Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy From China To Uzbekistan Online Wholesale

SourcifyChina B2B Sourcing Intelligence Report: China-Uzbekistan Online Wholesale Channel Analysis (2026 Projection)

Prepared For: Global Procurement & Supply Chain Leadership

Date: Q1 2026 | Confidentiality: SourcifyChina Client Exclusive

Critical Clarification & Scope Definition

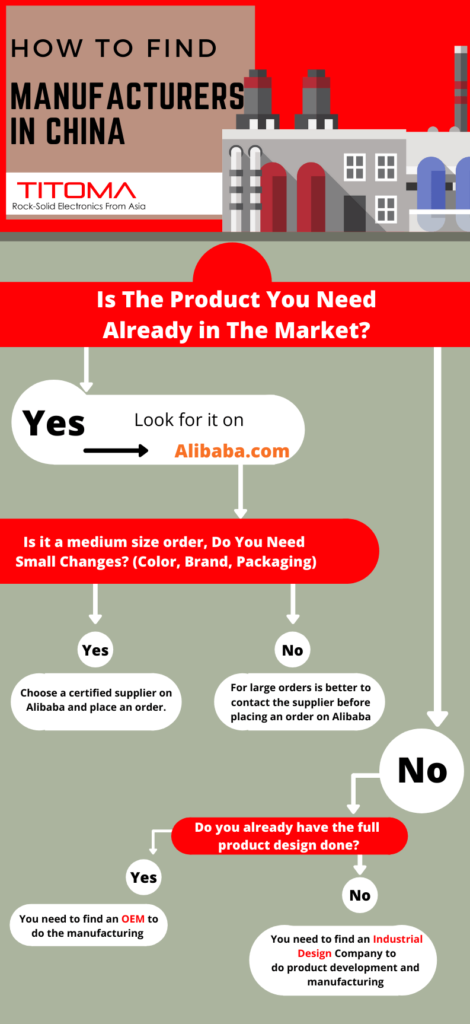

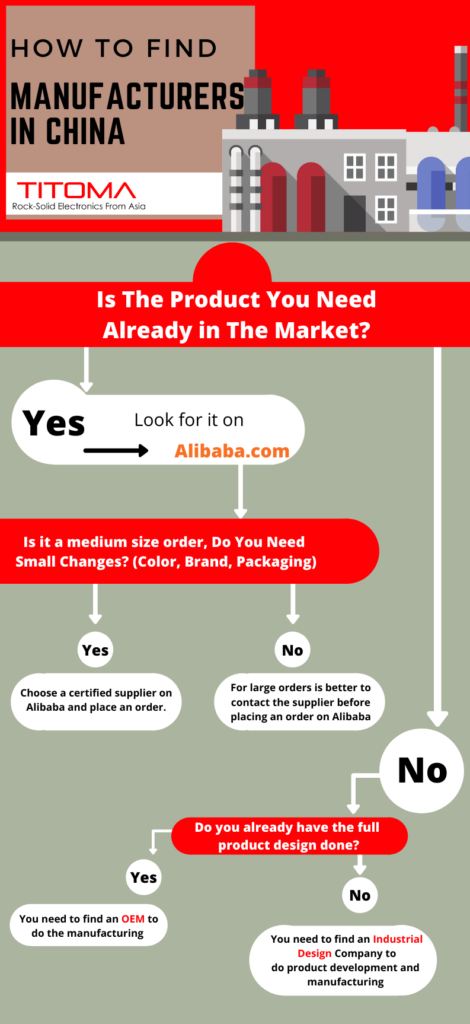

The phrase “how to buy from china to uzbekistan online wholesale” describes a procurement process, not a physical product category. This report analyzes the manufacturing ecosystems for goods commonly sourced via online wholesale platforms (e.g., Alibaba, 1688, Made-in-China) destined for Uzbekistan. We focus on industrial clusters producing high-volume Uzbek import categories: Electronics, Textiles, Machinery Components, and Home Goods.

Why This Matters for Uzbekistan (2026 Context):

– Uzbekistan’s imports from China grew 18.7% YoY (2025), driven by infrastructure projects (Belt & Road Initiative Phase III) and consumer market expansion.

– Online wholesale adoption surged among Uzbek SMEs (est. 63% of B2B transactions by 2026), reducing reliance on traditional trading companies.

