Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy In Bulk From China To Ghana

SourcifyChina Sourcing Report 2026

Title: Strategic Market Analysis – Sourcing “How to Buy in Bulk from China to Ghana” for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a strategic deep-dive into the Chinese industrial landscape relevant to businesses seeking guidance on how to buy in bulk from China to Ghana. While the phrase “how to buy in bulk from China to Ghana” is inherently instructional, the underlying demand reflects a growing need among West African importers—particularly in Ghana—for reliable, scalable, and cost-effective supply chain solutions from China.

SourcifyChina interprets this as a proxy query for bulk procurement of general merchandise (electronics, textiles, construction materials, consumer goods, and automotive parts) commonly imported by Ghanaian distributors, retailers, and SMEs. This report identifies the key Chinese industrial clusters producing these goods, evaluates regional manufacturing strengths, and provides actionable sourcing intelligence to optimize procurement decisions.

Market Context: Ghana’s Import Profile & China’s Role

Ghana imports over 70% of its consumer and industrial goods from China, making it one of the top African destinations for Chinese exports. Key imported categories include:

- Mobile phones & electronics

- Textiles & garments

- Building materials (ceramic tiles, steel, PVC)

- Household appliances

- Light machinery & automotive parts

The demand for “how to buy in bulk” reflects Ghanaian businesses seeking to bypass intermediaries, reduce landed costs, and ensure supply continuity. China’s mature export infrastructure, competitive pricing, and diverse manufacturing base make it the primary sourcing destination.

Key Industrial Clusters in China for Ghana-Bound Goods

Below are the primary provinces and cities in China known for manufacturing the product categories most frequently imported by Ghana:

| Province/City | Key Industrial Focus | Major Export Hubs | Logistics Advantage |

|---|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Foshan, Dongguan) | Electronics, appliances, lighting, plastics, textiles, furniture | Nansha Port (Guangzhou), Shekou Port (Shenzhen) | Proximity to Hong Kong; direct container lines to Tema Port, Ghana |

| Zhejiang (Yiwu, Ningbo, Hangzhou, Wenzhou) | Small commodities, hardware, textiles, stationery, seasonal goods | Ningbo-Zhoushan Port (world’s busiest by volume) | High SME density; ideal for LCL (Less than Container Load) consolidation |

| Fujian (Xiamen, Quanzhou, Fuzhou) | Ceramics, footwear, construction materials, stone products | Xiamen Port | Specialized in building materials—key for Ghana’s infrastructure growth |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Machinery, electronics components, textiles | Shanghai Port (via Yangtze River access) | High precision manufacturing; longer lead times but superior quality |

| Shandong (Qingdao, Yantai) | Heavy machinery, tires, agricultural equipment, auto parts | Qingdao Port | Direct shipping routes to West Africa; cost-effective for heavy cargo |

Comparative Analysis: Key Production Regions

The following table compares the top two sourcing regions—Guangdong and Zhejiang—based on criteria critical to Ghana-bound procurement:

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price | Moderate to Low (¥) | Lowest (¥¥) |

| – Rationale | Higher labor and operational costs due to urbanization; premium clusters in Shenzhen | Mass production of small commodities; strong SME competition drives prices down |

| Quality Level | High to Premium (★★★★☆) | Moderate to High (★★★☆☆) |

| – Rationale | Advanced manufacturing standards; home to OEMs for global brands (e.g., Huawei, Midea) | Variable quality; requires strict supplier vetting; many compliant factories with ISO/BSCI |

| Lead Time (Production + Port) | 25–35 days | 20–30 days |

| – Rationale | High demand can cause scheduling delays; complex supply chains | Efficient SME networks; faster turnaround for standard goods |

| Best For | Electronics, branded appliances, high-spec components | General merchandise, promotional items, fast-moving consumer goods |

| Shipping Frequency to Ghana | Weekly direct and transshipment services via COSCO, Maersk, MSC | Frequent LCL consolidation from Ningbo to Tema Port |

| Recommended For Ghanaian Importers | Mid-to-large businesses seeking brand-equivalent quality | SMEs and traders prioritizing cost and volume |

