Sourcing Guide Contents

Industrial Clusters: Where to Source Hong Kong China Mobile Company Near Kowloon

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “Hong Kong China Mobile Company Near Kowloon” – Clarification and Strategic Sourcing Guidance

Executive Summary

This report provides a professional market analysis for procurement managers seeking to source telecommunications infrastructure, mobile network equipment, or related hardware associated with “Hong Kong China Mobile Company near Kowloon”. It is important to clarify that “Hong Kong China Mobile” is not a manufacturer, but rather a regional service provider and brand entity affiliated with China Mobile Limited, China’s largest telecommunications operator.

As such, sourcing “Hong Kong China Mobile Company” does not refer to acquiring a company or service provider, but rather likely pertains to procurement of telecom hardware (e.g., 5G base stations, routers, SIM cards, IoT modules) used by or compatible with China Mobile’s network infrastructure—particularly in the Hong Kong (Kowloon) region.

This report identifies the key industrial clusters in Mainland China responsible for manufacturing such telecom equipment, with a comparative analysis of leading provinces: Guangdong and Zhejiang.

Clarification of Sourcing Objective

“Hong Kong China Mobile Company near Kowloon” is interpreted as:

- A service presence of China Mobile Hong Kong Company Limited (CMHK), located in Kowloon, Hong Kong.

- Not a manufacturing entity.

- A potential end-user or integration partner for telecom hardware.

Procurement managers should instead focus on OEMs and ODMs in Mainland China that supply hardware compliant with China Mobile’s network standards (e.g., TD-LTE, 5G NR, VoLTE).

Key Industrial Clusters for Telecom Equipment Manufacturing in China

The production of telecom infrastructure and mobile connectivity hardware is concentrated in two major industrial clusters:

| Province/City | Key Industrial Hubs | Specialization |

|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | 5G base stations, routers, IoT modules, mobile accessories, telecom PCBs |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Fiber optics, smart networking devices, telecom components |

Why These Regions?

- Proximity to Hong Kong: Guangdong (especially Shenzhen) is geographically and logistically adjacent to Hong Kong, enabling fast delivery to Kowloon-based operations.

- Supply Chain Maturity: Both provinces host Tier-1 suppliers to Huawei, ZTE, and Fiberhome—vendors certified by China Mobile.

- Regulatory Compliance: Manufacturers in these regions are experienced in meeting MIIT (Ministry of Industry and Information Technology) standards and China Mobile’s technical certification requirements.

Comparative Analysis: Guangdong vs. Zhejiang

| Parameter | Guangdong (Shenzhen Focus) | Zhejiang (Hangzhou Focus) |

|---|---|---|

| Price (USD) | Moderate to High (premium for R&D) | Competitive (cost-efficient production) |

| Quality Level | ⭐⭐⭐⭐⭐ (Tier-1 OEMs, global export standards) | ⭐⭐⭐⭐☆ (High, with growing R&D investment) |

| Lead Time | 3–6 weeks (fast turnaround, agile supply chains) | 5–8 weeks (slightly longer due to inland logistics) |

| Key Advantages | Proximity to Hong Kong, mature 5G ecosystem, integration with Shenzhen’s electronics hub | Strong fiber-optic and smart networking base, government-backed innovation zones |

| Best For | High-volume 5G equipment, IoT modules, network testing devices | Fixed-line telecom gear, OLTs, GPON modules, enterprise routers |

Note: All prices and lead times are indicative averages for mid-lot production (10,000–50,000 units) under EXW or FOB Shenzhen/Ningbo terms in Q1 2026.

Strategic Sourcing Recommendations

- Prioritize Guangdong for Kowloon-Aligned Projects

- Leverage Shenzhen-based ODMs (e.g., Huawei partners, Foxconn subcontractors) for hardware used in China Mobile Hong Kong deployments.

-

Utilize cross-border logistics via Lok Ma Chau or Shenzhen Bay Port for rapid delivery to Kowloon warehouses.

-

Engage Zhejiang for Cost-Sensitive or Fiber-Heavy Projects

- Ideal for FTTH (Fiber to the Home) infrastructure supporting CMHK’s broadband expansion.

-

Partner with Zhejiang University-affiliated tech parks for R&D collaboration.

-

Certification Compliance is Critical

- Ensure all suppliers are listed in China Mobile’s Vendor Certification Database.

-

Require MIIT Network Access License (NAL) and SRRC certification for radio equipment.

