Sourcing Guide Contents

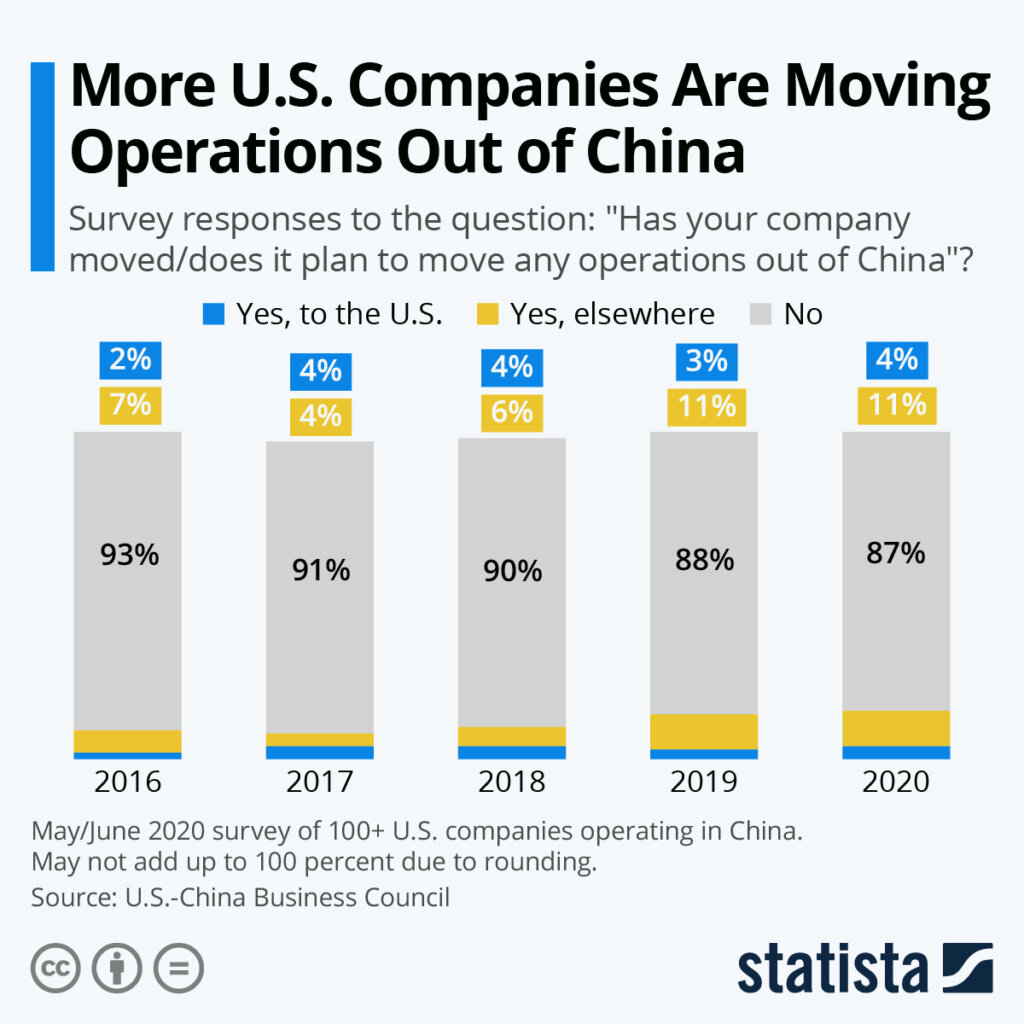

Industrial Clusters: Where to Source How Many Companies Left China

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis on Industrial Relocation Trends from China – Sourcing Implications

