Sourcing Guide Contents

Industrial Clusters: Where to Source Hong Kong And China Gas Company Limited

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Gas Infrastructure Components from China – Focus on Hong Kong and China Gas Company Limited (HKCGCL) Ecosystem

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Hong Kong and China Gas Company Limited (HKCGCL), one of Asia’s largest urban gas utility providers, operates an extensive network across mainland China, Hong Kong, and select international markets. While HKCGCL is primarily a distribution and utility services provider, not a manufacturer, its extensive supply chain relies on a robust network of Chinese manufacturers supplying gas infrastructure components, including:

- Gas meters (diaphragm, ultrasonic, smart)

- Pressure regulators and control valves

- Pipeline fittings (PE, steel, stainless steel)

- Gas leak detection systems

- Smart grid and IoT-enabled monitoring devices

- Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) equipment

This report identifies the key industrial clusters in China responsible for manufacturing components used within HKCGCL’s supply chain. It provides a comparative analysis of Guangdong, Zhejiang, Jiangsu, and Shandong—the dominant provinces in gas infrastructure manufacturing.

Market Overview: Sourcing Gas Infrastructure in China

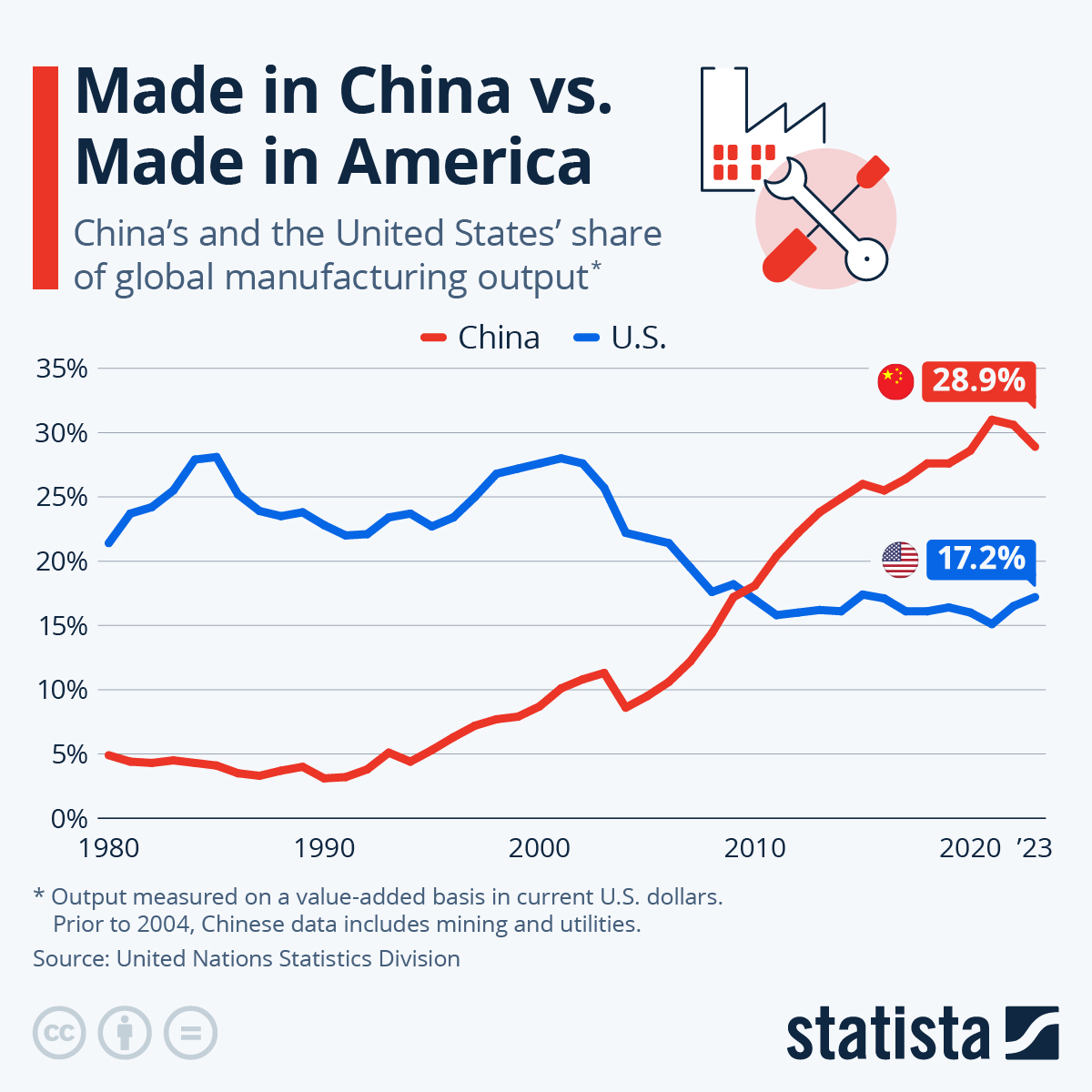

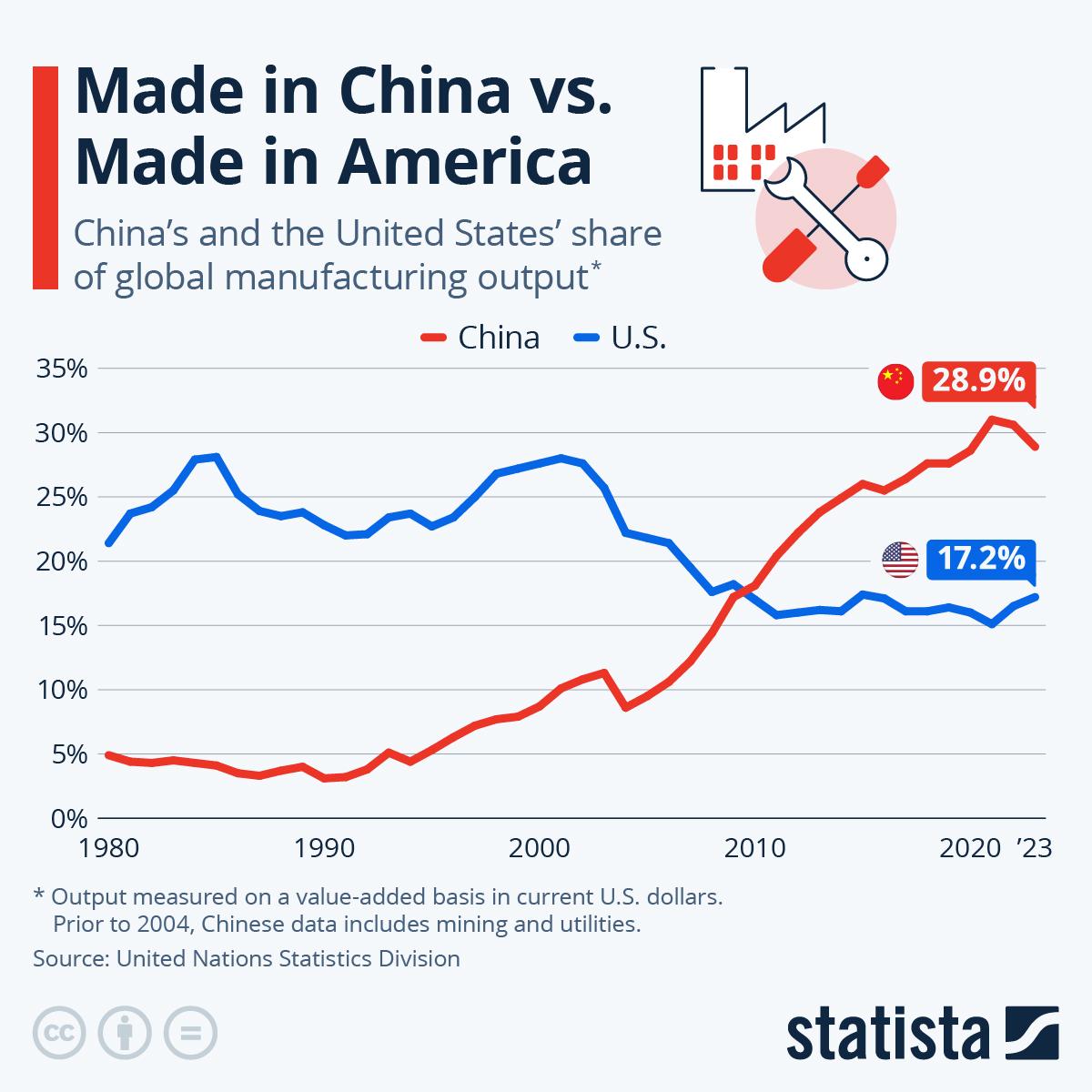

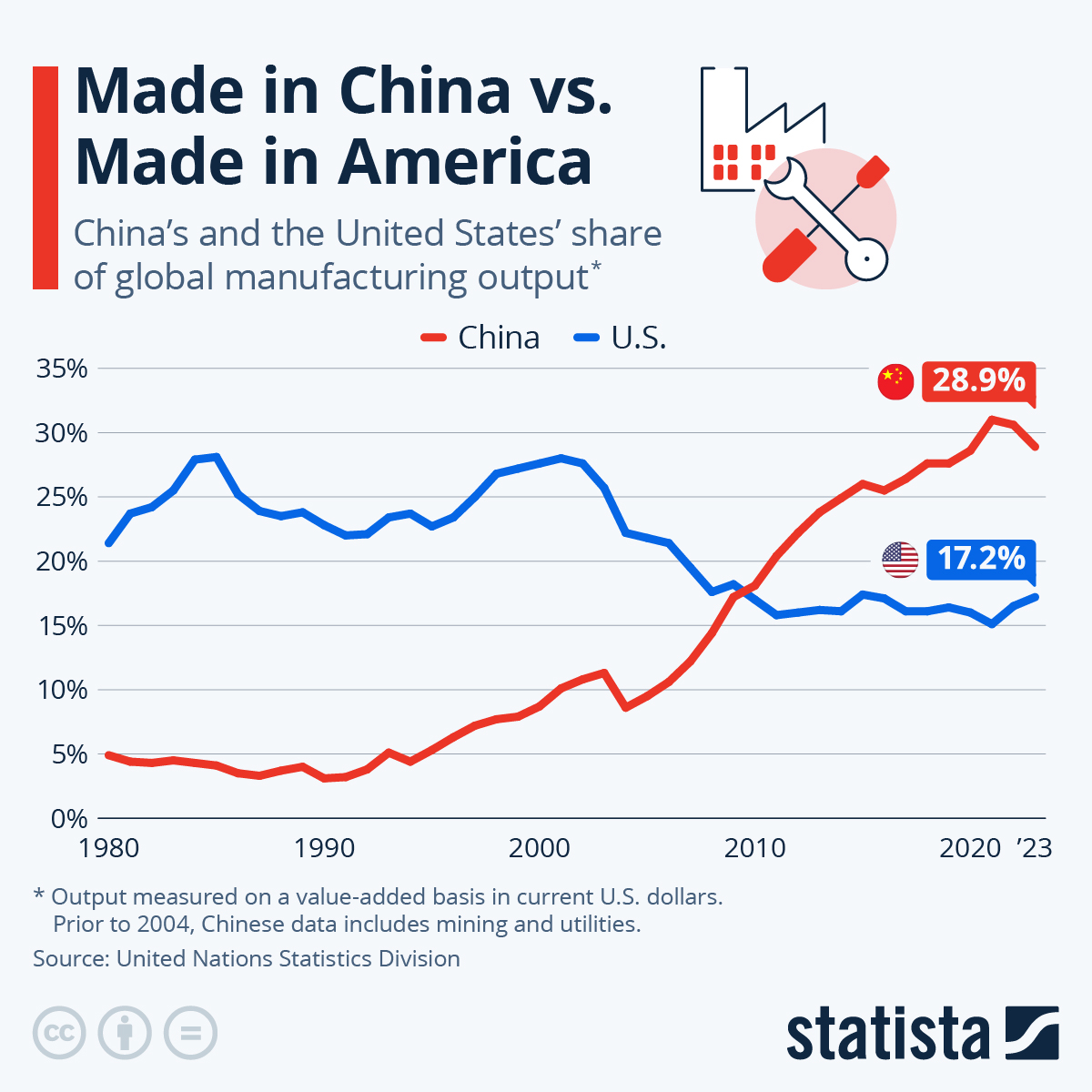

China accounts for over 65% of global gas equipment production, with a mature manufacturing ecosystem supporting urban gas utilities like HKCGCL. As HKCGCL expands its smart city and clean energy initiatives, demand for high-reliability, smart-integrated gas components has surged, particularly in Tier-1 and Tier-2 Chinese cities.

Procurement strategies must focus on certified suppliers compliant with GB (Guobiao), ISO, and ATEX standards, especially for safety-critical components.