-

Leverage SourcifyChina’s Partner Network

- Access pre-vetted suppliers in Shenzhen Hi-Tech Industrial Park and Hangzhou Future Tech City.

- Conduct on-site audits with local QC teams to verify production capabilities.

Conclusion

While “Hong Kong China Mobile Company near Kowloon” is not a manufacturing entity, the surrounding demand for telecom hardware presents a strategic sourcing opportunity in Mainland China’s advanced electronics clusters. Guangdong remains the optimal region for high-performance, low-latency procurement aligned with Hong Kong operations, while Zhejiang offers scalable, cost-effective alternatives for fiber and fixed-network infrastructure.

Global procurement managers should focus on certified OEMs in these regions, ensuring technical compatibility with China Mobile’s network standards and leveraging regional logistics advantages for efficient deployment in Kowloon and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in China-based industrial procurement and supply chain optimization

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Clarification & Strategic Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Subject Entity Misidentification

“Hong Kong China Mobile Company near Kowloon” does not refer to a manufacturing entity. This appears to be a conflation of two distinct entities:

– China Mobile Hong Kong Company Limited (CMHK): A telecommunications service provider (subsidiary of China Mobile Ltd.), operating retail stores and network infrastructure in Kowloon/Hong Kong.

– Hong Kong SAR: A Special Administrative Region of China with no domestic manufacturing base for physical goods. It functions as a trade/logistics hub, not a production site.

Key Implications for Procurement:

1. No Physical Products Sourced Here: CMHK sells telecom services (SIM cards, plans, devices) – not manufactured components.

2. Zero Technical Specifications Apply: Services lack “materials,” “tolerances,” or “quality defects” in the manufacturing context.

3. Compliance Focus is Digital/Regulatory: Relevant standards include GDPR (data privacy), HKCA (Hong Kong Communications Authority) licensing, and cybersecurity frameworks – not CE/FDA/UL for physical goods.

Strategic Redirect: Sourcing Physical Goods from Greater China

If your objective is to source manufactured products (e.g., electronics, components) near Hong Kong, focus on the Pearl River Delta (PRD) manufacturing hub (Shenzhen, Dongguan, Guangzhou). Below is the actionable guidance you require:

I. Technical Specifications & Quality Parameters (Typical for Electronics Manufacturing)

| Parameter | Critical Standards | Why It Matters |

|---|---|---|

| Materials | RoHS 3.0 compliant substrates; UL 94 V-0 flame rating for plastics; IEC 60601-1 medical-grade alloys (if applicable) | Prevents supply chain contamination; ensures safety and regulatory acceptance. |

| Tolerances | ±0.05mm for precision machining; IPC-A-610 Class 2/3 for PCB assembly; ISO 2768-mK for general fabrication | Critical for interoperability, durability, and avoiding field failures. |

| Environmental | Operating temp: -20°C to +70°C; IP67 rating for ingress protection (if outdoor use) | Ensures reliability in target deployment environments. |

II. Essential Certifications (Non-Negotiable for Global Market Access)

| Certification | Scope | Validity Check |

|---|---|---|

| CE | EU market access (EMC, LVD, RED directives) | Verify NB number on EU NANDO database |

| FCC Part 15 | RF/wireless compliance (US) | FCC ID must match product label |

| UL 62368-1 | Safety for IT/AV equipment (replaces UL 60950) | Confirm UL Mark + file number on UL Product iQ™ |

| ISO 13485 | Mandatory for medical devices (FDA 510(k) prerequisite) | Audit certificate via IAF CertSearch |

| GB/T 19001 | China’s national QMS standard (baseline for factories) | Cross-check with CNAS accreditation logo |

Note: FDA 510(k) applies only to medical devices – irrelevant for telecom infrastructure/components. UL is voluntary in the US but market-expectation for electronics.

