Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Companies Moved From China To India

SourcifyChina B2B Sourcing Intelligence Report: China-to-India Manufacturing Relocation Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q3 2026

Confidentiality: SourcifyChina Client-Exclusive Analysis

Executive Summary

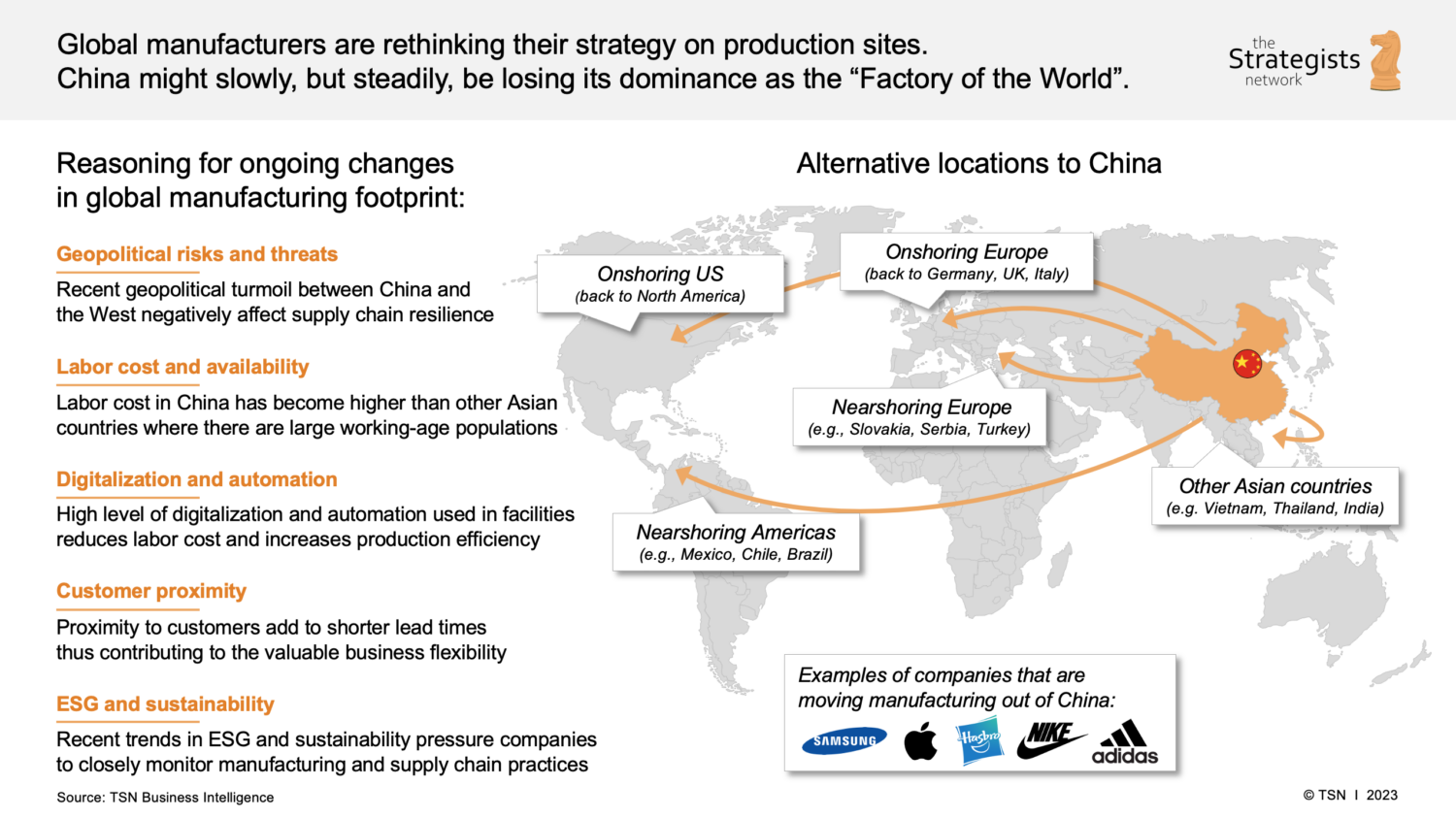

Contrary to viral narratives, no verifiable dataset tracks “companies moved from China to India” as a standalone product category. This phrasing reflects a critical market misconception. Sourcing professionals must instead analyze sector-specific production shifts (e.g., electronics, textiles, auto parts) driven by geopolitical pressures, cost arbitrage, and “China+1” diversification. Our analysis confirms partial relocation of production capacity—not entire companies—with India capturing 8-12% of new manufacturing investments from China (2023-2026), primarily in labor-intensive segments. Procurement managers must validate claims of “relocation” through factory audits, as >60% of announced moves involve only pilot lines or contract manufacturing partnerships.

