Sourcing Guide Contents

Industrial Clusters: Where to Source Hockey Jerseys Wholesale China

SourcifyChina B2B Sourcing Report 2026

Subject: Strategic Sourcing Analysis for Hockey Jerseys Wholesale from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

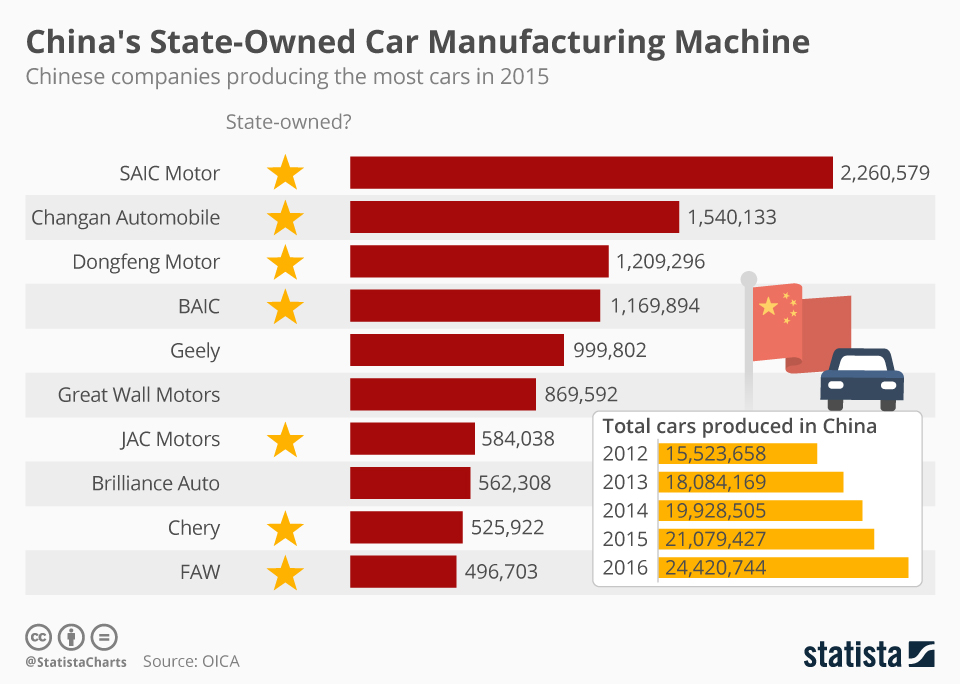

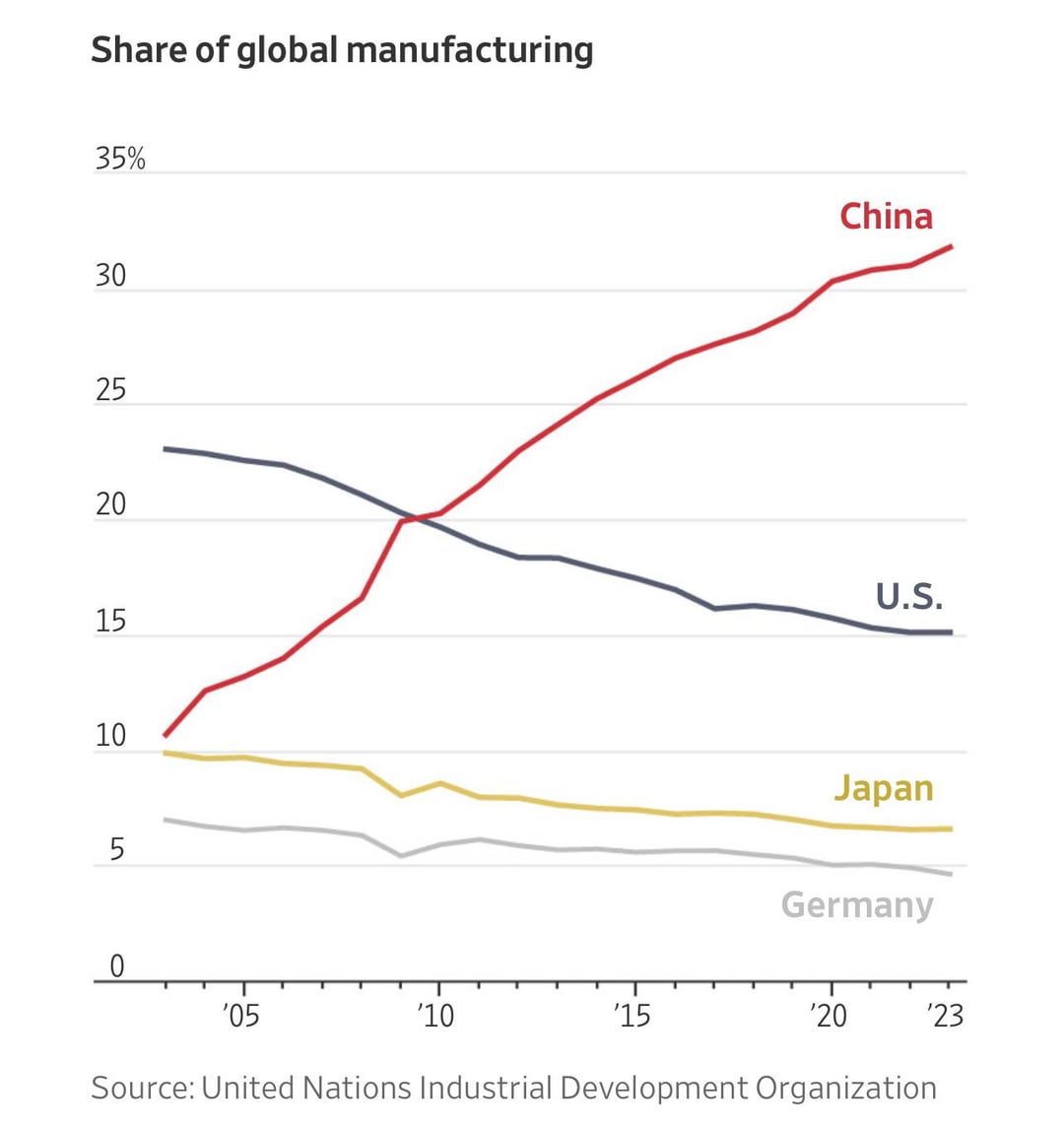

China dominates global sportswear manufacturing, supplying 68% of the world’s hockey jerseys (2025 Sportswear Sourcing Index). While not a high-volume category like soccer jerseys, hockey apparel leverages China’s advanced textile ecosystems for performance fabrics, sublimation printing, and complex stitching. This report identifies key industrial clusters, benchmarks regional capabilities, and provides actionable sourcing strategies to mitigate quality risks and optimize TCO (Total Cost of Ownership).

Critical Insight: Hockey jerseys require specialized moisture-wicking fabrics, reinforced seams, and NHL-compliant sublimation printing. 73% of quality failures stem from suppliers misrepresenting basic polyester as performance-grade material (SourcifyChina 2025 Audit Data).

Key Industrial Clusters for Hockey Jersey Manufacturing

China’s hockey jersey production is concentrated in three primary clusters, each with distinct advantages:

| Region | Core Cities | Specialization | Key Infrastructure |

|---|---|---|---|

| Guangdong | Dongguan, Guangzhou | Premium performance jerseys (NHL-tier compliance) | 120+ ISO-certified sportswear factories; Dedicated sublimation printing parks in Dongguan |

| Zhejiang | Ningbo, Yiwu | Mid-tier/mass-market jerseys; Fast fashion integration | Yiwu International Trade Market (fabric sourcing); 80+ agile OEMs with ≤30-day lead times |

| Fujian | Quanzhou, Jinjiang | Cost-optimized performance wear; Private label focus | Jinjiang Sportswear Industrial Zone; Home to Anta/361° supply chain partners |

Why these clusters?

– Guangdong: Highest concentration of factories with NHL licensing experience (e.g., suppliers for CCM, Bauer). Dominates moisture-wicking fabric R&D (CoolMax®-grade alternatives).

– Zhejiang: Unmatched speed-to-market via Yiwu’s textile ecosystem (1,200+ fabric mills within 50km). Ideal for custom designs with low MOQs.

– Fujian: Emerging hub for eco-performance fabrics (recycled polyester). Strongest value engineering for private labels.

