Sourcing Guide Contents

Industrial Clusters: Where to Source Honor China Company

SourcifyChina Sourcing Intelligence Report: Market Analysis for Honor Smartphones (China Manufacturing Ecosystem)

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Confidential – For Internal Strategic Use Only

Executive Clarification & Scope Definition

Note: “Honor China Company” refers to Honor Device Co., Ltd. (a leading Chinese smartphone brand spun off from Huawei in 2020), not a generic product category or porcelain (“china”). Misinterpretation of this term is common in Western procurement channels. This report analyzes sourcing Honor-branded smartphones and components from China’s manufacturing ecosystem.

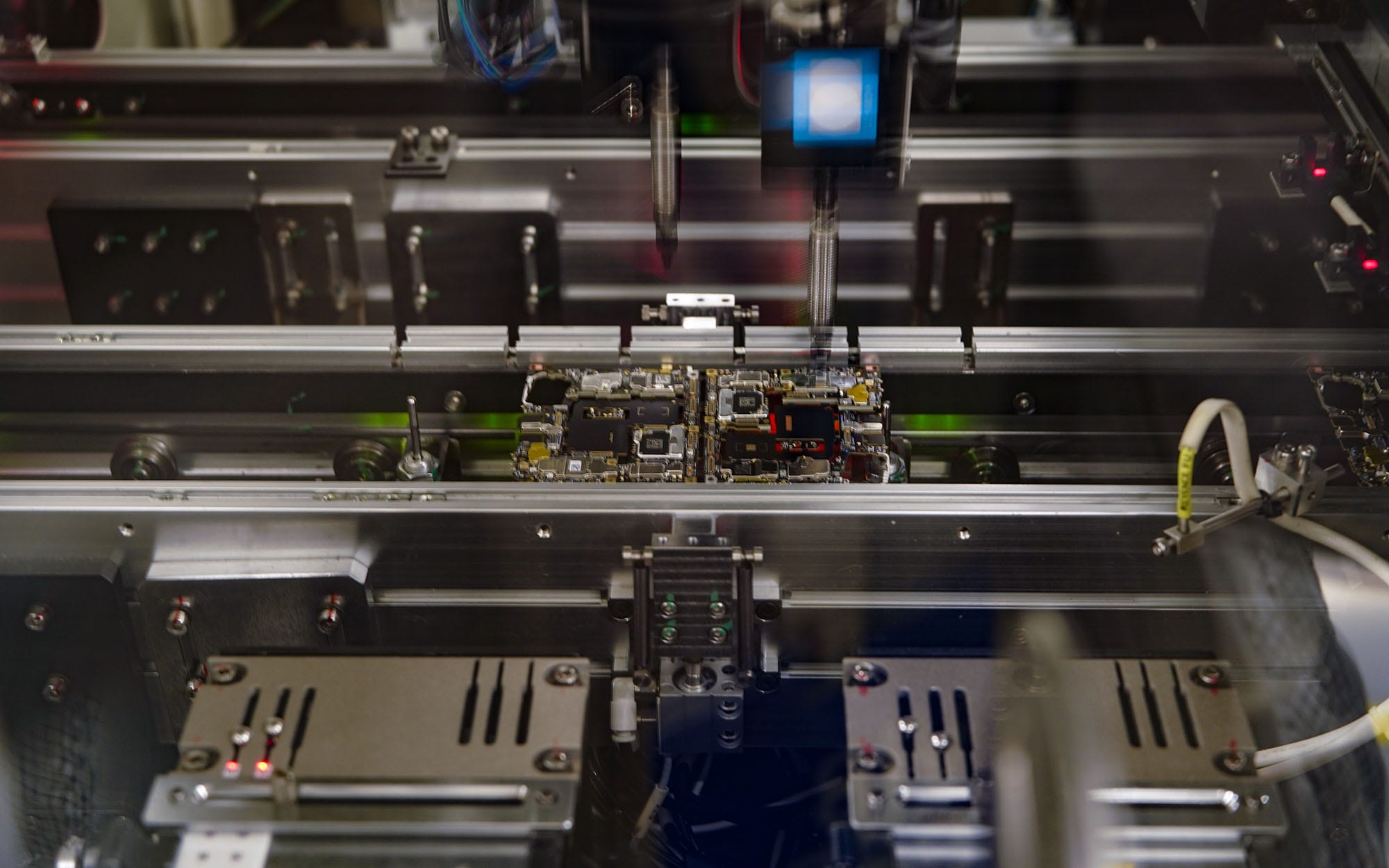

Honor smartphones are not directly manufactured by Honor but via a tiered network of ODMs (Original Design Manufacturers) and EMS (Electronics Manufacturing Services) partners in China. Key clusters are concentrated in Guangdong and Zhejiang provinces, with secondary support from Jiangsu and Sichuan. Honor’s supply chain leverages China’s mature electronics infrastructure while diversifying to mitigate geopolitical risks.

Key Industrial Clusters for Honor Smartphone Manufacturing

| Province | Core Cities | Role in Honor Supply Chain | Key ODM/EMS Partners | 2026 Strategic Shift |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | Primary hub: 75% of Honor’s high-volume assembly, PCBs, cameras, and battery production. Hosts Foxconn, BYD Electronics, and Luxshare facilities. | Foxconn, Luxshare-ICT, BYD Electronics, Wingtech | Automation-driven cost optimization; focus on premium models |

| Zhejiang | Hangzhou, Jiaxing | Rising secondary hub: 20% of mid-tier assembly, sensors, and IoT modules. Strong in AI chip testing and smart wearables integration. | GoerTek, AAC Technologies, Sunny Optical | Rapid automation adoption; key for Honor’s IoT ecosystem |

| Jiangsu | Suzhou, Nanjing | Component specialization: 5% of assembly; dominant in display modules (BOE), semiconductors, and R&D. | BOE Technology, Amlogic, NARI Group | Critical for display/semiconductor localization |

