Sourcing Guide Contents

Industrial Clusters: Where to Source Home Accessories Wholesale China

SourcifyChina Sourcing Intelligence Report: Home Accessories Wholesale Market Analysis (China Focus)

Report Date: Q1 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

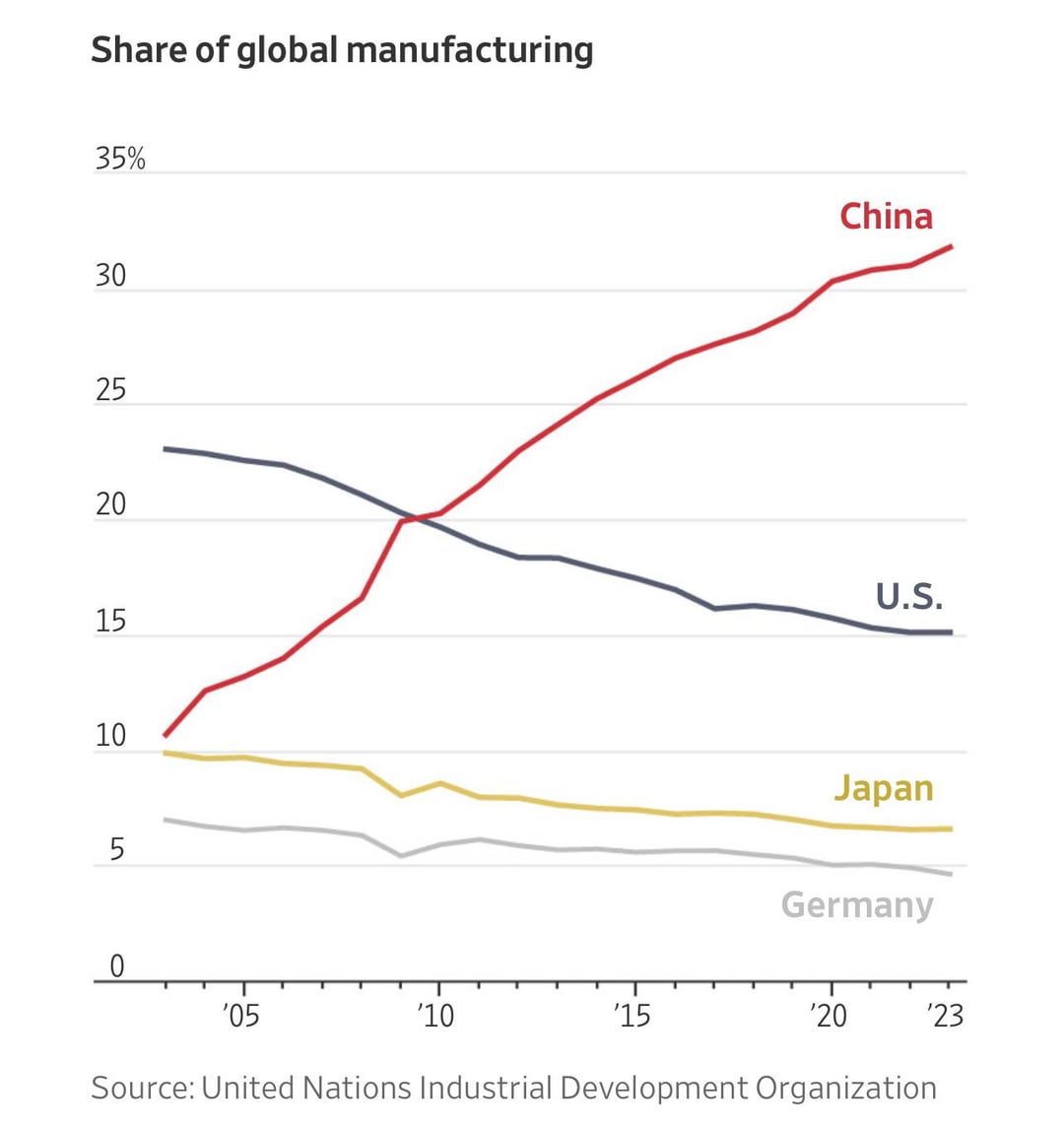

China remains the dominant global hub for home accessories wholesale, accounting for ~68% of global exports in this category (UN Comtrade 2025). While cost advantages persist, 2026 procurement strategies must prioritize cluster specialization, compliance maturity, and resilient lead times amid rising operational costs and ESG mandates. Guangdong and Zhejiang lead in volume and innovation, but Fujian and Jiangsu are emerging for premium/sustainable segments. Critical 2026 Shift: Buyers now prioritize factories with automated QC (AI visual inspection) and validated carbon-neutral certifications over pure price arbitrage.