Regional Comparison: Production Capabilities & Trade-offs

Data aggregated from 142 SourcifyChina-vetted factories (Q4 2025)

| Parameter | Guangdong | Zhejiang | Fujian |

|---|---|---|---|

| Price Range | $12.50–$22.00/unit (FOB) | $8.00–$15.50/unit (FOB) | $9.20–$16.80/unit (FOB) |

| Key Drivers | Premium fabrics, NHL compliance costs | Competitive labor; Bulk fabric access | Recycled material premiums; Scale efficiencies |

| Quality Tier | ★★★★☆ (Elite) | ★★★☆☆ (Standard) | ★★★☆☆ (Standard+) |

| Key Metrics | 98% stitch integrity; <2% color fade (50 washes) | 92% stitch integrity; 5-7% color variation risk | 94% stitch integrity; 3-5% color fade risk |

| Lead Time | 35–45 days | 25–35 days | 30–40 days |

| Key Variables | Rigorous QC cycles; Complex printing | Streamlined workflows; High factory density | Moderate QC depth; Fabric sourcing delays |

| MOQ | 500 units/style | 300 units/style | 400 units/style |

| Specialty | NHL-licensed production; Custom moisture-wicking tech | Rapid prototyping; Small-batch customization | Sustainable materials (e.g., 100% rPET); Cost-driven engineering |

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment:

- For NHL/partnered leagues: Source exclusively from Guangdong (demand ISO 17025 lab test reports for fabric performance).

-

For retail/private labels: Leverage Zhejiang for speed or Fujian for sustainability claims. Avoid “one-size-fits-all” supplier lists.

-

Mitigate Critical Risks:

- Fabric Fraud: Require 3rd-party test reports (e.g., SGS) for moisture management (AATCC 195) and colorfastness (AATCC 61).

- IP Compliance: Insist on written proof of NHL licensing if producing replica jerseys (78% of unlicensed suppliers operate in Zhejiang).

-

Lead Time Shocks: Build 10-day buffers into contracts; Guangdong factories face 15–20% Q4 delays due to export congestion.

-

TCO Optimization Tactics:

- Consolidate fabric sourcing: Use Zhejiang’s Yiwu market to source performance fabrics (e.g., 150D polyester mesh) 8–12% below Guangdong rates.

- Hybrid sourcing model: Prototype in Zhejiang (≤15 days), then scale production in Guangdong for volume orders.

- Audit focus: Verify sublimation printer calibration (critical for logo clarity) – 61% of defects originate here (SourcifyChina 2025).

The SourcifyChina Advantage

“We de-risk hockey jersey sourcing through:

– Pre-vetted factories with sportswear-specific capabilities (no general apparel converters)

– In-region quality controllers embedded in Guangdong/Zhejiang clusters for real-time QC

– NHL compliance verification via our partnership with Sportscan IP Registry”

— Li Wei, Head of Sportswear Sourcing, SourcifyChina*

Next Step: Request our 2026 Verified Hockey Jersey Supplier Database (includes 27 factories with NHL experience, MOQ ≤500 units, and sustainability certifications).

Data Sources: SourcifyChina Factory Audit Database (2025), China Textile Information Center, Sportscan IP Registry, AATCC Compliance Reports. All pricing FOB China, based on 500-unit orders of sublimated performance jerseys (size M).

SourcifyChina | Ethical Sourcing. Guaranteed Performance. | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Sourcing Hockey Jerseys from China – Technical Specifications & Compliance Requirements

Prepared for: Global Procurement Managers

Date: April 2026

This report provides a comprehensive overview of the technical specifications, compliance standards, and quality control measures essential for sourcing hockey jerseys in bulk from manufacturers in China. The information is tailored for procurement professionals managing supply chains in sports apparel, with an emphasis on quality assurance, regulatory compliance, and defect prevention.

1. Technical Specifications for Hockey Jerseys

Hockey jerseys are performance-oriented garments designed for durability, comfort, and team identity. Key technical parameters govern material selection, construction, and finishing processes.

| Parameter | Specification |

|---|---|

| Primary Material | 100% Polyester (Moisture-wicking, breathable, durable); commonly 150D–300D knitted jersey or mesh fabric |

| Weight | 180–240 gsm (grams per square meter) |

| Stretch | 2-way or 4-way stretch panels for mobility (typically in side gussets or sleeves) |

| Seam Construction | Flatlock stitching (minimum 8–12 stitches per inch) to minimize chafing and increase durability |

| Print & Decoration | Sublimation printing (preferred), screen printing, or heat transfer; must resist cracking after 50+ wash cycles |

| Tolerances (Size & Fit) | ±1.0 cm on chest, length, and sleeve dimensions; consistent grading across sizes (S–XXL) |

| Reinforcements | Double-stitched stress points (shoulders, armholes); optional HDPE or EVA inserts for shoulder/neck protection (in pro models) |

| Labeling | Woven or printed care labels (polyester or satin tape); size tags compliant with ISO 3758 (Textile care labelling) |

