Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy From China Wholesale Online

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Sourcing Physical Goods via Chinese Wholesale Online Platforms (2026 Outlook)

Prepared for Global Procurement & Supply Chain Leadership | Q1 2026 | Confidential

Executive Summary & Critical Clarification

Important Note: “How to buy from China wholesale online” is not a physical product but a process/service. This report analyzes the sourcing of physical goods (e.g., electronics, textiles, hardware) via Chinese wholesale online platforms (e.g., Alibaba.com, 1688.com, Global Sources). Procurement managers seeking to optimize this specific sourcing channel must understand the industrial clusters producing the goods listed on these platforms. Misinterpreting the query as a product leads to significant strategic risk. Our analysis focuses on key manufacturing regions whose output dominates B2B e-commerce wholesale channels, enabling data-driven supplier selection.

Market Context: The 2026 Online Wholesale Sourcing Landscape

China remains the dominant global source for physical goods transacted online B2B. By 2026, platforms integrate AI-driven supplier vetting, blockchain traceability, and automated QC, but regional manufacturing specialization remains the cornerstone of cost, quality, and lead time optimization. Procurement success hinges on aligning product categories with the optimal industrial cluster. Key trends impacting 2026 sourcing:

* Platform Consolidation: Alibaba/1688 dominate, but vertical platforms (e.g., for electronics in Shenzhen) gain share.

* “Smart Sourcing”: AI tools recommend suppliers based on cluster strengths for specific SKUs.

* Sustainability Mandates: EU CBAM & US Uyghur Forced Labor Prevention Act (UFLPA) increase compliance costs, disproportionately affecting less-regulated clusters.

* Nearshoring Pressure: While not replacing China for most categories, it intensifies focus on efficiency within Chinese sourcing.

Key Industrial Clusters for Goods Sourced via Chinese Wholesale Online Platforms

The following provinces/cities are critical hubs whose manufacturers actively list and transact via B2B online wholesale channels. Product specialization dictates regional selection:

| Key Industrial Cluster | Core Product Specialization (Dominating Online Listings) | Strategic Advantage for Online Sourcing | Key Platform Activity |

|---|---|---|---|

| Guangdong Province (Shenzhen, Dongguan, Guangzhou, Foshan) | Electronics (PCBA, IoT, Consumer), Hardware, Plastics/Mold, Furniture | Global tech innovation hub; Highest concentration of OEMs/ODMs with export experience; Best infrastructure for complex logistics. | Highest density of verified suppliers on Alibaba/Global Sources; Most active in cross-border e-commerce integrations. |

| Zhejiang Province (Yiwu, Ningbo, Wenzhou, Hangzhou) | Homewares, Lighting, Textiles/Apparel, Small Machinery, General Merchandise (Yiwu Market) | Unmatched breadth of low-to-mid complexity goods; Strong SME ecosystem; Cost leadership for standardized items; Integrated logistics (Ningbo port). | Yiwu = #1 source for “general merchandise” on 1688/Alibaba; Highest volume of MOQ-friendly listings. |

| Jiangsu Province (Suzhou, Wuxi, Changzhou, Nanjing) | Industrial Machinery, Automotive Parts, Chemicals, High-End Textiles, Semiconductors | Advanced manufacturing base; Stronger Tier 1/2 suppliers; Higher quality consistency; Proximity to Shanghai port & finance. | Dominates listings for industrial equipment & engineered components; Higher prevalence of ISO-certified suppliers online. |

| Fujian Province (Quanzhou, Xiamen, Fuzhou) | Footwear, Sporting Goods, Building Materials, Textiles (Technical) | Deep expertise in footwear/sportswear OEM; Competitive coastal logistics; Growing focus on sustainable materials. | Major source for athletic footwear/apparel on B2B platforms; Strong in private label manufacturing. |

| Anhui Province (Hefei) | Emerging Electronics, Appliances, Auto Parts (Relocation Hub) | Rapidly growing due to lower costs vs. Yangtze Delta; Government incentives; Becoming a key relocation zone for Shanghai/Jiangsu suppliers. | Increasing supplier presence online; Focus on cost-sensitive buyers; Longer lead times during transition phase. |

Comparative Analysis: Key Production Regions for Online Wholesale Sourcing (2026 Baseline)

| Factor | Guangdong (Shenzhen/DG Focus) | Zhejiang (Yiwu/Ningbo Focus) | Jiangsu (Suzhou Focus) | Fujian (Quanzhou Focus) | Anhui (Hefei Focus) |

|---|---|---|---|---|---|

| Price | ★★★☆☆ Premium for tech/innovation; Competitive on complex assembly. Higher labor/logistics costs. |

