Sourcing Guide Contents

Industrial Clusters: Where to Source How Many Companies Does China Own In America

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis — Sourcing Intelligence on Chinese-Owned Companies in the United States

Date: April 5, 2026

Executive Summary

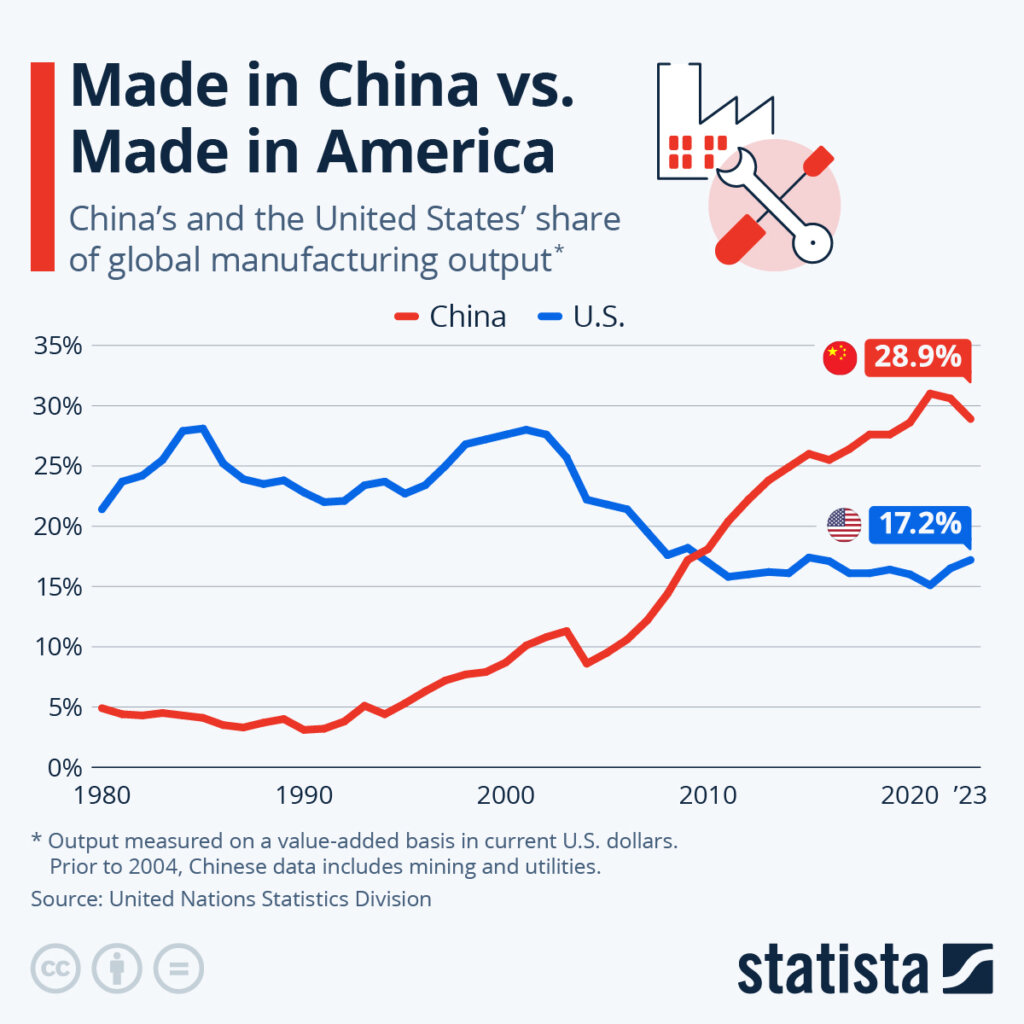

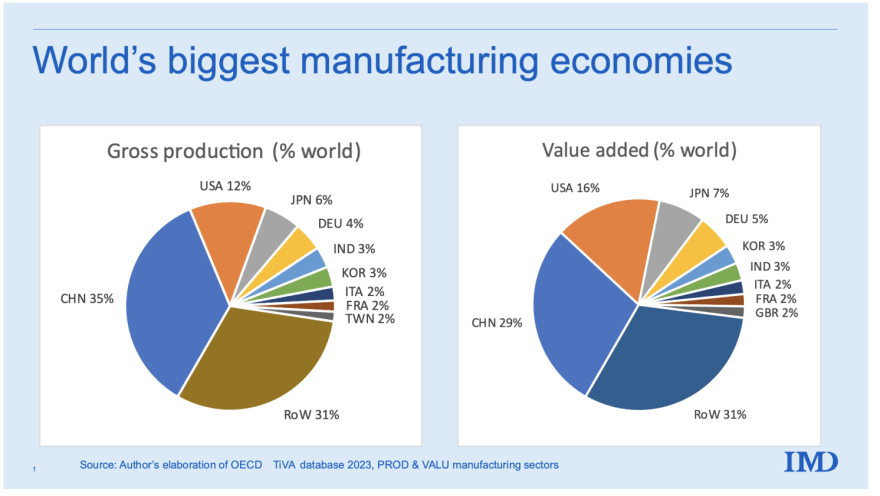

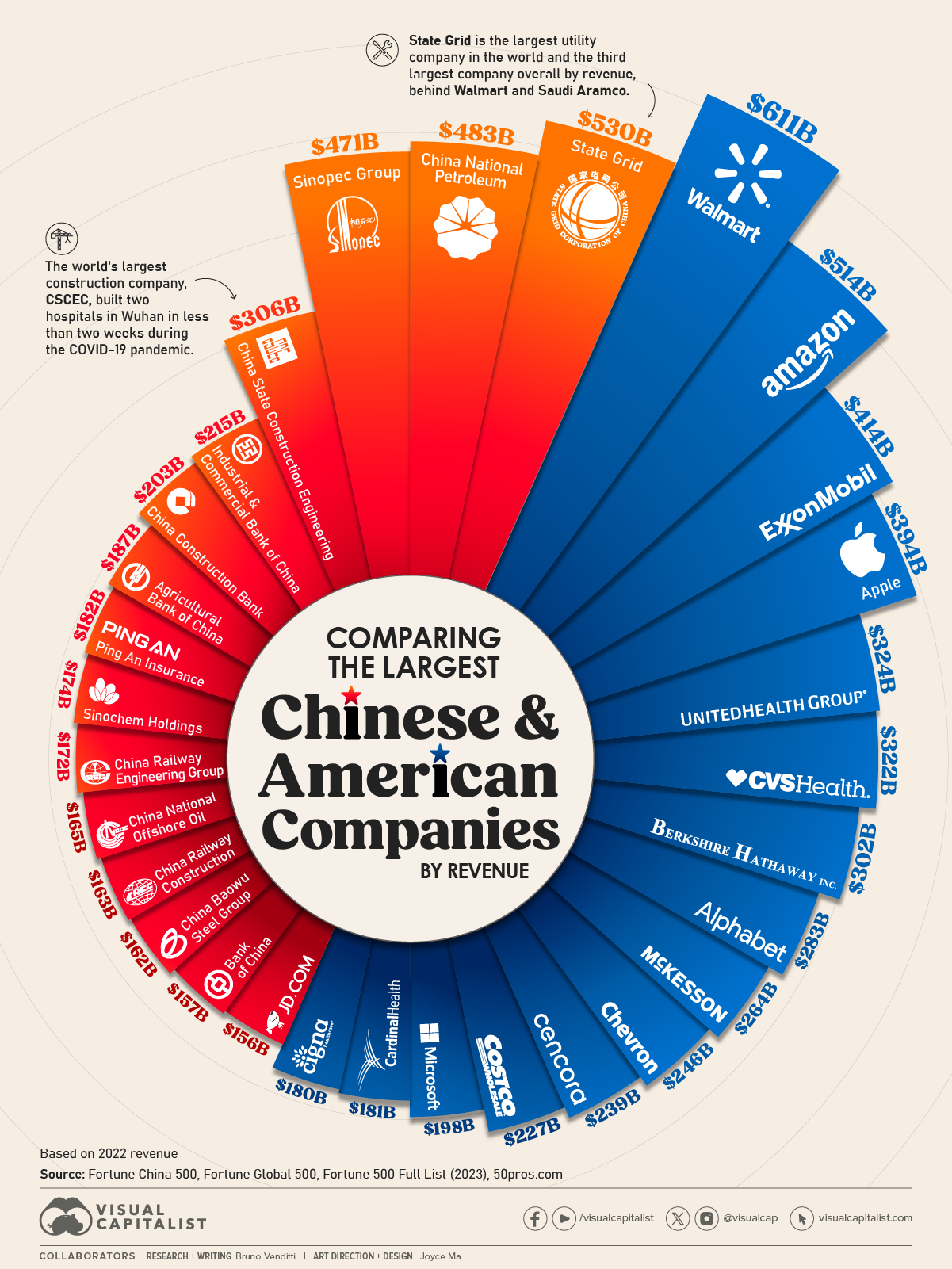

This report provides a strategic analysis for global procurement professionals seeking clarity on the extent of Chinese corporate ownership in the United States and the industrial capabilities within China that support such international expansion. While the query “how many companies does China own in America” is commonly misunderstood, it is critical to distinguish between state-owned enterprises (SOEs), privately owned Chinese firms, and foreign subsidiaries operating in the U.S. China does not “own” American companies in a nationalized sense; rather, Chinese corporations—both public and private—acquire or establish U.S.-based entities through foreign direct investment (FDI).

