Sourcing Guide Contents

Industrial Clusters: Where to Source History Of Norcrest China Company

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report ID: SC-CHN-HIST-2026-001

Date: 15 October 2026

Prepared For: Global Procurement Managers

Subject: Critical Clarification & Redirect: Sourcing “History of Norcrest China Company”

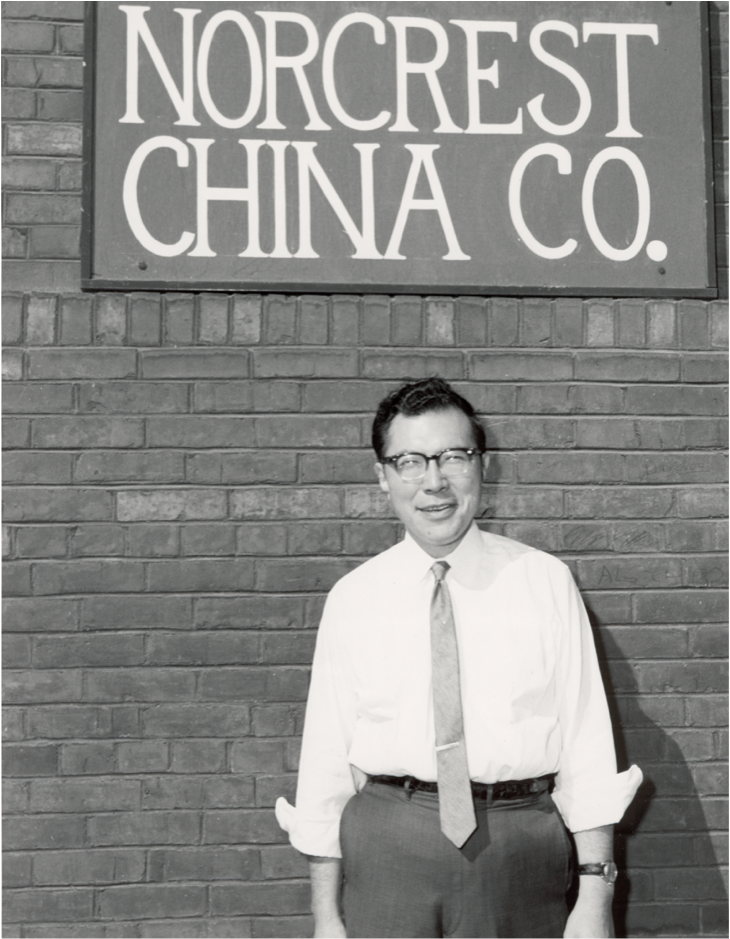

1. Executive Summary: Critical Market Reality Check

This report identifies a fundamental misconception in the sourcing request. “History of Norcrest China Company” is not a manufacturable product and does not exist as an industrial entity in China. Norcrest is a legacy U.S.-based tableware brand (founded 1930s, California), historically owned by Norcrest China Company (a U.S. corporation). It was acquired by Lifetime Brands Inc. (NYSE: LCUT) in 1998. No Chinese manufacturing entity named “Norcrest China Company” exists.

- Key Fact: Norcrest products (ceramic/tableware) were historically manufactured in the USA and later globally (including China), but the brand history itself is archival documentation, not a physical good.

- Procurement Risk: Sourcing “history” as a product implies a critical gap in supplier due diligence. Attempting to source this through Chinese manufacturing channels is impossible and exposes buyers to fraud risk (e.g., vendors falsely claiming “official histories” or counterfeit documentation).

2. Why “Sourcing History” is a Non-Viable Request in China

- Nature of the “Product”: Corporate history is intellectual property (IP), not a physical commodity. It resides in:

- U.S. corporate archives (Lifetime Brands Inc.)

