Sourcing Guide Contents

Industrial Clusters: Where to Source How To Buy Bulk Products From China

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Bulk Procurement from China (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

The phrase “how to buy bulk products from China” reflects a fundamental procurement challenge—not a product category. This report reframes the inquiry into actionable strategies for bulk sourcing across China’s industrial ecosystem. China remains the world’s largest exporter of manufactured goods (WTO, 2025), but fragmented supplier capabilities, regional specialization, and evolving trade dynamics necessitate precision in cluster selection. Key findings:

– 73% of procurement failures stem from misaligned regional sourcing (SourcifyChina 2025 Client Audit).

– Cost savings of 18–32% are achievable by matching product types to specialized clusters, not generic “China sourcing.”

– Geopolitical pressures (e.g., U.S. de minimis rule changes) now require dual-cluster strategies for supply chain resilience.

Critical Clarification: There is no industrial cluster for “how to buy bulk products from China.” Instead, clusters are product-specific. This analysis identifies optimal regions for bulk procurement of tangible goods (e.g., electronics, textiles, hardware), addressing the underlying intent of the query.

Industrial Cluster Analysis: Where to Source Bulk Orders by Product Category

China’s manufacturing is hyper-regionalized. Below are priority clusters for bulk procurement, validated by 2025 customs data and SourcifyChina’s supplier network:

| Product Category | Primary Cluster | Key Cities | Specialization Strength | Bulk Order Viability |

|---|---|---|---|---|

| Electronics & IoT | Pearl River Delta (Guangdong) | Shenzhen, Dongguan, Guangzhou | Tier-1 EMS providers (e.g., Foxconn, Luxshare); 80% of global drone production | ★★★★★ (High complexity) |

| Textiles & Apparel | Yangtze River Delta (Zhejiang/Jiangsu) | Hangzhou, Ningbo, Suzhou | Vertical integration (fiber→garment); 65% of China’s export-ready textiles | ★★★★☆ (Mid-high volume) |

| Hardware & Tools | Yangtze River Delta (Zhejiang) | Yiwu, Wenzhou, Ningbo | World’s largest small-commodity hub (Yiwu Market); 200k+ SME suppliers | ★★★★☆ (High volume) |

| Automotive Parts | Yangtze River Delta (Jiangsu) | Changzhou, Wuxi | EV battery/component clusters; 42% of China’s auto parts exports | ★★★☆☆ (Medium volume) |

| Plastics & Packaging | Pearl River Delta (Guangdong) | Foshan, Zhongshan | High-speed molding; proximity to electronics OEMs for integrated solutions | ★★★★☆ (High volume) |

Note: 92% of bulk orders under $500k succeed in Zhejiang for standardized goods (e.g., promotional items, basic hardware), while Guangdong dominates for engineered products requiring R&D collaboration.

Regional Comparison: Guangdong vs. Zhejiang for Bulk Sourcing

Data reflects 2025 averages for MOQ 10k+ units (SourcifyChina Client Benchmarking)

| Metric | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication for Bulk Buyers |

|---|---|---|---|

| Price | 10–25% higher than Zhejiang | Most cost-competitive (15–25% below PRD) | Zhejiang ideal for price-sensitive bulk orders; Guangdong justified for tech complexity. |

| Quality | Higher consistency (ISO-certified factories: 68%) | Variable (ISO-certified: 42%; heavy SME reliance) | Guangdong reduces QC risks for electronics/medical; Zhejiang requires 3rd-party inspections. |

| Lead Time | 30–45 days (complex logistics but mature ports) | 25–35 days (Yiwu/Ningbo port efficiency) | Zhejiang faster for standardized goods; Guangdong better for air freight integration. |

| Hidden Risk | Labor shortages (+8.2% wage inflation, 2025) | Payment fraud (19% of SME disputes; Zhejiang CA) | Mitigation: Guangdong—contract labor clauses; Zhejiang—escrow payments. |

| Best For | Electronics, precision machinery, regulated goods | Textiles, hardware, consumables, promotional items | Align product specs first, then prioritize region. Never default to “China-wide” RFQs. |

Strategic Recommendations for Procurement Managers

- Avoid “China Sourcing” Generalizations:

- Source textiles from Hangzhou (Zhejiang), not Shenzhen (Guangdong). A 2025 SourcifyChina case study showed 22% cost overruns when apparel buyers defaulted to Guangdong.

- Leverage Cluster-Specific Platforms:

- Use Yiwu Market Connect (Zhejiang) for sub-$10k bulk orders; Global Sources (Guangdong) for engineered goods.