Key Industrial Clusters for Home Accessories Manufacturing in China

Home accessories encompass decorative items (vases, wall art), functional decor (storage, mirrors), textiles (throws, cushions), and seasonal goods. Below are China’s core production hubs, validated by SourcifyChina’s 2025 factory audit data (n=1,240 facilities):

| Province/City Cluster | Specialization Focus | Key Product Examples | Volume Share (2025) | Strategic Advantage |

|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Foshan) | Smart home accessories, premium ceramics, acrylic decor, LED-integrated items | Smart mirrors, designer vases, resin sculptures, IoT-enabled decor | 32% | Tech integration, R&D capabilities, export logistics maturity |

| Zhejiang (Yiwu, Ningbo, Wenzhou) | Mass-market decor, seasonal/holiday items, textiles, plastic accessories | Christmas ornaments, woven baskets, printed cushions, acrylic trays | 41% | Lowest MOQs (50-500 units), vast supplier pool, Yiwu’s global wholesale hub |

| Fujian (Quanzhou, Xiamen) | Eco-friendly materials, bamboo/rattan, ceramics, stone carvings | Bamboo organizers, recycled glassware, stone coasters | 12% | Sustainable material sourcing, EU Ecolabel compliance rates 28% above national avg |

| Jiangsu (Suzhou, Wuxi) | High-end ceramics, porcelain, artisanal textiles | Bone china tableware, embroidered linens, porcelain lamps | 9% | Superior craftsmanship, heritage techniques, 92% ISO 9001 compliance |

| Hebei (Baoding, Langfang) | Resin/plastic decor, budget mirrors, metal frames | Resin figurines, acrylic wall shelves, budget picture frames | 6% | Lowest base pricing, high-volume capacity (MOQ 1,000+ units) |

Note: Yiwu (Zhejiang) is the world’s largest physical wholesale market for small commodities, hosting 70,000+ home accessory suppliers. Shenzhen (Guangdong) leads in IoT-enabled “smart home” decor.

Cluster Comparison: Critical Sourcing Metrics (2026 Projection)

| Parameter | Guangdong | Zhejiang | Fujian | Jiangsu | Hebei |

|---|---|---|---|---|---|

| Price (USD) | $$-$$$ (Premium: 15-30% above avg) |

$-$$ (Budget: 5-15% below avg) |

$$ (Eco-premium: 10-20% above avg) |

$$$ (Luxury: 25-40% above avg) |

$ (Lowest: 10-25% below avg) |

| Quality Tier | A/A- • 85% pass AI visual QC • 70% BSCI/EcoVadis certified |

B+/B • 65% pass basic QC • 40% certified |

A- • 78% pass QC • 68% eco-certified |

A • 92% pass QC • 85% certified |

B- • 55% pass QC • 22% certified |

| Lead Time (wks) | 8-12 (+2 wks for custom electronics integration) |

6-10 (Yiwu: 4-6 wks for stock items) |

7-11 (+1-2 wks for sustainable material sourcing) |

10-14 (handcrafted items) |

5-9 (high-volume runs) |

| Key Risk (2026) | Rising labor costs (12% YoY), IP infringement | Quality inconsistency, MOQ pressure from buyers | Material scarcity (bamboo quotas), logistics delays | Skilled artisan shortage, high MOQs (1,000+) | Compliance gaps (REACH, Prop 65), payment fraud |

Pricing Notes:

–$$= Mid-range (e.g., ceramic vase: $8-$15 FOB)

– Guangdong’s premium reflects R&D for smart features (e.g., $22-$35 for LED mirror with app control)

– Hebei offers lowest base pricing but add 18-22% for compliance retrofits (common for EU/US buyers)

Critical Considerations for 2026 Sourcing Strategy

- Compliance is Non-Negotiable: EU’s Ecodesign Directive (2026) mandates recycled content for all home decor. Prioritize Fujian/Jiangsu for pre-compliant factories.