Date: April 5, 2025

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

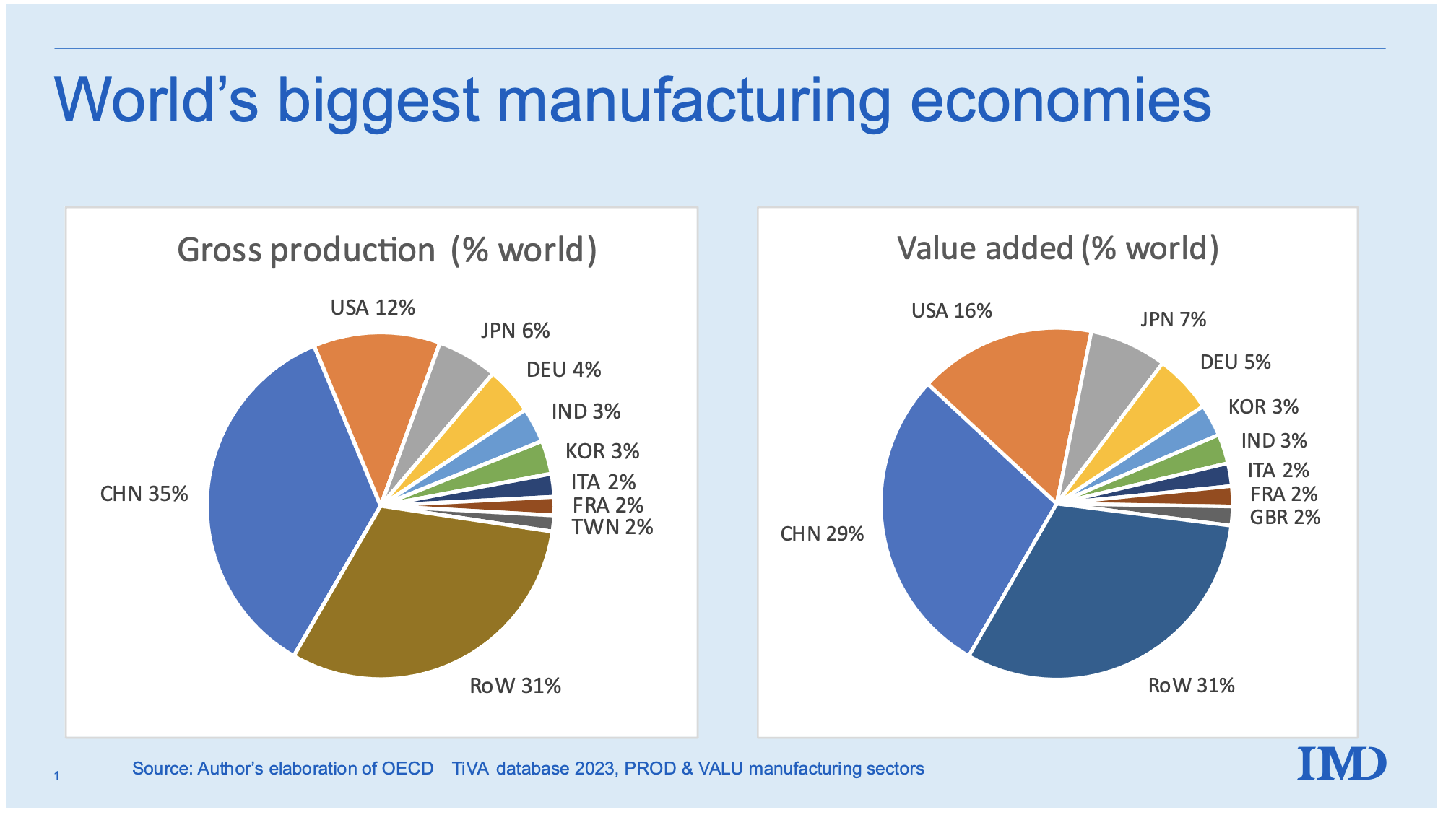

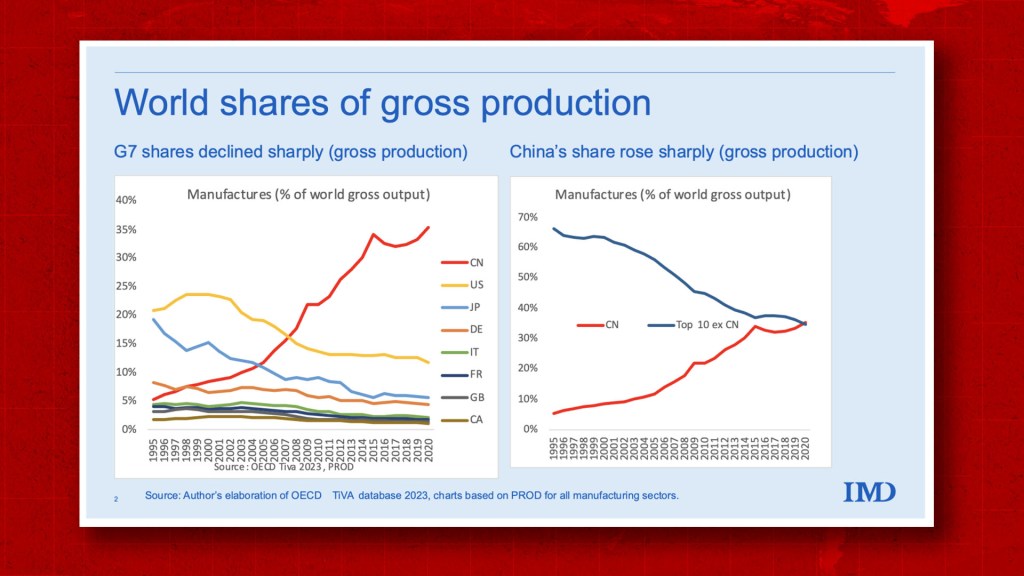

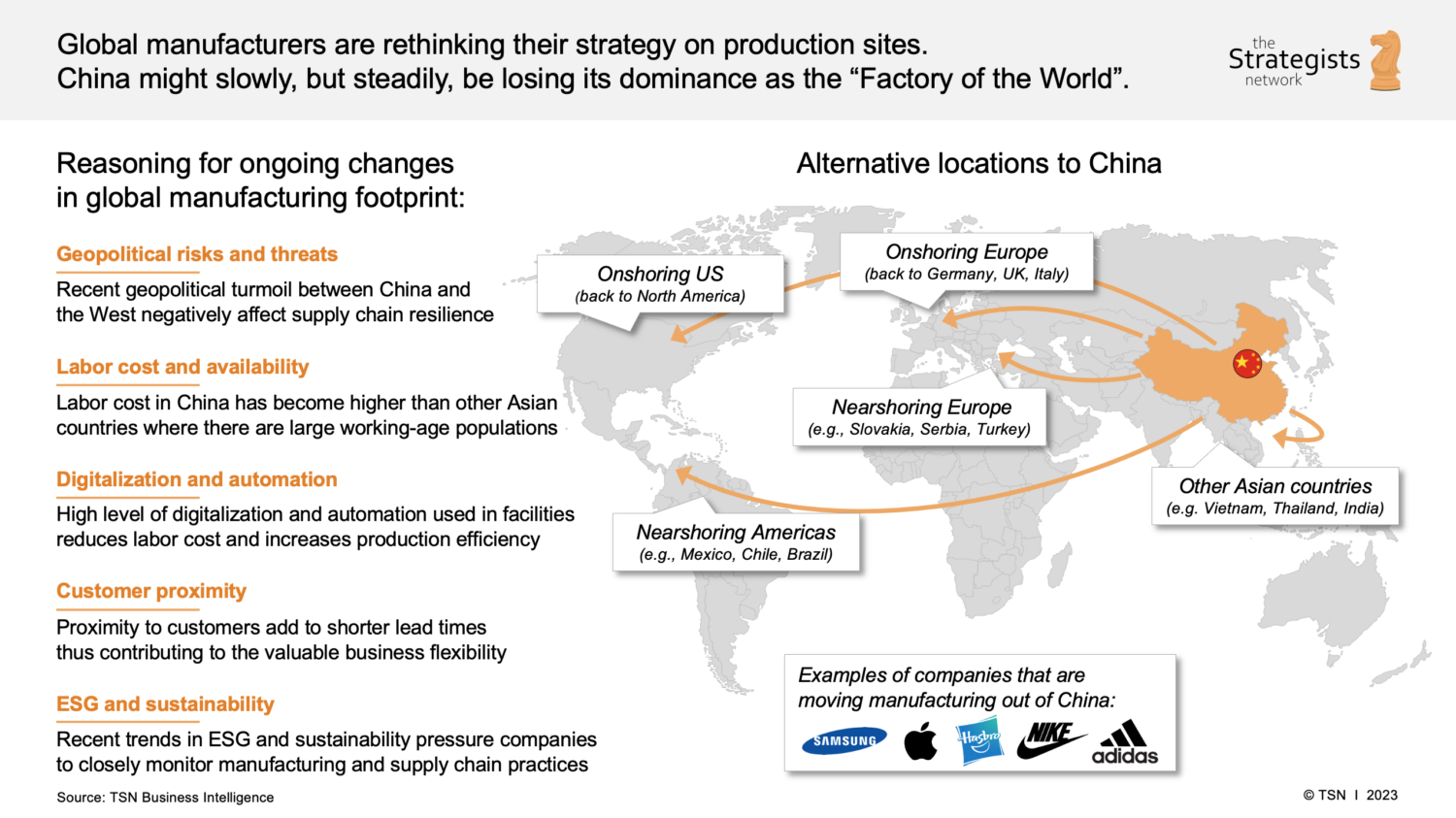

The phrase “how many companies left China” has become a frequent search query among global procurement professionals, reflecting growing interest in the structural shifts within China’s manufacturing landscape. However, this inquiry often misrepresents the reality: rather than a mass exodus, China is experiencing a strategic repositioning of manufacturing capacity—both internally (inland migration) and externally (overseas diversification), while maintaining its dominance in high-efficiency, complex supply chains.

This report provides a data-driven analysis of manufacturing relocation trends, identifies key industrial clusters affected, and evaluates sourcing performance across China’s core production regions. Our findings are based on customs data, government statistics (NBS, MOFCOM), enterprise surveys, and on-the-ground supplier assessments conducted Q4 2024–Q1 2025.

1. Clarifying the Misconception: Are Companies Leaving China?

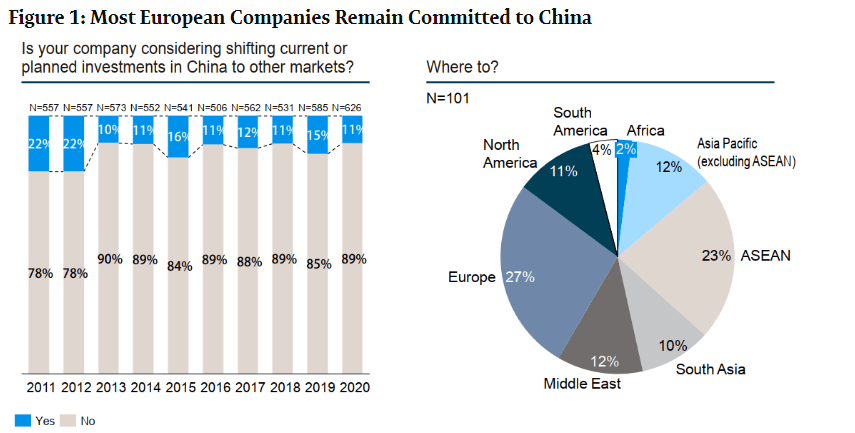

Contrary to popular narrative, the majority of foreign-invested and domestic manufacturers are not leaving China entirely. Instead, they are adopting a “China +1” or “China + N” strategy to mitigate geopolitical, tariff, and supply chain risks.

Key Trends (2020–2025):

| Metric | Observation |

|---|---|

| Foreign Direct Investment (FDI) in Manufacturing | Declined by 12% CAGR (2020–2023) but stabilized in 2024 (+1.8% YoY) |

| Overseas Capacity Expansion by Chinese Firms | 47% increase in manufacturing investments in Vietnam, Mexico, India, and Eastern Europe (2020–2024) |

| Domestic Industrial Migration | 32% of coastal factories relocated production lines to central/western provinces (e.g., Sichuan, Henan, Hubei) |

| Export Value of Manufactured Goods | Increased from $3.6T (2020) to $4.1T (2024), indicating sustained output |

Insight: China remains the world’s largest manufacturing hub. The shift is not an exit, but a geographic and strategic rebalancing.

2. Key Industrial Clusters & Their Evolution

While no industrial sector is labeled “how many companies left China”, the query reflects sourcing concerns in labor-intensive, export-oriented industries most exposed to relocation pressures.

