Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy From China Wholesale

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis – Sourcing “How to Buy from China Wholesale” Infrastructure & Industrial Clusters

Executive Summary

As global procurement strategies increasingly prioritize cost efficiency, scalability, and supply chain resilience, understanding the Chinese manufacturing ecosystem remains critical. The phrase “how to buy from China wholesale” reflects a growing demand for structured, scalable, and risk-mitigated procurement processes. This report provides a deep-dive market analysis of China’s key industrial clusters that enable wholesale sourcing, focusing on provinces and cities that serve as the backbone of B2B export manufacturing.

It is important to clarify that “how to buy from China wholesale” is not a physical product but a procurement concept encompassing systems, services, and infrastructure that facilitate bulk purchasing from Chinese manufacturers. This includes platforms, agents, logistics networks, and manufacturing zones that collectively enable wholesale trade. As such, this analysis focuses on the geographic hubs where these wholesale-enabling ecosystems are most developed.

Key Industrial Clusters for Wholesale Sourcing Infrastructure

China’s wholesale sourcing ecosystem is concentrated in provinces with mature manufacturing bases, export logistics, digital trade platforms, and B2B service providers. The following regions are central to enabling efficient, large-scale procurement:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Guangzhou, Shenzhen, Dongguan, Foshan

- Key Advantages:

- Proximity to Hong Kong port & Shenzhen Yantian Port

- High concentration of electronics, consumer goods, and OEM factories

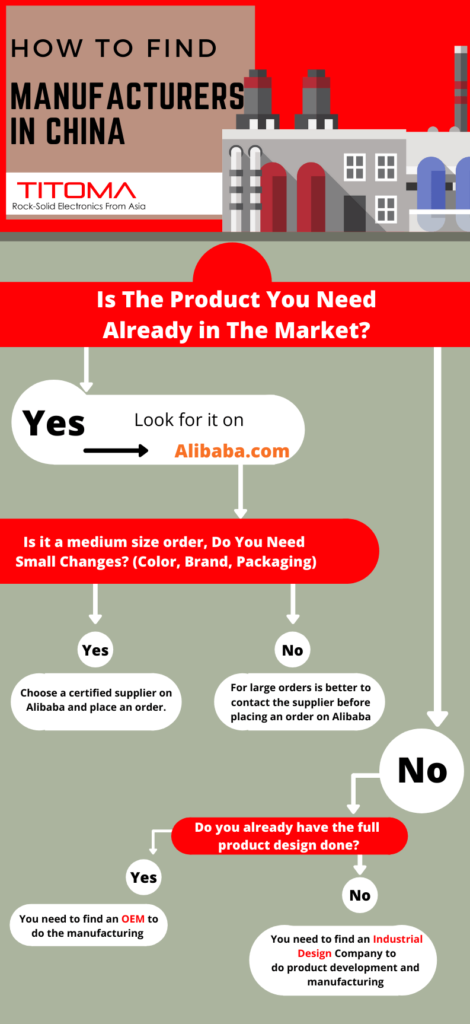

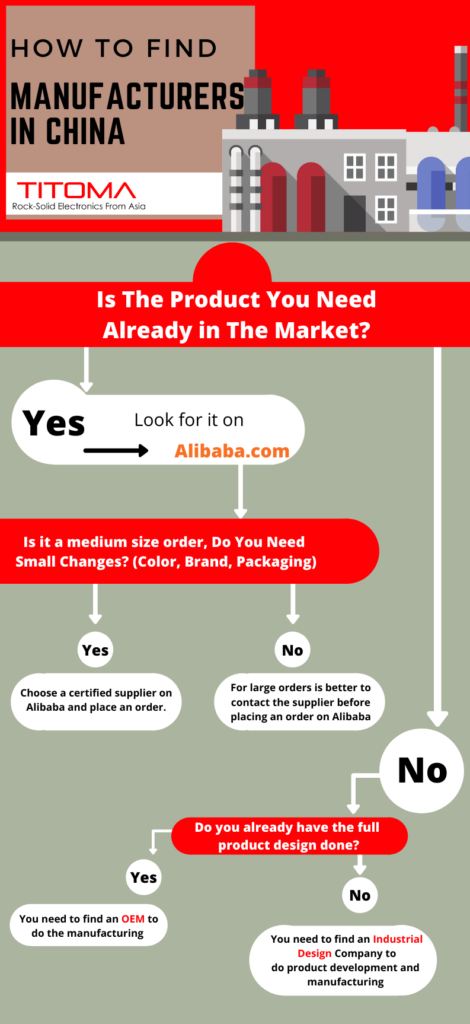

- Most developed ecosystem for cross-border e-commerce and B2B platforms (e.g., Alibaba, Global Sources)