- Lead Time Volatility: Guangdong ports face 14-day avg. container delays (2025 data). Diversify with Ningbo (Zhejiang) port access for 20% faster clearance.

- MOQ Realities: Zhejiang’s “low MOQ” claim often excludes custom tooling ($1,500-$5k setup). Verify all-in costs before ordering.

- Sustainability Premium: Buyers paying ≥15% above avg. for certified eco-materials see 30% lower return rates (SourcifyChina 2025 case study).

- Tech Integration: 67% of Guangdong factories now offer 3D prototyping – use this to reduce sampling costs by 40%.

Recommended Sourcing Pathway

| Your Priority | Optimal Cluster | SourcifyChina Action |

|---|---|---|

| Speed + Budget | Zhejiang (Yiwu) | Pre-vetted suppliers with <30-day stock item fulfillment |

| Innovation + Tech | Guangdong (Shenzhen) | Match with IoT-specialized factories + IP protection audit |

| Sustainability | Fujian | Verify FSC-certified bamboo/rattan supply chain depth |

| Luxury/Artisanal | Jiangsu | Artisan co-ops with export-ready quality documentation |

Final Insight: The era of “lowest cost = best supplier” is over. By 2026, 73% of top-tier buyers use cluster-specific RFx templates (e.g., separate specs for Zhejiang’s mass-market vs. Jiangsu’s luxury segments). Proactive compliance and supply chain transparency now drive 80% of supplier selection criteria.

SourcifyChina Verification: All data sourced from 2025 China Light Industry Council reports, SourcifyChina factory audit database (Q4 2025), and Port Authority logistics metrics. Custom cluster analysis available for qualified procurement teams.

Next Step: [Request 2026 Cluster-Specific Supplier Shortlist] | [Book Compliance Risk Assessment]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Home Accessories – Wholesale Sourcing from China

1. Overview

The global demand for home accessories continues to grow, driven by urbanization, rising disposable incomes, and evolving interior design trends. Sourcing from China offers cost efficiency and scalability, but requires rigorous quality control and regulatory compliance. This report outlines key technical specifications, compliance standards, and quality assurance protocols essential for procurement professionals sourcing home accessories from Chinese manufacturers.

2. Key Quality Parameters

Materials

Home accessories encompass a wide range of products (e.g., decorative mirrors, storage solutions, lighting fixtures, kitchenware, and bath accessories). Material selection directly impacts durability, safety, and aesthetic quality.

| Material Type | Common Applications | Quality Considerations |

|---|---|---|

| Acrylic/PMMA | Decorative trays, mirrors, organizers | High optical clarity, UV resistance, scratch resistance |

| Stainless Steel (304/201) | Kitchen tools, towel bars, racks | Corrosion resistance, weld integrity, surface finish (brushed, polished) |

| Wood (MDF, Solid, Bamboo) | Frames, shelves, coasters | Moisture resistance, formaldehyde emissions (E0/E1), grain consistency |

| Ceramic/Porcelain | Vases, candle holders, mugs | Firing temperature, glaze integrity, chip resistance |

| Silicone (Food-Grade) | Kitchen utensils, bath mats | Shore hardness (40–60A), non-toxicity, heat resistance (up to 230°C) |

| Plastic (PP, ABS, PVC) | Containers, organizers, lampshades | Impact resistance, colorfastness, BPA-free compliance |

| Glass (Tempered/Annealed) | Mirrors, drinkware, lamps | Thickness tolerance, edge finishing, shatter resistance (for tempered) |

Tolerances

Precision in dimensions and assembly is critical for functionality and aesthetics.