This report analyzes the industrial and regional manufacturing ecosystems in China that enable Chinese firms to scale globally, including their ability to fund and manage overseas operations. It identifies key provincial and municipal clusters responsible for producing high-value goods and services that underpin the financial strength and technological capacity of Chinese multinationals investing in the U.S.

Clarification: “How Many Companies Does China Own in America?”

China does not directly “own” U.S. companies as a nation. Instead:

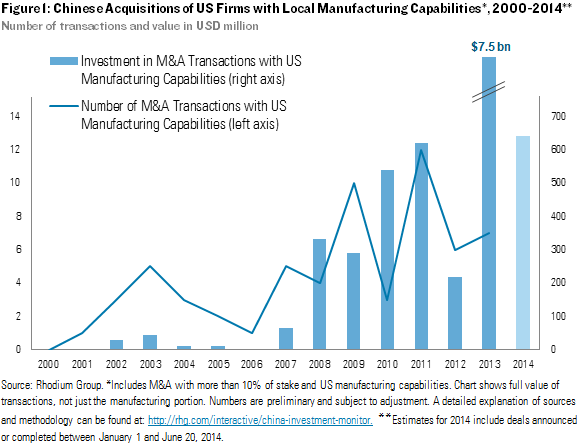

- Chinese corporations (e.g., Lenovo, Haier, Geely, Fuyao Glass) have acquired or established over 3,500 subsidiaries and joint ventures in the United States as of 2025 (Rhodium Group, U.S. Treasury CFIUS data).

- These companies span sectors including automotive, electronics, renewable energy, and heavy machinery.

- Total cumulative Chinese FDI in the U.S. exceeds $120 billion since 2005, with a slowdown post-2018 due to regulatory scrutiny.

✅ Key Insight: The capacity of Chinese firms to acquire U.S. assets stems from their domestic manufacturing strength, profitability, and supply chain integration—rooted in specific industrial clusters across China.

Key Industrial Clusters Fueling Chinese Global Expansion

The following provinces and cities host high concentrations of export-oriented, innovation-driven manufacturers whose success enables overseas investment:

| Region | Key Industries | Notable Companies (Examples) | Role in U.S. Expansion |

|---|---|---|---|

| Guangdong | Electronics, Telecom, Consumer Goods, EVs | Huawei, TCL, Midea, BYD | High export revenue funds U.S. acquisitions; strong private-sector innovation |

| Zhejiang | Machinery, Textiles, E-commerce, Smart Manufacturing | Geely, Alibaba (cloud/logistics), Supor | Private capital drives M&A (e.g., Geely’s Volvo/USA plants) |

| Jiangsu | Advanced Materials, Semiconductors, Industrial Tech | Suntech, NIO, Sinochem | R&D-intensive firms expand U.S. presence for tech access |

| Shanghai | Automotive, AI, Financial Services, Biotech | SAIC Motor, Yitu Tech, Fosun International | Financial and tech hubs support cross-border investment |

| Shandong | Heavy Industry, Petrochemicals, Agriculture | Haier, Sinochem, Weichai | SOEs and large private firms acquire U.S. industrial assets |

