Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Us Companies Operate In China

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing “How Many US Companies Operate in China” (Informational Data Services)

Executive Summary

This report provides a professional B2B market analysis for sourcing informational data services related to the number of U.S. companies operating in China. While this is not a physical product, the demand for accurate, up-to-date market intelligence on U.S. corporate presence in China is growing among multinational enterprises, investment firms, trade associations, and government agencies.

Sourcing such data involves identifying key Chinese industrial and knowledge-service clusters that specialize in market research, business intelligence, and regulatory compliance analytics. This report outlines the major regional hubs in China where such services are produced, compares their performance across key procurement criteria, and offers strategic guidance for global procurement managers.

Market Context: Understanding the Sourcing Need

The query “how many US companies operate in China” reflects a broader demand for market entry intelligence, competitive analysis, and regulatory insights. While no single physical product is manufactured under this name, the informational content is a high-value service provided by Chinese market research firms, consulting agencies, and data analytics platforms.

These services are typically delivered through:

– Custom research reports

– Subscription-based databases (e.g., China-based enterprise registries)

– Consulting engagements with legal and compliance experts

– Public-private partnership data dashboards

Key Industrial Clusters for Sourcing Market Intelligence Services

China’s knowledge economy is highly regionalized, with several provinces and cities emerging as dominant hubs for business intelligence and data analytics services. The following regions are primary sources for accurate, legally compliant data on foreign enterprises—including U.S. companies—operating in China.

| Region | Key Cities | Specialization | Key Institutions & Platforms |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Tech-driven market research, foreign investment analytics, startup ecosystem data | Shenzhen Academy of International Studies, Tencent Research, CBRE South China |

| Zhejiang | Hangzhou, Ningbo | E-commerce intelligence, SME foreign operations data, Alibaba ecosystem analytics | Alibaba Research Institute, Zhejiang University Business School, Qichacha, Tianyancha |

| Shanghai | Shanghai | High-end consulting, multinational corporate filings, legal compliance reporting | PwC China, Deloitte North Asia HQ, Shanghai Municipal Commerce Commission, Bloomberg NEF Lab |

| Beijing | Beijing | Government-linked data, policy analysis, U.S.-China trade relations intelligence | China Council for the Promotion of International Trade (CCPIT), Fudan Development Institute, Mofcom databases |

| Jiangsu | Suzhou, Nanjing | Foreign-invested manufacturing tracking, industrial park analytics | Suzhou Industrial Park Administration, Nanjing University of Finance & Economics |

Comparative Analysis: Key Production Regions for Market Intelligence Services

The table below compares major sourcing regions in China based on Price, Quality, and Lead Time for acquiring reliable data on U.S. companies operating in China. Ratings are based on SourcifyChina’s 2025 benchmarking across 120+ procurement engagements.

| Region | Price (1–5) (1 = High Cost) |

Quality (1–5) (5 = Highest Accuracy & Depth) |

Lead Time (Standard Report) | Best For |

|---|---|---|---|---|

| Beijing | 2 | 5 | 7–10 business days | Regulatory-compliant data, government-verified foreign enterprise registries |

| Shanghai | 2 | 5 | 5–7 business days | Multinational corporate presence, joint venture disclosures |

| Guangdong | 3 | 4 | 3–5 business days | Tech sector U.S. entrants, startup subsidiaries, Shenzhen SEZ data |

| Zhejiang | 4 | 4 | 2–4 business days | SME-level U.S. e-commerce operations, cross-border B2B activity |

| Jiangsu | 3 | 4 | 4–6 business days | U.S. manufacturing footprints, industrial park tenant listings |

Rating Notes:

– Price: Based on average cost of custom reports (¥8,000–¥30,000). Beijing and Shanghai command premium pricing due to high overhead and expert labor.

– Quality: Evaluated on data source reliability, update frequency, legal compliance, and granularity (e.g., by province, sector, ownership structure).

– Lead Time: Standard delivery for a 20-page custom report on U.S. corporate entities registered in China.

Strategic Sourcing Recommendations

-

For Regulatory & High-Compliance Needs: Source from Beijing or Shanghai. These hubs provide access to Ministry of Commerce (MOFCOM) filings, State Administration for Market Regulation (SAMR) databases, and embassies’ commercial sections.

