The global titanium production market is experiencing steady growth, driven by rising demand from aerospace, defense, medical, and industrial sectors. According to Grand View Research, the global titanium market size was valued at USD 22.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is underpinned by titanium’s exceptional strength-to-density ratio, corrosion resistance, and biocompatibility, making it indispensable in high-performance applications. With increasing investments in lightweight materials for aircraft and growing adoption in medical implants, titanium producers are scaling production capabilities and advancing extraction technologies. As competition intensifies, a select group of manufacturers has emerged at the forefront, combining vertical integration, innovative processing techniques, and consistent output to dominate the supply chain. Below, we examine the top eight titanium producers shaping the industry’s present and future.

Top 8 How Titanium Is Produced Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Titanium Industries, Inc.

Domain Est. 1995

Website: titanium.com

Key Highlights: Titanium Industries is a global leader in Specialty Metals supply. Complete inventory of Titanium Round Bar, Titanium Plate & Sheet, and more….

#2 Processing of titanium

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: This article discusses the main technologies for processing titanium-containing raw materials, the advantages, and disadvantages of various technological ……

#3 High

Domain Est. 1999

Website: arpa-e.energy.gov

Key Highlights: Titanium oxide is dissolved in a molten oxide, where it is directly and efficiently extracted as molten titanium metal. In this process, electrolysis is used to ……

#4 Titanium Manufacturing and Processing

Domain Est. 1999

Website: azom.com

Key Highlights: The video shows the manufacturing of titanium from the mining and refining of the titanium ore and takes it through the complex and expensive processing….

#5 The Process of Producing Titanium

Domain Est. 2007

Website: amcarbon.com

Key Highlights: The production of titanium begins with the extraction of suitable titanium-bearing ores. The two primary ores from which titanium is derived are ……

#6 Titanium Production Processes

Domain Est. 2019

Website: kyocera-sgstool.co.uk

Key Highlights: Titanium must undergo a number of processes to get from an ore to a finished product. Depending on the final application, the number of steps undertaken varies….

#7 to the Titanium Age

Domain Est. 2021

Website: iperionx.com

Key Highlights: IperionX aims to become a leading American titanium metal and critical materials company with our low cost, low carbon titanium technologies….

#8 Titanium Manufacturing Process and Products

Website: osaka-ti.co.jp

Key Highlights: First, the raw materials are chlorinated and distillated to produce pure TiCl4. Then, titanium sponge is attained by reducing the pure TiCl4 with magnesium. We ……

Expert Sourcing Insights for How Titanium Is Produced

H2: Projected 2026 Market Trends in Titanium Production

As global demand for high-performance materials accelerates across aerospace, medical, automotive, and renewable energy sectors, the production of titanium is expected to undergo significant transformation by 2026. Several key trends are shaping the titanium supply chain, extraction methods, and manufacturing technologies, driven by innovation, environmental concerns, and geopolitical factors.

