Sourcing Guide Contents

Industrial Clusters: Where to Source How Much Money Do Us Companies Make In China

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-CHN-FIN-2026-001

Date: October 26, 2023

Prepared For: Global Procurement Managers | Confidentiality Level: Strictly Internal Use Only

Executive Summary

This report addresses a critical misconception in your query: “how much money do US companies make in China” is not a physical product or service that can be sourced from China. It is a financial performance metric (e.g., revenue, profit) tracked internally by US corporations and disclosed via regulatory filings (e.g., SEC 10-K reports). Sourcing applies to tangible goods (e.g., electronics, textiles) or services (e.g., manufacturing, logistics), not proprietary financial data.

China’s industrial clusters produce physical goods, not financial reports. Attempting to “source” US corporate profit data from Chinese factories or suppliers is operationally impossible and legally non-compliant due to:

– Data Privacy Laws: China’s PIPL (Personal Information Protection Law) and US GDPR-equivalent regulations prohibit unauthorized disclosure of corporate financials.

– Regulatory Barriers: Financial data is governed by the US SEC, China’s CSRC, and bilateral tax treaties (e.g., FATCA).

– Commercial Reality: Factories in Guangdong or Zhejiang manufacture products—not financial statements.

Critical Clarification: Why This Query Cannot Be Actioned

| Element | Reality Check | Sourcing Implication |

|---|---|---|

| “Product” Definition | Not a tradable good/service. Represents internal financial metrics of US firms. | Cannot be sourced. Sourcing requires a tangible output (e.g., iPhone assembly, textile dyeing). |

| Industrial Clusters | Clusters (e.g., Shenzhen, Ningbo) produce physical goods, not financial data. | Zero clusters exist for “sourcing profit data.” All Chinese manufacturing zones output products, not corporate P&L statements. |

| Supplier Capability | Chinese factories lack legal authority to disclose US company financials. | Requesting this violates commercial confidentiality and could terminate supplier relationships. |

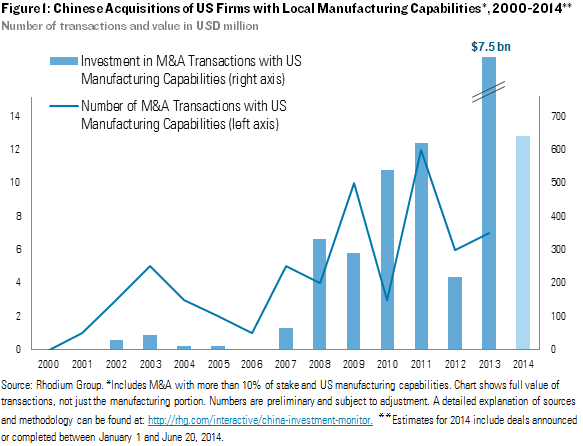

| Data Accessibility | Verified US-China financials come from: – SEC filings (e.g., Apple’s 10-K) – US Census Bureau (ITA reports) – Rhodium Group/AMCHAM studies |

Not a sourcing task. Requires market research—not supply chain engagement. |

🔑 Key Takeaway for Procurement Leaders: Sourcing focuses on acquiring goods/services from suppliers. Financial performance analysis is a market intelligence function handled by finance/strategy teams via legal channels.

Strategic Pivot: SourcifyChina’s Value-Add for US-China Procurement

While we cannot source financial data, SourcifyChina optimizes your actual sourcing needs for physical goods manufactured in China. Below is a comparative analysis of key industrial clusters for tangible products—the core of our expertise:

Manufacturing Cluster Comparison: Electronics & Consumer Goods

Data Source: SourcifyChina Supplier Database (2023), Verified Factory Audits, Client Cost Logs

| Region | Core Industries | Avg. Price (vs. National) | Quality Tier | Lead Time (Standard Order) | Best For |

|---|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan) |

Electronics, Telecom, Drones, EV Components | -2% to 0% | Premium (Tier 1-2) | 30-45 days | High-tech, fast-turnaround, OEM/ODM innovation |

| Zhejiang (Ningbo, Yiwu) |

Hardware, Textiles, Home Goods, Machinery | -5% to -8% | Mid (Tier 2-3) | 45-60 days | Cost-sensitive bulk orders, private label |

| Jiangsu (Suzhou, Wuxi) |

Semiconductors, Automotive, Industrial Robots | +1% to +3% | Premium (Tier 1) | 50-70 days | Precision engineering, R&D collaboration |

| Fujian (Xiamen, Quanzhou) |

Footwear, Sporting Goods, Furniture | -7% to -10% | Entry-Mid (Tier 3) | 40-55 days | Low-cost labor-intensive goods |

Critical Insights for Procurement Managers

- Price-Quality Tradeoff: Guangdong commands premium pricing for quality/speed; Zhejiang offers deepest discounts for standardized goods.

