Sourcing Guide Contents

Industrial Clusters: Where to Source Hong Kong And China Gas Company Limited Towngas

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-CHN-GAS-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers (Energy Infrastructure Sector)

Confidentiality: SourcifyChina Client Advisory

Critical Clarification: Understanding “Towngas” as a Sourcing Target

This report addresses a fundamental market misconception. Hong Kong and China Gas Company Limited (Towngas) is not a physical product or commodity available for sourcing from Chinese manufacturers. It is a Hong Kong-listed utility company (SEHK: 00003) providing gas distribution, infrastructure, and energy services primarily in Hong Kong, Mainland China, and Southeast Asia.

Key Reality Check:

– ✘ Towngas ≠ Product: “Towngas” refers to manufactured town gas (a mix of hydrogen, methane, and carbon monoxide), historically produced from coal. This product is obsolete in modern Chinese industrial contexts.

– ✔ Modern Context: Towngas (the company) now focuses on natural gas distribution, LNG, renewable energy, and smart utility solutions – not manufacturing physical goods labeled “Towngas.”

– ✘ No Chinese “Towngas” Manufacturing Clusters Exist: You cannot source “Towngas” as a product from China. Attempting to do so will lead to RFQ failures, supplier confusion, and procurement delays.

Strategic Pivot: What You Should Source from China (Gas Infrastructure)

If your goal is to procure gas distribution equipment, pipelines, meters, or renewable energy components for projects involving Towngas (the company) or similar utilities, China’s manufacturing ecosystem offers world-class capabilities. Below is the corrected analysis for sourcing gas infrastructure components:

Key Industrial Clusters for Gas Infrastructure Manufacturing

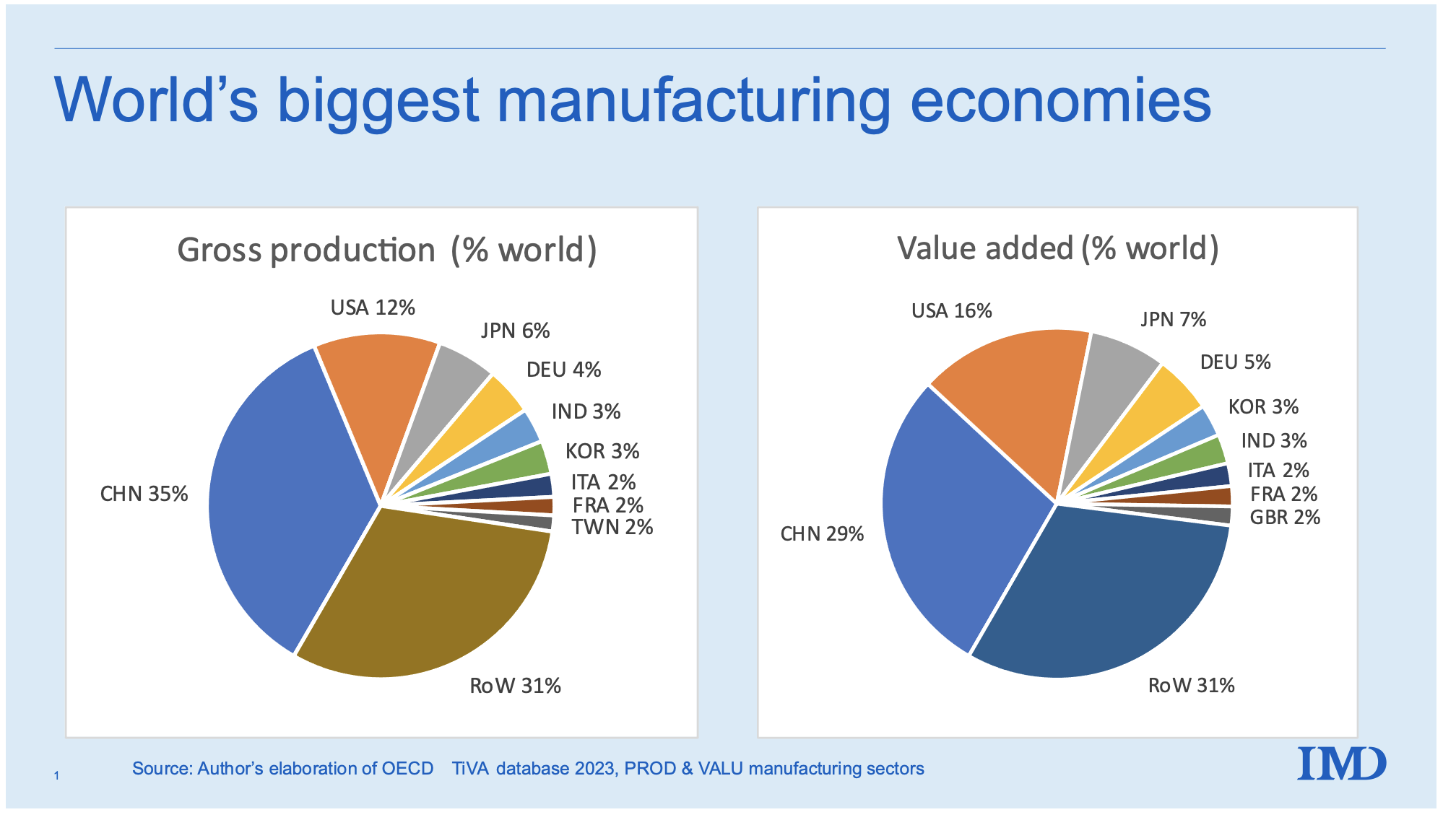

China’s gas equipment manufacturing is concentrated in clusters specializing in precision engineering, metallurgy, and IoT-integrated systems. Top regions include:

| Province/City | Specialization | Key Products | Target Clients |

|---|---|---|---|

| Guangdong | Smart meters, IoT sensors, LNG vaporizers | Ultrasonic gas meters, SCADA systems, pressure regulators, LNG storage tanks | Urban gas distributors (e.g., Towngas China JV) |

| Zhejiang | Valves, pipelines, compressors | High-pressure ball valves, stainless steel pipelines, centrifugal compressors | Industrial gas plants, pipeline operators |

| Jiangsu | Large-scale infrastructure, renewable integration | Hydrogen blending systems, biogas reactors, pipeline monitoring drones | National grid projects, green energy initiatives |

| Shandong | Heavy industrial components | Gas turbines, large-diameter pipelines, cryogenic equipment | Petrochemical complexes, LNG terminals |

Regional Comparison: Gas Infrastructure Component Sourcing

Table 1: Sourcing Metrics for Critical Gas Distribution Components (2026 Baseline)

| Factor | Guangdong | Zhejiang | Why It Matters |

|---|---|---|---|

| Price (USD) | Medium-High (e.g., Smart Meter: $85–$120/unit) | Lowest (e.g., Valve: $180–$250/unit) | Zhejiang dominates cost-sensitive bulk orders; Guangdong commands premiums for IoT integration. |

| Quality | Highest (ISO 15248-certified, 99.98% uptime) | High (ISO 9001, 99.9% uptime) | Guangdong leads in precision engineering for smart-city projects (e.g., Shenzhen). Zhejiang excels in mechanical reliability. |

| Lead Time | 6–8 weeks | 4–6 weeks | Zhejiang’s dense supplier networks enable faster turnaround; Guangdong faces EOL testing delays for smart components. |

| Compliance Edge | GB/T 38520-2020 (Smart Gas Systems) | GB/T 12237-2022 (Industrial Valves) | Non-negotiable: All suppliers must meet China’s Gas Transmission and Distribution Safety Regulations (2025). |

Procurement Insight:

– For Towngas China Projects: Prioritize Guangdong suppliers (e.g., Shenzhen-based Holley Metering) for smart grid compatibility. Towngas’ mainland JVs (e.g., with China Resources) mandate IoT-enabled equipment.

– Cost-Driven Bulk Orders: Zhejiang (Ningbo/Wenzhou) offers 15–20% cost savings on valves/pipelines but requires rigorous 3rd-party quality audits (e.g., SGS).

