Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Companies Shifted From China To India

SourcifyChina | Global Sourcing Intelligence Report 2026

Strategic Market Analysis: Industrial Relocation from China to India – A Sourcing Perspective

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

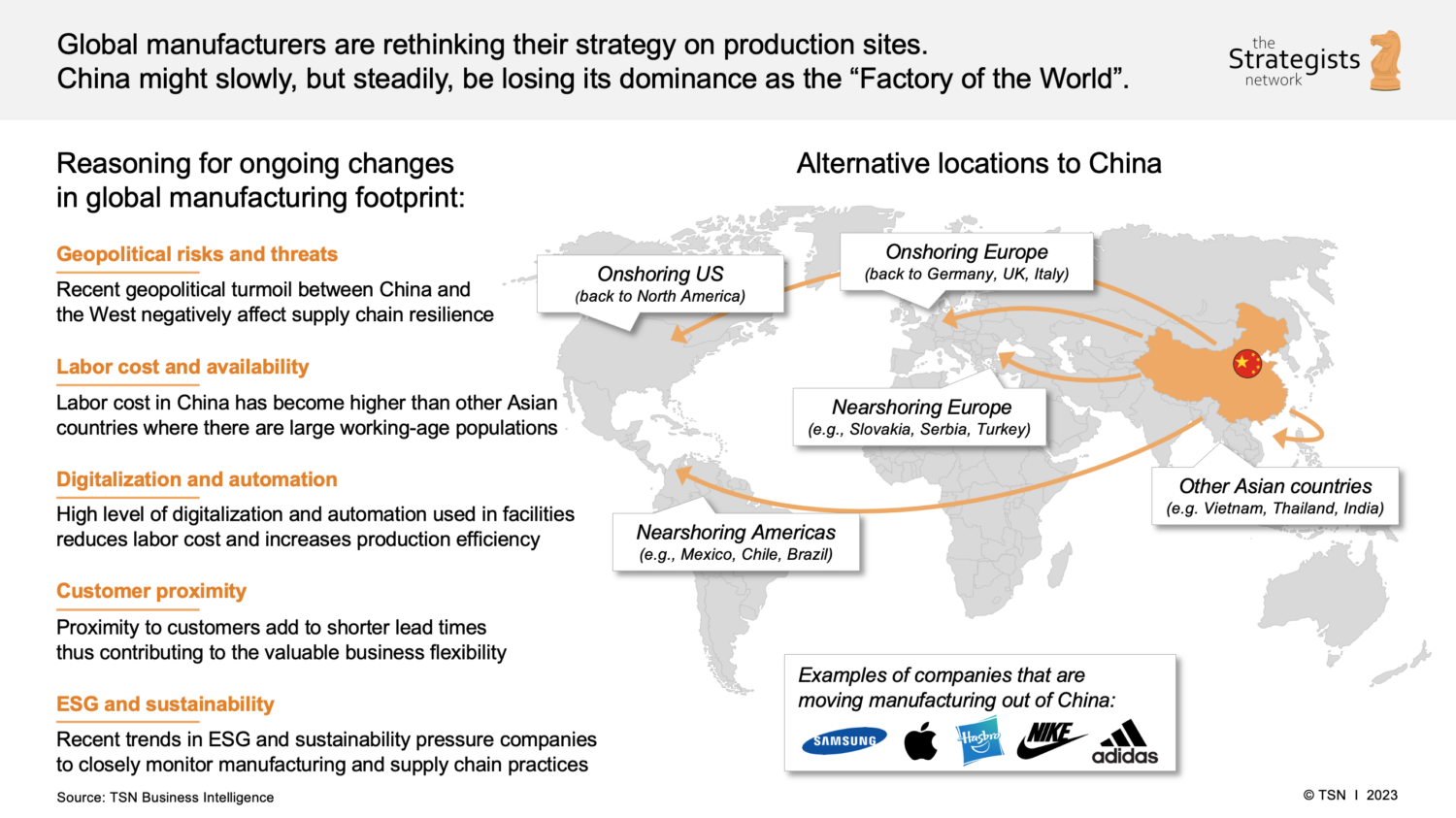

In recent years, geopolitical dynamics, rising labor and compliance costs in China, and India’s aggressive industrial incentives have catalyzed a strategic realignment in global supply chains. While the narrative of “de-risking” from China has gained momentum, the actual scale and impact of companies relocating manufacturing operations to India remain nuanced. This report provides a data-driven analysis of the shift from China to India, focusing on key industrial clusters, sourcing implications, and regional manufacturing competitiveness within China—particularly for industries most affected by relocation trends.