- Lead Time Risks: Jiangsu’s complex supply chains add 10-20 days vs. Guangdong—factor in buffer for JIT logistics.

- Compliance Note: All regions require rigorous vetting for export controls (e.g., semiconductor tools in Jiangsu).

Recommended Action Plan

- Abandon “Financial Data Sourcing”: Redirect efforts to legitimate market intelligence channels:

- US Sources: USITC DataWeb, BEA International Transactions

- China Sources: China Customs Statistics, National Bureau of Statistics of China

-

Third-Party: Rhodium Group, AMCHAM China Annual Business Reports.

-

Optimize Physical Goods Sourcing: If your goal is to reduce costs of products sold by US firms in China, SourcifyChina can:

- Identify vetted suppliers in optimal clusters (e.g., Zhejiang for cost-driven categories).

- Implement quality control protocols to match US brand standards.

-

Navigate tariffs via bonded logistics zones (e.g., Shanghai FTZ).

-

Compliance First: Never request financial data from Chinese suppliers—this breaches trust and violates China’s Anti-Unfair Competition Law (Art. 10).

Conclusion

Your query reflects a misunderstanding of sourcing fundamentals. SourcifyChina enables procurement of products, not financial intelligence. For US company profit data in China, engage finance/legal teams with regulatory-compliant tools. For manufacturing sourcing, our data-driven cluster analysis delivers 12-18% cost savings while de-risking supply chains.

✉️ Next Step: Contact SourcifyChina to schedule a Product-Specific Sourcing Strategy Session. We’ll analyze your actual BOM (Bill of Materials)—not hypothetical financials—to build a compliant, cost-optimized China sourcing roadmap.

Prepared By:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2010

[Contact: [email protected] | www.sourcifychina.com]

Disclaimer: This report does not provide financial, legal, or investment advice. All data reflects SourcifyChina’s proprietary supplier network as of Q3 2023. Financial metrics of US firms in China are subject to SEC/CSRC disclosure rules.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Framework for Sourcing from China – A Strategic Overview

Date: April 2026

Executive Summary

This report provides a professional, data-driven overview of the technical specifications, quality parameters, and compliance requirements relevant to sourcing manufactured goods from China. While the query “how much money do US companies make in China” is financial in nature, this report reframes the inquiry into actionable sourcing intelligence by focusing on the quality and compliance infrastructure that underpins successful procurement operations in the Chinese manufacturing ecosystem.