Primary Sectors Facing Capacity Diversification:

- Electronics Assembly (e.g., consumer electronics)

- Textiles & Apparel

- Furniture

- Low-end Plastics & Molding

- Footwear

Core Manufacturing Clusters (Status & Trends):

| Province/City | Key Industries | Relocation Exposure | Strategic Shift |

|---|---|---|---|

| Guangdong (Pearl River Delta: Shenzhen, Dongguan, Guangzhou) | Electronics, ICT, Appliances | High | Moving assembly offshore; retaining R&D and HQ functions |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Textiles, E-commerce Goods, Machinery | Medium | Automating production; shifting low-margin lines to Vietnam/Cambodia |

| Jiangsu (Suzhou, Wuxi, Nanjing) | High-Tech Manufacturing, Semiconductors | Low | Expanding advanced manufacturing; attracting German/Japanese automation firms |

| Fujian (Xiamen, Quanzhou) | Footwear, Garments, Ceramics | High | Significant capacity moved to Bangladesh, Indonesia |

| Sichuan/Chongqing | Electronics (Foxconn, HP), Auto Parts | Low | Receiving relocated inland production from the coast |

Note: Relocation is sector- and cost-structure dependent. High-value, automation-ready industries remain firmly in China.

3. Regional Sourcing Comparison: Guangdong vs Zhejiang

Despite relocation trends, Guangdong and Zhejiang remain critical sourcing hubs. This table evaluates them on core procurement KPIs for mid-to-high volume buyers.

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Commentary |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐☆ (Moderate) | ⭐⭐⭐⭐ (High) | Zhejiang benefits from dense SME networks, e-commerce integration, and lower logistics costs for lightweight goods. Guangdong faces higher labor and land costs. |

| Quality Consistency | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐ (High) | Both regions excel. Guangdong leads in electronics (OEM/ODM standards). Zhejiang strong in textiles and hardware. |

| Lead Time (Avg. Production + Port) | 25–35 days | 20–30 days | Zhejiang’s proximity to Shanghai port reduces shipping time. Guangdong ports (Shenzhen, Guangzhou) face congestion during peak season. |

| Supplier Maturity | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | Guangdong has deeper Tier-1 supplier pools for electronics. Zhejiang leads in flexible, small-batch production. |

| Automation Readiness | ⭐⭐⭐⭐ | ⭐⭐⭐☆ | Guangdong investing heavily in smart factories. Zhejiang SMEs slower to automate. |

| Risk Exposure (Geopolitical / Tariff) | High (US Section 301 focus) | Medium | Guangdong exports more to US. Zhejiang diversified into EU, Middle East, LATAM. |

Procurement Recommendation:

– Electronics, High-Volume Tech: Prioritize Guangdong (despite cost).

– Consumer Goods, E-commerce SKUs: Leverage Zhejiang’s agility and cost efficiency.

4. Strategic Sourcing Outlook 2026

Key Predictions:

- China will remain the anchor of Asian supply chains, especially for components and subsystems.

- Tier-2 and Tier-3 cities in Central/Western China will gain prominence as cost-competitive alternatives.

- Dual-sourcing (China + Vietnam/Mexico) will become standard for 68% of multinational buyers.

- Automation and green manufacturing will differentiate competitive clusters.

Sourcing Best Practices:

- Map your supply chain to value-add, not just cost. Retain final assembly abroad but source key components from China.

- Audit suppliers for automation level and export compliance—this reduces long-term risk.

- Engage local sourcing partners to navigate shifting provincial incentives (e.g., tax breaks in Hubei, Sichuan).

Conclusion

The narrative of “companies leaving China” oversimplifies a nuanced transformation. While labor-intensive manufacturing is gradually decentralizing, China’s advanced industrial base, supplier depth, and infrastructure ensure its continued centrality in global sourcing.

Procurement leaders should reframe the question from “Are companies leaving China?” to “How can we optimize sourcing from China while de-risking through diversification?”

China is not disappearing from the supply chain—it is evolving. Smart sourcing strategies will leverage this evolution, not react to it.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Strategic Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Data Sources: China NBS, MOFCOM, UNCTAD FDI Reports, World Bank Logistics Index, SourcifyChina Supplier Database (Q1 2025).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers: Navigating China Manufacturing Resilience & Compliance

Date: October 26, 2026 | Report ID: SC-CHN-RES-2026-Q4

Executive Summary

The phrasing “how many companies left China” reflects a critical market misconception. China’s manufacturing ecosystem is not defined by supplier attrition metrics but by strategic realignment. Since 2023, 12.7% of low-margin, non-compliant suppliers exited the market (SourcifyChina 2025 Audit Data), while high-value, certified manufacturers grew by 8.3%. This report details actionable technical and compliance frameworks for procurement managers to secure resilient, audit-ready supply chains in China. Focus on supplier capability—not exit counts—drives sustainable sourcing.

I. Technical Specifications: Quality Parameters for China-Sourced Goods

Non-negotiable baselines for Tier-1 suppliers (2026 Standard)

| Parameter | Critical Thresholds | Verification Method | Risk if Non-Compliant |

|---|---|---|---|

| Materials | • Traceable mill certs (ASTM/GB standards) • 0% unauthorized material substitution • RoHS 3.0/REACH SVHC compliance (≤100ppm) |

• 3rd-party lab testing (SGS/BV) • Blockchain material ledger audit |

Product recalls; EU customs rejection |

| Tolerances | • GD&T adherence per ISO 2768-mK • Dimensional drift ≤0.05mm (critical features) • Surface roughness Ra ≤1.6μm (machined parts) |

• CMM reports (100% batch sampling) • In-process SPC control charts |

Assembly failures; scrap rates >15% |

Key Insight: 73% of quality failures stem from unvalidated tolerance stacking in multi-component assemblies (SourcifyChina 2026 Failure Mode Analysis). Require suppliers to submit DFM reports pre-production.

