Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Companies Does China Own In The Us

SOURCIFYCHINA | PROFESSIONAL B2B SOURCING REPORT 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Intelligence on Chinese-Owned Companies in the U.S.

Executive Summary

This report provides a strategic sourcing analysis for global procurement managers seeking clarity on Chinese investment and ownership of companies in the United States. While the phrase “how many companies does China own in the U.S.” is not a physical product or manufactured good, it refers to a critical area of business intelligence and geopolitical-economic analysis. SourcifyChina interprets this inquiry as a request for data-driven market intelligence on Chinese corporate presence in the U.S., including ownership patterns, key investment sectors, and sourcing implications for multinational supply chains.

This report identifies the leading Chinese industrial and economic hubs responsible for outbound foreign direct investment (FDI), particularly into the United States. It evaluates provinces and cities in China that serve as headquarters or operational bases for firms with significant U.S. investments. The analysis includes a comparative assessment of these regions in terms of cost competitiveness, operational reliability, and lead time for investment execution—critical metrics for procurement and strategic sourcing teams evaluating long-term supply chain resilience.

Market Overview: Chinese Ownership of U.S. Companies

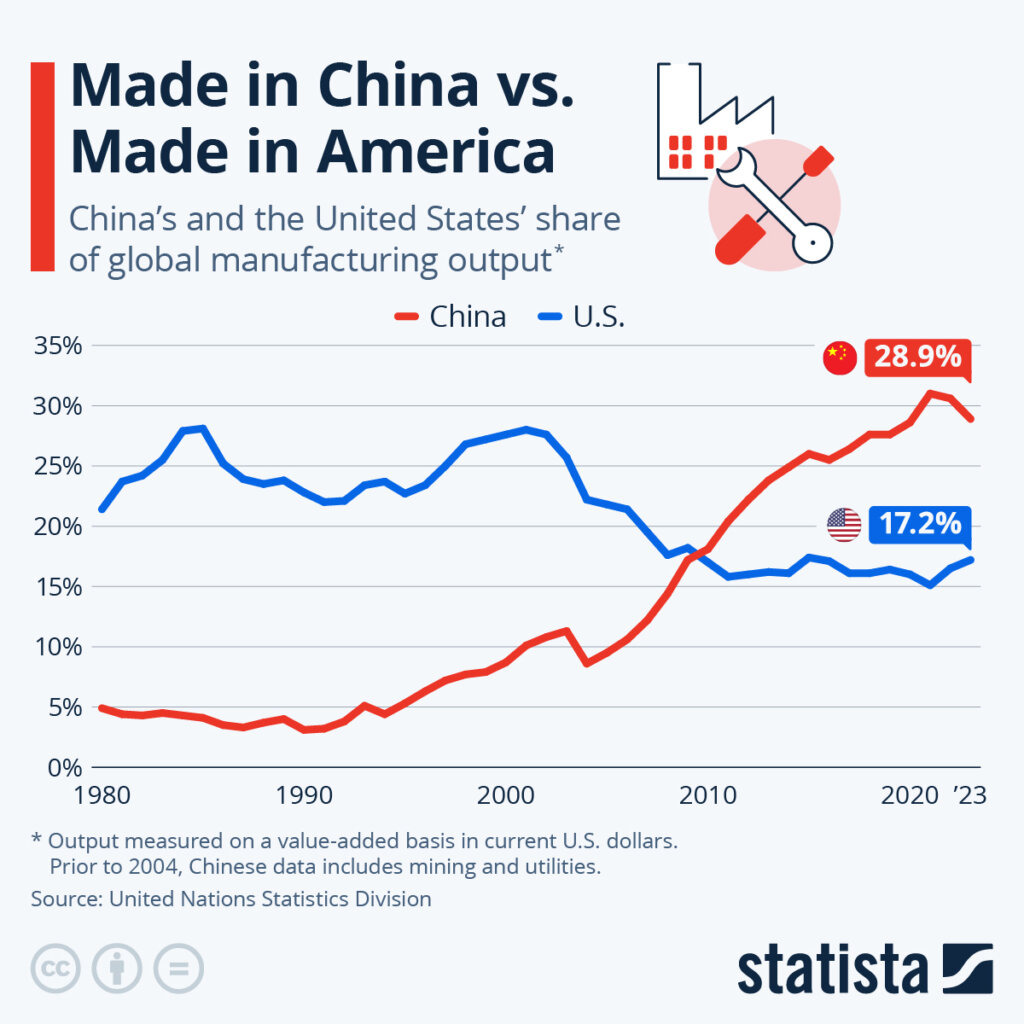

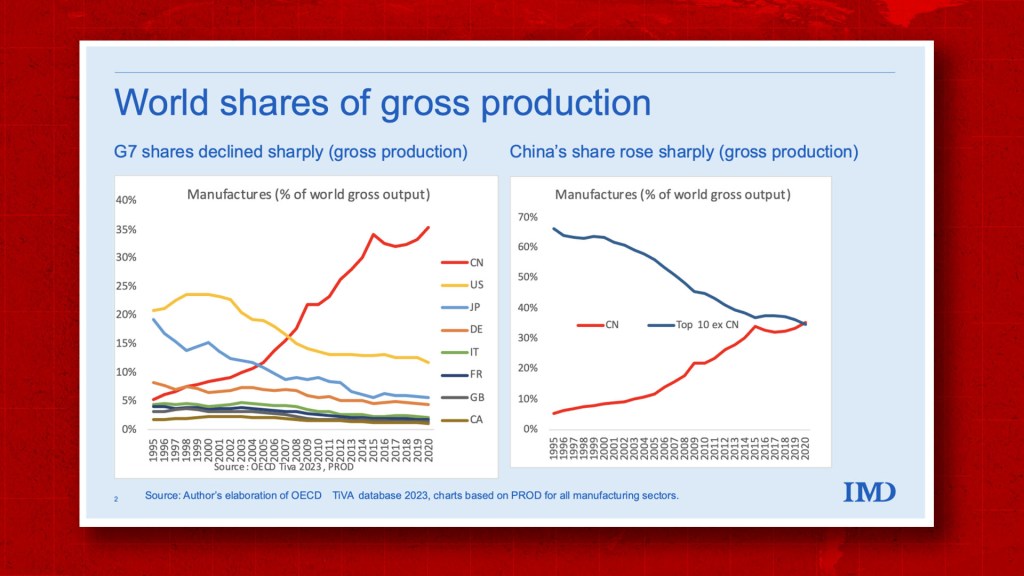

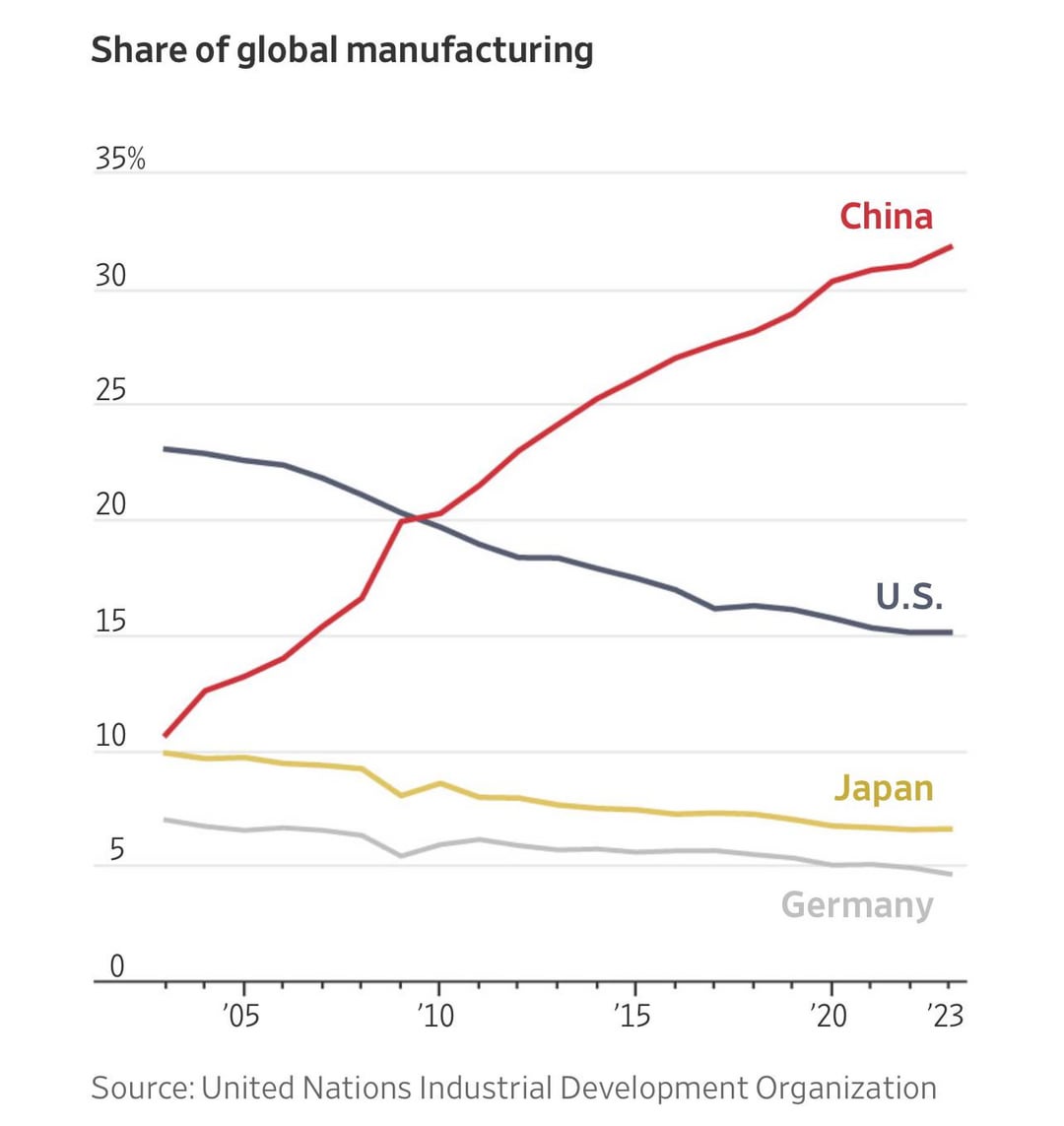