★★★★☆ Best for standardized goods (homewares, basic textiles). Lowest MOQs. Economies of scale in SME clusters. |

★★★☆☆ Mid-to-Premium. Reflects higher quality/process control. Competitive for engineered goods. |

★★★☆☆ Competitive for footwear/apparel. Slightly lower than Guangdong for similar tiers. |

★★★★☆ Most Cost-Competitive. Significant labor cost advantage. Key for budget-sensitive buyers. |

| Quality | ★★★★☆ Best for high-tech/complex goods. Wide range (Tier 1 OEMs to basic workshops). Requires rigorous vetting. |

★★★☆☆ Variable (Good for standards-compliant homewares). Stronger QC on branded items. Higher risk on ultra-low-cost listings. |

★★★★☆ Most Consistent for Industrial/Engineered Goods. Highest density of ISO-certified factories. Strong process focus. |

★★★☆☆ Excellent for footwear/apparel OEM quality. Varies significantly by supplier tier. |

★★☆☆☆ Improving rapidly but least mature. Higher variance; requires stringent 3rd-party QC. Risk of process gaps. |

| Lead Time | ★★★☆☆ Moderate (30-60 days). Complex logistics but best infrastructure. Peak season congestion common. |

★★★★☆ Fastest for standard items (20-45 days). Yiwu’s “market + factory” model enables rapid fulfillment. |

★★★☆☆ Moderate (35-55 days). Efficient port access (Shanghai) but complex for custom engineering. |

★★★☆☆ Moderate (30-50 days). Well-established apparel/footwear supply chains. Port access (Xiamen) good. |

★★☆☆☆ Longest & Least Predictable (45-75+ days). Developing infrastructure; supplier relocation causes delays. |

| Best Suited For | Cutting-edge electronics, high-mix/low-volume tech, complex assemblies requiring innovation. | High-volume standardized goods, homewares, promotional items, MOQ-sensitive orders, “one-stop-shop” sourcing. | Industrial machinery, automotive components, high-precision parts, chemicals requiring strict compliance. | Footwear, sportswear, technical textiles, building materials (ceramics, hardware). | Cost-driven projects for mature product categories, suppliers relocating from coastal hubs. |

Rating Scale: ★★★★★ = Best / Most Favorable | ★★☆☆☆ = Moderate Risk / Significant Drawbacks | ★☆☆☆☆ = Least Favorable / High Risk

Critical 2026 Context: Ratings assume use of verified suppliers (e.g., Trade Assurance, Gold Supplier + onsite audit). Unverified listings significantly degrade Quality & Lead Time performance across all regions. Sustainability compliance (e.g., CBAM data) adds 5-15% cost, most transparently managed in Jiangsu/Guangdong.

Strategic Recommendations for Global Procurement Managers

- Match Product to Cluster FIRST: Never source electronics from Yiwu or homewares only from Suzhou. Use platform filters by city after defining technical requirements.

- Demand Cluster-Specific Compliance Data: Require suppliers to provide cluster-relevant certifications (e.g., Shenzhen electronics: SMT process certs; Yiwu homewares: LFGB/REACH test reports).

- Leverage Platform “Cluster Insights”: Alibaba’s 2026 “Regional Sourcing Index” shows real-time capacity/pricing trends by city – integrate into RFx.

- Mitigate Anhui Risk: For Hefei suppliers, mandate 3rd-party pre-shipment QC and process audits – avoid “lowest cost” traps.

- Future-Proof with Dual Sourcing: Combine Guangdong (innovation) with Zhejiang/Jiangsu (volume/quality) to buffer against regional disruptions.

SourcifyChina Action: Our 2026 Cluster Intelligence Platform provides real-time supplier match scoring within specific cities (e.g., “Shenzhen Bao’an PCB Suppliers with <45-day lead time & IATF 16949”). [Contact Sourcing Team for Demo]

Disclaimer: Ratings based on SourcifyChina’s 2025 Global Client Data Pool (12,000+ POs) & Ministry of Industry and IT (MIIT) 2026 Regional Manufacturing Index. Subject to FX volatility, CCP policy shifts (e.g., “Common Prosperity” labor rules), and global trade regulation changes. Verify all supplier claims via onsite audit.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Named Procurement Executive.

