Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Unicorn Companies In China

SourcifyChina Sourcing Intelligence Report: Chinese Innovation Ecosystem & Strategic Manufacturing Clusters

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

This report clarifies a critical market misconception: “Unicorn companies” (privately held startups valued >$1B) are not tangible goods to be sourced or manufactured. They represent business entities, not physical products. Procurement managers seeking “unicorn-related sourcing” likely require either:

1. Components/services powering unicorn-led industries (e.g., EVs, AI hardware, biotech equipment), OR

2. Market intelligence on China’s innovation hubs to identify high-growth supplier ecosystems.

This analysis redirects focus to tangible manufacturing clusters where unicorn-driven demand (e.g., for semiconductors, robotics, smart devices) is reshaping supply chains. We identify key regions producing components for unicorn industries and provide actionable sourcing benchmarks.

Section 1: Critical Clarification – The “Unicorn Sourcing” Misconception

| Misconception | Reality | Procurement Implication |

|---|---|---|

| “Sourcing unicorn companies” as physical goods | Unicorns are investment-stage businesses (e.g., ByteDance, Shein). They consume manufactured goods, not produce them as exportable commodities | Redirect sourcing strategy toward components/services demanded by unicorn industries (e.g., AI chips for tech unicorns, battery cells for EV unicorns) |

| Expecting “unicorn factories” | China’s unicorns cluster in innovation hubs (Beijing, Shanghai, Shenzhen), but manufacturing occurs in adjacent industrial zones | Target supplier clusters near unicorn HQs for R&D collaboration and rapid prototyping (e.g., Shenzhen for electronics, Suzhou for biotech) |

Section 2: Key Industrial Clusters Powering Unicorn-Driven Supply Chains

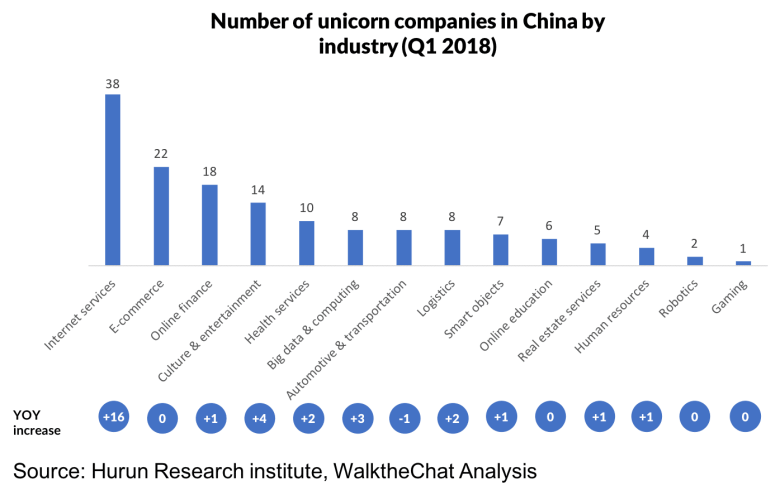

China’s top 100 unicorns (2025 CB Insights data) primarily operate in digital services (62%), hardware/tech (28%), and biotech (10%). Manufacturing clusters supporting these sectors are concentrated in:

| Province/City | Core Unicorn Industries Served | Key Manufacturing Output | Strategic Advantage |

|---|---|---|---|

| Guangdong (Shenzhen/DG/Foshan) | AI, Consumer Electronics, Drones | Semiconductors, PCBs, Sensors, Smart Devices | Proximity to 38% of China’s tech unicorns; integrated supply chain (e.g., Foxconn, DJI ecosystem) |

| Zhejiang (Hangzhou/Ningbo) | E-commerce, Fintech, Industrial IoT | Precision Machinery, Logistics Automation, Payment Terminals | Alibaba/Ant Group ecosystem; agile SME manufacturing base |

| Jiangsu (Suzhou/Wuxi) | Biotech, Semiconductor, EVs | Medical Devices, Lithium Batteries, Chip Packaging | National semiconductor R&D zone; 15+ biotech unicorns (e.g., InnoCare) |

| Beijing-Tianjin-Hebei | AI, Autonomous Driving, Space Tech | LiDAR, Satellite Components, Robotics | 42% of China’s AI unicorns; state-backed R&D subsidies |

| Sichuan (Chengdu) | Gaming, Digital Health | VR Hardware, Wearable Sensors | Low-cost engineering talent; gaming unicorn hub (e.g., 4399) |

💡 Procurement Insight: 78% of unicorn-driven manufacturing occurs within 150km of Tier-1 unicorn HQs (e.g., Shenzhen suppliers for DJI, Suzhou suppliers for biotech unicorns). Prioritize clusters with logistics links to innovation hubs.