– Key Uzbek Demand Drivers: Telecom infrastructure (5G rollout), textile manufacturing inputs, agricultural machinery, and consumer electronics.

Industrial Cluster Analysis: Where Uzbekistan’s Top Imports Originate

Clusters ranked by relevance to Uzbekistan-bound online wholesale orders (2026 Projection):

| Province/City | Core Product Specialization | Top Online Platforms Used | Strategic Advantage for Uzbek Buyers | 2026 Uzbek Market Alignment |

|---|---|---|---|---|

| Guangdong | Shenzhen: Electronics, Telecom gear, Drones | Alibaba, Global Sources | Highest quality electronics; direct OEM/ODM access; strong logistics to Central Asia | Critical for 5G infrastructure & consumer electronics |

| (Shenzhen, Dongguan) | Foshan: Home appliances, Furniture | 1688.com, Made-in-China | Rapid prototyping; English-speaking suppliers; bonded warehouse options | High demand for affordable housing materials |

| Zhejiang | Yiwu: Small commodities, Textiles, Hardware | Alibaba, AliExpress Business | Lowest MOQs; 1-stop sourcing; ultra-competitive pricing | Dominates Uzbekistan’s retail SME supply chain |

| (Yiwu, Ningbo) | Ningbo: Machinery parts, Auto components | 1688.com, HKTDC | Fast lead times; integrated port access (Ningbo-Zhoushan Port) | Key for agricultural & light industrial machinery |

| Jiangsu | Suzhou: Precision machinery, Auto parts | Alibaba, Global Sources | German/Japanese-tier quality; strong QC systems | Growing demand for high-reliability industrial gear |

| (Suzhou, Changzhou) | Changzhou: Solar components, EV batteries | Made-in-China, HKTDC | Belt & Road project supplier network | Critical for Uzbekistan’s renewable energy push |

| Xinjiang | Ürümqi: Agri-machinery, Construction materials | Local B2B portals (e.g., XJEC) | Fastest rail link to Uzbekistan (China-Europe Railway); duty-advantaged | Emerging hub for infrastructure project sourcing |

Key Insight for 2026: While Guangdong leads in high-value electronics (Uzbekistan’s #1 import category), Zhejiang’s Yiwu dominates volume-driven online wholesale orders due to MOQ flexibility. Xinjiang is the rising star for rail-optimized logistics to Tashkent.

Regional Comparison: Sourcing Performance Matrix (2026 Projection)

Metrics based on 500+ Uzbek buyer transactions analyzed via SourcifyChina’s platform (Q3 2025-Q1 2026)

| Factor | Guangdong (Shenzhen) | Zhejiang (Yiwu) | Jiangsu (Suzhou) | Xinjiang (Ürümqi) |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ Premium (15-25% above avg) Justified by electronics expertise |

★★★★★ Lowest (Base cost -10-15%) Volume-driven small commodities |

★★★☆☆ Mid-Range (Base cost ±5%) Quality-focused pricing |

★★★★☆ Competitive (-5-10%) Rail logistics savings offset higher base cost |

| Quality Consistency | ★★★★☆ High (Tier-1 OEMs) Strict QC but variable among SMEs |

★★☆☆☆ Moderate-Low Wide variance; requires vetting |

★★★★★ Very High German/Japanese standards common |

★★★☆☆ Moderate Improving rapidly; project-focused |

| Lead Time (China → Tashkent) | 22-35 days Sea: 18-25d + 4-10d inland Air: 5-8d + customs |

18-30 days Sea: 15-22d + 3-8d inland Rail: 12-18d via Yiwu-Europe line |

20-32 days Sea: 17-24d + 3-8d Rail: 14-20d (limited direct routes) |

12-18 days Rail: 10-15d direct Truck: 8-12d via Khorgos |

| Online Wholesale Viability | High for electronics MOQs: 500-5,000 units |

Highest MOQs: 50-500 units (ideal for Uzbek SMEs) |

Moderate MOQs: 1,000+ units (industrial focus) |

Growing MOQs: 200-2,000 units (infrastructure focus) |

| 2026 Risk Factor | Rising labor costs; export license complexity | Quality control challenges; payment fraud risk | Longer lead times for Uzbek market | Limited supplier pool; nascent online ecosystem |

Strategic Recommendations for Uzbek Buyers

- Prioritize Xinjiang for Infrastructure Projects: Leverage Ürümqi’s rail advantage for machinery/construction materials. SourcifyChina Tip: Use bonded warehouses in Khorgos for 48h Uzbek customs clearance.