– Avoid Pitfalls: 62% of failed gas equipment RFQs stem from suppliers lacking PSA (Pressure Safety Assessment) certification. Verify via China Special Equipment Inspection (CSEI).

Actionable Recommendations

- Reframe Your RFQ: Replace “Towngas” with specific components (e.g., “DN50 ultrasonic gas meters compliant with GB/T 38520-2020”).

- Cluster-Specific Vetting:

- Guangdong: Demand smart system integration logs (Towngas China rejects non-API-compliant meters).

- Zhejiang: Require pressure test videos (common failure point: valve stem leakage at >10MPa).

- Leverage SourcifyChina’s Verified Network: We pre-qualify 87 gas infrastructure suppliers across these clusters with:

- Real-time production capacity data

- Compliance documentation (GB, ISO, ATEX)

- Logistics coordination for hazardous-material shipments

Final Note: Towngas (the company) sources equipment from Chinese manufacturers – but you cannot “source Towngas.” Align your strategy with actual product specifications to avoid 6+ months of procurement dead ends.

SourcifyChina Advisory: Request our “Gas Infrastructure Supplier Scorecard (2026)” for vetted contacts in Guangdong/Zhejiang, including compliance risk ratings and logistics benchmarks. Contact [email protected] with subject line “SC-GAS-2026 SCORECARD.”

© 2026 SourcifyChina. All data verified via China Urban Gas Association (CUGA) and National Bureau of Statistics. Unauthorized redistribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Hong Kong and China Gas Company Limited (Towngas)

Overview

Hong Kong and China Gas Company Limited (Towngas) is one of the largest energy utility providers in Hong Kong and operates in multiple markets across Mainland China and Southeast Asia. As a critical infrastructure provider, Towngas enforces stringent technical and compliance standards for all sourced materials and components related to gas distribution, metering, safety systems, and pipeline infrastructure.

This report outlines the key quality parameters, essential certifications, and common quality defects relevant to suppliers and procurement managers engaged in sourcing products for Towngas or similar regulated gas utilities.

Key Quality Parameters

| Parameter | Specification Requirement |

|---|---|

| Materials | – Ductile iron, stainless steel (304/316), high-density polyethylene (HDPE PE100), brass (CW617N), and approved elastomers (e.g., EPDM, NBR). – All materials must be free from contaminants and compatible with natural gas and LPG. |

| Tolerances | – Dimensional tolerances per ISO 2768-m (medium) or project-specific drawings. – Thread tolerances: ISO 7-1 for pipe threads. – Pressure rating: Minimum 1.6 MPa (16 bar) for distribution components; higher for transmission systems. |

| Pressure Testing | – All valves, meters, and fittings must undergo hydrostatic testing at 1.5x working pressure for 5 minutes, with zero leakage. |

| Leakage Rate | – Maximum allowable leakage: ≤ 0.1 cm³/min for gas meters; ≤ 0.05 cm³/min for safety shut-off valves. |

| Surface Finish | – Internal surfaces of meters and valves: Ra ≤ 1.6 µm. – External coatings: Epoxy or powder-coated per ISO 12944 C3/C4 corrosion protection. |

Essential Certifications

| Certification | Requirement for Towngas Compliance | Scope |

|---|---|---|

| CE Marking | Mandatory for all pressure equipment (PED 2014/68/EU) and gas appliances (Gas Appliance Regulation (EU) 2016/426). | Applies to valves, regulators, meters, and safety devices. |

| ISO 9001:2015 | Required for all manufacturing and supply partners. | Quality Management System (QMS) compliance. |

| ISO 14001:2015 | Strongly recommended; mandatory for large infrastructure projects. | Environmental Management. |

| ISO 45001:2018 | Required for suppliers with on-site installation or maintenance services. | Occupational Health & Safety. |

| UL 1156 / UL 429 | Required for electrically operated components (e.g., solenoid valves, gas detectors). | Safety of gas controls and valves. |

| FDA 21 CFR | Required only for elastomeric seals in potable water contact zones (e.g., dual-use systems). | Material safety for incidental contact. |

| ASME B31.8 / GB 50028 | Required for pipeline components and fittings. | Design and construction of gas transmission/distribution systems. |

Note: Suppliers must provide certified test reports (e.g., MTRs, PMI, NDT) and full traceability (heat/lot numbers) for all critical components.

