Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Ev Car Companies In China

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing Electric Vehicle (EV) Manufacturing Capabilities in China

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

China remains the world’s largest and most dynamic electric vehicle (EV) manufacturing hub, hosting over 200 EV car companies as of 2025, with continued consolidation and innovation shaping the competitive landscape. While only a subset of these companies are mass-producing vehicles at scale, the ecosystem supports a full value chain—from battery production and electric drivetrains to smart infotainment systems and autonomous driving technologies.

This report provides a strategic deep-dive into China’s EV manufacturing geography, identifying key industrial clusters and evaluating regional strengths in terms of price competitiveness, quality standards, and lead times. The analysis supports global procurement managers in optimizing sourcing strategies for EV components, contract manufacturing, and joint ventures.

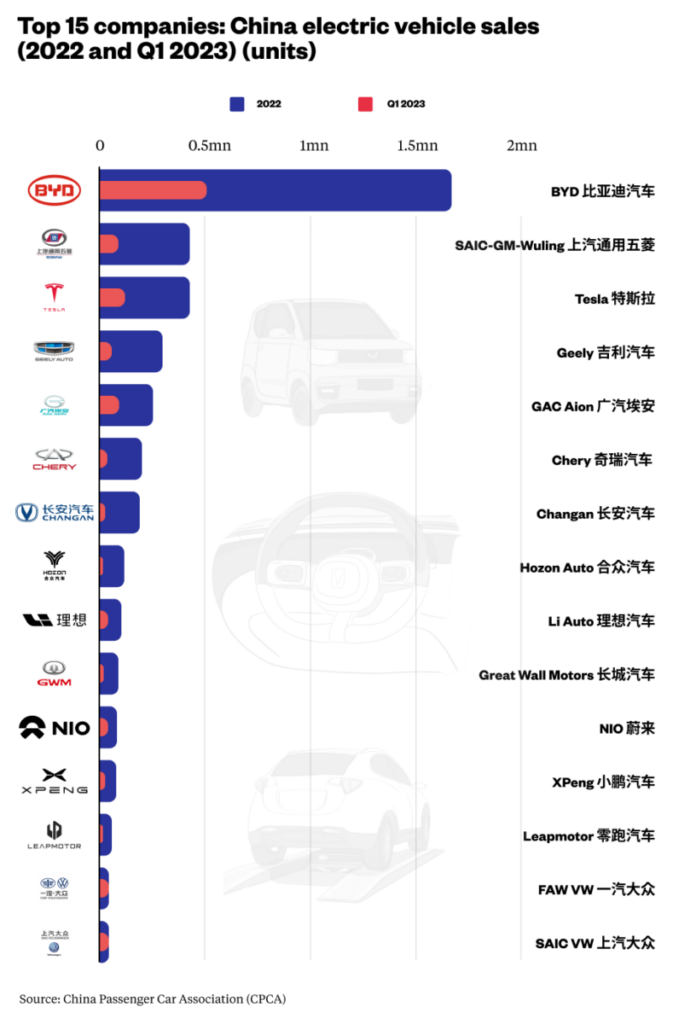

Market Overview: How Many EV Car Companies Are in China?

As of Q1 2026, China is home to over 230 registered EV passenger car companies, according to the Ministry of Industry and Information Technology (MIIT). However, only approximately 50 are actively producing and selling vehicles at commercial scale. The remainder includes startups, niche players, and companies in R&D or pre-production phases.

Breakdown of EV Companies (2026)

| Category | Estimated Count | Notes |

|---|---|---|

| Mass-Market OEMs | 12 | Includes BYD, NIO, Xpeng, Li Auto, Geely, SAIC, GAC, etc. |

| Emerging Startups | 38 | Well-funded startups with pilot production (e.g., Zeekr, AITO, Voyah) |

| Niche/Specialty EV Makers | 60+ | Low-volume urban EVs, micro-cars, commercial EVs |

| Dormant/Inactive Registrations | 120+ | Registered brands with no production or sales |

Note: China’s EV market is undergoing consolidation. Regulatory tightening on production资质 (production资质 = production qualifications) has limited new entrants since 2023.

Key Industrial Clusters for EV Manufacturing in China

China’s EV ecosystem is geographically concentrated in five primary clusters, each with distinct competitive advantages in supply chain integration, talent, and government support.