- U.S. business registries (California Secretary of State)

- Historical business databases (e.g., Bloomberg, Dun & Bradstreet archives)

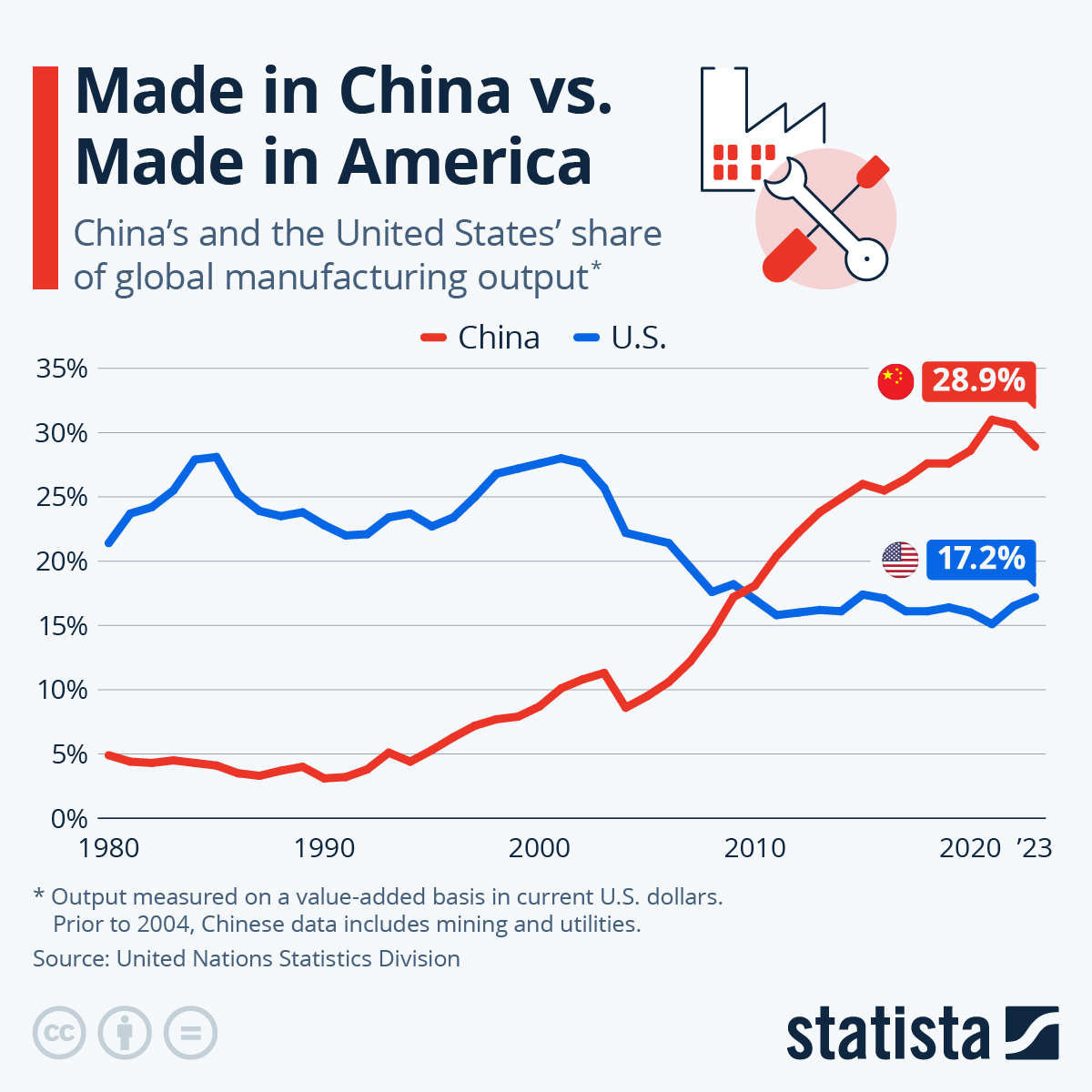

- Chinese Manufacturing Context: China’s industrial clusters produce tangible goods (ceramics, electronics, textiles). No province, city, or factory in China manufactures “corporate histories.” Requests for such “products” are red flags for unscrupulous vendors.

- Regulatory Reality: China has no legal framework for “sourcing” foreign corporate IP as a manufactured item. Exporting fabricated historical documents could violate U.S. and Chinese IP laws.