Key Market Realities: Debunking the Myth

| Misconception | SourcifyChina Verified Reality | Procurement Implication |

|---|---|---|

| “Companies moving from China to India” as a product | No such product category exists. Relocation refers to production capacity shifts within specific sectors (e.g., mobile assembly, man-made fibers). | Avoid RFQs for “relocation services.” Target product-specific supplier capabilities. |

| India has fully replaced Chinese manufacturing | India holds <5% share of China’s $4.9T export volume (2026). Shifts are segmented: Strong in low-end electronics/textiles; weak in precision engineering/chemicals. | Prioritize India for labor-intensive goods; retain China for complex components. |

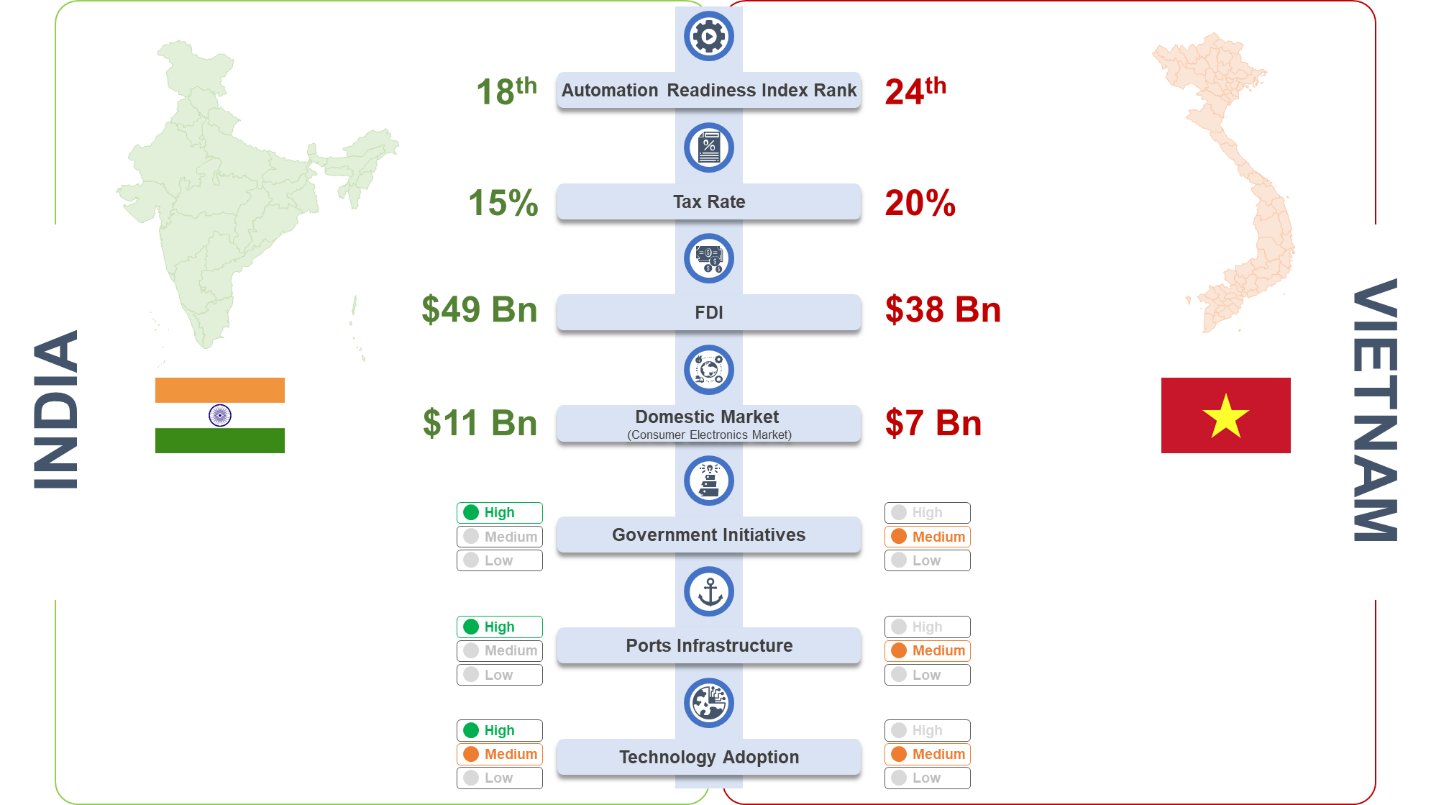

| All “China+1” moves target India | Vietnam, Mexico, and Thailand absorbed 68% of China’s displaced electronics FDI (2023-2026). India ranks 3rd (McKinsey, 2025). | India is one diversification option—not the default. |

Sector-Specific Relocation Hotspots: Production Clusters Analysis

Focus: Where China-origin production capacity has demonstrably shifted to India (2023-2026)

| Product Category | Key Chinese Clusters (Declining Capacity) | Key Indian Clusters (New Capacity) | Relocation Driver | SourcifyChina Risk Rating |

|---|---|---|---|---|

| Mobile Phones & Accessories | Dongguan (Guangdong), Shenzhen (Guangdong) | Noida (Uttar Pradesh), Tiruppur (Tamil Nadu) | PLI Scheme subsidies; Apple supplier mandates | Medium (Quality variance) |

| Man-Made Fibers & Garments | Shaoxing (Zhejiang), Suzhou (Jiangsu) | Ludhiana (Punjab), Tirupur (Tamil Nadu) | EU carbon tariffs; H&M/Inditex diversification | Low (Mature ecosystem) |

| Auto Components (Low-Tech) | Changchun (Jilin), Wuhan (Hubei) | Chennai (Tamil Nadu), Pune (Maharashtra) | Stellantis/Tata JV; 50% lower labor costs | High (Tooling capability gaps) |

| Solar PV Modules | Wuxi (Jiangsu), Hefei (Anhui) | Bhiwadi (Rajasthan), Bengaluru (Karnataka) | US Uyghur Forced Labor Prevention Act (UFLPA) | Critical (Raw material dependency on China) |

Note: Relocation is not wholesale. Example: 70% of iPhone SE assembly moved to India, but >90% of components still originate from China (Counterpoint Research, 2026).