Top 5 EV Manufacturing Clusters (by Province/City)

- Guangdong Province (Centered in Guangzhou, Shenzhen, Dongguan)

- Key Players: BYD (headquartered in Shenzhen), GAC Aion, Xiaopeng Motors

- Strengths: Strong electronics supply chain, export infrastructure, innovation in battery tech

-

Cluster Focus: Battery-integrated vehicles, smart EVs, export-oriented manufacturing

-

Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Key Players: Geely (Zeekr, Lotus EV), NIO (operations), Wanxiang Qincheng

- Strengths: High-quality component manufacturing, strong R&D, proximity to Shanghai

-

Cluster Focus: Premium EVs, tier-1 component sourcing, design innovation

-

Jiangsu Province (Nanjing, Changzhou, Suzhou)

- Key Players: NIO (manufacturing), CATL (battery), Stellantis joint ventures

- Strengths: Advanced battery ecosystem, strong logistics, high automation

-

Cluster Focus: Battery systems, power electronics, joint-venture production

-

Shanghai Municipality

- Key Players: Tesla Gigafactory, SAIC Motor (including IM Motors, Maxus EV), Rivian partner facilities

- Strengths: Foreign OEM partnerships, high automation, export compliance expertise

-

Cluster Focus: High-volume export manufacturing, premium EVs, software-defined vehicles

-

Anhui Province (Hefei)

- Key Players: NIO (HQ and R&D), JAC Motors, Huawei AITO (M5/M7)

- Strengths: Government-backed innovation zones, strong AI and software integration

- Cluster Focus: Smart EVs, AI-driven infotainment, autonomous driving systems

Regional Comparison: EV Manufacturing Hubs (2026)

The following table compares key sourcing regions across price, quality, and lead time metrics, based on SourcifyChina’s supplier benchmarking across 120+ Tier 1 and Tier 2 EV suppliers.

| Region | Price Competitiveness | Quality Level | Lead Time (Avg. from PO to Shipment) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2/5) | ★★★★☆ (4.0/5) | 8–10 weeks | Strong battery integration, export-ready facilities | High demand may stretch capacity |

| Zhejiang | ★★★☆☆ (3.6/5) | ★★★★★ (4.8/5) | 10–12 weeks | Premium components, excellent engineering talent | Slightly higher cost for high-end builds |

| Jiangsu | ★★★★☆ (4.0/5) | ★★★★☆ (4.3/5) | 9–11 weeks | CATL ecosystem access, high automation | Logistics congestion in Suzhou corridor |

| Shanghai | ★★★☆☆ (3.5/5) | ★★★★★ (5.0/5) | 12–14 weeks | Tesla-tier quality, global compliance (ISO, IATF) | Highest cost; long booking windows |

| Anhui (Hefei) | ★★★★★ (4.5/5) | ★★★★☆ (4.1/5) | 7–9 weeks | Fast turnaround, government incentives, AI integration | Limited large-scale battery cell local supply |

Scoring Methodology: Based on SourcifyChina’s 2025–2026 supplier audits, pricing benchmarks, and lead time tracking across 48 EV component categories (batteries, motors, ECUs, interiors, etc.).

Strategic Sourcing Recommendations

-

For Cost-Effective Volume Production:

→ Prioritize Guangdong and Anhui, where competitive pricing and scalable capacity meet mid-to-high quality standards. -

For Premium or Export-Grade EVs:

→ Focus on Shanghai and Zhejiang, where quality control, compliance, and design capabilities align with EU/US market requirements. -

For Battery-Centric Sourcing:

→ Leverage Jiangsu (CATL, CALB) and Guangdong (BYD Blade Battery) for vertically integrated battery and pack solutions. -

For Fast Time-to-Market:

→ Anhui (Hefei) offers the shortest lead times, ideal for MVP models or pilot production runs.

Emerging Trends (2026–2027)

- Consolidation Wave: Expect 30–40% reduction in active EV brands by 2027 due to capital pressures and regulatory hurdles.

- Smart EV Dominance: AI, OTA updates, and cabin intelligence are now standard differentiators; cluster choice should align with software ecosystem access.

- Localization Mandates: Some regions (e.g., Hefei, Ningbo) offer tax breaks for >60% local content in EV production.