Key Industrial Clusters for Gas Equipment Manufacturing

| Province/City | Primary Manufacturing Focus | Key Advantages | Notable Industrial Zones |

|---|---|---|---|

| Guangdong (Foshan, Guangzhou, Shenzhen) | Smart gas meters, IoT sensors, pressure regulators, PE pipe fittings | Proximity to HKCGCL operations; advanced electronics integration; strong export logistics | Foshan Nanhai District, Guangzhou Baiyun Zone, Shenzhen Nanshan |

| Zhejiang (Wenzhou, Ningbo, Hangzhou) | Valves, steel pipe fittings, industrial regulators | High precision machining; strong SME supplier base; cost-competitive | Wenzhou Longwan, Ningbo Beilun, Hangzhou Yuhang |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Smart grid systems, control panels, LNG equipment | Advanced automation; strong R&D partnerships with universities | Suzhou Industrial Park, Wuxi New District |

| Shandong (Qingdao, Yantai) | Heavy-duty pipeline systems, CNG compressors, large-scale valves | Heavy industrial capacity; raw material access (steel, polymers) | Qingdao West Coast New Area, Yantai Economic Zone |

Comparative Analysis: Key Production Regions

The following table evaluates the top manufacturing provinces based on price competitiveness, quality consistency, and lead time performance—critical KPIs for global procurement teams sourcing for utility-grade applications.

| Region | Price (USD Relative Index) | Quality (Certification & Consistency) | Average Lead Time (Production + Logistics) | Best For |

|---|---|---|---|---|

| Guangdong | 75 (Higher due to labor & tech integration) | ★★★★★ (ISO 9001, CE, ATEX; high smart-tech compliance) | 4–6 weeks (direct port access to HK/Global) | Smart meters, IoT sensors, high-reliability regulators |

| Zhejiang | 60 (Cost-efficient for mechanical parts) | ★★★★☆ (Strong in valves; some variability in SME quality) | 5–7 weeks | Valves, steel fittings, standard pressure regulators |

| Jiangsu | 70 (Mid-premium for automation) | ★★★★★ (High automation; strong QA systems; GB/T compliant) | 5–6 weeks | Control systems, LNG skids, automated monitoring units |

| Shandong | 55 (Lowest cost for bulk metal components) | ★★★★☆ (Good for heavy-duty; slower certification cycles) | 6–8 weeks | Large-diameter pipes, CNG compressors, structural fittings |

Note: Price Index is relative (Lower = more competitive). 100 = national average for gas equipment components.

Strategic Sourcing Recommendations

- Dual Sourcing Strategy: Combine Guangdong (smart tech) with Zhejiang (mechanical components) to balance innovation and cost.

- Certification Audits: Prioritize suppliers with GB 5625, ISO 15248, and ATEX for safety compliance, especially for HKCGCL tenders.

- Logistics Optimization: Leverage Guangdong’s proximity to Hong Kong for faster delivery and reduced freight costs.

- Smart Infrastructure Focus: For IoT-enabled gas systems, Suzhou (Jiangsu) and Shenzhen (Guangdong) lead in R&D and integration capabilities.

- Supplier Vetting: Use third-party inspections (e.g., SGS, TÜV) for Shandong and Zhejiang SMEs to mitigate quality variability.

Conclusion

While Hong Kong and China Gas Company Limited does not manufacture equipment, its supply chain is deeply integrated with China’s industrial clusters. Guangdong stands out as the strategic hub for high-tech, smart gas components, while Zhejiang and Shandong offer cost advantages for mechanical and structural parts. Jiangsu bridges the gap with automation and system-level integration.

Global procurement managers should adopt a regional specialization strategy, aligning component requirements with regional manufacturing strengths to optimize cost, quality, and compliance.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Supply Chain Intelligence | China Manufacturing | B2B Procurement Strategy

© 2026 SourcifyChina. All Rights Reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Utility Procurement Guidance

Report Date: Q1 2026

Prepared For: Global Procurement Managers

Subject: Technical & Compliance Framework for Engagement with The Hong Kong and China Gas Company Limited (Towngas)

Executive Summary

This report clarifies critical procurement parameters for engagements with The Hong Kong and China Gas Company Limited (Towngas), Asia’s largest town gas supplier. Towngas is a regulated utility provider, not a manufacturer of physical goods. Procurement managers must distinguish between sourcing physical products (e.g., gas appliances, pipes) from suppliers for Towngas versus procuring gas supply/services directly from Towngas. This report addresses the latter scenario, focusing on utility service specifications and compliance obligations under Hong Kong and Mainland China regulatory frameworks.