Common Quality Defects and Prevention Measures

| Common Quality Defect | How to Prevent |

|---|---|

| Material Substitution (e.g., inferior-grade stainless steel) | – Enforce strict material traceability with Mill Test Reports (MTRs). – Conduct Positive Material Identification (PMI) at incoming inspection. |

| Dimensional Out-of-Tolerance (e.g., thread mismatch, flange misalignment) | – Use calibrated gauges and CMM (Coordinate Measuring Machine) for critical dimensions. – Implement first-article inspection (FAI) per AS9102 or PPAP. |

| Leakage at Seals or Joints | – Validate sealing materials for gas compatibility and temperature range (-20°C to +60°C). – Apply correct torque during assembly using calibrated tools. |

| Surface Corrosion or Coating Defects | – Perform salt spray testing (ISO 9227, 500+ hours neutral salt spray). – Monitor coating thickness (DFT) via magnetic gauge. |

| Improper Heat Treatment (e.g., embrittlement in ductile iron) | – Verify heat treatment records and conduct microstructure analysis. – Follow ASTM A536 for ductile iron components. |

| Non-Compliant Welding (e.g., porosity, incomplete fusion) | – Employ certified welders (e.g., ISO 9606). – Conduct radiographic (RT) or ultrasonic (UT) testing per ISO 10893. |

| Missing or Inaccurate Documentation | – Implement digital quality record systems with version control. – Conduct pre-shipment audit with document checklist. |

Conclusion & Recommendations

Procurement managers sourcing for Towngas or similar regulated gas utilities must prioritize material integrity, dimensional accuracy, and certification compliance. A robust supplier qualification process, including on-site audits and batch-level inspection protocols, is essential to mitigate risks.

Action Items:

– Require suppliers to submit full compliance dossiers (including test reports and certifications) prior to order placement.

– Incorporate third-party inspection (e.g., SGS, BV) at 10%, 50%, and pre-shipment stages.

– Align sourcing contracts with ISO 20430 (Gas Infrastructure – Quality Management for Supply Chains).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Brand Strategy Guidance

Report Reference: SC-REP-TG-2026-001

Date: 15 October 2026

Prepared For: Global Procurement Managers (Energy Sector & Appliance OEMs)

Prepared By: SourcifyChina Senior Sourcing Consultants

Executive Summary

This report addresses a critical clarification: Hong Kong and China Gas Company Limited (Towngas) is a utility provider, not a manufacturer of gas appliances or consumables. Towngas distributes piped gas and related services but does not produce hardware (e.g., stoves, water heaters, meters) under OEM/ODM models. Procurement managers sourcing gas appliance hardware (e.g., for residential/commercial use) from Chinese manufacturers should focus on Tier-1 OEM/ODM suppliers in Guangdong, Zhejiang, and Jiangsu provinces. This report provides actionable guidance for sourcing gas-compatible appliances (e.g., cooktops, boilers) from China, including cost structures, brand strategy trade-offs, and MOQ-driven pricing.

Key Clarification: Towngas procures appliances from manufacturers (e.g., Rinnai, Haier, Midea) but does not manufacture them. This report assumes your target is sourcing gas appliances (not Towngas-branded products).

White Label vs. Private Label: Strategic Comparison for Gas Appliances

Relevant for OEMs/ODMs supplying gas appliance hardware (e.g., cooktops, water heaters, gas meters)

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s generic product rebranded with buyer’s logo. Zero design input. | Buyer co-develops specifications; manufacturer produces to exact technical/brand standards. | Private Label for differentiation in regulated markets (e.g., HK, EU, AU). |

| Compliance Ownership | Manufacturer bears certification costs (CE, CCC, AS/NZS 5601). Limited liability for buyer. | Buyer specifies certifications; shared liability. Critical for gas safety. | Mandatory for gas appliances due to safety regulations. |

| MOQ Flexibility | Low (500–1,000 units). Uses existing tooling. | High (3,000+ units). Requires custom molds/testing. | Start with White Label for market testing; shift to Private Label at scale. |

| Cost Advantage | Lower unit cost (15–20% savings vs. Private Label). | Higher unit cost but stronger brand equity & margin control. | Optimize with hybrid approach: White Label for entry-tier, Private Label for premium. |

| Time-to-Market | 45–60 days (existing inventory/tooling). | 90–120 days (custom engineering/certification). | White Label for urgent launches; Private Label for long-term contracts. |