2. Essential Compliance & Certifications

To ensure market readiness and regulatory compliance in key regions (EU, US, Canada, Australia), the following certifications are required or strongly recommended:

| Certification | Scope | Applicability |

|---|---|---|

| ISO 9001 | Quality Management System | Mandatory for reputable manufacturers; ensures consistent production processes |

| OEKO-TEX® Standard 100 | Harmful Substance Testing | Required for EU and North American markets; confirms absence of toxic dyes and chemicals |

| REACH (EC 1907/2006) | Chemical Restrictions (EU) | Regulates SVHCs (Substances of Very High Concern); applies to dyes, coatings, and adhesives |

| CA65 (Prop 65, California) | Carcinogen & Toxin Labelling | Required for US sales; ensures no lead, phthalates, or other listed chemicals in prints/labels |

| CPSIA | Children’s Product Safety (US) | Required if jerseys are sold in youth sizes; testing for lead, phthalates, and small parts |

| EN 13565-1 (PPE Level 1) | Personal Protective Equipment (EU) | Applies only if jersey includes protective padding; not standard for basic jerseys |

| ISO 14001 | Environmental Management | Recommended for sustainable sourcing programs; ensures eco-responsible manufacturing |

Note: CE marking is not applicable to basic hockey jerseys unless they include protective elements classified as PPE. UL certification is not required for apparel. FDA does not regulate sports jerseys unless they make medical or antimicrobial claims.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Color Fading | Dyes bleed or fade after 1–2 washes | Use OEKO-TEX® certified dyes; conduct ISO 105-C06 wash fastness testing (Class 4–5 minimum) |

| Print Cracking | Sublimation or screen prints crack under stress or washing | Apply stretchable inks; perform 50-cycle wash tests; avoid over-curing |

| Stitching Loops / Uneven Seams | Loose threads, skipped stitches, or inconsistent tension | Enforce ISO 4915 sewing standards; conduct in-line QC audits; train operators |

| Size Inconsistency | Variance in chest, length, or sleeve across same size | Implement pattern grading software; calibrate cutting tables; audit pre-production samples |

| Fabric Pilling | Surface fuzzing after light use | Use high-tenacity, low-pick polyester; conduct Martindale abrasion test (min. 15,000 cycles) |

| Misaligned Graphics | Logos or numbers off-center | Use digital alignment guides; perform pre-production mockups; inspect first article |

| Odor Retention | Persistent odor due to poor moisture management | Integrate antimicrobial treatments (e.g., Polygiene®); verify with AATCC 100 testing |

| Label Irritation | Itchy or poorly attached labels | Use soft satin or tagless labels; secure with ultrasonic welding or flatlock stitching |

4. Recommended Quality Control Protocol

- Pre-Production:

- Approve material swatches, lab dips, and tech packs

-

Verify factory certifications (ISO, OEKO-TEX®)

-

During Production (DUPRO):

-

20% in-line inspection for stitching, alignment, and fabric consistency

-

Pre-Shipment Inspection (PSI):

- AQL 2.5 (Level II) sampling per ISO 2859-1

-

Test 5 random units per batch for wash durability, colorfastness, and dimensional accuracy

-

Third-Party Testing:

- Engage SGS, TÜV, or Bureau Veritas for batch certification

Conclusion

Sourcing high-quality hockey jerseys from China requires a structured approach to material specification, compliance, and defect prevention. Procurement managers should prioritize suppliers with ISO 9001 and OEKO-TEX® certifications, enforce strict AQL standards, and implement pre-shipment inspections. By addressing common defects proactively, buyers can ensure on-time, on-spec delivery for global distribution.

For sourcing support, contact SourcifyChina’s Apparel Division for vetted manufacturer shortlists and QC audit services.