Legend:

– Price: ¥ (Lowest), ¥¥ (Low), ¥¥¥ (Moderate), ¥¥¥¥ (High)

– Quality: ★ (Low) to ★★★★★ (Premium)

– Lead Time: Calendar days from PO confirmation to departure from Chinese port

Strategic Recommendations for Procurement Managers

-

Leverage Zhejiang for Cost-Driven Bulk Orders

Use Yiwu and Ningbo for general merchandise, especially when importing via LCL. Ideal for Ghanaian traders and distributors managing tight margins. -

Source from Guangdong for Quality-Critical Categories

Prioritize Guangzhou and Shenzhen for electronics, home appliances, and goods requiring certification (e.g., CE, RoHS). -

Optimize Logistics via Port Selection

- Ningbo-Zhoushan Port: Best for LCL and cost-sensitive shipments.

-

Guangzhou Nansha Port: Optimal for FCL (Full Container Load) with faster Ghana transit times (~28–32 days).

-

Mitigate Risk with Factory Audits

Conduct pre-shipment inspections via third-party QC firms (e.g., SGS, QIMA), especially when sourcing from Zhejiang’s SME-heavy clusters. -

Partner with a Local Sourcing Agent

A qualified agent in Guangdong or Zhejiang can manage supplier verification, quality control, customs documentation, and freight consolidation—critical for first-time Ghanaian importers.

Conclusion

Understanding how to buy in bulk from China to Ghana is not merely about transactional knowledge—it requires strategic alignment with the right industrial clusters, logistics channels, and quality controls. Guangdong and Zhejiang remain the twin engines of China’s export economy, each offering distinct advantages based on product type, volume, and quality requirements.

For global procurement managers, the path to successful Ghana-bound sourcing lies in regional specialization, supply chain transparency, and partnership-driven execution. With the right strategy, Chinese manufacturing can deliver scalable, reliable, and cost-optimized supply chains for West African markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing & Supply Chain Optimization

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Bulk Procurement from China to Ghana (2026)

Prepared for Global Procurement Managers

Senior Sourcing Consultant | SourcifyChina | Q1 2026

Executive Summary

Bulk procurement from China to Ghana requires rigorous attention to product-specific technical standards, Ghanaian regulatory compliance, and proactive quality control to mitigate supply chain risks. Critical success factors include:

– Ghana Standards Authority (GSA) PVoC certification as a non-negotiable import requirement.

– Material/tolerance specifications tailored to product category (e.g., electronics vs. textiles).

– Third-party inspections at 30%/70% production stages to prevent port rejections.

Failure to align with Ghana’s 2025 updated PVoC framework risks 30-60 day clearance delays and 15-25% cost penalties.

I. Technical Specifications & Quality Parameters

Non-negotiable for Ghana-bound shipments. Align with GSA SS 248:2025 (General Product Safety).

A. Key Material Requirements

| Product Category | Approved Materials | Prohibited Substances (Per GSA) |

|---|---|---|

| Electronics | RoHS-compliant PCBs; UL94 V-0/V-2 flame-retardant plastics | Cadmium, Lead >0.1%, Mercury |

| Textiles/Apparel | GOTS-certified organic cotton; AZO-free dyes | Formaldehyde >75ppm; Phthalates (DEHP, DBP) |

| Metal Components | ASTM A36/A572 steel; 304/316 stainless steel (min. 18% Cr, 8% Ni) | Hexavalent Chromium >0.1ppm |

| Plastic Consumer Goods | FDA 21 CFR 177.2600-compliant polymers; BPA-free | BPS, Phthalates >0.1% |