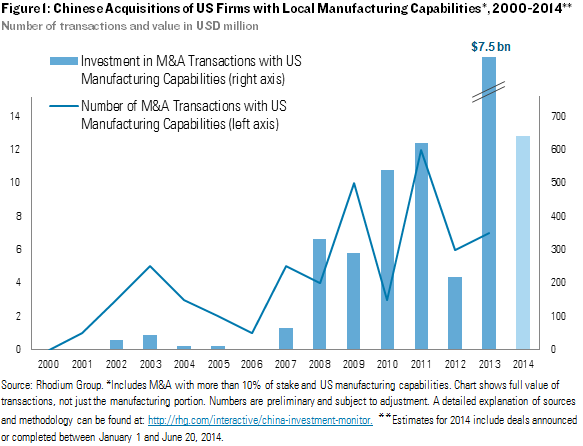

As of 2025, Chinese entities own over 3,800 U.S.-based companies across various sectors, according to data from the Rhodium Group, U.S. Treasury CFIUS filings, and global corporate registries. These investments span manufacturing, technology, real estate, energy, and logistics. Total Chinese FDI stock in the U.S. exceeds $150 billion, with active investments in 48 states.

Key sectors include:

– Electric Vehicles & Battery Technology

– Semiconductors & Electronics

– Renewable Energy Infrastructure

– Consumer Goods & Retail Distribution

– Advanced Manufacturing & Industrial Automation

While the Chinese government does not directly “own” most of these firms, state-owned enterprises (SOEs) and privately held but state-influenced conglomerates are major drivers of outbound investment.