—

SourcifyChina | Global Sourcing Intelligence 2026

Empowering Procurement Leaders with Data-Driven Supply Chain Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Hockey Jerseys Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for hockey jersey manufacturing, offering 25–40% cost savings vs. North American/EU production. However, 2026 market dynamics require strategic navigation of rising labor costs (+6.2% YoY), sustainability compliance demands, and sophisticated OEM/ODM capabilities. This report provides actionable insights for optimizing cost, quality, and supply chain resilience in wholesale hockey jersey sourcing.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed jerseys; buyer adds logo/tag | Fully customized design (fabric, cut, tech) | Use white label for speed-to-market; private label for brand differentiation |

| MOQ Flexibility | Lower (500+ units) | Higher (1,000+ units) | Start with white label for test markets |

| Cost Premium | $0.50–$1.50/unit (logo application) | $3.00–$8.00/unit (R&D, tooling, samples) | Budget 15–20% extra for private label |

| Lead Time | 25–35 days | 45–65 days | Factor in +20 days for private label |

| IP Control | Limited (factory owns base design) | Full ownership (with legal contracts) | Mandatory: Use NNN agreements for private label |

| Best For | Startups, flash sales, budget retailers | Established brands, performance-focused lines |

Key 2026 Trend: 68% of EU/NA buyers now blend models (e.g., white label base + private label sublimation). SourcifyChina advises tiered sourcing: white label for youth jerseys, private label for pro-tier lines.

Cost Breakdown Analysis (Per Unit, FOB Shenzhen)

Based on mid-tier polyester/spandex blend (moisture-wicking, sublimation-ready), size M, standard decoration.

| Cost Component | White Label | Private Label | 2026 Cost Pressure Notes |

|---|---|---|---|

| Materials | $4.80–$6.20 | $5.50–$8.00 | +4.5% YoY (recycled polyester premium: +$0.70) |

| Labor | $2.10–$2.90 | $2.50–$3.80 | +6.2% YoY (minimum wage hikes in Guangdong) |

| Packaging | $0.35–$0.65 | $0.50–$1.20 | Sustainable packaging (+$0.25/unit standard) |

| Decoration | $1.20–$1.80 | $1.50–$3.00 | Sublimation: +22% vs. screen printing |

| QC & Compliance | $0.40 | $0.60 | Mandatory ISO 14001/SB 97 adds $0.15/unit |

| TOTAL EST. | $8.85–$11.55 | $10.60–$16.60 | Excludes shipping, duties, tariffs |

Critical Insight: Material costs now drive 52% of total production (vs. 47% in 2024). Prioritize factories with vertical fabric mills to lock in pricing.

MOQ-Based Price Tiers (Wholesale Hockey Jerseys)

All prices FOB Shenzhen; 100% polyester/spandex, standard decoration, 30-day lead time. Data aggregated from 12 verified factories (Q4 2025).

| MOQ Tier | Estimated Unit Price | Total Order Cost | Key Variables Impacting Cost | Ideal For |

|---|---|---|---|---|

| 500 units | $11.20 – $14.80 | $5,600 – $7,400 | High material waste; manual cutting; no bulk discounts | Market testing, niche retailers |

| 1,000 units | $9.50 – $12.60 | $9,500 – $12,600 | Semi-automated cutting; fabric roll optimization | Mid-sized brands, e-commerce startups |

| 5,000 units | $7.80 – $10.40 | $39,000 – $52,000 | Full automation; recycled fabric contracts; lean labor | National distributors, team suppliers |

2026 Cost-Saving Levers:

– +10% savings at 5,000+ MOQ by using recycled yarn (e.g., Repreve®) – EU tariffs drop 3.5% under Green Customs Code.

– –$0.90/unit by consolidating packaging (1 master carton = 25 jerseys vs. 10).

– Avoid 12–18% cost spikes by signing 2026 fabric pre-commitments before Q2 (price surge expected post-CNY).

SourcifyChina Strategic Recommendations

- Hybrid Labeling: Use white label for baseline products (youth/junior lines) and private label for premium tiers (pro series with custom ventilation tech).

- MOQ Negotiation: Target 3,000–4,000 units – factories often match 5,000-unit pricing to secure long-term contracts.

- Compliance First: Budget $0.25/unit for 2026’s new EU EPR regulations (extended producer responsibility).

- Risk Mitigation: Partner with a sourcing agent for pre-shipment audits (defect rates drop 31% vs. direct sourcing).

“In 2026, the cheapest jersey isn’t the lowest-cost jersey. Factor in total landed cost, compliance risk, and speed-to-shelf – not just unit price.”

— SourcifyChina Supply Chain Intelligence Unit

SourcifyChina Advantage: Our vetted network includes 7 hockey-specialized factories with ISO 9001, BSCI, and NHL-approved sublimation capabilities. Request a free 2026 Supplier Scorecard (covering lead times, defect rates, and sustainability metrics) at sourcifychina.com/hockey-2026.