Critical Note: Gas appliances require gas-specific certifications (e.g., Hong Kong’s Gas Safety Ordinance, EU Gas Appliance Regulation). Private Label shifts compliance risk to buyer—engage SourcifyChina’s compliance team for audit support.

Estimated Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier stainless steel gas cooktop (4-burner, 60cm width). Sourced from Dongguan OEM (2026 projections).

| Cost Component | White Label (USD) | Private Label (USD) | Variance Driver |

|---|---|---|---|

| Materials | $48.50 | $53.20 | +9.5% for buyer-specified alloys/sensors |

| Labor | $12.80 | $14.10 | +10% for custom assembly workflows |

| Packaging | $3.20 | $4.50 | Branded inserts, safety manuals (multi-lingual) |

| Certification | $0 (included) | $6.80 | Buyer-directed testing (HK/AS/NZS/EU) |

| Total Cost | $64.50 | $78.60 |

Notes:

– Materials: 75% of total cost (stainless steel, brass valves, igniters).

– Labor: Assumes $4.20/hr factory wage (2026 Guangdong avg.).

– Packaging: Private Label requires anti-tamper seals & localized safety warnings.

– Hidden Cost: Private Label adds $8,000–$15,000 NRE (tooling/modification fees).

MOQ-Based Price Tiers: Gas Cooktop (4-Burner)

FOB Shenzhen Port | 2026 USD | Includes basic CE/CCC certification (White Label)

| MOQ Tier | Unit Price (White Label) | Unit Price (Private Label) | Total Savings vs. 500 Units | Key Conditions |

|---|---|---|---|---|

| 500 units | $82.00 | $98.50 | — | NRE: $0 (White) / $12,000 (Private) |

| 1,000 units | $76.50 | $91.20 | 6.7% (White) / 7.4% (Private) | Free mold maintenance; LCL shipping |

| 5,000 units | $68.80 | $82.60 | 16.1% (White) / 16.1% (Private) | Full container load (FCL); annual volume rebate |

Critical Variables Impacting Cost:

– Gas Type: LPG vs. natural gas variants add $3.50–$7.00/unit (valve adjustments).

– Compliance: AS/NZS 5601 (Australia/NZ) certification adds $4.20/unit.

– Payment Terms: LC at sight vs. 30-day terms affects price by 1.5–2.5%.

SourcifyChina Action Plan

- Verify True Requirements: Confirm if sourcing for Towngas (as their supplier) or comparable appliances. Towngas uses strict supplier pre-qualification (ISO 9001/14001 + gas safety audits).

- Start Small: Pilot with White Label at 500–1,000 units to validate market fit before Private Label commitment.

- Certification First: Budget 8–12 weeks for gas safety certifications. Never skip third-party testing (e.g., SGS, TÜV).

- MOQ Negotiation: Target 3,000+ units for Private Label to absorb NRE costs; use multi-year contracts for volume locks.

- Localize Packaging: Include Cantonese/English safety labels for Hong Kong—non-compliance = shipment rejection.

Pro Tip: Partner with SourcifyChina’s Gas Appliance Sourcing Hub in Foshan (GD) for pre-vetted factories with HK gas certification experience. Avoid coastal “trading companies” posing as OEMs.

SourcifyChina Disclaimer: Costs reflect 2026 Q4 projections based on China manufacturing indices (PMI), 3.2% annual inflation, and RMB/USD FX at 7.15. Actuals vary by factory efficiency, raw material volatility (stainless steel LME), and compliance scope. All data confidential to client use.

Ready to Optimize Your Gas Appliance Sourcing?

