The global hot water discharge pipe market is experiencing robust growth, driven by rising demand from residential, commercial, and industrial sectors for efficient water heating and distribution systems. According to Grand View Research, the global pipes and tubes market size was valued at USD 185.6 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030—with hot water discharge applications representing a significant segment, particularly in HVAC, plumbing, and renewable energy installations. Similarly, Mordor Intelligence reports a growing trend in infrastructure development and urbanization, especially across the Asia-Pacific region, further accelerating the need for durable, heat-resistant piping solutions. As industries prioritize energy efficiency and compliance with safety standards, leading manufacturers are investing in advanced materials like PEX, CPVC, and stainless steel to meet evolving performance requirements. In this competitive landscape, the top 10 hot water discharge pipe manufacturers have distinguished themselves through innovation, scalability, and adherence to international quality benchmarks, positioning them at the forefront of a rapidly expanding market.

Top 10 Hot Water Discharge Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 RenewABILITY Energy Inc.

Domain Est. 2000

Website: renewability.com

Key Highlights: The Power-Pipe is a proven, practical, affordable technology that dramatically reduces energy use and water heating costs in a wide variety of applications….

#2 Thermon

Domain Est. 1994

Website: thermon.com

Key Highlights: New Electric Boiler Solution. Thermon’s Minke™ Electric Hot Water Boiler from the Precision Boiler family delivers power, precision, and reliability in a ……

#3 Watts

Domain Est. 1995

Website: watts.com

Key Highlights: A leading manufacturer of water quality solutions. Water safety, flow control, backflow prevention, drainage. Learn more about our products!…

#4 Zurn

Domain Est. 1995

Website: zurn.com

Key Highlights: Zurn is a leader in commercial, municipal, and industrial markets. We manufacture the largest breadth of engineered water solutions in the industry….

#5 Cerro Flow Products

Domain Est. 1996

Website: cerro.com

Key Highlights: Welcome to Cerro Flow Products LLC®. We manufacture world-class copper tube and supply fittings for the Plumbing, HVAC/Refrigeration, and Industrial markets….

#6 IPEX Inc.

Domain Est. 2009

Website: ipexna.com

Key Highlights: IPEX Inc. manufactures advanced PVC & CPVC piping systems for several applications for the Canadian market. Learn more….

#7

Domain Est. 1994

Website: aosmith.com

Key Highlights: A. O. Smith is proud to be known as one of the world’s leading providers of water heating and water treatment solutions….