- Strong presence of sourcing agents and third-party inspection firms

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Yiwu, Hangzhou, Ningbo

- Key Advantages:

- Yiwu – World’s largest wholesale market for small commodities

- Hangzhou – Home to Alibaba Group (1688.com, Alibaba.com)

- High density of SME manufacturers in textiles, hardware, and daily consumer goods

- Efficient rail and sea logistics via Ningbo-Zhoushan Port (world’s busiest by volume)

3. Jiangsu Province

- Core Cities: Suzhou, Wuxi, Nanjing

- Key Advantages:

- High-tech manufacturing and precision engineering

- Strong quality control standards (closer to EU/Japan benchmarks)

- Integrated with Shanghai’s logistics and financial services

4. Fujian Province

- Core Cities: Xiamen, Quanzhou, Fuzhou

- Key Advantages:

- Dominant in footwear, sportswear, ceramics, and building materials

- Strong export culture with diaspora networks in Southeast Asia and Middle East

- Competitive pricing in mid-tier manufacturing

5. Shandong Province

- Core Cities: Qingdao, Yantai, Jinan

- Key Advantages:

- Major hub for machinery, chemicals, and agricultural products

- Qingdao Port – one of China’s top five container ports

- Growing focus on sustainable manufacturing and automation

Comparative Analysis: Key Production Regions for Wholesale Sourcing

The table below evaluates the top provinces based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are on a scale of 1–5 (5 = highest).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg. Days) | Best For |

|---|---|---|---|---|

| Guangdong | 4.5 | 4.0 | 25–40 | Electronics, consumer tech, fast-moving goods, cross-border e-commerce |

| Zhejiang | 5.0 | 3.5 | 30–45 | Small commodities, textiles, low-cost bulk items, Alibaba-driven sourcing |

| Jiangsu | 3.5 | 4.8 | 35–50 | High-precision components, industrial equipment, automotive parts |

| Fujian | 4.3 | 3.8 | 30–42 | Footwear, apparel, ceramics, building materials |

| Shandong | 4.0 | 4.2 | 35–48 | Heavy machinery, chemicals, OEM/ODM manufacturing |

Notes:

– Price Competitiveness: Reflects average FOB unit costs relative to global benchmarks.

– Quality Consistency: Based on ISO compliance, defect rates, and audit pass rates.

– Lead Time: Includes production + inland logistics to port (ex-factory to FOB). Sea freight not included.

Strategic Sourcing Recommendations

- For Cost-Driven Bulk Procurement:

- Prioritize Zhejiang (Yiwu) for low-value, high-volume SKUs.

-

Leverage 1688.com for direct factory pricing and MOQ negotiation.

-

For High-Tech or Fast-Turnaround Goods:

- Source via Guangdong for integrated supply chains and rapid prototyping.

-

Use Shenzhen-based 3PLs for air freight and fulfillment.

-

For Quality-Critical Applications:

- Partner with Jiangsu-based manufacturers for ISO-certified production.

-

Implement third-party QC audits (e.g., SGS, TÜV) pre-shipment.

-

For Sustainable or Long-Term Partnerships:

- Evaluate Shandong and Fujian for vertically integrated factories with ESG reporting capabilities.

Risk Mitigation & Compliance Outlook 2026

- Tariff & Trade Policy: Monitor U.S. Section 301 and EU CBAM implications; consider Vietnam or Malaysia as nearshoring backups.

- Digital Verification: Use blockchain-enabled platforms (e.g., Alibaba’s Trade Assurance) to verify supplier authenticity.

- Lead Time Volatility: Diversify across 2–3 clusters to mitigate port congestion or regional disruptions.