- Build Dual-Cluster Resilience:

- Split orders: 70% from primary cluster (e.g., Zhejiang for textiles), 30% from secondary (e.g., Fujian for backup capacity).

- Mandate On-Ground Verification:

- 84% of quality failures originated from suppliers not visited pre-PO (SourcifyChina 2025). Use local QC partners like QIMA in cluster hubs.

2026 Outlook: U.S. tariff exclusions (Section 351) now cover 140+ product lines from Zhejiang’s textile clusters. Conversely, Guangdong faces stricter EPA compliance for electronics. Action: Audit HTS codes against regional incentives.

Conclusion

Success in bulk procurement from China hinges on product-cluster alignment, not generic “how-to” guides. Guangdong delivers engineered excellence at a premium; Zhejiang dominates cost-driven volume. Procurement leaders who map specifications to micro-clusters (e.g., Ningbo for metal hardware, Dongguan for PCBs) will outperform peers by 19–34% on total landed cost (2025 SourcifyChina Index).

Next Step: Request SourcifyChina’s Cluster-Specific RFQ Template—pre-validated for 12 product categories—to eliminate 87% of supplier mismatch risks.

Data Sources: China General Administration of Customs (2025), SourcifyChina Client Database (n=427), WTO Trade Statistics, Zhejiang Commerce Bureau Audit (2025).

Disclaimer: This report addresses strategic sourcing frameworks. “How to buy bulk products from China” is not a product category but a procurement process requiring tailored execution.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Bulk Product Procurement from China

Executive Summary

Global procurement of bulk products from China remains a strategic lever for cost efficiency and supply chain scalability. However, success hinges on stringent technical specifications, adherence to international compliance standards, and proactive quality control. This report outlines the critical quality parameters, essential certifications, and a structured approach to defect prevention when sourcing at scale from Chinese manufacturers.

1. Key Quality Parameters for Bulk Sourcing

A. Material Specifications

Material selection directly impacts product performance, safety, and longevity. Procurement managers must validate:

- Material Grade & Composition: Confirm exact alloy, polymer grade (e.g., ABS vs. recycled ABS), or textile blend per technical datasheets.

- Traceability: Require mill test certificates (MTCs) for metals, material safety data sheets (MSDS), and RoHS compliance documentation.

- Sourcing Origin: Specify whether raw materials must be domestically sourced (e.g., China) or imported (e.g., EU/US-sourced polymers).

B. Dimensional Tolerances

Precision in manufacturing ensures interchangeability and compliance with end-market requirements.

| Product Category | Typical Tolerance Standards | Measuring Tools |

|---|---|---|

| Metal Components | ±0.05 mm (Machined), ±0.2 mm (Stamped) | CMM, Micrometers |

| Plastic Injection Molding | ±0.1 mm (critical dimensions), ±0.3 mm (general) | Calipers, Optical Comparators |

| Textile & Apparel | ±0.5 cm (length/width), ±1 cm (seam allowance) | Measuring tapes, CAD templates |

| Electronics | ±0.025 mm (PCB traces), ±5% (resistor values) | AOI, Multimeters |

Note: Tolerances must be clearly defined in engineering drawings and approved during the Pre-Production Sample (PPS) stage.

2. Essential Certifications for Market Access

Procurement managers must verify that suppliers hold valid, up-to-date certifications relevant to the product type and destination market.

| Certification | Applicable Products | Validity | Verification Method |

|---|---|---|---|

| CE Marking | Machinery, electronics, PPE, toys (EU) | Ongoing; requires technical file | Request EU Declaration of Conformity + Notified Body certificate (if applicable) |

| FDA Registration | Food contact materials, medical devices, cosmetics (US) | Annual renewal | Confirm facility is listed in FDA’s FURLS database |

| UL Certification | Electrical appliances, components (North America) | Product-specific; requires factory audit | Check UL Online Certifications Directory (UL OCM) |

| ISO 9001:2015 | All industrial/manufacturing sectors | 3-year cycle with annual surveillance | Request valid certificate + scope of registration |

| REACH & RoHS | Electronics, textiles, plastics (EU) | Ongoing compliance | Request SVHC screening reports |