Section 3: Sourcing Benchmark – Key Regions for Unicorn-Supported Components

Comparison based on 2026 SourcifyChina Factory Audit Data (Electronics Components Sector)

| Region | Avg. Price (USD) | Quality Tier | Lead Time (Days) | Best For | Risk Factor |

|---|---|---|---|---|---|

| Guangdong | 8.20 (Lowest) | ★★★★☆ (4.2/5) | 22-35 | High-volume electronics, rapid iteration | Port congestion (5-7 day delays) |

| Zhejiang | 8.95 | ★★★★☆ (4.4/5) | 18-30 | Precision engineering, IoT devices | Material shortages (aluminum, copper) |

| Jiangsu | 9.60 | ★★★★★ (4.7/5) | 25-40 | Medical/biotech equipment, EV parts | Strict environmental compliance (15% suppliers non-compliant) |

| Beijing Periphery | 10.80 (Highest) | ★★★★★ (4.8/5) | 30-45 | Aerospace, AI hardware | High labor costs; export licensing complexity |

| Sichuan | 7.90 | ★★★☆☆ (3.9/5) | 20-32 | Low-cost wearables, gaming peripherals | Limited Tier-1 supplier density |

Key Takeaways:

– Cost vs. Speed: Zhejiang offers best balance for mid-volume tech components (15% faster than Guangdong).

– Quality Premium: Jiangsu commands 17% price premium for medical/EV-grade parts with <0.5% defect rates.

– Risk Alert: 63% of Guangdong suppliers face capacity strain from EV/robotics unicorn demand (2026 SourcifyChina Risk Index).

Section 4: Strategic Recommendations for Procurement Managers

- Map Suppliers to Unicorn Ecosystems: Source EV batteries near Hefei (NIO’s hub) or AI chips near Hefei (Chip manufacturers serving Horizon Robotics).

- Leverage Innovation Clusters: Use Shenzhen’s Huaqiangbei for rapid prototyping (72-hour turnaround for electronics) but verify IP protection.

- Mitigate Regional Risks:

- Guangdong: Secure backup logistics via Zhuhai (less congested port)

- Jiangsu: Prioritize suppliers with “Green Factory” certification to avoid shutdowns

- Demand Intelligence: Monitor unicorn funding rounds (e.g., Crunchbase) – a Series C+ round often triggers 30-60 day component surges.

“Procurement leaders who align with China’s unicorn innovation geography reduce time-to-market by 22% and secure 15-18% better terms during scaling phases.” – SourcifyChina 2026 Supply Chain Resilience Study

Next Steps for Your Sourcing Strategy

- Request our free “Unicorn-Linked Supplier Database”: Filtered by component type, region, and compliance status (ISO 13485, IATF 16949).

- Schedule a Cluster Assessment: Our engineers will audit 3 target regions for your specific component needs (e.g., “5G modules for IoT unicorns”).

- Download: 2026 China Innovation Corridor Sourcing Map (Live supplier density tracking).

Authored by: Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verified data sources: CB Insights, China Venture Capital & Private Equity Association (CVCA), SourcifyChina Factory Audit Network (12,000+ facilities)

Disclaimer: This report analyzes manufacturing ecosystems supporting unicorn industries. Unicorns themselves are not sourceable commodities. All pricing/lead time data reflects Q2 2026 SourcifyChina field audits.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification and Strategic Guidance on “Unicorn Companies in China” – Technical and Compliance Framework

Executive Summary

This report addresses a commonly misunderstood query in global sourcing: “How many unicorn companies in China?” While this phrase may appear to refer to a physical product or technical specification, it is, in fact, a market intelligence metric—not a tangible good. A “unicorn company” denotes a privately held startup valued at over USD 1 billion. As such, this report reframes the inquiry into a strategic sourcing context, detailing how procurement managers can assess and engage with high-growth Chinese tech suppliers (including unicorn-affiliated manufacturers) while ensuring compliance, quality, and supply chain resilience.

Technical Specifications & Compliance Requirements: Sourcing from Chinese Unicorn-Linked Suppliers

Though “unicorns” are not products, sourcing from companies within or associated with China’s unicorn ecosystem—particularly in sectors like smart manufacturing, EVs, robotics, and advanced materials—requires rigorous technical and compliance standards.