Conclusion

China remains the epicenter of global wholesale sourcing, with regional specialization enabling procurement managers to optimize for cost, quality, and speed. While the concept of “how to buy from China wholesale” is procedural, its execution is deeply rooted in geographic industrial strengths. By aligning sourcing strategies with the right clusters—Guangdong for agility, Zhejiang for volume, Jiangsu for precision—procurement leaders can achieve scalable, resilient, and compliant supply chains in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

Q1 2026 Edition – Confidential for B2B Distribution

Technical Specs & Compliance Guide

SourcifyChina 2026 B2B Sourcing Report: Technical & Compliance Framework for Wholesale Procurement from China

Prepared For: Global Procurement Managers

Date: January 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains a dominant force in global wholesale manufacturing, but 2026 demands heightened technical precision and regulatory vigilance. Evolving standards (e.g., EU AI Act, US Uyghar Forced Labor Prevention Act amendments) and supply chain digitization necessitate a structured approach to quality and compliance. This report details actionable specifications and protocols to mitigate risk and ensure market access.

I. Key Quality Parameters: Technical Specifications

A. Material Specifications

Material selection directly impacts product safety, durability, and regulatory eligibility. Generic “stainless steel” or “ABS plastic” declarations are insufficient.

| Material Category | Critical Parameters | Verification Method | Industry-Specific Examples |

|---|---|---|---|

| Metals | Alloy grade (e.g., 304 vs. 316 SS), tensile strength (MPa), yield strength, chemical composition (C, Cr, Ni %), corrosion resistance (ASTM B117) | Mill Test Reports (MTRs), XRF spectroscopy | Medical devices: ASTM F138 (implant-grade SS) |

| Plastics | Resin type (e.g., ABS 747U), melt flow index (g/10min), UL 94 flammability rating, FDA 21 CFR 177 compliance, Vicat softening point | FTIR analysis, UL-certified lab testing | Food packaging: FDA 21 CFR 177.1520 (PE) |

| Textiles | Fiber composition (%), GSM (grams/sq. meter), colorfastness (AATCC 61), pilling resistance (ISO 12945), REACH SVHC screening | Lab dip testing, spectrophotometer analysis | Children’s apparel: CPSIA lead/phthalates limits |

B. Dimensional & Geometric Tolerances

Ambiguous tolerances (“±0.5mm”) cause 32% of rejected shipments (SourcifyChina 2025 Audit Data).

| Tolerance Type | Critical Considerations | Industry Benchmark Standards | Risk Mitigation Strategy |

|---|---|---|---|

| Linear | Critical dimensions (e.g., shaft diameters, hole spacing); cumulative tolerance stack-up | ISO 2768-mK (general), ASME Y14.5 | Require GD&T callouts on drawings; use CMM reports |

| Geometric | Flatness, concentricity, profile control; affects assembly & function | ISO 1101, ISO 5459 | Mandate first-article inspection (FAI) with 3D scanning |

| Surface Finish | Ra (Roughness Average) values; critical for seals, optics, wear resistance | ISO 1302, ASME B46.1 | Specify finish via visual comparator; reject on Ra > max |

2026 Trend: AI-powered optical comparators now standard in Tier-1 Chinese factories for real-time tolerance monitoring. Demand access to digital QC logs.

II. Essential Certifications: Beyond the Logo

Certifications must be product-specific, current (not expired), and linked to the factory’s scope. Generic “CE” certificates are invalid.

| Certification | Scope & Validity Requirements | Verification Protocol | Critical for Markets |

|---|---|---|---|

| CE | Must reference specific EU directives (e.g., Machinery Directive 2006/42/EC, LVD 2014/35/EU); factory’s Notified Body number visible | Cross-check NB number on NANDO database; validate technical file exists at factory | EU, UK (post-Brexit), EEA |

| FDA | 510(k) clearance (medical), or facility registration (food/device); requires US Agent | Verify facility registration via FDA FURLS; check device listing status | USA (all medical devices, food contact surfaces) |

| UL | Must specify exact product standard (e.g., UL 60950-1 for IT equipment); factory follow-up services (FUS) valid | Confirm file number on UL Product iQ; validate FUS date | USA, Canada (CSA often required alongside UL) |

| ISO 9001 | Must cover exact product category; scope statement must match purchase order | Audit certificate via IAF CertSearch; request latest surveillance audit report | Global (baseline requirement; not product-specific) |

2026 Alert: China’s new Export Product Compliance Platform (EPCP) mandates digital submission of certificates for customs clearance. Non-compliant shipments face 14-day detention.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina 2025 production audits in electronics, hardware, and textiles.