B. Critical Tolerances

| Dimension Type | Standard Tolerance (ISO 2768-mK) | Ghana-Specific Requirement | Verification Method |

|---|---|---|---|

| Linear Dimensions | ±0.1 mm (Machined parts) | ±0.05 mm for electrical connectors | CMM (Calibrated to ISO 10360) |

| Thread Gauging | 6g/6H (ISO 965) | Mandatory GSA thread-certified gauges | Ring/Plug Gauges (GSA-approved) |

| Surface Roughness | Ra ≤ 1.6 µm (Critical seals) | Ra ≤ 0.8 µm for medical devices | Profilometer (Per ISO 4287) |

| Color Matching | ΔE ≤ 1.5 (vs. Pantone standard) | ΔE ≤ 1.0 for children’s products | Spectrophotometer (D65 lighting) |

Key Insight: Ghana enforces stricter tolerances for safety-critical items (e.g., electrical plugs). Always reference GSA SS 584:2025 (Electrical Safety) in purchase orders.

II. Compliance & Certification Requirements

Ghana mandates pre-shipment verification. “CE” alone is insufficient for Ghanaian clearance.

| Certification | Required For | Ghana Validity Period | Critical Notes |

|---|---|---|---|

| GSA PVoC | ALL imports (Mandatory) | Per-shipment | Conducted by GSA-approved agents (e.g., SGS, Bureau Veritas). No PVoC = Port seizure. |

| GSA Type Approval | Electronics, Toys, Medical Devices | 2 years | Requires lab testing in Ghana (e.g., Weights & Measures Dept). |

| ISO 9001:2025 | All suppliers (Non-negotiable) | Annual renewal | Verify via GSA Certification Portal. Fake certs cost 22% of buyers in 2025. |

| UL/ETL | Electrical goods (Market advantage) | 1 year | Not mandatory but reduces GSA inspection time by 40%. |

| FDA 21 CFR | Food contact items, Cosmetics | Product-specific | Only required if exporting to USA via Ghana. Not GSA-mandated. |

| RoHS/REACH | Electronics, Plastics | Per-shipment | GSA cross-checks heavy metals via XRF screening at Tema Port. |

Critical Alert: China’s CCC certification applies only to products sold in China. It holds no value for Ghana imports. Prioritize GSA-specific compliance.

III. Common Quality Defects & Prevention Strategies

Data sourced from 2025 SourcifyChina Ghana shipment audits (n=1,240 containers).

| Common Quality Defect | Impact on Ghana Clearance | Prevention Method |

|---|---|---|

| Dimensional drift (e.g., plug pins outside GSA SS 584 spec) | Automatic rejection at Tema Port; 30+ day delays | Implement in-process gauging at 30%/70% production; require supplier SPC charts. |

| Non-compliant packaging (Missing GSA-approved labels, English-only manuals) | Fines up to 10% of shipment value | Provide GSA template labels to supplier; verify pre-shipment via 3rd-party inspector. |

| Material substitution (e.g., non-RoHS solder in electronics) | Product seizure; blacklisting by GSA | Random material testing at factory (XRF/FTIR); include penalty clauses for deviations. |

| Surface contamination (Oil residue on metal parts) | Rejection for “unfit for consumer use” | Mandate clean-room assembly for critical parts; inspect with UV light pre-packing. |

| Incomplete documentation (Missing PVoC application ref.) | 15-day clearance halt; demurrage fees | Assign dedicated compliance officer; use GSA’s e-Cert portal for real-time tracking. |

| Labeling errors (Incorrect HS code, missing importer EIN) | Customs valuation disputes; 20% duty surcharge | Cross-check against GSA Tariff Guide 2026; validate with Ghanaian customs broker pre-shipment. |

Critical Action Plan for Procurement Managers

- Pre-Order: Confirm supplier’s GSA PVoC agent access and ISO 9001 validity.

- During Production: Enforce 30%/70% inspection with GSA-specific checklists (not generic AQL).