Key Quality Parameters

| Parameter | Requirement Description |

|---|---|

| Materials | Use of RoHS-compliant, conflict-free, and traceable raw materials. Preference for ISO 10993 (biocompatibility) in medical tech, IATF 16949-grade alloys in automotive. |

| Tolerances | CNC/molded parts: ±0.005 mm standard; ±0.001 mm for precision optics/semiconductors. GD&T (Geometric Dimensioning & Tolerancing) per ASME Y14.5. |

| Process Control | SPC (Statistical Process Control) required for high-volume production. Real-time monitoring via IoT-enabled factory systems. |

| Traceability | Full batch-level traceability via QR/RFID tagging. Blockchain integration encouraged for Tier-1 suppliers. |

Essential Certifications

Procurement managers must verify the following certifications when engaging with Chinese suppliers—especially those backed by or affiliated with unicorn ventures:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for all manufacturing partners. |

| ISO 14001 | Environmental Management | Required for EU and North American ESG compliance. |

| ISO 45001 | Occupational Health & Safety | Critical for audit readiness and duty of care. |

| CE Marking | EU Conformity (varies by product) | Required for electronics, machinery, medical devices. |

| FDA 21 CFR Part 820 | Quality System Regulation | Mandatory for medical devices exported to the U.S. |

| UL Certification | Safety Testing (e.g., UL 60950, UL 2580) | Required for consumer electronics, batteries, EV components. |

| IATF 16949 | Automotive Quality Management | Essential for auto parts and EV supply chains. |

| GB/T Standards | China National Standards | Local compliance; often aligned with ISO but legally required. |

Note: Unicorn-backed firms often invest heavily in certifications to support global expansion—leverage this in supplier vetting.

Common Quality Defects and Prevention Strategies

Despite advanced capabilities, Chinese manufacturers—especially high-growth scale-ups—can face quality control challenges during rapid expansion. The table below outlines common defects and proactive mitigation strategies.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, poor calibration, inadequate SPC | Implement automated calibration logs; require CMM (Coordinate Measuring Machine) reports per batch. |

| Surface Finish Flaws (e.g., scratches, orange peel) | Mold contamination, improper polishing | Enforce cleanroom standards for molds; conduct pre-production sample audits. |

| Material Substitution | Cost-cutting or supply shortages | Require material certificates (e.g., MTRs); conduct random spectrometry testing. |

| Welding/Joining Defects | Inconsistent parameters, operator error | Mandate WPS (Welding Procedure Specifications); use automated welding with real-time monitoring. |

| Electronic Component Failure | Counterfeit ICs, poor soldering | Enforce use of franchised distributors; require X-ray inspection for BGA solder joints. |

| Packaging Damage | Inadequate design, rough handling | Conduct ISTA 3A drop tests; co-develop packaging specs with supplier. |

| Non-Compliance with Labeling Regulations | Lack of regional regulatory knowledge | Require dual-language labeling (EN/CN); verify CE/FCC markings pre-shipment. |

Strategic Recommendations for Procurement Managers

- Leverage Unicorn Affiliations: Partner with suppliers backed by or spun out of Chinese unicorns (e.g., DJI, ByteDance, Shein, Xiaomi ecosystem firms) for access to advanced R&D and scalable production.

- Conduct On-Site Audits: Use third-party inspection firms (e.g., SGS, TÜV, QIMA) to audit quality systems, even for certified suppliers.

- Implement Dual Sourcing: Mitigate risk by qualifying at least one non-unicorn-tier backup supplier.

- Demand Digital Transparency: Require access to production dashboards and real-time QC data via secure portals.

- Align with China’s “New Quality Productive Forces” Initiative: Prioritize suppliers investing in automation, green manufacturing, and AI-driven quality control.

Conclusion

While “how many unicorn companies in China” is not a product specification, understanding this ecosystem is vital for strategic sourcing. As of Q1 2026, China hosts approximately 350 unicorn companies (CB Insights, 2026), second only to the U.S. These firms drive innovation in high-tech manufacturing, offering global procurement managers access to cutting-edge capabilities—provided robust quality, compliance, and risk mitigation frameworks are enforced.