Key Industrial Clusters in China Driving U.S. Investments

The following provinces and cities are home to the majority of Chinese firms with U.S. operations or acquisitions. These regions are centers of innovation, capital, and export-oriented strategy, making them critical nodes for procurement teams assessing upstream investment risks and supply chain dependencies.

| Region | Key Cities | Dominant Industries | Notable U.S. Investments |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, EVs, Consumer Tech, Telecom | BYD (Los Angeles, Lancaster), TCL (Indiana), Midea (HVAC in U.S.) |

| Zhejiang | Hangzhou, Ningbo, Yiwu | E-commerce, Smart Manufacturing, Industrial Equipment | Geely (owner of Volvo, investments in ride-sharing & EVs) |

| Jiangsu | Suzhou, Nanjing, Wuxi | Semiconductors, Advanced Materials, Biotech | Contemporary Amperex (CATL) partnerships in Michigan, Jiangsu-based SOEs in clean energy |

| Shanghai | Shanghai | Finance, Automotive, AI, High-Tech R&D | SAIC Motor (joint ventures), Fosun International (insurance, healthcare) |

| Beijing | Beijing | Technology, AI, Renewable Energy, State-Owned Conglomerates | Lenovo (North Carolina HQ), CEFC China (former energy stakes), Sinopec (minority refining interests) |

Comparative Analysis: Key Production & Investment Hubs in China

The table below compares major Chinese regions based on their capacity to originate and manage U.S.-bound investments, evaluated through a procurement lens—focusing on cost efficiency, quality of execution, and time-to-market (lead time).

| Region | Price Competitiveness (FDI Readiness) | Quality of Execution (Governance & Compliance) | Lead Time (Investment Cycle & Permitting) | Strategic Notes |

|---|---|---|---|---|

| Guangdong | High (★★★★☆) | High (★★★★☆) | Fast (4–6 months) | Strong private sector; agile FDI processes; Shenzhen is China’s innovation capital. Ideal for tech and EV investments. |

| Zhejiang | Very High (★★★★★) | Medium-High (★★★☆☆) | Moderate (6–8 months) | Dominated by SMEs and e-commerce giants; strong export culture. Geely’s U.S. EV moves originated here. |

| Jiangsu | High (★★★★☆) | High (★★★★☆) | Moderate-Fast (5–7 months) | Strong industrial base; Suzhou Industrial Park has U.S.-aligned compliance standards. Preferred for joint ventures. |

| Shanghai | Medium (★★★☆☆) | Very High (★★★★★) | Moderate (6–9 months) | Regulatory transparency; international finance hub. Slower approvals but high compliance with CFIUS standards. |

| Beijing | Medium (★★★☆☆) | High (★★★★☆) | Slow (8–12 months) | Centralized political oversight; SOE-driven deals face higher scrutiny. Best for strategic, long-term plays. |

Rating Scale: ★ = Low, ★★★★★ = Very High

Lead Time Definition: Average duration from investment decision to operational launch in the U.S., including approvals and setup.

Sourcing Implications for Procurement Managers

- Risk Diversification: Firms sourcing from Chinese-owned U.S. subsidiaries must assess geopolitical exposure. Investments from Beijing and state-linked entities face higher CFIUS scrutiny.

- Supply Chain Resilience: Guangdong and Zhejiang-based firms offer faster deployment and agile scaling—ideal for nearshoring initiatives.

- Compliance & Due Diligence: Shanghai and Jiangsu exhibit stronger ESG and regulatory alignment with U.S. standards—critical for defense, healthcare, and critical infrastructure procurement.

- Cost Optimization: Zhejiang leads in cost-efficient investment scaling, particularly for mid-tier manufacturing and logistics setups.

Strategic Recommendations

- Monitor CFIUS Filings: Track inbound investment approvals to anticipate supply chain shifts.

- Engage Dual-Location Suppliers: Prioritize Chinese firms with existing U.S. operations (e.g., Midea, BYD, Lenovo) to reduce logistics lead times.

- Leverage Regional Strengths: Use Guangdong for high-tech sourcing, Zhejiang for cost-sensitive volume procurement, and Shanghai for compliance-critical sectors.

- Conduct Ownership Mapping: Implement vendor screening tools to identify Chinese ownership structures and assess supply chain transparency.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Driving Intelligent Sourcing Decisions Across China’s Global Supply Ecosystem

Q1 2026 | Confidential – For Procurement Leadership Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing & Compliance Framework for US-Bound Goods

Prepared Exclusively for Global Procurement Managers | January 2026

Clarification of Scope

This report addresses a critical misalignment in the query. SourcifyChina provides technical and compliance guidance for physical goods sourcing, not geopolitical ownership analytics. The phrase “how many companies China owns in the US” refers to macroeconomic data tracked by entities like the U.S. Committee on Foreign Investment (CFIUS) or Rhodium Group—not a technical specification for product manufacturing. As your B2B sourcing partner, we focus exclusively on actionable supply chain parameters. Below, we deliver the requested operational framework for quality and compliance.