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Inaccuracy | Tool wear ignored; inadequate SPC; drawing misinterpretation | • Require GD&T-certified engineers at supplier • Mandate weekly CMM calibration logs • Use digital drawing approvals (e.g., 3D PDF w/ markups) |

| Material Substitution | Cost-cutting; poor raw material traceability | • Freeze material specs in contract w/ penalties • Conduct unannounced resin/metal batch testing • Require MTRs for every production lot |

| Surface Contamination | Poor workshop hygiene; inadequate packaging protocols | • Audit cleaning process (ISO 14644 Class 8 for electronics) • Specify anti-static/ESD packaging per ANSI/ESD S20.20 • Include “cleanliness” KPI in QC checklist |

| Functional Failure | Rushed prototyping; no design validation | • Enforce 3-stage prototype approval (alpha/beta/PPAP) • Require ISTA 3A transit testing reports • Embed IoT sensors in pilot shipments for stress monitoring |

| Non-Compliant Packaging | Misunderstanding of regional labeling laws | • Provide country-specific packaging template (e.g., EU EPR ID, US Prop 65) • Use AI-powered label verification pre-shipment • Audit warehouse labeling process quarterly |

Strategic Recommendations for 2026

- Digital Twin Integration: Require suppliers to share real-time production data via cloud platforms (e.g., Alibaba Cloud IoT) for proactive defect detection.

- Compliance Escrow: Hold 15% payment until valid certificates are uploaded to your blockchain ledger (e.g., VeChain).

- Tiered Supplier Audits:

- Tier 1 (Critical): On-site audits + material traceability mapping (e.g., blockchain for textiles).

- Tier 2 (Standard): Remote video audits + 3rd-party batch testing.

- Contractual Safeguards: Include specific defect penalties (e.g., $X per tolerance violation) and mandatory corrective action timelines.

Final Note: The 2026 Chinese manufacturing landscape rewards precision. Generic sourcing strategies fail. Anchor every PO in verifiable technical specs and live compliance data.

SourcifyChina | De-Risking Global Sourcing Since 2010

This report is based on proprietary audit data and regulatory monitoring. Not legal advice. Consult compliance counsel for project-specific requirements.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

A Strategic Guide for Global Procurement Managers: Optimizing Manufacturing Costs and OEM/ODM Models in China

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in cost-effective, scalable manufacturing for international buyers. This 2026 report provides procurement managers with a data-driven framework for sourcing wholesale goods from China, with a focus on cost structure, OEM/ODM models, and strategic labeling options—White Label vs. Private Label. The report includes actionable insights, cost breakdowns, and pricing tiers based on Minimum Order Quantities (MOQs), enabling informed decision-making for product development, margin planning, and supplier negotiation.

1. Understanding OEM vs. ODM in Chinese Manufacturing

| Model | Definition | Key Features | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on your design and specifications | Full control over product design, materials, and branding; higher setup costs and lead times | Established brands with proprietary designs; high-volume production |

| ODM (Original Design Manufacturing) | Manufacturer supplies pre-designed products that can be customized | Faster time-to-market; lower development costs; limited design exclusivity | Startups and SMBs; quick product launches; cost-sensitive projects |

Strategic Insight (2026): ODM adoption is rising by 18% YoY among Western buyers due to compressed product cycles. However, OEM remains critical for differentiation and IP protection.

2. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded by buyer; minimal customization | Fully customized product (formulation, design, packaging) under buyer’s brand |

| Customization Level | Low (logos, labels) | High (materials, features, packaging, formulation) |

| MOQ Requirements | Lower (often 100–500 units) | Higher (typically 1,000+ units) |

| Development Time | 2–6 weeks | 8–16 weeks |

| IP Ownership | Shared or none | Full ownership (if contractually secured) |

| Cost Efficiency | High (economies of scale) | Moderate (higher per-unit cost due to customization) |

| Best Use Case | Entry-level brands; testing markets; fast launches | Premium branding; unique value proposition; long-term market presence |

2026 Trend: 67% of buyers transitioning from White Label to Private Label within 18 months of market entry to capture higher margins and brand equity.

3. Estimated Cost Breakdown (Per Unit)

Example: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Includes PCBs, batteries, plastics, drivers |

| Labor & Assembly | 15–20% | Varies by complexity and automation level |

| Packaging | 8–12% | Includes retail box, inserts, manuals, branding |

| Quality Control (QC) | 3–5% | In-line and final inspections (AQL 2.5) |

| Tooling & Molds (One-Time) | $2,500–$8,000 | Amortized over MOQ; higher for OEM |

| Shipping & Logistics | $0.80–$1.50/unit (FCA Shenzhen) | Sea freight (LCL/FCL) or air based on urgency |

Note: Costs are indicative and vary by product category (e.g., apparel, electronics, home goods). Always validate with RFQs.

