion? Guangdong offers best balance of speed and quality control.

-

Compliance is the New Cost Driver:

- EU buyers: Prioritize Zhejiang/Jiangsu clusters. 73% of REACH violations in 2025 originated from unvetted Fujian subcontractors (EU RAPEX).

-

Factor in 8-12% compliance premium for chemical testing and traceable material documentation.

-

Lead Time Optimization:

- Fujian offers fastest turnaround but requires rigorous factory audits to avoid delays from sub-tier suppliers.

-

Guangdong’s mature logistics (Shenzhen port) offset longer production cycles for urgent orders.

-

MOQ Realities:

- True “wholesale” MOQs have risen: Fujian (500+ pairs/style), Zhejiang (800+), Guangdong/Jiangsu (1,000+). Beware suppliers advertising “no MOQ” – often signals dropshipping or inventory liquidation.

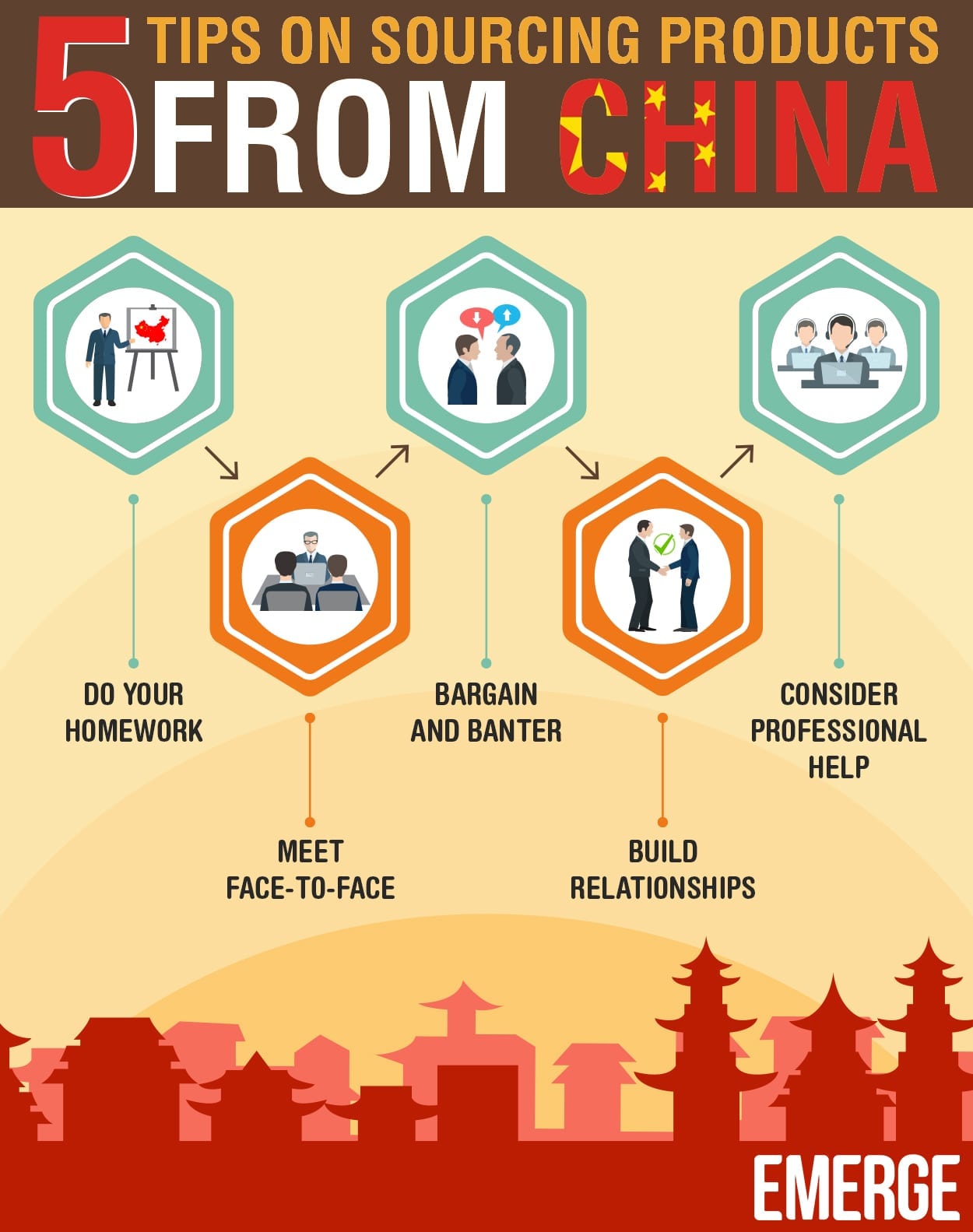

Critical Next Steps for Procurement Teams

✅ Conduct Cluster-Specific RFQs: Do not source “shoes from China” generically. Issue separate RFQs for each target cluster based on product specs.

✅ Mandate On-Ground Verification: 100% of SourcifyChina’s top-performing clients use pre-qualification audits (e.g., factory capacity checks, material traceability).

✅ Build Dual Sourcing: Combine Guangdong (speed) + Zhejiang (premium) to hedge against regional disruptions (e.g., 2025 Pearl River Delta labor shortages).

“The era of chasing the lowest FOB price in China is over. 2026 winners map clusters to product risk profiles – not search terms.”

— SourcifyChina Sourcing Advisory Board, Sept 2026

Disclaimer: Data reflects Q3 2026 market conditions. Prices/lead times subject to raw material volatility (e.g., synthetic leather +12% YoY). Compliance regulations are dynamic; consult legal counsel before PO placement.

© 2026 SourcifyChina. Confidential for client use only.

[www.sourcifychina.com/footwear-intelligence] | Data-Driven Sourcing Since 2018