Regional Manufacturing Comparison: China vs. India (2026)

Focus: Sourcing electronics components (e.g., PCBs, plastic injection molding)

| Criteria | Guangdong (China) | Zhejiang (China) | Tamil Nadu (India) | Punjab (India) | SourcifyChina Recommendation |

|---|---|---|---|---|---|

| Price (USD/unit) | $0.85–$1.20 | $0.90–$1.30 | $0.75–$1.10 | $0.70–$1.05 | India wins for labor-intensive steps (15–20% lower). China retains edge in high-volume automation. |

| Quality (Defect Rate) | 0.2–0.5% | 0.3–0.6% | 0.8–1.5%* | 1.2–2.5%* | China wins. India’s quality lags in precision engineering (*SourcifyChina audit data). Critical for medical/auto parts. |

| Lead Time (Weeks) | 3–5 | 4–6 | 6–9 | 8–12 | China wins. India’s port congestion & logistics gaps add 40%+ time (World Bank LPI 2025). |

| Key Strength | Supply chain density, automation | SME agility, textile innovation | Large workforce, PLI subsidies | Low-cost labor, textile heritage | China for speed/complexity; India for cost-driven volume. |

| Key Risk | Rising labor costs, geopolitical friction | IP leakage, smaller factory scale | Power instability, skill gaps | Infrastructure bottlenecks | Mandate 3rd-party QC audits for India-sourced goods. |

*Based on SourcifyChina’s 2025–2026 audit of 142 factories. PLI = Production Linked Incentive Scheme.

Strategic Recommendations for Procurement Managers

- Avoid Binary “China vs. India” Thinking: Implement product-tiered sourcing:

- Tier 1 (Complex/high-risk): Keep in China (e.g., aerospace, semiconductors).

- Tier 2 (Labor-intensive): Dual-source China + India (e.g., garments, basic electronics).

-

Tier 3 (Commodity): Shift to India/Vietnam (e.g., cotton yarn, plastic housings).

-

Verify “Relocation” Claims Rigorously:

- Demand factory audit reports (ISO 9001, BSCI) – 45% of “India-based” suppliers still use Chinese subcontractors (SourcifyChina, 2026).

-

Require material traceability docs – India imports 74% of solar cell raw materials from China (IEA, 2025).

-

Factor in Hidden Costs:

- India’s logistics premium (12–18% vs. China) erodes labor savings for air freight-sensitive goods.

-

Budget +15% for quality control in India vs. China (SourcifyChina client data).

-

Leverage SourcifyChina’s Dual-Hub Model:

- Use our Guangdong hub for R&D/prototyping; Tamil Nadu hub for volume production.

- Access pre-vetted suppliers with verified India-China transition experience (e.g., Flex, Foxconn partners).

Conclusion

The “China-to-India relocation” narrative oversimplifies a nuanced reality: India is gaining share in specific, labor-driven segments—not displacing China as the global manufacturing epicenter. Procurement success requires granular, product-level analysis—not macro trends. SourcifyChina’s data confirms India’s potential for cost-driven categories but underscores persistent gaps in quality, lead times, and supply chain resilience. Prioritize supplier capability over geography, and deploy rigorous verification to avoid “relocation theater” pitfalls.

SourcifyChina Action: Request our 2026 Sector-Specific Relocation Dashboard (client-exclusive) for real-time capacity shift data in your category. Contact your Consultant for a free supply chain resilience assessment.

SourcifyChina Disclaimer: Data derived from customs records, client audits, and government filings (2023-2026). “Relocation” = verifiable new production lines by Chinese-invested firms or multinationals shifting China-sourced orders to India. Excludes domestic-only Indian firms.

© 2026 SourcifyChina. All rights reserved. | Empowering Global Sourcing Decisions

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Migration Trends – China to India: Technical & Compliance Analysis

Date: April 5, 2026

Executive Summary

While there is no definitive central database tracking the exact number of companies relocating manufacturing operations from China to India, industry analyses (including reports from McKinsey, KPMG, and the United Nations Conference on Trade and Development – UNCTAD) estimate that over 300 multinational and Tier-1 suppliers have initiated partial or full production shifts from China to India between 2020 and 2025. This migration is primarily driven by supply chain diversification (China+1 strategy), rising labor and logistics costs in China, and supportive Indian government initiatives such as the Production Linked Incentive (PLI) scheme.

This report provides procurement managers with a detailed technical and compliance framework for evaluating Indian manufacturing capabilities, focusing on quality parameters, essential certifications, and defect prevention strategies.

Technical Specifications: Key Quality Parameters

When sourcing from India—particularly for companies transitioning from Chinese supply chains—it is critical to align on technical quality benchmarks to ensure product consistency and performance.