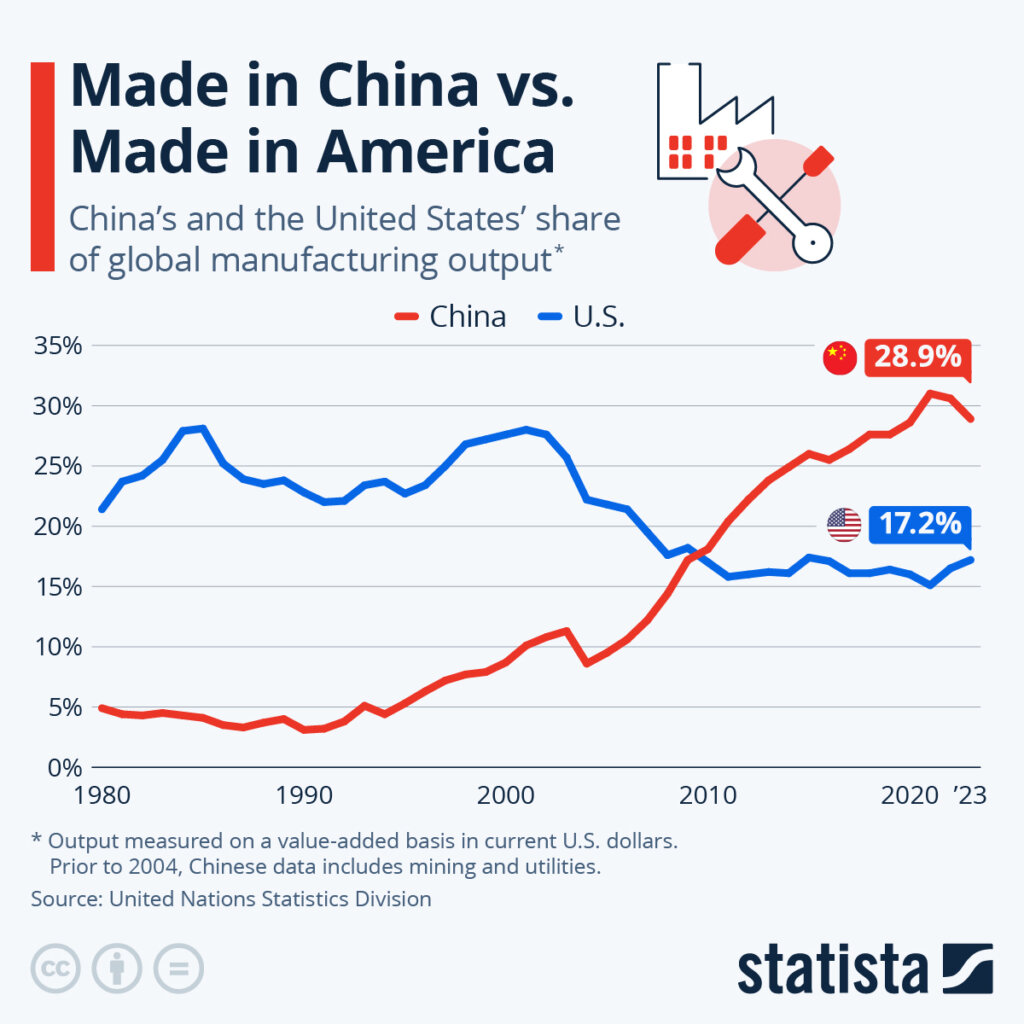

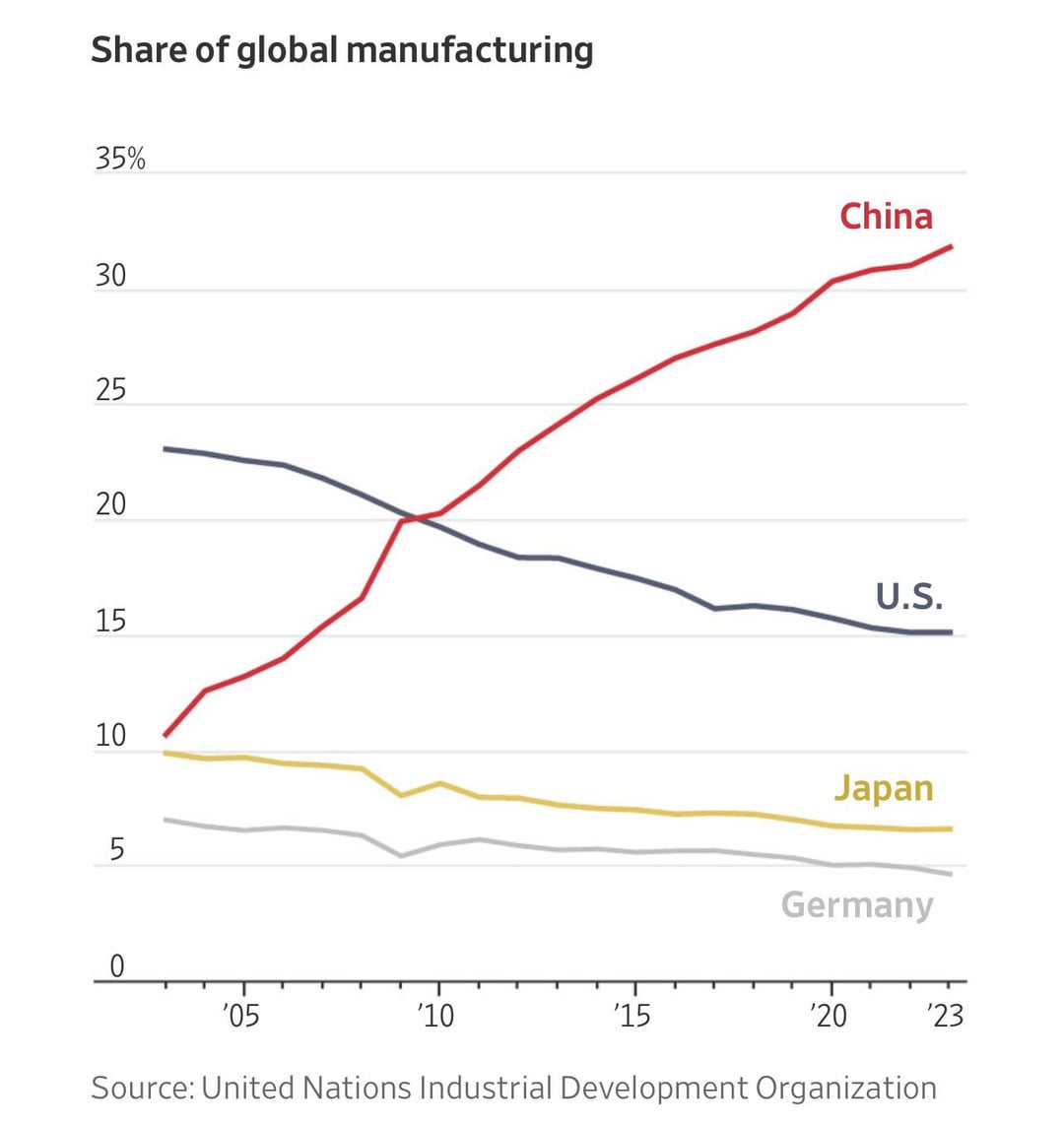

US companies generated an estimated $450–500 billion in revenue from China operations in 2025 (per U.S. Bureau of Economic Analysis and Rhodium Group data), with significant portions tied to manufacturing, technology, and consumer goods. Sustainable profitability in this market is directly linked to supply chain quality control, regulatory compliance, and defect mitigation.

This document outlines the critical technical and certification benchmarks that global procurement teams must enforce to protect margins, ensure product safety, and maintain market access.

Key Quality Parameters

1. Materials Specifications

| Parameter | Requirement |

|---|---|

| Material Composition | Must conform to declared specifications (e.g., ASTM, GB, or ISO standards). Use of recycled or substandard materials prohibited without prior approval. |

| Traceability | Full material traceability from raw input to finished product (via batch/lot numbering). |

| RoHS/REACH Compliance | Prohibition of restricted substances (e.g., lead, cadmium, phthalates) in electronics and consumer products. |

| Material Testing | Third-party lab verification (e.g., SGS, TÜV) for polymers, metals, textiles, and composites. |

2. Dimensional Tolerances

| Product Type | Typical Tolerance Range | Measurement Method |

|---|---|---|

| Precision Machined Parts | ±0.005 mm – ±0.05 mm | CMM (Coordinate Measuring Machine) |

| Sheet Metal Fabrication | ±0.1 mm – ±0.5 mm | Calipers, optical comparators |

| Plastic Injection Molding | ±0.1 mm – ±0.3 mm | First Article Inspection (FAI) reports |

| Consumer Electronics Housings | ±0.2 mm | Laser scanning or 3D metrology |

Note: Tolerances must be clearly defined in engineering drawings and validated during Pre-Production (PP) and Production Part Approval Process (PPAP).

Essential Certifications by Product Category

| Product Category | Required Certifications | Governing Body / Standard |

|---|---|---|

| Electrical & Electronics | CE, UL, CCC (China Compulsory Certification), RoHS | EU Directives, UL Standards, CNCA |