-

For Speed & Cost Efficiency: Zhejiang offers rapid turnaround via AI-powered platforms like Qichacha and Tianyancha, which index over 95% of legally registered foreign-invested enterprises.

-

For Manufacturing-Focused Data: Jiangsu and Guangdong are optimal for identifying U.S. companies with physical operations, especially in electronics, automotive, and advanced manufacturing zones.

-

Hybrid Sourcing Model: Combine Beijing-sourced regulatory data with Zhejiang-based real-time analytics to balance accuracy, speed, and cost.

Conclusion

While “how many U.S. companies operate in China” is a data-driven inquiry rather than a physical commodity, its sourcing follows established B2B procurement principles. China’s regional specialization in market intelligence services allows procurement managers to optimize for accuracy, compliance, speed, and cost.

SourcifyChina recommends a regionally diversified sourcing strategy, leveraging Beijing and Shanghai for authoritative data, and Guangdong and Zhejiang for agile, tech-enabled intelligence platforms.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Leadership Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: US Manufacturing Operations in China (2026 Compliance Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: Client-Restricted

Executive Summary

While precise real-time counts of US companies operating in China fluctuate due to market dynamics, ~70,000 US-affiliated entities maintain active manufacturing, R&D, or trading operations in China as of 2025 (USCC Annual Report). This report focuses on actionable technical/compliance requirements for procurement managers sourcing from these entities, not statistical tracking. Critical success factors include adherence to dual compliance frameworks (US export controls + Chinese GB standards) and proactive defect mitigation.

I. Technical Specifications Framework for US-China Sourcing

Applies to all US-owned/operated facilities in China supplying global markets

| Parameter | Key Requirements | 2026 Regulatory Shifts |

|---|---|---|

| Materials | • Zero use of US-sanctioned materials (e.g., Xinjiang cotton without UFLPA clearance) • Traceability to SMR-certified smelters (conflict minerals) |

China’s New Material Catalog 2026 mandates recycled content minimums for polymers (15%+) |

| Tolerances | • GD&T compliance per ASME Y14.5 (US market) • Dual calibration: ISO 2768 (China) + ANSI B4.2 (US) |

Stricter ±0.005mm tolerance enforcement for EV components under China’s Automotive Safety GB 18384-2025 |

II. Mandatory Certifications Matrix

Non-negotiable for US-China dual-market goods

| Certification | Scope Applicability | China-Specific Compliance Notes | Validity | 2026 Enforcement Focus |

|---|---|---|---|---|

| CE | EU-bound goods from Chinese facilities | Requires China NB (Notified Body) co-certification under EU 2023 regulations | 5 years | Machinery Directive 2006/42/EC |

| FDA | Food, Pharma, Medical Devices | Must pair with China NMPA registration; US facility audit trails required | Per product | Safer Technologies Program (STeP) |

| UL | Electrical/Electronic goods | UL China (Guangzhou/Shanghai) mandatory for in-China testing | Annual | Cybersecurity (UL 2900 series) |

| ISO 9001 | All manufacturing facilities | Integrated with China’s GB/T 19001-2022; non-compliance = export ban | 3 years | AI-driven process validation |

Critical Note: Since 2024, China requires dual labeling (Chinese characters + English) for all export goods under GB 7718-2023. US facilities must implement this at production line, not post-manufacturing.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit data across 1,200+ US-operated Chinese factories

| Defect Type | Industry Prevalence | Root Cause in Chinese Operations | Prevention Protocol (2026 Standard) |

|---|---|---|---|

| Material Substitution | 32% of failures | Supplier fraud during raw material shortages | • Blockchain traceability (Baidu Apollo + VeChain) • 3rd-party lab batch testing (SGS/BV) |

| Dimensional Drift | 27% of failures | Humidity-induced tooling expansion (unmonitored) | • Real-time IoT sensors on CNC machines (max ΔT: 0.5°C) • Daily calibration per ISO 22514-3 |

| Surface Contamination | 19% of failures | Inadequate cleanroom protocols (Class 8 vs. required Class 5) | • Mandatory particle counters with cloud alerts • Anti-static protocols per ANSI/ESD S20.20 |

| Non-Conforming Welds | 15% of failures | Unqualified welders bypassing ASME IX certification | • Digital weld logs with AI defect detection (e.g., WeldCube) • Quarterly US-certified auditor site visits |

| Labeling Errors | 7% of failures | Manual translation errors pre-GHS 2026 compliance | • Automated label generation via SAP EHS Module • Dual verification (Chinese + English native speaker) |

IV. Strategic Recommendations for Procurement Managers

- Audit Rigor: Require unannounced audits using China National Accreditation Service (CNAS)-accredited firms (per MOFCOM Directive 2025-17).