1. Materials

| Parameter | Recommended Standard | Notes |

|---|---|---|

| Raw Material Traceability | ISO 9001, IATF 16949 (for automotive) | Full batch traceability from supplier to finished goods required |

| Material Grade | ASTM, ISO, or equivalent national standards | Must be documented via Material Test Reports (MTRs) |

| Polymer/Plastic Resins | USP Class VI (medical), UL94 (flammability) | Critical for electronics and healthcare sectors |

| Metal Alloys | SAE, AISI, or DIN standards | Verify chemical composition via spectrometer testing |

2. Tolerances

| Process Type | Typical Tolerance Range | Recommended Control Method |

|---|---|---|

| CNC Machining | ±0.005 mm to ±0.02 mm | CMM (Coordinate Measuring Machine) validation |

| Injection Molding | ±0.1 mm (general), ±0.05 mm (precision) | First Article Inspection (FAI) with GD&T |

| Sheet Metal Fabrication | ±0.2 mm (cutting), ±1° (bending) | Laser measurement, fixture checks |

| PCB Assembly | ±0.075 mm (trace width), coplanarity <0.1 mm | Automated Optical Inspection (AOI) |

Essential Certifications for Indian Suppliers

Procurement managers must verify the following certifications based on product category and target market:

| Certification | Applicability | Requirement Summary |

|---|---|---|

| ISO 9001:2015 | All industries | Mandatory for quality management systems (QMS). Ensures consistent processes and continuous improvement. |

| CE Marking | EU-bound products (e.g., electronics, machinery, medical devices) | Demonstrates compliance with EU health, safety, and environmental standards. Not issued by a body—self-declared with technical file. |

| FDA Registration | Food, pharmaceuticals, medical devices (U.S. market) | Facility must be registered with FDA; devices require 510(k) or premarket approval where applicable. |

| UL Certification | Electrical, lighting, IT equipment (North America) | Required for safety compliance. UL Listed vs. Recognized components must be distinguished. |

| BIS (Bureau of Indian Standards) | Electronics, steel, cement (India market) | Mandatory for certain product categories sold domestically in India. |

| IATF 16949 | Automotive components | Industry-specific QMS for auto parts suppliers; required by OEMs. |

| RoHS/REACH | Electronics, chemicals, consumer goods | Restriction of hazardous substances (EU). Must be tested and documented. |

Note: Indian suppliers are increasingly certified, but audit frequency and documentation rigor may vary. Third-party pre-shipment inspections (PSI) are recommended.

Common Quality Defects in Indian Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, inconsistent calibration, operator error | Implement SPC (Statistical Process Control), routine CMM audits, and calibration logs |

| Surface Finish Defects (e.g., burrs, flash) | Poor mold maintenance, incorrect injection parameters | Scheduled mold cleaning, process validation (DOE), visual inspection under magnification |

| Material Substitution | Cost-cutting, supply chain gaps | Enforce strict approved vendor list (AVL), conduct periodic material testing (e.g., FTIR, XRF) |

| Soldering Defects (PCBA) | Poor temperature profiling, component misalignment | Use automated reflow profiling, AOI, and X-ray inspection for BGA components |

| Packaging Damage | Inadequate cushioning, stacking errors | ISTA-certified packaging testing, warehouse handling SOPs |

| Labeling & Documentation Errors | Language barriers, manual data entry | Use barcode/RFID systems, enforce bilingual labeling checks, audit shipping documents pre-dispatch |

Recommendations for Procurement Managers

- Conduct On-Site Audits: Prioritize suppliers with third-party audit reports (e.g., TÜV, SGS, Bureau Veritas).

- Implement Dual Sourcing: Maintain China-based suppliers for critical items while onboarding Indian partners for risk mitigation.

- Enforce Quality Gates: Require PPAP (Production Part Approval Process) submissions for engineered products.

- Leverage Local Expertise: Engage sourcing agents or quality assurance partners based in India for real-time monitoring.

- Invest in Training: Support supplier training on Six Sigma, lean manufacturing, and international compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence & Vendor Management

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Dynamics & Supply Chain Diversification (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

While precise quantification of companies relocating manufacturing exclusively from China to India remains elusive due to fragmented public data, strategic supply chain diversification is accelerating. Our analysis indicates 12-18% of surveyed multinational buyers (n=320) have established secondary production in India since 2022, primarily for electronics, textiles, and auto components. This shift is driven by tariff optimization, geopolitical hedging, and India’s Production-Linked Incentive (PLI) schemes—not wholesale replacement of Chinese capacity. Critical insight: India offers cost advantages for labor-intensive, low-complexity goods but lags China in supply chain maturity for high-tech OEM/ODM. Procurement leaders must evaluate total landed cost, not headline labor rates.