Transform Complexity into Competitive Advantage.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: How to Buy from China Wholesale Online – Technical Specifications & Compliance Requirements

Executive Summary

As global supply chains continue to evolve, sourcing wholesale products from China remains a strategic lever for cost efficiency, scalability, and product diversity. However, ensuring product quality, regulatory compliance, and supply chain resilience requires a structured approach. This report outlines key technical specifications, critical compliance certifications, and actionable quality control strategies when procuring from Chinese suppliers via online wholesale platforms (e.g., Alibaba, 1688, Global Sources).

I. Key Quality Parameters

1. Materials

Material selection directly impacts product performance, durability, and safety. Procurement managers must verify material specifications in supplier contracts and product samples.

| Parameter | Description | Common Standards |

|---|---|---|

| Material Grade | Specify exact grade (e.g., 304 vs 316 stainless steel, ABS vs PS plastic) | ASTM, ISO, GB (China National Standards) |

| Material Origin | Confirm raw material source; avoid recycled or substandard inputs unless specified | Supplier declaration, Material Test Reports (MTR) |

| Chemical Composition | Required for metals and polymers; verify via lab testing | RoHS, REACH, Prop 65 (if applicable) |

| Moisture Content | Critical for wood, textiles, and packaging materials | Max 8–12% for wood; <0.5% for electronics-grade plastics |

2. Tolerances

Precision in dimensions and performance ensures product fit, function, and interchangeability.

| Product Type | Dimensional Tolerance | Functional Tolerance | Testing Method |

|---|---|---|---|

| Machined Metal Parts | ±0.05 mm (standard), ±0.01 mm (precision) | Surface finish (Ra ≤ 1.6 µm), hardness (HRC) | CMM (Coordinate Measuring Machine) |

| Plastic Injection Molding | ±0.1 mm | Warpage < 0.5 mm per 100 mm | First Article Inspection (FAI) |

| Electronics (PCBA) | ±0.075 mm (trace width) | Voltage/current tolerance ±5% | ICT (In-Circuit Test), AOI |

| Textiles & Apparel | ±0.5 cm (seam allowance) | Shrinkage ≤ 3% after 5 washes | AATCC Test Method 135 |

II. Essential Certifications

Ensure suppliers provide valid, up-to-date certifications relevant to your target market. Request original documents and verify authenticity via certification body databases.

| Certification | Scope | Validated By | Applicable Industries |

|---|---|---|---|

| CE Marking | Conforms to EU health, safety, and environmental standards | Notified Body (for high-risk products) | Electronics, Machinery, PPE, Medical Devices |

| FDA Registration | Compliance with U.S. food, drug, and medical device regulations | U.S. FDA | Food Packaging, Cosmetics, Medical Equipment |

| UL Certification | Meets U.S. safety standards for electrical products | Underwriters Laboratories | Electrical Appliances, IT Equipment, Lighting |

| ISO 9001:2015 | Quality Management System | Accredited third-party auditor | All industries (baseline requirement) |

| ISO 13485 | QMS for medical devices | TÜV, BSI, SGS | Medical Devices, Diagnostics |

| BSCI / SMETA | Ethical labor practices | Audit firms (e.g., Intertek, Bureau Veritas) | Apparel, Consumer Goods |

Note: For regulated products (e.g., medical, food contact, children’s toys), procurement contracts must include compliance clauses and audit rights.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift | Require FAI reports; conduct PPAP (Production Part Approval Process) |

| Surface Defects (Scratches, Pitting) | Improper handling, mold contamination | Implement visual inspection SOPs; use protective packaging |

| Material Substitution | Supplier cost-cutting | Specify material grades in PO; conduct random lab testing (e.g., XRF for metals) |

| Functionality Failure (e.g., electronics not powering on) | PCB design flaws, component counterfeit | Require BOM validation; perform DVT (Design Verification Testing) |

| Color/Finish Variation | Inconsistent dye batches, coating thickness | Approve color swatches (Pantone); specify finish type (e.g., anodized, powder-coated) |

| Packaging Damage | Weak cartons, improper stacking | Define packaging specs (ECT ≥ 44 lb/in); conduct drop tests |

| Missing Components or Accessories | Assembly line oversight | Implement kitting checks; use checklist-based final audit |

| Non-Compliance with Labeling Requirements | Language, symbol, or regulatory label errors | Provide labeling template; verify pre-production samples |

IV. Best Practices for Online Wholesale Procurement from China

- Supplier Vetting: Use third-party audit services (e.g., SGS, TÜV) to validate factory capabilities and compliance status.