-

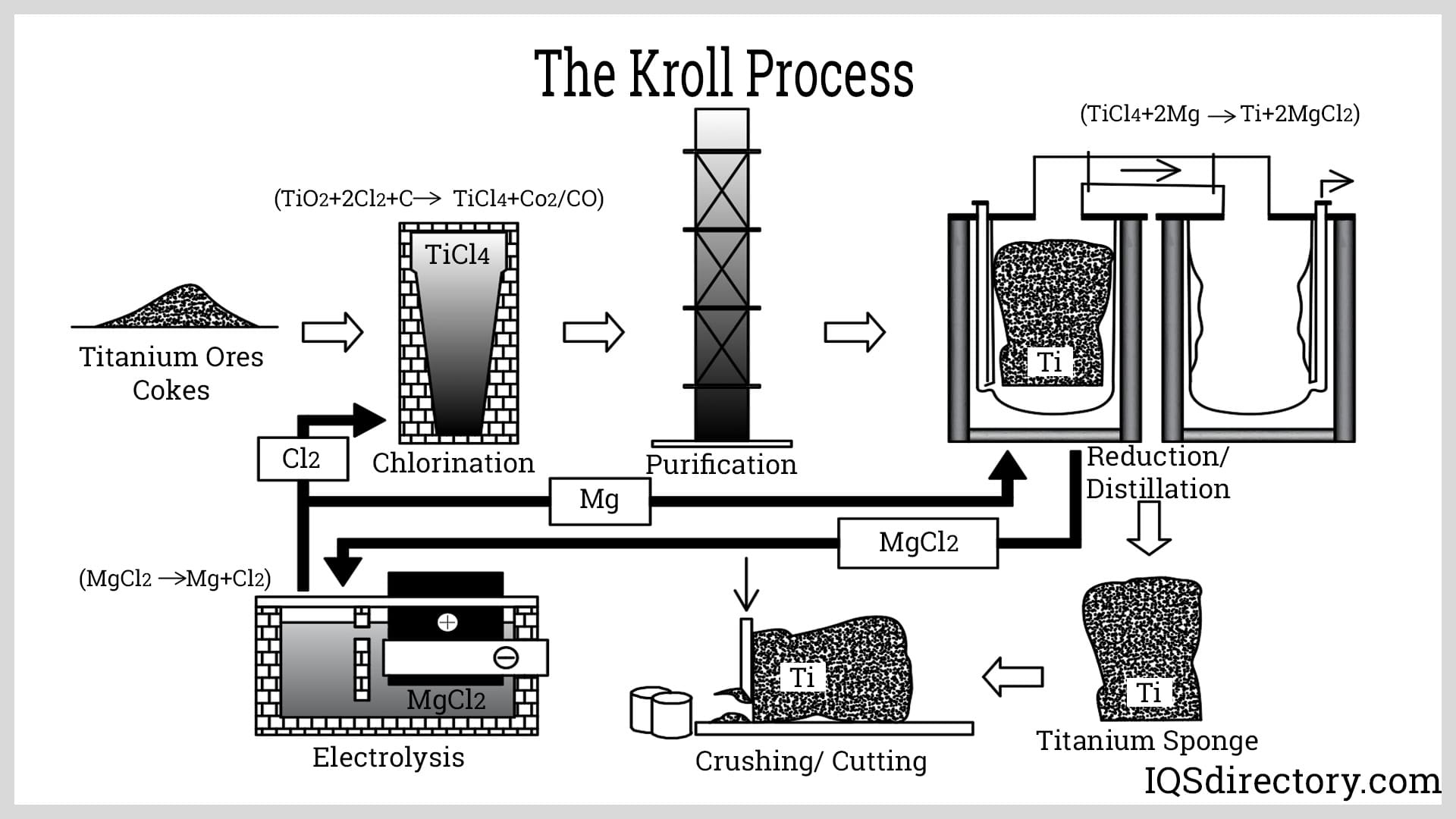

Increased Adoption of Sustainable and Energy-Efficient Processes

Traditional titanium production via the Kroll process—energy-intensive and reliant on chlorine and magnesium—is facing pressure to evolve. By 2026, industry leaders are projected to scale up alternative methods such as the FFC Cambridge Process and Armstrong Process, which offer lower carbon footprints and reduced processing times. These methods enable direct reduction of titanium tetrachloride (TiCl₄) or titanium dioxide (TiO₂) into metallic titanium using molten salt electrolysis or continuous gas-phase reduction, respectively. Investment in green hydrogen-powered reduction techniques is also expected to rise, aligning with global net-zero targets. -

Expansion of Titanium Sponge Production in Asia

China and Japan are anticipated to dominate titanium sponge production by 2026, collectively accounting for over 60% of global output. China’s vertically integrated supply chains, government-backed R&D, and growing aerospace ambitions (e.g., COMAC’s C919 program) are driving capacity expansions. Meanwhile, Japan continues to refine high-purity titanium production for semiconductor and medical applications, leveraging its expertise in precision metallurgy. -

Rise of Additive Manufacturing (AM) and Near-Net-Shape Production

The growing use of titanium in 3D printing for aerospace and biomedical implants is reshaping production dynamics. By 2026, an estimated 15–20% of titanium powder used in additive manufacturing will be produced through advanced atomization techniques (e.g., plasma rotating electrode process and electron beam melting). This shift reduces material waste and supports on-demand manufacturing, decreasing reliance on traditional wrought forms and forging. -