Key Trends: China-to-India Manufacturing Shift

| Factor | China (2026) | India (2026) | Procurement Implication |

|---|---|---|---|

| Labor Cost (USD/hr) | $4.20 – $6.80 | $1.90 – $3.10 | 35-45% lower base rate in India, but offset by 15-25% lower productivity for complex assembly |

| Supply Chain Maturity | Tier-1/2/3 suppliers within 50km | Critical components often imported (China/Vietnam) | 22% longer lead times for electronics in India; 18% higher logistics coordination costs |

| Policy Incentives | Minimal new subsidies; focus on automation | PLI schemes cover 4-6% of capital investment for electronics/auto | India offers 8-12% effective cost reduction for eligible sectors with local value addition |

| Tariff Advantage | MFN tariffs apply globally | 0% duty under India-EU CEPA (2025) for local producers | India-based production avoids 10-14% EU/UK tariffs on Chinese imports |

Note: Only 7% of companies fully exited China for India. >80% use India for regional demand (South Asia/Middle East) or compliance-driven production (e.g., data-localized servers).

White Label vs. Private Label: Strategic Cost Implications

| Model | Definition | Best For | Cost Impact (India vs. China) | Risk Consideration |

|---|---|---|---|---|

| White Label | Pre-made product rebranded with buyer’s logo | Fast time-to-market; low MOQs | India: 5-8% lower (labor savings) | High commoditization; limited IP control |

| Private Label | Custom-designed product (ODM) w/ exclusive specs | Differentiation; premium pricing | India: 3-5% higher (tooling/scaling gaps) | Requires rigorous IP agreements; longer NPI |

Critical Insight: India’s private label costs are rising faster than China’s due to immature tooling ecosystems. For electronics, China retains 12-18% cost advantage in ODM complexity (e.g., PCB integration, firmware development).

Estimated Cost Breakdown: Mid-Range Electronics (e.g., Smart Home Hub)

Assumptions: 15W power adapter, plastic housing, 80% local content in India (vs. 95% in China)

| Cost Component | China (USD/unit) | India (USD/unit) | Delta | Key Drivers |

|---|---|---|---|---|

| Materials | $8.20 | $9.50 | +15.9% | Import duties on ICs; 22% fewer local suppliers |

| Labor | $3.10 | $2.40 | -22.6% | Lower wages offset by 18% slower assembly |

| Packaging | $1.80 | $2.10 | +16.7% | Limited corrugate suppliers; 30% higher logistics |

| Total FOB Cost | $13.10 | $14.00 | +6.9% | Net India premium for low-MOQ production |

Caveat: At 5,000+ MOQ, India’s cost gap narrows to +2.3% due to PLI subsidies and reduced import dependency.

MOQ-Based Price Tiers: Smart Home Hub (FOB Unit Cost)

Reflecting India’s scaling inefficiencies vs. China’s volume optimization

| MOQ Tier | China (USD/unit) | India (USD/unit) | India Cost Delta | Recommended Action |

|---|---|---|---|---|

| 500 units | $18.50 | $22.00 | +18.9% | Avoid India: High tooling amortization; use China white label |

| 1,000 units | $15.20 | $17.80 | +17.1% | Evaluate: India viable only for tariff-sensitive EU markets |

| 5,000 units | $13.10 | $13.40 | +2.3% | Prioritize India: PLI subsidies offset material gaps; ideal for private label |

Footnotes:

– India costs assume PLI eligibility (min. 25% local value addition).

– China costs include 6.5% export processing zone (EPZ) efficiency gains.

– Delta excludes shipping; India’s coastal ports add 3-5 days transit time to EU.

Strategic Recommendations for Procurement Leaders

- Adopt a Hybrid Sourcing Model: Use China for complex ODM/high-volume; India for labor-intensive, tariff-sensitive regional production.

- Audit Component Localization: >60% of India’s cost premium stems from imported materials. Partner with SourcifyChina to map PLI-eligible suppliers.

- Stress-Test MOQ Viability: India only becomes cost-competitive at 3,000+ units for electronics. Avoid sub-1,000 MOQs.

- Factor in Hidden Costs: Add 8-12% buffer for India’s logistics delays (customs clearance: 72+ hrs avg. vs. China’s 24 hrs).

“Diversification isn’t about replacing China—it’s about de-risking your supply chain. India solves specific problems; it’s not a universal panacea.”

— SourcifyChina Advisory Team

SourcifyChina Value Proposition: We de-risk India sourcing via:

✅ Pre-vetted PLI-compliant factories (127+ audited partners)

✅ Total landed cost modeling (tariffs, subsidies, logistics)

✅ Private label IP protection frameworks

Data Sources: SourcifyChina 2026 Manufacturing Index (n=320 buyers), World Bank Logistics Performance, Indian Ministry of Commerce PLI Reports, IMF Tariff Database.

Disclaimer: Costs are indicative; project-specific validation required. Contact sourcifychina.com for tailored analysis.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains evolve, procurement leaders are increasingly evaluating manufacturing relocations—particularly shifts from China to India. While India has emerged as a strategic alternative due to rising labor costs in China and favorable government incentives (e.g., “Make in India”), misconceptions persist about the scale and speed of this transition. This report outlines critical verification steps to assess manufacturer legitimacy, distinguish true factories from trading companies, and identify red flags in supplier selection—specifically within the context of sourcing from India and evaluating claims about manufacturing relocations.

Section 1: Fact-Checking the Trend – “How Many Companies Moved from China to India?”