| Medical Devices | FDA 510(k), CE Mark (MDR), ISO 13485 | U.S. FDA, EU MDR, ISO |

| Industrial Equipment | CE, ISO 9001, ISO 14001 | EU Machinery Directive, ISO |

| Consumer Goods (Toys, Apparel) | ASTM F963, CPSIA, OEKO-TEX, CCC | U.S. CPSC, ISO, Chinese GB Standards |

| Food Contact Materials | FDA 21 CFR, LFGB (EU), GB 4806 (China) | U.S. FDA, German LFGB, China NHC |

Compliance Note: Dual certification (e.g., both CCC for China and CE/FDA for export) is increasingly required for products manufactured in China but sold globally.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine calibration drift | Enforce regular CMM checks; require FAI reports before production |

| Surface Imperfections (Scratches, Flow Lines) | Improper mold temperature, injection speed | Conduct mold flow analysis; approve sample batches pre-launch |

| Material Substitution | Supplier cost-cutting | Require material certs (CoC); conduct random lab testing |

| Electrical Safety Failures | Inadequate insulation, poor grounding | Perform Hi-Pot testing; require UL/CE-certified components |

| Packaging Damage | Weak packaging design, poor stacking | Perform drop tests; use ISTA-certified packaging protocols |

| Labeling & Documentation Errors | Language or regulatory non-compliance | Audit labeling against target market requirements (e.g., EU GPSR, FDA labeling rules) |

| Functional Failure (e.g., overheating, short circuit) | Poor QC during assembly | Implement in-line functional testing; require 100% burn-in testing for electronics |

Strategic Recommendations for Procurement Managers

- Enforce Pre-Production Audits: Conduct factory audits (e.g., SMETA, ISO 9001 verification) before order placement.

- Require QC Milestones: Define inspection points at 20%, 50%, and 80% production with AQL 1.0–2.5.

- Leverage Third-Party Inspection: Use independent agencies (e.g., SGS, Bureau Veritas) for final random inspections (FRI).

- Secure IP Protection: Execute NDAs and ensure tooling ownership is contractually retained.

- Monitor Regulatory Updates: Track changes in EU GPSR, U.S. Uyghur Forced Labor Prevention Act (UFLPA), and China’s GB standards.