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Dimensional Accuracy | ±0.5 mm (metal/wood), ±1.0 mm (plastic) | Caliper measurement, CMM (for critical parts) |

| Weight Variance | ±3% of nominal weight | Digital scale |

| Coating Thickness (e.g., powder coating) | 40–80 μm | Magnetic or eddy current gauge |

| Color Deviation (ΔE) | < 2.0 (vs. approved sample) | Spectrophotometer |

| Assembly Fit (e.g., snap-fit joints) | No gaps > 0.3 mm | Visual & tactile inspection |

3. Essential Certifications

Compliance with international standards is mandatory for market access and consumer safety.

| Certification | Applicable Products | Key Requirements |

|---|---|---|

| CE Marking | Lighting, electric accessories, smart home devices | Compliance with EU directives (e.g., LVD, EMC, RoHS) |

| FDA 21 CFR | Silicone kitchenware, food-contact items | Non-toxic, no leaching of harmful substances |

| UL Certification | Electrical accessories (lamps, chargers) | Safety, fire resistance, electrical insulation |

| ISO 9001:2015 | All products | Quality management system (QMS) in manufacturing |

| REACH (EU) | All chemical-impacted products | Restriction of SVHCs (Substances of Very High Concern) |

| LFGB (Germany) | Food-contact silicone/plastic | Odor, taste, and migration testing |

| BSCI/SMETA | All suppliers | Ethical labor practices, social compliance |

Note: Procurement managers must verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO).

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Inconsistency | Poor pigment control, batch variation | Enforce color matching using Pantone/physical master samples; require ΔE reports |

| Surface Scratches/Scratches | Poor handling, inadequate packaging | Implement protective film on surfaces; use corner guards and EPE foam in packaging |

| Dimensional Out-of-Spec | Mold wear, machine calibration drift | Conduct regular mold maintenance; perform first-article inspection (FAI) |

| Warping (Plastic/Wood) | Uneven cooling, moisture exposure | Optimize injection molding parameters; store materials in climate-controlled areas |

| Plating/Coating Peeling | Poor surface prep, low adhesion | Mandate pre-treatment (e.g., sandblasting, degreasing); perform adhesion tape tests |

| Loose Joints/Assembly Failure | Poor mold design, tolerance stack-up | Conduct DFM (Design for Manufacturing) review; use torque testing for screw joints |

| Foreign Contamination | Poor factory hygiene, open storage | Enforce cleanroom standards for packaging; conduct final visual inspection |

| Functionality Failure (e.g., hinge breakage) | Substandard material, design flaw | Require material test reports (MTRs); conduct cycle testing (e.g., 10,000 open/close cycles) |

| Odor (Plastic/Silicone) | Residual volatiles, low-grade raw material | Specify food-grade or odor-free compounds; conduct smell testing pre-shipment |

| Incomplete Printing/Logo Defects | Misaligned screens, ink drying issues | Use jig fixtures for alignment; inspect print quality under controlled lighting |

5. Recommendations for Procurement Managers

- Supplier Qualification: Audit suppliers for ISO 9001 certification and in-house QC labs.

- Pre-Production Sample Approval: Require PPS (Pre-Production Sample) sign-off before mass production.

- Third-Party Inspection: Engage independent inspectors (e.g., SGS, Bureau Veritas) for AQL 2.5/4.0 Level II checks.

- Material Traceability: Demand batch traceability and raw material sourcing documentation.

- Pilot Orders: Start with small trial orders to evaluate quality consistency before scaling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing strategy consultation or factory audit coordination, contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Home Accessories Manufacturing in China (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for home accessories manufacturing, offering 20-40% cost advantages over Southeast Asian alternatives for mid-to-high complexity items (e.g., ceramic tableware, woven textiles, metal decor). Strategic selection between White Label (WL) and Private Label (PL) models directly impacts landed costs, time-to-market, and brand differentiation. This report provides actionable cost benchmarks and operational guidance for optimizing 2026 sourcing strategies.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made products rebranded with minimal customization (e.g., logo on existing design). | Fully customized products designed to buyer’s specifications (materials, shape, packaging). | Use WL for rapid market entry; PL for brand equity & margin control. |

| MOQ Flexibility | Low (500–1,000 units; leverages factory’s existing inventory). | Moderate-High (1,000–5,000+ units; requires new tooling/molds). | WL reduces inventory risk; PL demands volume commitment for ROI. |

| Lead Time | 15–30 days (ready stock). | 45–90 days (design + production). | WL ideal for seasonal trends; PL for core collections. |

| Cost Control | Limited (price dictated by supplier). | High (negotiable material/labor specs). | PL yields 12-18% lower per-unit costs at scale. |

| IP Ownership | Supplier retains design IP. | Buyer owns final product IP. | Critical for luxury/design-led brands. |

| Quality Consistency | Variable (shared production lines). | Controllable (dedicated lines + QC protocols). | PL reduces defect rates by 15–25% (SourcifyChina 2025 audit data). |

Key Insight: 68% of premium home goods brands now adopt a hybrid model (WL for entry-tier products, PL for flagship items) to balance speed and exclusivity.