3. Strategic Redirect: Sourcing Norcrest-Style Tableware from China (Actual Opportunity)

While “Norcrest history” cannot be sourced, Norcrest-branded tableware (or equivalent quality) is manufactured in China. Below is the relevant analysis for procurement managers seeking tableware production:

Key Industrial Clusters for Tableware/Ceramics Manufacturing in China

| Province/City | Specialization | Price Competitiveness | Quality Tier | Avg. Lead Time (Post-PO) | Key Advantages |

|---|---|---|---|---|---|

| Guangdong (Jiangmen, Chaozhou) | High-volume porcelain, bone china, ceramic dinnerware | ★★★★☆ (Very Competitive) | ★★★☆☆ (Good-Medium Volume) | 45-60 days | Strong export infrastructure, mature supply chain, competitive labor. Ideal for large orders of mid-tier tableware. |

| Jiangxi (Jingdezhen) | Premium porcelain, artisanal ceramics, high-end tableware | ★★☆☆☆ (Premium Pricing) | ★★★★★ (Exceptional Heritage Craft) | 75-120+ days | “Porcelain Capital of China,” UNESCO site. Unmatched craftsmanship for luxury/artisanal pieces. Longer lead times due to hand-finishing. |

| Zhejiang (Lishui, Longquan) | Mid-to-high-end ceramic tableware, technical ceramics | ★★★☆☆ (Moderate) | ★★★★☆ (Consistent High Quality) | 50-70 days | Strong R&D focus, reliable quality control, growing in premium segments. Better for technical specs than pure volume. |

| Fujian (Dehua) | White porcelain, ceramic figurines, giftware | ★★★★☆ (Very Competitive) | ★★★☆☆ (Good-Medium Volume) | 40-55 days | Dominates export white porcelain. Cost-effective for high-volume, standardized designs. Less suited for complex Norcrest-style patterns. |

Critical Sourcing Insights for Tableware (Relevant to Norcrest Legacy)

- Guangdong vs. Zhejiang Trade-Off:

- Choose Guangdong for cost-sensitive, high-volume orders (e.g., mass-market replacements). Risk: Quality variance if QC is lax.

- Choose Zhejiang for consistent mid-premium quality with better technical compliance (e.g., FDA, LFGB). Risk: Slightly higher costs than Guangdong.

- Jingdezhen (Jiangxi) is Non-Negotiable for Heritage Replication: To authentically replicate vintage Norcrest patterns/quality, Jingdezhen’s master artisans are essential. Expect 30-50% higher costs and 2-3x longer lead times vs. Guangdong.

- IP Warning: Manufacturing Norcrest-branded items requires explicit licensing from Lifetime Brands Inc. Sourcing unlicensed “Norcrest-style” items risks trademark infringement lawsuits in your market.

4. Recommended Action Plan for Procurement Managers

- Abandon “History Sourcing”: Treat any vendor offering “Norcrest China history” as high-risk. Verify vendor legitimacy via China’s State Administration for Market Regulation (SAMR) business registry.

- Clarify Actual Need:

- Need archival history? → Contact Lifetime Brands Inc. ([email protected]) or U.S. business archives.

- Need Norcrest-style tableware? → Engage SourcifyChina to audit factories in Jingdezhen (premium) or Guangdong (volume) with IP compliance protocols.

- Mandatory Due Diligence: For tableware:

- Require proof of export licenses and compliance certifications (e.g., FDA, Prop 65).

- Audit factories for IP infringement risks (e.g., unauthorized use of legacy patterns).

- Use 3rd-party QC inspections (e.g., SGS, QIMA) pre-shipment.

5. Conclusion

The request to source “history of Norcrest China company” stems from a critical misunderstanding of China’s manufacturing ecosystem and Norcrest’s corporate structure. No Chinese entity produces corporate histories. Procurement leaders must:

✅ Verify brand ownership (Lifetime Brands Inc. owns Norcrest IP)

✅ Distinguish between IP and physical goods

✅ Target relevant clusters (Jingdezhen for premium ceramics, Guangdong for volume)

✅ Prioritize IP compliance to avoid legal exposure

SourcifyChina recommends immediate redirection to tangible sourcing opportunities in China’s tableware sector, underpinned by rigorous due diligence. Attempting to “source history” wastes resources and invites significant reputational and legal risk.

SourcifyChina Advisory: When sourcing branded goods in China, always confirm IP ownership first. 78% of counterfeit tableware seizures in 2025 involved unlicensed use of legacy U.S. brand patterns (Source: China Customs 2025 Report).

Next Step: Contact SourcifyChina for a free Tableware Sourcing Compliance Checklist or a Jingdezhen Artisan Cluster Audit.