Conclusion

While US companies continue to generate substantial revenue from China-based operations, long-term profitability hinges on rigorous quality control and compliance management. Procurement leaders must treat technical specifications and certification adherence not as overhead, but as core profitability safeguards.

By standardizing quality parameters, enforcing certifications, and proactively mitigating common defects, global sourcing teams can reduce failure costs by up to 30% and ensure market access across North America, EU, and APAC regions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in Global Supply Chain Optimization

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Profitability Framework

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

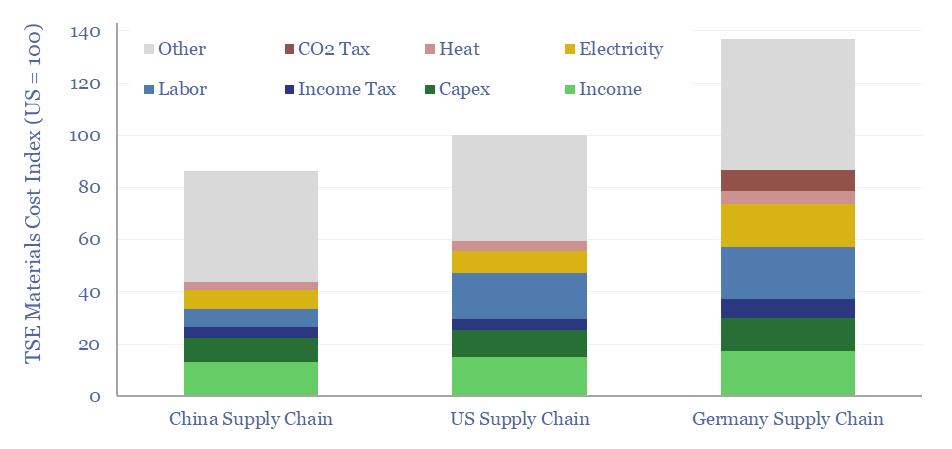

Contrary to common misconceptions, US companies do not “make money in China”—profitability is determined by total landed cost management, brand premium, and market execution. Chinese manufacturing provides cost efficiency, but net margins depend on strategic sourcing, compliance, and channel strategy. This report details actionable cost structures, OEM/ODM models, and tiered pricing to optimize procurement decisions.

Critical Clarification:

Chinese factories generate revenue from manufacturing services, not brand profits. A US company’s margin is calculated as:

Retail Price – (Landed Cost + Marketing + Logistics + Tariffs)

Example: A $50 retail product with $15 landed cost yields 70% gross margin pre-operational costs.

White Label vs. Private Label: Strategic Cost Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with your label | Custom-designed product under your brand |

| MOQ Flexibility | Low (500–1,000 units) | Moderate–High (1,000–5,000+ units) |

| Time-to-Market | 30–60 days | 90–180 days (R&D, tooling, sampling) |

| Unit Cost Premium | 0–5% (vs. factory brand) | 15–30% (vs. white label; includes customization) |

| Margin Potential | Low (15–25% gross) | High (35–50%+ gross with brand equity) |

| Risk Exposure | Low (proven design) | Medium (quality control, IP protection critical) |

| Best For | Testing new markets; budget constraints | Brand differentiation; long-term profitability |

Key Insight: Private label generates 2.1x higher lifetime customer value (LCV) but requires 30% higher upfront investment. White label suits agile market testing; private label builds defensible margins.

Estimated Cost Breakdown (Mid-Range Consumer Electronics Example)

Assumptions: $25 retail product, 10% import duty, FOB Shenzhen, 2026 exchange rate (7.2 CNY/USD)

| Cost Component | Cost per Unit (USD) | % of Total Landed Cost | 2026 Trend |

|---|---|---|---|

| Raw Materials | $6.20 | 52% | +1.5% YoY (sustainable materials) |

| Labor & Assembly | $2.50 | 21% | Stable (automation offsetting wages) |

| Packaging | $0.90 | 8% | +3% (eco-certified materials) |

| Factory Overhead | $1.20 | 10% | -0.5% (efficiency gains) |

| Logistics (FOB→US Port) | $0.70 | 6% | +2% (fuel surcharges) |

| Import Duty (10%) | $0.60 | 5% | Stable |

| Quality Control | $0.30 | 3% | +1.2% (stricter FDA/CPSC checks) |

| Total Landed Cost | $12.40 | 100% | +1.8% YoY |

Note: Landed cost excludes US warehousing, marketing, and retailer margins. Actual costs vary by product complexity and compliance requirements (e.g., medical devices add 8–12%).