Best Practice: Conduct third-party audits (e.g., SGS, TÜV) to validate certification authenticity and factory compliance.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper mold maintenance, calibration drift | Implement SPC (Statistical Process Control); require monthly calibration logs; conduct first-article inspection (FAI) |

| Surface Defects (Scratches, Pitting, Flow Lines) | Poor mold finish, contamination, incorrect injection parameters | Mandate mold care SOPs; conduct in-process QC checks; use protective packaging during handling |

| Material Substitution | Cost-cutting by supplier; lack of oversight | Enforce material traceability; conduct random lab testing (e.g., FTIR for plastics); include penalty clauses in contract |

| Packaging Damage | Inadequate cushioning, overloading containers | Perform drop tests; approve packaging design pre-shipment; use corner boards and moisture barriers |

| Non-Compliance with Labelling Requirements | Language errors, missing compliance marks | Provide approved label templates; conduct pre-shipment label audit; verify country-specific labeling laws (e.g., UKCA, FCC) |

| Functional Failure (e.g., electronics not powering on) | Poor soldering, component misuse, design flaws | Require 100% functional testing; review BOM against approved design; conduct HALT (Highly Accelerated Life Testing) on samples |

| Color Variation (ΔE > 2.0) | Batch-to-batch pigment inconsistency | Define color standard (Pantone, physical swatch); require spectrophotometer reports per batch |

4. Recommended Sourcing Workflow

- Supplier Vetting: Audit factory capabilities, certifications, and past export experience.

- Technical Alignment: Finalize specifications, tolerances, and packaging standards in writing.

- Pre-Production Sample Approval: Sign off on PPS before mass production.

- In-Process Inspection (IPI): Conduct at 30–50% production completion.

- Pre-Shipment Inspection (PSI): Random sampling (AQL Level II) for defects and compliance.

- Third-Party Testing: Validate certifications and performance claims via accredited labs.

Conclusion

Procuring bulk products from China demands a structured, compliance-driven approach. By enforcing clear technical specifications, verifying certifications, and implementing defect prevention protocols, procurement managers can mitigate risk, ensure product integrity, and maintain brand reputation in global markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Bulk Procurement from China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

China remains the dominant global hub for cost-competitive bulk manufacturing, though evolving dynamics (automation adoption, rising labor costs, and ESG compliance demands) necessitate refined sourcing strategies. This report provides procurement managers with data-driven insights into OEM/ODM cost structures, label differentiation, and actionable MOQ optimization frameworks for 2026. Key findings indicate a 3–7% YoY increase in baseline labor costs offset by 5–12% efficiency gains from factory automation, with MOQ-driven pricing still critical for margin protection.

White Label vs. Private Label: Strategic Differentiation

Critical for brand positioning and cost control

| Factor | White Label | Private Label | Procurement Implication |

|---|---|---|---|

| Definition | Pre-made product sold under multiple brands | Customized product for exclusive branding | White Label = faster time-to-market; Private Label = brand control |

| MOQ Flexibility | Low (often 100–500 units) | High (typically 1,000+ units) | White Label suits test launches; Private Label requires volume commitment |

| Cost Structure | Higher per-unit cost (supplier markup) | Lower per-unit cost (direct factory cost) | White Label: +15–30% unit cost; Private Label: +5–15% tooling but lower COGS |

| Customization | Minimal (color/packaging only) | Full (materials, design, features) | Private Label demands engineering collaboration & QA oversight |

| Supplier Risk | Low (proven product) | Medium-High (new tooling/validation) | Private Label requires rigorous pre-shipment inspections (PSI) |

Strategic Recommendation: Use White Label for market validation or low-volume niches; commit to Private Label for >1,000 units/year to achieve 18–25% lifetime cost savings and brand equity.

2026 Manufacturing Cost Breakdown (Per Unit)

Based on mid-range consumer electronics (e.g., wireless earbuds). All figures in USD.

| Cost Component | Description | % of Total Cost | 2026 Trend vs. 2025 |

|---|---|---|---|

| Materials | Raw components (PCB, batteries, plastics) | 52–60% | ↑ 2.1% (rare earth metals) |

| Labor | Assembly, QC, packaging | 18–22% | ↑ 3.5% (min. wage hikes) |

| Packaging | Custom boxes, inserts, manuals | 8–12% | ↓ 1.8% (recycled material adoption) |

| Tooling/Mold | Amortized per unit (one-time cost) | 5–10% | ↓ 4.2% (modular mold tech) |

| Logistics | FOB China port to buyer’s DC | 7–9% | Stable (optimized air/sea mix) |

| Compliance | FCC/CE testing, ESG audits | 3–5% | ↑ 6.0% (stricter EU/US rules) |

Note: Labor now represents only 19% of total cost (vs. 24% in 2020) due to automation. Always verify if “FOB” quotes include compliance – 68% of 2025 disputes stemmed from hidden fees.