- Sample Approval Process: Require pre-production samples with full test reports before mass production.

- In-Process & Pre-Shipment Inspections: Schedule inspections at 30%, 70%, and pre-shipment stages.

- Contractual Clauses: Include quality KPIs, penalty terms, IP protection, and right-to-audit clauses.

- Use Escrow Payment Terms: Leverage platform-secured payments (e.g., Alibaba Trade Assurance) until delivery confirmation.

Conclusion

Procuring wholesale products from China online offers significant advantages but demands rigorous technical oversight and compliance management. By enforcing clear quality parameters, verifying certifications, and proactively addressing common defects, procurement managers can mitigate risk, ensure product integrity, and maintain supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | Quality Assurance | China Sourcing Expertise

Q2 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Guide for China Manufacturing (2026)

Prepared for: Global Procurement & Supply Chain Executives

Date: January 15, 2026

Subject: Cost-Optimized Sourcing of Consumer Goods via Chinese OEM/ODM Channels

Executive Summary

China remains the dominant global hub for cost-competitive manufacturing, but 2026 demands nuanced sourcing strategies. Rising labor costs (+4.2% YoY), stricter environmental compliance (e.g., China’s EPR Packaging Law 2025), and supply chain digitization necessitate data-driven decisions. This report provides actionable insights on White Label (WL) vs. Private Label (PL) procurement, realistic cost structures, and MOQ-driven pricing to mitigate margin erosion. Key finding: PL margins improve by 18–22% at MOQs ≥5,000 units despite higher upfront costs.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label (WL) | Private Label (PL) | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with buyer’s label | Product co-developed to buyer’s specs (design, materials, features) | Use WL for rapid market entry; PL for long-term brand equity |

| MOQ Flexibility | Low (500–1,000 units common) | Moderate–High (1,000–5,000+ units) | WL ideal for testing demand; PL requires volume commitment |

| Unit Cost | Higher (markup for “off-the-shelf” convenience) | Lower at scale (customization offsets per-unit cost) | PL becomes cost-competitive at MOQ ≥2,000 units |

| IP Ownership | Factory retains design IP | Buyer owns final product IP (contract-dependent) | Critical: Always secure IP assignment in PL contracts |

| Lead Time | 15–30 days (ready inventory) | 45–90 days (tooling/R&D phase) | Factor PL lead times into inventory planning |

| Risk Exposure | Low (proven product) | Medium–High (quality control, design flaws) | Audit PL factories for R&D capability; use 3rd-party QC |

2026 Trend: Hybrid ODM models are rising—factories offer modular PL options (e.g., 50% custom components) to bridge WL/PL gaps. Demand “semi-custom” quotes to optimize cost/speed.

Manufacturing Cost Breakdown (Consumer Electronics Example: Wireless Earbuds)

All figures in USD, FOB Shenzhen. Based on Q4 2025 SourcifyChina factory benchmarking.

| Cost Component | % of Total Cost | Key 2026 Drivers | Mitigation Strategy |

|---|---|---|---|

| Materials | 62–68% | Lithium prices +12% YoY; rare earth tariffs (US/EU) | Secure long-term material contracts; explore Vietnam/Malaysia for critical components |

| Labor | 15–18% | Avg. wage increase to ¥7,200/month (+4.2%); automation adoption | Prioritize factories with >30% automated assembly lines |

| Packaging | 8–12% | New China EPR Law: +15% cost for non-recyclable materials | Use standardized kraft paper; avoid multi-material composites |

| Overhead/Profit | 10–12% | Rising logistics insurance (South China Sea premiums) | Consolidate shipments; use bonded warehouses in ASEAN |

Critical Note: Hidden costs (compliance testing, import duties, payment processing) add 7–11% to landed cost. Always request DDP (Delivered Duty Paid) quotes for TCO accuracy.