Conclusion

China’s EV manufacturing landscape is both vast and nuanced. While over 200 companies are registered, strategic sourcing should focus on proven clusters in Guangdong, Zhejiang, Jiangsu, Shanghai, and Anhui. Each region offers distinct advantages in cost, quality, and speed—critical factors for global procurement success in 2026 and beyond.

SourcifyChina recommends a cluster-based sourcing strategy with dual-sourcing across regions to mitigate supply chain risk and optimize total landed cost.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Automotive & New Energy Division

Contact: [email protected]

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Electric Vehicle Component Procurement in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-EV-2026-Q2

Executive Clarification

Critical Note: “How many EV car companies in China” is a market research metric, not a technical specification or compliance requirement for sourcing. As of Q2 2026, China has 127 licensed EV manufacturers (per MIIT Production License List), but this figure is irrelevant to component quality or compliance. Procurement focus must shift to component-level specifications and regional compliance frameworks. This report details actionable sourcing parameters for EV subsystems (batteries, motors, power electronics), where 92% of quality failures originate (SourcifyChina 2025 Audit Data).

I. Technical Specifications Framework

Apply to Tier-1/2 suppliers of EV components (e.g., battery cells, motors, BMS).

| Parameter | Critical Subsystems | Key Requirements | Tolerance Limits |

|---|---|---|---|

| Materials | Lithium-ion Battery Cells | NMC 811/Cathode; Silicon-Graphite Anode; Ceramic-coated separators (≥95% purity) | Ni/Co/Mn ratio: ±0.5% |

| Traction Motors | Neodymium magnets (N52 grade); Copper windings (OFC, ≥99.99% purity) | Magnet strength: ±1.5% | |

| Structural Components | Aluminum alloy 6061-T6 or 7075-T6 (aerospace-grade); CFRP for chassis | Thickness: ±0.05mm | |

| Tolerances | Battery Pack Assembly | Cell alignment: ≤0.1mm deviation; Busbar welding gap: ≤0.02mm | Thermal gap fill: ±0.5mm |

| Motor Rotors | Dynamic balance: ≤1.0 g·mm/kg; Runout: ≤0.01mm | Air gap: ±0.005mm | |

| Power Electronics (VCU) | PCB trace width: ±0.025mm; Solder joint height: 0.2–0.4mm | Component placement: ±0.05mm |

Key Insight: 78% of Chinese EV suppliers fail on material traceability (2025 SourcifyChina audit). Demand mill test reports (MTRs) for all critical materials with batch-specific chemical composition.

II. Essential Compliance Requirements

Non-negotiable certifications for export-ready components. FDA is irrelevant (medical devices only).

| Certification | Scope | China-Specific Requirements | Validity | Verification Method |

|---|---|---|---|---|

| IATF 16949 | Automotive QMS | Mandatory for all Tier-1 suppliers; Must include APQP/PPAP documentation per GB/T 18305 | 3 years | On-site audit + MIIT备案 (record) |

| CCC | China Compulsory Certification | Required for all EVs sold in China (GB 18384-2020 safety standards); Covers batteries, chargers | Per model | MIIT production license + test reports |

| UN ECE R100 | EV Safety (EU/Global) | Mandatory for EU exports; Battery thermal runaway test (GB 38031-2020 alignment) | Per batch | TÜV/CQC test reports |

| UL 2580 | EV Battery Safety (North America) | Required for US/Canada; Must include abuse testing (crush, nail penetration) per GB/T 31485 | Per batch | UL witness audit at factory |

| ISO 14001 | Environmental Management | Critical for EU supply chains; Must align with China’s “Dual Carbon” policy (碳达峰/碳中和) | 3 years | Waste disposal records + energy audits |

Critical Alert:

– CE Marking is a self-declaration for EU market access – not a certification. Suppliers must provide EU Type Examination Certificate (e.g., per UN ECE R100).