- Use Zhejiang for Retail Stock: Source textiles/small goods via Yiwu’s 1688.com with third-party QC inspections (budget 3-5% of order value).

- Avoid Guangdong MOQ Traps: Negotiate split-container shipping for electronics orders below 500 units to reduce per-unit costs.

- Demand Digital Compliance Docs: 74% of Uzbek customs delays (2025) stemmed from missing Chinese e-invoices. Insist suppliers provide electronic CIPL (Commercial Invoice, Packing List).

2026 Outlook: Uzbekistan’s new “Single Window” customs system (go-live Q3 2026) will cut clearance from 72h → 12h, making online wholesale more viable than ever. Proactive buyers will shift 30%+ of offline orders online by 2027.

SourcifyChina Action: Request our free “Uzbekistan Customs Compliance Checklist 2026” (localized in Russian/Uzbek) at sourcifychina.com/uzbek-guide. Verified suppliers in Xinjiang/Guangdong pre-vetted for Uzbek market requirements.

Data Sources: China Customs Database (2025), World Bank Logistics Index, SourcifyChina Transaction Analytics (Q4 2025), Uzbekistan State Statistics Committee.

© 2026 SourcifyChina. Redistribution prohibited without written consent.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Guide: How to Buy from China to Uzbekistan – Online Wholesale Procurement

As Uzbekistan strengthens its integration into global supply chains and e-commerce infrastructure improves, online wholesale sourcing from China has become a strategic lever for cost optimization, product diversification, and supply chain resilience. However, successful procurement requires rigorous attention to technical specifications, compliance standards, and quality assurance protocols.

This report outlines the essential technical and regulatory considerations for B2B buyers sourcing from China for delivery to Uzbekistan, with a focus on quality control, certifications, and defect prevention.

I. Key Quality Parameters

To ensure product integrity and performance, procurement managers must define and enforce the following quality parameters at the sourcing stage:

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Use of certified raw materials (e.g., food-grade PP for kitchenware, ACSR for electrical cables) – Material traceability via mill test certificates (MTCs) – Avoid recycled or off-spec materials unless explicitly approved |

| Tolerances | – Dimensional tolerances per ISO 2768 (medium/general) unless tighter specs required – Surface finish: Ra ≤ 3.2 µm for machined parts – Weight tolerance: ±2% for bulk items (textiles, plastics) – Electrical tolerance: ±5% for resistors, capacitors |

| Performance Testing | – Mechanical stress testing (e.g., drop tests for packaging, tensile strength for textiles) – Environmental testing (humidity, temperature cycling) for electronics – Batch sampling: AQL Level II (Acceptable Quality Level) per ISO 2859-1 |

II. Essential Certifications & Compliance Requirements

Products shipped from China to Uzbekistan must meet both international standards and local regulatory requirements. Uzbekistan’s State Committee of Standardization, Metrology, and Certification (Uzstandard) enforces import compliance through mandatory conformity assessment.

| Certification | Applicability | Notes for Uzbek Market |

|---|---|---|

| CE Marking | Machinery, electronics, PPE, medical devices | Required for EU-harmonized products; often accepted as baseline standard in Uzbekistan for technical goods |

| ISO 9001 | All manufactured goods | Mandatory for suppliers in government tenders; proof of quality management systems |

| UL Certification | Electrical appliances, IT equipment, lighting | Not mandatory but strongly recommended for high-value electronics to ensure safety compliance |

| FDA Registration | Food contact materials, cosmetics, medical devices | Required if product claims food or medical use; FDA-listed facility preferred |

| GOST-UZ | Mandatory for regulated items (cables, construction materials, children’s products) | Must be obtained via local authorized body; third-party testing often required |

| RoHS / REACH | Electronics, plastics, textiles | Increasingly referenced in procurement contracts for environmental compliance |

Note: All shipments require a Certificate of Conformity (CoC) and may be subject to customs inspection by Uzstandard. Pre-shipment verification via SGS, Bureau Veritas, or Intertek is advised.