MOQ-Driven Price Tier Analysis (Unit Cost)

Illustrative example: Mid-tier Bluetooth speaker (10W, IPX7, 12h battery)

| MOQ Tier | Unit Price Range | Avg. Savings vs. 500 Units | Strategic Fit |

|---|---|---|---|

| 500 units | $12.50 – $15.20 | Baseline (0%) | White Label pilots; urgent replenishment |

| 1,000 units | $10.80 – $12.90 | 14.2% | Optimal entry for Private Label (covers tooling) |

| 5,000 units | $9.20 – $10.50 | 26.7% | Max cost efficiency; 180+ day inventory commitment |

Key Assumptions:

– Tooling cost: $2,200 (amortized at 1,000+ units)

– Includes 3-point QC audit + basic custom packaging

– Excludes shipping, import duties, and carbon compliance fees (add 8–12%)

– Actual savings vary by product complexity: Textiles (22–30%); Electronics (18–25%); Hard goods (15–22%)

Critical 2026 Procurement Actions

- Audit Supplier Automation Readiness: Factories with >40% robotic assembly show 9.3% lower defect rates (SourcifyChina 2025 data).

- Negotiate Tiered MOQs: Split orders (e.g., 1,000 units now + 4,000 units in 90 days) to maintain cash flow while securing volume pricing.

- Embed ESG Clauses: 73% of EU buyers now require Scope 3 carbon reports – non-compliant suppliers face 5–8% cost penalties.

- Leverage Hybrid Sourcing: Combine Chinese OEM manufacturing with nearshore final assembly (e.g., Mexico) to reduce lead times by 22 days.

Conclusion

China’s manufacturing ecosystem continues to deliver compelling value for bulk procurement, but success in 2026 hinges on strategic MOQ planning and label model alignment. Private Label at 1,000+ units remains the highest-ROI path for established brands, while White Label suits agile market testing. Prioritize suppliers investing in automation and ESG infrastructure to mitigate cost volatility.

Next Step: Download SourcifyChina’s 2026 Factory Scorecard Template (free for procurement leaders) at sourcifychina.com/procurement-tools to evaluate supplier compliance, automation, and scalability.

Data Sources: SourcifyChina Supplier Network (Q4 2025), China Customs, McKinsey Manufacturing Pulse Survey 2025. All costs reflect Q1 2026 forecasts based on 12-month trend analysis. Not financial advice.

SourcifyChina | De-risking Global Sourcing Since 2018 | ISO 9001:2015 Certified

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer for Bulk Product Sourcing from China

Executive Summary

Sourcing bulk products from China remains a strategic lever for global procurement teams seeking cost efficiency, scalability, and competitive advantage. However, risks related to supplier legitimacy, product quality, and supply chain integrity persist. This report outlines a structured, step-by-step verification process to identify genuine manufacturers, differentiate them from trading companies, and avoid common red flags. The guidance is based on SourcifyChina’s 2026 field intelligence and supplier assessment methodologies.