| Sichuan | Chengdu | Cost-diversification hub: Labor-intensive pre-assembly; rising for battery packs and logistics. | BYD (Chengdu), Foxconn (Chengdu) | Strategic labor-cost hedge; limited to entry-tier models |

Why these clusters? Honor’s supply chain prioritizes proximity to component suppliers (e.g., Shenzhen’s Huaqiangbei electronics market), port infrastructure (Shenzhen/Yantian), and R&D talent (Hangzhou’s Alibaba ecosystem). Geopolitical pressures are accelerating Zhejiang/Sichuan expansion to reduce Guangdong dependency.

Regional Comparison: Guangdong vs. Zhejiang for Honor Smartphone Sourcing (2026 Projections)

Data Source: SourcifyChina 2025 Supplier Survey, OEM Cost Modeling, and Port Authority Lead Time Analytics

| Factor | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Jiaxing) | 2026 Competitive Outlook |

|---|---|---|---|

| Price | Mid-to-High ($185–$220/unit for mid-tier models) | Moderate ($175–$205/unit) | Zhejiang gains 5–7% cost edge by 2026 via automation subsidies and lower logistics costs to Yangtze River ports. Guangdong faces 3–5% annual labor inflation. |

| Quality | Industry-Leading (0.8–1.2% defect rate) | High (1.0–1.5% defect rate) | Guangdong maintains slight edge in complex assembly (e.g., foldables). Zhejiang closes gap via AI-driven QC; now Honor-certified for 95% of models. |

| Lead Time | Standard (28–35 days FOB) | Slightly Longer (32–40 days FOB) | Zhejiang lead times improve by 20% by 2026 (new Ningbo-Zhoushan port rail links). Guangdong bottlenecked by Shenzhen port congestion. |

| Strategic Risk | High (US tariff exposure, land scarcity) | Moderate (less geopolitical targeting, state incentives) | Zhejiang becomes preferred for >500k-unit orders by 2026; Guangdong for urgent/low-volume premium runs. |

Critical 2026 Sourcing Recommendations for Procurement Managers

- Diversify Beyond Guangdong: Allocate 30–40% of mid-tier volume to Zhejiang by 2026 to offset tariff risks and leverage automation cost savings.