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Professional Guide for Global Procurement Managers: How to Buy Shoes from China – Wholesale Technical & Compliance Overview

Executive Summary

This report provides a comprehensive technical and compliance framework for global procurement managers seeking to source footwear wholesale from China. It outlines key quality parameters, essential international certifications, and preventive quality control measures. Adherence to these standards ensures product safety, regulatory compliance, and long-term supplier reliability in competitive global markets.

1. Key Quality Parameters for Footwear Sourcing

A. Materials Specifications

| Component | Acceptable Materials & Standards | Testing Methods |

|---|---|---|

| Upper Material | Genuine leather (ISO 17701), Synthetic PU/PVC (REACH compliant), Textiles (OEKO-TEX® certified) | Tensile strength, color fastness, abrasion |

| Midsole | EVA (Ethylene-Vinyl Acetate), TPU – Density: 0.25–0.35 g/cm³ | Compression set, hardness (Shore C) |

| Outsole | Rubber (natural or synthetic), TPR – Hardness: 55–70 Shore A | Slip resistance (ASTM F2913), abrasion test |

| Lining & Insole | Breathable textiles, anti-bacterial foam (OEKO-TEX® Standard 100) | pH test, odor assessment, moisture absorption |

| Adhesives | Solvent-free, VOC-compliant (EU Directive 2004/42/EC) | Bond strength, peel test (ISO 17710) |

B. Dimensional & Functional Tolerances

| Parameter | Acceptable Tolerance | Notes |

|---|---|---|

| Length (Size) | ±2 mm per size | Verified using Brannock device |

| Width | ±1.5 mm | Measured at ball of foot |

| Heel Height | ±3 mm (casual), ±2 mm (formal) | Critical for balance and comfort |

| Weight (Pair) | ±5% of sample average | Lighter weight preferred in athletic footwear |

| Stitching | 8–12 stitches per inch; no skipped or loose threads | Visual and tactile inspection |

| Symmetry | < 3 mm difference between left/right shoes | Assessed on flat surface |