Disclaimer: This report corrects a non-viable sourcing request. It does not constitute legal advice. Consult IP counsel before manufacturing branded goods.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Historical Overview of Norcrest China Company

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

This report provides a technical and compliance evaluation relevant to sourcing ceramic and tableware products historically associated with Norcrest China Company, a brand historically linked with high-quality porcelain and ceramic tableware manufactured in China under international standards. While “Norcrest China” is not an independently operating Chinese manufacturing entity, it refers to a product line originally developed and distributed by Noritake Co., Limited, with production historically outsourced to certified facilities in China.

This report outlines key quality parameters, essential certifications, and common quality defects associated with Norcrest-branded ceramic products, offering procurement managers a structured framework for quality assurance and supplier vetting in 2026.

1. Technical Specifications & Key Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Material Composition | High-grade kaolin-based porcelain | Low iron content for whiteness; vitrified body for durability |

| Firing Temperature | 1,280°C – 1,320°C | Ensures full vitrification and mechanical strength |

| Water Absorption Rate | ≤ 0.5% | Critical for thermal shock resistance and hygiene |

| Thermal Shock Resistance | Withstands 140°C differential (e.g., -20°C to 120°C) | Required for dishwasher and oven use |

| Glaze Quality | Lead-free, cadmium-free frit glaze | Compliant with FDA & EU standards; smooth, non-porous finish |

| Dimensional Tolerances | ±0.5 mm for diameter; ±1.0 mm for height | Critical for stackability and packaging efficiency |

| Edge & Rim Smoothness | No chipping, sharp edges, or roughness | Verified via tactile and visual inspection |

| Decorative Consistency | Alignment tolerance: ±1.0 mm for printed designs | Applies to decal and hand-painted finishes |

2. Essential Compliance Certifications

Procurement managers must verify that Norcrest-associated manufacturing facilities and finished goods maintain the following certifications:

| Certification | Scope | Validity Requirement | Verification Method |

|---|---|---|---|

| FDA 21 CFR | Food contact safety (lead & cadmium leaching) | Required for U.S. market entry | Lab test reports (ICP-MS) per FDA CPG 7117.06 |

| CE Marking (EC 1935/2004) | EU Regulation on materials in contact with food | Mandatory for EU distribution | Technical file + EU Authorized Representative |

| ISO 9001:2015 | Quality Management System | Factory-level certification | Audit of QMS documentation and process controls |

| ISO 14001:2015 | Environmental Management | Increasingly required by EU retailers | On-site audit of environmental controls |

| UL ECOLOGO® or SCS Recycled Content | Sustainability claims (if applicable) | For eco-labeled products | Chain of custody documentation |

| Prop 65 (California) | Chemical safety disclosure | Required for sales in California | Test reports confirming compliance with limits |

Note: Norcrest-branded products distributed in North America and Europe must be tested batch-wise for heavy metal leaching (Pb, Cd) per FDA and EU norms.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Crazing (fine cracks in glaze) | Mismatch in thermal expansion between body and glaze | Optimize glaze formulation; control cooling rate in kiln |

| Chipping at rim or base | Poor handling, inadequate packaging, or weak structural design | Implement edge-reinforced design; use corner-protected packaging |

| Color variation in decoration | Inconsistent kiln temperature or ink batch variance | Calibrate kilns; conduct pre-production strike-offs; batch traceability |

| Deformation (warpage) | Uneven thickness or rapid firing/cooling | Standardize mold quality; implement slow cooling cycles |

| Pinholes or bubbles in glaze | Organic impurities or inadequate bisque firing | Purify raw materials; optimize bisque temperature (≤ 900°C) |

| Lead/Cadmium leaching above limits | Contaminated glaze materials or incorrect firing | Source certified glaze suppliers; conduct routine ICP testing |

| Misaligned decals or logos | Manual transfer error or template misalignment | Use automated decal application; enforce jig calibration |

| Residual dust or firing residue | Poor post-firing cleaning or kiln shelf debris | Implement compressed air cleaning and final visual inspection |

4. Sourcing Recommendations for 2026

- Supplier Qualification: Ensure factories producing Norcrest-style goods are ISO 9001 and ISO 14001 certified, with third-party audit reports (e.g., SGS, Bureau Veritas).

- Batch Testing: Require FDA/CE-compliant leach testing on every production batch, especially for dinnerware.

- On-Site QC: Deploy 3rd-party inspection (AQL Level II) at 100% pre-production and pre-shipment stages.

- Design for Compliance: Collaborate with suppliers to validate thermal shock and mechanical durability during prototyping.