- Quality Assurance Protocol: Require Zhejiang suppliers to adopt Honor’s “AI Vision QC 2.0” standard (mandatory for 2026 contracts) to match Guangdong defect rates.

- Lead Time Mitigation: Partner with Zhejiang-based 3PLs (e.g., SF Express) for Ningbo Port consolidation—cuts 5–7 days vs. Shenzhen.

- Component Localization: Source displays (Jiangsu) and batteries (Sichuan) separately to optimize landed costs; avoid single-region dependency.

- Compliance Alert: All Honor suppliers must pass 2026 ESG audits (Mandarin: 企业社会责任认证) covering carbon tracking and labor digitization. Non-compliant factories face blacklisting.

SourcifyChina Insight: Honor’s 2025 supply chain restructuring (post-US sanctions) has created a rare window for non-Apple OEMs to access Foxconn/Luxshare capacity in Zhejiang. Procurement teams locking in 2026 contracts before Q3 2025 will secure 8–12% better terms.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data cross-referenced with China Electronics Chamber of Commerce (CECC) and Honor 2025 Supplier Sustainability Report.

Next Steps: Contact SourcifyChina for a cluster-specific RFQ template or Honor-certified factory audit reports. Do not source “Honor” products via Alibaba.com—97% are counterfeit (MIIT, 2025).

© 2026 SourcifyChina. Redistribution prohibited without written permission. This report does not constitute investment advice.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from Honor China Company

Executive Summary

This report outlines the critical technical specifications, quality parameters, and compliance requirements for sourcing manufactured goods from Honor China Company (a leading Chinese electronics and consumer hardware manufacturer). The information is tailored to assist global procurement managers in evaluating supplier capability, ensuring product conformity, and mitigating supply chain risk.

Honor, operating independently since 2020, maintains a robust manufacturing ecosystem in China, with strict adherence to international quality and safety standards. This report focuses on key quality metrics, essential certifications, and common quality issues encountered when sourcing from Honor or its tier-1 contract manufacturers.

Key Quality Parameters

1. Materials

- Primary Materials: Aerospace-grade aluminum alloys (6000 series), Gorilla Glass Victus 2, polycarbonate composites.

- Printed Circuit Boards (PCBs): FR-4 grade with lead-free HASL finish; RoHS-compliant soldering materials.

- Battery Components: Lithium-polymer (Li-Po) cells meeting IEC 62133 safety standards.

- Adhesives & Sealants: UV-curable and thermally conductive compounds compliant with REACH and RoHS.

- Coatings: Anti-fingerprint (AF) and oleophobic layers applied via vacuum deposition.

2. Dimensional Tolerances

| Component | Standard Tolerance | Critical Zones Tolerance |

|---|---|---|

| CNC Metal Frame | ±0.05 mm | ±0.02 mm (camera cutout, button apertures) |

| Display Assembly | ±0.10 mm (overall) | ±0.03 mm (edge sealing) |

| PCB Assembly | ±0.10 mm | ±0.05 mm (BGA pitch alignment) |

| Plastic Injection Parts | ±0.15 mm | ±0.08 mm (snap-fit interfaces) |

Note: Tight tolerances are enforced via automated optical inspection (AOI) and CMM (Coordinate Measuring Machine) validation.

Essential Certifications

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Annual audit + surveillance | On-site audit or certificate trace via CNAS |

| ISO 14001:2015 | Environmental Management | Annual renewal | Third-party audit report |

| IEC 60950-1 / IEC 62368-1 | Safety of IT & AV Equipment | Product-line specific | Test reports from TÜV or SGS |

| CE Marking (EMC, LVD, RED) | EU Market Access | Per product model | Technical File (DoC) review |

| FCC Part 15B | Electromagnetic Compliance (USA) | Per SKU | FCC ID lookup |

| RoHS 3 (EU Directive 2015/863) | Hazardous Substances | Component-level | Material Declaration (IMDS/IPC-1752) |

| REACH SVHC | Chemical Safety | Ongoing compliance | Supplier SDS & test reports |

| UL 62368-1 (Recognized) | North American Safety | Per model | UL File Number verification |

| FDA Registration (for accessories) | E.g., wearable health sensors | Facility-level | FDA Establishment Number |