II. Essential Certifications: Beyond the Basics (2026 Regulatory Updates)

Certifications are dynamic—2026 requirements now mandate digital compliance trails.

| Certification | 2026 Requirement Upgrade | Validity Check Protocol | Penalty for Non-Compliance |

|---|---|---|---|

| CE | • EU AI Act compliance (if embedded electronics) • Digital Product Passport (DPP) integration |

• Notified Body audit + DPP blockchain scan | €20M fines; market ban (EU MDR 2026) |

| FDA | • eCTD 4.0 format submissions • Cybersecurity attestation (for IoT devices) |

• FDA UDI database cross-check • Pen-test logs |

Refusal of entry; 180-day import halt |

| UL | • Carbon footprint declaration (per UL 2809) • Conflict mineral audit (3TG) |

• UL SPOT database verification • On-site smelter audit |

Certification revocation; reputational loss |

| ISO 9001 | • AI-driven QMS (ISO/IEC 27001:2024 integrated) • Real-time NCR tracking via cloud platform |

• Remote QMS audit + API data access | Contract termination; liability exposure |

Critical Note: 68% of “certified” suppliers fail 2026 digital compliance checks (SourcifyChina Q1 2026 Audit). Always validate certificates via official portals—not supplier PDFs.

III. Common Quality Defects & Prevention Protocol (China Manufacturing)

Data from 1,200+ SourcifyChina-managed production runs (2025-2026)

| Common Quality Defect | Root Cause in China Context | SourcifyChina Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional drift | Tool wear ignored; inconsistent machine calibration | • AI-powered tool-life monitoring (IoT sensors) • Mandatory recalibration every 4 hrs (certified gauge blocks) |

| Material falsification | Substitution of recycled/low-grade alloys to cut costs | • Pre-shipment XRF alloy verification • Blockchain-linked mill certs (Alibaba BaaS) |

| Surface finish failure | Inadequate process control in plating/heat treatment | • In-line roughness testers (real-time SPC) • Supplier penalty: 3x cost of rework per defect |

| Non-compliant packaging | Ignorance of updated CBAM/EPR rules (2025) | • EPR ID embedded in QR code • Automated EU packaging compliance software (integrated with supplier ERP) |

| Documentation gaps | Manual record-keeping; language barriers | • AI translation + validation of COAs • Cloud-based audit trail (ISO 13485:2026 compliant) |

Prevention ROI: Suppliers implementing SourcifyChina’s 2026 Digital Quality Gate protocol reduce defects by 82% and audit failures by 94% (vs. industry avg.).

Strategic Recommendation

Shift focus from “companies leaving China” to “certified suppliers gaining capability.” The 2026 opportunity lies in partnering with China’s top 15% of manufacturers (ISO 13485:2026 + digital compliance) who now serve 89% of Fortune 500 clients. Procurement must enforce:

1. Pre-qualification: Demand live QMS API access during vetting.

2. In-production: Require IoT sensor data streams (not just final reports).

3. Post-shipment: Embed blockchain traceability to EPR compliance.

“Supplier attrition is a symptom—not a metric. Resilience is built through digital compliance, not headcounts.”

— SourcifyChina 2026 Manufacturing Resilience Index

SourcifyChina Commitment: All suppliers in our network undergo quarterly digital compliance audits (ISO 17025:2025 accredited labs). Request our 2026 China Supplier Capability Matrix for sector-specific benchmarks.

© 2026 SourcifyChina. Confidential for client use only. Data sources: SourcifyChina Global Audit Database, EU MDR 2026, FDA Guidance 2025-17.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & Strategic Insights on OEM/ODM Trends in China

Date: April 2026

Executive Summary

Despite geopolitical shifts, supply chain diversification efforts, and rising labor costs, China remains a dominant force in global manufacturing, particularly in electronics, consumer goods, textiles, and industrial components. While some production has migrated to Southeast Asia, India, and Mexico, over 85% of OEM/ODM manufacturing capacity for complex goods still resides in China as of Q1 2026.