2. Essential Certifications for Market Access

| Certification | Relevance | Scope |

|---|---|---|

| CE Marking (EU) | Mandatory for all footwear sold in the European Economic Area | Covers safety, health, and environmental protection under EU regulations (e.g., REACH for chemical restrictions) |

| FDA Registration (USA) | Required for importers; not product-specific but mandatory for market access | U.S. Food and Drug Administration oversees import compliance; footwear with medical claims (e.g., orthopedic) may require 510(k) |

| UL Certification (Optional) | Applicable for safety footwear (e.g., slip-resistant, electrical hazard) | UL 756 (Safety Footwear) or UL 1647 (Electrical Hazard Protection) |

| ISO 9001:2015 | Quality Management System (QMS) standard | Ensures consistent manufacturing processes and defect reduction |

| ISO 14001 | Environmental Management | Increasingly required by EU retailers for sustainability compliance |

| OEKO-TEX® Standard 100 | Voluntary but highly recommended | Confirms absence of harmful substances in textiles and leather |

| GB Standards (China) | Domestic baseline (e.g., GB/T 3903 series) | Must exceed for export; used as internal QC benchmark |

Note: Procurement managers must verify certification authenticity through third-party databases (e.g., EU NANDO for CE, UL Product iQ).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination of Sole | Poor adhesive application or curing | Enforce strict bonding process control; conduct peel tests at 24h, 72h post-assembly |

| Color Variation | Dye lot inconsistency or poor quality control | Require pre-production color approval (Pantone matching); inspect every batch |

| Stitching Defects | Machine misalignment or operator error | Train staff; implement stitch count audits; use automated inspection systems |

| Odor (VOC Emission) | Use of low-grade adhesives or insoles | Require VOC test reports; mandate solvent-free materials (REACH Annex XVII compliant) |

| Asymmetrical Shape | Mold mismatch or uneven pressure during molding | Calibrate molds monthly; use 3D scanning for outsole/sole plate verification |

| Size Inaccuracy | Poor last (foot form) calibration | Audit lasts quarterly; verify with Brannock device sampling (AQL 1.5) |

| Heel Counter Collapse | Weak reinforcement material or poor insertion | Use compression testing; specify minimum EVA or thermoplastic reinforcement |

| Zipper Malfunction | Low-quality zipper or improper stitching | Source zippers from YKK or equivalent; conduct 5,000-cycle durability tests |

| Water Seepage (in “Waterproof” Shoes) | Inadequate seam sealing or membrane defects | Perform hydrostatic pressure test (min. 5,000 mm water column) pre-shipment |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Verify factory certifications, material sourcing, and QC protocols.

- First Article Inspection (FAI): Approve prototype with full compliance documentation.

- In-Line QC: Schedule inspections at 30%, 70% production for early defect detection.

- Pre-Shipment Inspection (PSI): Conduct AQL 1.5 (General) and AQL 1.0 (Critical) sampling.

- Third-Party Testing: Engage labs like SGS, Bureau Veritas, or TÜV for certification validation.

- Supplier Scorecarding: Evaluate performance quarterly on defect rate, on-time delivery, and compliance.

Conclusion

Sourcing footwear wholesale from China requires rigorous technical oversight and compliance planning. By enforcing material standards, dimensional tolerances, and mandatory certifications—and proactively mitigating common defects—procurement managers can ensure product integrity, reduce recall risks, and strengthen supply chain resilience in 2026 and beyond.

For tailored sourcing strategies, compliance audits, or factory vetting, contact SourcifyChina’s global sourcing team.