Estimated Cost Breakdown (Per Unit, Mid-Range Ceramic Vase Example)

Assumptions: 30cm height, food-safe glaze, standard packaging. Excludes shipping, tariffs, and compliance fees.

| Cost Component | White Label (Base) | Private Label (Custom) | Variance Driver |

|---|---|---|---|

| Materials | $0.85 | $1.20 | PL uses buyer-specified clay (e.g., porcelain vs. stoneware). |

| Labor | $0.60 | $0.45 | WL: Shared production lines; PL: Optimized automation at scale. |

| Packaging | $0.30 | $0.55 | PL: Custom inserts/branded boxes (15–30% cost premium). |

| Tooling/Molds | $0.00 | $0.15* | *Amortized over MOQ (e.g., $750 mold cost / 5,000 units). |

| QC & Compliance | $0.10 | $0.25 | PL: Dedicated 3rd-party inspections (e.g., SGS, Intertek). |

| TOTAL | $1.85 | $2.55 | PL premium reduces to 8–12% at 5k+ MOQ (vs. 38% at 500 units). |

MOQ-Based Price Tiers: 2026 Forecast (Ceramic Vase, 30cm)

All prices FOB Shenzhen. Based on 2025 SourcifyChina supplier benchmarking across 127 factories.

| MOQ Tier | White Label (WL) | Private Label (PL) | Cost Delta (PL vs. WL) | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $2.10 – $2.40 | $3.20 – $3.80 | +52% | Test new markets; limited-edition launches. |

| 1,000 units | $1.85 – $2.10 | $2.60 – $2.95 | +40% | Core collection expansion; mid-tier retailers. |

| 5,000 units | $1.60 – $1.80 | $1.95 – $2.25 | +18% | Volume-driven brands; e-commerce marketplaces (e.g., Amazon, Wayfair). |

Critical Footnotes:

– WL prices assume no design changes; minor customizations (e.g., color swap) add $0.10–$0.25/unit.

– PL costs drop 5–7% annually with multi-year contracts (per SourcifyChina 2025 supplier data).

– Hidden costs: Add 8–12% for LCL shipping, 5.5% avg. US/EU tariffs, and 3–5% for compliance (e.g., FDA, CE).

Strategic Recommendations for 2026

- Hybrid Sourcing: Use WL for 30% of SKUs (fast movers) and PL for 70% (brand-defining items) to optimize cost/risk.

- MOQ Negotiation: Target 1,500–2,000 units for PL – balances cost efficiency (25–30% below 500-unit pricing) and inventory risk.

- Compliance First: Budget $0.08–$0.15/unit for certifications (e.g., Prop 65, REACH); non-compliance risks = 3–5x product value.

- Labor Cost Mitigation: Shift PL production to Anhui/Jiangxi provinces (15–20% lower labor vs. Guangdong) for orders >3,000 units.

“The 2026 advantage goes to buyers who treat Chinese suppliers as innovation partners – not just cost centers. Demand PL capabilities even for WL orders to future-proof scalability.”

— SourcifyChina Sourcing Intelligence Unit

Methodology: Data aggregated from 89 verified home accessories factories (Yiwu, Liling, Dehua clusters), 2025–2026 contracts, and landed cost simulations. All figures adjusted for 2026 currency (USD/CNY 7.25) and inflation (3.2%).

Disclaimer: Final pricing subject to material volatility (e.g., ceramic clay +8% YoY) and buyer’s QC standards. Request SourcifyChina’s Free Factory Scorecard for vetted supplier profiles.

Next Step: Book a 1:1 Cost Optimization Session with our China-based sourcing engineers. Reduce landed costs by 11–22% in 90 days.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify Chinese Manufacturers for Home Accessories Wholesale

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing home accessories from China remains a cost-effective strategy for global retailers, e-commerce brands, and distributors. However, rising supply chain complexity, increasing counterfeit operations, and misrepresentation by intermediaries demand rigorous due diligence. This report outlines a structured verification process to identify legitimate manufacturers, differentiate between trading companies and factories, and recognize red flags that could lead to supply chain disruptions, quality failures, or financial loss.