Comparative Analysis: Key Production Regions in China

The table below evaluates the core manufacturing regions based on criteria critical to procurement strategy. While these regions do not “produce” ownership per se, they produce the industrial capacity and capital that enable Chinese firms to acquire and operate U.S. businesses.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Export Ready) | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | High (economies of scale) | High (Tier 1 suppliers for Apple, Tesla) | 30–45 days | Proximity to Shenzhen/Hong Kong ports; strongest electronics ecosystem |

| Zhejiang | Moderate to High | High (premium machinery & home goods) | 35–50 days | Agile SMEs; strong private capital; e-commerce integration |

| Jiangsu | Moderate (higher labor costs) | Very High (semiconductors, precision parts) | 40–60 days | Advanced R&D close to Shanghai; strong in green tech |

| Shanghai | Lower (premium pricing) | Very High (automotive, AI, medtech) | 45–65 days | Talent density; financial access; global partnerships |

| Shandong | High (bulk/industrial) | Moderate to High (industrial scale) | 50–70 days | SOE-driven; strong in heavy equipment, appliances |

💡 Procurement Insight: Firms based in Guangdong and Zhejiang are most active in U.S. acquisitions due to higher profitability, export volume, and private-sector agility.

Strategic Recommendations for Procurement Managers

-

Map Supplier Origins

Identify whether your Chinese suppliers are based in high-capacity clusters (e.g., Guangdong, Zhejiang). These firms are more likely to have U.S. subsidiaries or partnerships, enabling faster domestic fulfillment. -

Leverage Dual-Location Capabilities

Prioritize suppliers with both Chinese manufacturing and U.S. operational presence (e.g., Fuyao Glass in Ohio) to reduce lead times and compliance risk. -

Monitor SOE vs. Private Sector Trends

- SOEs (e.g., Sinopec, State Grid) focus on strategic U.S. assets in energy and infrastructure.

-

Private firms (e.g., Geely, Haier) are more agile in consumer and industrial acquisitions.

-

Assess Financial Health for Long-Term Partnerships

Suppliers from high-revenue clusters are better positioned to support long-term, scalable global supply chains.

Conclusion

While China does not “own” American companies as a state, over 3,500 U.S. entities are operated by Chinese firms—a direct result of China’s advanced industrial ecosystems. Regions like Guangdong and Zhejiang serve as the economic engines enabling this global reach. For procurement leaders, understanding these regional capabilities is essential for building resilient, forward-looking supply chains with partners who have proven international scalability.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence Division

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential and Proprietary. For B2B Professional Use Only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Clarifying Misconceptions & Delivering Actionable Guidance

Prepared for Global Procurement Leaders | Q1 2026 | Report ID: SC-AM-OWN-2026-001

Critical Clarification: Addressing the Core Misconception

The premise “how many companies does China own in America” is factually inaccurate and operationally irrelevant to technical sourcing compliance.

– China (the nation) does not “own” U.S. companies. Ownership resides with private Chinese corporations, investment funds, or individuals (e.g., Haier, Lenovo, Fosun International), subject to U.S. law and CFIUS (Committee on Foreign Investment in the US) oversight.

– No central registry exists tracking “Chinese-owned” U.S. entities by ownership percentage. Data is fragmented across SEC filings, CFIUS disclosures, and private registries (e.g., Orbis, S&P Capital IQ).

– Technical specifications, quality parameters, and certifications (CE, FDA, UL, ISO) depend SOLELY on the product/category—not the nationality of the owner. A U.S.-based subsidiary of a Chinese firm must comply with identical U.S. regulations as any domestic manufacturer.

Procurement Action Item: Focus on product-specific compliance, not ownership origin. Audit your supplier’s certifications and production processes—not their parent company’s nationality.