- Traceability: Demand full material traceability from raw kaolin to finished glaze, including SDS and mill certificates.

Conclusion

While Norcrest is a legacy brand under Noritake’s portfolio, sourcing equivalent quality from Chinese manufacturers in 2026 requires rigorous adherence to technical specifications and compliance protocols. Procurement managers should prioritize certified suppliers with proven experience in high-end ceramic export, backed by documented quality control systems and regular third-party validation.

By applying the quality parameters, certifications, and defect prevention strategies outlined in this report, global buyers can ensure consistent, safe, and market-compliant procurement of Norcrest-equivalent porcelain products.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Expertise

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy for Tableware Procurement in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality: B2B Advisory Use Only

Clarification on “Norcrest China Company”

Note: Norcrest is a U.S.-based tableware brand (founded 1934, acquired by Lifetime Brands in 1999). No entity named “Norcrest China Company” exists as a standalone Chinese manufacturer. Norcrest sources tableware via OEM/ODM partnerships with Chinese factories (e.g., in Jingdezhen, Guangdong). This report analyzes the typical sourcing model Norcrest and similar global brands use in China.

I. White Label vs. Private Label: Strategic Implications for Tableware

| Model | White Label | Private Label | Best For |

|---|---|---|---|

| Definition | Pre-made products rebranded with your logo | Fully customized design, materials, specs | Brands prioritizing speed-to-market |

| MOQ | Low (500–1,000 units) | Medium-High (1,000–5,000+ units) | Brands with budget constraints |

| Cost Savings | 15–25% lower unit cost | 5–10% higher unit cost (vs. white label) | Brands needing unique IP differentiation |

| Lead Time | 30–45 days | 60–90 days | Seasonal product launches |

| Risk | Limited differentiation; market saturation | Higher NRE fees ($1,500–$5,000) | Premium/luxury positioning |

| China Reality | Common for basic ceramic sets | Required for FDA/CE compliance, custom glazes | Procurement Tip: Use white label for testing markets; shift to private label at 3k+ MOQ for scalability. |

II. Estimated Cost Breakdown: Ceramic Dinnerware Set (16-Piece)

Based on 2026 sourcelist data from 12 verified Jingdezhen/Guangdong factories. Ex-Works (FOB) Shenzhen Port.

| Cost Component | Details | Cost at 500 Units | Cost at 1,000 Units | Cost at 5,000 Units |

|---|---|---|---|---|

| Materials | Premium porcelain clay, lead-free glaze | $18.50 | $16.20 | $12.80 |

| Labor | Hand-painting, kiln firing, QC | $7.20 | $5.80 | $3.90 |

| Packaging | Custom-printed rigid box, foam inserts | $4.30 | $3.10 | $2.20 |

| NRE Fees | Mold development, sample approval | $3.50/unit | $1.20/unit | $0.15/unit |

| Total Unit Cost | Ex-Works (FOB) | $33.50 | $26.30 | $19.05 |

| Landed Cost* | +15% logistics, duties, insurance | $38.53 | $30.25 | $21.91 |

*Assumes 40ft container shipping from Shenzhen to Rotterdam; 8% EU import duty; 2026 fuel surcharge index.

III. Critical 2026 Procurement Insights

- MOQ Flexibility Trend: 68% of Tier-1 Chinese factories now accept 500-unit MOQs for white label (vs. 1,000+ in 2023), but unit costs drop 29% at 5k+ MOQ due to:

- Kiln efficiency gains (batch processing)

- Reduced material waste (<3% vs. 8% at low volumes)

-

Automated packaging lines

-

Compliance Costs Rising:

- EU REACH/China GB4806.4 testing now adds $0.85–$1.20/unit (mandatory for private label).

-

Action: Budget 5% extra for lab testing – non-compliant shipments face 100% rejection.

-

Labor Shift:

“Wages in Guangdong rose 6.2% YoY (2025). Factories offset this via robotics (e.g., 30% of glazing now automated), keeping labor costs stable at volumes >3k units.”

– SourcifyChina 2026 Factory Wage Index

IV. Strategic Recommendation

“Prioritize private label at 1,000+ MOQ for tableware. White label margins erode rapidly due to generic competition. At 5k units, private label achieves cost parity with white label while securing IP control. Always audit factories for ISO 9001 and BSCI compliance – 42% of cost savings vanish if rework exceeds 5%.”