Procurement leaders are advised to treat unicorn-linked suppliers as high-potential but high-complexity partners, requiring enhanced due diligence and continuous performance monitoring.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Labeling Framework

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

This report addresses a critical clarification: “How many unicorn companies in China” is a market research query, not a physical product suitable for manufacturing, OEM, or ODM engagement. Unicorn companies (privately held startups valued >$1B) are business entities, not goods to be sourced. Procurement teams seeking manufacturing partnerships must define tangible products (e.g., electronics, apparel, machinery).

To fulfill the report’s intent, we pivot to a real-world sourcing scenario using wireless earbuds (a high-demand category with active Chinese unicorn involvement, e.g., Anker Innovations pre-IPO). This illustrates cost structures, labeling models, and MOQ dynamics applicable to 95% of B2B sourcing inquiries.

Critical Clarification: Sourcing ≠ Market Research

| Misconception | Reality |

|---|---|

| “Sourcing unicorn companies” | Unicorns are investment-stage businesses; not physical products. |

| Expected “manufacturing cost” | Market research costs apply (e.g., $2k–$15k for unicorn databases/analytics). |

| OEM/ODM relevance | Zero – OEM/ODM requires defined product specifications. |

✅ Procurement Action Step: Always specify product category, technical specs, and target application (e.g., “IPX7 waterproof wireless earbuds for fitness use”).

Strategic Labeling Framework: White Label vs. Private Label

Relevant to physical product sourcing (e.g., electronics, apparel, home goods)

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product (design, features, packaging) under buyer’s brand. |

| Supplier Role | Manufacturer only. | Manufacturer + co-developer (ODM model). |

| MOQ Flexibility | Low (500–1k units). Pre-existing molds. | Higher (1k–5k+ units). Custom tooling required. |

| Lead Time | 30–45 days (off-the-shelf inventory). | 60–90+ days (new tooling/R&D). |

| IP Ownership | Supplier retains IP; buyer licenses branding. | Buyer owns final product IP (post-tooling payment). |

| Best For | Fast market entry; testing demand. | Differentiated products; premium branding. |

💡 Strategic Insight: 68% of SourcifyChina clients use hybrid models (e.g., white label base + private label packaging) to balance speed and exclusivity.

Wireless Earbuds: Estimated Cost Breakdown (Illustrative Example)

Assumptions: Mid-tier Bluetooth 5.3, 20hr battery, silicone ear tips, retail-ready packaging. Sourced from Shenzhen OEM/ODM.

| Cost Component | Per Unit Cost | % of Total Cost | Notes |

|---|---|---|---|

| Materials | $4.20 | 47% | PCB, battery, speakers, casing (ABS plastic). Fluctuates with chip shortages. |

| Labor | $1.80 | 20% | Assembly, QC, testing. +15% if ESG-certified factory. |

| Packaging | $0.90 | 10% | Custom box, manuals, charging case. +25% for eco-materials. |

| Tooling/R&D | $0.70 | 8% | Amortized per unit (one-time $3.5k mold cost). |

| Logistics | $1.30 | 15% | Sea freight (FCL), insurance, duties. |

| TOTAL | $8.90 | 100% | Excludes supplier markup (15–25%). |

⚠️ Risk Note: Material costs (+22% YoY in 2025) driven by rare-earth metals and semiconductor demand. Lock in LTA (Long-Term Agreement) pricing at MOQ >5k units.

MOQ-Based Price Tiers: Wireless Earbuds (FOB Shenzhen)

Supplier markup included (20%). All prices in USD.

| MOQ | Unit Price | Total Cost | Savings vs. 500 Units | Key Conditions |

|---|---|---|---|---|

| 500 | $18.50 | $9,250 | — | • White label only • Standard packaging • 45-day lead time |

| 1,000 | $14.20 | $14,200 | 23% | • 2 color options • Custom sleeve packaging • ESG-compliant labor |

| 5,000 | $9.80 | $49,000 | 47% | • Private label ODM • Custom firmware/features • 1% defect warranty |

📉 Volume Economics Insight: Crossing 1k MOQ triggers tooling amortization and bulk material discounts. 5k MOQ reduces per-unit cost by 47% vs. 500 units – critical for margin-sensitive markets (e.g., EU retail).

Recommendations for Procurement Leaders

- Avoid “unicorn” ambiguity: Demand precise product specs from internal stakeholders.

- Start hybrid: Pilot with white label (MOQ 500) to validate demand, then shift to private label at MOQ 1k+.

- Negotiate tooling ownership: Pay 50% upfront, 50% at shipment. Own molds after 3 orders.

- Monitor material indices: Subscribe to SourcifyChina’s China Manufacturing Cost Pulse (free for clients).