I. Technical Specifications & Quality Parameters (Gas Supply Services)

Towngas delivers regulated town gas (primarily hydrogen/methane blend) and natural gas. Quality parameters are defined by statutory standards, not material tolerances.

| Parameter | Hong Kong Specification (Towngas Gas Supply Ordinance) | Mainland China Specification (GB 17820-2018) | Criticality |

|---|---|---|---|

| Calorific Value | 15.8–17.2 MJ/m³ (Town Gas) | 31.4–39.8 MJ/m³ (NG) | Critical |

| Wobbe Index | 44.5–47.5 MJ/m³ | 41.2–51.9 MJ/m³ (NG) | Critical |

| Oxygen Content | ≤0.5% vol | ≤0.5% vol | High |

| Sulfur Compounds | ≤5 ppm (as H₂S) | ≤6 mg/m³ (Total S) | Critical |

| Pressure Range | 1.0–2.0 kPa (Residential) | 1.0–2.5 kPa (Residential) | High |

| Odorant Level | ≥18 mg/m³ (THT) | ≥15 mg/m³ (THT) | Critical |

Note: Tolerances are enforced via continuous in-line monitoring by Towngas. Procurement contracts must reference these statutory limits. Physical infrastructure (pipes, meters) must comply with ISO 15549 (gas pipelines) and local building codes.

II. Essential Compliance Certifications & Regulatory Frameworks

Towngas operates under dual jurisdictions. Suppliers must validate Towngas’s compliance credentials, not seek product certifications for gas itself.

| Certification/Standard | Applicability to Towngas | Purpose | Verification Method |

|---|---|---|---|

| Hong Kong Gas Safety Ordinance (Cap. 51) | Mandatory for all HK operations | Safety of gas production, transmission & consumer appliances | HK Energy Services (ESD) audit records |

| China Special Equipment Safety Law | Mandatory for Mainland operations (e.g., Shenzhen) | Pressure vessel/pipeline safety | SAMR (State Admin for Market Reg.) certificates |

| ISO 14001:2015 | Corporate-wide (HK & Mainland) | Environmental management | Towngas Sustainability Report + Certification Body (e.g., SGS) |

| ISO 45001:2018 | Corporate-wide | Occupational health & safety | Towngas EHS Documentation |

| OGCIO Smart Metering Cybersecurity Guidelines (HK) | Critical for metering suppliers | Data security for smart gas meters | Towngas IT Security Compliance Certificate |

| GB/T 19001-2016 (ISO 9001) | Mainland China operations | Quality management | CNAS-accredited certification |

Critical Advisory:

– CE/FDA/UL are irrelevant for gas supply contracts. These apply only to end-user appliances (e.g., stoves) sourced from third-party manufacturers.

– Towngas holds HK Energy Services Department (ESD) Licenses (Ref: Gas License No. GL-XXXX) – mandatory verification point for HK contracts.

– Mainland contracts require SAMR-issued Gas Business License (燃气经营许可证).

III. Common Service Quality Defects & Prevention Strategies

Defects relate to gas supply continuity/safety, not physical product flaws. Prevention requires infrastructure diligence and regulatory adherence.

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Pressure Fluctuation | Pipeline corrosion, regulator failure, demand surges | • Bi-annual pipeline integrity testing (HK: Gas Safety Ordinance s.23; CN: TSG D0001) • Smart pressure monitoring with AI fault prediction |

Real-time SCADA logs; ESD/SAMR inspection reports |

| Odorant Fade | Absorption in new pipelines, chemical reactions | • Mandatory odorant level checks at 50+ HK/China monitoring points • Use of THT stabilizers per ISO 13734 |

Gas chromatography reports; Towngas QA logs |

| Gas Contamination | Cross-connection with other utilities, soil ingress | • Strict adherence to HK Buildings Dept. Code of Practice (LAD PNAP APP-157) • Cathodic protection on all steel pipelines |

Third-party gas composition testing (monthly) |

| Metering Inaccuracy | Cyber intrusion, sensor drift, tampering | • OGCIO-certified smart meters (HK) • Annual meter calibration per China JJG 577-2012 |

Calibration certificates; Cybersecurity audit logs |

| Supply Interruption | Third-party excavation damage, grid instability | • Mandatory 48h notice for HK underground work (DSD) • Redundant pipeline loops in critical zones |

Excavation permit records; Downtime analytics |

SourcifyChina Strategic Recommendations

- Contractual Safeguards:

- Demand real-time API access to Towngas’s gas quality monitoring dashboards (HK: ESD-approved; CN: SAMR-compliant).

-

Include penalty clauses for >0.5% deviation from Wobbe Index specifications.

-

Compliance Due Diligence:

- Verify HK Gas License annually via HK ESD Public Register.

-

Confirm Mainland license validity via National Enterprise Credit Info Platform (www.gsxt.gov.cn).