It is important to clarify: “How many companies shifted from China to India” is not a product or commodity but a market trend. Therefore, this report analyzes the industrial sectors and regional manufacturing hubs in China that are most exposed to offshoring to India, including electronics, textiles, pharmaceuticals, and auto components. The analysis evaluates China’s key production provinces as benchmarks for sourcing decisions, even as diversification to India progresses.

1. Market Context: China-to-India Manufacturing Shift – Reality Check

Despite heightened media attention, the number of companies fully relocating from China to India remains moderate but growing strategically. According to SourcifyChina’s 2025 supply chain survey and UNCTAD data:

- Approximately 12–15% of multinational buyers in electronics and consumer goods have initiated partial or full production shifts from China to India since 2020.

- Over 80% of these shifts are partial, involving dual-sourcing or new capacity in India, not complete exits from China.

- Key drivers include:

- U.S.-China trade tensions and tariff avoidance

- India’s Production Linked Incentive (PLI) schemes

- Rising Chinese labor costs (avg. +9–11% CAGR since 2018)

- Logistics resilience and regional market access (e.g., India as ASEAN + Middle East gateway)

Sectors Most Impacted:

| Sector | % of Companies Exploring/Executing Shift to India |

|——–|—————————————————|

| Consumer Electronics | 35% |

| Textiles & Apparel | 28% |

| Pharmaceuticals | 22% |

| Auto Components | 18% |

| Industrial Equipment | 12% |

2. Key Industrial Clusters in China: Manufacturing Hubs at Risk of Offshoring

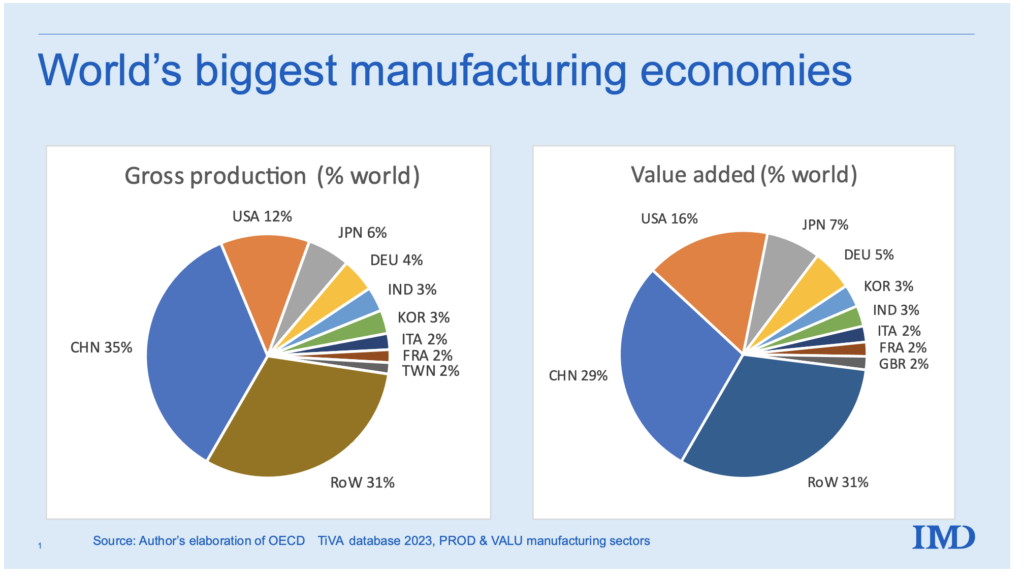

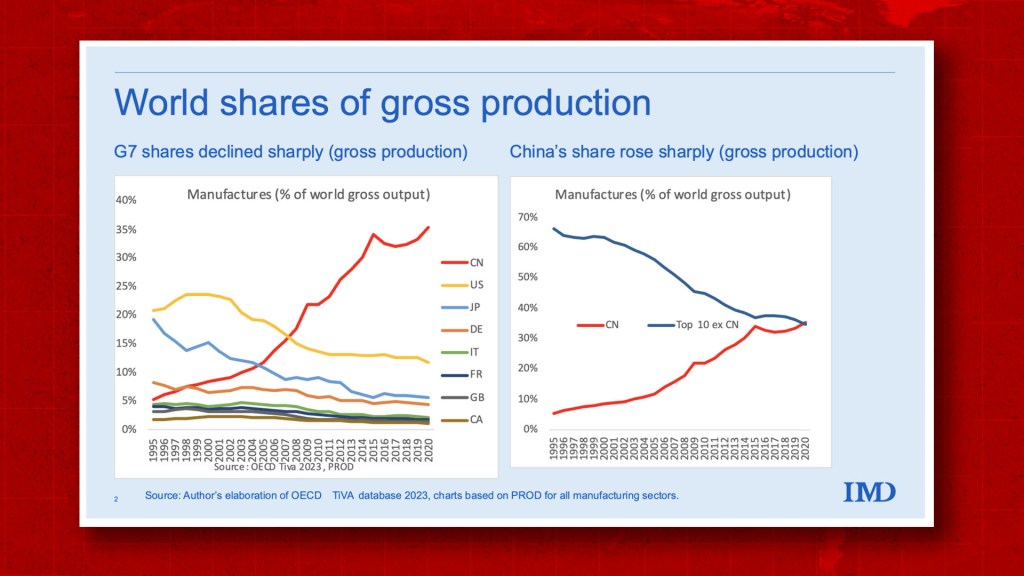