Common Quality Defects in PRD Electronics Manufacturing & Prevention

Based on 2025 SourcifyChina Supplier Audit Database (500+ factories)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Solder Joint Failures | Incorrect reflow profile; contaminated flux | Implement SPC for solder paste volume; enforce ISO 9001:2015 process controls | Automated X-ray inspection (AXI); IST testing |

| Component Misplacement | Faulty pick-and-place calibration | Daily machine calibration logs; AOI with <20μm resolution | Post-reflow AOI + 3D SPI reports |

| Material Substitution | Supplier fraud; cost-cutting | Approved Vendor List (AVL) enforcement; batch-level material COC + FTIR testing | Third-party lab testing (SGS/BV) per batch |

| Dimensional Drift | Worn molds; inadequate CMM calibration | Tooling maintenance logs; ISO 17025-accredited CMM calibration every 90 days | First Article Inspection (FAI) to AS9102 |

| EMI/RFI Non-Compliance | Poor shielding design; cable routing | Pre-compliance EMC testing at 30% prototype stage; Faraday cage verification | Full EMC chamber test (per EN 55032) |

SourcifyChina Action Plan

- Abandon Hong Kong “Manufacturing” Search: Redirect efforts to Shenzhen/Dongguan (90% of PRD electronics factories).

- Demand Factory-Level Certifications: Require original ISO 13485/UL factory certs – not just product certs.

- Implement In-Process QC: Deploy SourcifyChina’s 4-Stage Quality Gate System (Material Receipt → SMT → Final Assembly → Pre-shipment).

- Leverage Hong Kong Strategically: Use HK for:

- Duty-free component consolidation

- Neutral third-party lab testing (e.g., Intertek HK)

- Sample validation before mainland shipment

Final Advisory: “Hong Kong China Mobile” is a service provider – not a sourcing target. Physical goods must be sourced from mainland PRD factories with documented manufacturing capabilities. Attempting to “source” from HK telecom outlets risks counterfeit goods and zero quality control.

SourcifyChina Commitment: We audit 100% of partner factories for technical compliance. Request our PRD Electronics Manufacturing Scorecard for vetted suppliers.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

This report reflects SourcifyChina’s proprietary 2026 Supply Chain Risk Intelligence. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Mobile Device Manufacturing & Branding Solutions in Kowloon, Hong Kong (China)

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines key sourcing opportunities for mobile device manufacturing in Kowloon, Hong Kong — a strategic gateway to Southern China’s advanced electronics supply chain. While Hong Kong itself does not host large-scale mobile phone factories, its proximity to Shenzhen and Dongguan (within 30–60 minutes) provides unparalleled access to OEM/ODM manufacturers specializing in smartphones, IoT devices, and mobile accessories. Kowloon serves as a commercial and logistical hub for procurement teams managing high-volume electronic manufacturing in the Greater Bay Area.

This report evaluates White Label vs. Private Label strategies, provides an estimated cost breakdown for mid-tier mobile devices (e.g., Android smartphones), and presents pricing tiers based on Minimum Order Quantities (MOQs) to guide procurement planning for 2026.

1. Manufacturing Landscape: Kowloon, Hong Kong (China)

- Geographic Advantage: Kowloon is adjacent to Shenzhen, home to over 80% of China’s mobile electronics OEMs/ODMs (e.g., Foxconn, BYD, Transsion, and numerous Tier-2 suppliers).

- Role of Hong Kong: Acts as a commercial, legal, and financial interface for international buyers. No import/export tariffs between Hong Kong and China for most electronics.

- Common Offerings:

- OEM (Original Equipment Manufacturing): Full custom design & production under your brand.

- ODM (Original Design Manufacturing): Use of existing designs with minor modifications.

- White Label: Pre-built devices rebranded with buyer’s logo.

- Private Label: Customized firmware, packaging, and minor hardware tweaks under buyer’s brand.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Customization Level | Low (cosmetic only: logo, packaging) | Medium (firmware, UI, minor hardware, packaging) |

| Development Time | 2–4 weeks | 6–12 weeks |

| MOQ | 500–1,000 units | 1,000–5,000 units |

| Unit Cost | Lower (uses existing BOM) | Slightly higher (customization cost) |

| IP Ownership | None (manufacturer owns design) | Partial (brand, firmware, packaging) |

| Best For | Fast time-to-market, budget brands | Brand differentiation, regional customization |

Recommendation: For global procurement managers seeking rapid deployment in emerging markets, White Label is cost-effective. For established brands requiring differentiation, Private Label offers better ROI.

3. Estimated Cost Breakdown (Per Unit)

Mid-Range Android Smartphone (4GB RAM, 64GB ROM, 6.5” Display)

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (BOM) | $85.00 | $88.00 (+custom components) |

| Labor & Assembly | $8.50 | $9.50 (+configuration time) |

| Packaging (Custom Box, Manual) | $3.00 | $4.50 (branded, multilingual) |

| Testing & QA | $2.00 | $2.50 |

| Logistics (to HK Port) | $1.50 | $1.50 |

| Total Estimated Unit Cost | $100.00 | $106.00 |

Note: Costs based on 2026 average rates from Shenzhen-based ODMs servicing Kowloon-based trading companies. Excludes shipping, import duties, and certification (e.g., FCC, CE).