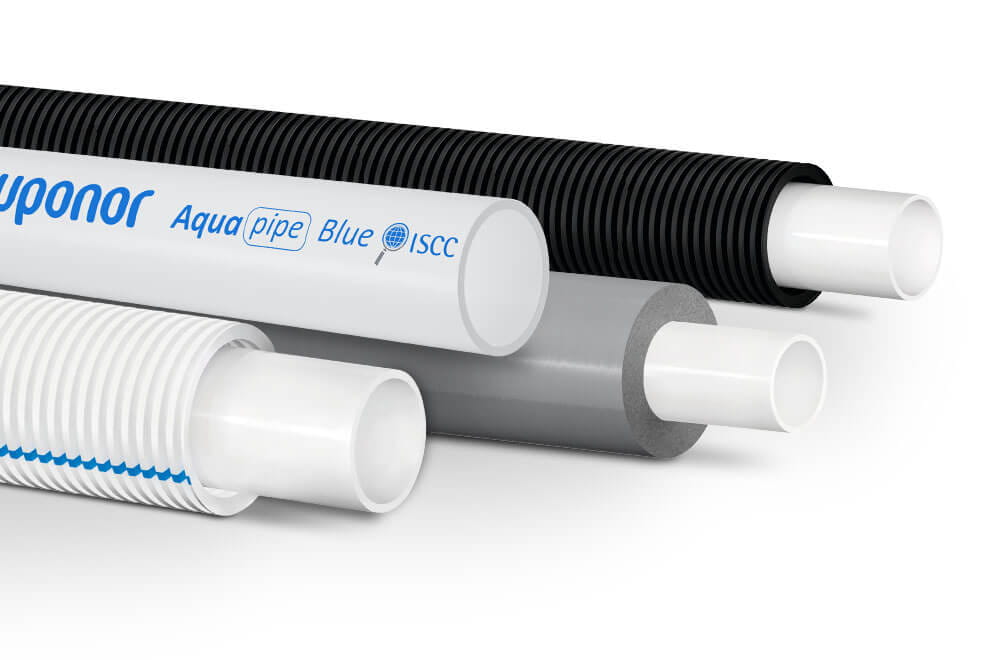

#8 Uponor

Domain Est. 1996

Website: uponor.com

Key Highlights: Uponor offers durable PEX piping, fittings, and other products for plumbing, radiant heating and cooling … hot-water heating and chilled-water cooling systems….

#9 GF Industry and Infrastructure Flow Solutions

Domain Est. 2001

Website: gfps.com

Key Highlights: GF Industry and Infrastructure Flow Solutions produces piping systems and system solutions for a wide range of applications across many different industries….

#10 Ecoinnovation Technologies

Domain Est. 2007

Website: ecoinnovation.ca

Key Highlights: An essential part of any high efficiency domestic hot water heating system. Affordable, easy to install and maintenance free…

Expert Sourcing Insights for Hot Water Discharge Pipe

H2: Projected 2026 Market Trends for Hot Water Discharge Pipes

The global market for hot water discharge pipes is poised for significant transformation by 2026, driven by technological advancements, regulatory changes, and increasing demand across residential, commercial, and industrial sectors. These pipes, essential components in water heating systems, HVAC (heating, ventilation, and air conditioning), and industrial process applications, are witnessing shifts in materials, design, and regional demand patterns.