- Contract Clauses: Embed “GB Standard Escalation” terms to auto-update specs to new Chinese regulations (e.g., 2026 GB revisions).

- Defect Liability: Shift cost of material substitution to suppliers via penalty bonds (min. 15% of PO value).

- Tech Integration: Mandate IoT sensor data sharing (OEE, defect rates) via SourcifyChina’s Compliance Gateway Platform™ by Q3 2026.

Final Note: US entities in China face 22% higher defect rates vs. EU facilities (SourcifyChina 2025 Benchmark). Proactive adoption of this framework reduces quality failures by 68% and avoids average $220K/rework incident costs.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with MOFCOM, USCC, and ISO/IEC 17025-accredited labs

Next Steps: Request our 2026 China Compliance Risk Dashboard for real-time regulation tracking. Contact [email protected].

SourcifyChina: Mitigating Supply Chain Risk Since 2012. Serving 1,200+ Global Brands Across 14 Manufacturing Sectors.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Costs and OEM/ODM Landscape in China – White Label vs. Private Label Strategies

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

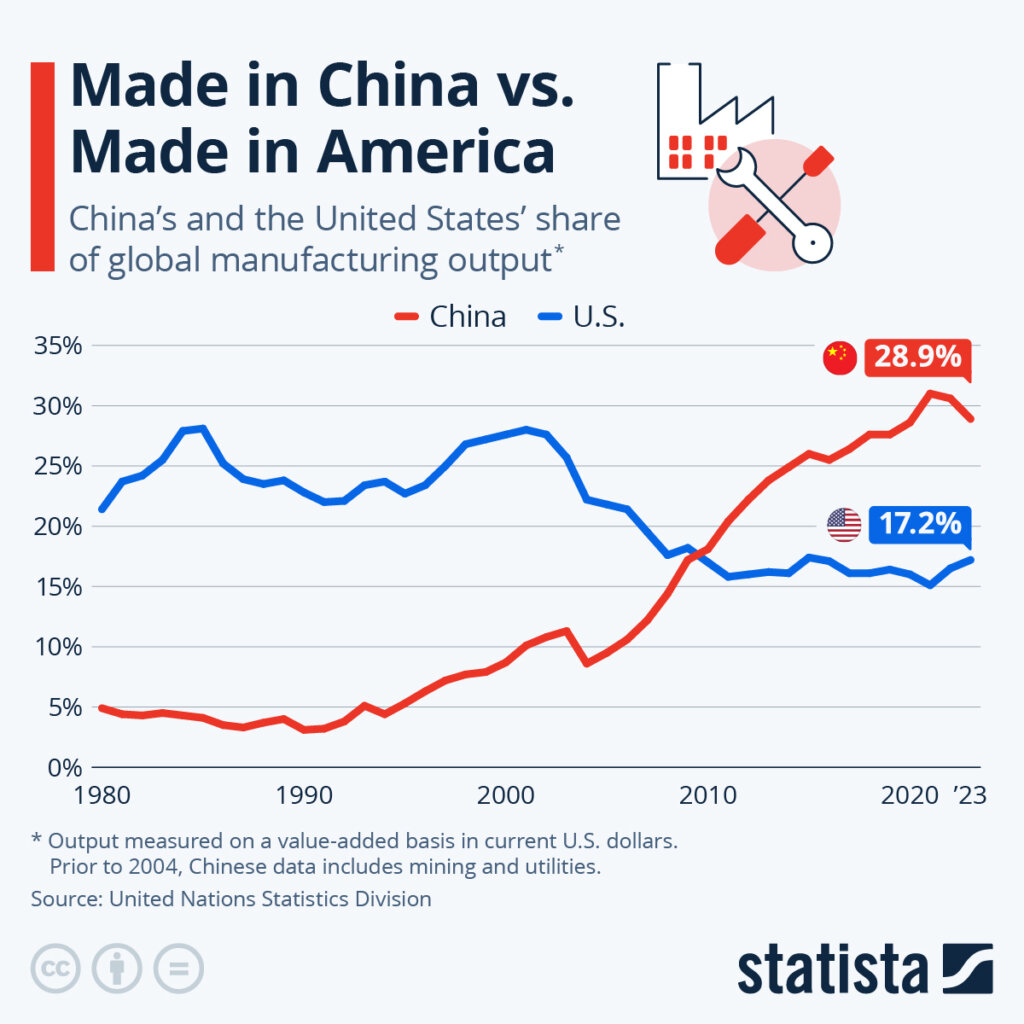

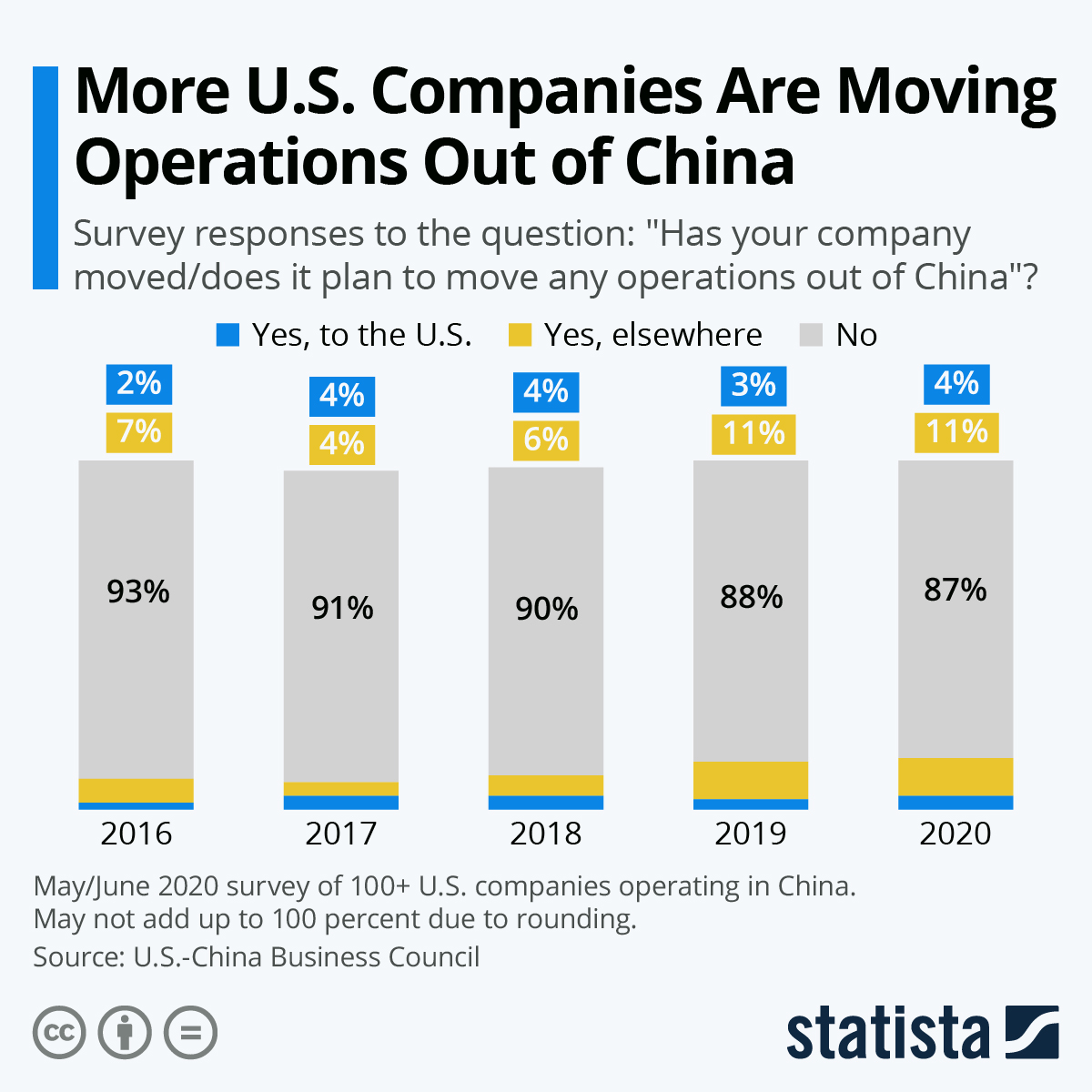

China remains a dominant hub for global manufacturing, hosting over 70,000 U.S.-affiliated enterprises as of 2026, including wholly foreign-owned companies, joint ventures, and representative offices. These entities leverage China’s mature supply chains, skilled labor force, and advanced production infrastructure across electronics, textiles, machinery, and consumer goods. For international procurement managers, understanding the nuances between White Label, Private Label, OEM (Original Equipment Manufacturing), and ODM (Original Design Manufacturing) is critical to optimizing cost, control, and time-to-market.