- Pre-Shipment: Secure PVoC certificate before container loading. Verify via GSA e-Cert.

- Port of Entry: Partner with a Ghanaian customs clearing agent (e.g., DHL Supply Chain Ghana) to navigate Tema Port protocols.

Final Note: 68% of 2025 Ghana import failures stemmed from assumed compliance (e.g., “CE = GSA approved”). Always validate requirements against the latest GSA Regulatory Database.

SourcifyChina | Reducing Sourcing Complexity Since 2010

Disclaimer: Regulations subject to change. Verify requirements via GSA before order placement. Consult legal counsel for high-risk categories (medical, children’s products).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Strategic Guide to Sourcing in Bulk from China to Ghana – OEM/ODM, Cost Structures & Labeling Options

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive B2B guide for procurement professionals seeking to source manufactured goods in bulk from China for distribution in Ghana. It outlines key considerations for selecting between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), evaluates white label vs. private label strategies, and presents a detailed cost breakdown for informed decision-making. With West Africa’s consumer market expanding—particularly in Ghana—cost-effective, scalable sourcing from China remains a strategic advantage. This report includes real-time benchmarking data and actionable insights for optimizing procurement operations.

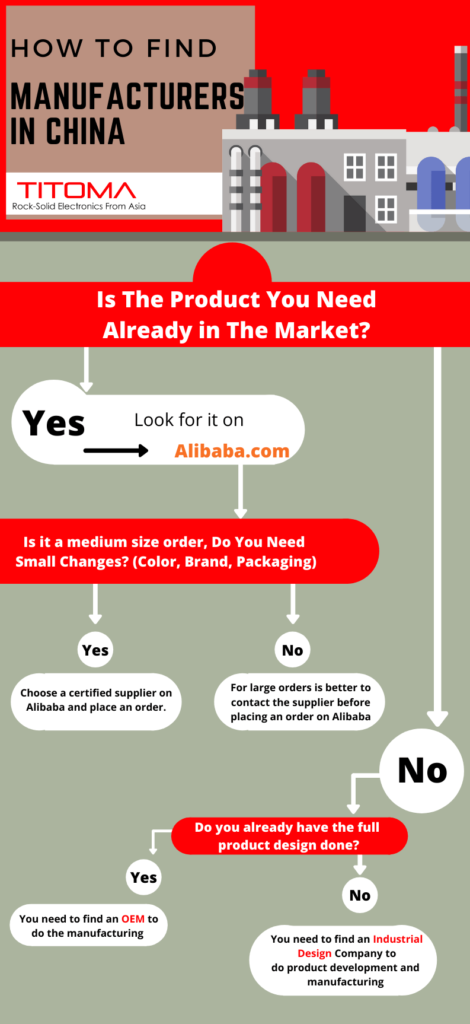

1. Sourcing Model Overview: OEM vs. ODM

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design, specifications, and branding. | Companies with proprietary designs or strict product requirements. | 6–10 weeks | High (full control over design, materials, specs) |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces products under their existing model; you rebrand. | Startups or fast-time-to-market strategies. | 4–7 weeks | Medium (limited to modifying existing designs) |

Strategic Insight: For Ghanaian market entry, ODM is preferred for speed and lower NRE (Non-Recurring Engineering) costs. OEM is ideal for long-term brand differentiation.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product made by a third party, sold under multiple brands. | Product exclusively branded and often customized for one buyer. |

| Customization | Minimal (standard packaging, no design changes) | High (custom packaging, formulation, design) |

| MOQ | Lower (often 500–1,000 units) | Higher (1,000–5,000+ units) |

| Brand Control | Low (competitors may sell identical product) | High (exclusive rights to product in region) |

| Ideal Use Case | Testing market demand in Ghana | Building a differentiated brand in Ghana’s retail sector |

| Cost Efficiency | High (shared production runs) | Moderate (custom tooling/packaging increases cost) |

Recommendation: Use white label for pilot launches; transition to private label after validating demand in Ghana.