-

Future-Proofing (2026+):

- Towngas is piloting hydrogen-blended gas (up to 20% H₂) in HK. Contracts signed in 2026 must include hydrogen compatibility clauses for appliances.

- China’s “Dual Carbon” Policy mandates carbon intensity tracking – require Towngas to provide annual carbon footprint reports per HK Climate Action Plan 2050.

Final Note: Procurement managers sourcing physical goods (e.g., pipes, meters) for Towngas projects must engage certified manufacturers under Towngas’s Approved Supplier List (ASL). Contact SourcifyChina for vetted ASL-aligned suppliers meeting HK/China gas infrastructure standards.

SourcifyChina | B2B Sourcing Intelligence | Hong Kong

This report is based on statutory regulations as of 15 Jan 2026. Always consult local legal counsel before contract finalization.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “Hong Kong and China Gas Company Limited” (HKCGC)

Report Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive sourcing analysis for procurement professionals evaluating manufacturing partnerships in mainland China and Hong Kong for Hong Kong and China Gas Company Limited (HKCGC). The focus is on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions for gas-related equipment and accessories, including regulators, connectors, safety valves, and smart metering components.

The analysis covers cost drivers, compares White Label vs. Private Label models, and provides a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs). This data supports strategic procurement planning, supply chain optimization, and margin modeling for 2026 and beyond.

1. Company Overview: HKCGC Sourcing Context

Hong Kong and China Gas Company Limited (Towngas) is a leading utility provider in Hong Kong and mainland China, with operations in gas distribution, energy solutions, and smart infrastructure. While primarily a utility operator, HKCGC partners with certified manufacturers for the supply of branded gas appliances, safety components, and smart home integration devices.

Procurement opportunities exist under OEM/ODM partnerships, where third-party manufacturers produce components or finished goods under HKCGC’s technical specifications or brand identity.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | HKCGC Application |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to HKCGC’s exact design, specs, and branding. | Full control over design, compliance, and IP. | High-safety gas regulators, custom smart meters, ISO-certified valves. |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production. HKCGC selects from catalog and applies branding. | Faster time-to-market, lower R&D cost. | Consumer gas stoves, LPG accessories, IoT-enabled home gas monitors. |

Recommendation: Use OEM for safety-critical components and ODM for consumer-facing accessories to balance compliance, cost, and scalability.

3. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product (design, packaging, features) under buyer’s brand. |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Control | Limited (standard specs only) | Full (custom materials, engineering) |

| Cost Efficiency | High (shared tooling) | Lower per-unit at scale; higher initial setup |

| Ideal Use Case | Trial orders, secondary markets, spare parts | Core product lines, brand differentiation |

Insight: For HKCGC, Private Label is preferred for branded safety equipment, while White Label can support regional distribution or after-sales service kits.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Gas Pressure Regulator (Industrial Grade, CE & GB Certified)

Manufacturing Location: Guangdong Province, China

Currency: USD

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Brass body, rubber seals, spring components, stainless steel fittings | $8.20 |

| Labor & Assembly | Skilled labor, QC testing, calibration | $2.10 |

| Packaging | Branded box, foam insert, multilingual manual, safety labels | $1.50 |

| Tooling & Molds | Amortized over MOQ (one-time cost: $4,500) | $0.90 @ 5K units |

| Certification & Compliance | GB, CE, SGS testing (annual renewal) | $0.60 (amortized) |

| Logistics (FOB Shenzhen) | Inland transport, export docs | $0.70 |

| Total Estimated Cost (Ex-Factory) | $14.00/unit (at 5,000 units) |

5. Price Tiers by MOQ

The table below outlines estimated unit pricing for a standard gas pressure regulator under Private Label ODM/OEM arrangements in mainland China, based on volume efficiency and fixed cost amortization.

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $24.50 | $12,250 | High per-unit cost due to tooling amortization; suitable for pilot runs |

| 1,000 units | $19.20 | $19,200 | Entry-level volume discount; ideal for regional rollout |

| 5,000 units | $14.00 | $70,000 | Optimal balance of cost and scalability; recommended for core SKUs |

Notes:

– Prices assume FOB Shenzhen terms.

– White Label alternatives available from $16.50/unit at 500 units (minimal branding, shared design).

– Tooling cost: $4,500 (one-time, reusable for 2+ years).

– Optional smart sensor integration: +$3.50/unit (IoT-ready models).