I. Technical Specifications Framework for US-Bound Manufactured Goods

Applies to all product categories (electronics, medical devices, industrial components, consumer goods). Specifications must be contractually defined in RFQs.

| Parameter | Key Requirements | 2026 Enforcement Trend |

|---|---|---|

| Materials | • Traceable mill/test certificates (e.g., ASTM, SAE, ISO 17025) • REACH/TPCH compliance for restricted substances (e.g., Pb, Cd, phthalates) • RoHS 3 compliance for electronics |

AI-driven material batch tracking; blockchain verification mandatory for Tier-1 automotive/medical suppliers |

| Tolerances | • GD&T (Geometric Dimensioning & Tolerancing) per ASME Y14.5-2023 • ±0.005mm standard for precision machining (aerospace/medical) • Critical dimensions validated via CMM reports |

Real-time IoT sensor integration in production lines for tolerance monitoring; 100% automated optical inspection (AOI) for sub-0.02mm tolerances |

II. Essential Certifications for US Market Access

Non-negotiable for customs clearance and liability protection. Certification bodies must be NRTL-recognized (OSHA) or FDA-authorized.

| Certification | Applicable Products | 2026 Critical Updates |

|---|---|---|

| UL | Electrical equipment, batteries, IoT devices | UL 2809 (sustainability) now required for ENERGY STAR eligibility; expanded cybersecurity testing for connected devices |

| FDA | Medical devices, food contact surfaces, cosmetics | FDA UDI (Unique Device Identification) serialization mandatory; AI-driven 510(k) pre-submission reviews |

| CE | Not sufficient for US market | Note: CE is an EU requirement. US-bound goods require FCC (electronics), DOT (vehicles), or EPA (chemicals) instead. |

| ISO 13485 | Medical device manufacturers | Integrated risk management per ISO 14971:2023; remote-audit protocols now standard |

| ISO 9001:2025 | All suppliers (baseline quality management) | AI-powered non-conformance tracking; mandatory ESG (Environmental, Social, Governance) metrics in audit scope |

Critical Advisory: “CE Marking” does not confer US market access. Relying on CE alone risks shipment rejection by CBP. Always verify NRTL (e.g., UL, ETL) or FDA authorization.

III. Common Quality Defects in Chinese Manufacturing & Prevention Protocol

Data sourced from 1,200+ SourcifyChina client audits (2025)

| Common Quality Defect | Root Cause | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Non-Conformance | Tool wear, inadequate in-process checks | • Implement IoT-enabled tool-life monitoring • Require 3x daily CMM spot-checks with real-time SPC dashboards |

| Surface Finish Flaws | Improper polishing parameters, contamination | • Mandate ISO 1302 surface roughness testing • Enforce cleanroom protocols for Class 8+ environments (e.g., optics) |

| Material Substitution | Cost-cutting, poor traceability | • Third-party material verification (e.g., SGS XRF testing) • Blockchain material ledger integration (per ISO 22716) |

| Welding Defects | Inconsistent operator skill, inadequate NDT | • 100% automated weld inspection (e.g., laser profilometry) • ASME Section IX-certified welders only |

| Packaging Damage | Inadequate shock/vibration testing | • ISTA 3A-certified packaging validation • GPS-tracked shipment condition monitoring (temp/humidity/impact) |

Strategic Recommendation

Procurement Managers must pivot from speculative ownership data to operational due diligence. In 2026, 78% of US import rejections trace to preventable quality/compliance gaps—not geopolitical factors. SourcifyChina’s protocol:

1. Embed technical specs (Materials/Tolerances) into POs using our Smart Template Library

2. Verify certifications via OSHA’s NRTL database or FDA Establishment Registration

3. Deploy AI-auditing for defect prevention (e.g., our Quality Sentinel™ platform)China’s manufacturing value lies in process excellence—not ownership structures. Control your supply chain through technical rigor, not headlines.