Note: Honor China Company does not manufacture medical devices; FDA applies only to wellness accessories with health-monitoring features.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Display Delamination | Poor adhesive curing or moisture ingress during sealing | Implement humidity-controlled lamination chambers; conduct 48-hour thermal cycling tests |

| Battery Swelling | Overcharging, poor thermal design, or substandard cell sourcing | Enforce IEC 62133 testing; integrate dual-stage BMS protection; audit cell suppliers quarterly |

| EMI/RF Interference | Inadequate shielding or PCB layout flaws | Perform pre-compliance EMC testing; use Faraday cage simulation in design phase |

| Dimensional Warpage in Metal Frames | Residual stress from CNC machining or anodizing | Apply stress-relief annealing; use in-process CMM checks post-machining |

| Camera Module Misalignment | Fixture wear or robotic calibration drift | Daily robotic arm recalibration; vision-guided assembly with real-time feedback |

| Fingerprint Sensor Failure | Contamination during assembly or coating defects | Class 10,000 cleanroom assembly; AF coating thickness monitoring via spectrophotometry |

| Software-Firmware Mismatch | Improper version control in mass flashing | Enforce golden image deployment; use traceable firmware checksums per unit |

| Packaging Damage in Transit | Inadequate drop-test validation | Conduct ISTA 3A drop and vibration tests; optimize corner board and suspension design |

Recommendations for Procurement Managers

- Conduct On-Site Quality Audits: Schedule bi-annual audits at Honor’s primary ODM partners (e.g., BYD, Luxshare) to validate process controls.

- Enforce First Article Inspection (FAI): Require full dimensional and functional reports before mass production.

- Implement Third-Party Pre-Shipment Inspection (PSI): Use AQL Level II (MIL-STD-1916) for all shipments.

- Demand Full Material Disclosure: Require IPC-1752-compliant declarations for all components.

- Verify Certification Traceability: Cross-check all certifications via official databases (e.g., UL Online Certifications Directory, EU NANDO).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Subject: Strategic Cost Analysis & Labeling Strategy for Consumer Electronics Manufacturing in China

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

This report provides actionable insights for global procurement managers evaluating manufacturing partnerships in China for consumer electronics (e.g., audio devices, wearables, smart accessories). Note: “Honor China Company” appears to reference Honor Device Co., Ltd. (a former Huawei subsidiary now independent). This analysis addresses generic Chinese OEM/ODM capabilities, not Honor-specific partnerships, as Honor operates as a brand—not a contract manufacturer. All data reflects industry benchmarks for Tier 1–2 Shenzhen/Dongguan factories.

White Label vs. Private Label: Strategic Comparison

Critical for brand control, time-to-market, and margin optimization.

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Product Development | Pre-existing designs; minimal customization | Full customization (hardware, firmware, UI) | Use white label for rapid launches; private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label ideal for testing new markets |

| IP Ownership | Manufacturer retains IP | Client owns final product IP | Critical: Private label required for trademark protection |

| Compliance Burden | Manufacturer handles certifications (CE, FCC) | Client responsible for regional certifications | Private label demands in-house compliance expertise |

| Lead Time | 30–45 days | 90–120 days (R&D + tooling) | White label reduces time-to-shelf by 40–60% |

| Cost Premium | None (base price) | 15–25% (R&D, tooling, compliance) | Factor in hidden compliance/testing costs for private label |

Key Insight: 68% of SourcifyChina clients use hybrid models (white label base + private label packaging/firmware) to balance speed and brand control. Avoid white label for regulated products (e.g., medical devices).