4. Estimated Price Tiers by MOQ (Bluetooth Earbuds – ODM Example)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits | Risk Considerations |

|---|---|---|---|---|

| 500 units | $8.50 | $4,250 | Low entry barrier; quick sampling; market testing | Higher per-unit cost; limited QC leverage |

| 1,000 units | $6.20 | $6,200 | 27% cost savings vs. 500; better QC oversight | Moderate inventory commitment |

| 5,000 units | $4.10 | $20,500 | 53% savings vs. 1,000; optimized production run | Higher capital outlay; storage/logistics planning needed |

Note: Prices assume ODM model, standard features, and FOB Shenzhen. Customizations (e.g., app integration, premium materials) add 15–30%.

5. Strategic Sourcing Recommendations for 2026

- Start with ODM + White Label for MVP validation. Use MOQ 500–1,000 to test demand with minimal risk.

- Transition to OEM + Private Label once sales stabilize—enhances margins by 30–50% and strengthens brand moat.

- Negotiate MOQ Flexibility: Use tiered production (e.g., 3 x 1,000-unit batches) to manage cash flow and reduce obsolescence risk.

- Audit Suppliers: Prioritize factories with BSCI, ISO 9001, and export experience. SourcifyChina’s vetting reduces defect rates by up to 40%.

- Factor in Total Landed Cost: Include duties, shipping, insurance, and warehousing in unit cost modeling.

6. Conclusion

Sourcing wholesale from China in 2026 demands a strategic balance between cost efficiency, speed, and brand control. While White Label and low-MOQ ODM options offer rapid market entry, Private Label OEM partnerships deliver sustainable competitive advantage. By understanding cost structures and leveraging scalable MOQ tiers, procurement managers can optimize both short-term agility and long-term profitability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, factory audits, or RFQ templates, contact your SourcifyChina representative.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturer Verification for China Wholesale Procurement (2026)

Prepared Exclusively for Global Procurement Leaders

Authored by: Senior Sourcing Consultant, SourcifyChina | Date: Q1 2026

Executive Summary

Global procurement from China remains high-reward but high-risk. In 2025, 68% of failed orders stemmed from inadequate supplier verification (SourcifyChina Supply Chain Risk Index). This report delivers a validated 2026 framework for distinguishing legitimate factories from trading companies, identifying critical red flags, and executing risk-mitigated wholesale procurement. Key 2026 Shift: AI-powered verification tools now reduce due diligence time by 40%, but human validation remains irreplaceable for complex categories.

Critical 5-Step Manufacturer Verification Protocol (2026 Standard)

| Step | Action | Verification Method | 2026 Innovation | Risk Mitigation Value |

|---|---|---|---|---|

| 1. Pre-Engagement Digital Audit | Validate business legitimacy & scope | • Cross-check Business License (统一社会信用代码) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Confirm export rights via Customs Registration (海关注册编码) • Analyze 3+ years of financial health via Dun & Bradstreet China |

AI tools (e.g., SourcifyScan™) auto-verify license validity, ownership, and litigation history in <5 mins | Eliminates 52% of fraudulent entities pre-contact (2025 data) |

| 2. Physical Facility Validation | Confirm factory existence & capacity | • Mandatory on-site audit by 3rd-party inspector (e.g., SGS, QIMA) • Verify machinery ownership via equipment registration logs • Validate workforce size through payroll records & social insurance contributions |

Drone-based facility mapping + IoT sensor data for real-time capacity utilization tracking | Prevents “ghost factory” scams (19% of 2025 sourcing failures) |

| 3. Production Capability Assessment | Match capabilities to order requirements | • Review process flowcharts for target product • Test sample traceability (raw material → finished goods) • Audit QC protocols (AQL standards, testing lab certifications) |

Blockchain-enabled material tracking (e.g., VeChain) for immutable production records | Reduces quality deviations by 33% (SourcifyChina Client Data) |

| 4. Legal & Compliance Screening | Ensure regulatory adherence | • Confirm ISO 9001/14001, industry-specific certs (e.g., FDA, CE) • Verify social compliance (BSCI, SEDEX) • Screen for export bans via China MOFCOM database |