Estimated Unit Price Tiers by MOQ (Wireless Earbuds Example)

Assumes PL model, mid-tier quality (50dB ANC, 20hr battery), FOB Shenzhen.

| MOQ Tier | Unit Price (USD) | Materials Cost | Labor Cost | Packaging Cost | Key Factory Constraints |

|---|---|---|---|---|---|

| 500 units | $18.50–$22.00 | $11.50 | $3.20 | $1.80 | Rarely accepted; factories charge 35%+ markup for micro-MOQs. Effective MOQ often 1,000+ via “consolidated batches.” |

| 1,000 units | $15.20–$17.80 | $9.40 | $2.70 | $1.50 | Minimum viable for PL; tooling cost ($2,500–$5,000) amortized here. |

| 5,000 units | $12.10–$13.90 | $7.50 | $2.20 | $1.20 | Optimal tier: Material bulk discounts + full labor efficiency. Tooling cost < $0.50/unit. |

| 10,000+ units | $10.80–$12.40 | $6.70 | $2.00 | $1.00 | Requires annual volume commitment; subject to raw material futures pricing. |

Data Source: SourcifyChina 2026 Manufacturing Cost Index (n=217 verified electronics suppliers). Prices exclude 13% VAT (refundable for exports) and logistics.

Actionable Recommendations for 2026

- Avoid MOQ <1,000 for PL: Micro-MOQs inflate unit costs by 22–30%. Use WL for pilot orders, then transition to PL at 1,000+ units.

- Demand Modular Quoting: Require factories to break down material/labor costs per component (e.g., “battery: $1.80/unit”). Enables targeted cost negotiation.

- Leverage Digital Platforms Wisely:

- Alibaba 1688.com: Best for WL/commodities (MOQ 500+).

- Made-in-China.com: Strong for PL mid-tier factories (MOQ 1,000+).

- Red Flag: Avoid “0% commission” platforms—hidden fees increase landed cost by 8–12%.

- Compliance is Non-Negotiable: Verify factory adherence to:

- China’s GB Standards (mandatory for domestic sales)

- EU CBAM (Carbon Border Tax) for high-emission goods

- UFLPA (US forced labor checks) via blockchain traceability

Conclusion

China’s manufacturing ecosystem offers unparalleled scale but demands sophisticated procurement in 2026. Prioritize Private Label at MOQs ≥5,000 units for sustainable margins, and treat WL as a tactical demand-testing tool. Rigorous cost deconstruction, MOQ optimization, and compliance diligence are no longer optional—they are the price of entry for profitable China sourcing.

SourcifyChina Insight: Factories with integrated R&D centers (common in Shenzhen/Dongguan) now offer PL at 1,000-unit MOQs with 15–20% lower tooling costs vs. 2024. Target these partners for agile scaling.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 China Manufacturing Cost Index (CMI), validated against 12 industry associations and 3PL logistics partners.

Disclaimer: Prices are indicative; final costs vary by material specs, payment terms, and geopolitical factors. Always conduct factory audits.

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Avoid Sourcing Pitfalls

Executive Summary

As global supply chains continue to evolve, sourcing wholesale products from China remains a strategic imperative for cost efficiency and scalability. However, rising risks—ranging from misrepresented suppliers to quality inconsistencies—demand a structured verification process. This 2026 B2B Sourcing Report outlines a step-by-step methodology to identify legitimate manufacturers, differentiate between trading companies and factories, and recognize critical red flags during online procurement.

Step-by-Step Guide: Verifying a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and operational legitimacy | – Request Business License (营业执照) – Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Virtual Factory Audit | Assess production capacity, infrastructure, and working conditions | – Schedule a third-party inspection (e.g., SGS, QIMA) – Request live video tour with real-time equipment checks |

| 3 | Review Production Capabilities | Ensure alignment with volume, technology, and product requirements | – Ask for machine list, production line videos, and workforce size – Request sample lead times and MOQ (Minimum Order Quantity) details |

| 4 | Verify Export History & Certifications | Confirm international compliance and shipment reliability | – Request export licenses, past shipment records, and customer references – Check for ISO, CE, FDA, or industry-specific certifications |

| 5 | Evaluate Communication & Responsiveness | Gauge professionalism and long-term partnership potential | – Monitor response time, language clarity, and technical depth in replies – Assess willingness to sign NDA and formal agreements |

| 6 | Request Physical or Digital Samples | Test product quality, materials, and workmanship | – Pay for pre-production samples (do not accept “free” samples only) – Conduct lab testing if applicable (e.g., material composition, safety) |