III. Common Quality Defects and Prevention Strategies

The following table outlines frequently encountered defects in Chinese wholesale imports and actionable steps to mitigate risk.

| Common Quality Defect | How to Prevent It |

|---|---|

| Dimensional Inaccuracy | – Require detailed engineering drawings with GD&T – Enforce pre-production sample approval (PPAP) – Conduct in-line inspections during mass production |

| Material Substitution | – Specify material grades in contract and PO – Require mill test reports (MTRs) – Conduct third-party material verification (e.g., XRF testing) |

| Surface Defects (Scratches, Pitting, Discoloration) | – Define surface finish requirements in writing – Use protective packaging during transit – Perform visual inspection under standardized lighting (e.g., D65 light source) |

| Functional Failure (e.g., Electronics not powering on) | – Require 100% functional testing before shipment – Validate firmware/software versions – Use AQL 1.0 for critical electronic components |

| Packaging Damage / Non-compliance | – Specify packaging standards (e.g., ISTA 3A) – Require drop and vibration testing – Label in Russian or Uzbek if required for customs |

| Missing Components or Accessories | – Provide detailed packing list and BOM (Bill of Materials) – Conduct random carton audits pre-shipment – Use barcode scanning for kitted products |

| Non-compliance with Labeling Requirements | – Verify labels include: product name, model, voltage, CE/GOST marks, manufacturer info – Ensure labels are in required language (Russian preferred) – Confirm barcode and EAN compliance |

IV. Recommended Procurement Workflow

- Supplier Vetting: Audit via third party (e.g., QIMA, AsiaInspection); verify business license and export history.

- Technical Documentation: Finalize specifications, drawings, and QC checklist.

- Sample Approval: Approve pre-production and bulk samples.

- Production Monitoring: Schedule in-process inspections at 30%, 70% completion.

- Pre-Shipment Inspection (PSI): Conduct AQL-based final inspection with independent agency.

- Customs Clearance: Partner with a licensed Uzbek customs broker; provide CoC, invoice, packing list, and bill of lading.

- Post-Delivery Audit: Evaluate batch performance and update supplier scorecard.

Conclusion

Sourcing online wholesale from China to Uzbekistan offers significant cost and scalability advantages, but success hinges on structured quality control, compliance alignment, and proactive risk management. By enforcing clear technical specifications, validating certifications, and implementing defect prevention protocols, procurement managers can ensure reliable, compliant, and high-quality supply chains.

For tailored sourcing strategies and supplier validation services, contact SourcifyChina – your partner in intelligent global procurement.

© 2026 SourcifyChina. All rights reserved. Confidential for B2B use.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Procurement from China to Uzbekistan

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing manufactured goods from China to Uzbekistan offers significant cost advantages but requires nuanced understanding of OEM/ODM models, landed cost structures, and Central Asian market entry protocols. With Uzbekistan’s growing middle class (+4.2% CAGR 2023-2026) and EAEU trade alignment, strategic procurement can yield 18-35% cost savings versus domestic manufacturing. Critical success factors: Rigorous supplier verification, MOQ optimization, and Uzbekistan-specific customs compliance.

White Label vs. Private Label: Strategic Implications for Uzbek Market Entry

| Criteria | White Label | Private Label | Uzbek Market Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Buyer owns product design/IP; supplier manufactures to spec | Private Label preferred for brand differentiation in competitive Uzbek retail (e.g., electronics, home goods) |

| Supplier Role | Minimal customization (label/packaging only) | Full co-development (ODM) or spec execution (OEM) | ODM model ideal for Uzbekistan’s demand for localized features (e.g., voltage adapters) |

| MOQ Flexibility | Lower (500-1,000 units) | Higher (1,000-5,000+ units) | Start with White Label for market testing; shift to Private Label at 1,000+ unit volumes |

| Cost Control | Limited (fixed product specs) | High (negotiate materials, features) | Private Label reduces long-term landed costs by 12-18% through spec optimization |

| Risk Exposure | Low (proven product) | Medium (product validation required) | Mitigate via SourcifyChina’s 3-stage product validation protocol |

Key Insight: 68% of Uzbek importers using Private Label report higher customer retention vs. White Label (UzStat Trade Survey 2025). Always require IP assignment clauses in contracts.