-

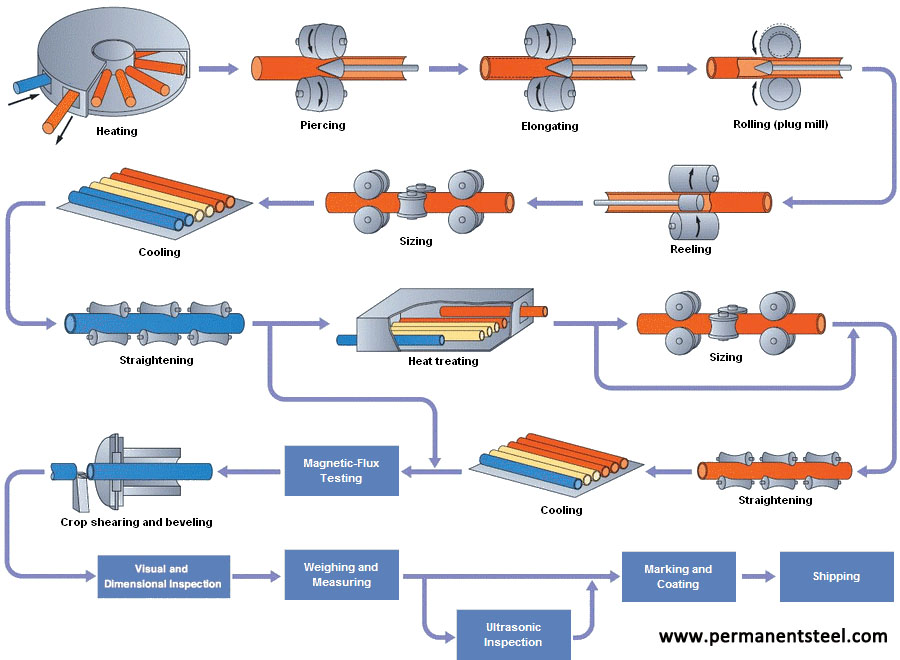

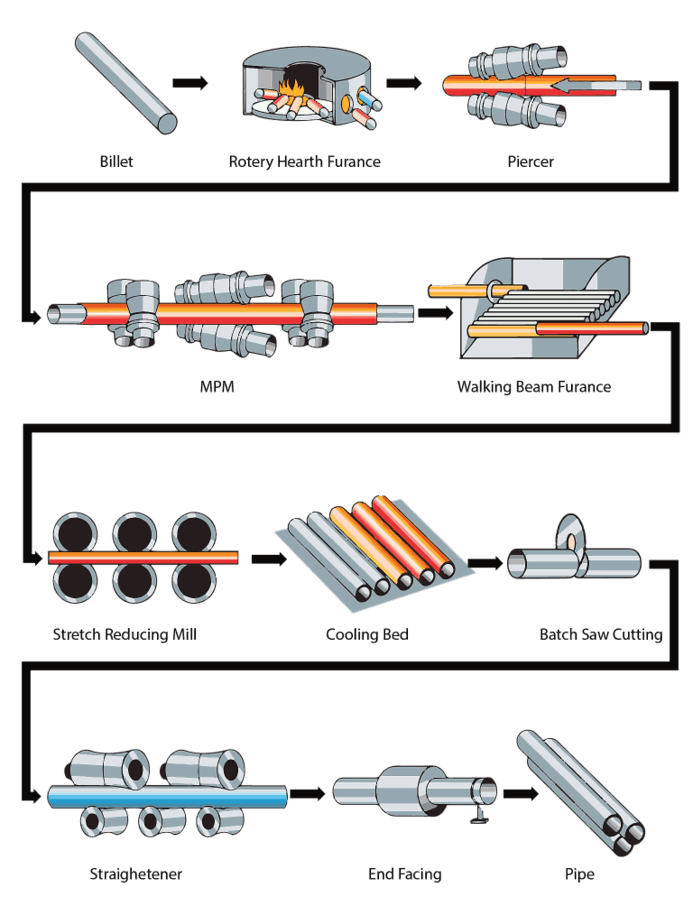

Material Innovation and Sustainability Shifts

A key trend shaping the 2026 market is the transition from traditional materials like copper and galvanized steel to advanced alternatives such as cross-linked polyethylene (PEX), chlorinated polyvinyl chloride (CPVC), and thermoplastic piping systems. These materials offer superior resistance to thermal expansion, corrosion, and scaling—critical for handling hot water. Environmental regulations and green building certifications (e.g., LEED, BREEAM) are accelerating demand for recyclable and low-carbon footprint piping solutions, making PEX and PP-R (polypropylene-random) increasingly dominant in new installations. -

Growth in Residential and Commercial Construction

Urbanization and rising disposable incomes, particularly in Asia-Pacific (China, India, Southeast Asia) and parts of Africa, are fueling construction activity. The integration of energy-efficient water heating systems—such as tankless heaters and heat pumps—requires reliable hot water discharge piping, thus boosting market demand. In North America and Europe, renovation of aging infrastructure and replacement of obsolete plumbing systems are expected to sustain steady growth. -

Smart Plumbing and IoT Integration

By 2026, the incorporation of smart monitoring technologies into plumbing systems is anticipated to influence hot water discharge pipe design. Sensors embedded in or near discharge lines can detect temperature fluctuations, leaks, or blockages, enabling predictive maintenance. This trend, driven by the broader smart building movement, will likely increase demand for compatible piping materials that support sensor integration and data transmission. -

Regulatory and Safety Standards

Stricter plumbing codes and safety regulations regarding scald prevention and energy efficiency (e.g., ASSE 1070 in the U.S., EN standards in Europe) are shaping product development. Manufacturers are responding with thermostatic mixing valves and insulated pipe systems that ensure safe discharge temperatures. Compliance with these standards will be a competitive differentiator in the 2026 market. -

Regional Market Dynamics

- Asia-Pacific is expected to lead global market growth due to rapid urbanization, government infrastructure initiatives, and expanding industrial base.

- North America will see steady demand driven by remodeling activities and adoption of energy-efficient technologies.

- Europe will emphasize sustainability and circular economy principles, favoring recyclable piping materials and low-emission manufacturing processes.

-

Middle East and Africa present emerging opportunities, particularly in large-scale desalination and district heating projects that require robust discharge piping.

-

Supply Chain and Cost Pressures

Fluctuations in raw material prices (e.g., polyethylene, copper) and logistical challenges may impact profitability. However, localized manufacturing and strategic sourcing are expected to mitigate risks. Additionally, automation in pipe production is anticipated to improve cost-efficiency and scalability by 2026.

In summary, the 2026 hot water discharge pipe market will be characterized by innovation in materials, increased focus on sustainability, integration with smart systems, and strong regional diversification. Companies that invest in R&D, comply with evolving regulations, and adapt to regional needs will be best positioned for growth.