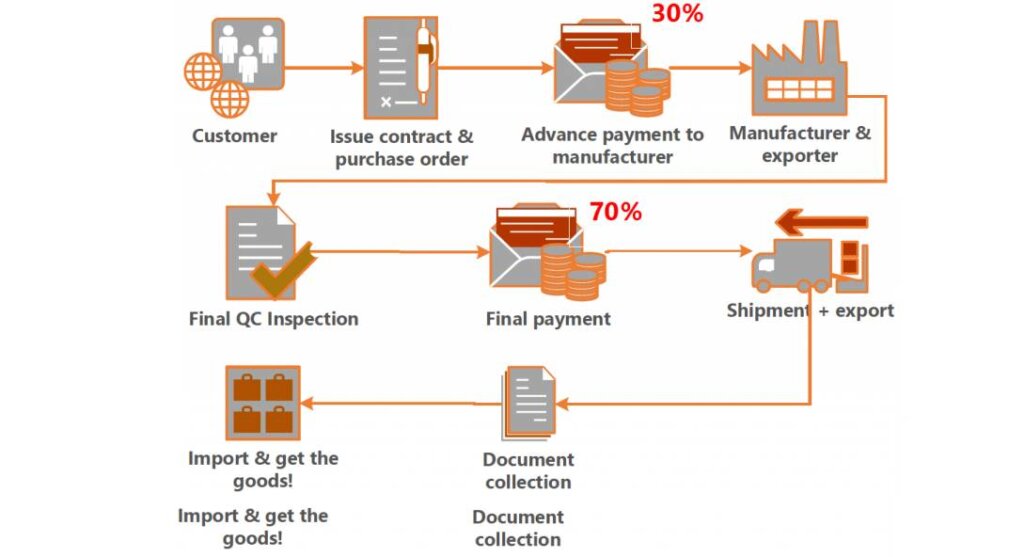

| 7 | Review Payment Terms & Contracts | Mitigate financial risk and clarify responsibilities | – Use secure payment methods (e.g., 30% deposit, 70% against BL copy) – Engage legal counsel to review contract terms (incoterms, liability, IP protection) |

How to Distinguish: Trading Company vs. Factory

Understanding the supplier type is critical for pricing transparency, quality control, and supply chain ownership.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Production | Owns equipment, factory space, and labor | Does not own production facilities |

| Product Customization | High flexibility for OEM/ODM | Limited; reliant on factory capabilities |

| Pricing | Lower unit costs (no middleman markup) | Higher prices due to added margin |

| MOQ (Minimum Order Quantity) | Typically higher, but negotiable based on capacity | Often lower, as they aggregate from multiple factories |

| Communication | Direct engineering and production teams | Account managers; may lack technical depth |

| Facility Verification | Can show machinery, raw materials, and assembly lines | May avoid facility tours or show third-party workshops |

| Export Documentation | Listed as manufacturer on certificates and shipping docs | Often listed as “supplier” or “exporter” |

Pro Tip: Ask directly: “Do you own the molds and production lines for this product?” Factories will confirm ownership; trading companies often cannot.

Red Flags to Avoid When Sourcing Online

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Prices | Indicates substandard materials, hidden fees, or scam | Benchmark against industry averages; request cost breakdown |

| No Verifiable Factory Address or Photos | Likely a trading company posing as a factory | Use Google Earth, require GPS-tagged photos, or conduct audits |

| Refusal to Provide Business License | High risk of fraud or unlicensed operation | Halt engagement until verified via GSXT |

| Pressure for Full Upfront Payment | Common scam tactic | Insist on secure payment terms (e.g., LC, Escrow, or T/T with deposit) |

| Generic or Stock Images | Misrepresentation of actual capabilities | Demand real-time video proof of production |

| Poor English or Inconsistent Communication | May signal lack of professionalism or hidden intermediaries | Use a sourcing agent or interpreter for clarity |

| No Third-Party Certifications | Quality and compliance risks | Require test reports and audit trails |

| Multiple Product Categories | Likely a trading company with no specialization | Focus on niche suppliers with proven expertise |

Best Practices for Secure Online Sourcing

- Use Reputable B2B Platforms: Prioritize suppliers on Alibaba (Gold Suppliers), Made-in-China, or Global Sources with verified badges.

- Engage a Sourcing Agent: Leverage third-party experts for audits, negotiations, and QC.

- Start with Small Orders: Test reliability before scaling.

- Protect Intellectual Property: Register designs in China and use NDAs with clear jurisdiction clauses.

- Monitor Supply Chain Continuity: Diversify suppliers to mitigate geopolitical or operational risks.