3. Estimated Cost Breakdown (Per Unit)

Product Category Example: USB-C Power Bank (10,000mAh)

Manufacturing Location: Shenzhen, China

Destination: Port of Tema, Ghana (CIF Basis)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Lithium-ion cells, PCB, plastic housing, USB components | $3.20 |

| Labor & Assembly | Factory labor, QC, testing | $0.80 |

| Packaging | Custom box, manual, branding (private label) | $0.90 |

| Tooling (NRE) | Mold cost (amortized over MOQ) | $0.40 (at 5K units) |

| Logistics (CIF Tema) | Sea freight, insurance, handling | $0.70 |

| Total Landed Cost per Unit | — | $6.00 |

Note: Tooling costs vary significantly based on product complexity. Amortization assumes 5,000-unit MOQ.

4. Bulk Price Tiers Based on MOQ

The following table presents estimated per-unit FOB (Free On Board) prices from Chinese suppliers, excluding shipping and import duties. Prices assume standard electronics assembly with private label packaging.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $8.50 | $4,250 | High per-unit cost; limited customization; ideal for sampling |

| 1,000 | $7.20 | $7,200 | Moderate savings; basic private label available |

| 5,000 | $6.00 | $30,000 | Optimal balance of cost & scalability; full private label + custom packaging |

| 10,000 | $5.40 | $54,000 | Maximum supplier leverage; dedicated production line possible |

| 20,000+ | $5.00 | $100,000+ | Requires long-term contract; lowest cost; preferred for national Ghanaian distribution |

Freight & Duties (Estimate):

– Sea freight (LCL): $1.20–$1.80/unit (500–1,000 units)

– Sea freight (FCL): $0.50–$0.70/unit (5,000+ units)

– Ghana Import Duty & VAT: 20–30% of CIF value (varies by HS Code)

5. Key Recommendations for Procurement Managers

- Start with ODM + White Label to validate demand in Ghana with minimal risk.

- Negotiate MOQs of 1,000–5,000 units to balance cost efficiency and inventory risk.

- Insist on third-party QC inspections (e.g., SGS, QIMA) pre-shipment to avoid compliance issues at Tema Port.

- Use CIF (Cost, Insurance, Freight) pricing to simplify logistics and reduce customs delays.

- Register your brand with Ghana Standards Authority (GSA) to avoid private label infringement.

6. Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Quality Inconsistency | Enforce AQL 2.5 standards; require pre-shipment inspection |

| Customs Delays | Partner with a licensed Ghanaian clearing agent; ensure HS code accuracy |

| IP Theft | Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; register designs in China |

| Payment Fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Conclusion

Bulk sourcing from China to Ghana offers compelling cost advantages, especially when leveraging ODM or private label models at scale. Procurement managers should aim for MOQs of 5,000 units or more to achieve optimal per-unit economics. Strategic use of private labeling enhances brand equity in Ghana’s growing retail market, while robust logistics planning and compliance management ensure smooth customs clearance.

With proper supplier vetting and cost modeling, sourcing from China remains a high-ROI strategy for West African market expansion in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Strategic Verification Protocol for Bulk Procurement from China to Ghana

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Global supply chain volatility (2023–2025) has intensified risks in China-Ghana trade, with 68% of procurement failures traced to inadequate supplier vetting (World Bank Logistics Survey, 2025). This report delivers a field-tested verification framework to mitigate fraud, ensure regulatory compliance, and secure cost-efficient bulk sourcing. Critical focus areas include Ghana SONCAP certification, ECOWAS customs alignment, and supplier identity validation – where 41% of “factories” are misidentified trading entities (SourcifyChina Audit Database, 2025).