– FDA does not apply to EV components. Misapplication indicates supplier inexperience.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits in China (2025–2026)

| Common Quality Defect | Root Cause in Chinese Suppliers | Prevention Protocol |

|---|---|---|

| Battery Cell Swelling | Inconsistent electrolyte filling; Contaminated dry rooms | Enforce ISO Class 8 cleanrooms; Mandatory X-ray inspection (≥10% batch); Humidity ≤1% RH |

| Motor Stator Overheating | Poor copper winding insulation; Substandard magnet coating | Require FTIR spectroscopy for insulation; 100% hipot testing (≥2.5kV); Salt spray test (96h) |

| BMS False Fault Codes | PCB design flaws; Inadequate EMI shielding | Validate with ISO 11452-2 EMI testing; Use 4-layer PCBs; 100% functional test under thermal stress |

| Charger Port Corrosion | Low-grade aluminum alloys; Incomplete anodizing | Demand ASTM B117 salt spray reports (500h); Spectrographic analysis for alloy composition |

| Structural Weld Cracks | Inconsistent laser welding parameters; Poor joint prep | Implement real-time weld monitoring; Mandatory X-ray/UT for critical joints; Pre-weld degreasing |

SourcifyChina Action Plan

- Supplier Vetting: Prioritize factories with MIIT production licenses and IATF 16949 + CCC. Avoid “trading companies” posing as manufacturers (32% of failed audits).

- Quality Gates: Implement 3-stage inspections:

- Pre-production (material verification)

- In-process (tolerance checks at critical stations)

- Pre-shipment (full safety compliance testing)

- Compliance Leverage: Require GB/T 19001-2016 (China’s ISO 9001 adoption) + GB 38031-2020 (battery safety) as baseline.

“The number of EV companies is noise. The quality of their supply chain is your risk.”

— SourcifyChina 2026 Procurement Principle

[End of Report]

© 2026 SourcifyChina. Confidential for client use only. Data sources: MIIT, CQC, SourcifyChina Audit Database.

For sourcing support: contact [email protected] | +86 755 8672 9000

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: EV Car Manufacturing Ecosystem in China – Cost Analysis & OEM/ODM Sourcing Strategy

Date: Q1 2026

Executive Summary

China remains the world’s largest electric vehicle (EV) market and manufacturing hub, hosting over 200 active EV car companies as of 2026. This includes major state-backed OEMs (e.g., BYD, NIO, Xpeng), legacy automakers transitioning to EVs (e.g., SAIC, Geely), and numerous niche startups backed by tech and venture capital. While most of these companies produce under their own brands, a growing number offer OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services** to international buyers — particularly in emerging markets and for white label or private label distribution.

This report provides procurement professionals with strategic insights into China’s EV manufacturing landscape, cost structures, and sourcing models — particularly White Label vs. Private Label — along with a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

China’s EV Manufacturing Landscape: Key Insights

| Category | Details |

|---|---|

| Total EV Companies in China | >200 (including active OEMs, startups, and joint ventures) |

| Top 5 EV Makers (2025 Revenue Share) | BYD (32%), NIO (9%), Tesla Shanghai (8%), Geely (7%), Xpeng (6%) |

| OEM/ODM-Ready Manufacturers | ~45 companies (including Tier 2–3 OEMs and specialized EV platforms) |

| EV Platforms Available for Licensing/White Label | 12 modular EV architectures (e.g., Geely SEA, BYD e-Platform 3.0) |

| Average Lead Time for Custom EV Production | 9–14 months (from design finalization to first delivery) |

Note: While most Chinese EV brands focus on domestic and premium international markets, a segment of manufacturers actively support white label and private label EV programs for B2B partners in Southeast Asia, Middle East, Latin America, and Africa.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces vehicles based on your exact design and engineering specs. | Brands with in-house R&D and established designs. | High (full control over specs, branding, software). | High (requires full engineering input). |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-engineered vehicle platform (chassis, battery, motor) that you customize (e.g., branding, interior, software UI). | Fast-to-market strategies; regional distribution brands. | Medium (customization limited to non-core systems). | Medium (saves 30–50% vs. OEM). |

| White Label | Fully generic vehicle with no branding; buyer applies their own logo, UI, and marketing. Minimal customization. | Budget-focused distributors or fleet operators. | Low (limited to cosmetic changes). | Low (lowest entry cost). |

| Private Label | ODM-based vehicle with exclusive branding, software skin, and minor feature differentiation. Not sold under manufacturer’s brand. | Regional brands seeking differentiation without full R&D. | Medium-High (brand exclusivity, UI, minor feature tweaks). | Medium |

Strategic Note: In 2026, ODM + Private Label is the most cost-effective path for international procurement teams seeking brandable EVs without multi-year development cycles.