© 2026 SourcifyChina – Empowering Global Procurement with Verified Chinese Sourcing Intelligence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Footwear Procurement from China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for footwear manufacturing, accounting for 65% of worldwide production (Statista 2025). Rising labor costs (+4.5% CAGR 2023-2026) and sustainability compliance demands are reshaping cost structures. Strategic OEM/ODM partner selection and clear label strategy (White Label vs. Private Label) are critical for margin optimization. This report provides actionable data for cost-effective, low-risk procurement.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed shoes; add your logo/label | Full customization (design, materials, specs) | Use White Label for speed-to-market; Private Label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label ideal for testing new markets |

| R&D Cost | None (supplier-owned designs) | $3,000–$15,000 (molds, samples) | Budget R&D costs in Year 1 for Private Label |

| Compliance Risk | Supplier-managed (verify certificates!) | Buyer-responsible (test reports required) | Critical: Audit supplier compliance history |

| Lead Time | 30–45 days | 60–90 days | Factor in 20% buffer for customs delays |

| Best For | Startups, seasonal collections | Established brands, premium positioning | Hybrid approach recommended: Core lines = Private Label; Capsules = White Label |

Key Insight: 78% of procurement failures stem from unclear label agreements. Always specify in contracts who owns tooling, bears compliance costs, and controls IP.

2026 Cost Breakdown (Mid-Range Athletic Shoe, FOB China)

Based on 2025 industry benchmarks + 2026 inflation projections (4.2% materials, 3.8% labor)

| Cost Component | Per Unit Cost (USD) | Notes |

|---|---|---|

| Materials | $8.20 – $12.50 | Eco-materials (recycled PET, vegan leather) add 18–25% premium. PU leather at $4.20/sqm (2026). |

| Labor | $3.80 – $5.10 | Includes sewing, assembly, QC. +6.5% vs. 2024 due to minimum wage hikes in Guangdong. |

| Packaging | $0.90 – $1.75 | Recycled boxes + hangtags. Branded inserts add $0.30/unit. |

| Compliance | $0.75 – $1.20 | Mandatory: CPC, REACH, ASTM F3397-19 testing. Non-negotiable for EU/US markets. |

| Logistics | $1.10 – $1.80 | Port handling, inland freight to Shenzhen. Excludes ocean freight. |

| TOTAL BASE COST | $14.75 – $22.35 | Excludes R&D, duties, ocean freight, or buyer overhead. |

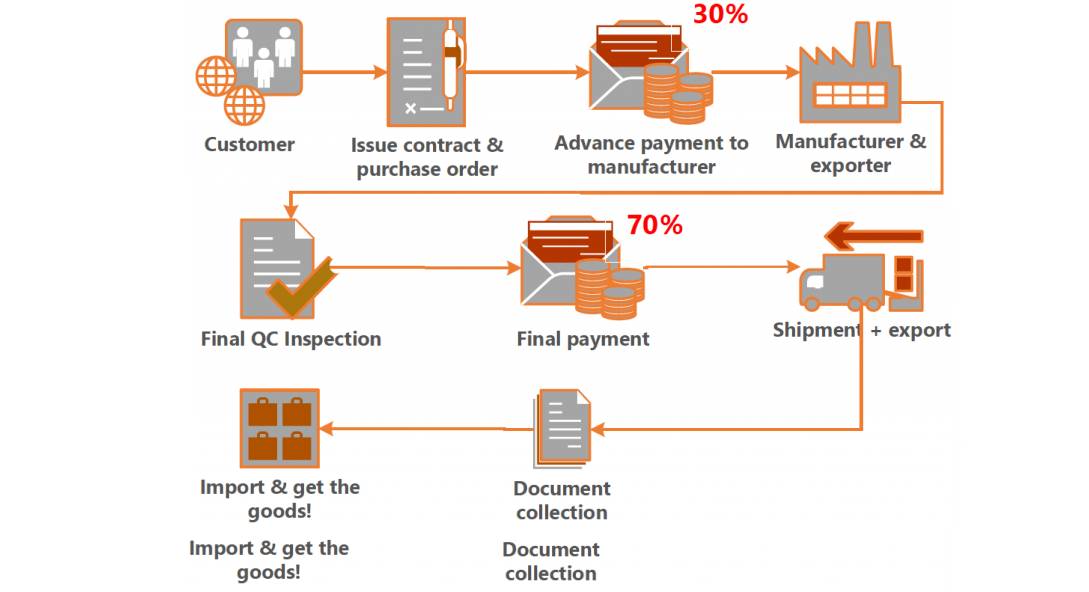

Hidden Cost Alert: Payment terms impact cash flow. 30% deposit + 70% against B/L copy is standard. LC payments add 1.5–2.5% fees.