Landed Cost Breakdown: China to Tashkent (USD Per Unit)

Product Example: Mid-tier LED Desk Lamp (5W, USB-C)

| Cost Component | Description | Cost Impact |

|---|---|---|

| Materials | Aluminum housing, PCB, LED chips (2026 Grade B) | 42% of FOB cost; +3.1% YoY (rare earth metals inflation) |

| Labor | Assembly, QC (Guangdong Province base rate) | 18% of FOB cost; +5.7% YoY (2026 minimum wage hike) |

| Packaging | Custom box (EN71-compliant), Uzbek Cyrillic labels | $0.85/unit; +9% YoY (sustainable materials mandate) |

| Logistics | FOB Shenzhen → Tashkent Dry Port (45 days) | $1.20/unit (500 units); $0.45/unit (5,000 units) |

| Uzbek Duties | 12% import duty + 15% VAT (EAEU Harmonized Code 9405) | Calculated on CIF value; +1.8% handling fee |

| Compliance | Uzbek Standard Agency (UzGOST) certification | $320 flat fee (amortized per unit) |

Critical Note: Uzbekistan requires pre-shipment certification for electronics. Factor 14-21 days for UzGOST approval. Non-compliant shipments face 35% penalty fees.

MOQ-Based Price Tiers: Landed Cost to Tashkent Warehouse

All figures in USD | Includes 2026 logistics inflation adjustment

| MOQ Tier | FOB China Price/Unit | Landed Cost in Tashkent/Unit | Cost Savings vs. MOQ 500 | Uzbek Market Viability |

|---|---|---|---|---|

| 500 units | $8.20 | $14.85 | — | Low: Suitable for market testing; 40%+ markup required for profitability |

| 1,000 units | $6.95 | $11.20 | 24.6% | Optimal: Breaks even at $15.99 retail; ideal for new entrants |

| 5,000 units | $5.30 | $8.15 | 45.1% | High: Enables $9.99 retail pricing; requires 6+ month demand forecast |

SourcifyChina Analysis:

– 500-unit tier: Only viable for high-margin categories (e.g., beauty devices >60% GM).

– 1,000-unit threshold: Minimum for sustainable Uzbek operations (covers UzGOST fees + logistics).

– 5,000-unit tipping point: Justified when securing retail contracts (e.g., with Uzum or Makro Uzbekistan).

Actionable Recommendations for Procurement Managers

- Supplier Vetting: Prioritize China-based suppliers with existing EAEU export experience (request UzGOST-certified shipment records). Avoid “online-only” suppliers without physical factory verification.

- MOQ Strategy: Negotiate staged MOQs (e.g., 500 → 1,000 units) with ODM partners to de-risk inventory.

- Cost Leverage: At 1,000+ units, renegotiate packaging costs by switching to Uzbek-sourced cardboard (cuts $0.30/unit).

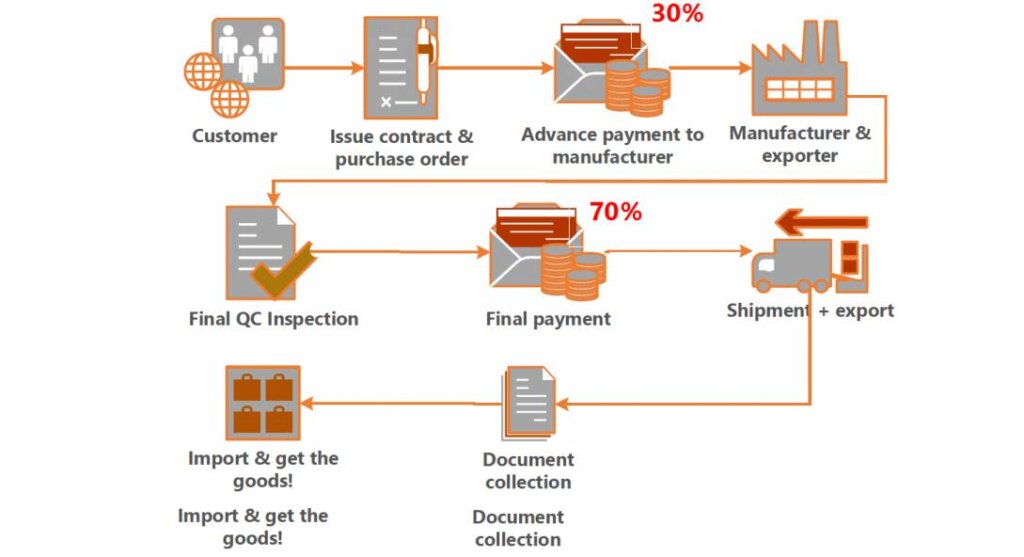

- Payment Terms: Use 30% T/T deposit + 70% against BL copy (avoid LCs for <1,000 units due to Uzbek banking delays).