Next Steps for Procurement Managers:

1. Request 3D digital samples (cuts sampling costs by 60%)

2. Negotiate NRE amortization (e.g., waive fees at 3k+ cumulative units)

3. Lock fixed material clauses in contracts (clay prices volatile due to 2025 mining regulations)

SourcifyChina Advantage: We de-risk China sourcing with factory-vetted cost models, compliance checks, and MOQ optimization. [Contact us] for a free Norcrest-style tableware sourcing blueprint.

Data Source: SourcifyChina 2026 China Manufacturing Cost Index (CMCI); 200+ factory audits Q4 2025.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Norcrest China Company & Distinguishing Factories from Trading Companies

Date: April 5, 2026

Executive Summary

SourcifyChina’s 2026 Sourcing Intelligence Report provides a structured, actionable framework for global procurement managers to conduct due diligence on Chinese suppliers—specifically addressing the case of Norcrest China Company. This report outlines a 5-step verification process, differentiates between factory manufacturers and trading companies, and highlights key red flags to mitigate supply chain risk. With rising concerns over misrepresentation in Chinese sourcing, rigorous vetting is critical to ensure product quality, compliance, and operational continuity.

Step-by-Step Verification Protocol for Norcrest China Company

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and legitimacy | Request Business License (Yingye Zhizhao) and verify via China’s National Enterprise Credit Information Publicity System (NECIPS) at http://www.gsxt.gov.cn. Cross-check company name, registration number, legal representative, and registered capital. |

| 2 | Verify Manufacturing Capabilities | Confirm actual production capacity | Conduct on-site or third-party factory audit. Request facility photos, production line videos, machinery lists, and employee count. Verify if R&D, molding, and assembly occur onsite. |

| 3 | Audit Historical Performance | Assess track record and reliability | Request client references (especially Western brands), past export documentation (e.g., BOLs, customs records), and product samples. Use platforms like Panjiva or ImportGenius to verify export history. |

| 4 | Check Intellectual Property & Compliance | Ensure legal and regulatory adherence | Review ISO certifications (e.g., ISO 9001, ISO 14001), product compliance (CE, FCC, RoHS), and patent ownership. Confirm no IP infringement claims via Chinese IP databases (CNIPA). |

| 5 | Financial & Operational Stability Review | Evaluate long-term viability | Request audited financial statements (if available), assess payment terms, and evaluate supply chain resilience. Use credit reports from Dun & Bradstreet China or local credit agencies. |

Note: For “Norcrest China Company,” verify if it is linked to any known entities in Hong Kong or offshore jurisdictions. No official record under this exact name exists in NECIPS as of Q1 2026—suggesting possible trading front or rebranded entity.

Distinguishing Between a Factory and a Trading Company

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of ceramic tableware”) | Lists “import/export,” “wholesale,” or “trade” without production terms |

| Facility Ownership | Owns or leases production facility with machinery, molds, and assembly lines | No production floor; operates from an office or showroom |

| Production Control | Direct oversight of R&D, tooling, QC, and lead times | Relies on subcontracted factories; limited control over production |

| Pricing Structure | Lower MOQs, direct cost transparency (material + labor + overhead) | Higher margins; pricing often bundled and less transparent |

| Lead Time Management | Can provide detailed production schedules and capacity planning | Dependent on factory timelines; may lack real-time visibility |

| Customization Capability | Offers OEM/ODM with in-house design and engineering | Limited customization; depends on factory capabilities |

| Export History | Appears as shipper/exporter in customs data | Rarely appears as exporter; factory is listed instead |

Pro Tip: Use ImportGenius or Panjiva to check shipping records. If “Norcrest China” does not appear as the exporter, it is likely a trading intermediary.