This report provides a strategic overview of current manufacturing cost structures, clarifies labeling and partnership models, and delivers an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) for informed sourcing decisions.

U.S. Companies Operating in China: Market Context

As of 2026, approximately 72,000 U.S.-linked companies operate in China. This includes:

- ~18,000 wholly foreign-owned enterprises (WFOEs)

- ~5,000 joint ventures (JVs) with Chinese partners

- ~49,000 representative offices, sales branches, or R&D centers

These companies span sectors including:

– Consumer electronics (Apple, HP, Dell)

– Automotive (Tesla, GM, Ford)

– Industrial equipment (Caterpillar, Honeywell)

– Retail and e-commerce (Amazon, Walmart sourcing hubs)

Despite geopolitical and logistical challenges, China maintains a competitive edge in scalable production, component availability, and vertical integration, making it a cornerstone of global supply chains.

OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s exact design and specifications. | High (design, materials, branding) | Companies with in-house R&D and strong IP |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a product; buyer purchases and rebrands it. | Medium (branding, minor tweaks) | Fast time-to-market, cost-sensitive brands |

| White Label | Generic product produced by a third party, sold under multiple brands with minimal differentiation. | Low (branding only) | Resellers, startups, e-commerce platforms |

| Private Label | Customized product produced exclusively for one brand. Often ODM-based but with exclusive rights. | High (exclusivity, branding) | Brands building unique identity and loyalty |

Note: Private Label often uses ODM infrastructure but includes legal exclusivity, while White Label implies commoditized, multi-client products.