Supply Chain Diversification and Raw Material Sourcing

Geopolitical tensions and supply chain vulnerabilities are prompting producers to diversify sources of titanium feedstock—primarily rutile and ilmenite. Countries like Australia, Mozambique, and Sierra Leone are expanding mining operations, while recycling of titanium scrap (especially from aerospace and industrial sectors) is expected to grow, reaching nearly 30% of total input material by 2026. Enhanced sorting and purification technologies are making recycled titanium more cost-competitive. -

Digitalization and AI in Process Optimization

By 2026, digital twins, AI-driven predictive maintenance, and real-time monitoring systems will be widely implemented in titanium production facilities. These technologies optimize furnace performance, reduce energy consumption, and improve yield consistency, particularly in sponge and ingot production. Machine learning models are being deployed to predict alloy behavior and defect formation, enhancing quality control. -

Regulatory and Environmental Pressures

Stricter emissions standards in the EU and North America are compelling producers to adopt carbon capture and storage (CCS) technologies and transition to renewable energy sources. The EU’s Carbon Border Adjustment Mechanism (CBAM) may impact titanium imports, incentivizing cleaner production methods. As a result, companies are increasingly pursuing ISO 14001 certification and lifecycle assessments to demonstrate sustainability compliance.

In conclusion, the 2026 titanium production landscape will be defined by technological innovation, sustainability imperatives, and regional shifts in manufacturing capacity. Producers who invest in cleaner processes, digital integration, and supply chain resilience will be best positioned to meet rising demand while aligning with global environmental and economic goals.

Common Pitfalls in Sourcing How Titanium Is Produced (Quality, IP)

When sourcing information or materials related to titanium production, especially for industrial, academic, or commercial use, organizations often encounter significant challenges related to both quality assurance and intellectual property (IP) protection. Understanding these pitfalls is critical to ensuring reliable sourcing and safeguarding competitive advantages.

Quality-Related Pitfalls

1. Inconsistent Raw Material Purity

Sourcing titanium feedstock—such as titanium sponge or scrap—can be risky due to variable chemical composition. Impurities like oxygen, nitrogen, or iron can severely affect mechanical properties in the final product. Suppliers from less-regulated regions may lack standardized testing, leading to inconsistent quality and costly rework or rejection in critical applications (e.g., aerospace or medical implants).

2. Lack of Traceability and Certification

Many suppliers fail to provide full material traceability or mill test certificates (MTCs), making it difficult to verify compliance with international standards such as ASTM B265 or AMS 2249. Without proper documentation, end users risk non-compliance in regulated industries and potential liability issues.

3. Variability in Production Processes

Titanium can be produced using different methods (e.g., Kroll process, Hunter process, or emerging molten salt electrolysis). Sourcing from multiple suppliers without understanding their exact production methodology can result in performance inconsistencies. For example, variations in vacuum arc remelting (VAR) cycles affect microstructure and fatigue resistance.

4. Substandard Processing and Fabrication

Even with high-grade titanium, downstream processing such as forging, rolling, or heat treatment can degrade quality if performed by inadequately equipped or unqualified vendors. Poor process control may introduce defects like porosity or inclusions, compromising structural integrity.

Intellectual Property-Related Pitfalls

1. Exposure of Proprietary Production Methods

Disclosing specific details about titanium processing parameters (e.g., temperature profiles, alloying techniques, or refining steps) during sourcing negotiations can inadvertently expose trade secrets. Suppliers or intermediaries might misuse or replicate these processes without proper legal safeguards.

2. Inadequate IP Clauses in Contracts

Standard procurement agreements often lack robust IP protection clauses. Without clear ownership definitions for jointly developed processes or modifications, companies risk losing rights to innovations derived from sourced materials or collaborative R&D efforts.

3. Reverse Engineering Risks

High-performance titanium alloys (e.g., Ti-6Al-4V ELI) are often reverse-engineered by competitors. Sourcing from vendors in jurisdictions with weak IP enforcement increases the likelihood of unauthorized replication, especially if material samples or technical data are shared without non-disclosure agreements (NDAs).

4. Open-Source or Public Domain Misinterpretation

Assuming that general knowledge about titanium production (e.g., the Kroll process) is freely usable can lead to infringement if specific patented improvements—such as energy-efficient reduction techniques or novel purification systems—are unknowingly adopted. Many modern titanium production methods are protected by active patents.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough supplier audits and demand full quality documentation.