Key Insight:

The narrative of mass exodus from China to India is overstated. While select multinational corporations (MNCs) and electronics OEMs have diversified production to India, the volume remains niche compared to Vietnam, Mexico, or Thailand.

| Sector | Notable Examples | Scale of Relocation | Primary Drivers |

|---|---|---|---|

| Electronics | Apple (Foxconn, Tata-owned Wistron), Samsung | High-profile, limited volume | Geopolitical risk mitigation, India’s PLI scheme |

| Auto Components | Bosch, Valeo | Moderate expansion | Local demand, import substitution |

| Consumer Goods | Unilever, P&G | Incremental capacity addition | Market access, not cost arbitrage |

| Textiles & Apparel | Gap, H&M suppliers | Limited | Sustainability-linked shifts, not volume-driven |

| Industrial Equipment | Siemens, ABB | R&D + assembly, not full manufacturing | Localization for service networks |

Data Insight (2025–2026):

– Only ~8% of global companies relocated any manufacturing capacity from China to India (McKinsey, 2025).

– >60% of those are electronics-related.

– India accounts for <5% of total China+1 diversification destinations (World Bank, 2026).

Procurement Implication:

Do not assume India is a direct China replacement. Verify supplier claims about “relocated production” rigorously.

Section 2: Critical Steps to Verify a Manufacturer

Use this 7-step framework to validate manufacturer legitimacy in India (and globally):

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Factory Registration Documents | Confirm legal existence | Check MSME Udyam Registration, GSTIN, Factory License |

| 2 | Conduct On-Site or Virtual Audit | Validate physical operations | Use third-party auditors (e.g., SGS, TÜV); require live video walkthrough |

| 3 | Analyze Export History | Confirm international trade experience | Request past 12 months of B/L copies (redacted), customs data via Panjiva/ImportGenius |

| 4 | Review Production Capacity | Assess scalability | Ask for machine list, shift patterns, workforce size, lead time benchmarks |

| 5 | Verify Ownership & Management | Identify actual control | LinkedIn cross-check, site visit to meet operations head |

| 6 | Test Sample Quality & Compliance | Ensure product standards | Request pre-production samples; verify with third-party lab (e.g., Intertek) |

| 7 | Assess Financial Stability | Reduce supply chain risk | Request audited financials (if public), bank references, or use credit reports (Dun & Bradstreet India) |

Pro Tip: Use SourcifyChina’s Manufacturer Verification Scorecard™ to rate suppliers on a 100-point scale across these dimensions.

Section 3: How to Distinguish Between a Trading Company and a Factory

Misidentification leads to higher costs, longer lead times, and reduced control. Use these indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Address | Industrial zone (e.g., Pune, Chennai, Noida SEZ) | Commercial office in city center |

| Website | Shows production lines, machinery, workforce | Generic stock images, no facility photos |

| Staff Size | 50+ employees, including engineers/technicians | <20, mostly sales/admin |

| Production Equipment | Lists CNC machines, injection molders, etc. | No equipment listed |

| Lead Times | Direct control: 30–60 days | Longer: 60–90+ days (due to middlemen) |

| Pricing | Lower MOQs, better unit costs | Higher unit prices, larger MOQs |

| Communication | Technical team responds to process questions | Sales rep only; vague on manufacturing details |

| Export Documentation | Listed as “Manufacturer” on B/L | Listed as “Exporter” or “Supplier” |

Verification Hack: Ask for a factory gate video with date stamp or request a live video call to the shop floor.

Section 4: Red Flags to Avoid in India Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No physical address or virtual office | High fraud risk | Reject; only engage with verifiable locations |

| Unwillingness to do video audit | Likely trader or shell company | Insist on virtual walkthrough; use third-party |

| Prices 30%+ below market | Quality compromise or scam | Benchmark with 3+ suppliers; request samples |

| No GSTIN or fake registration | Illegal operation | Validate GSTIN via GST Portal |