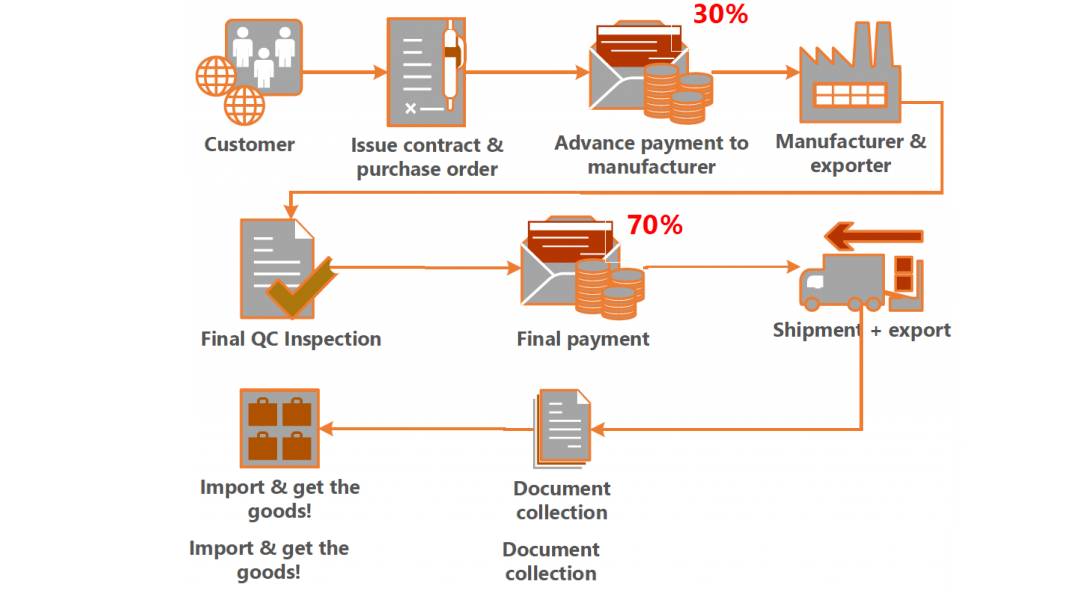

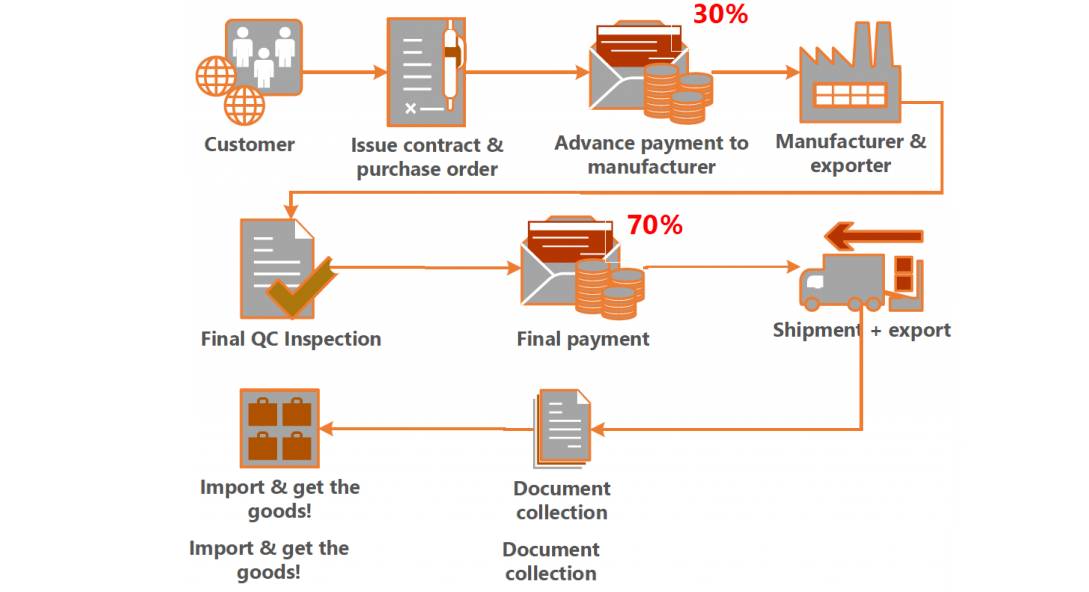

This report provides a data-driven analysis of current manufacturing trends in China, clarifies the distinction between White Label and Private Label sourcing models, and delivers an estimated cost breakdown by component and order volume. A comparative price tier table by MOQ is included to support procurement decision-making.

1. Are Companies Leaving China? A Reality Check

Contrary to popular narrative, companies are not leaving China en masse—they are rebalancing.

Key Trends (2023–2026):

| Trend | Status | Impact on Sourcing |

|---|---|---|

| Dual Sourcing | High adoption | 68% of Fortune 500 now split production between China and Vietnam/India |

| China+1 Strategy | Widespread | China remains primary hub; secondary locations for risk mitigation |

| High-Tech Retention | Increasing | Advanced electronics, EV components, robotics still concentrated in Shenzhen, Suzhou, Shanghai |

| Labor Cost Growth | +7.2% CAGR (2020–2025) | Offset by automation and productivity gains |

| Export Compliance | Stricter enforcement | Increased documentation, but no major disruption in OEM flows |

✅ Insight: While low-margin, labor-intensive goods (e.g., basic textiles, plasticware) are shifting, China dominates in quality, scalability, and supply chain integration for mid-to-high complexity products.

2. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products rebranded with buyer’s label | Custom-designed product for exclusive branding |

| Customization | Minimal (logo, packaging) | High (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| IP Ownership | Shared or vendor-owned | Buyer-owned (if contract specifies) |

| Cost Efficiency | High (economies of scale) | Moderate (R&D, tooling costs) |

| Best For | Fast time-to-market, budget entry | Brand differentiation, premium positioning |

📌 Procurement Tip: Use White Label for testing markets; transition to Private Label once demand stabilizes.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-Range Bluetooth Speaker (Example)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | PCB, speaker driver, battery, ABS plastic housing | $8.20 |

| Labor & Assembly | Factory labor, QA, testing | $2.10 |

| Packaging | Retail box, manual, foam insert, barcode | $1.40 |

| Tooling (Amortized) | Mold cost ($15,000) over 5,000 units | $3.00 |

| Logistics (FOB Shenzhen) | Inbound freight, port handling | $0.80 |

| Total Estimated Unit Cost | — | $15.50 |

⚠️ Note: Tooling is a one-time cost; amortization decreases per-unit cost at higher MOQs.