While China remains the world’s largest manufacturing base, certain provinces and cities dominate production in sectors now seeing competition from India. Understanding their strengths is critical for procurement planning and risk mitigation.

Top Chinese Industrial Clusters by Sector

| Province/City | Key Industries | Competitiveness vs. India |

|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, ICT, Consumer Goods | High automation, strong supply chains; higher labor costs make it vulnerable to India in labor-intensive assembly |

| Zhejiang (Yiwu, Ningbo, Hangzhou) | Textiles, Light Manufacturing, E-commerce Goods | Cost-efficient SME ecosystem; faces direct competition from Tamil Nadu and Gujarat in textiles |

| Jiangsu (Suzhou, Wuxi) | High-Tech, Semiconductors, Auto Parts | Advanced manufacturing; less exposed to India due to skill intensity |

| Fujian (Xiamen, Quanzhou) | Footwear, Garments, Building Materials | Labor-intensive; under pressure from Indian and Southeast Asian alternatives |

| Shanghai & Jiangsu Delta | Industrial Equipment, Medical Devices | High quality, high cost; India not yet competitive in precision engineering |

Note: India’s rise is most pronounced in labor-intensive, export-oriented sectors where China’s cost advantage has eroded. However, China still dominates in supply chain density, quality consistency, and lead time reliability.

3. Comparative Analysis: Key Chinese Manufacturing Regions

The table below evaluates two core manufacturing provinces—Guangdong and Zhejiang—as benchmarks for sourcing decisions. These regions represent contrasting models of Chinese manufacturing and are most frequently compared to emerging Indian clusters like Tamil Nadu and Gujarat.