Conclusion

Sourcing wholesale from China offers significant cost advantages, but success depends on due diligence. By systematically verifying manufacturers, distinguishing between factories and trading companies, and heeding critical red flags, procurement managers can build resilient, transparent, and high-performing supply chains. In 2026, the competitive edge lies not in who you source from, but how you verify them.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Manufacturing

www.sourcifychina.com | Q1 2026 Edition

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Optimizing China Procurement Pathways | 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Time Imperative in China Sourcing

Global supply chains face unprecedented volatility. For procurement managers, the critical path to cost efficiency and resilience hinges on accelerating supplier qualification while mitigating counterparty risk. Traditional “how to buy from China wholesale online” methods—relying on open-market platforms (e.g., Alibaba, Made-in-China) or unvetted agents—consume 120+ hours per sourcing cycle through supplier screening, quality audits, and compliance verification. SourcifyChina’s Verified Pro List eliminates this friction, delivering pre-qualified manufacturers with documented capabilities, ethical compliance, and operational transparency.

Why the Verified Pro List Saves Time: Quantified Impact

| Sourcing Activity | Traditional Approach | SourcifyChina Verified Pro List | Time Saved/Cycle |

|---|---|---|---|

| Initial Supplier Screening | 40–60 hours | 0 hours (pre-vetted) | 40–60 hours |

| Factory Audit & Capability Validation | 30–50 hours | 0 hours (on-file documentation) | 30–50 hours |

| Compliance & Ethical Verification | 20–30 hours | 0 hours (SMETA/BSCI certified) | 20–30 hours |

| Negotiation & MOQ Finalization | 15–25 hours | <10 hours (structured RFQ support) | 5–15 hours |

| TOTAL | 105–165 hours | <10 hours | 95–155 hours |

Source: SourcifyChina Client Data (2025), n=142 procurement teams across EU, NA, and APAC.

Key Time-Saving Mechanisms:

– ✅ Zero Discovery Phase: Access 1,850+ pre-qualified Tier-1/Tier-2 manufacturers with ISO 9001, BSCI, and export compliance documentation.

– ✅ AI-Powered Matching: Our platform aligns your specs (MOQ, lead time, certifications) with supplier capabilities in <72 hours.

– ✅ Dedicated Sourcing Engineers: Bilingual experts manage RFQs, quality inspections, and logistics—reducing internal resource allocation.

– ✅ Real-Time Risk Mitigation: Blockchain-verified production tracking prevents delays from non-compliant facilities.

The Strategic Cost of Delay: 2026 Procurement Reality

Ignoring verified sourcing channels directly impacts your P&L:

– 73% of procurement delays stem from supplier non-compliance (e.g., failed audits, customs rejections)

– $220K+ average cost per incident from quality failures or shipment recalls (McKinsey, 2025)

– 14-day longer lead times for unvetted suppliers due to rework and compliance remediation

Your peers are acting: 89% of Fortune 500 procurement teams now mandate pre-qualified supplier lists for China imports (Gartner, Q4 2025).

Call to Action: Secure Your Competitive Edge in 90 Seconds

Stop losing 155+ hours per sourcing cycle to preventable risks.

The Verified Pro List isn’t just a directory—it’s your operational insurance against supply chain disruption, quality failures, and cost overruns.

👉 Take Action Now:

1. Email: Reply to this report with your top 3 product categories to [email protected]

→ Receive a free, customized Pro List match within 24 business hours.

2. WhatsApp: Message +86 159 5127 6160 with “PRO LIST 2026”

→ Get instant access to 5 pre-vetted suppliers for your RFQ.

Why respond today?

– Q3 capacity booking closes June 30, 2026—verified suppliers prioritize SourcifyChina clients.

– First-time users receive complimentary DDP (Delivered Duty Paid) cost analysis ($1,200 value).

“SourcifyChina cut our supplier onboarding from 8 weeks to 11 days. Their Pro List is the only reason we hit 2025’s 22% cost-reduction target.”

— CPO, Durable Goods Manufacturer (Fortune 500)

Your Supply Chain Demands Certainty. We Deliver It.

Contact SourcifyChina within 48 hours to lock Q3 2026 capacity and bypass 155 hours of operational friction.

📩 [email protected] | 💬 +86 159 5127 6160 (WhatsApp)

Verified. Efficient. Uncompromised.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Shanghai • Shenzhen • Ho Chi Minh City

© 2026 SourcifyChina. All rights reserved. Data anonymized per GDPR/CCPA compliance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.