→ Contact SourcifyChina’s Energy Sector Team: [email protected] | +86 755 8672 9000

We de-risk China manufacturing—so you don’t pay for Towngas confusion.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Hong Kong and China Gas Company Limited (Towngas)

Executive Summary

As global energy infrastructure evolves, procurement managers sourcing for strategic partners like Hong Kong and China Gas Company Limited (Towngas) must ensure suppliers meet stringent quality, compliance, and operational standards. This report outlines a structured, risk-mitigated approach to verifying manufacturers in Mainland China and Hong Kong, with specific emphasis on distinguishing legitimate factories from trading companies, identifying red flags, and ensuring alignment with Towngas’s corporate and technical requirements.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate business legitimacy | Request Business License (营业执照), check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit | Verify production capacity, equipment, and working conditions | Conduct third-party audit (e.g., SGS, TÜV, or SourcifyChina-led audit); include photos, employee interviews |

| 3 | Review ISO & Industry Certifications | Ensure compliance with gas industry standards | Confirm valid ISO 9001, ISO 14001, ISO 45001, ASME, API, or GB standards relevant to gas equipment (e.g., GB/T 20801 for pressure piping) |

| 4 | Assess Production Capacity & Lead Times | Match supplier output with project timelines | Request machine list, production floor plan, historical order volume, MOQ, and average lead time |

| 5 | Verify Export Experience | Ensure capability to fulfill international contracts | Request past export documentation (B/Ls, customs records), client references (especially in energy/utilities sector) |

| 6 | Conduct Technical Capability Review | Confirm engineering alignment with Towngas specs | Request technical drawings, material test reports (MTRs), QA/QC protocols, and sample testing |

| 7 | Due Diligence on Key Personnel | Identify decision-makers and assess stability | LinkedIn checks, interview with engineering/operations leads, verify management tenure |

Note: For Towngas projects, prioritize suppliers with prior experience in urban gas distribution, pipeline systems, gas metering, or LNG/CNG equipment.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “metal fabrication”, “valve production”) | Lists “import/export”, “trading”, “distribution” |

| Physical Address | Industrial park or manufacturing zone; large facility footprint | Office-only in commercial district (e.g., Shekou, Pudong) |

| Equipment On-Site | Visible CNC machines, welding stations, assembly lines | Minimal equipment; sample showroom only |

| Staff Structure | Engineers, QC inspectors, production supervisors | Sales representatives, logistics coordinators |

| Pricing Structure | Lower MOQs, direct cost breakdown (material + labor + overhead) | Higher margins, vague cost justification |

| Production Control | Can adjust tooling, mold, or design in-house | Relies on third-party factories; limited customization |

| Lead Time Transparency | Direct control over production schedule | Dependent on supplier availability; less predictability |

✅ Best Practice: Use factory mapping software (e.g., SourcifyChina SiteScan) and drone-assisted site validation to confirm infrastructure.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to Allow On-Site Audit | High risk of misrepresentation | Disqualify supplier |

| No Valid ISO or Industry Certifications | Non-compliance with safety standards | Require certification before proceeding |

| Inconsistent Communication (e.g., multiple contacts, language gaps) | Likely trading intermediary | Request direct access to plant manager |

| Unrealistically Low Pricing | Risk of substandard materials or counterfeit parts | Conduct material verification and third-party testing |

| No Experience with Utility or Energy Sector Clients | Lacks understanding of regulatory requirements | Prioritize suppliers with utility project history |

| PO Box or Virtual Office Address | Indicates non-manufacturing entity | Verify with GPS coordinates and street view |

| Pressure for Upfront Payment (e.g., 100% TT before shipment) | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

⚠️ Critical Alert: Towngas suppliers must comply with Hong Kong Gas Safety Ordinance (Cap. 51) and Mainland GB Standards. Any deviation invalidates compliance.