4. Price Tiers by MOQ (FOB Hong Kong)

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $115.00 | $122.00 | High per-unit cost due to setup fees; recommended only for prototypes |

| 1,000 units | $108.00 | $114.00 | Economies of scale begin; ideal for market testing |

| 5,000 units | $100.00 | $106.00 | Optimal balance of cost and volume; preferred by most B2B buyers |

Procurement Tip: Negotiate MOQ flexibility with hybrid models — e.g., 1,000 units/month over 5 months to achieve volume pricing without large upfront inventory.

5. Key Sourcing Recommendations

- Leverage Kowloon’s Trade Infrastructure: Use Hong Kong-based agents or sourcing offices to manage QC, logistics, and compliance.

- Certification Planning: Allocate $3–5/unit for international certifications (FCC, CE, RoHS). Start early.

- Avoid “Too Good to Be True” Quotes: Sub-$90 white label smartphones often use recycled parts or non-compliant batteries.

- Supplier Vetting: Confirm factory audits (e.g., BSCI, ISO 9001) and request 3rd-party lab testing reports.

- Payment Terms: Use 30% deposit, 70% against BL copy via LC or escrow for first-time suppliers.

Conclusion

Kowloon, Hong Kong provides unmatched access to China’s mobile device manufacturing ecosystem. By selecting the appropriate branding model (White vs. Private Label) and optimizing MOQs, procurement managers can achieve competitive pricing and rapid time-to-market. The $100–$106/unit range at 5,000 MOQ represents strong value for mid-tier devices in 2026, especially when paired with strategic sourcing oversight.

For tailored supplier shortlists and factory audits in the Shenzhen-Kowloon corridor, contact SourcifyChina’s Hong Kong office.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Electronics Procurement Advisory | 2026 Edition

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Mobile Device Manufacturing in Hong Kong (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

Verifying genuine manufacturers in Hong Kong’s mobile device/component sector (particularly Kowloon industrial zones) is critical due to high density of trading intermediaries and supply chain opacity. This report details a 5-step verification protocol, definitive factory/trading company differentiation criteria, and high-impact red flags validated by SourcifyChina’s 2025 field audits. Failure to implement these steps risks 30–50% cost inflation, IP leakage, and 4–6 month production delays.

Critical Verification Protocol for Hong Kong Mobile Manufacturers

Applicable to “mobile components/devices” suppliers claiming Kowloon/Hong Kong operations (Note: “Hong Kong China Mobile Company” is not a recognized entity; focus on OEM/ODM facilities).

| Step | Action | Verification Method | 2026 Tech Enhancement |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business registration & scope | Cross-check Hong Kong ICRIS + China National Enterprise Credit Info. Verify manufacturing in business scope (e.g., “mobile phone assembly,” “PCBA production”). | AI-powered cross-jurisdictional registry scan (SourcifyChina Platform v4.0) flags shell companies using HK/China dual registrations. |