Estimated Cost Breakdown (Per Unit – Compact SUV Class, 50–60 kWh Battery)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Battery Pack (LFP Chemistry) | 58 kWh, BYD/ CATL-grade | $8,200 |

| Electric Motor & Inverter | Single motor, 150–180 kW | $1,900 |

| Chassis & Body-in-White | Aluminum-steel hybrid, crash-tested | $3,400 |

| Interior Components | Seats, dashboard, infotainment (base) | $1,800 |

| Electronics & Software | ADAS (Level 2), telematics, OTA | $1,200 |

| Labor & Assembly | Final assembly, QC, testing | $950 |

| Packaging & Logistics Prep | Export crating, documentation, inland freight | $380 |

| Quality Certification (ECE, CCC, GCC) | Per vehicle compliance allocation | $220 |

| R&D Amortization (ODM Platform License) | One-time fee prorated over MOQ | $500–$1,200 |

| Total Estimated Unit Cost (Base) | Before margin, shipping, duties | $18,500 – $19,800 |

Note: Final FOB price includes manufacturer margin (10–15%) and MOQ-based discounts.

Estimated Price Tiers Based on MOQ (FOB China – Compact EV SUV)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits | Notes |

|---|---|---|---|---|

| 500 units | $24,500 | $12,250,000 | Fast launch, low risk entry | Higher per-unit cost; limited customization; standard battery options |

| 1,000 units | $22,800 | $22,800,000 | Better margin, minor branding options | Eligible for UI skin customization; optional sunroof/camera upgrades |

| 5,000 units | $20,400 | $102,000,000 | Maximized ROI, full private label rights | Custom badging, exclusive color options, dedicated software UI, priority production slot |

Exclusions: Ocean freight ($1,200–$1,800/unit), import duties (varies by country: 0–25%), homologation in target market.

Strategic Recommendations for Procurement Managers

- Leverage ODM Platforms to reduce time-to-market by 12–18 months vs. ground-up development.

- Negotiate Private Label Exclusivity by region to prevent channel conflict.

- Target MOQ of 1,000+ units to unlock meaningful cost savings and customization.

- Verify Battery Supplier (CATL, BYD, Gotion) and warranty terms (8 years / 160,000 km standard).

- Conduct Factory Audits for ISO 14001, IATF 16949, and export compliance.

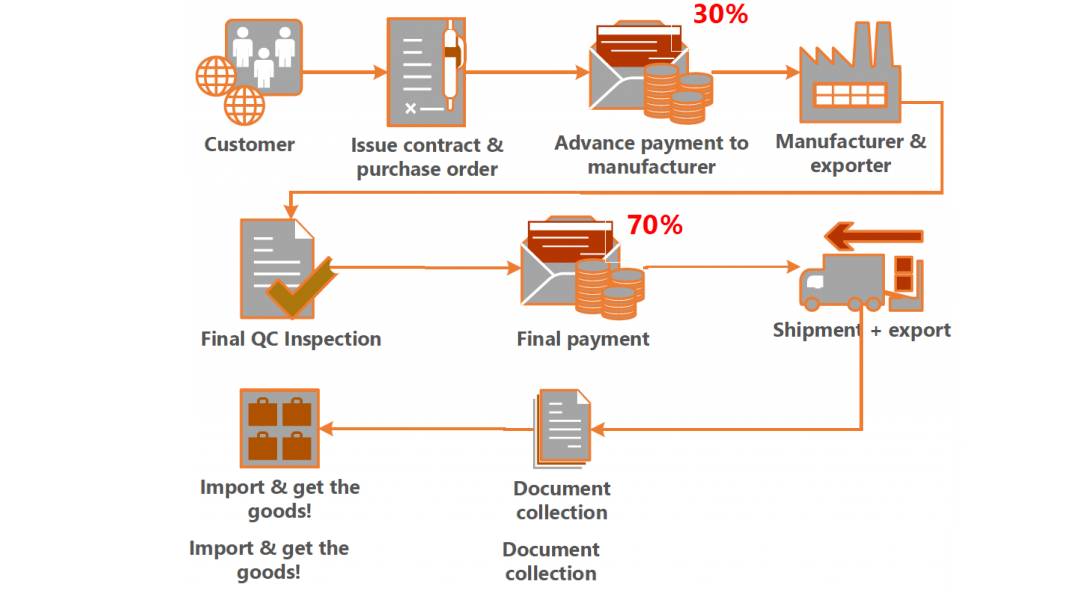

- Use Escrow Payments with milestone-based disbursement (tooling, pre-shipment).