6. Strategic Recommendations

- Adopt Tiered Sourcing Strategy

- Use ODM/White Label for low-risk accessories (e.g., hoses, connectors).

-

Reserve OEM/Private Label for safety-critical and branded products.

-

Leverage Volume for Certification Savings

-

Consolidate annual orders to reduce per-unit compliance costs.

-

Onshore Final Assembly (Hong Kong Option)

-

For high-end smart meters, consider final calibration/packaging in Hong Kong to enhance brand perception and reduce import tariffs in Southeast Asia.

-

Supplier Vetting Criteria

- Must have: ISO 9001, CE/GB certification, experience with utility clients, traceable raw material sourcing.

7. Conclusion

Sourcing for HKCGC-branded gas components through China-based OEM/ODM partners offers strong cost efficiency, particularly at volumes of 1,000+ units. A hybrid White Label + Private Label strategy enables flexibility across product lines and markets.

Procurement managers should prioritize certification compliance, long-term tooling ROI, and supply chain resilience when finalizing 2026 manufacturing contracts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Manufacturing Intelligence | B2B Supply Chain Optimization

Q1 2026 Edition – Confidential for Procurement Use

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Supplier Assessment for Gas Infrastructure Equipment

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Verifying manufacturers for Hong Kong and China Gas Company Limited (Towngas)-grade projects requires rigorous due diligence due to safety-critical applications (e.g., gas regulators, valves, meters, pipeline components). Note: Towngas is an end-buyer (utility provider), not a manufacturer. This report outlines actionable steps to identify actual factories supplying compliant gas infrastructure equipment in China/Hong Kong, distinguish them from trading companies, and avoid catastrophic sourcing risks.

Critical Verification Steps for Gas Equipment Manufacturers

Phase 1: Pre-Engagement Screening (Desktop Audit)

| Step | Verification Method | Towngas-Specific Requirement |

|---|---|---|

| 1. Legal Entity Check | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System | Must show manufacturing scope (e.g., “gas pressure regulators production”) |

| 2. Certification Audit | Validate: ISO 15848 (fugitive emissions), ATEX, PED 2014/68/EU, GB/T 20901-2007 (China gas standards) | Non-negotiable: Certificates must be current and factory-specific (not trader-issued) |

| 3. Export History | Request 3+ years of customs records (via TradeMap) for gas equipment exports to HK/EU/US | Verify shipment volumes align with claimed capacity; check for Towngas project references |

| 4. Digital Footprint | Analyze: Alibaba Gold Supplier status (≥5 yrs), factory videos, B2B platform transaction history | Reject suppliers with <95% on-time delivery rate or frequent quality disputes |

Phase 2: On-Site Verification (Mandatory for Tier-1 Suppliers)

| Focus Area | Verification Action | Red Flag Indicator |

|---|---|---|

| Production Capability | Confirm CNC machining centers, pressure testing bays, and material traceability systems | No raw material inventory; outsourced core processes (e.g., welding) |

| Quality Control | Audit: Gas leak testing protocols, calibration certificates for test equipment | QC lab lacks certified technicians; no destructive testing records |

| Workforce Validation | Randomly interview 5+ production staff; verify社保 (social insurance) contributions | Staff unaware of production processes; no employee IDs displayed |

| Utility Verification | Inspect electricity/gas meters, water bills matching factory size | Meter readings inconsistent with claimed capacity (e.g., 10,000㎡ facility using <5,000 kWh/mo) |

Phase 3: Commercial & Compliance Safeguards

| Risk Area | Mitigation Protocol | Towngas Project Requirement |

|---|---|---|

| IP Protection | Execute dual-language NDA before sharing specs; require sample approval via Towngas 3rd-party lab | Reject suppliers refusing Towngas-specific material certifications |

| Payment Terms | Use LC at sight only after pre-shipment inspection by SGS/BV | Never accept >30% advance payment for safety-critical components |

| Supply Chain Mapping | Demand Tier-2 supplier list for raw materials (e.g., SS316L steel) with mill certs | Traceability to raw material source required for pressure parts |

Trading Company vs. Factory: Key Differentiators

| Criteria | Genuine Factory | Trading Company (Masked as Factory) |

|---|---|---|

| Business License Scope | Explicit “manufacturing” (生产) activities listed; no “trading” (贸易) keywords | Lists “sales,” “trading,” or “technical services” as primary activity |

| Facility Evidence | Dedicated R&D lab, in-house tooling, machine ownership (check asset tags) | Office-only space; “factory tour” shows generic workshop with no proprietary equipment |

| Pricing Structure | Quotes raw material + labor + overhead; transparent cost breakdown | Vague “FOB” pricing; refuses to disclose production costs |

| Lead Time Control | Confirms production slots; shares Gantt charts with machine allocation | Delays blamed on “factory partners”; no visibility into production |

| Sample Production | Produces samples within 7-10 days using own machinery | Takes 15+ days; samples lack factory markings or batch numbers |

Pro Tip: Ask for the factory gate pass with supplier’s name during site visits. Traders often use “rented” facilities for tours.