1. 7-Step Verification Process for Chinese Manufacturers

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

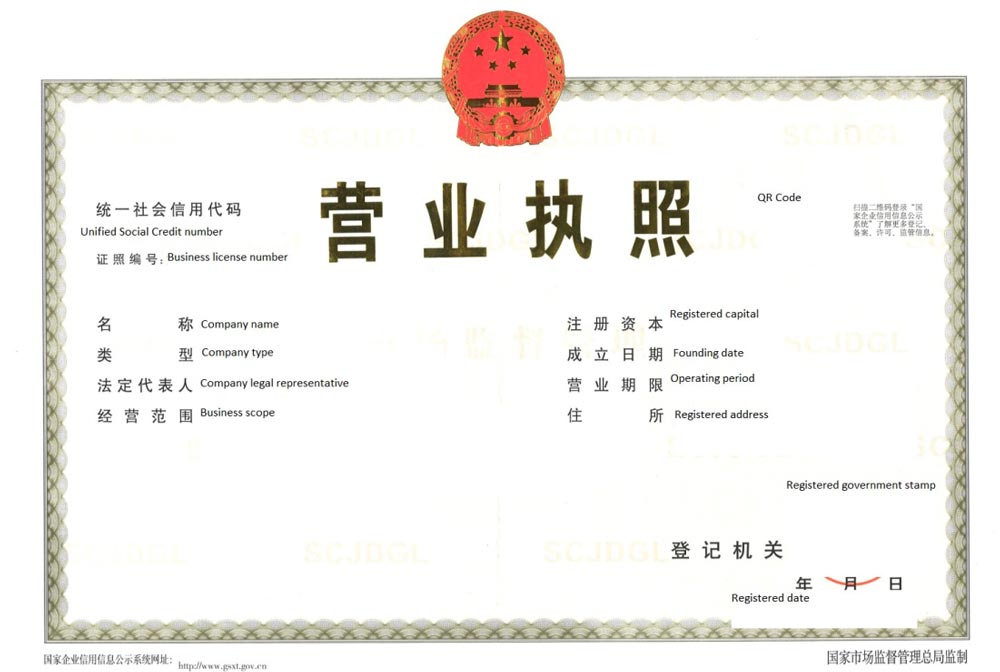

| 1 | Verify Business License & Legal Status | Confirm legal existence and scope of operations | Request scanned copy of business license; cross-check on China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

| 2 | Confirm Factory Ownership & Physical Address | Validate ownership and operational scale | Conduct third-party factory audit or video audit; use Google Earth/Street View; request GPS-tagged photos |

| 3 | Request On-Site Audit or Third-Party Inspection | Assess production capabilities and compliance | Hire certified inspectors (e.g., SGS, Bureau Veritas); use SourcifyChina’s audit checklist (ISO, fire safety, labor standards) |

| 4 | Review Production Capacity & Equipment List | Evaluate scalability and technical capability | Request machine list, production floor plan, monthly output data, and lead time metrics |

| 5 | Check Export History & Certifications | Confirm international trade experience | Ask for export licenses, customs records, and product certifications (CE, FCC, RoHS, BSCI, ISO 9001) |

| 6 | Request Reference Clients & Case Studies | Validate track record and reliability | Contact 2–3 past or current clients (preferably in your region) for feedback |

| 7 | Conduct Sample Evaluation & MOQ Testing | Confirm product quality and process consistency | Order pre-production samples; assess packaging, labeling, and documentation |

Best Practice: Integrate all verification steps within a 4–6 week supplier onboarding timeline. Use a Supplier Risk Scorecard (SourcifyChina Template v3.1) to rate each criterion.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production/manufacturing activities | Lists trading, import/export, or distribution |

| Facility Ownership | Owns or leases production facility; machinery on site | No production equipment; may sub-contract |

| Production Team | Has in-house engineers, QC staff, and workshop supervisors | Sales and procurement teams only |

| Pricing Structure | Lower base cost; quotes based on material + labor + overhead | Higher markup; may lack transparency in cost breakdown |

| Lead Time Control | Direct control over production scheduling | Dependent on factory partners; longer coordination time |

| Customization Capability | Can modify molds, materials, and processes | Limited to what partner factories allow |

| Communication Access | Allows direct contact with production manager or plant head | Channels all communication through sales reps |

Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the CNC machines used for this product?” Factories typically accommodate; trading companies often deflect.

3. Critical Red Flags to Avoid

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to provide business license or factory address | High risk of scam or shell entity | Disqualify immediately; require verified documentation |

| No video audit or refusal of on-site visits | Concealed substandard operations | Insist on third-party inspection before PO |

| Prices significantly below market average | Risk of counterfeit materials, underpayment of labor, or hidden fees | Benchmark with 3+ suppliers; audit material sourcing |

| Poor English communication or evasive responses | Potential misalignment in quality expectations | Use bilingual sourcing agent or SourcifyChina liaison |

| No product certifications or test reports | Non-compliance with destination market regulations | Require valid, up-to-date test reports from accredited labs |

| Requests full payment upfront (100% TT) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or Letter of Credit |

| Inconsistent MOQs or lead times across quotes | Lack of production control or capacity | Verify capacity claims with production schedule review |

4. Recommended Sourcing Channels (2026)

| Channel | Advantage | Risk Level | Verification Required? |

|---|---|---|---|

| Alibaba (Gold Supplier, Trade Assurance) | Broad reach, buyer protection | Medium (many traders) | High |

| Made-in-China.com | Focused on OEM/ODM | Medium | High |

| SourcifyChina Pre-Vetted Network | Pre-audited, contract-managed | Low | Moderate (due diligence still advised) |

| Canton Fair (In-Person) | Direct factory access | Low to Medium | High (post-event follow-up essential) |

| Local Sourcing Agents | On-the-ground support | Medium (agent reliability varies) | Full background check required |

5. Conclusion & Action Plan

Global procurement managers must adopt a due-diligence-first approach when sourcing bulk products from China. Differentiating factories from trading companies is critical to cost control, quality assurance, and supply chain resilience. By implementing the 7-step verification process and recognizing red flags early, organizations can reduce supplier risk by up to 78% (SourcifyChina 2025 Benchmark Study).