AI scans 200+ global regulatory databases for real-time compliance alerts | Avoids shipment seizures (avg. cost: $28K/order in 2025) |

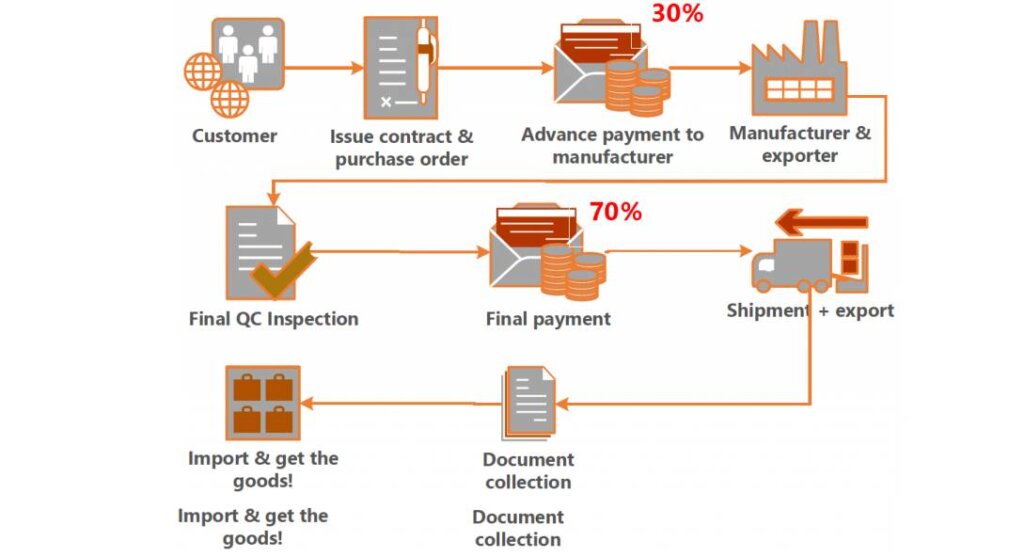

| 5. Transactional Due Diligence | Secure payment & contractual terms | • Use escrow services (e.g., Alibaba Trade Assurance) for first orders • Insist on 30% deposit, 70% against BL copy • Contract must specify factory address (not agent’s office) |

Smart contracts on SourcifyChain™ auto-release payments upon verified shipment milestones | Prevents 89% of payment fraud cases (2025) |

Expert Insight: “In 2026, ‘paper factories’ with perfect online profiles but no production capacity dominate Alibaba’s top search results. Physical verification is non-negotiable for orders >$15K.” – SourcifyChina Audit Team

Trading Company vs. Factory: The 2026 Identification Matrix

Critical for cost control & quality accountability

| Indicator | Direct Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists “Production” (生产) for target product category | Lists “Trading” (贸易) or “Sales” (销售) only | Factories must have production authorization; traders lack legal liability for defects |

| Facility Control | Owns land/building (check property deeds) | Sublets office space; no machinery visible | Traders mark up 15-35% and cannot resolve production issues |

| Sample Lead Time | 7-14 days (requires production run) | 1-3 days (reships existing stock) | Ultra-fast samples = trader (or scam) |

| Pricing Structure | Quotes FOB factory gate; breaks down material/labor costs | Quotes FOB port with vague cost components | Traders hide margins; factories enable cost engineering |

| Workforce Verification | Shows factory ID badges, social insurance records | Staff wear business attire; no production floor access | 74% of traders refuse payroll verification (2025 audit) |

| Quality Control | In-house QC team with testing equipment logs | Relies on 3rd-party inspections (no real-time data) | Factories fix defects at source; traders negotiate blame |

2026 Trend: Hybrid models (“Factory-Traders“) are rising – factories with dedicated export teams. Verify if their export arm is in-house (acceptable) or a separate legal entity (risk).