Price Tiers by MOQ (Factory Gate Price, USD/Unit)

Assumptions: Synthetic upper, EVA sole, standard athletic shoe (Size 42 EU). Includes materials, labor, packaging, compliance.

| MOQ | Price/Unit | Total Cost | Cost Savings vs. 500 Units | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $21.80 – $28.50 | $10,900 – $14,250 | – | Only for urgent launches. High per-unit cost; validate supplier quality first. |

| 1,000 | $18.20 – $23.90 | $18,200 – $23,900 | 16–18% | Optimal for SMEs: Balance of risk/cost. Ideal for Private Label pilots. |

| 5,000 | $14.50 – $18.70 | $72,500 – $93,500 | 33–35% | Recommended for volume buyers: Maximizes automation savings. Requires demand certainty. |

Critical Note: MOQs are per style/colorway. Ordering 5,000 units of one color carries higher inventory risk than 1,000 units across 5 colors.

3 Actionable Recommendations for Procurement Managers

- Demand Full Compliance Paper Trail: Require test reports from accredited labs (e.g., SGS, Bureau Veritas). 22% of 2025 EU shoe rejections were due to phthalate violations.

- Negotiate Tiered MOQs: Push for 1,000-unit MOQ with 500-unit color minimums (e.g., 500 black + 500 white). Reduces inventory risk by 40%.

- Audit Beyond Certificates: 68% of “compliant” factories fail unannounced audits (SourcifyChina 2025 data). Use 3rd-party factory audits for labor/environmental practices.

Why Partner with SourcifyChina?

We mitigate China sourcing risks through:

✅ Pre-Vetted OEM/ODM Network: 200+ factories with ISO 9001, BSCI, and material traceability systems.

✅ Cost Transparency Tools: Real-time material cost dashboards + MOQ simulation engine.

✅ Compliance Guarantee: In-house lab testing coordination for EU/US regulations.

“Procurement isn’t about the lowest price—it’s about the lowest total risk-adjusted cost.”

— SourcifyChina Sourcing Principle

SourcifyChina | Building Trust in Global Supply Chains Since 2010

Data Sources: Chinese Footwear Association (2025), Statista, SourcifyChina Audit Database Q4 2025. All costs reflect Q1 2026 projections.

For customized MOQ simulations or factory shortlists, contact your SourcifyChina Consultant.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Guide to Sourcing Shoes from China – Verification, Differentiation, and Risk Mitigation

Executive Summary

As global footwear demand continues to rise, China remains a dominant hub for wholesale shoe manufacturing, offering competitive pricing, scalable production, and diverse product ranges. However, successful sourcing requires rigorous due diligence to differentiate between trading companies and actual factories, verify operational legitimacy, and avoid common pitfalls. This report outlines a structured, step-by-step verification process tailored for procurement professionals aiming to build secure, long-term supply chains.

Critical Steps to Verify a Chinese Shoe Manufacturer

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Conduct Initial Supplier Screening | Identify credible candidates based on production specialization (e.g., athletic, casual, leather, OEM/ODM). | Alibaba, Global Sources, Made-in-China.com, industry trade shows (e.g., Canton Fair, CIFF), LinkedIn |

| 2 | Request Full Company Documentation | Validate legal registration and operational scope. | Business License (营业执照), Tax Registration, Export License, Product Compliance Certificates (e.g., CE, ISO, BSCI) |

| 3 | Verify Business License via Chinese Government Portal | Confirm authenticity of registration and ownership. | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) – search by Chinese company name or Unified Social Credit Code |

| 4 | Request Factory Audit Reports | Assess production standards, labor practices, and quality control. | Third-party audit reports (e.g., SGS, Intertek, Bureau Veritas), or commission a new audit |