Common Pitfalls Sourcing Hot Water Discharge Pipe (Quality, IP)

Sourcing hot water discharge pipes requires careful attention to material specifications, environmental conditions, and compliance standards. Overlooking critical factors can lead to premature failure, safety hazards, and costly downtime. Below are key pitfalls related to quality and IP (Ingress Protection) considerations:

Inadequate Material Quality for Temperature and Pressure

One of the most frequent pitfalls is selecting pipes made from substandard or unsuitable materials. Hot water discharge systems often operate at elevated temperatures (frequently exceeding 60°C) and fluctuating pressures. Using pipes not rated for these conditions—such as standard PVC instead of chlorinated polyvinyl chloride (CPVC) or temperature-resistant polypropylene (PP-R)—can result in deformation, cracking, or catastrophic failure. Always verify material certifications (e.g., ASTM, ISO standards) and ensure long-term thermal stability.

Ignoring UV and Environmental Resistance

Pipes exposed to outdoor environments must resist UV degradation, ozone, and temperature cycling. Low-quality polymers or non-stabilized materials can become brittle and crack when exposed to sunlight over time. Sourcing pipes without UV-resistant additives or protective coatings leads to reduced service life, especially in rooftop or external discharge applications.

Overlooking Ingress Protection (IP) Ratings for Associated Components

While pipes themselves are not typically assigned IP ratings, the overall discharge system may include enclosures, valves, or connection points that interface with electrical components or control systems. A common oversight is failing to ensure that these ancillary components meet appropriate IP ratings (e.g., IP65 or higher for dust and water resistance in damp or washdown environments). Inadequate IP protection can lead to water ingress into control boxes or sensors, causing electrical faults or system shutdowns.

Poor Joint and Connection Quality

Even high-quality pipe material can fail due to poor installation practices or substandard fittings. Sourcing incompatible or low-grade connectors, gaskets, or solvent cements compromises the integrity of joints—common failure points in hot water systems. Ensure compatibility between pipe and fittings, and use components designed specifically for hot water applications.

Lack of Compliance with Local Codes and Standards

Different regions have specific plumbing and safety codes (e.g., UPC, IPC, WRAS, NSF). Sourcing pipes that do not meet local regulatory requirements can result in failed inspections, liability issues, or non-compliance penalties. Always confirm that the pipe material and system design adhere to applicable standards for hot water discharge in the installation region.

Avoiding these pitfalls requires due diligence in supplier qualification, material verification, and system design review—ensuring long-term reliability and safety of the hot water discharge system.

H2: Logistics & Compliance Guide for Hot Water Discharge Pipe

1. Product Overview

Hot Water Discharge Pipe is a specialized piping system designed to safely transport high-temperature water (typically from boilers, heat exchangers, or industrial processes) from source to disposal or recirculation points. These pipes are engineered to withstand thermal expansion, high pressure, and corrosive environments. Common materials include stainless steel (e.g., 304, 316), CPVC (for lower temperature ranges), or insulated carbon steel with protective linings.

2. Regulatory & Compliance Requirements

2.1 International & National Standards

- ASME B31.9 – Building Services Piping: Covers piping systems for steam, hot water, and other services in industrial, institutional, and commercial buildings.

- ASME B31.1 – Power Piping: Applies to piping in electric power generating stations, industrial and institutional plants, and central and district heating plants.

- ASTM A269/A269M – Standard Specification for Seamless and Welded Austenitic Stainless Steel Tubing for General Service.

- IPC (International Plumbing Code) – Governs safe discharge of hot water, including temperature limits and venting.

- OSHA 29 CFR 1910.253 – Safety standards for handling high-pressure and high-temperature systems.

- EPA & Local Environmental Regulations: Discharge of hot water into municipal drains or waterways may require permits under the Clean Water Act (NPDES permit in the U.S.).

2.2 Temperature & Discharge Restrictions

- Hot water discharged into sanitary sewer systems must generally be below 40°C (104°F) unless otherwise permitted.

- Facilities discharging water above regulated thresholds must install cooling systems (e.g., cooling towers, heat exchangers) or apply for an industrial wastewater discharge permit.