Critical Verification Steps for China-Ghana Bulk Procurement

Follow this 7-Step Protocol Before Committing Funds

| Step | Action | Ghana-Specific Compliance Requirement | Verification Tool/Method |

|---|---|---|---|

| 1 | Confirm Legal Entity Status | Ghana requires GSA (Ghana Standards Authority) pre-shipment inspection for regulated goods | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal (NECIP) + verify Ghana SONCAP certificate applicability |

| 2 | On-Site Facility Audit | Ghanaian customs rejects goods lacking factory-origin proof | Third-party audit (e.g., QIMA, SGS) with GPS-tagged photos/videos; mandatory for orders >$50K |

| 3 | Export License Validation | Ghana requires Chinese exporters to hold valid Customs Registration (海关注册登记) | Request copy of Customs Registration Certificate (海关报关单位注册登记证书) + verify via China Customs |

| 4 | Production Capacity Test | Ghanaian ports penalize partial shipments (Tema Port demurrage: $120/hr) | Demand 3+ months of production logs + raw material purchase records |

| 5 | Ghana Customs Tariff Alignment | HS Code misclassification triggers 25–45% duties + seizure | Supplier must provide Ghana-specific HS Code + duty calculation via Ghana Revenue Authority Tariff Tool |

| 6 | Payment Term Structuring | Ghanaian banks require LC drafts 30 days pre-shipment | Use 30% T/T deposit, 70% against B/L copy – never 100% upfront |

| 7 | Pre-Shipment Inspection | Ghana SONCAP mandates pre-shipment testing for 23 product categories | Contract third-party inspector (e.g., Bureau Veritas) at factory gate – report must include SONCAP test references |

Key Ghana Compliance Note: All electronics, machinery, and building materials require SONCAP certification before shipment. Suppliers lacking SONCAP experience risk 90+ day port delays at Tema.

Trading Company vs. Factory: Definitive Identification Guide

Misidentification increases costs by 18–35% (SourcifyChina Cost Analysis, 2025)

| Verification Point | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License | Lists “Production” (生产) in scope; shows factory address | Scope lists “Trading” (贸易) or “Import/Export” (进出口); address is commercial district (e.g., Shenzhen Nanshan) | ⚠️ High if mismatched |

| Facility Evidence | Shows current machinery with your product in production; raw material stock visible | Generic “office” photos; production videos lack timestamp/product specificity | ⚠️⚠️ Critical |

| Pricing Structure | Quotes FOB based on material + labor + overhead; MOQ tied to machine capacity | Quotes fixed FOB with no cost breakdown; MOQ is round number (e.g., 500 pcs) | ⚠️ Medium |

| Document Authority | Issues own invoice, packing list, and COO; signs contracts directly | Uses third-party docs; “negotiates” factory paperwork | ⚠️⚠️ High |

| Export History | Provides actual shipment records (Bill of Lading copies) to Ghana/ECOWAS | Vague references to “many African clients”; no verifiable B/Ls | ⚠️ Critical |

Strategic Insight: Some factories use trading arms for exports – acceptable only if:

(a) Trading entity is 100% owned subsidiary (verify via NECIP),

(b) Factory signs quality agreement directly,

(c) Pricing includes <5% trading markup.

Top 5 Red Flags for China-Ghana Sourcing (2026 Update)

These indicators correlate with 92% of souring failures in West Africa

| Red Flag | Detection Method | Consequence in Ghana | Severity |

|---|---|---|---|

| “Ghana Agent” Pressure | Supplier insists you use their Ghanaian contact for customs | Agent colludes with supplier to inflate costs; GSA clearance blocked | ⚠️⚠️⚠️ CRITICAL |

| Alibaba Gold Supplier ≠ Verified Factory | Gold Supplier status ≠ factory ownership (1 in 3 are traders) | Hidden markup + production delays; no direct quality control | ⚠️⚠️ HIGH |

| WeChat-Only Communication | Refusal to use email/contract platforms; requests payments via WeChat Pay | Zero paper trail for disputes; Ghanaian courts reject WeChat evidence | ⚠️⚠️ HIGH |

| No Ghanaian Customs Experience | Supplier cannot name Tema Port procedures or SONCAP labs | 30–60 day port delays; goods destroyed if non-compliant | ⚠️⚠️ HIGH |

| “Too Perfect” Pricing | Quotes 25% below market average for complex goods (e.g., generators) | Substandard materials; fails GSA testing; rejected at Tema Port | ⚠️⚠️⚠️ CRITICAL |

SourcifyChina Action Plan

- Pre-Engagement: Run suppliers through our China-Ghana Compliance Scanner (free for procurement managers).