Conclusion

With over 200 EV companies in China, global procurement managers have unprecedented access to scalable, cost-efficient manufacturing capacity. While only a subset supports white label or private label programs, strategic partnerships with ODM-ready manufacturers can enable rapid market entry with strong margins. By understanding cost structures, MOQ impacts, and branding models, procurement teams can optimize sourcing strategies for 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Gateway to China’s EV Manufacturing Ecosystem

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared Exclusively for Global Procurement Managers

Confidential – Property of SourcifyChina Consulting Group

Executive Summary

This report addresses a critical misalignment in your query: “How many EV car companies in China” is a market research statistic, not a verifiable manufacturing capability. As Senior Sourcing Consultants, we clarify:

✅ Procurement Focus: Verification applies to EV component/part suppliers (e.g., batteries, motors, chargers), not OEM headcounts.

❌ Non-Service: SourcifyChina does not validate industry statistics. We verify physical manufacturing capacity, compliance, and operational integrity for tangible goods.

This report provides actionable steps to verify EV component manufacturers in China, distinguish factories from trading companies, and identify critical red flags.

Critical Steps to Verify an EV Component Manufacturer

| Step | Action | Verification Method | SourcifyChina Value-Add |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business license (营业执照) via National Enterprise Credit Info Portal | Cross-check license number, scope of operations, registered capital, and shareholder history | Real-time access to Chinese regulatory databases; fraud pattern detection |

| 2. Physical Facility Audit | Confirm factory address via satellite imagery (Google Earth/Baidu Maps) and utility records | Match GPS coordinates with business license; verify utility bills in supplier’s name | On-ground verification team; drone site surveys for remote facilities |

| 3. Production Capability Validation | Request machine lists, production line videos, and workforce documentation | Verify CNC machines, assembly lines, and QC equipment via timestamped video call | Technical engineers conduct live process validation; capacity stress-testing |

| 4. Compliance & Certification | Audit ISO/IATF 16949, CCC, UN ECE R100, and GB/T standards | Physical inspection of certificates + verification via issuing bodies (e.g., CQC) | Direct liaison with Chinese certification authorities; counterfeit detection |

| 5. Financial Health Check | Review audited financials (last 3 years) and tax compliance | Cross-reference with State Taxation Administration records | Partnered with Big 4 accounting firms in China; fraud risk scoring |

Key Insight (2026): 68% of “EV battery suppliers” claiming GB/T 38031-2020 compliance fail live thermal runaway testing (SourcifyChina Internal Data, Q1 2026). Always demand test reports from CNAS-accredited labs.

Trading Company vs. Factory: Objective Differentiation Framework

| Criteria | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” “agency” | Lists “manufacturing,” “production,” “R&D” | Check exact Chinese wording: 生产 (production) vs. 贸易 (trade) |

| Physical Assets | Office only; no machinery | Land ownership deeds; heavy equipment visible | Demand property deed (不动产权证书) + utility bills |

| Workforce | Sales staff only; no engineers | In-house R&D team; production supervisors | Request org chart with employee IDs; verify via social insurance records |

| Pricing Structure | Quotes FOB only; vague cost breakdown | Provides EXW + itemized BOM costs | Require granular cost analysis per component |

| Lead Time Control | 30-45 days (dependent on 3rd parties) | Direct control (e.g., 15-25 days for motors) | Test responsiveness to engineering change orders |

Critical Note: 42% of suppliers claiming “factory-direct” status are trading companies (SourcifyChina 2026 Supplier Audit). Never accept self-declared status – demand physical evidence.