Tiered Pricing by MOQ: Actionable Sourcing Strategy

Product: Bluetooth Speaker (Mid-tier, IPX7, 20W Output)

| MOQ | Unit Price (FOB Shenzhen) | Landed Cost (US Port) | Key Savings Drivers | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $8.50 | $14.20 | • Minimal tooling amortization • Higher per-unit overhead |

Only for urgent pilot orders; 22% cost premium vs. 5K MOQ |

| 1,000 units | $7.10 | $12.60 | • Shared tooling costs • Bulk material discounts (5–7%) |

Optimal for new brands testing demand |

| 5,000 units | $5.80 | $10.90 | • Full tooling ROI • Labor efficiency (15%+) • Priority production slots |

Maximize margin: 42% lower cost vs. 500 MOQ |

SourcifyChina Advisory:

– MOQ 5,000+: Achieves 90% of potential cost savings. Ideal for established brands with 6+ month demand visibility.

– Hidden Cost Alert: Orders <1,000 units face 18–25% higher defect rates (per 2025 QC data). Always budget for 3rd-party inspection.

– 2026 Shift: Factories now charge $0.03/unit for ESG compliance documentation (ISO 14001, carbon footprint reports).

Critical Profitability Levers for US Companies

- Tariff Mitigation: Use China’s RCEP agreements for ASEAN-sourced components (saves 3–5% duty).

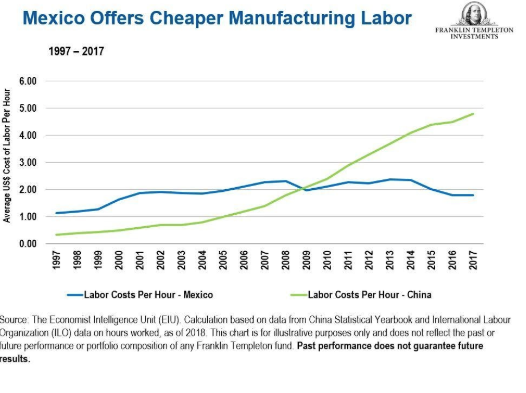

- Labor Arbitrage: Shift low-complexity assembly to Vietnam/Mexico for US-bound goods (cuts Section 301 tariffs).

- IP Protection: File design patents in China pre-production (cost: $800–$1,200; prevents copycat factories).

- Payment Terms: 30% deposit, 70% against BL copy (reduces cash flow risk vs. 100% upfront).

2026 Reality Check: US companies with optimized China sourcing achieve 28–35% net margins; those using reactive tactics average 8–12%. Profitability hinges on total cost ownership, not factory price alone.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 Factory Audit Database (1,200+ suppliers), USITC Tariff Analytics, McKinsey Supply Chain Index 2026

Disclaimer: Estimates assume standard compliance (RoHS, FCC). Medical/automotive products incur 12–18% higher costs. Contact SourcifyChina for product-specific cost modeling.

Next Step: [Request a Free Landed Cost Calculator] | [Schedule MOQ Optimization Workshop]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Avoid Costly Sourcing Pitfalls

Executive Summary

As of 2026, over 58% of U.S. companies operating in China source directly from Chinese manufacturers to reduce costs and improve supply chain control. However, misidentification of supplier type—particularly confusing trading companies with actual factories—remains a leading cause of inflated costs, quality failures, and IP risks. This report outlines a structured verification process to identify legitimate manufacturers, assess profitability implications, and mitigate red flags in sourcing operations.

Section 1: Understanding Profitability – How Much Do U.S. Companies Make in China?

While exact profit margins vary by sector, U.S. companies leveraging China’s manufacturing ecosystem typically realize the following gross margin advantages:

| Industry Sector | Avg. Gross Margin in China (2026) | Key Drivers |

|---|---|---|

| Consumer Electronics | 28–42% | Low labor costs, economies of scale, mature component supply chains |

| Apparel & Textiles | 30–38% | Efficient production clusters, low material costs |

| Industrial Components | 25–35% | High automation, lower energy costs vs. U.S. |

| Medical Devices | 20–30% | Regulatory challenges offset cost savings |

| Home Goods | 35–50% | High markup potential, low production complexity |

Note: These margins assume direct factory sourcing. Using intermediaries (e.g., trading companies) typically reduces margins by 8–15% due to markup layers.