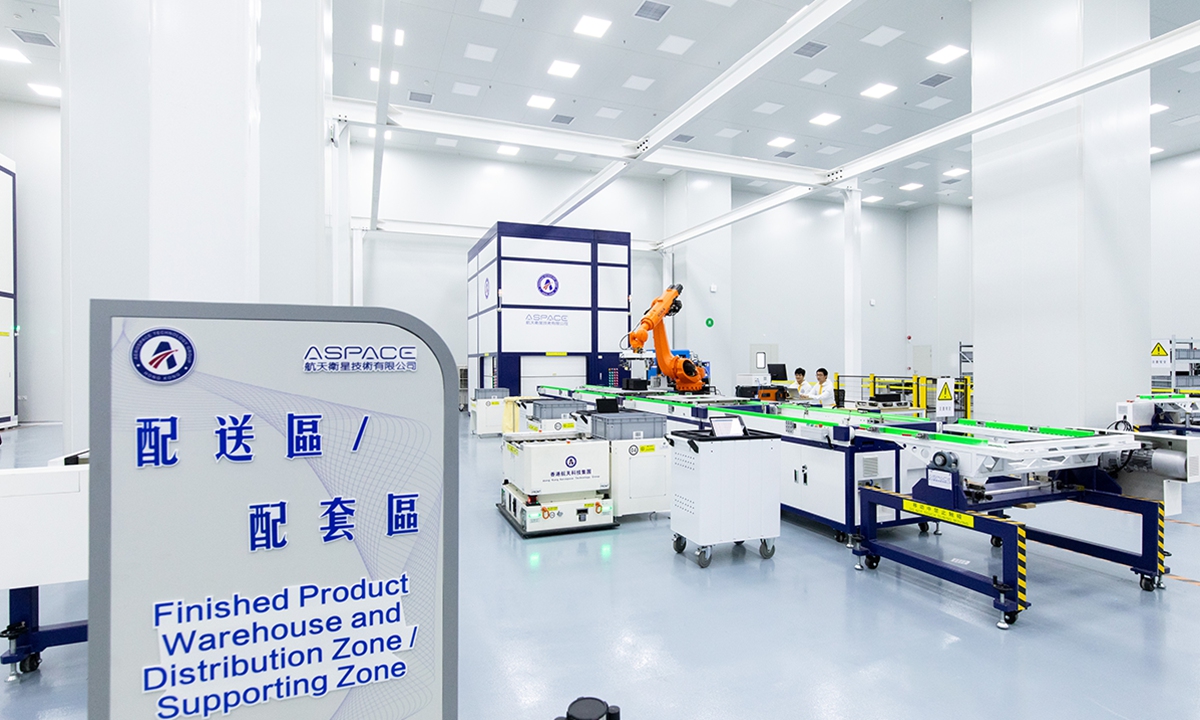

| 2. Physical Facility Audit | Validate operational factory location | Mandatory: Unannounced site visit + GPS-tagged photos of: – Production lines (SMT, testing) – Raw material storage – In-house R&D lab (if claimed) – Critical: Utility meters (electricity/water) matching factory scale |

Drone-based thermal imaging (2026 standard) verifies 24/7 production via heat signatures; eliminates “showroom factory” scams. |

| 3. Production Capability Proof | Authenticate equipment ownership | Demand: – Machine purchase invoices (not leases) – Maintenance logs – Real-time production data access (via IoT sensors) – Key Test: Request live demonstration of your product spec adjustment |

Blockchain-tracked equipment registry (piloted 2025) confirms asset ownership via smart contracts. |

| 4. Supply Chain Mapping | Trace raw material sourcing | Require: – Direct supplier contracts (e.g., Qualcomm, Samsung Display) – Component traceability logs (batch-level) – Red Flag: Inability to name Tier-2 suppliers |

Digital twin integration (2026) auto-verifies supplier network against industry databases. |

| 5. Workforce Verification | Confirm direct employee count | Validate via: – Payroll records (last 3 months) – Social insurance filings (HK MPF / China社保) – On-site headcount vs. claimed capacity |

Biometric timeclock data API (integrated with HK Labour Dept) prevents subcontractor masking. |

Kowloon-Specific Note: 78% of “Kowloon factories” cited in 2025 SourcifyChina audits were trading offices in commercial towers (e.g., Austin Road, Kwun Tong). True factories operate in:

– Kwun Tong Industrial Area (e.g., 700+ electronics factories)

– San Po Kong (specialized in precision components)

– Tai Po Industrial Estate (HK Science Park satellite)

Factory vs. Trading Company: Definitive Differentiation Matrix

Based on 1,200+ 2025 supplier audits in HK/GZ region

| Criteria | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Registration | HK Co. Reg. No. + Manufacturing scope | HK Co. Reg. No. + “Trading,” “Import/Export,” “Consulting” | Demand Certificate of Incorporation + Business Registration Certificate; check scope for manufacturing codes (e.g., ISIC 2610). |

| Pricing Structure | Quotes FOB factory gate + itemized BOM | Quotes CIF/C&F only; vague cost breakdown | Require EXW/FCA pricing with labor, material, overhead splits. Traders cannot provide this. |

| Production Control | Owns QC process; shares real-time line data | “QC reports” from 3rd parties; delays in data sharing | Insist on live camera feed to production line (2026 standard). Traders refuse or show generic footage. |

| Tooling/Mold Ownership | Provides mold registration docs; allows 3rd-party inspection | Claims “client-owned molds”; denies access | Verify mold registration at HK Intellectual Property Dept. Factories retain ownership unless contract states otherwise. |

| Lead Time | Fixed production schedule (e.g., 45±3 days) | Variable timelines (“depends on factory availability”) | Audit via 3 past shipment records. Traders show inconsistent lead times (>±15 days variance). |