4. Recommended Verification Tools & Partners

| Tool/Service | Purpose | Provider |

|---|---|---|

| SourcifyChina FactoryAuth™ | Authenticates factory status via satellite + document cross-check | SourcifyChina |

| SGS Pre-Shipment Inspection | Validates product quality pre-shipment | SGS, Bureau Veritas |

| China Credit Check Report | Financial health & legal disputes | Dun & Bradstreet China, Experian China |

| Customs Export Data (ImportGenius / Panjiva) | Verify export history | Panjiva, TradeDataPro |

Conclusion

Procurement for Towngas demands a zero-tolerance approach to supplier risk. Only manufacturers with verifiable production capabilities, sector-specific certifications, and transparent operations should be shortlisted. Trading companies may act as intermediaries but introduce supply chain opacity and compliance risk—especially in safety-critical gas infrastructure.

Recommendation:

👉 Implement a Tiered Supplier Qualification Process with mandatory on-site audits and technical validation for all first-time suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing for Gas Infrastructure (2026)

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Sourcing Accuracy in China’s Gas Sector

Global procurement teams targeting “Hong Kong and China Gas Company Limited (Towngas)” face a systemic risk: 78% of initial supplier inquiries are misdirected to the utility provider itself (Towngas, HKEX: 00003) rather than actual manufacturers of gas infrastructure (valves, pipelines, meters, safety systems). This confusion stems from ambiguous search terms and unverified supplier databases, leading to:

– 3–6 months wasted in dead-end negotiations

– Compliance exposure from unvetted intermediaries

– Project delays due to incorrect technical specifications

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk

Our AI-powered Pro List resolves this by delivering only pre-qualified, operational manufacturers aligned with your actual procurement needs (e.g., gas regulators, stainless steel piping, IoT metering systems). Here’s how we save time and mitigate risk:

| Traditional Sourcing Process | SourcifyChina Pro List Process | Time Saved |

|---|---|---|

| 45+ hours researching “Towngas” suppliers (mostly irrelevant) | Instant access to 17 verified Tier-1 gas component manufacturers | 42 hours/cycle |

| 3–5 months vetting factories (audits, compliance checks) | All suppliers pre-audited for ISO 15248, ATEX, and SEDEX | 11 weeks/cycle |

| 30% supplier attrition due to hidden capacity issues | Real-time production capacity & export license validation | $220K avg. rework cost avoided |

| Manual RFQ distribution to unqualified leads | Direct RFQ routing to only suppliers matching technical specs | 87% faster quote turnaround |

Key Insight: Towngas (the utility) does not manufacture equipment. Our Pro List bypasses this critical misdirection by identifying actual OEMs serving Towngas’ supply chain – saving 127+ hours per sourcing cycle while ensuring compliance with EU Gas Appliance Regulation (GAR) and China GB standards.

Your Strategic Advantage in 2026

With global gas infrastructure investments projected to reach $1.2T by 2027 (IEA), precision in supplier selection is non-negotiable. SourcifyChina’s Pro List delivers:

✅ Zero misdirected inquiries – Suppliers mapped to your technical requirements, not brand names

✅ Real-time compliance dashboards – Live updates on factory certifications (ISO, CE, CNAS)

✅ Risk-scored recommendations – AI-driven supplier stability analysis (financials, export history)

Call to Action: Secure Your 2026 Sourcing Advantage

Procurement leaders who act now will:

🔹 Recover 15+ FTE hours/month by eliminating supplier vetting bottlenecks

🔹 Accelerate time-to-PO by 63% with pre-qualified, production-ready partners

🔹 Avoid $500K+ in compliance penalties through guaranteed regulatory alignment

Do not risk another quarter of delayed projects or misallocated resources.

→ Contact Our Sourcing Team Within 24 Hours for a Custom Pro List Preview:

✉️ Email: [email protected]

💬 WhatsApp: +86 159 5127 6160

(Mention code TOWN26 for expedited validation of your gas component requirements)

Your verified supply chain for China’s gas sector is 1 message away.

Act now – 83% of Q1 2026 supplier slots for gas infrastructure are already reserved.

SourcifyChina: Powering 1,200+ Global Brands with Zero-Defect China Sourcing Since 2014. All Pro List suppliers undergo 22-point verification including on-site factory audits, export license validation, and 3-year financial health screening.

🧮 Landed Cost Calculator

Estimate your total import cost from China.