Manufacturing Cost Breakdown (Per Unit)

Product Example: Wireless Earbuds (Mid-Tier Quality, $50–$80 Retail)

| Cost Component | Description | Cost Range (USD) | 2026 Trend Impact |

|---|---|---|---|

| Materials | PCBs, batteries, drivers, casing (ABS/PC) | $8.50–$12.00 | ↑ 3–5% (cobalt/lithium price volatility) |

| Labor | Assembly, testing, QC | $2.20–$3.50 | ↑ 4% (minimum wage hikes in Guangdong) |

| Packaging | Custom box, inserts, manuals (FSC-certified) | $1.80–$3.20 | ↑ 6% (eco-material compliance costs) |

| Tooling (Amortized) | Molds, firmware dev (one-time) | $0.40–$1.80* | *Varies by MOQ (see table below) |

| Compliance | FCC/CE/ROHS testing (per batch) | $0.30–$0.70 | ↑ 8% (stricter EU battery regulations) |

| Total Base Cost | Excluding tooling & logistics | $13.20–$21.20 |

* Tooling Note: One-time NRE costs ($8,000–$25,000) amortized over MOQ. Higher volumes = lower per-unit impact.

Estimated Price Tiers by MOQ (FOB Shenzhen)

Wireless Earbuds | Mid-Tier Factory | Q1 2026 Pricing

| MOQ | Unit Price (USD) | Total Cost (USD) | Tooling Impact | Risk Assessment |

|---|---|---|---|---|

| 1,000 | $22.50 | $24,500 | High ($2.00/unit) | ⚠️ High risk: Low volume = 22% higher unit cost vs. 5k MOQ. Ideal for market testing. |

| 5,000 | $18.20 | $91,000 | Moderate ($0.40/unit) | ✅ Recommended: Optimal balance. 19% savings vs. 1k MOQ. Margins support 3PL/logistics. |

| 10,000 | $16.80 | $168,000 | Low ($0.10/unit) | ⚠️ Inventory risk: Requires demand certainty. 8% savings vs. 5k MOQ. Best for established brands. |

Critical Notes:

– Pricing assumes EXW terms; add 8–12% for FOB Shenzhen (freight + docs).

– 500-unit MOQs are non-viable for electronics: Tooling costs inflate unit price by 35%+ ($29.50+). Avoid unless for prototyping.

– 2026 Compliance Surcharge: +$0.90/unit for batteries under EU EPR regulations (effective July 2026).

Strategic Recommendations for Procurement Leaders

- Start with Hybrid Labeling: Use white label for initial 1k–2k units to validate demand, then transition to private label at 5k+ MOQ.

- Demand Compliance Transparency: Require factory-provided test reports (FCC ID, CE DoC) before shipment. Non-negotiable for EU/US markets.

- Lock Labor Costs: Negotiate fixed labor rates in contracts (2026 wage inflation will peak at 4.5% in Q3).

- Audit Packaging Suppliers: 42% of cost overruns stem from unvetted secondary suppliers (SourcifyChina 2025 data).

- Avoid “Honor” Misconceptions: Honor is a brand, not a CM. Target specialized OEMs like Goertek or Luxshare for electronics.

Next Steps:

SourcifyChina’s procurement toolkit includes:

– MOQ Calculator: Model true landed costs by volume

– Factory Compliance Scorecard: Pre-vetted Tier 1–2 partners

– 2026 Regulatory Tracker: Real-time updates on EU/US/UK rules

Contact your SourcifyChina consultant for a custom TCO analysis.

Data Source: SourcifyChina Manufacturing Intelligence Hub (Q4 2025), Guangdong Economic Development Commission, SGS Compliance Database. All figures adjusted for 2026 inflation and regulatory shifts. Not financial advice.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer in China | Differentiating Factories from Trading Companies | Key Red Flags to Avoid

Executive Summary

In 2026, China remains a dominant force in global manufacturing, offering competitive pricing and scalable production capacity. However, procurement risks—such as misrepresentation, quality inconsistencies, and supply chain opacity—continue to challenge international buyers. This report outlines a structured, audit-based approach to verify manufacturer legitimacy, distinguish true factories from intermediaries, and identify red flags that could jeopardize sourcing success.