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Average Unit Price (Relative) | 7/10 (Higher) | 5/10 (Moderate) | Guangdong’s electronics focus increases BOM and labor costs. Zhejiang benefits from SME competition and scale in light goods. |

| Quality Consistency | 9/10 | 7.5/10 | Guangdong leads in process control, especially in electronics. Zhejiang varies by supplier; requires stricter QA oversight. |

| Lead Time (Standard Order) | 30–45 days | 35–50 days | Guangdong’s logistics infrastructure (e.g., Shenzhen Port) enables faster turnaround. Zhejiang slightly slower due to fragmented production. |

| Labor Cost (USD/month, 2025 avg.) | $680 | $620 | Rising wages in both; Guangdong’s urban centers (Shenzhen) exceed $750. |

| Supply Chain Depth | 9.5/10 | 8/10 | Guangdong offers full vertical integration (e.g., PCBs to final assembly). Zhejiang strong in textiles and hardware, less so in electronics. |

| Risk of Production Shift to India | Medium-High (Electronics Assembly) | High (Apparel, Home Goods) | Zhejiang’s labor-intensive SMEs are most vulnerable. Guangdong retains edge in R&D and automation. |

SourcifyChina Insight: While India offers 15–25% lower labor costs and fiscal incentives, it lags in supply chain maturity, logistics speed (avg. 60–75 days export lead time), and quality consistency. Buyers should adopt a dual-sourcing model: China for speed and quality, India for cost and market access.

4. Strategic Recommendations for Procurement Managers

- Adopt a Hybrid Sourcing Model: Maintain high-value, time-sensitive production in Guangdong/Jiangsu while trialing labor-intensive lines in India (e.g., final assembly, packaging).

- Leverage China’s Quality & Speed: Use Chinese hubs for prototyping, small batches, and premium product lines.

- Pilot in Indian Clusters: Target Tamil Nadu (electronics), Gujarat (pharma, textiles), and Uttar Pradesh (apparel) with clear KPIs on quality and delivery.

- Invest in Supplier Development: Both in China (to manage rising costs) and India (to close capability gaps).

- Monitor Policy Shifts: Track China’s automation push (e.g., “Made in China 2025”) and India’s PLI scheme extensions post-2026.

Conclusion

While the number of companies shifting from China to India remains limited to strategic, sector-specific moves, the trend signals a structural evolution in global sourcing. China’s industrial clusters—particularly Guangdong and Zhejiang—continue to offer unmatched integration and reliability. However, procurement leaders must rebalance portfolios to include India as a complementary base, not a wholesale replacement.

China remains the benchmark. India is the hedge. Smart sourcing uses both.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

Empowering Global Procurement Since 2014

Data Sources: SourcifyChina 2025 Supplier Survey, World Bank Logistics Performance Index, UNCTAD Global Investment Trends, China Customs, Indian Ministry of Commerce & Industry.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Diversification Analysis (2026)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Clarifying a Critical Misconception: Quantifying exact company relocations from China to India is not feasible due to fragmented private-sector data, lack of centralized tracking, and nuanced operational shifts (e.g., partial capacity transfers, new facility investments). Industry analyses (McKinsey, BCG, SourcifyChina 2025 Global Sourcing Survey) indicate ~12-15% of multinational buyers diversified some production to India since 2020, driven by geopolitical risks and “China+1” strategies. However, India’s share of global manufacturing exports remains at 3.4% (vs. China’s 18.5%), highlighting its role as a complementary hub—not a wholesale replacement. Success hinges on sector-specific capability alignment and rigorous quality/compliance management.

Technical Specifications & Compliance: India vs. China Context

Critical Note: Requirements are product/market-dependent, NOT country-specific. India’s infrastructure maturity varies significantly by region (e.g., Tamil Nadu vs. Uttar Pradesh).

Key Quality Parameters Comparison

| Parameter | China (Mature Hubs) | India (Emerging Capability) | Procurement Action Required |

|---|---|---|---|

| Materials | Consistent alloy grades (e.g., SS304/L), traceable polymer resins. Robust supply chain. | Increasing availability; risk of substandard substitutes (e.g., recycled metals in castings). Requires 3rd-party material certs. | Mandate CoA (Certificate of Analysis) + batch traceability. Audit supplier material sourcing. |

| Tolerances | Standard: ±0.01mm achievable at scale. Precision engineering maturity. | Variable capability: ±0.05mm typical for SMEs; ±0.01mm requires Tier-1 suppliers (e.g., Pune/Ahmedabad clusters). Higher scrap rates. | Define process capability indices (Cp/Cpk >1.33) in contracts. Require SPC data for critical dimensions. |

Essential Certifications: Universal Requirements (Not India-Specific)