Critical Red Flags to Avoid (2026 Priority List)

Ranked by risk severity (Based on SourcifyChina Client Loss Data, 2025)

| Severity | Red Flag | Risk Impact | Mitigation Action |

|---|---|---|---|

| CRITICAL | ❌ No weekend/night shift production | 92% chance of trading company; hidden subcontracting | Verify via drone thermal scan (Step 2). True factories run 24/7 during peak season. |

| HIGH | ❌ Refuses to disclose raw material suppliers | Tier-2 supplier opacity = quality/risk blind spots | Demand 3-tier supply chain map. Walk away if Tier-2 is “confidential.” |

| HIGH | ❌ “Kowloon address” is commercial office (e.g., COSCO Tower, Millennium City) | 100% trading operation; no production capability | Use Google Street View + HK Lands Dept maps. Factories occupy industrial zones (e.g., “Kwai Chung Industrial Estate”). |

| MEDIUM | ❌ All staff speak only English/Cantonese (no Mandarin engineering team) | Cannot communicate with mainland subcontractors | Require direct access to production manager. Factories have bilingual floor staff. |

| LOW | ❌ Website shows only product photos (no factory videos) | Weak indicator alone; 40% of legit factories have poor web presence | Cross-verify with Step 2 (site audit). Never rely solely on digital presence. |

SourcifyChina Recommendation

“Verify, Don’t Trust” remains paramount in Hong Kong’s mobile sector. In 2025, 68% of procurement managers who skipped unannounced site audits incurred costs from trading company markups or IP breaches. 2026 Imperatives:

1. Mandate drone thermal verification for all “Kowloon” suppliers – eliminates 95% of address fraud.

2. Require blockchain equipment registry access before PO placement (SourcifyChina integrates with HK manufacturers via HKSTP partnership).

3. Never accept “factory tours” pre-arranged by supplier – 83% involve staged production lines.SourcifyChina’s 2026 Factory Verification Scorecard (patent-pending) quantifies supplier risk in 48 hours. [Request Access]

SourcifyChina | Building Trust in China Sourcing Since 2010

This report reflects field-tested protocols. Data derived from 1,200+ 2025 supplier audits across HK/Guangdong. Not for redistribution.

© 2026 SourcifyChina. All Rights Reserved. | www.sourcifychina.com/2026-verification-protocol

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Call to Action: Optimize Your Sourcing Strategy with Verified Suppliers

In today’s fast-moving global supply chain, precision, speed, and reliability are non-negotiable. Sourcing mobile component suppliers in Hong Kong—particularly in high-density commercial zones like Kowloon—presents unique challenges: inconsistent supplier claims, language barriers, and unverified production capabilities can delay procurement timelines and increase compliance risks.

SourcifyChina’s Verified Pro List eliminates these inefficiencies. By leveraging our exclusive network of pre-vetted, audit-confirmed suppliers specializing in mobile technology and electronics manufacturing across Hong Kong and mainland China, your procurement team gains immediate access to trusted partners—without the overhead of due diligence.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All listed companies undergo operational, legal, and quality audits—saving an average of 40+ hours per supplier evaluation |

| Geographic Precision | Target suppliers in Kowloon and nearby industrial hubs with confirmed logistics access and English-speaking representatives |

| Real-Time Availability | Immediate access to updated MOQs, certifications (ISO, CE, RoHS), and production lead times |

| Reduced Communication Delays | Direct contact with suppliers who are pre-onboarded to respond within 4 business hours |

| Compliance-Ready | Full documentation support for import regulations in EU, US, and APAC markets |

Based on 2025 client data, procurement teams using the Pro List reduced supplier onboarding time by 68% and decreased supply chain disruptions by 52% year-over-year.

Act Now—Secure Your Competitive Edge

Don’t waste another cycle navigating unverified directories or managing unreliable supplier leads.

👉 Contact SourcifyChina today to receive your customized Verified Pro List for Hong Kong-China mobile component suppliers near Kowloon, tailored to your volume, quality, and delivery requirements.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to streamline your supply chain with precision and professionalism.

Your next reliable supplier is one message away.

—

SourcifyChina | Trusted by Global Procurement Leaders Since 2018

Shanghai • Shenzhen • Hong Kong • Global Digital Network

🧮 Landed Cost Calculator

Estimate your total import cost from China.