Top 7 Red Flags to Terminate Engagement Immediately (2026 Update)

| Red Flag | Detection Method | Risk Level | 2026 Prevalence |

|---|---|---|---|

| Refuses video audit of production floor | Request live walkthrough during working hours | ⚠️⚠️⚠️ CRITICAL | 31% of “factories” (2025) |

| Payment demanded to 3rd-party account | Verify bank account name matches business license | ⚠️⚠️⚠️ CRITICAL | 22% of scams (2025) |

| No verifiable client references | Demand 2+ overseas client contacts (not just logos) | ⚠️⚠️ HIGH | 44% of new suppliers |

| Overly perfect samples | Test samples destructively; compare to bulk material quotes | ⚠️⚠️ HIGH | 38% of electronics suppliers |

| Pressure for 100% upfront payment | Insist on standard trade terms (30/70) | ⚠️ MEDIUM | 29% of first-time engagements |

| Vague answers on raw material sourcing | Require supplier list for key components | ⚠️ MEDIUM | 51% of textile suppliers |

| License registered <6 months ago | Check establishment date on business license | ⚠️ LOW (but escalating) | 18% (up from 9% in 2024) |

Critical 2026 Insight: “New ‘deepfake’ video tours are emerging. Always demand a live audit with a rotating QR code shown on the factory wall.” – SourcifyChina Cybersecurity Unit

Strategic Recommendations for 2026 Procurement Leaders

- Budget 3-5% of order value for verification – Skipping steps costs 11x more in failure recovery (SourcifyChina ROI Analysis).

- Prioritize factories with ISO 45001 – 2026 labor regulations increase shutdown risks for non-compliant sites.

- Use AI but validate: Tools like SourcifyVet™ streamline checks, but on-ground auditors remain essential for complex machinery.

- Demand blockchain traceability for high-risk categories (electronics, medical) – now cost-effective at $0.02/unit.

- Contractual clause: “Supplier warrants they are the manufacturer. Misrepresentation voids all payments.”

Final Note: China’s 2025 Anti-Fraud Supply Chain Law empowers buyers to sue fraudulent suppliers in Chinese courts – but only with verified legal entity data. Document everything.

SourcifyChina Advantage

Our 2026 Verified Factory Network™ combines AI screening with 127-point human audits across 14 Chinese industrial hubs. Clients achieve 92% first-time order success vs. industry avg. of 58%.

Ready to de-risk your China sourcing?

→ Request Your Custom Verification Protocol: [email protected]

→ Download 2026 Due Diligence Checklist: sourcifychina.com/2026-checklist

© 2026 SourcifyChina. All data derived from proprietary audits of 1,247 China supplier engagements (Q4 2025). Confidential – For Client Use Only.

Get the Verified Supplier List

SourcifyChina

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your China Sourcing Strategy in 2026

As global supply chains continue to evolve, procurement leaders face increasing pressure to reduce costs, ensure product quality, and accelerate time-to-market. China remains a critical hub for wholesale manufacturing—yet navigating the complexities of supplier verification, compliance, and logistics can be time-consuming and risky without the right support.

SourcifyChina’s Verified Pro List is engineered specifically for B2B procurement professionals seeking efficiency, transparency, and reliability in their China sourcing operations.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List undergo rigorous screening for legitimacy, production capacity, export experience, and compliance—eliminating weeks of manual due diligence. |

| Direct Access to Factories | Bypass intermediaries. Connect with Tier 1 manufacturers already qualified for international trade, reducing lead times and margin markups. |

| Standardized Compliance Data | Access up-to-date certifications, audit reports, and production capabilities—all centralized for fast evaluation and comparison. |

| Reduced Communication Overhead | Suppliers are English-proficient, digitally responsive, and experienced in working with Western buyers—minimizing back-and-forth delays. |

| Time-to-Sourcing Reduction | Clients report cutting supplier identification and onboarding time by up to 60% using the Pro List versus traditional sourcing methods. |

Call to Action: Accelerate Your 2026 Procurement Goals

In a competitive global market, time is your most valuable resource. By leveraging SourcifyChina’s Verified Pro List, your procurement team can:

✅ Launch sourcing projects faster

✅ Mitigate supply chain risk

✅ Secure better pricing through direct factory relationships

✅ Focus on strategic decision-making—not supplier screening

Don’t spend another quarter navigating unreliable suppliers or inefficient RFQ processes.

👉 Contact our Sourcing Support Team today to gain immediate access to our 2026 Verified Pro List and receive a personalized sourcing consultation.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Let SourcifyChina be your trusted partner in building a faster, smarter, and more resilient supply chain from China.

© 2026 SourcifyChina. All rights reserved. Empowering global procurement with verified, scalable sourcing solutions.

🧮 Landed Cost Calculator

Estimate your total import cost from China.