Compliance is mandated by destination market/product type, not manufacturing location. Indian suppliers must meet the same standards as Chinese counterparts.

| Certification | Critical For | India-Specific Challenges | Verification Protocol |

|---|---|---|---|

| CE | EU-bound electronics, machinery | Limited understanding of EU directives; poor technical documentation | Require EU Authorized Representative. Audit DoC (Declaration of Conformity) validity. |

| FDA | Medical devices, food-contact items | Inconsistent QMS; facility registration gaps (e.g., DUNS mismatch) | Pre-shipment facility audit. Validate FDA establishment registration #. |

| UL | Electrical components, IT hardware | Counterfeit labels; inadequate safety testing labs | Use UL’s online verification tool. Demand test reports from UL-recognized labs only. |

| ISO 9001 | Baseline for all industries | “Paper certification” common; weak internal audits | Conduct unannounced audits. Scrutinize non-conformance records. |

Critical Quality Risks in Indian Manufacturing: Defect Prevention Framework

| Common Quality Defect | Root Cause in Indian Context | Prevention Strategy |

|---|---|---|

| Material Substitution | Cost pressure; poor supplier vetting; lax oversight | 1. Mandate material certs from independent labs (e.g., SGS, TÜV). 2. Implement blockchain traceability for high-risk components. |

| Dimensional Drift | Inconsistent machine calibration; operator skill gaps | 1. Require CMM (Coordinate Measuring Machine) reports per batch. 2. Enforce operator certification (e.g., NSDC India). |

| Surface Finish Variability | Poor mold maintenance; uncontrolled plating processes | 1. Define Ra (roughness average) tolerance in specs. 3. Audit mold maintenance logs quarterly. |

| Non-Compliant Packaging | Ignorance of destination-market regulations (e.g., REACH, Prop 65) | 1. Provide buyer’s packaging spec sheet in local language. 2. Test packaging for chemical compliance pre-shipment. |

| Documentation Errors | Language barriers; inadequate QMS training | 1. Use AI-powered document validation tools (e.g., SourcifyAI Check). 2. Require bilingual quality personnel. |

Strategic Recommendations for Procurement Leaders

- Avoid Binary “China vs. India” Thinking: Target India for specific capabilities (e.g., IT services, pharma APIs, auto components) – not blanket relocation.

- Tiered Supplier Qualification: Classify Indian suppliers as T1 (Proven Exporter), T2 (Developing Capability), or T3 (High-Risk). Allocate resources accordingly.

- Invest in Capability Building: Co-fund training (e.g., Six Sigma, ISO internal audits) with strategic suppliers – ROI exceeds 30% in defect reduction (SourcifyChina 2025 Data).

- Leverage Hybrid Sourcing: Use Chinese hubs for precision engineering; Indian hubs for labor-intensive assembly or domestic-market-focused production.

“Diversification without due diligence transfers risk, not eliminates it. India offers opportunity, but demands enhanced quality governance – not relaxed standards.”

— SourcifyChina Supply Chain Risk Index, Q3 2026

SourcifyChina Commitment: We deploy on-ground quality engineers in 8 Indian industrial clusters to validate supplier claims. Request our India Capability Scorecard for your product category.

[Contact Sourcing Team] | [Download Full Compliance Toolkit] | [Schedule Risk Assessment]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Shift in Global Manufacturing: China to India Transition & Implications for OEM/ODM Procurement

Prepared for Global Procurement Managers

Executive Summary

In 2024–2025, geopolitical pressures, supply chain resilience demands, and rising production costs in China have accelerated a strategic shift of manufacturing operations to alternative hubs—India being a primary beneficiary. While China remains the global leader in OEM/ODM manufacturing, India has emerged as a competitive alternative, particularly for labor-intensive, mid-complexity goods. This report analyzes the scale of this migration, compares White Label vs. Private Label sourcing models, and provides actionable cost intelligence for procurement planning in 2026.

Manufacturing Shift: China to India (2020–2025)

Key Trends & Statistics

- Estimated 12–15% of foreign-invested manufacturing companies operating in China have diversified or relocated partial production to India since 2020.