– Use NDAs and clearly define IP ownership in sourcing contracts.

– Source from certified suppliers compliant with industry standards (e.g., NADCAP for aerospace).

– Monitor patent landscapes to ensure freedom to operate.

– Limit disclosure of sensitive process data to only what is necessary.

By proactively addressing quality and IP risks, organizations can ensure reliable titanium sourcing while protecting their technical and commercial interests.

Logistics & Compliance Guide for How Titanium Is Produced

Overview of Titanium Production Process

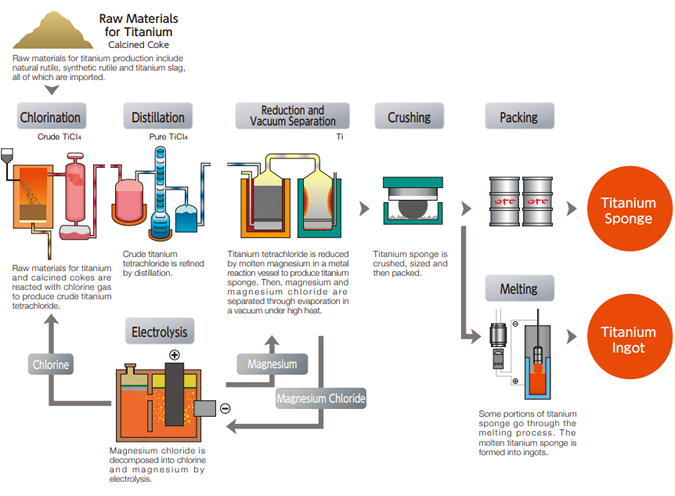

Titanium production is a complex, multi-stage industrial process that begins with the extraction of raw ore and ends with refined titanium metal or alloys. The primary ore used is ilmenite or rutile, both rich in titanium dioxide (TiO₂). The two principal methods for converting this ore into usable titanium metal are the Kroll process and, to a lesser extent, the Hunter process. Most commercial titanium is produced via the Kroll process due to its scalability and purity outcomes.

The process generally follows these steps:

– Mining and concentration of titanium-bearing ores

– Conversion of TiO₂ into titanium tetrachloride (TiCl₄)

– Reduction of TiCl₄ to metallic titanium sponge

– Melting and purification into ingots

– Fabrication into final forms (sheet, bar, etc.)

Each stage involves specific logistical considerations and compliance requirements.

Mining and Ore Transport Logistics

The journey of titanium begins at the mine site, typically located in countries such as Australia, South Africa, Canada, and China. Ilmenite and rutile are often mined via open-pit methods and then processed onsite to increase TiO₂ concentration.

Logistics Considerations:

– Heavy haul trucks and conveyors transport raw ore to processing plants.

– Concentrated ore is shipped in bulk carriers or railcars to chemical processing facilities.

– Proper packaging and moisture control are required to prevent degradation during transport.

– Supply chain visibility and tracking systems (e.g., GPS, RFID) help monitor shipments.

Compliance Requirements:

– Adherence to local mining regulations (e.g., MSHA in the U.S., DMRE in South Africa).

– Environmental permits for land use, water discharge, and dust control.

– Export controls for strategic minerals (some titanium ores may be monitored under international trade agreements).

– Compliance with the International Maritime Solid Bulk Cargoes (IMSBC) Code for sea transport.

Chlorination and Purification of TiCl₄

The concentrated TiO₂ is reacted with chlorine and coke at high temperatures (around 900–1000°C) in fluidized bed reactors to produce titanium tetrachloride (TiCl₄), a volatile liquid.

Logistics Considerations:

– TiCl₄ is highly corrosive and moisture-sensitive; requires specialized stainless steel or glass-lined containers.

– Transport via ISO tank containers or dedicated chemical tankers.

– Strict scheduling needed due to process integration with reduction facilities.

Compliance Requirements:

– Classified as a hazardous material (UN1838, Hazard Class 8 – Corrosive).

– Must comply with ADR (Europe), 49 CFR (U.S.), and IMDG Code (international shipping).

– Requires Safety Data Sheets (SDS) and proper labeling (corrosive, toxic if inhaled).

– Facilities must meet OSHA PSM (Process Safety Management) standards due to high-pressure and high-temperature operations.