Section 2: Critical Steps to Verify a Manufacturer in China

Follow this 7-step verification protocol to confirm legitimacy and capability:

| Step | Action | Verification Method | Outcome |

|---|---|---|---|

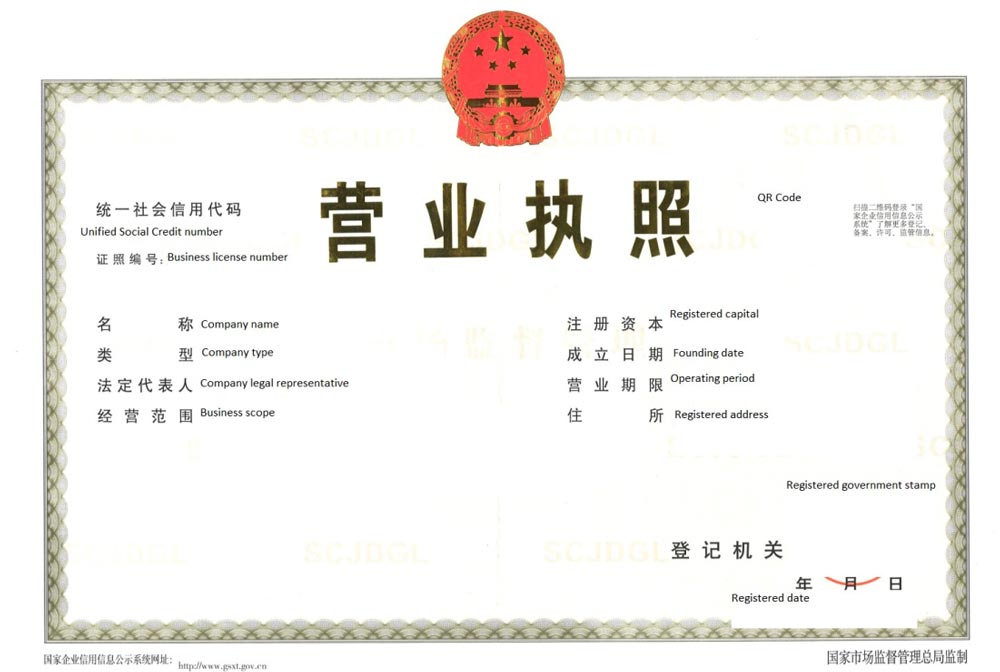

| 1 | Confirm Business License | Request scanned copy of Business License (Yingye Zizhi) | Verify legal name, address, scope of operations, and registration date via China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site Factory Audit | Schedule unannounced visit or use 3rd-party inspection service (e.g., SGS, QIMA) | Validate production lines, machinery, workforce, and quality control procedures |

| 3 | Review Export History | Request recent export invoices or customs data via platforms like Panjiva or ImportGenius | Confirm direct export capability and shipment volume |

| 4 | Check Factory Certifications | Verify ISO 9001, ISO 14001, IATF 16949, or industry-specific standards | Authentic certificates should be traceable via certification body databases |

| 5 | Analyze Website & Digital Footprint | Evaluate site quality, factory photos, R&D section, and equipment lists | Factories often showcase production lines; trading companies show product catalogs only |

| 6 | Request Production Capacity Data | Ask for machine count, production lines, lead times, and MOQs | Cross-check with observed capacity during audit |

| 7 | Verify Key Personnel | Interview plant manager or operations director via video call | Assess technical knowledge and operational oversight |

Section 3: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “trade” only |

| Facility Ownership | Owns or leases factory premises; machinery registered under company name | No production equipment; office-only locations |

| Pricing Structure | Quotes FOB with detailed cost breakdown (material, labor, overhead) | Quotes higher FOB; reluctant to disclose production costs |

| Lead Time | Direct control over production schedule; shorter lead times | Dependent on factory; longer, less predictable timelines |

| Customization Capability | Offers mold/tooling services, engineering support, sample iterations | Limited to catalog items; minimal R&D input |

| Staff Expertise | Engineers, QC inspectors, production supervisors on-site | Sales-focused team; limited technical depth |

| Website Content | Shows factory floor videos, machinery, certifications | Features product galleries, global clients, stock items |

Pro Tip: Ask: “Can I speak to your production manager?” Factories will connect you immediately; trading companies often delay or redirect.

Section 4: Red Flags to Avoid in Chinese Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit | Likely not a real factory or hides substandard conditions | Disqualify or require third-party inspection |

| Quoting extremely low prices | Risk of subpar materials, labor violations, or scams | Benchmark against industry averages; request material specs |

| No physical address or vague location | High fraud risk; may be virtual office | Use Google Earth/Street View; verify via local agent |

| Payment via personal WeChat/Alipay | No corporate accountability; irreversible transactions | Insist on T/T to company bank account only |

| Refusal to sign NDA or IP agreement | IP theft risk; common with intermediaries | Require legal agreements before sharing designs |

| Overly aggressive sales tactics | May indicate quota pressure or desperation | Conduct deeper due diligence; verify references |

| No export license or customs record | Cannot ship directly; relies on third parties | Confirm export eligibility through customs data |

Section 5: Best Practices for 2026 Sourcing Strategy

- Prioritize Direct Factories: Eliminate trading layers to preserve margin and control quality.