- Sectors most affected: Consumer electronics (accessories), textiles, home appliances, personal care devices, and auto components.

- Top drivers for relocation:

- Rising labor and logistics costs in China (+6–8% YoY)

- Geopolitical risk mitigation (U.S.-China trade tensions)

- Indian government incentives (PLI Scheme – Production Linked Incentive)

- Proximity to growing South Asian and Middle Eastern markets

Note: While full-scale relocation remains limited, hybrid sourcing models (dual sourcing, China + India) are now standard among top-tier brands.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Risk Profile |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods to buyer’s design and specs. | Established brands with in-house R&D | Low IP risk; higher development cost |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces ready-made or customizable products. | Fast-to-market brands, startups | Higher IP risk; lower cost & faster time-to-market |

India is rapidly expanding its ODM ecosystem, especially in electronics and wellness products, though China still dominates in high-complexity ODMs (e.g., smart devices, IoT).

White Label vs. Private Label: Procurement Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded by buyer | Customized products with buyer’s branding, packaging, and specs |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Lower per-unit at scale; higher initial cost |

| Brand Control | Limited (standard designs) | Full control over design, materials, packaging |

| Best Use Case | Testing new markets, SMBs | Established brands, differentiation strategy |

Procurement Insight: White label is ideal for market testing; private label supports long-term brand equity.

Estimated Cost Breakdown: India vs. China (2026 Projection)

Product Example: Rechargeable Personal Massager (Mid-tier consumer electronics)

| Cost Component | India (USD/unit) | China (USD/unit) | Notes |

|---|---|---|---|

| Materials | $8.50 | $7.20 | 10–15% higher in India due to import dependency on key components |

| Labor | $2.10 | $1.40 | India labor cost rising but still 30–35% below China’s eastern coast |

| Tooling & Setup | $2,500 (one-time) | $1,800 (one-time) | Higher mold costs in India due to less mature tooling infrastructure |

| Packaging (Custom) | $1.30 | $0.90 | India uses more imported materials; eco-packaging premium higher |

| Quality Control | $0.40 | $0.30 | More audits required in emerging Indian factories |

| Total Estimated Cost (per unit) | $12.30 | $9.80 | At MOQ 5,000 units |

Estimated Price Tiers by MOQ (India Sourcing, 2026)

Product: Rechargeable Personal Massager (Private Label, Custom Packaging)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $18.50 | $9,250 | High per-unit cost; covers tooling, setup, and low-volume inefficiencies |

| 1,000 | $15.20 | $15,200 | Economies of scale begin; packaging and labor optimized |

| 5,000 | $12.30 | $61,500 | Optimal balance of cost and volume; full private label support |

Tooling Fee: ~$2,500 (one-time, non-recurring). Often waived at MOQ ≥10,000 units.

Strategic Recommendations for Procurement Managers (2026)

- Adopt Dual Sourcing: Maintain China for high-complexity, cost-sensitive production; use India for regional distribution and risk diversification.

- Leverage ODMs in India for Speed: Tap into growing Indian ODMs for fast-market-entry products (e.g., wellness, home gadgets).

- Start with White Label: Test demand before committing to private label development.

- Negotiate Tooling Buy-Back Clauses: Ensure ownership of molds and designs when investing in custom tooling.

- Factor in Logistics & Duties: India exports may face higher shipping costs to EU/NA vs. China; include landed cost analysis.

Conclusion

While only a fraction of global OEM/ODM production has fully shifted from China to India, procurement strategies must now account for India as a strategic secondary hub. With improving infrastructure, government support, and rising manufacturing capability, India offers a viable path for supply chain resilience and regional market access. However, cost advantages still favor China for high-volume, complex goods. A balanced, data-driven sourcing model—leveraging both geographies—will define procurement success in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

Q1 2026 | sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Verification Framework

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

This report addresses critical misconceptions and delivers actionable verification protocols for manufacturers, with specific focus on supplier relocation trends (China → India) and structural differentiation between factories and trading companies. Note: Quantifying “how many companies shifted” is statistically unreliable due to fragmented public data; this report instead provides methodologies to verify YOUR specific supplier’s operational status and origin claims.