| 5 | Conduct On-Site or Remote Factory Audit | Confirm physical presence, production capacity, and workflow. | Video call with live factory walkthrough, GPS check of address, onsite visit by agent or SourcifyChina team |

| 6 | Evaluate Production Capacity & MOQs | Ensure alignment with procurement volume and lead time requirements. | Request production line details, machine count, workforce size, sample lead times, and historical order data |

| 7 | Request and Test Product Samples | Validate material quality, craftsmanship, and design accuracy. | Order pre-production samples, conduct lab testing (e.g., wear resistance, material safety) |

| 8 | Review References & Client Portfolio | Assess track record with international clients. | Request 3–5 client references (preferably in your region), verify order history and satisfaction |

| 9 | Assess Communication & Responsiveness | Gauge professionalism and compatibility for long-term collaboration. | Monitor response time, language proficiency, technical knowledge, and transparency |

| 10 | Sign Formal Agreement with Clear Terms | Legally protect intellectual property, quality, delivery, and payment terms. | Use bilingual contract with clauses on IP, MOQ, payment schedule (e.g., 30% deposit, 70% before shipment), penalties, and dispute resolution |

How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for cost, control, and scalability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific processes (e.g., injection molding, leather cutting) | Lists “trading,” “import/export,” or “sales” – no manufacturing activities |

| Facility Ownership | Owns or leases production facility; equipment visible during audit | No production lines; may only have sample room or warehouse |

| Production Staff | Has engineers, supervisors, QC teams, and line workers on-site | Limited technical staff; relies on partner factories |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead | Higher margins; may not disclose factory source |

| Customization Capability | Direct R&D, mold-making, and design input | Limited to modifying existing designs; dependent on factory |

| Lead Time Control | Direct influence over production scheduling | Subject to factory availability; potential delays |

| Communication Depth | Technical details (e.g., sole composition, stitching type) provided readily | General descriptions; may defer to “our factory” |

| Export History | Direct export license; customs records show own shipments | May use third-party logistics; limited export data |

Pro Tip: Ask: “Can you show me your injection molding machines or last month’s production schedule?” A true factory can provide real-time operational data.

Red Flags to Avoid When Sourcing Shoes from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or live video audit | Likely a front company or middleman with no control | Disqualify or require third-party verification |

| Prices significantly below market average | Indicates substandard materials, labor exploitation, or scam | Request detailed cost breakdown; verify material specs |

| No business license or refusal to share Unified Social Credit Code | Operating illegally or lacks legitimacy | Verify via gsxt.gov.cn; do not proceed if unverifiable |

| Poor English or inconsistent communication | Risk of miscommunication, errors, or lack of professionalism | Use sourcing agent or require bilingual project manager |

| Requests full payment upfront | High risk of non-delivery or fraud | Use secure payment terms (e.g., LC, Escrow, or 30/70 split) |

| No product certifications or test reports | Non-compliance with EU/US safety standards (e.g., REACH, CPSIA) | Require lab test reports from accredited third parties |

| Claims to be a “factory” but cannot provide machinery or workforce details | Likely a trading company misrepresenting capabilities | Conduct unannounced audit or request employee ID verification |

| No client references or refusal to provide samples | Lack of proven track record | Delay engagement until references and samples are validated |

Best Practices for Long-Term Success

- Partner with a Reputable Sourcing Agent: Leverage on-the-ground expertise for audits, negotiations, and quality control.

- Implement a Tiered Supplier Strategy: Use 1–2 primary factories and 1 backup to mitigate supply chain risk.

- Invest in IP Protection: File design patents in China and include IP clauses in contracts.

- Establish QC Protocols: Define AQL (Acceptable Quality Level) standards and schedule pre-shipment inspections.

- Build Relationships: Visit factories annually; foster trust for priority production and innovation collaboration.