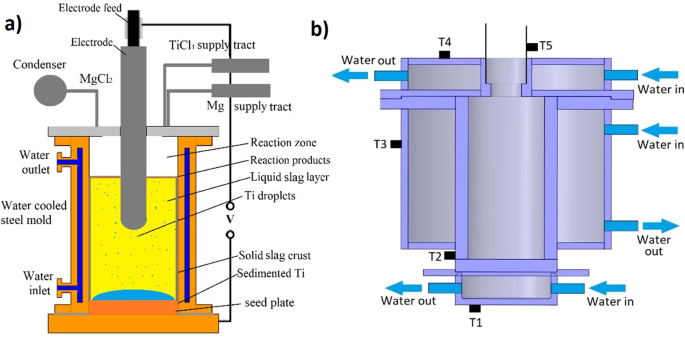

Reduction to Titanium Sponge (Kroll Process)

TiCl₄ vapor is reduced with molten magnesium in an inert argon atmosphere at approximately 800–850°C. This produces titanium “sponge” and magnesium chloride byproduct.

Logistics Considerations:

– Batch process requiring long reaction cycles (up to several days).

– Reactor vessels are sealed and transported as units or processed in situ.

– Spent reactor vessels require cooling and safe handling before transport.

– Sponge is removed under inert atmosphere to prevent oxidation or pyrophoric reactions.

Compliance Requirements:

– Handling under strict inert gas protocols to prevent fire/explosion risks.

– Compliance with NFPA 484 (Standard for Combustible Metals) for titanium sponge.

– Worker protection under OSHA or EU directives (respiratory protection, fire-resistant clothing).

– Waste magnesium chloride must be processed and disposed of according to environmental regulations (e.g., RCRA in the U.S.).