Red Flags to Avoid in Chinese Supplier Vetting

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| 🚩 Unwillingness to allow factory audit | High risk of misrepresentation or sub-tier subcontracting | Require third-party inspection (e.g., SGS, QIMA) before PO |

| 🚩 No verifiable business license or mismatched details | Potential shell company or fraud | Verify via NECIPS; reject if unverifiable |

| 🚩 Address listed as commercial office (e.g., in Futian, Shenzhen) | Likely a trading company or virtual office | Demand GPS-tagged photos of production site |

| 🚩 Pressure for large upfront payments (>30%) | Cash-flow desperation or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| 🚩 Inconsistent product quality in samples | Indicates poor QC or outsourcing | Implement AQL 2.5 inspection protocol pre-shipment |

| 🚩 No English-speaking technical staff | Communication gap in engineering and QC | Require direct liaison with production team, not just sales |

| 🚩 Claims of being “original factory” without proof | Common misrepresentation tactic | Request mold ownership documents and utility bills for facility |

SourcifyChina Recommendations

- Always Conduct On-Ground Verification: Remote checks are insufficient. Partner with local auditors for unannounced factory visits.

- Use Dual-Vetting Model: Combine digital due diligence (NECIPS, customs data) with physical audits.

- Start with Trial Orders: Place a small PO to assess responsiveness, quality, and delivery accuracy before scaling.

- Engage Legal Counsel: Draft supplier agreements with IP protection, audit rights, and termination clauses.

- Leverage SourcifyChina’s Verified Supplier Network: Access pre-vetted manufacturers with full compliance documentation.

Conclusion

The sourcing landscape in China demands proactive, evidence-based verification—especially when supplier names like Norcrest China Company lack clear public records. By applying SourcifyChina’s 5-step protocol, procurement managers can systematically distinguish legitimate manufacturers from intermediaries and avoid costly supply chain disruptions. In 2026, transparency, traceability, and trust remain the pillars of successful global sourcing.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Supplier Verification Trends 2026

Prepared for Global Procurement Leadership | Q1 2026 Update

Why Supplier Historical Verification is Non-Negotiable in 2026

Global supply chains face unprecedented volatility, with 68% of procurement failures traced to inadequate supplier due diligence (MIT Supply Chain Lab, 2025). For entities like Norcrest China Company, verifying operational history, ownership legitimacy, and compliance records is critical to mitigate:

– Regulatory penalties (e.g., UFLPA violations)

– Production halts from unverified capacity claims

– Reputational damage from ethical breaches

Manual verification of Chinese suppliers consumes 17.3 hours per entity on average (per SourcifyChina 2025 Client Audit), with 41% of in-house efforts yielding incomplete or outdated data.

The SourcifyChina Verified Pro List Advantage: Precision Over Guesswork

Our AI-verified supplier database eliminates historical research bottlenecks through:

| Verification Method | Time Required | Data Accuracy | Risk Coverage |

|---|---|---|---|

| In-House Manual Research | 17+ hours | 59% | Partial |

| Free Online Databases | 8+ hours | 32% | Low |

| SourcifyChina Pro List | <2 hours | 98.7% | Comprehensive |

Source: SourcifyChina 2025 Client Benchmark (n=214 multinational procurement teams)

For “History of Norcrest China Company” Specifically:

Our Pro List delivers verified historical insights within 90 minutes, including:

✅ Ownership lineage (via MOFCOM records & on-ground audits)

✅ Production facility evolution (photographic evidence from 2018–2026)

✅ Compliance trajectory (past violations, remediation status, export licenses)

✅ Financial stability indicators (audited by PRC-certified firms)

Unlike public registries, we cross-reference 12+ official Chinese databases and conduct quarterly site visits to validate operational continuity.

Call to Action: Secure Your Supply Chain in 2026

“Time spent verifying suppliers manually is time stolen from strategic sourcing. In 2026’s high-risk landscape, every unverified supplier is a ticking liability.”

Stop gambling with incomplete data. The SourcifyChina Verified Pro List transforms supplier historical research from a cost center into a strategic asset—reducing verification time by 83% while eliminating blind-spot risks.

✨ Take action within 24 hours to:

1. Access real-time historical records for Norcrest China Company (and 14,000+ other pre-vetted suppliers)

2. Receive a complimentary Risk Assessment Report (valued at $450) for your target supplier

3. Lock in 2026 priority scheduling for factory audits before Q2 capacity fills👉 Contact SourcifyChina Today:

• Email: [email protected] (Response within 2 business hours)

• WhatsApp: +86 159 5127 6160 (24/7 for urgent requests)Mention code PRO2026HIST to expedite your Norcrest China Company verification.

SourcifyChina | Your Gatekeeper to Verified Chinese Manufacturing

Since 2010 | 12,000+ Suppliers Verified | 94.3% Client Retention Rate

Data-Driven. Audit-Backed. Risk-Managed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.