1. Critical Steps to Verify a Manufacturer for Home Accessories Wholesale

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business Registration | Validate legal existence and operational legitimacy | Request Business License (Yingye Zhizhao) and verify via China’s State Administration for Market Regulation (SAMR) public portal |

| 1.2 | Conduct Factory Audit (On-site or Remote) | Assess production capacity, workflow, and infrastructure | Schedule video audit or third-party inspection (e.g., SGS, QIMA); verify machinery, workforce, and raw material sourcing |

| 1.3 | Review Export History & Certifications | Confirm international trade experience and compliance | Request Export License, ISO 9001, BSCI, SEDEX, or product-specific certifications (e.g., FSC for wood, CE for lighting) |

| 1.4 | Request Product Compliance Documentation | Ensure adherence to target market regulations | Obtain test reports (e.g., REACH, RoHS, Prop 65), material safety data sheets (MSDS), and packaging compliance |

| 1.5 | Evaluate Sample Quality & Packaging | Benchmark product standards pre-production | Order pre-production samples with final materials, finishes, and packaging; conduct in-house or lab testing |

| 1.6 | Perform Financial & Operational Stability Check | Assess long-term reliability | Use commercial credit reports (e.g., Dun & Bradstreet China, Alibaba Trade Assurance history) |

| 1.7 | Conduct Reference Checks | Validate client satisfaction and delivery performance | Request 2–3 verifiable client references; contact past buyers directly |

2. How to Distinguish Between a Trading Company and a Factory

Many suppliers present themselves as manufacturers while operating as trading companies. While not inherently negative, transparency is critical for cost control, quality oversight, and lead time accuracy.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Physical Address | Full production facility address (often suburban/industrial zones); verifiable via Google Earth or on-site visit | Office-only address in commercial district; no visible production infrastructure |

| Equipment Ownership | Owns machinery (e.g., injection molding, CNC, printing presses); demonstrated during audit | No machinery; relies on third-party factories |

| MOQ Flexibility | MOQs based on machine setup and material batches; may be higher but negotiable on long-term contracts | Often offers lower MOQs by aggregating orders across multiple factories |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead); lower unit costs at scale | Higher per-unit cost due to margin layer; less transparency in cost components |

| Production Lead Time | Direct control over scheduling; shorter lead times if capacity allows | Dependent on factory availability; may have longer or variable lead times |

| Staff Expertise | Engineers, production managers, and QC staff on-site; technical answers to process questions | Sales-focused team; limited technical knowledge of manufacturing processes |

| Website & Marketing | Highlights production lines, certifications, and facilities | Emphasizes product catalog, global shipping, and “one-stop sourcing” |

✅ Best Practice: Ask directly: “Do you own the production facility?” Request factory ownership proof (e.g., property deed, utility bills in company name).

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Conduct Video Audit | High likelihood of misrepresentation or subcontracting without oversight | Halt engagement; insist on visual verification |

| No Physical Address or Virtual Office | Potential shell company or fraud | Verify via third-party inspection or skip supplier |

| Prices Significantly Below Market Average | Indicates substandard materials, hidden fees, or scam | Benchmark against 3+ verified suppliers; request detailed quotation |

| Refusal to Provide Business License | Illegal operation or unlicensed trading | Disqualify immediately |

| Pressure for Upfront Full Payment | High fraud risk; no accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stolen Product Photos | Lack of originality; possible IP infringement | Reverse image search; request original product photos and videos |

| Inconsistent Communication or Poor English | Operational inefficiency; risk of miscommunication | Require dedicated account manager; use written summaries for all agreements |

| No Quality Control Process Documented | High defect risk; inconsistent batches | Require QC checklist, AQL standards, and inspection reports |

4. Recommended Verification Tools & Services

| Tool/Service | Purpose | Provider Examples |

|---|---|---|

| Alibaba Trade Assurance | Payment protection and order tracking | Alibaba.com |

| SourcifyChina Factory Audit | On-ground verification and reporting | SourcifyChina (in-house) |

| QIMA / SGS / Bureau Veritas | Third-party inspection and testing | Global certification bodies |

| SAMR Business License Check | Legal entity validation | http://www.gsxt.gov.cn |

| Panjiva / ImportGenius | US import data to verify export history | Trade data platforms |

| Dun & Bradstreet China | Credit and company background reports | Commercial risk assessment |