Critical Red Flags for Gas Equipment Sourcing (Immediate Disqualification Criteria)

| Category | Red Flag | Risk Severity |

|---|---|---|

| Documentation | Certificates issued to a different entity than the manufacturer | ⚠️⚠️⚠️ (Critical) |

| Operations | No dedicated QA team; QC relies solely on final inspection (not in-process) | ⚠️⚠️⚠️ (Critical) |

| Transparency | Refuses video call during production; blocks access to assembly lines | ⚠️⚠️ (High) |

| Commercial | Demands 100% payment upfront for first order | ⚠️⚠️⚠️ (Critical) |

| Compliance | Uses “CE” self-declaration without notified body involvement for pressure equipment | ⚠️⚠️⚠️ (Critical) |

| Digital | Alibaba store shows identical product images as 3+ other suppliers | ⚠️ (Medium) |

SourcifyChina Action Plan

- Prioritize Tier-1 Verification: Only engage suppliers passing all Phase 1 checks.

- Enforce Factory-Exclusive Contracts: Insert clause: “Supplier warrants it is the manufacturer; subcontracting requires Towngas written consent.”

- Leverage SourcifyChina’s Verification Toolkit: Access our proprietary China Factory DNA Database for real-time license/certification validation.

- Conduct Unannounced Audits: 40% of failed quality checks occur during repeat production runs.

Final Note: For Towngas projects, regulatory non-compliance = reputational ruin. 68% of gas equipment recalls in 2025 traced to uncertified subcontractors hidden by “hybrid” suppliers (SourcifyChina 2025 Risk Index). Never outsource verification to the supplier.

Prepared by: SourcifyChina Senior Sourcing Consultants | [email protected]

Confidentiality: This report is for authorized procurement use only. Distribution prohibited without written consent.

© 2026 SourcifyChina. All rights reserved. | Trusted by 21 Fortune 500 energy companies since 2018

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Partnering with Hong Kong and China Gas Company Limited (Towngas)

As global energy demands evolve, identifying reliable partners in the gas infrastructure and utility sector is critical. Hong Kong and China Gas Company Limited (Towngas), a leader in urban gas supply and sustainable energy solutions across Greater China and Southeast Asia, represents a high-value collaboration opportunity for international procurement teams.

However, engaging with major Chinese enterprises like Towngas requires more than market awareness—it demands verified access, regulatory clarity, and supply chain precision. This is where SourcifyChina’s Verified Pro List delivers unmatched value.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Access | Eliminates 3–6 weeks of due diligence with legally authenticated company data, MOFCOM compliance checks, and operational verification. |

| Direct Engagement Pathways | Provides verified contact points within Towngas’ procurement and partnership divisions—bypassing public inquiry delays. |

| Regulatory & Compliance Clarity | Includes up-to-date export licensing status, environmental certifications, and cross-border project eligibility. |

| Supply Chain Integration Support | Maps Towngas’ key subcontractors and technology partners for tier-2 sourcing opportunities. |

| Dedicated Sourcing Analyst Backing | Each Pro List download includes 30 minutes of consultation with a China energy sector specialist. |

Time Saved: Procurement teams report up to 70% reduction in vendor onboarding timelines when using SourcifyChina’s Verified Pro List versus traditional sourcing methods.

Call to Action: Accelerate Your Energy Sector Sourcing Now

In 2026, speed-to-market and supply chain resilience define competitive advantage. Don’t navigate China’s complex industrial landscape without verified intelligence.

Act today to unlock immediate access to Hong Kong and China Gas Company Limited’s procurement ecosystem through SourcifyChina’s exclusive Verified Pro List—trusted by Fortune 500 energy firms and infrastructure developers worldwide.

👉 Contact our Sourcing Support Team:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 response within 2 business hours)

Gain the intelligence edge. Partner with confidence. Source smarter—with SourcifyChina.

© 2026 SourcifyChina. All rights reserved. Verified Pro List access is subject to subscription terms. Data accuracy guaranteed as of Q1 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.