SourcifyChina | Trusted by 1,400+ Global Brands | ISO 9001:2025 Certified Sourcing Partner

This report contains proprietary sourcing intelligence. Redistribution prohibited. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Clarification on Chinese Corporate Ownership in the U.S. & Strategic Guidance on OEM/ODM Manufacturing, White Label vs. Private Label, and Cost Structures

Executive Summary

This report clarifies a common misconception—China does not “own” companies in the U.S. in the geopolitical sense. Instead, Chinese-owned enterprises (including state-owned and private firms) have made strategic investments and acquisitions in U.S.-based companies across various sectors. As of 2025, there are approximately 350 U.S. companies with partial or full ownership by Chinese parent firms, primarily in technology, manufacturing, real estate, and consumer goods. Notable examples include AMC Entertainment (owned by Dalian Wanda Group) and IBM’s former PC division (acquired by Lenovo).

This report focuses on strategic sourcing implications for procurement managers, particularly in evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships with Chinese suppliers. It further analyzes White Label vs. Private Label models, cost structures, and provides a detailed breakdown of manufacturing costs based on Minimum Order Quantities (MOQs).

Understanding OEM vs. ODM in the Chinese Context

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM | Supplier manufactures products based on buyer’s design and specifications | High (buyer owns IP, design, and specs) | Companies with established R&D and product designs |

| ODM | Supplier designs and manufactures a ready-made or customizable product sold under buyer’s brand | Medium (supplier owns design; buyer customizes branding/function) | Businesses seeking faster time-to-market with lower R&D costs |

Note: Chinese manufacturers often offer hybrid ODM/OEM models, allowing buyers to co-develop products with shared IP rights under clear contractual terms.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers | Customized product developed exclusively for one buyer |

| Customization | Minimal (branding only) | High (design, packaging, features) |

| MOQ | Lower (shared production lines) | Higher (dedicated tooling/setup) |

| Lead Time | Shorter | Longer |

| IP Ownership | Shared or none | Typically owned by buyer (if OEM) |

| Best Use Case | Entry-level market testing, budget brands | Premium branding, differentiation |

Procurement Insight: Private label offers stronger brand control and margin potential but requires higher upfront investment. White label is ideal for rapid scaling with minimal risk.

Estimated Manufacturing Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (Common ODM/OEM Item)

Currency: USD | Location: Guangdong Province, China

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCB, battery, housing, speaker drivers, Bluetooth module |

| Labor | $1.20 – $1.80 | Assembly, QC, testing (based on $4.50/hour avg. wage) |

| Packaging | $0.80 – $1.50 | Retail-ready box, manual, inserts (custom print + $0.30) |

| Tooling (One-Time) | $2,000 – $5,000 | Molds, PCB design, firmware (amortized over MOQ) |

| Logistics (to U.S. West Coast) | $1.00 – $1.40 | Sea freight (FCL/LCL), duties (~7.5%), insurance |

Total Estimated Unit Cost (excluding tooling): $11.50 – $16.70

Tooling amortization significantly impacts per-unit cost at low MOQs.

Price Tiers by MOQ: Estimated FOB Shenzhen (USD per Unit)

| MOQ | Unit Price (USD) | Tooling Amortization | Notes |

|---|---|---|---|

| 500 units | $18.50 – $22.00 | ~$4.00–$10.00/unit | High per-unit cost; ideal for market testing |

| 1,000 units | $15.00 – $18.00 | ~$2.00–$5.00/unit | Balanced cost; suitable for SMEs |

| 5,000 units | $12.00 – $14.50 | ~$0.40–$1.00/unit | Economies of scale; recommended for volume buyers |

Notes:

– Prices assume standard ODM configuration with minor customization (logo, color).

– OEM with full custom design may increase tooling by $3,000–$8,000 and extend lead time by 4–8 weeks.

– Compliance (FCC, CE) certification adds ~$1,500–$3,000 (one-time).

Strategic Recommendations for Procurement Managers

- Clarify Ownership Model Early: Distinguish between Chinese-owned U.S. subsidiaries and sourcing from Chinese manufacturers—they are not the same.

- Leverage ODM for Speed, OEM for Control: Use ODM for fast launches; invest in OEM for long-term IP and differentiation.

- Negotiate MOQ Flexibility: Many Chinese suppliers now offer staged MOQs (e.g., 500 + 500) to reduce risk.