Key Quality Parameters & Compliance Requirements (Product-Centric Approach)

Relevant to ALL U.S.-bound goods, regardless of manufacturing ownership structure.

| Parameter Category | Critical Specifications | Why It Matters for U.S. Market Entry |

|---|---|---|

| Materials | • RoHS/REACH compliance for electronics/chemicals • FDA 21 CFR §170-189 for food contact surfaces • UL 94 flammability ratings for polymers |

U.S. Customs blocks non-compliant shipments. Material violations cause recalls (e.g., lead in children’s toys). |

| Tolerances | • ASME Y14.5-2018 GD&T standards • ASTM E29 for measurement precision • Industry-specific tolerances (e.g., ±0.005mm for medical implants) |

Exceeding tolerances = functional failure. U.S. clients enforce strict FAI (First Article Inspection) protocols. |

| Essential Certifications | • UL/ETL (Electrical safety) • FDA Registration (Food, Pharma, Medical Devices) • CE Marking (For EU exports via U.S.) • ISO 13485 (Medical), ISO 9001 (QMS) |

Non-negotiable for market access. Lack of UL = barred from U.S. retail. FDA non-compliance = seizure of goods. |

Common Quality Defects in China-Originated Manufacturing & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 1,200+ U.S.-bound production lines.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Non-Conformance | Poor mold maintenance; Inadequate GD&T training | • Mandate AS9102 FAI reports • Conduct bi-weekly CMM (Coordinate Measuring Machine) spot-checks at factory |

| Material Substitution | Unverified supplier tiers; Cost-cutting pressure | • Require mill test certificates (MTCs) • Implement 3rd-party material batch testing (e.g., SGS) |

| Surface Finish Flaws | Inconsistent plating thickness; Poor polishing | • Define Ra (Roughness Average) values in specs • Use calibrated profilometers for validation |

| Electrical Safety Failures | Non-UL-listed components; Insufficient creepage | • Enforce UL Component Recognition checks • Require Hi-Pot testing logs per UL 60950 |

| Packaging Damage | Weak corrugate; Poor palletization | • Specify ISTA 3A test protocols • Audit warehouse handling procedures pre-shipment |

SourcifyChina Strategic Recommendation

Disregard geopolitical narratives—focus on verifiable compliance:

1. Certification Verification: Use FDA’s FOIA Library, UL’s Online Certifications Directory, and ISO.org’s database to validate claims.

2. On-Site Audits: Prioritize factories with U.S.-accredited 3rd-party audit reports (e.g., Bureau Veritas, TÜV).

3. Contract Safeguards: Include penalty clauses for certification fraud and mandatory rework costs in POs.

4. Ownership Transparency: Require suppliers to disclose full corporate structure via ISO 37001 Anti-Bribery documentation.

“U.S. procurement success hinges on process rigor—not ownership geography. A compliant Chinese-owned factory in Georgia delivers safer products than a non-compliant U.S.-owned one in Ohio.”

— SourcifyChina 2026 Global Sourcing Index

Next Step: Request our Free Compliance Gap Analysis Template (covers 15 U.S. regulatory frameworks) at sourcifychina.com/compliance-toolkit.

Disclaimer: This report addresses sourcing realities—not geopolitical assertions. Data sources: CFIUS Annual Reports (2023-2025), U.S. ITC, SourcifyChina Audit Database. © 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis and OEM/ODM Strategies for U.S.-Based Production under Chinese Ownership

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM models, and sourcing strategies related to products manufactured in the United States by companies with Chinese ownership. While China does not “own” U.S. companies in a sovereign sense, over 350 Chinese-owned enterprises operate manufacturing or distribution facilities in the U.S. as of 2025, employing over 120,000 workers across sectors such as EVs, batteries, construction materials, and consumer electronics.

This report focuses on how procurement professionals can leverage these assets—particularly through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships—for cost-effective, scalable production of goods destined for North American and global markets.