- Continuous monitoring of discharge temperature may be required.

2.3 Material & Installation Compliance

- Use only materials rated for the maximum operating temperature and pressure.

- Piping must include thermal expansion joints or loops to prevent stress fractures.

- Insulation (e.g., mineral wool, elastomeric) is often required to:

- Prevent heat loss

- Reduce burn hazards (surface temperature < 60°C / 140°F per OSHA)

- Comply with energy efficiency codes (e.g., ASHRAE 90.1)

3. Logistics & Transportation

3.1 Packaging & Handling

- Pipes must be protected from physical damage during transit.

- Stainless steel pipes: Bundled with protective end caps and separated by spacers to prevent scratching.

- CPVC/thermoplastic pipes: Stored away from UV exposure and extreme temperatures.

- Mark packaging with:

- “Fragile”

- “Keep Dry”

- “This Side Up”

- Temperature sensitivity warnings

3.2 Storage Requirements

- Store indoors or under cover in a dry, well-ventilated area.

- Avoid prolonged exposure to sunlight (especially for CPVC).

- Elevate from ground level using skids to prevent moisture absorption.

- Follow FIFO (First In, First Out) inventory practices.

3.3 Transport Considerations

- Use vehicles with enclosed trailers to prevent weather exposure.

- Secure loads to prevent shifting; use straps or braces.

- Avoid sharp impacts or bending during loading/unloading.

- For international shipments: Comply with IMDG Code if transported by sea, IATA for air freight (rare for pipe).

4. Installation & Safety Compliance

4.1 Worker Safety

- Personnel must wear heat-resistant gloves, eye protection, and flame-resistant clothing.

- Follow Lockout/Tagout (LOTO) procedures before installation or maintenance.

- Ensure adequate ventilation in confined spaces.

4.2 Installation Best Practices

- Follow manufacturer’s specifications for support spacing, especially for long runs.

- Install drip legs and proper slope for condensate drainage.

- Use appropriate gaskets and seals rated for high temperatures (e.g., graphite, PTFE).

- Pressure test system per ASME B31.1 or B31.9 before commissioning.

5. Documentation & Recordkeeping

Required Documentation:

- Material Test Reports (MTRs) for all piping components

- As-built drawings showing routing, supports, and insulation

- Pressure test reports

- Compliance certificates (e.g., ASME, NSF for potable water contact, if applicable)

- Environmental discharge permits (if applicable)

Maintenance Logs:

- Temperature and pressure monitoring records

- Inspection and repair logs

- Insulation integrity checks

6. Disposal & End-of-Life

- Recycle metal piping (stainless steel, carbon steel) through certified metal recyclers.

- Dispose of non-metallic components (e.g., CPVC, insulation) in accordance with local hazardous waste regulations.

- Decontaminate pipes if used with toxic or regulated fluids prior to disposal.

7. Key Compliance Checklist

| Requirement | Status (✓/✗) |

|——————————————–|————–|

| Material complies with ASME/ASTM standards | |

| Discharge temperature < local limit | |

| NPDES or local discharge permit obtained | |

| Thermal insulation installed | |

| Expansion joints included | |

| Pressure tested and documented | |

| Worker PPE and LOTO implemented | |

Note: Always consult local authorities and environmental agencies to ensure compliance with regional discharge and safety regulations. Regulations may vary significantly by jurisdiction.

Conclusion for Sourcing Hot Water Discharge Pipe:

In conclusion, sourcing a suitable hot water discharge pipe requires careful consideration of material compatibility, temperature and pressure ratings, corrosion resistance, and compliance with relevant plumbing codes and standards. Materials such as copper, CPVC, or PEX are commonly used due to their durability and ability to withstand high temperatures typically associated with hot water systems. It is essential to ensure that the selected piping material is specifically rated for hot water discharge applications to prevent premature failure, leaks, or safety hazards. Additionally, evaluating long-term cost-effectiveness, ease of installation, and maintenance requirements will contribute to a reliable and efficient system. By partnering with reputable suppliers and adhering to engineering best practices, the proper hot water discharge pipe can be sourced to ensure safe, code-compliant, and sustainable performance over the system’s lifespan.