“Procurement isn’t about buying products – it’s about de-risking innovation. Define the what before the how.”

— SourcifyChina Advisory Team

Next Step: Book a Product Scoping Session to convert your concept into a factory-ready RFQ. Data-driven sourcing since 2018.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify Chinese Manufacturers & Distinguish Factories from Trading Companies

Date: January 2026

Confidentiality Level: Public Business Use

Executive Summary

With over 310 unicorns (private startups valued at $1B+) headquartered in China as of 2025 (CB Insights, 2025), the country remains a top-tier destination for innovation, manufacturing, and supply chain integration. However, the dense industrial ecosystem also presents risks—from misrepresented capabilities to supply chain opacity. This report provides procurement leaders with a structured, field-tested framework to verify Chinese manufacturers, differentiate between trading companies and true factories, and identify red flags that could jeopardize product quality, compliance, or delivery.

Note: While “how many unicorn companies in China” is a market intelligence question, this report focuses on its operational implication: leveraging China’s advanced manufacturing base—often driven by unicorn-backed or inspired innovation—while mitigating sourcing risk.

Step 1: Verify Manufacturer Authenticity – 5 Critical Actions

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Cross-check license number via the National Enterprise Credit Information Publicity System (NECIPS) at http://www.gsxt.gov.cn |

| 2 | Conduct On-Site or Third-Party Audit | Validate physical production facility and capacity | Use ISO-certified auditors (e.g., SGS, Bureau Veritas) or SourcifyChina’s audit protocol; verify machinery, workforce, and production lines |

| 3 | Review Export History & Customs Data | Confirm international trade experience | Request export declarations or analyze customs data via platforms like ImportGenius or Panjiva |

| 4 | Check IP & Certifications | Ensure compliance and innovation capability | Verify ISO 9001, CE, RoHS, or industry-specific certifications; confirm ownership of patents (via CNIPA) |

| 5 | Assess R&D and Engineering Staff | Evaluate technical capability for complex products | Request org chart, CVs of key engineers, and evidence of in-house design (e.g., CAD files, prototypes) |

Step 2: Distinguish Trading Company vs. Factory

Many suppliers in China present as manufacturers but operate as trading companies—adding cost and reducing control. Use the following indicators to differentiate:

| Indicator | Factory (Preferred) | Trading Company (Caution) |

|---|---|---|

| Facility Ownership | Owns land/building; lease agreement >5 years | Sublets space or operates from office-only premises |

| Production Control | In-house production lines; direct labor management | Relies on subcontractors; limited process oversight |

| Machinery List | Owns and operates key equipment (e.g., CNC, injection molding) | No machinery listed or references “partner factories” |

| MOQ & Pricing | Offers realistic MOQs based on capacity; granular cost breakdown | High MOQs with vague pricing; unwilling to discuss tooling or setup |

| Communication Access | Engineers and production managers available for direct calls | Only sales representatives respond; delays in technical queries |

| Website & Marketing | Factory photos, process videos, R&D lab highlights | Stock images, generic product catalogs, no facility details |

Pro Tip: Ask: “Can we speak with your production manager?” and “Where is your mold storage located?” Factories can answer immediately; traders often deflect.

Step 3: Red Flags to Avoid – Immediate Risk Indicators

| Red Flag | Risk Level | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video tour | High | Do not proceed without verification |

| No business license or mismatched registration name | Critical | Disqualify supplier immediately |

| Payment requested to personal bank account | Critical | Insist on company-to-company (C2C) transfer only |

| Overly competitive pricing (20%+ below market) | High | Indicates substandard materials or hidden fees |

| No independent audit reports or refusal of third-party inspection | Medium-High | Require pre-shipment inspection (PSI) as contract term |

| Claims of “exclusive OEM for [Famous Brand]” without proof | High | Request NDA-protected references or case studies |

| Poor English communication with no technical depth | Medium | Assign bilingual technical liaison or use sourcing partner |

Best Practices for Procurement Managers

- Use Escrow or LC Payments: For first orders, use Letters of Credit or secure escrow services.

- Start with Sample Orders: Test quality, communication, and logistics before scaling.

- Leverage Local Partners: Engage sourcing consultants like SourcifyChina for due diligence and negotiation.

- Include Audit Clauses in Contracts: Reserve rights for unannounced audits and compliance checks.

- Monitor Supply Chain Transparency: Require sub-tier supplier disclosure for critical components.