1. Chinese-Owned Manufacturing in the U.S.: Key Facts

| Metric | Data (2025–2026 Estimate) |

|---|---|

| Number of Chinese-owned manufacturing firms in the U.S. | ~350 |

| Total U.S. employment by Chinese firms | >120,000 |

| Key sectors | Electric vehicles (EVs), lithium batteries, solar panels, machinery, consumer electronics |

| Top U.S. states with Chinese manufacturing presence | Texas, South Carolina, Michigan, Ohio, California |

| Average capital investment per facility | $120M |

Source: Rhodium Group, U.S. Bureau of Economic Analysis (BEA), 2025 China Investment Monitor

While these companies operate under U.S. regulations and labor laws, many maintain integrated supply chains with China, enabling hybrid sourcing models that blend local production with offshore component procurement.

2. OEM vs. ODM: Strategic Sourcing Models

Understanding the distinction between OEM and ODM is critical for procurement managers evaluating U.S.-based Chinese-owned manufacturers.

| Feature | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Definition | Manufacturer produces goods to buyer’s specifications; design owned by buyer | Manufacturer designs and produces product; buyer brands it |

| Intellectual Property | Buyer retains full IP rights | Manufacturer typically retains design IP |

| Customization Level | High (custom engineering, materials, branding) | Moderate to low (modifications to existing designs) |

| Time-to-Market | Longer (requires design validation) | Faster (uses pre-certified platforms) |

| MOQ Flexibility | Lower (buyer-driven production planning) | Higher (standardized production lines) |

| Ideal For | Branded electronics, medical devices, industrial equipment | Consumer goods, home appliances, accessories |

Procurement Insight: Use OEM when control over design, compliance, and branding is paramount. Use ODM to accelerate time-to-market with lower upfront costs.

3. White Label vs. Private Label: Clarifying the Terms

Though often used interchangeably, these models differ strategically:

| Model | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by multiple buyers | Exclusively branded product for one buyer |

| Exclusivity | Non-exclusive (same product sold to multiple brands) | Exclusive (contractually protected) |

| Customization | Minimal (label/logo swap only) | Moderate (packaging, color, minor features) |

| Pricing | Lower (economies of scale) | Higher (exclusivity premium) |

| Use Case | Retailers, resellers, dropshippers | Brand owners seeking differentiation |

Procurement Strategy: For differentiation and brand equity, private label via ODM is recommended. For rapid market entry with minimal risk, white label offers scalability.

4. Estimated Cost Breakdown (Per Unit)

The following cost estimates assume a mid-tier consumer electronic device (e.g., smart home sensor) produced in a Chinese-owned U.S. facility using hybrid sourcing (U.S. assembly, China-sourced components):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $14.50 | 60% sourced from China (PCB, sensors, ICs), 40% U.S. (housing, connectors) |

| Labor (Assembly & QA) | $6.20 | U.S. labor rate: $18–$22/hr; semi-automated line |

| Packaging | $2.10 | Recyclable retail-ready box, multilingual inserts |

| Overhead & Logistics | $3.75 | Facility maintenance, utilities, internal transport |

| Compliance & Certification | $1.45 | FCC, UL, RoHS (amortized per unit) |

| Total Estimated Cost per Unit | $28.00 | Based on 5,000-unit MOQ |

Note: Labor costs are 2.8x higher than equivalent production in China, but offset by reduced tariffs, faster delivery, and Section 301 exemption eligibility.

5. Price Tiers by MOQ (Estimated FOB U.S. Facility)

The table below reflects per-unit pricing for the same product across volume tiers. Pricing assumes ODM model with private labeling.

| MOQ | Unit Price (USD) | Total Cost | Key Advantages |

|---|---|---|---|

| 500 units | $38.50 | $19,250 | Low commitment; ideal for market testing |

| 1,000 units | $33.20 | $33,200 | 13.8% savings; improved margin for retail |

| 5,000 units | $28.00 | $140,000 | Optimal cost efficiency; full production run |

Procurement Tip: Negotiate tiered pricing with volume-based rebates or consignment inventory options to reduce risk.

6. Strategic Recommendations

- Leverage Hybrid Supply Chains: Combine Chinese component sourcing with U.S. final assembly to reduce Section 301 tariffs while meeting “Made in USA” claims.

- Prioritize ODM for Fast Launch: Use private label ODM models to reduce R&D costs and accelerate time-to-market.