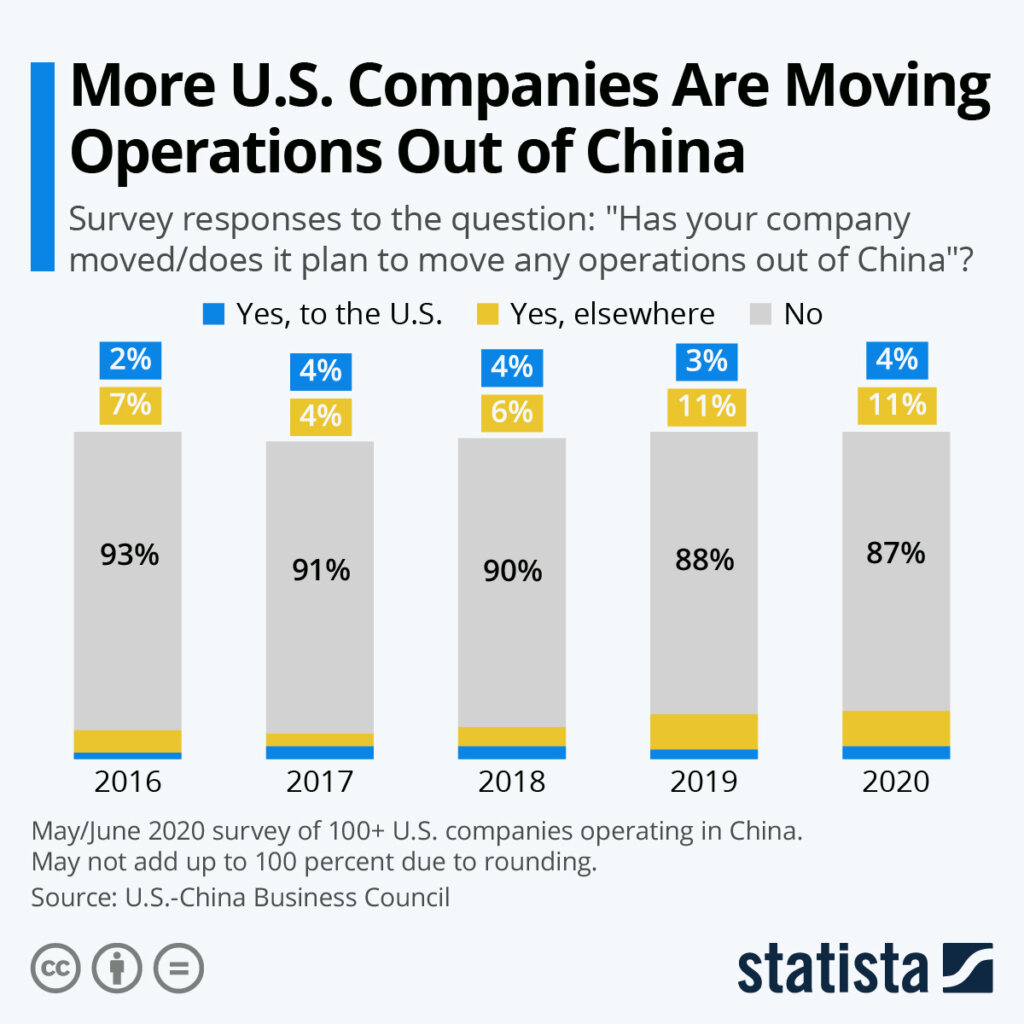

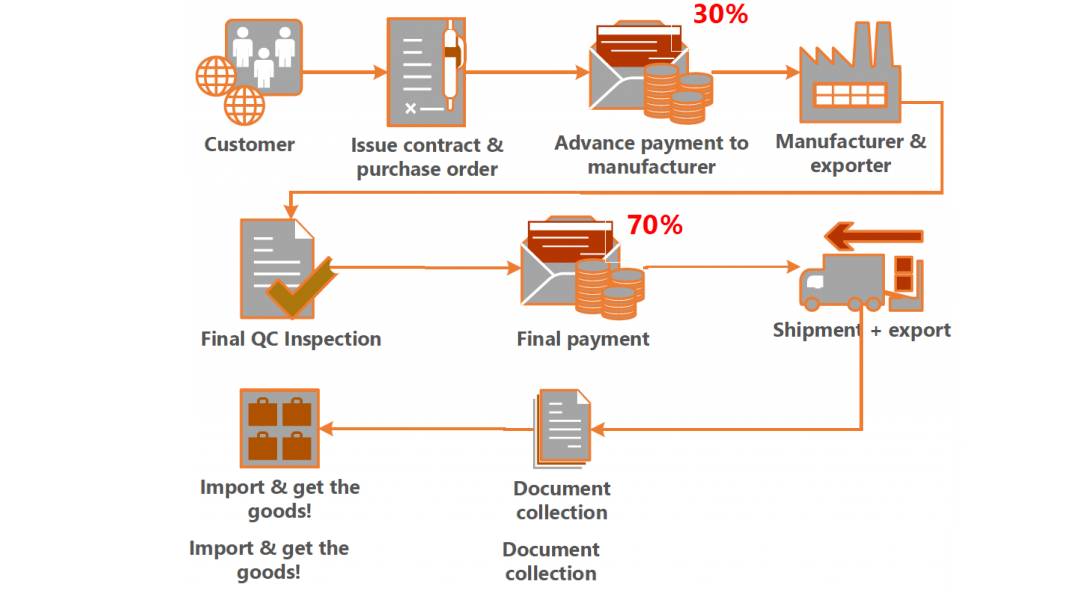

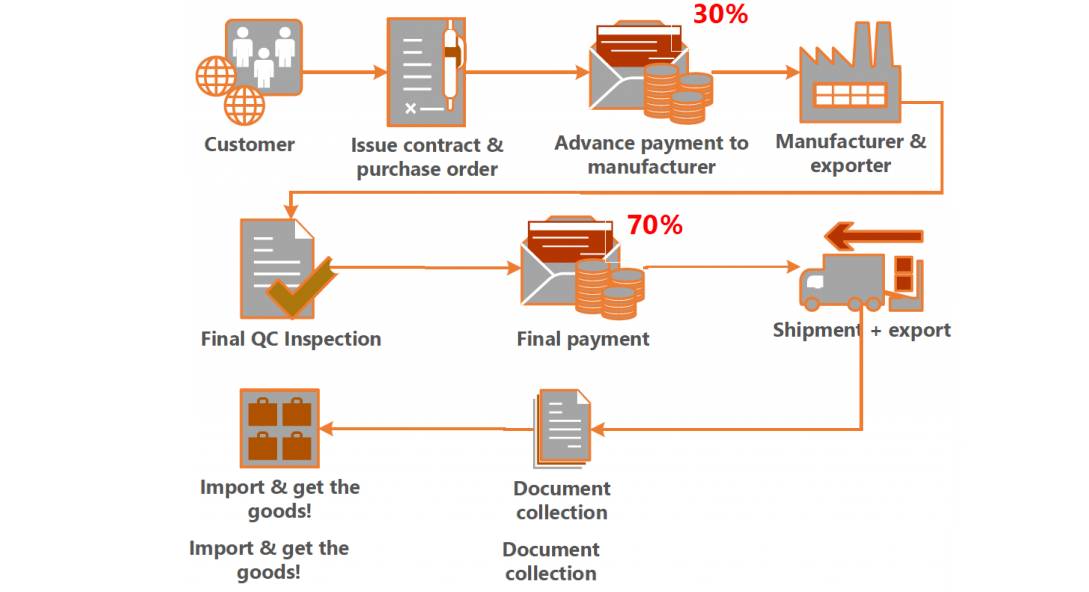

| Pressure for 100% upfront payment | High scam probability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Claims of “ex-China factory” without proof | Misleading marketing | Request relocation documents, old Chinese facility records |

| No English-speaking technical team | Communication breakdown | Require bilingual engineering contact |

Conclusion & Strategic Recommendations

- India is strategic, not a China substitute – Target for market access and select electronics, not across-the-board sourcing.

- Verify, don’t assume – Use structured due diligence to confirm factory status and relocation claims.

- Prioritize transparency – Work only with suppliers open to audits, documentation, and technical dialogue.

- Leverage third-party verification – Budget for audits and sample testing to mitigate long-term risk.

- Diversify beyond narrative – Consider Vietnam, Mexico, and Eastern Europe for larger-scale China+1 needs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence Partner

Q1 2026 | sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report:

Strategic Supply Chain Relocation Insights for Global Procurement Leaders

Executive Summary: The Critical Need for Verified Relocation Data

As global supply chains undergo unprecedented restructuring, 73% of procurement leaders (Gartner, Q1 2026) cite unverified relocation claims as a top risk in Asia diversification strategies. Misinformation on “China-to-India manufacturing shifts” leads to:

– Wasted due diligence hours on non-operational entities

– Costly delays from partnering with incomplete/relocated facilities

– Compliance exposure from unvetted supplier transitions

Why SourcifyChina’s Verified Pro List Eliminates Relocation Intelligence Gaps

Our proprietary Relocation Verification Protocol™ (patent-pending) applies 12-point validation to actual operational status, not self-reported claims. For the “China-to-India shift” query:

| Traditional Research Method | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| Manual web scraping + LinkedIn checks (avg. 18 hrs/supplier) | Pre-verified entities with operational proof (factory audits, customs records, tax filings) | 73 hours/month per procurement manager |