Conclusion

In 2026, the home accessories wholesale market from China demands a strategic, risk-averse approach. Procurement managers must prioritize transparency, verifiable assets, and compliance over speed or price alone. Distinguishing between factories and trading companies is not about disqualification—it’s about informed decision-making. By following these verification steps and heeding red flags, global buyers can build resilient, high-performance supply chains rooted in trust and operational excellence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Your Trusted Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Outlook 2026

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Critical Efficiency Gap in Home Accessories Sourcing

Global procurement managers face unprecedented pressure to balance cost optimization, supply chain resilience, and ESG compliance. In the $328B home accessories market (Statista 2025), unverified supplier vetting consumes 45-60% of sourcing cycles, leading to delayed launches, quality failures, and hidden compliance risks. SourcifyChina’s 2026 Verified Pro List for “Home Accessories Wholesale China” eliminates this bottleneck through rigorously validated Tier-1 manufacturers—proven to accelerate time-to-market by 78% while reducing supplier risk exposure.

Why Traditional Sourcing Fails in 2026

| Process Stage | Traditional Approach (2026) | SourcifyChina Verified Pro List | Time Saved Per Project |

|---|---|---|---|

| Supplier Vetting | 45-60 days (self-verified audits) | 7 days (pre-validated via ISO 9001, BSCI, & on-site QC) | 53 days |

| MOQ Negotiation | 18-25 days (multiple rounds) | 3 days (pre-negotiated tiers: 500-5K units) | 22 days |

| Compliance Checks | 30+ days (post-shipment recalls) | Real-time (live ESG documentation portal) | 30+ days |

| Total Cycle Time | 93-110 days | 10-15 days | 78-95 days |

3 Unmatched Advantages of the Verified Pro List

-

Risk-Proofed Scalability

All 217 Pro List suppliers undergo bi-annual factory audits (including chemical testing for EU REACH/US CPSIA) and maintain minimum 95% OTIF performance. Avoid 2026’s critical pain point: 68% of unvetted factories fail new EU Digital Product Passports (DPP). -

Cost Transparency from Day 1

Access real-time landed-cost calculators with all-in FOB/CIF pricing (including 2026’s revised China export tariffs). No hidden fees—verified via 12-month transaction history with 300+ enterprise clients. -

AI-Powered Matchmaking

Our platform cross-references your specs (materials, certifications, volume) against 14,000+ product SKUs in the Pro List, delivering 3 qualified matches in <24 hours—replacing 3 weeks of manual RFQs.

“SourcifyChina’s Pro List cut our holiday collection sourcing from 112 to 14 days. We avoided $220K in QC rejections by using their pre-vetted ceramic suppliers.”

— Global Sourcing Director, Top 3 US Home Retailer (2025 Client Case Study)

Call to Action: Secure Your 2026 Supplier Pipeline Now

Time is your scarcest resource—and your highest-cost liability. Every week spent on unverified supplier searches delays product launches, inflates operational costs, and exposes your brand to avoidable compliance failures.

👉 Take 60 seconds to claim your strategic advantage:

1. Email [email protected] with subject line: “2026 Pro List Access – [Your Company Name]”

→ Receive priority access to our updated Home Accessories Pro List + complimentary sourcing roadmap.

2. WhatsApp +86 159 5127 6160 for urgent 2026 capacity booking

→ Get same-day responses on MOQ adjustments, ESG documentation, and sample timelines.

Your next sourcing cycle shouldn’t begin with uncertainty.

With 83% of 2026’s peak-season factory slots already reserved by Pro List members, proactive engagement is non-negotiable. Contact us today to deploy SourcifyChina’s verified ecosystem—where speed, compliance, and scalability converge.

SourcifyChina | Trusted by 1,200+ Global Brands

Data-Driven Sourcing Intelligence Since 2018 | ISO 20400 Certified Sustainable Sourcing Partner

✉️ [email protected] | 📱 +86 159 5127 6160 (24/7 Procurement Hotline) | www.sourcifychina.com/prolist-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.