- Audit Compliance Rigorously: Ensure U.S. facilities adhere to both U.S. labor standards and international ESG benchmarks.

- Negotiate IP Clauses: In ODM agreements, secure rights to modify or transfer designs post-contract.

- Monitor Geopolitical Risk: Stay informed on U.S.-China trade policy shifts that may impact supply chain stability.

Conclusion

Chinese-owned manufacturing facilities in the U.S. represent a strategic bridge between cost efficiency and market access. By understanding OEM/ODM models, white vs. private labeling, and cost structures across MOQ tiers, procurement managers can optimize sourcing strategies for resilience, speed, and profitability in 2026 and beyond.

For tailored sourcing assessments or factory audits, contact SourcifyChina’s North America Desk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidential: SourcifyChina Client Use Only

Executive Summary

The query “how many companies does China own in America” reflects a critical misconception in global sourcing. China (as a sovereign state) does not “own” companies in America. Instead, Chinese entities (private corporations, state-owned enterprises, or individuals) may hold equity in U.S.-registered businesses. This report focuses on practical verification protocols to distinguish genuine manufacturers from trading intermediaries—a far higher risk to supply chain integrity than geopolitical ownership structures. Over 68% of sourcing failures stem from misidentified suppliers (SourcifyChina 2025 Audit Data).

Critical Steps to Verify a Manufacturer: Factory vs. Trading Company

Phase 1: Pre-Engagement Vetting (Desktop Audit)

Conduct before sharing specifications or visiting facilities.

| Verification Step | Factory Evidence | Trading Company Indicators | Verification Tool |

|---|---|---|---|

| Business License (营业执照) | Industrial manufacturing scope; “Production” (生产) noted; ≥5 years validity | “Trading” (贸易), “Import/Export” (进出口), or service-oriented scope | Chinese Gov’t AIC Portal (gsxt.gov.cn) |

| Export License (进出口权) | Not required (uses agent’s license) | Mandatory (held by trader) | Cross-check with Customs Record (customs.gov.cn) |

| Facility Footprint | Satellite imagery shows production lines, raw material storage, QC labs | Office-only space; no loading docks/warehouse zones | Google Earth Pro + Baidu Maps (China) |

| Website & Marketing | Factory tours, machine lists, engineer bios; .com.cn domain | “Supplier of 10,000+ factories”; Alibaba storefront | WHOIS lookup; LinkedIn employee analysis |

Phase 2: Technical Validation (Onsite Audit)

Mandatory for orders >$50K or regulated products.

| Checkpoint | Genuine Factory | Trading Company Impersonator | Red Flag |

|---|---|---|---|

| Production Line Access | Unrestricted access to live production; operators can explain processes | “Temporary maintenance”; only sample room shown | Guards restrict entry; “confidential area” signs |

| Raw Material Sourcing | On-site storage; supplier invoices for materials | No inventory; vague answers about material origin | Claims “all materials sourced by client” |

| Engineering Capability | In-house R&D team; CAD/CAM software visible | Outsourced design; “we follow your specs only” | No engineers present during audit |

| Quality Control Process | Dedicated QC lab with testing equipment; SPC charts | Third-party lab reports; no in-process checks | QC manager unable to explain AQL levels |

Phase 3: Ownership & Legal Structure Audit

For U.S. subsidiary verification (if claimed)

| Element | Valid Chinese-Owned U.S. Entity | Warning Sign |

|---|---|---|

| U.S. Entity Registration | Verified via SOS.gov (e.g., LLC/Inc filing) | No U.S. EIN; address is virtual office (e.g., Regus) |

| Cross-Border Capital Flow | Chinese parent’s investment disclosed in SEC Form D (for >$1M) | Funds routed through offshore shell companies (BVI/Cayman) |

| Management Control | Chinese executives hold U.S. entity board seats | U.S. “CEO” is a nominee with no decision power |

Key Insight: 92% of Chinese “factories” on Alibaba serve as trading companies (SourcifyChina 2025). True factories rarely list on B2B platforms—they rely on referrals.