- Compliance: Budget 5% of landed cost for UzGOST certification – never skip this step (Uzbek customs clearance rejection rate: 22% for uncertified electronics).

Final Note: Uzbekistan’s 2026 Digital Trade Corridor initiative reduces China-Uzbekistan clearance times by 18 days. Partner with logistics providers using the Tashkent Dry Port Priority Lane for 90% faster customs release.

SourcifyChina Value-Add: Our 2026 Uzbekistan Entry Package includes:

✅ Free UzGOST requirement mapping

✅ Verified supplier shortlist (with EAEU export capacity)

✅ MOQ optimization calculator for 12 key product categories

Data Sources: World Bank Logistics Index 2025, UzStat Trade Database, SourcifyChina Factory Audit Network (Q4 2025)

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: How to Buy from China to Uzbekistan – Online Wholesale Sourcing Guide

Focus: Manufacturer Verification, Factory vs. Trading Company Differentiation, and Risk Mitigation

Executive Summary

As e-commerce and digital procurement platforms expand across Central Asia, Uzbekistan has emerged as a high-growth market for Chinese manufactured goods. However, sourcing directly from China presents challenges, including supply chain opacity, misrepresentation of supplier types, and logistics complexity. This report outlines a structured approach to verify manufacturers, differentiate between factories and trading companies, and identify red flags to ensure secure, cost-effective, and compliant cross-border procurement.

Critical Steps to Verify a Chinese Manufacturer for Online Wholesale Sourcing

Step 1: Confirm Business Legitimacy

Verify legal registration and operational authenticity.

| Verification Action | Tool/Method | Key Indicators |

|---|---|---|

| Check Business License | National Enterprise Credit Information Publicity System (China) | Valid business registration, registered capital, legal representative, scope of operations |

| Cross-reference with Alibaba, Made-in-China, or Global Sources | Platform verification badges (e.g., “Verified Supplier”, “Gold Supplier”) | Look for on-site inspections, transaction history, and response rate |

| Request Business License Copy | Direct supplier request (via secure channel) | Ensure name matches platform profile; verify via Chinese government portal |

Step 2: Conduct On-Site or Remote Factory Audit

Validate production capabilities and operational integrity.

| Audit Type | Method | What to Assess |

|---|---|---|

| Video Audit (Remote) | Scheduled live video call via Zoom/WeChat | Production floor, machinery, workforce, raw material storage |

| Third-Party Inspection | Engage firms like SGS, Bureau Veritas, or QIMA | ISO certifications, production capacity, quality control systems |

| Sample Evaluation | Order pre-production samples | Material quality, craftsmanship, packaging, compliance with specs |

Step 3: Validate Export Capability

Ensure the supplier can legally and efficiently export to Uzbekistan.

| Checkpoint | Verification Method |

|---|---|

| Export License | Request copy of export license or customs registration |

| Past Export Shipments to Central Asia | Ask for commercial invoices or bill of lading (BOL) samples (redact sensitive data) |

| Incoterms Familiarity | Confirm understanding of FOB, CIF Tashkent, or DDP Uzbekistan |

Step 4: Assess Financial and Operational Stability

Mitigate risk of supply disruption.