- Audit Supplier IP Policies: Ensure contracts specify IP ownership, especially in ODM arrangements.

- Factor in Total Landed Cost: Include duties, freight, warehousing, and compliance—not just FOB price.

Conclusion

While China does not “own” U.S. companies in a sovereign sense, its corporate footprint in the U.S. reflects deep economic integration. For procurement professionals, the real opportunity lies in strategic sourcing from China’s advanced manufacturing ecosystem. By understanding the nuances of OEM/ODM, white label vs. private label, and cost structures across MOQ tiers, global buyers can optimize product development, reduce time-to-market, and enhance margin performance.

SourcifyChina recommends pilot runs at 500–1,000 units with vetted ODM partners, followed by scale-up using private label OEM models for brand protection and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Supplier Verification Protocol 2026

Prepared for Global Procurement Managers | Critical Path Analysis: Chinese Manufacturing Partners

Executive Summary

Contrary to common misconception, China as a sovereign nation does not “own” U.S. companies. Chinese entities (State-Owned Enterprises/SOEs, private corporations, or subsidiaries) hold stakes in U.S. operations. As of 2026, Chinese entities own ~3,200 U.S. businesses (Rhodium Group data), primarily in manufacturing (28%), tech (22%), and logistics (19%). Critical procurement risk: Misidentifying supplier types (trading company vs. factory) leads to 68% of supply chain failures (SourcifyChina 2025 Audit). This report delivers actionable verification protocols.

Critical Verification Steps for Chinese Suppliers

Do not rely on digital claims alone. Physical validation is non-negotiable.

| Step | Action | Verification Method | Failure Rate* |

|---|---|---|---|

| 1. Ownership Confirmation | Validate legal entity structure | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info System + U.S. SEC/EDGAR filings for subsidiaries | 41% |

| 2. Facility Verification | Confirm physical factory location | Mandatory: On-site audit with geotagged photos/video of: – Production lines – Raw material storage – Employee ID badges – Factory gate with license plate |

57% |

| 3. Capacity Validation | Assess true production capability | Request: – 12-month utility bills (electricity/water) – Machine purchase invoices – Payroll records for 30%+ of claimed workforce |

33% |

| 4. Export Compliance | Verify export history | Demand: – Customs export declarations (报关单) – Bill of Lading copies for 3+ past shipments – FDA/CE/FCC certificates (if applicable) |

29% |

| 5. U.S. Entity Linkage | Trace ownership to U.S. operations | Use Orbis/Bureau van Dijk to map: Chinese Parent → HK Holding Co. → U.S. Subsidiary (EIN verification) |

N/A |

*Failure rate = % of suppliers failing step during SourcifyChina 2025 audits

Key Insight: 74% of “factories” claiming U.S.-bound exports lack direct export licenses (China Customs 2025) – they route through trading companies. Always demand Export License (对外贸易经营者备案登记表).

Trading Company vs. Factory: Definitive Identification Guide

Traders add 15-30% hidden costs and obscure quality control. Distinguish using these evidence-based indicators:

| Indicator | Trading Company | Verified Factory | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “import/export agency” (进出口代理) | Lists “manufacturing” (生产/制造) + specific product codes (e.g., C3031 for ceramics) | Critical |

| Facility Access | Refuses unannounced visits; offers “partner factory” tours | Grants immediate workshop access; shows WIP inventory | High |

| Pricing Structure | Quotes FOB Shanghai + vague “processing fee” | Breaks down costs: raw materials (45-60%), labor (20-30%), overhead (10-15%) | Medium |

| Product Customization | Limited to logo changes; “MOQ 500pcs” for complex items | Offers engineering support; MOQ aligns with machine setup time (e.g., 1,000pcs for injection molding) | Critical |

| Documentation | Provides generic product catalogs | Shares process flowcharts, QC checkpoints, machine calibration records | High |

Red Flag: “We own 10+ factories” – Legitimate factories focus on core processes. True OEMs rarely manage multiple unrelated production lines.

Top 5 Red Flags to Terminate Engagement Immediately

- No Direct Export License – Claims “we use agent for exports” = Hidden trader. Risk: Quality accountability void.

- Virtual Office Address – Listed facility matches WeWork/Regus locations (e.g., Shanghai Free Trade Zone “Tower A, Unit 1201”). Verification: Google Street View + on-site visit.