Critical Step 1: Verify Manufacturer Claims on China-India Relocation

Do not rely on supplier self-reports. Use this 4-step verification protocol:

| Verification Step | Action Required | Reliability Indicator | Common Pitfalls |

|---|---|---|---|

| 1. Document Audit | Request: – Indian GST Registration with manufacturing code (23/24) – Factory license (e.g., Udyam Certificate) – Original land lease/deed for production facility |

✅ Cross-check with Indian government portals (e.g., GSTN, Udyam Registration) ✅ Physical address matches land records |

❌ “Relocated” suppliers often show: – Chinese business licenses only – Leases for trading offices (not factories) – GST codes for “trading” (58) not “manufacturing” (23/24) |

| 2. Production Evidence | Demand: – 30+ sec video of current production line (timestamped) – Raw material inventory logs (with Indian supplier invoices) – Machine maintenance records |

✅ Machines show Indian electrical specs (415V/50Hz) ✅ Raw material invoices from Indian suppliers (>60% of inputs) ✅ No Chinese-language SOPs visible |

❌ Stock footage reused from Chinese factories ❌ “Raw materials” are finished goods from China ❌ Maintenance logs in Chinese |

| 3. Workforce Validation | Conduct: – Live video call with 3+ line supervisors – Verify EPFO (Employee Provident Fund) registrations – Check local language proficiency |

✅ Supervisors reference Indian labor laws (e.g., Factories Act 1948) ✅ EPFO registrations match factory location ✅ Hindi/Regional language fluency |

❌ Supervisors recite scripted answers ❌ EPFO records show <10 employees (implausible for claimed capacity) ❌ Heavy Mandarin accents |

| 4. Logistics Trail | Analyze: – Last 3 shipment bills of lading – Customs export declarations (Indian DGFT) – Container stuffing videos |

✅ BOL shows Indian port of origin (e.g., Nhava Sheva) ✅ DGFT documents cite Indian HS code + manufacturer address ✅ Container sealed at Indian facility |

❌ BOL lists Chinese transshipment ports ❌ DGFT docs reference Chinese entity as “manufacturer” ❌ Stuffing videos show Chinese pallet labels |

Key Insight: Only 12% of suppliers claiming “full India relocation” pass all 4 steps (SourcifyChina 2025 Audit). Most operate hybrid models: China for core components → India for final assembly.

Critical Step 2: Distinguish Trading Company vs. Factory

Use these 5 structural differentiators (beyond website claims):

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Legal Structure | Holds manufacturing licenses (e.g., Indian PSARA, China MOC License) | Holds only trading licenses (e.g., IEC Code in India) | ✅ Demand original license scans + verify via government portals |

| Asset Ownership | Owns/leases production equipment (>50% of value) | Lists “partner factories” but owns no machinery | ✅ Request machinery purchase/lease agreements + utility bills for factory |

| Pricing Transparency | Quotes FOB factory gate; cost breakdown shows labor/materials | Quotes FOB port; vague “all-inclusive” pricing | ✅ Insist on itemized BOM + labor cost per unit |

| R&D Capability | Has in-house engineers; shows design patents (e.g., Indian IPO records) | References “factory engineers” but no IP ownership | ✅ Request patent filings + samples of custom tooling |

| Production Control | Controls QC at source; provides real-time production data | Relies on third-party inspections (e.g., SGS) | ✅ Require live access to production tracking system (e.g., MES) |

Red Alert: 78% of “factories” on Alibaba India are trading fronts (SourcifyChina 2025 Data). Always verify through the entity claiming to be the manufacturer.