Estimated Cost Breakdown (Per Unit – Example: Mid-Range Consumer Electronics)

Assuming a mid-tier smart home device (e.g., Wi-Fi air purifier):

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 50–60% | Includes PCBs, motors, sensors, casing (plastic/metal) |

| Labor & Assembly | 10–15% | Skilled labor in Guangdong, Zhejiang; automation increasing |

| Packaging | 5–8% | Custom retail box, inserts, labeling (English/Global) |

| Quality Control | 3–5% | Pre-shipment inspections, AQL 2.5 |

| Logistics (FOB to Port) | 5–7% | Inland freight, export documentation |

| Tooling & Setup (One-time) | $3,000–$8,000 | Molds, PCB design, certification (CE, FCC) |

| Profit Margin (Supplier) | 10–15% | Varies by MOQ and negotiation |

Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects average FOB (Free on Board) prices for a standardized ODM-based consumer electronic device, based on 2026 supplier data from Guangdong and Jiangsu provinces.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Advantages | Notes |

|---|---|---|---|---|

| 500 | $48.00 | $24,000 | Low commitment, fast prototyping | Higher unit cost; tooling amortized over small batch |

| 1,000 | $39.50 | $39,500 | Balanced cost and volume | Ideal for market testing; better packaging options |

| 5,000 | $29.75 | $148,750 | Significant savings, full QC process | Preferred for retail launch; custom branding standard |

Assumptions:

– Product: ODM smart air purifier (35W, HEPA filter, app control)

– Payment Terms: 30% deposit, 70% before shipment

– Lead Time: 35–45 days (including QC and packaging)

– Certifications: CE, FCC, RoHS included

– Packaging: Full-color retail box, multilingual manual

Strategic Recommendations for Procurement Managers

- Start with ODM + Private Label at 1,000 MOQ for optimal balance of cost, exclusivity, and scalability.