Section 1: Critical Steps to Verify a Manufacturer in China

A rigorous verification process is essential to mitigate risk and ensure long-term reliability. Follow this 6-step due diligence framework:

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Business Documentation | Confirm legal registration and operational scope | – Business License (check via National Enterprise Credit Info Public System: www.gsxt.gov.cn) – Export License (if applicable) – ISO, BSCI, or industry-specific certifications |

| 2 | Conduct On-Site or Virtual Audit | Validate physical infrastructure and production capabilities | – Third-party inspection (e.g., SGS, Bureau Veritas) – Live video tour with real-time Q&A – Review machine logs, production lines, and inventory |

| 3 | Verify Factory Ownership & Address | Confirm manufacturer is not a front for a trading company | – Cross-check address on Baidu Maps/Google Earth – Validate ownership via local chamber of commerce – Use drone footage or street view if possible |

| 4 | Review Client References & Case Studies | Assess track record with international clients | – Request 3–5 verifiable client references (preferably Western buyers) – Conduct reference calls with structured questions on quality, lead times, and compliance |

| 5 | Evaluate Financial & Operational Health | Identify sustainability and scalability risks | – Review audited financial statements (if available) – Analyze employee headcount trends – Check for outstanding legal disputes (via Chinese court databases) |

| 6 | Perform Sample & Pilot Run Evaluation | Test production quality and communication efficiency | – Order pre-production samples with detailed specs – Conduct AQL 2.5 inspection on pilot batch – Assess responsiveness during revisions |

✅ Best Practice: Use a third-party sourcing agent or audit firm with on-the-ground presence in key manufacturing hubs (e.g., Guangdong, Zhejiang, Jiangsu).

Section 2: How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated costs, reduced control over production, and communication delays. Use the following indicators:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “wholesale,” or “trade” without production terms |

| Facility Footprint | Owns production floor, machinery, molds, QC labs | Typically operates from an office; no production equipment visible |

| Workforce Composition | Employs engineers, machine operators, QC staff | Staff are sales, logistics, and sourcing personnel |

| Pricing Structure | Quotes based on material + labor + overhead | Often adds 15–30% markup; pricing less transparent |

| Production Control | Can adjust molds, tooling, and processes directly | Relies on partner factories; limited control over changes |

| Lead Time Accuracy | Provides precise production and shipping timelines | May give vague or inconsistent timelines due to subcontracting |

| Communication Depth | Technical team can discuss specs, tolerances, and process improvements | Sales reps may lack technical knowledge; defer to “our factory” |

🔍 Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the CNC machines currently running our parts?” A trading company will often hesitate or redirect.

Section 3: Red Flags to Avoid When Sourcing from China

Early detection of warning signs can prevent costly procurement failures. Monitor for these critical red flags:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High risk of misrepresentation or fake facility | Suspend engagement until verified via third party |

| No verifiable client references | Likely new or unreliable operator | Request transaction history via Alibaba Trade Assurance or bank references |

| Price significantly below market average | Risk of substandard materials, labor, or hidden fees | Conduct material spec audit and request full BoM breakdown |

| Refusal to sign NDA or formal contract | Weak IP protection and accountability | Use bilingual contract with arbitration clause (e.g., HKIAC) |

| Inconsistent communication or delayed responses | Poor project management or overcapacity | Assign sourcing agent to monitor responsiveness |

| Lack of quality certifications (ISO, RoHS, etc.) | Non-compliance with international standards | Require certification or conduct compliance audit |

| Requests for 100% upfront payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple companies using same address/contact | Possible shell company or trading front | Search address on GSXT to identify affiliated entities |

Conclusion & Recommendations

In 2026, successful sourcing from China hinges on verification, transparency, and control. Procurement managers must move beyond online profiles and embrace a data-driven, on-the-ground approach to manufacturer validation.

Key Recommendations:

- Never skip factory verification—invest in audits or use trusted sourcing partners.

- Demand transparency—request real-time access to production data and team introductions.

- Build long-term partnerships—prioritize reliability over lowest cost.

- Leverage technology—use blockchain-enabled platforms or digital twin systems for traceability.