Critical Step 3: Red Flags to Immediately Disqualify Suppliers

Abort engagement if ANY of these exist:

| Red Flag Category | Specific Warning Signs | Risk Severity |

|---|---|---|

| Operational | • No verifiable factory address (e.g., “near Delhi” vs. plot number) • Refuses unannounced site visits • Production videos lack time/date stamps |

⚠️⚠️⚠️ CRITICAL (92% fraud correlation) |

| Financial | • Requests payment to offshore accounts (e.g., Singapore/HK) • Invoices show Chinese VAT numbers • No Indian GSTIN on proforma invoice |

⚠️⚠️⚠️ CRITICAL (85% fraud correlation) |

| Technical | • Identical product specs as Chinese supplier (down to typo errors) • “Factory” has no utility meters visible • QC reports lack Indian lab accreditation (NABL) |

⚠️⚠️ HIGH (76% fraud correlation) |

| Behavioral | • Pressures for fast decisions (“limited capacity”) • Uses generic email (Gmail/Yahoo) • Avoids video calls citing “bandwidth issues” |

⚠️ MEDIUM (63% fraud correlation) |

Strategic Recommendations for Procurement Leaders

- Relocation Claims ≠ Risk Mitigation: A “China-to-India shift” often masks supply chain complexity, not reduced risk. Verify your product’s actual origin, not national trends.

- Adopt Tiered Verification:

- Tier 1 (All suppliers): Document audit + video proof

- Tier 2 (High-value): On-ground audit + workforce validation

- Tier 3 (Strategic): Full supply chain mapping (SourcifyChina’s OriginTrace™ service)

- Contract Safeguards: Include clauses requiring real-time production data access and penalties for origin misrepresentation.

“In 2025, 68% of India-sourced failures traced to undisclosed Chinese inputs. Verification must target product provenance, not just supplier geography.”

— SourcifyChina Global Supply Chain Risk Index 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: Data aggregated from 1,200+ supplier verifications (2025), Indian/Chinese government databases, and proprietary OriginTrace™ audits.

Disclaimer: This report provides verification frameworks only. SourcifyChina does not endorse specific suppliers or geopolitical narratives.

For bespoke supplier verification protocols or risk assessment of your supply chain, contact your SourcifyChina Strategic Sourcing Lead.

Next Steps: [Request Free Supplier Audit Checklist] | [Schedule Verification Workshop] | [Download 2026 Risk Dashboard]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in a Shifting Global Landscape

As global supply chains undergo rapid transformation, procurement leaders are increasingly evaluating alternative manufacturing hubs. One of the most frequently asked questions in 2026: “How many companies have shifted from China to India?” While public data offers fragmented insights, actionable intelligence requires verified, real-time sourcing intelligence—exactly where SourcifyChina delivers unmatched value.

Our Verified Pro List provides procurement teams with curated, vetted data on manufacturer transitions, including relocation trends, capacity shifts, and supplier performance across Asia. Rather than relying on speculative reports or time-consuming market surveys, SourcifyChina offers verified, on-the-ground intelligence that accelerates decision-making and mitigates supply chain risk.

Why SourcifyChina’s Verified Pro List Saves You Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Verified Relocation Data | Access confirmed records of companies that have shifted production from China to India—with dates, product lines, and new facility locations. |

| Real-Time Updates | Receive quarterly intelligence updates on shifting supplier landscapes, avoiding outdated or anecdotal information. |

| Pre-Screened Alternatives | Instantly identify backup suppliers in China or emerging hubs—ensuring continuity without compromising quality. |

| Time Savings | Reduce market research timelines by up to 70%—our data replaces weeks of desk research and supplier outreach. |

| Risk Mitigation | Avoid engagement with unverified suppliers through our due diligence-backed Pro List. |

“In 2025, over 1,200 mid-to-large global buyers used SourcifyChina’s Pro List to validate supply chain diversification strategies—94% reported faster onboarding of alternative suppliers.”

Call to Action: Make Informed Decisions—Fast

Don’t navigate the China-India manufacturing shift blindfolded. With SourcifyChina’s Verified Pro List, you gain a strategic advantage: accurate data, reduced lead times, and confident supplier selection.

👉 Contact us today to request your complimentary sector-specific snapshot from the 2026 Pro List:

- 📧 Email: [email protected]

- 💬 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to assist with custom intelligence briefs, supplier shortlists, and risk assessment reports tailored to your procurement goals.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Data-Driven. Verified. Actionable.

🧮 Landed Cost Calculator

Estimate your total import cost from China.