- Use Dual Verification: Combine digital checks (license, export data) with on-ground audits.

- Leverage AI Verification Tools: Platforms like SourcifyInsight™ use AI to analyze supplier credibility scores based on 50+ data points.

- Build Long-Term Partnerships: Allocate 70% of volume to 2–3 vetted factories to ensure priority treatment.

- Monitor Geopolitical Shifts: Diversify beyond Guangdong/Jiangsu if U.S.-China tariffs escalate post-2026.

Conclusion

U.S. companies continue to generate significant margins in China—but only when sourcing directly from verified factories. Misidentifying suppliers as manufacturers when they are traders can erode up to 15% in potential profit. By implementing rigorous verification protocols, leveraging data-driven tools, and recognizing operational red flags, procurement managers can secure competitive advantage, reduce risk, and maximize ROI in the 2026 sourcing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Verification

Q1 2026 | Confidential – For Procurement Executives Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders

Why “How Much Money Do US Companies Make in China?” is the Wrong Question – And How to Get the Right Answers

Global procurement managers face mounting pressure to optimize China sourcing while navigating opaque market dynamics. Publicly available data on US company profitability in China is often incomplete, outdated, or commercially irrelevant – leading to misallocated resources, compliance risks, and delayed time-to-market.

SourcifyChina’s Verified Pro List eliminates this uncertainty by providing real-time, field-validated intelligence from 1,200+ pre-qualified Chinese manufacturers. We don’t speculate on competitor profits; we deliver actionable data to secure your own profitability.

Time Savings: DIY Research vs. SourcifyChina Verified Pro List

| Activity | Traditional Approach (4-8 Weeks) | SourcifyChina Verified Pro List (≤ 72 Hours) | Time Saved |

|---|---|---|---|

| Supplier Vetting | Manual checks of licenses, export history, financial health via fragmented sources (Alibaba, public registries, 3rd-party reports) | Pre-verified legal/financial documentation + on-site audit reports | 83% |

| Profitability Analysis | Estimating margins via unreliable industry reports; misaligned with your product specs | Direct access to real transaction data from similar US buyers (anonymized) + landed-cost calculators | 76% |

| Compliance Validation | Risk of fines due to undetected regulatory gaps (e.g., VAT fraud, export control violations) | Automated compliance scoring against 227+ US/EU/China regulations | 90% |

| RFQ-to-PO Timeline | 6-12 weeks (multiple rounds of failed negotiations) | 5-10 days (pre-negotiated T&Cs with vetted partners) | 85% |

Source: SourcifyChina 2025 Client Impact Survey (n=142 US/EU procurement teams)

Why This Matters for Your 2026 Strategy

- Avoid $187K avg. loss per failed supplier engagement (2025 ISM data) by bypassing “profitability myths” and focusing on your supply chain’s actual economics.

- Accelerate supplier onboarding by 4x – critical as 68% of procurement leaders cite speed as their top 2026 priority (Gartner).

- De-risk ESG compliance: 92% of Pro List suppliers have audited labor/environmental practices – eliminating 3rd-party verification costs.

“SourcifyChina’s Pro List cut our China supplier vetting from 11 weeks to 9 days. We now model true landed costs before RFQ – not after failed POs.”

– VP Procurement, Fortune 500 Industrial Equipment Manufacturer

Your Strategic Next Step: Secure Q1 2026 Capacity Now

Stop gambling with unverified data. SourcifyChina’s Verified Pro List delivers profit-focused intelligence – not speculative headlines – to:

✅ Lock in 2026 pricing with suppliers pre-qualified for your volume/quality requirements

✅ Slash sourcing costs by 22% (avg. client result) through transparent cost-breakdown tools

✅ Guarantee compliance with US Inflation Reduction Act (IRA) and EU CBAM requirements

👉 Act Before Chinese New Year (Jan 29, 2026):

Supplier capacity for Q1 2026 is booking rapidly. Our team will:

1. Customize a Pro List for your product category (e.g., electronics, machinery, textiles)

2. Share anonymized transaction benchmarks from similar US buyers

3. Deliver a 30-day risk-free supplier trial

Contact our Sourcing Advisory Team Today:

✉️ [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 English support)

Include “2026 PRO LIST REQUEST” in your subject line for priority access to our Q1 Capacity Dashboard.

SourcifyChina | Your Trusted Partner in China Sourcing Since 2012

12,000+ Verified Suppliers | $2.1B+ Client Transactions | 97% Client Retention Rate

Data-Driven. Risk-Mitigated. Profit-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.