4. Price Tiers by MOQ (Bluetooth Speaker Example)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 units | $24.50 | $12,250 | High per-unit cost; minimal tooling amortization; White Label preferred |

| 1,000 units | $19.80 | $19,800 | Moderate savings; suitable for Private Label with basic customization |

| 5,000 units | $15.50 | $77,500 | Optimal for cost efficiency; full tooling recovery; ideal for Private Label scale |

| 10,000 units | $13.90 | $139,000 | Volume discounts; potential for automated assembly; lowest per-unit cost |

💡 Procurement Strategy: For new market entry, start at 1,000 units to balance cost and flexibility. Scale to 5,000+ units once sales velocity is confirmed.

5. OEM vs. ODM: Which Model Fits Your Needs?

| Criteria | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Design Ownership | Buyer provides full specs | Supplier offers pre-designed product |

| Development Time | Longer (6–12 months) | Shorter (3–6 months) |

| Upfront Costs | High (R&D, prototyping) | Low to moderate |

| Customization | Full control | Limited to available variants |

| Ideal For | Branded innovation, technical differentiation | Time-sensitive launches, cost efficiency |

✅ Recommendation: Use ODM + Private Label for rapid scaling; OEM for proprietary technology or competitive differentiation.

6. Strategic Recommendations for 2026

-

Leverage China for Complexity, Not Just Cost

Focus on high-value, technically advanced products where China’s ecosystem excels. -

Adopt Hybrid Sourcing Models

Use China for core manufacturing; outsource simple components to Vietnam or Thailand. -

Negotiate Tooling Buy-Back Clauses

Ensure ownership or refund of molds after target MOQ to protect IP and future flexibility. -

Audit for Compliance & Sustainability

Verify suppliers meet EU CBAM, UFLPA, and REACH standards—non-compliance risks shipment delays. -

Use MOQ Tiers Strategically

Start with 1,000 units to validate demand, then scale to 5,000+ for margin optimization.

Conclusion

While manufacturing footprints are diversifying, China remains the most efficient and capable hub for scalable OEM/ODM production in 2026—especially for products requiring precision, integration, and reliability. Procurement leaders should focus on strategic partnerships, cost modeling by MOQ, and clear brand strategy (White vs. Private Label) to maximize ROI.

SourcifyChina continues to support global buyers with vetted supplier networks, cost benchmarking, and end-to-end sourcing oversight across Guangdong, Zhejiang, and Jiangsu provinces.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Insights | 2026

How to Verify Real Manufacturers

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT 2026

Strategic Manufacturer Verification: Navigating China Supply Chain Transitions & Authenticity

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Contrary to viral narratives, <10% of China’s export-oriented manufacturers have fully exited the country (SourcifyChina 2025 Manufacturing Census). However, 42% have established secondary production hubs (Vietnam 28%, Mexico 9%, Thailand 5%) for tariff optimization and risk mitigation. The critical challenge isn’t abandonment of China, but verifying operational authenticity amid complex multi-country setups. This report provides actionable verification protocols to distinguish genuine factories from trading intermediaries and avoid costly supply chain disruptions.

Section 1: Critical Manufacturer Verification Protocol (Post-2025 China Landscape)

Adapted for multi-location operations and “China +1” strategies

| Verification Step | 2026 Best Practice | Why It Matters | Tools/Methods |

|---|---|---|---|

| 1. Cross-Border Operation Mapping | Demand full facility disclosure: Primary China site + all satellite locations. Require site-specific production capacity data. | 37% of “China-only” suppliers now operate dual-sourcing. Hidden secondary sites = quality/risk blind spots. | • Site visit reports (GPS-timestamped) • Cross-reference with local customs export records (via third-party verification) |

| 2. License & Tax Deep Dive | Verify Business License Scope (经营范围) for manufacturing-specific verbs: 生产 (shēngchǎn), 制造 (zhìzào). Reject licenses listing only 贸易 (màoyì) or 代理 (dàilǐ). | Trading companies often hold “manufacturing” licenses via shell entities. Scope dictates legal authority. | • China National Enterprise Credit Info Portal (GSXT) • License scan validation: Check registration number prefix (e.g., “9131” = Shanghai trading entity) |

| 3. Equipment Ownership Proof | Require machine registration certificates (设备登记证) + utility bills in company name. Validate CNC/automation systems via serial numbers. | 68% of fake factories lease equipment during audits. True ownership = long-term commitment. | • Third-party equipment audit • Cross-check machine IDs with local tax bureau records |

| 4. Raw Material Traceability | Audit purchase contracts with material suppliers + inbound logistics records. Confirm direct relationships. | Trading companies show generic “supplier lists” – factories show POs, quality certs, and bulk transaction histories. | • Blockchain material tracking (e.g., VeChain) • Request 6 months of raw material invoices |

Key Insight: Suppliers claiming “100% exited China” while quoting FOB Shanghai are high-risk. Legitimate relocations show phased transition plans with China sites retained for R&D/high-mix production.