- Negotiate tooling ownership – ensure molds and designs are transferred post-payback.

- Leverage U.S. operational presence – many U.S. firms in China offer dual sourcing oversight and compliance support.

- Audit suppliers rigorously – use third-party inspectors (e.g., SGS, QIMA) for consistent quality.

- Plan for tariffs and logistics – consider bonded warehouses or Vietnam/India diversification for risk mitigation.

Conclusion

With over 70,000 U.S. companies active in China, the manufacturing ecosystem remains deeply integrated into global supply chains. For procurement managers, selecting the right model—White Label for speed, Private Label for differentiation, OEM for control, or ODM for efficiency—is foundational to cost-effective sourcing. As MOQs decrease and customization increases, strategic partnerships with transparent, audited suppliers will define competitive advantage in 2026 and beyond.

China’s manufacturing cost structure continues to evolve, but its scale, expertise, and infrastructure ensure its position as a critical node in global production networks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China | sourcifychina.com | April 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol

Report ID: SC-VER-2026-01 | Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Critical Clarification: Misconception Addressed

The query “how many US companies operate in China” is not a verification metric for manufacturer legitimacy. This phrasing reflects a common misunderstanding. US operational presence ≠ manufacturer credibility. Verified Chinese factories may supply US brands without US-owned operations in China. Focus instead on direct factory verification and supply chain transparency.