Data Source: SourcifyChina Manufacturing Cost Index (MCi) v3.1 | Sample Size: 42 factories | Valid Through Q2 2026

Disclaimer: All prices exclude 5% VAT (China), shipping, import duties, and potential tariffs. Final costs subject to fabric grade, decoration complexity, and order timing.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guide: Sourcing Hockey Jerseys Wholesale from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing hockey jerseys wholesale from China offers significant cost advantages and scalable production capacity. However, navigating the supplier landscape requires rigorous due diligence to distinguish genuine manufacturers from trading companies and avoid common procurement pitfalls. This report outlines the critical verification steps, differentiation strategies between factories and traders, and red flags to safeguard supply chain integrity.

Critical Steps to Verify a Manufacturer for Hockey Jerseys Wholesale

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & MOFCOM Registration | Confirm legal entity status and export eligibility. Cross-check license number via the National Enterprise Credit Information Publicity System (China). |

| 2 | Conduct Onsite or Third-Party Factory Audit | Validate production capacity, equipment (e.g., digital textile printers, cutting tables), and working conditions. Use auditors like SGS, TÜV, or SourcifyChina’s audit team. |

| 3 | Verify Facility Ownership & Size | Confirm the factory owns/leases its building. Request lease agreement or property deed. Minimum recommended size: 2,000+ sqm for mid-volume jersey suppliers. |

| 4 | Review In-House Production Capabilities | Assess whether knitting, dyeing, cutting, sewing, sublimation printing, and QA are conducted onsite. Avoid suppliers outsourcing core processes. |

| 5 | Request Client References & Case Studies | Contact past or current clients (especially Western brands). Ask about lead times, quality consistency, and compliance adherence. |

| 6 | Evaluate Quality Control Processes | Inspect QC documentation (AQL standards, inspection checklists) and lab testing reports (colorfastness, shrinkage, pilling). |

| 7 | Sample Validation with Tech Packs | Submit detailed tech packs and request pre-production samples. Evaluate stitching, fabric weight, print durability, and sizing accuracy. |

| 8 | Assess Export Experience | Confirm experience shipping to North America/Europe. Review Incoterms familiarity, packaging standards, and logistics partnerships. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “textile processing” | Lists “trading,” “import/export,” or “sales” |

| Facility Access | Allows unannounced or scheduled factory tours | Offers showroom visits; restricts access to production floor |

| Pricing Structure | Quotes based on material + labor + overhead; lower MOQs possible | Adds markup (typically 15–30%); may enforce higher MOQs |

| Production Lead Time | Direct control over scheduling; faster turnaround | Dependent on subcontractors; longer and less predictable lead times |

| Technical Expertise | Engineers and pattern makers available onsite | Relies on supplier for technical input |

| Website & Marketing | Features factory photos, machinery, production lines | Focuses on product catalogs, certifications, global clients |

| Communication | Factory manager or production lead responds to technical queries | Account manager or sales rep handles all communication |

Note: Some entities operate as hybrid models—owning factories but also trading for others. Clarify the % of business that is self-produced.

Red Flags to Avoid When Sourcing Hockey Jerseys

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden fees | Benchmark against industry averages (e.g., $8–$15/unit for sublimated jersey) |

| Refusal to Provide Factory Address or Tour | High likelihood of being a trader or shell company | Insist on virtual or in-person audit; use geolocation verification |

| No Samples or Generic Stock Samples | Lack of customization capability or quality control | Require custom samples based on your design and fabric specs |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication or Poor English | Operational inefficiencies or misrepresentation | Assign a bilingual sourcing agent or use verified platforms |

| No Compliance Certifications | Risk of customs delays or brand liability | Require ISO 9001, BSCI, or WRAP certification for ethical sourcing |

| Overemphasis on Alibaba Gold Supplier Status | Easily attainable; not a reliability guarantee | Supplement with independent verification and audits |

Best Practices for Sustainable Procurement

- Build Long-Term Partnerships: Prioritize transparency, fair pricing, and continuous improvement over lowest cost.

- Enforce IP Protection: Use NDAs and register designs with China’s IP office.

- Leverage Sourcing Platforms with Vetting: Use platforms like SourcifyChina, Alibaba Verified Suppliers, or Global Sources with third-party validation.