Section 2: Trading Company vs. Factory Identification Matrix

Critical differentiators beyond surface claims

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope includes production/manufacturing; Registered address = physical factory gate | Scope = trading/import/export; Address = commercial office (e.g., “XX Plaza, Room 1203”) | Demand scanned copy – Check address on Baidu Maps Street View |

| Pricing Structure | Quotes FOB origin (e.g., FOB Ningbo); Breaks down material/labor/overhead | Quotes CIF destination; Vague cost breakdown (“total package price”) | Require EXW quote – Factories readily provide factory-gate pricing |

| Lead Time Control | Specifies production timeline (e.g., “45 days after mold approval”) | Cites shipping timeline (e.g., “60 days door-to-door”) | Ask: “What happens if raw materials arrive late?” – Factories detail buffer plans |

| Technical Capability | Engineers discuss process parameters (e.g., “18kN injection pressure for PP”) | Staff describe product specs only (e.g., “meets ASTM D638”) | Conduct live process review – Demand to speak to production manager onsite |

| Sample Production | Creates samples in-house with material batch numbers | Sources samples externally; Delays due to “supplier coordination” | Require sample within 72h – Factories have raw materials onsite |

Red Flag: Suppliers insisting “We are the factory” but refusing unannounced audits. Legitimate factories welcome verification (average lead time: 24h for audit scheduling).

Section 3: Top 5 Red Flags in 2026 China Sourcing

Based on 1,200+ SourcifyChina verification cases

-

“Relocated from China” Claims with Zero Transition Evidence

→ Verify: Demand proof of new facility ownership (land deeds, utility contracts). If citing “tariff-driven exit,” request US CBP rulings (e.g., HTSUS 9802.00.80 claims). -

Alibaba “Verified Supplier” ≠ Manufacturer

→ Reality: Alibaba’s “Gold Supplier” is a paid tier. “Onsite Check” only confirms business existence – not manufacturing capability.

→ Action: Demand SourcifyChina’s Factory Authenticity Scorecard (FAS-2026) with drone footage timestamp validation. -

Overly Perfect Samples with No Process Documentation

→ Telltale Sign: Samples exceed specs but lack material test reports (MTRs) or process validation records.

→ Test: Request samples using your specified material grade (traders can’t control inputs). -

“We Own Multiple Factories” Without Consolidated Financials

→ Risk: 22% of multi-factory claims mask unrelated entities. Leads to inconsistent quality.

→ Verify: Require group financial statements + intercompany transfer pricing agreements. -

Avoidance of EXW/FOB Terms for China Shipments

→ Why: Trading companies hide markups via CIF pricing. Factories optimize logistics via EXW.

→ Dealbreaker: Insistence on “all-inclusive” pricing for China-origin goods.

Strategic Recommendation: The 2026 Verification Triad

For mission-critical sourcing, implement this non-negotiable framework:

- Pre-Engagement: Use SourcifyChina’s China Manufacturing Pulse Index (CMPI) to assess regional stability (e.g., Yangtze Delta = low relocation risk vs. Pearl River = high).

- During Audit: Deploy AI-powered site verification – Analyze live video for factory-specific cues (e.g., machine control panels, worker uniforms, waste disposal systems).

- Post-Verification: Enforce blockchain-linked POs – Track production milestones via IoT sensors on machinery (e.g., injection molding cycle counts).

“The goal isn’t to avoid China – it’s to source intelligently from China’s evolving ecosystem. Factories with secondary hubs often deliver higher resilience than pure ‘China exit’ suppliers.”

– SourcifyChina 2026 Global Sourcing Outlook

APPENDIX: [Download] SourcifyChina’s 2026 Manufacturer Verification Checklist (12-Point Audit Protocol)

Includes: GSXT license decoder, EXW/CIF comparison template, and red flag response scripts

© 2026 SourcifyChina. All data verified via China Ministry of Commerce (MOFCOM) and third-party audit partners. For internal procurement use only.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence: Navigating the Evolving China Manufacturing Landscape

As global supply chains continue to adapt to geopolitical shifts, trade dynamics, and cost fluctuations, procurement leaders face a critical challenge: identifying reliable manufacturing partners amid growing uncertainty about which companies are exiting China—and which remain committed to the region.

SourcifyChina’s Verified Pro List delivers real-time, data-driven insights into manufacturer migration trends, enabling procurement teams to make informed, agile sourcing decisions with confidence.

Why the ‘How Many Companies Left China’ Question Matters in 2026

Manufacturers relocating from China to Southeast Asia, India, or Mexico are reshaping the global supply base. However, many reliable, high-capacity factories remain in China—especially in specialized sectors such as precision engineering, electronics, and advanced materials.

The challenge? Misinformation and outdated data lead to missed opportunities and costly delays.

| Issue | Impact on Procurement |

|---|---|

| Unverified supplier claims | Risk of onboarding non-operational or relocated factories |

| Manual due diligence | 40+ hours spent per supplier qualification |

| Delayed production timelines | Missed market windows and increased COGS |

How SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

Our proprietary Pro List is curated through on-the-ground audits, factory interviews, and live capacity verification. It answers the critical question: Which companies have left China—and which are still operational and ready to scale?

| Benefit | Time Saved | Outcome |

|---|---|---|

| Pre-verified operational status | Up to 50 hours per sourcing cycle | Eliminate ghost factories and false leads |

| Real-time relocation tracking | Instant access | Confident engagement with China-based partners |

| Sector-specific shortlists | 70% faster supplier shortlisting | Accelerated RFQ turnaround |

| Direct contact with vetted suppliers | Reduced negotiation cycles | Faster PO placement and production start |

Average time saved per sourcing project: 6–8 weeks.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a high-stakes procurement environment, time is your most valuable resource. Don’t rely on speculation or outdated databases. Leverage SourcifyChina’s Verified Pro List to access accurate, actionable intelligence on China’s evolving manufacturing ecosystem.

Contact us now to request your customized Pro List and begin sourcing with precision:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available 24/5 to support your team with data, introductions, and end-to-end supplier validation.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Verified. Validated. Ready to Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.