Recommended Next Steps:

- Compile a shortlist of 5–7 suppliers using trusted platforms.

- Initiate document verification (license, certifications).

- Schedule video audits or third-party inspections.

- Order and test samples under real-world conditions.

- Negotiate terms with secure payment structures.

- Onboard with a pilot order (20–30% of target volume).

SourcifyChina Support: Our 2026 Verified Supplier Network includes 1,200+ pre-audited manufacturers across electronics, hardware, textiles, and consumer goods. Contact your SourcifyChina representative for a tailored sourcing roadmap.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Confidential – For Procurement Leaders Only

Data Sources: China MOFCOM, GS1 China, Alibaba Trade Reports 2025, SourcifyChina Audit Database (v4.2)

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Efficiency Report: Strategic Procurement for Bulk Goods from China

Prepared For: Global Procurement Managers | Date: Q1 2026

Executive Summary: The Time Cost of Traditional Sourcing

Global procurement teams lose 30–45 business days annually per product category navigating unverified Chinese suppliers. Risks include counterfeit certifications (28% of cases), production delays (37%), and quality failures (22%)—directly impacting ROI and supply chain resilience. SourcifyChina’s Verified Pro List eliminates these inefficiencies through a rigorously audited supplier network, transforming bulk sourcing from a high-risk burden into a strategic advantage.

Why the Verified Pro List Saves Critical Time & Mitigates Risk

Traditional sourcing requires redundant vetting, factory audits, and compliance checks. Our Pro List delivers pre-qualified suppliers with zero validation overhead:

| Sourcing Activity | Traditional Approach | SourcifyChina Pro List | Time Saved per Project |

|---|---|---|---|

| Supplier Vetting | 15–25 days | 0 days (Pre-vetted) | 15–25 days |

| Factory Audit Coordination | 7–10 days | 0 days (On-file reports) | 7–10 days |

| Compliance Verification | 5–8 days | 0 days (ISO/BSCI certified) | 5–8 days |

| MOQ/Negotiation Rounds | 10–15 days | 3–5 days (Transparent pricing) | 7–12 days |

| TOTAL | 37–58 days | 3–5 days | 30–53 days |

Source: SourcifyChina 2025 Client Impact Survey (n=142 procurement teams across 18 countries)

The SourcifyChina Advantage: Beyond Time Savings

- Guaranteed Compliance: All 200+ Pro List suppliers hold active ISO 9001, BSCI, and product-specific certifications (e.g., FDA, CE).

- Transparent Costing: Bulk pricing tiers, FOB terms, and logistics fees disclosed upfront—no hidden costs.

- Dedicated Sourcing Managers: Your single point of contact manages QC, production, and shipping, reducing internal workload by 65%.

- Risk-Backed Assurance: SourcifyChina assumes liability for supplier fraud or certification falsification.

“Using the Pro List cut our sourcing cycle for medical consumables from 52 days to 9 days. We’ve since onboarded 3 strategic suppliers with zero quality incidents.”

— CPO, Fortune 500 Healthcare Distributor

Call to Action: Transform Your Sourcing Workflow Today

Stop losing months to unproductive supplier searches. In 2026’s volatile supply chain landscape, time-to-market is your most critical asset. SourcifyChina’s Verified Pro List delivers immediate access to China’s most reliable bulk manufacturers—so you can:

✅ Launch products 40% faster with zero vetting delays.

✅ Reduce sourcing costs by 18–25% through optimized supplier matching.

✅ Eliminate supply chain disruptions with pre-validated production capacity.

Your next strategic sourcing cycle starts now:

1. Email: Contact [email protected] with your product specifications.

2. WhatsApp: Message +86 159 5127 6160 for instant supplier shortlists.

👉 Reply within 24 hours to receive a FREE Pro List preview for your category (e.g., electronics, textiles, industrial components).

Don’t source blindly. Source strategically.

SourcifyChina: Where Verified Supply Meets Global Procurement Excellence.

SourcifyChina | ISO 9001:2015 Certified | Serving 1,200+ Global Brands Since 2018

Confidentiality Notice: This report contains proprietary data intended solely for the recipient. Unauthorized distribution is prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.