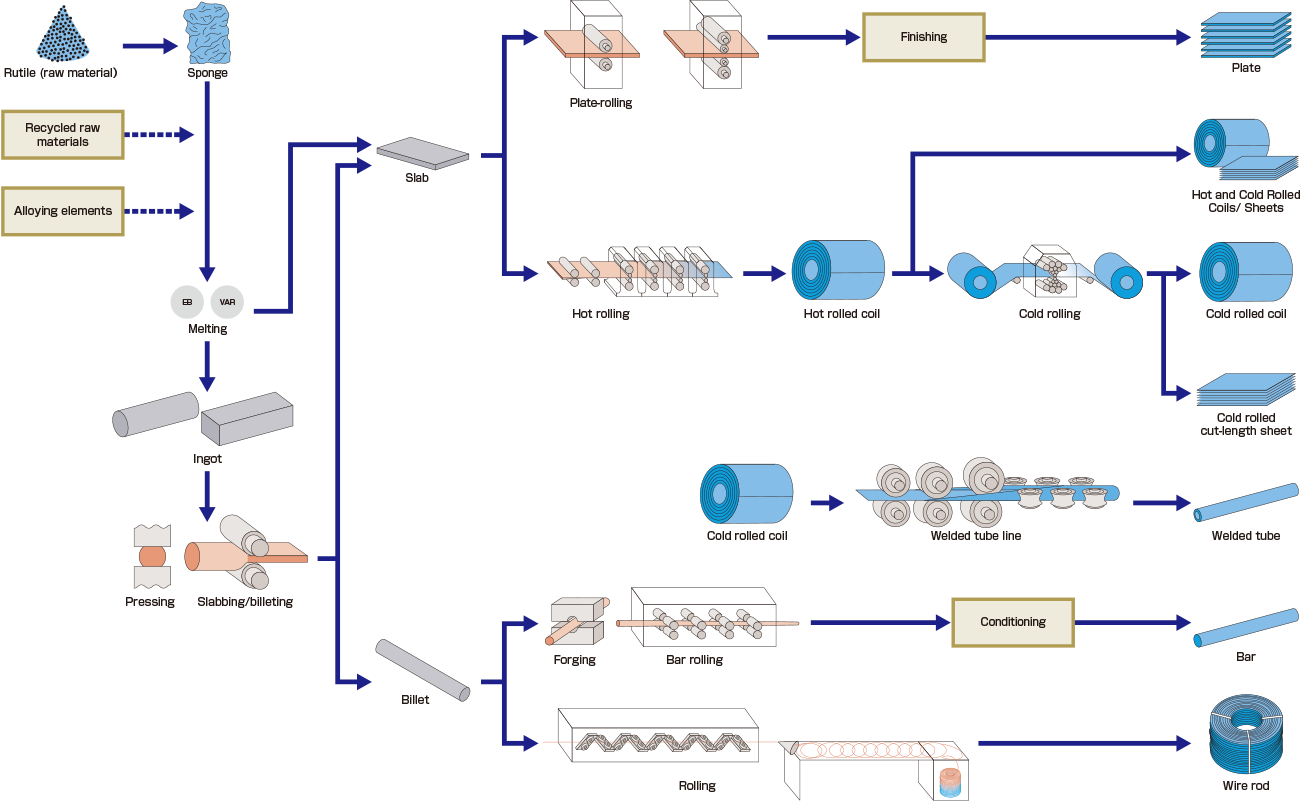

Vacuum Distillation and Melting

After reduction, the titanium sponge undergoes vacuum distillation to remove residual magnesium and salts. The purified sponge is then compressed with alloying elements (e.g., vanadium, aluminum) and melted in a vacuum arc furnace to form ingots.

Logistics Considerations:

– Ingot sizes range from hundreds of kilograms to several tons; require heavy lifting and specialized cranes.

– Melting is energy-intensive and typically centralized at major titanium producers.

– Logistics coordination between sponge production and melting facilities is crucial.

Compliance Requirements:

– Electrical safety standards for high-power arc furnaces (e.g., NFPA 70E).

– Emissions controls for off-gassing during vacuum distillation.

– Ingot quality must meet aerospace or medical standards (e.g., AMS, ASTM).

– Traceability systems required for high-integrity applications (e.g., FAA, ISO 9001:2015, AS9100).

Final Fabrication and Distribution

Titanium ingots are further processed into billets, bars, sheets, or tubes using forging, rolling, or extrusion. These semi-finished products are distributed to end users in aerospace, medical, and industrial sectors.

Logistics Considerations:

– Temperature-controlled transport for certain alloys to prevent phase changes.

– Use of protective coatings and desiccants to prevent surface oxidation.

– Just-in-time delivery models common in aerospace manufacturing.

– Customs documentation and export licenses may be required for international shipments.

Compliance Requirements:

– ITAR (International Traffic in Arms Regulations) applies to certain titanium alloys used in defense.

– REACH and RoHS compliance for European markets.

– Certification to sector-specific standards (e.g., NADCAP for aerospace heat treatment).

– Recordkeeping for material traceability (mill test reports, CoC – Certificate of Conformance).

Environmental, Health, and Safety (EHS) Compliance

Throughout the titanium supply chain, EHS compliance is critical due to the hazardous materials and high-energy processes involved.

Key Requirements:

– Air emissions monitoring (chlorine, particulates, VOCs).

– Wastewater treatment for acid runoff and metal salts.

– Spill prevention and response plans (SPCC) for chlorine and TiCl₄.

– Regular audits and employee training per ISO 14001 and ISO 45001 standards.

Conclusion

The production of titanium involves intricate logistics and rigorous compliance measures across all stages—from mining to final distribution. Companies must integrate advanced supply chain management with strict adherence to environmental, safety, and trade regulations to ensure operational efficiency and regulatory compliance. As demand for titanium grows in high-performance industries, maintaining a compliant and resilient logistics network will remain essential.

In conclusion, titanium is primarily sourced and produced through a complex, energy-intensive process that begins with the extraction of titanium-bearing minerals such as ilmenite and rutile from mineral sand deposits. The most common method for refining titanium into its pure metallic form is the Kroll process, which involves converting the mineral into titanium tetrachloride (TiCl₄), followed by reduction with magnesium in an inert atmosphere to produce titanium sponge. This sponge is then melted and purified further to create usable titanium ingots. Despite being the ninth most abundant element in the Earth’s crust, titanium’s high reactivity at elevated temperatures and the cost of extraction make its production challenging and expensive. Ongoing research into more efficient methods, such as the FFC Cambridge process, aims to reduce costs and environmental impact. Overall, titanium’s exceptional strength-to-density ratio, corrosion resistance, and performance at high temperatures ensure its critical role in aerospace, medical, and industrial applications, driving continued innovation in its production methods.