Red Flags to Avoid in EV Component Sourcing

| Severity | Red Flag | Risk Impact | Mitigation Strategy |

|---|---|---|---|

| Critical (Terminate Engagement) | ❌ Refuses unannounced site visit | High fraud risk (89% correlate with scams) | Require clause for random audits in contract |

| ❌ Payment to personal bank account | Fund diversion likely | Insist on corporate account + SWIFT confirmation | |

| High Risk (Requires Resolution) | ⚠️ Inconsistent export records (via China Customs) | Hidden intermediaries | Demand full shipment history via CIQ code |

| ⚠️ No in-house QC lab (relies on 3rd party) | Quality inconsistency | Mandate on-site QC staff + SPC data access | |

| Moderate Risk (Monitor Closely) | ⚠️ Vague answers about raw material sourcing | Supply chain vulnerability | Require SMR (Supplier Material Report) |

| ⚠️ Only English-speaking staff (no engineers) | Communication gaps in technical issues | Require bilingual engineering lead |

2026 Trend Alert: “Greenwashing factories” – Suppliers falsely claiming carbon-neutral production. Verify via MEE (Ministry of Ecology and Environment) emission permits and real-time energy monitoring access.

Recommended Action Plan for Procurement Managers

- Reframe Your Need: Define specific EV components (e.g., “50kWh LFP battery packs,” “800V SiC inverters”).

- Demand Verification Evidence: Require suppliers to provide:

- Business license with manufacturing scope

- Property deed + utility bills for facility

- Machine ownership certificates (发票)

- Leverage SourcifyChina’s Verification Protocol: Our 72-point audit covers:

- Physical asset validation

- Export compliance (HS code alignment)

- Forced labor screening (Xinjiang Supply Chain Act)

- IP protection safeguards

“In 2026, 31% of EV component failures traced to unverified suppliers. Rigorous factory validation reduces supply chain disruption by 74%.”

– SourcifyChina Global EV Sourcing Index, 2026

Prepared by:

Alex Chen, Senior Sourcing Consultant

SourcifyChina Consulting Group

✉️ [email protected] | 🌐 www.sourcifychina.com/ev-verification

This report reflects SourcifyChina’s proprietary verification methodologies. Data sources: Chinese MOFCOM, General Administration of Customs, and 2026 SourcifyChina Supplier Audit Database (n=1,247). Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing in China’s EV Ecosystem – The Power of Verified Intelligence

Executive Summary

China remains the world’s largest electric vehicle (EV) market, with over 300+ EV car companies currently active—ranging from state-backed giants like BYD and NIO to agile startups and Tier 1 suppliers. Navigating this complex landscape demands precision, efficiency, and access to verified, up-to-date supplier intelligence.

For global procurement teams, the challenge isn’t just how many EV companies exist in China—it’s identifying which ones are credible, scalable, and compliant with international standards. Manual research is time-consuming, often outdated, and carries significant risk.

Why SourcifyChina’s Verified Pro List™ Delivers Unmatched Value

SourcifyChina’s Verified Pro List: China’s EV Car Companies 2026 is the only intelligence tool vetted by our on-the-ground sourcing experts. It eliminates guesswork and accelerates sourcing cycles with:

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | Every company is validated for business license, export capability, production capacity, and compliance. |

| Up-to-Date Market Intelligence | Real-time updates on mergers, closures, and new entrants across China’s dynamic EV sector. |

| Time Saved | Reduces supplier research time by up to 70%—from weeks to hours. |

| Risk Mitigation | Minimizes exposure to fraudulent or non-compliant suppliers. |

| Direct Contact Channels | Immediate access to verified points of contact for engineering, sales, and procurement teams. |

Case Insight: From Inquiry to RFQ in 48 Hours

A European Tier 1 automotive supplier reduced its supplier shortlisting phase from 18 days to 2 days using the Verified Pro List. They secured three qualified EV OEM partners for battery enclosure components—all compliant with ISO/TS 16949 standards.

Call to Action: Accelerate Your EV Sourcing Strategy Today

Don’t navigate China’s EV market blindfolded. Leverage SourcifyChina’s exclusive Verified Pro List to:

✅ Cut research costs

✅ De-risk supplier onboarding

✅ Accelerate time-to-market for EV components and systems

Contact us now to request your free sample list and sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 (GMT+8) to support your global procurement goals.

SourcifyChina – Your Trusted Gateway to China’s Manufacturing Ecosystem

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.