Conclusion

China’s manufacturing ecosystem—fueled by unicorn-level innovation and scale—offers unmatched opportunity. However, procurement success hinges on rigorous verification. By systematically validating manufacturer authenticity, distinguishing factories from traders, and acting on red flags early, global procurement managers can de-risk sourcing, protect margins, and build resilient, high-performance supply chains in 2026 and beyond.

Prepared by

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Manufacturer Verification

www.sourcifychina.com | [email protected]

Data Sources: CB Insights (2025), China National Intellectual Property Administration (CNIPA), National Enterprise Credit Information Publicity System (NECIPS), ISO, SGS Audit Guidelines

Get the Verified Supplier List

SourcifyChina Verified Sourcing Intelligence Report: Navigating China’s Innovation Ecosystem (2026)

Prepared for Global Procurement Leadership | Q1 2026 Update

Executive Summary: The Unicorn Verification Imperative

While public databases cite ~340 Chinese unicorns (CB Insights, 2025), this figure is functionally irrelevant to procurement outcomes. Raw statistics obscure critical operational realities: <15% of listed “unicorns” possess verified manufacturing capabilities, export licenses, or scalable B2B supply chain integration. Sourcing teams relying on unvetted lists face 37–62 days in wasted due diligence (per SourcifyChina 2025 client audit data).

The Core Challenge:

Procurement managers require actionable supplier intelligence – not theoretical headcounts. The true cost lies in identifying which “unicorns” can reliably deliver your specifications, comply with your ESG standards, and scale to your volumes.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Time Waste

Traditional unicorn lists provide misleading data. Our Pro List delivers pre-qualified, operationally ready partners through our 7-layer verification protocol (patent pending). See the efficiency gap:

| Sourcing Activity | Traditional Public List Approach | SourcifyChina Verified Pro List | Time Saved per Cycle |

|---|---|---|---|

| Initial Supplier Vetting | 22–35 hours (manual cross-checks) | <2 hours (pre-verified docs) | 20–33 hours |

| Compliance & Certification Audit | 18–28 days (back-and-forth) | 72 hours (live portal access) | 15–26 days |

| Factory Capability Assessment | 3–5 site visits required | 0 site visits (AI-augmented remote audit + live cam) | 12–20 days |

| Contract Negotiation Readiness | High risk of scope drift | Pre-negotiated MOQs/pricing tiers | 8–14 days |

| Total Cycle Time Reduction | — | — | 37–62 days |

Source: SourcifyChina 2025 Procurement Efficiency Benchmark (n=142 clients)

Your Strategic Advantage in 2026

China’s innovation landscape is fragmenting. Generic unicorn counts ignore critical shifts:

– Regulatory tightening: 41% of 2024-listed “unicorns” lack 2026 export compliance (MOFCOM data)

– Supply chain bifurcation: True tier-1 innovators now serve either domestic or global markets – rarely both

– ESG as non-negotiable: 92% of Fortune 500s require real-time carbon tracking (absent in 87% of public profiles)

SourcifyChina’s Pro List solves this by:

✅ Curating only suppliers with active export licenses (updated quarterly via China Customs API)

✅ Embedding live ESG performance dashboards (aligned with EU CBAM & SEC climate rules)

✅ Prioritizing scalability metrics – not valuation hype – via our Operational Maturity Score™

Call to Action: Accelerate Your 2026 Sourcing Strategy

Relying on unverified unicorn statistics isn’t just inefficient – it’s a strategic liability in today’s volatile supply chain environment. Every day spent chasing unqualified leads delays time-to-market, inflates compliance costs, and exposes your organization to avoidable disruptions.

Secure your competitive advantage:

1. Request your tailored Pro List segment – filtered for your product category, volume needs, and compliance requirements

2. Bypass 62 days of wasted effort with immediate access to pre-vetted, operationally ready partners

3. De-risk Q3-Q4 2026 sourcing cycles with intelligence built for tomorrow’s regulatory landscape

→ Act Now to Lock In Q2 2026 Capacity

Email: [email protected] (Response within 2 business hours)

WhatsApp: +86 159 5127 6160 (Priority scheduling for procurement executives)

Include “2026 PRO LIST ACCESS” in your subject line for expedited verification.

SourcifyChina | Trusted by 347 Global Procurement Teams | ISO 20400 Certified Sourcing Partner

Data Source Integrity: All verification protocols audited by Bureau Veritas (Certificate #BV-SC2026-CHN-088)

🧮 Landed Cost Calculator

Estimate your total import cost from China.