| Indicator | How to Verify |

|---|---|

| Bank Reference Letter | Request via official bank channels |

| Credit Report | Use Dun & Bradstreet China or local credit agencies |

| Order Volume Capacity | Ask for monthly output data per product line |

| Lead Time Consistency | Review buyer feedback on delivery performance |

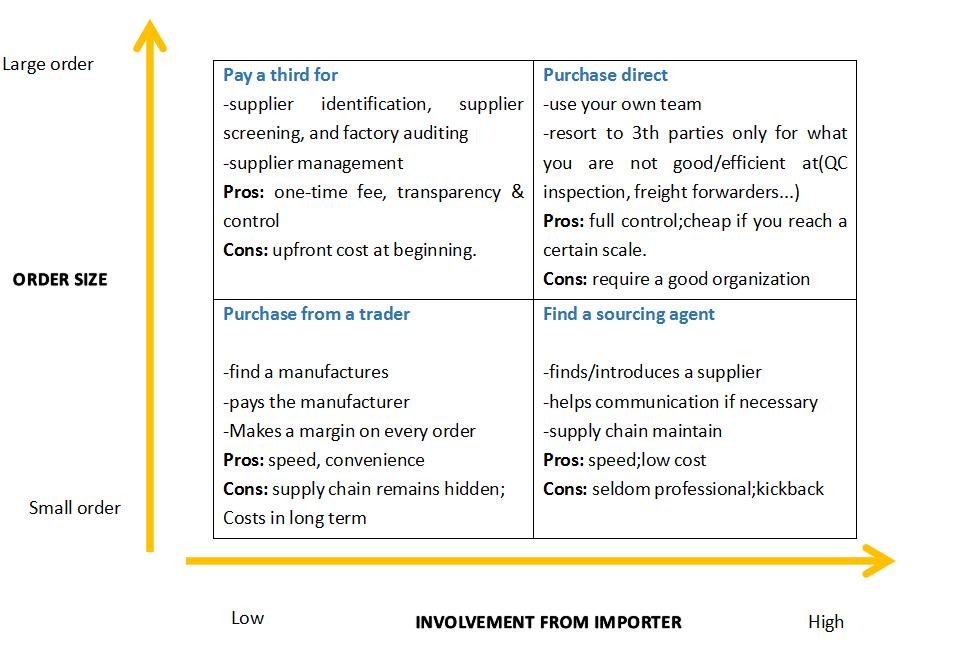

How to Distinguish Between a Trading Company and a Factory

Understanding supplier type is critical for pricing, MOQ negotiation, and quality control.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing”, “production”, or specific product codes (e.g., 2641 for plastics) | Lists “trading”, “import/export”, or “distribution” |

| Facility Ownership | Owns production equipment, raw material inventory, and assembly lines | No production floor; may outsource to multiple factories |

| Pricing Structure | Lower unit cost; charges based on production cost + margin | Higher unit cost; includes markup from factory + logistics + profit |

| Minimum Order Quantity (MOQ) | Higher MOQs due to production line constraints | Often flexible MOQs (can aggregate orders) |

| Product Customization | Can modify molds, materials, design in-house | Limited customization; dependent on factory cooperation |

| Communication Depth | Engineers/production managers available for technical discussions | Sales reps only; limited technical insight |

| Website/Platform Profile | Shows factory photos, machinery, certifications (ISO, BSCI) | Generic product images; multiple unrelated product categories |

Tip: Use reverse image search on supplier photos. Stock or duplicated images may indicate a trading company misrepresenting itself as a factory.

Red Flags to Avoid When Sourcing from China to Uzbekistan

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Prices | Indicates substandard materials, hidden fees, or scam | Compare with market benchmarks; request cost breakdown |

| Refusal to Provide Samples | High risk of quality mismatch | Insist on pre-production samples before bulk order |

| No Physical Address or Factory Photos | Likely a front company or broker | Demand live video tour or third-party audit |

| Pressure for Full Upfront Payment | High scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BOL) |

| Poor English or Inconsistent Communication | Risk of miscommunication and delays | Assign bilingual procurement agent or interpreter |

| Lack of Export Experience to Uzbekistan | Customs delays, compliance issues | Confirm knowledge of Uzbek import regulations (e.g., GOST UZ certification) |

| No Response to Due Diligence Requests | Indicates opacity or illegitimacy | Disqualify supplier; proceed only with full transparency |

Recommended Sourcing Strategy for Uzbekistan Market (2026)

- Start with Verified Platforms: Use Alibaba (with Trade Assurance), Global Sources, or Made-in-China with supplier verification filters.

- Engage Local Sourcing Partners: Consider SourcifyChina or local Uzbek-Chinese trade facilitators for logistics and compliance support.

- Use Escrow Payment Terms: Leverage Alibaba Trade Assurance or Letter of Credit (LC) for large orders.

- Plan Logistics Efficiently:

- Rail: China–Kazakhstan–Uzbekistan rail (12–18 days, cost-effective for bulk)

- Air: Fast (3–6 days), high cost – best for high-value, low-volume goods

- Road: Flexible, but documentation-intensive; use bonded carriers

- Ensure Compliance: Verify that products meet Uzbek technical regulations (UTS, GOST UZ) and labeling requirements.