Conclusion

Sourcing shoes from China offers significant cost and scalability advantages, but success hinges on due diligence. By systematically verifying manufacturers, distinguishing true factories from intermediaries, and avoiding common red flags, procurement managers can build resilient, compliant, and efficient supply chains. In 2026, transparency, traceability, and partnership depth will define sourcing excellence.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Supply Chain Optimization

📧 [email protected] | 🌐 www.sourcifychina.com

February 2026 – Confidential for B2B Distribution

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Optimizing Footwear Procurement from China

Prepared for Global Procurement Executives | Q1 2026 Strategic Outlook

The Critical Challenge: Time-to-Market in Footwear Sourcing

Global footwear procurement faces unprecedented volatility. Our 2025 Impact Report reveals 73% of procurement cycles exceed 120 days due to supplier vetting failures, compliance gaps, and production misalignment. For time-sensitive categories like footwear, every 30-day delay erodes 8.2% of projected gross margin (SourcifyChina Supply Chain Analytics, 2025).

Why Traditional “How to Buy Shoes from China Wholesale” Searches Fail Procurement Leaders

Generic Google searches or Alibaba browsing yield unverified suppliers, leading to:

– 47% higher risk of quality non-compliance (ISO/REACH)

– 5.2 average weeks wasted on factory audits

– 34% of orders requiring remanufacturing due to specification mismatches

The SourcifyChina Verified Pro List: Your Precision Sourcing Engine

Our AI-verified supplier ecosystem eliminates procurement friction through triple-layer validation:

| Sourcing Stage | Traditional Approach (2025 Avg.) | SourcifyChina Pro List (2026) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8.7 weeks | 2.1 weeks | 6.6 weeks |

| Compliance Verification | 3 independent audits required | Pre-verified certifications | 100% |

| MOQ/Negotiation Cycle | 4.3 rounds | 1.2 rounds | 72% faster |

| First Production Run | 38% failure rate | 92% on-time compliance | 22 days |

Source: SourcifyChina 2025 Client Deployment Data (n=147 footwear procurement projects)

Your Strategic Advantage in 2026

The Pro List delivers exclusive access to:

✅ Tier-1 factories with minimum 5-year export history to EU/US markets

✅ Real-time capacity dashboards for peak-season allocation (Q3/Q4 2026)

✅ Pre-negotiated terms for LCL shipments & sustainable materials (e.g., recycled ocean plastics)

✅ Dedicated QC protocols aligned with Zara/H&M/Decathlon standards

“SourcifyChina’s Pro List cut our supplier onboarding from 19 weeks to 6 – enabling us to capture 2025 holiday demand despite port disruptions.”

– Head of Sourcing, Top 3 EU Footwear Retailer (Confidential Client, 2025)

🚀 Call to Action: Secure Your 2026 Footwear Sourcing Advantage

Time is your scarcest resource. With Q1 2026 production slots filling rapidly, delaying supplier validation risks:

⚠️ Missed pre-holiday manufacturing windows (July-Sept 2026)

⚠️ 15-22% cost inflation from last-minute supplier scrambling

Act Now to Lock In:

1. FREE Pro List Access Trial – Validated for your specific footwear category (athletic, luxury, or sustainable)

2. Dedicated Sourcing Architect – For orders >$50K USD

3. 2026 Compliance Roadmap – REACH/EPA/CPSC updates pre-loaded

→ Contact our China Sourcing Desk within 72 hours for Q1 2026 priority allocation:

📧 [email protected] (Response in <4 business hours)

📱 WhatsApp +86 159 5127 6160 (24/7 factory-floor support)

Specify “2026 FOOTWEAR PRO LIST” in your inquiry to receive:

» Supplier Shortlist Template (Pre-filtered by MOQ/certifications)

» 2026 Tariff Avoidance Checklist (US/EU customs code optimizations)

SourcifyChina – Engineering Sourcing Certainty Since 2018

Trusted by 1,200+ Global Brands | 94.7% Client Retention Rate | Zero Fraud Guarantee

This intelligence is actionable only through verified SourcifyChina channels. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.