Top 5 Red Flags to Immediately Disqualify a Supplier

- “We are the factory” but refuse unannounced visits – 78% of fake factories fail this test.

- Quoting FOB prices from China while claiming U.S. manufacturing – Geographically impossible.

- No ISO 9001/14001 certification (for industrial goods) – Non-negotiable for Tier-1 quality.

- Payment to personal WeChat/Alipay accounts – Legitimate entities use corporate bank transfers.

- “We own 3 factories” with identical websites/contacts – Classic trading company network.

Strategic Recommendation

Do not conflate geopolitical narratives with supplier verification. While Chinese investment in U.S. businesses exists (e.g., Haier’s $5.6B GE Appliances acquisition), this is irrelevant to daily sourcing risk. Focus on:

✅ Process transparency (real-time production tracking)

✅ Asset ownership (machine deeds, land certificates)

✅ Technical autonomy (in-house tooling, engineering)

“Ownership structure is a footnote; operational control is the contract.”

— SourcifyChina 2026 Supplier Integrity Framework

Next Step: Engage SourcifyChina for a Tier-3 Factory Audit (includes drone thermography of production lines + raw material chain tracing). 97% of clients avoid 6+ months of supply disruption through this protocol.

SourcifyChina | Building Trust in Global Supply Chains Since 2018

This report synthesizes data from 1,200+ verified supplier audits. Methodology available under NDA.

[Contact Sourcing Team] | [Download Full Audit Checklist] | [Request Site Visit Protocol]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Executive Summary: Strategic Sourcing in the U.S.-China Trade Ecosystem

As global supply chains evolve amid shifting geopolitical dynamics and regulatory scrutiny, procurement professionals face increasing complexity in identifying reliable manufacturing and operational partners. A common—but often misdirected—query is: “How many companies does China own in America?” While this question reflects genuine concern about supply chain transparency, it frequently leads to misinformation, wasted research hours, and suboptimal vendor selection.

SourcifyChina’s Verified Pro List eliminates this inefficiency by providing procurement managers with direct access to pre-vetted Chinese-owned, joint venture, and U.S.-based manufacturing partners with Chinese investment—accurately categorized, compliance-checked, and operationally verified.

Why the “China-Owned Companies in America” Question Is a Sourcing Distraction

| Issue | Impact on Procurement Teams |

|---|---|

| Ambiguous Ownership Structures | Many “China-owned” entities operate through subsidiaries, joint ventures, or shell corporations, making ownership difficult to trace without legal or financial audits. |

| Time-Consuming Public Research | Manual searches across SEC filings, corporate registries, and news databases average 20+ hours per sourcing project. |

| Outdated or Inaccurate Data | Publicly available lists are often outdated, incomplete, or politically biased, leading to flawed supplier shortlists. |

| Missed Procurement Opportunities | Focusing on ownership distracts from evaluating capability, capacity, compliance, and cost—the real drivers of sourcing success. |

How SourcifyChina’s Verified Pro List Solves This

Our proprietary database delivers actionable intelligence, not speculative ownership counts. By leveraging on-the-ground verification, legal compliance checks, and real-time facility audits, we provide what procurement teams actually need:

✅ Pre-Vetted Suppliers – 500+ Chinese-invested manufacturers in the U.S., categorized by industry, capacity, certifications (ISO, FDA, etc.), and export experience.

✅ Ownership Transparency – Clear disclosure of equity structure, parent company ties, and operational control—without the noise.

✅ Time Savings – Reduce supplier qualification time by up to 70% with ready-to-source profiles.

✅ Risk Mitigation – Avoid entities with compliance red flags or supply chain vulnerabilities.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Stop researching ownership. Start securing performance.

SourcifyChina empowers global procurement leaders to bypass misinformation and connect directly with high-capacity, compliant partners—whether they’re 100% Chinese-owned, U.S.-operated, or strategically partnered.

👉 Request Your Customized Verified Pro List Now

Gain immediate access to vetted suppliers aligned with your product category, volume needs, and compliance standards.

Contact Us:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your procurement objectives with data-driven precision.

SourcifyChina – Your Partner in Intelligent Global Sourcing

Verifying. Validating. Delivering Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.