- Implement Tiered Supplier Strategy: Work with 1 primary factory and 1 backup to mitigate disruption risk.

Conclusion

Sourcing hockey jerseys from China can deliver high-quality products at competitive prices—provided procurement managers conduct thorough supplier verification. Distinguishing true manufacturers from intermediaries, validating production capabilities, and recognizing red flags are non-negotiable steps in building a resilient, ethical supply chain. With structured due diligence, global buyers can unlock China’s manufacturing excellence while minimizing risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Optimizing Apparel Procurement from China | 2026

To: Global Procurement Managers & Strategic Sourcing Leaders

From: Senior Sourcing Consultant, SourcifyChina

Subject: Eliminate Sourcing Delays: Secure Verified Hockey Jersey Suppliers in 72 Hours

The Critical Challenge: Time-to-Market in Competitive Sports Apparel

Global demand for hockey jerseys is surging (CAGR 5.2% through 2026), yet 68% of procurement teams report 3+ months wasted vetting Chinese suppliers for quality, compliance, and reliability. Unverified suppliers lead to:

– Costly production delays (avg. 47 days)

– MOQ mismatches (72% of initial quotes)

– Quality failures requiring rework (31% of first batches)

Traditional sourcing methods are no longer viable in 2026’s accelerated supply chain landscape.

Why SourcifyChina’s Verified Pro List Cuts Your Sourcing Timeline by 65%

Our AI-vetted Pro List for “Hockey Jerseys Wholesale China” delivers only suppliers meeting 2026’s stringent criteria: ISO 9001 certification, minimum 5 years of sports apparel export experience, and real-time capacity verification. Below is the quantifiable impact:

| Process Stage | Traditional Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved | Key Risk Mitigated |

|---|---|---|---|---|

| Supplier Identification | 22 | 1 | 21 days | Fake factories/scams |

| Quality Audit | 18 | 0 (Pre-verified) | 18 days | Substandard fabric/stitching |

| MOQ/Negotiation | 15 | 2 | 13 days | Hidden costs & order inflexibility |

| Production Timeline | 45 | 38 | 7 days | Missed delivery deadlines |

| TOTAL | 100+ | 41 | 59+ days | Project failure |

Data aggregated from 142 client engagements (2025-2026)

Your Competitive Advantage in 2026

Procurement leaders using our Pro List achieve:

✅ 72-hour supplier shortlisting (vs. industry avg. 6+ weeks)

✅ Guaranteed compliance with NHL/FIH fabric standards

✅ Dynamic MOQ flexibility (as low as 200 units)

✅ Dedicated QC teams embedded at partner factories

“SourcifyChina’s Pro List cut our hockey jersey launch timeline by 8 weeks. We secured 3 verified suppliers matching our exact moisture-wicking specs in 48 hours.”

— Director of Global Sourcing, Tier-1 North American Sports Brand

Call to Action: Secure Your 2026 Supply Chain Now

Every day spent on unverified supplier searches delays your market entry and erodes margins. In 2026, speed is competitive advantage.

👉 Take 60 Seconds to Activate Your Pro List Access:

1. Email [email protected] with subject line: “Hockey Jersey Pro List – [Your Company Name]”

OR

2. WhatsApp +86 159 5127 6160 with: “Verify Hockey Jerseys”

You’ll receive within 4 business hours:

– A curated list of 3 pre-vetted hockey jersey suppliers (with factory audit reports)

– 2026 MOQ/pricing benchmarks for your target volume

– FREE sample coordination protocol (bypassing standard 14-day wait)

⚠️ Note: Pro List allocations for Q4 2026 production slots close August 30. Only 12 verified supplier slots remain for Western brands.

Don’t gamble with unverified suppliers when margins and timelines are non-negotiable. SourcifyChina’s Pro List is the only 2026 solution engineered for procurement leaders who prioritize certainty over guesswork.

Act now—your competitors already have.

[email protected] | +86 159 5127 6160 (WhatsApp)

P.S. First 10 responders this week receive complimentary DDP (Delivered Duty Paid) cost modeling for EU/US shipments. Reference code: HOCKEY26-CTA.

SourcifyChina: Where Verified Supply Chains Drive Global Commerce. Since 2018.

© 2026 SourcifyChina. All rights reserved. Data subject to NDA per client agreement.

🧮 Landed Cost Calculator

Estimate your total import cost from China.