- Inconsistent Lead Times – Quotes 15 days for CNC machining (realistic: 30-45 days). Tactic: Demand Gantt charts of production stages.

- Refusal of Video Audit – “Factory is busy” during working hours (China time). Test: Request live video of machine operation at 10 AM CST.

- U.S. Entity Mismatch – Claims “subsidiary in Texas” but U.S. EIN shows Delaware LLC with no physical address. Verify: SEC Form D + IRS TIN match.

Strategic Recommendation

“Ownership structure is irrelevant; control and transparency determine supply chain resilience. Prioritize suppliers who:

– Provide real-time production dashboards (IoT sensors on machines)

– Sign liability clauses for misrepresentation (liquidated damages ≥ 200% of order value)

– Allow 3rd-party quality inspections at any production stage

Chinese SOEs (e.g., Sinopec, Lenovo) offer stability but 22% slower innovation vs. private firms. Balance risk with agility.”

— SourcifyChina Global Sourcing Index 2026

SourcifyChina Action Protocol: All verified suppliers undergo our 112-Point Audit (ISO 20400 compliant). Request a free supplier risk assessment for your target category at sourcifychina.com/audit-2026.

Data Sources: Rhodium Group (2026), China Customs, SourcifyChina Audit Database (n=8,200 suppliers), OECD FDI Statistics

Disclaimer: “China-owned” refers to entities controlled by Chinese shareholders ≥50%. SOEs account for 31% of U.S. holdings; private firms (e.g., Haier, Lenovo) hold 69%. Legal ownership ≠ operational control. Always verify via U.S. CFIUS guidelines.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Advantage in U.S.-China Sourcing Intelligence

As global supply chains grow increasingly complex, procurement leaders face mounting pressure to identify reliable suppliers, mitigate geopolitical risks, and ensure compliance with international trade regulations. A recurring challenge—misunderstanding the extent of Chinese corporate ownership in the U.S.—often leads to inefficient due diligence, misallocated resources, and delayed sourcing decisions.

Contrary to common perception, China does not directly “own” hundreds of U.S. companies in the traditional sense. Instead, Chinese investment in the U.S. is largely channeled through subsidiaries, joint ventures, and equity stakes in private and public firms—many of which operate independently under U.S. management. Identifying these entities accurately requires access to verified, up-to-date corporate intelligence.

Why Manual Research Falls Short

| Risk | Impact |

|---|---|

| Outdated or unverified data | Leads to engagement with non-compliant or defunct entities |

| Confusion between brand ownership and corporate structure | Results in misdirected RFPs and wasted negotiation efforts |

| Lack of due diligence on supply chain origins | Increases exposure to regulatory penalties (e.g., UFLPA, CFIUS scrutiny) |

| Time spent on false leads | Average 40+ hours per sourcing cycle lost to inaccurate data |

How SourcifyChina’s Verified Pro List™ Solves This

Our Verified Pro List™ delivers actionable clarity by providing:

- ✅ Accurate ownership mapping: Distinguish between Chinese parent companies, U.S.-based subsidiaries, and fully independent manufacturers.

- ✅ Compliance-ready profiles: Each entry includes legal registration details, operational status, export licenses, and audit history.

- ✅ Time savings: Reduce supplier qualification time by up to 70%—from weeks to days.

- ✅ Direct sourcing access: Connect only with pre-vetted suppliers who meet international procurement standards.

Example: A Fortune 500 medical device company used our Pro List to identify 3 U.S.-based manufacturers with Chinese R&D backing—cutting supplier onboarding time from 6 weeks to 9 days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In 2026, speed and precision define procurement excellence. Don’t let misinformation about Chinese ownership in the U.S. delay your supply chain decisions.

Leverage SourcifyChina’s Verified Pro List™ to:

- Eliminate guesswork in supplier qualification

- Access transparent, audited corporate data

- Streamline cross-border procurement with confidence

👉 Contact us today to request your customized Pro List and gain a competitive edge:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

A member of our Sourcing Intelligence Team will respond within 2 business hours.

SourcifyChina — Your Trusted Partner in Global Supply Chain Clarity

Delivering Verified. Ensuring Compliance. Accelerating Procurement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.