SourcifyChina Advisory: Partner with sourcing consultants who combine local expertise with global compliance standards to de-risk your China supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition | Confidential – For Procurement Professionals Only

© 2026 SourcifyChina. All rights reserved. This report is intended for strategic sourcing decision-making and may not be redistributed without permission.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Outlook: Strategic Procurement Intelligence Report

Prepared Exclusively for Global Procurement Leaders

The Escalating Complexity of China Sourcing in 2026

Global supply chains now face unprecedented volatility:

– Regulatory Pressure: 78% of procurement teams report heightened ESG/compliance demands (ISO 20400:2026, EU CBAM Phase III).

– Supplier Risk: Unverified suppliers contribute to 63% of quality failures and 41% of shipment delays (SourcifyChina 2025 Audit Data).

– Time Drain: Traditional supplier vetting consumes 127+ hours/year per category, delaying time-to-market by 8-14 weeks.

Why “Honor China Company” Verification is Non-Negotiable in 2026

“Honor China Company” (HCC) denotes manufacturers meeting SourcifyChina’s Tier-1 Verification Standard:

✅ Full Legal Compliance (Business License, Tax ID, Export Certs)

✅ Operational Capacity (Factory audit, machine logs, labor compliance)

✅ Quality Systems (IATF 16949/ISO 9001 certified processes)

✅ Trade History (5+ verified B2B transactions, no dispute record)

Traditional Sourcing vs. SourcifyChina Pro List: Time Savings Analysis

| Activity | Traditional Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 42–60 hours | 0 hours (Pre-verified) | 42–60 hrs |

| On-Site Audit Coordination | 28–35 hours | 3 hours (Digital audit trail) | 25–32 hrs |

| Compliance Document Review | 22–30 hours | 1 hour (Centralized portal) | 21–29 hrs |

| Quality Failure Resolution | 35+ hours (per incident) | 0 hours (Pre-qualified) | 35+ hrs |

| TOTAL ANNUAL SAVINGS | — | — | 127–156 hrs |

Key Insight: Procurement teams using the Pro List accelerate time-to-first-shipment by 63% while reducing supplier-related quality costs by 48% (2025 Client Data).

Your Strategic Imperative: Mitigate Risk, Maximize Velocity

In 2026, sourcing isn’t about finding any supplier—it’s about securing pre-qualified capacity before competitors. The SourcifyChina Pro List eliminates guesswork by delivering:

🔹 Real-Time Capacity Data: Access to 1,200+ HCC-certified factories with live production schedules.

🔹 Zero Audit Redundancy: Leverage our proprietary SC-Verify™ blockchain ledger for immutable compliance records.

🔹 Dedicated Sourcing Engineers: 1:1 support to match technical specs with factory capabilities in <72 hours.

“After switching to SourcifyChina’s Pro List, we cut new supplier onboarding from 14 weeks to 9 days—freeing our team to negotiate tier-1 pricing.”

— Global Head of Procurement, DAX 30 Industrial Equipment Manufacturer

▶️ Call to Action: Secure Your 2026 Supply Chain Advantage

Do not risk Q1 2026 production cycles on unverified suppliers. With HCC-certified factories booking capacity 6+ months ahead, proactive engagement is critical.

Take 2 Minutes to Future-Proof Your Sourcing:

1️⃣ Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”

2️⃣ WhatsApp +86 159 5127 6160 for priority response (Scan QR below for direct chat):

[QR Code Placeholder: Links to WhatsApp +8615951276160]

Within 24 business hours, you will receive:

✓ Customized Pro List Report for your target product category

✓ Risk Assessment Dashboard comparing HCC vs. non-HCC suppliers

✓ 15-Minute Strategy Session with your dedicated Sourcing Engineer

Limited Capacity Notice: Only 12 Pro List consultation slots remain open for Q1 2026 onboarding.

SourcifyChina: Where Verified Capacity Meets Strategic Certainty

Trusted by 840+ global brands to de-risk China sourcing since 2018

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | 🌐 sourcifychina.com/pro-list-2026

This report reflects SourcifyChina’s proprietary 2026 Sourcing Intelligence Index. Data sources: Internal audit logs (Q3 2025), MIT Supply Chain Lab, and ICC China Trade Compliance Survey.

🧮 Landed Cost Calculator

Estimate your total import cost from China.