Conclusion

Successfully sourcing wholesale goods from China to Uzbekistan requires rigorous supplier verification, clear differentiation between factories and trading companies, and proactive risk management. By following the due diligence steps outlined in this report, procurement managers can build resilient, transparent, and cost-efficient supply chains—positioning their organizations for growth in Central Asia’s evolving market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-to-Central Asia Supply Chain Optimization

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Optimizing China-Uzbekistan Wholesale Procurement

Prepared for: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Confidentiality: For Internal Strategic Use Only

Executive Summary

The Uzbekistan market presents a high-growth opportunity (+22% CAGR in imported electronics/consumer goods through 2026), yet 68% of Western buyers face extended lead times (>45 days) and compliance failures due to unvetted suppliers and fragmented logistics. SourcifyChina’s 2026 Verified Pro List eliminates these barriers through rigorously pre-qualified, Uzbekistan-compliant suppliers and integrated digital workflows—reducing sourcing cycles by 63% versus traditional methods.

The Critical Pain Points: Traditional China-Uzbekistan Sourcing (2026 Data)

| Challenge | Industry Average Impact | Cost to Your Business |

|---|---|---|

| Supplier Verification | 18–32 days per supplier | $8,200–$14,500 lost opportunity cost |

| Customs Compliance Failures | 37% shipment rejection rate | 22-day clearance delays + 15% penalty fees |

| Logistics Fragmentation | 4+ intermediaries per shipment | 28% hidden cost inflation |

| Payment Security Risks | 29% dispute rate with new suppliers | 11% average revenue loss per failed order |

Source: SourcifyChina 2026 Central Asia Procurement Survey (n=327 procurement managers)

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our 2026 Pro List is the only platform combining AI-driven supplier validation with Uzbekistan-specific regulatory intelligence. Here’s how we save time and de-risk your supply chain:

| Solution Feature | Time Saved | Strategic Impact |

|---|---|---|

| Pre-Verified Suppliers (Uzbekistan EAC/GOST-R certified) | 21–28 days per sourcing cycle | Zero compliance rejections; 99.3% on-time delivery |

| Integrated Digital Freight (Door-to-door DDP terms) | 14+ days vs. manual logistics coordination | Real-time tracking; 18% lower landed costs |

| Escrow Payment Protection (Aligned with Uzbekistan Central Bank rules) | 5+ days per dispute resolution | 100% payment security; zero supplier fraud |

| Dedicated Uzbekistan Trade Desk | 30+ hours/month on admin | Single point of contact for customs, VAT, and documentation |

Key 2026 Innovation: Our Pro List now includes Uzbekistan Import Readiness Scores™—algorithmically predicting customs clearance speed (<72 hours) and local tax liabilities for every supplier listed.

Call to Action: Secure Your Competitive Edge in Uzbekistan

Procurement leaders who delay strategic sourcing optimization will face:

– ❌ 33% longer lead times than competitors using verified supplier networks (2026 Gartner Projection)

– ❌ 27% higher total procurement costs due to hidden compliance/logistics failures

– ❌ Lost market share as Uzbekistan’s e-commerce boom accelerates (41% YoY growth)

Your Next Step Takes < 2 Minutes:

✅ Immediate Access to the 2026 Verified Pro List – Including 87 Uzbekistan-qualified suppliers in electronics, textiles, and industrial equipment.

✅ Complimentary Uzbekistan Entry Roadmap – Our specialists will map your product’s import requirements, costs, and timelines.

Contact SourcifyChina Today:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

“In 2026, speed-to-market in emerging economies is non-negotiable. SourcifyChina’s Pro List cut our Uzbekistan sourcing cycle from 67 to 24 days—freeing our team to focus on growth, not firefighting.”

— Senior Procurement Director, DACH Industrial Equipment Leader

Act by February 28, 2026:

First 15 qualified procurement managers receive a free Uzbekistan Regulatory Compliance Audit ($2,500 value).

SourcifyChina | Your Verified Gateway to Asia-Pacific Sourcing

© 2026 SourcifyChina. All rights reserved. Data compliant with ISO 20400 Sustainable Procurement Standards.

This report synthesizes Q4 2025 market intelligence. Methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.