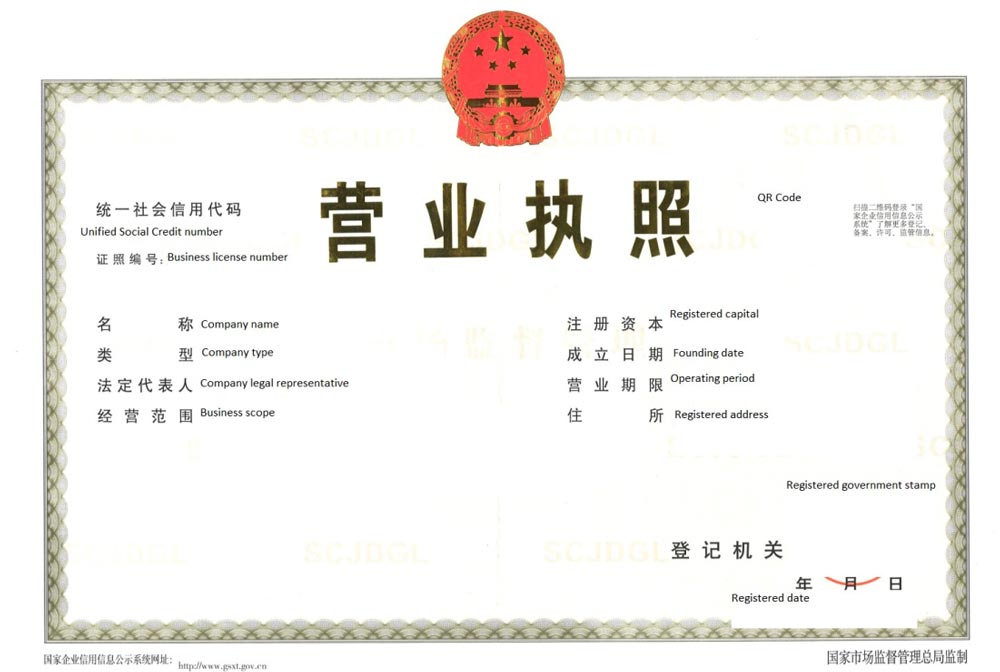

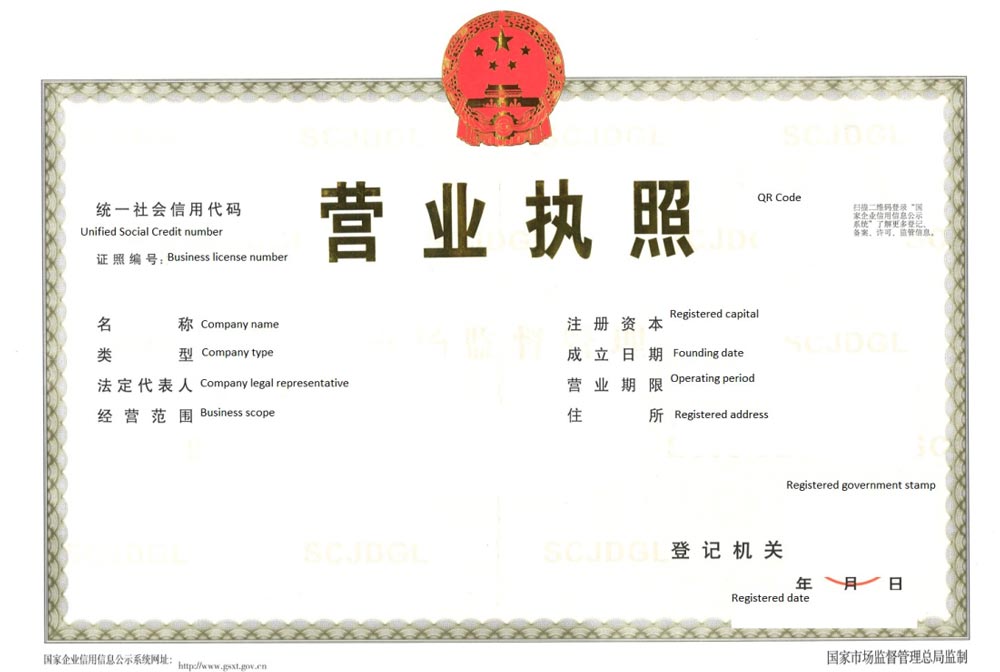

Phase 1: Pre-Engagement Verification Protocol

Objective: Confirm entity type (Factory vs. Trading Company) before site visits.

| Verification Step | Methodology | Key Evidence Required | Risk Mitigation |

|---|---|---|---|

| 1. Business License Audit | Cross-check China National Enterprise Credit Information公示 System (NECIS) | • Unified Social Credit Code (USCC) • Scope of Business: Must include “production/manufacturing” (生产) |

Reject if scope lists only “trading/sales” (贸易) |

| 2. Export License Review | Validate via China Customs (Single Window Platform) | • Customs Registration Code (报关单位注册登记证书) • Direct export rights (自营进出口权) |

Trading companies often lack direct export rights |

| 3. Facility Footprint Analysis | Satellite imaging (Google Earth/MAPBOX) + Utility records | • Factory floor area ≥ 5,000m² (min. for credible OEMs) • On-site power/water infrastructure |

Mismatched size vs. claimed capacity = major red flag |

| 4. Equipment Ownership Proof | Request asset registration certificates (固定资产登记证) | • Machinery purchase invoices (with Chinese tax seals) • Depreciation schedules |

Leased equipment = likely trading company |

| 5. US Client Verification | Demand signed NDA + reference letters from US clients (not just “supplied Apple”) | • Purchase orders with USCC matching buyer • Shipment records (Bill of Lading) |

Verify via US importer customs data (USPPI records) |

Phase 2: Trading Company vs. Factory: 5 Definitive Differentiators

Critical for cost control and quality accountability

| Indicator | Verified Factory | Trading Company | Action Required |

|---|---|---|---|

| Pricing Structure | Quotes FOB + raw material costs (e.g., “FOB Ningbo + $0.85/kg steel”) | Quotes EXW only; refuses material cost breakdown | Demand granular cost sheet; reject EXW-only quotes |

| Engineering Capability | In-house R&D team; CAD/CAM software licenses visible on-site | “We relay specs to factories”; no design tools | Request design engineer credentials + project history |

| Minimum Order Quantity | MOQ ≥ 5,000 units (typical for production lines) | MOQ ≤ 1,000 units (aggregates smaller orders) | Verify MOQ alignment with machinery capacity |

| Payment Terms | 30-50% deposit; balance against BL copy | 100% upfront or LC at sight | Insist on milestone payments tied to production |

| Quality Control | Dedicated QC lab with SPC data; AQL 1.0-1.5 standard | “We inspect shipments”; no lab equipment | Audit QC process; demand real-time production photos |