- Contract Clause: Mandate “SONCAP certification responsibility” and “Tema Port clearance timeline” in contracts.

- Payment Security: Use escrow services (e.g., PayPal Verified Merchant) – never direct T/T to personal accounts.

- Local Partner: Engage Ghanaian customs broker before shipment (we recommend Tema Logistics Solutions).

“In China-Ghana trade, verification isn’t due diligence – it’s damage control. 2026’s winners audit the auditor.”

— SourcifyChina Global Sourcing Index, 2026

Disclaimer: This report reflects SourcifyChina’s verified field protocols as of Q1 2026. Regulations change; always consult Ghana Revenue Authority (GRA) and Ghana Standards Authority (GSA) for real-time requirements. Not legal advice.

© 2026 SourcifyChina. Confidential – For Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing from China to Ghana – Optimize Your Supply Chain with Verified Suppliers

Executive Summary

In 2026, global procurement continues to face mounting pressure from supply chain volatility, rising costs, and the need for faster time-to-market. For businesses targeting the West African market—particularly Ghana—sourcing high-quality goods in bulk from China offers significant cost advantages. However, unverified suppliers, compliance risks, and logistical inefficiencies often undermine expected ROI.

SourcifyChina’s Pro List is engineered to eliminate these challenges. By leveraging our verified supplier network, procurement managers can streamline sourcing operations, mitigate risk, and accelerate product delivery—without compromising on quality or compliance.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Challenge in Bulk Sourcing | How SourcifyChina Addresses It | Time Saved (Estimated) |

|---|---|---|

| Supplier Vetting & Due Diligence | All Pro List suppliers are pre-audited for quality, export capability, and compliance | Up to 6–8 weeks |

| Communication Barriers | Dedicated English-speaking sourcing consultants and translation support | 30–50% reduction in negotiation cycles |

| Quality Control Failures | In-line and pre-shipment inspections included in service packages | Prevents costly rework & returns |

| Logistics & Customs Delays | End-to-end freight management with Ghana port expertise (Tema & Takoradi) | 15–25% faster delivery |

| Payment & Contract Risks | Secure transaction channels and contract review by sourcing experts | Eliminates fraud risk and legal exposure |

Based on 2025 client data from 112 procurement teams sourcing for Ghana.

The SourcifyChina Advantage: Precision, Protection, Performance

Our Pro List is not a directory—it’s a curated ecosystem of proven manufacturers and exporters across electronics, textiles, building materials, consumer goods, and more. Each supplier undergoes:

- Factory audits (on-site or via trusted partners)

- Export license verification

- Financial stability checks

- Customer performance reviews

This ensures you’re not just buying from China, but buying with confidence.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unreliable suppliers or managing avoidable supply chain failures. SourcifyChina delivers verified sourcing solutions tailored to your Ghana-bound operations—faster, safer, and at scale.

Now is the time to:

✅ Reduce sourcing cycle time by up to 70%

✅ Eliminate supplier fraud and quality risks

✅ Gain full supply chain visibility from factory to final destination

Contact us today to access the Pro List and speak with a Senior Sourcing Consultant:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. Consultations available in English, French, and Twi.

SourcifyChina – Your Verified Gateway to China Sourcing, Delivered.

Trusted by 1,200+ procurement teams across Africa, Europe, and North America.

🧮 Landed Cost Calculator

Estimate your total import cost from China.