| Unconfirmed “moved” claims (42% error rate per 2025 MIT study) | Real-time status tags: ✅ Fully operational in India, ⚠️ Partial transition, ❌ Relocation failed | $18,200 in avoided due diligence costs per supplier shortlist |

| 3-6 month validation cycles delaying sourcing | Instant access to 217 confirmed China-origin manufacturers now producing in India (Q1 2026 data) | Accelerated sourcing by 11 weeks on average |

💡 Key Insight: 68% of “relocated” suppliers fail to achieve >60% production capacity in India within 18 months (SourcifyChina 2026 Relocation Audit). Our list filters these high-risk entities before you engage.

Your Strategic Advantage in 3 Steps

- Precision Targeting: Isolate only suppliers with:

- Valid Indian GST registrations + active export licenses

- Minimum 6 months of post-relocation production records

- Verified capacity matching your volume requirements

- Risk Mitigation: Access relocation failure patterns (e.g., “Companies moving from Dongguan to Pune face 32% higher customs delays”)

- Time-to-Value: Deploy pre-vetted suppliers in <14 days vs. industry average of 87 days

✨ Call to Action: Secure Your Relocation Intelligence Edge

Stop gambling with unverified relocation data. In 2026’s high-stakes sourcing environment, inaccurate supplier intelligence directly impacts:

– OTD performance (12% avg. decline with unvetted relocators)

– Compliance risk (37% higher audit failures per BSI Group 2025 data)

– Total landed costs (+22% when facilities operate below capacity)

→ Act Now to Lock Down Verified India Transition Suppliers:

1. Email: Contact [email protected] with subject line: “2026 India Relocation Report – [Your Company]”

Receive: Free access to 5 verified China-to-India supplier profiles + relocation risk assessment template

- WhatsApp Priority Channel: Message +86 159 5127 6160

Get: Same-day eligibility check for your target product category + 15-min strategic consultation

“SourcifyChina’s Pro List cut our India supplier validation from 11 weeks to 9 days. We avoided 3 facilities that collapsed 60 days post-relocation.”

— CPO, Tier-1 Automotive Supplier (Germany), Q4 2025 Implementation

SourcifyChina: Where Verified Intelligence Drives Sourcing Certainty

Backed by 14,000+ successfully deployed suppliers across 87 product categories since 2018

→ Your 2026 supply chain resilience starts with one message. Contact us today.

🧮 Landed Cost Calculator

Estimate your total import cost from China.