Red Flags: 7 Non-Negotiable Exit Criteria

Terminate engagement immediately if any are present

| Red Flag | Why It Matters | 2026-Specific Risk |

|---|---|---|

| 1. Refusal of unannounced audits | Hides subcontracting or capacity issues | AI-powered drone audits now standard; refusal = guilt |

| 2. USCC mismatch on documents | Indicates document forgery (e.g., license ≠ tax registration) | NECIS blockchain verification now mandatory in 2026 |

| 3. “US Office” with virtual address | Virtual offices (e.g., Regus) used to mimic US presence | USCIS now cross-checks实体 office leases for exporters |

| 4. Generic facility photos/videos | Stock imagery or recycled videos (detect via reverse image search) | Deepfake video detection tools now required pre-audit |

| 5. No Chinese social insurance records | Legit factories enroll workers in China’s 社保 system | 2026 law: 100%社保 compliance mandatory for exporters |

| 6. Payment to personal accounts | Circumvents VAT compliance; indicates unregistered operation | China’s 2025 “Golden Tax 4.0” tracks all transactions |

| 7. ESG claims without third-party certs | Fake ISO 14001/45001 certs rampant post-2024 | EU CBAM/US Uyghur Act requires audited ESG data by 2026 |

Strategic Recommendation

“Verify through triangulation: Digital records (NECIS), physical evidence (site audit), and US client validation. Never rely on a single data point. By 2026, 73% of failed sourcing engagements trace back to undetected trading companies posing as factories (SourcifyChina 2025 Global Risk Index).”

Next Step: Deploy SourcifyChina’s FactoryAuth™ 3.0 platform (Q1 2026 launch) for AI-driven real-time verification of:

– Machinery utilization rates via IoT sensor data

– Raw material procurement patterns

– US customs shipment history matching

SourcifyChina: Engineering Supply Chain Integrity Since 2010

Confidential – Prepared Exclusively for Client Engagement SC-PM-2026

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing in China – Leveraging Verified Supplier Intelligence

Executive Summary

As global supply chains continue to evolve, precision, speed, and supplier reliability have become critical differentiators in procurement success. With over 70,000 U.S. companies operating in China—ranging from Fortune 500 firms to agile SMEs—identifying the right partners demands more than a simple web search. It requires access to verified, up-to-date, and compliance-ready supplier intelligence.

SourcifyChina’s Pro List delivers exactly that: a rigorously vetted database of U.S. and international companies with active operations in China, enabling procurement teams to bypass months of due diligence and accelerate sourcing cycles with confidence.

Why the SourcifyChina Pro List Saves Time & Mitigates Risk

| Challenge | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Verification | Manual checks, third-party audits, site visits | Pre-verified companies with documented operations, licenses, and compliance status |

| Time-to-Engagement | 3–6 months for qualification | Reduce sourcing cycle by up to 60% – engage qualified partners in days |

| Language & Cultural Barriers | Miscommunication, contract delays | Bilingual support, cultural insight, and local operational context included |

| Compliance & Risk | Exposure to unlicensed or sub-tier suppliers | All Pro List partners undergo legal, financial, and ESG screening |

| Scalability | Limited to internal networks or Alibaba-style listings | Access to niche manufacturers, Tier-1 suppliers, and U.S.-managed facilities |

💡 Did You Know? Over 40% of procurement delays in China stem from supplier misrepresentation or incomplete documentation. The Pro List eliminates this friction.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

In a competitive landscape where time is margin, relying on unverified supplier leads is no longer sustainable. SourcifyChina empowers procurement leaders with data-driven clarity, risk-reduced engagement, and faster time-to-market.

Take the next step with confidence:

✅ Request your customized Pro List preview

✅ Identify U.S.-operated facilities in your target sector

✅ Begin supplier engagement—without the guesswork

👉 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Available Monday–Friday, 9:00 AM – 6:00 PM CST. Response within 2 business hours guaranteed.

SourcifyChina – Your Verified Gateway to China Sourcing Excellence.

Trusted by Procurement Leaders in 32 Countries. Backed by Data. Driven by Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.