Sourcing Guide Contents

Industrial Clusters: Where to Source Hip Hop Clothing Wholesale China

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Hip Hop Clothing Wholesale from China

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

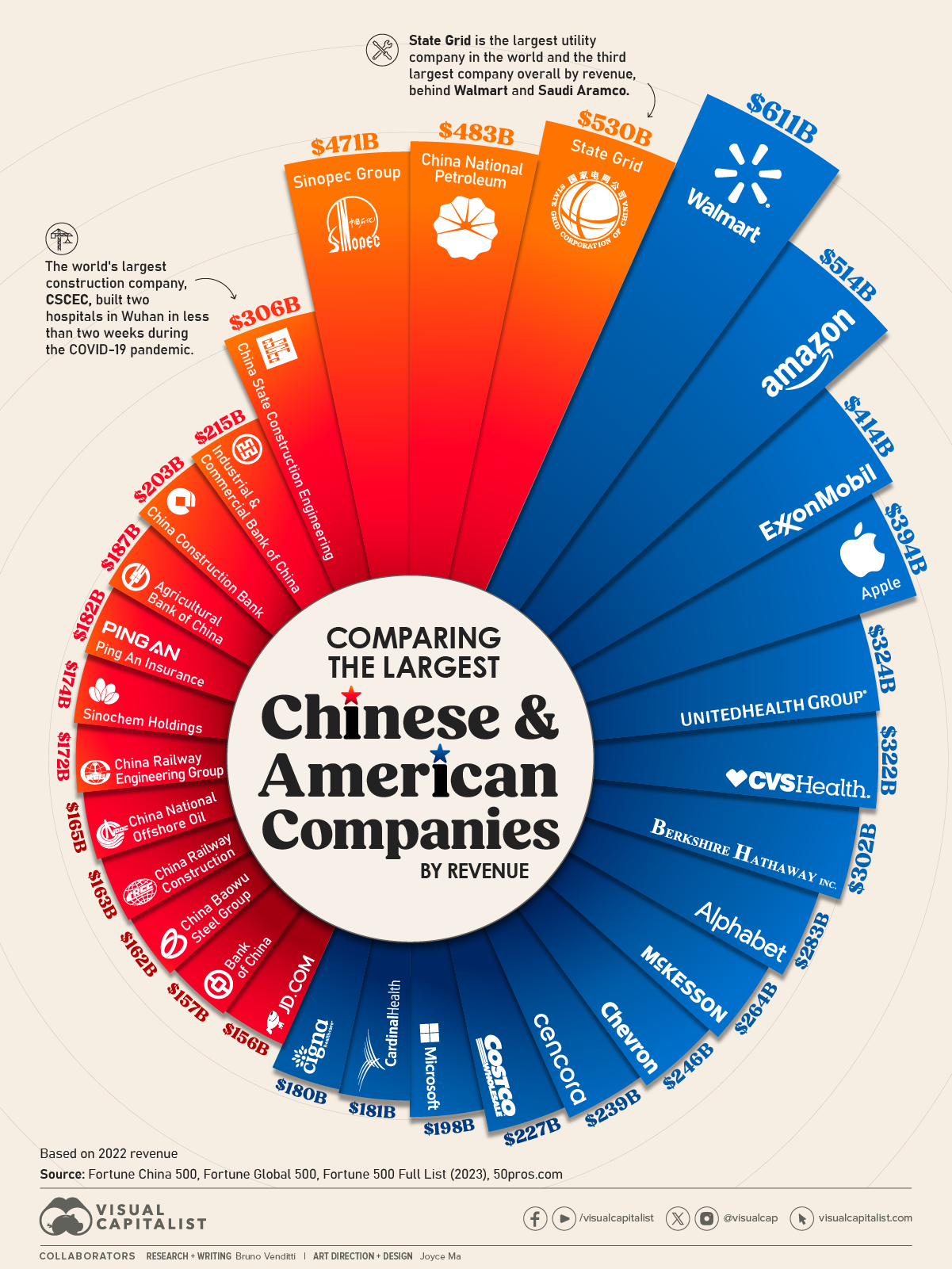

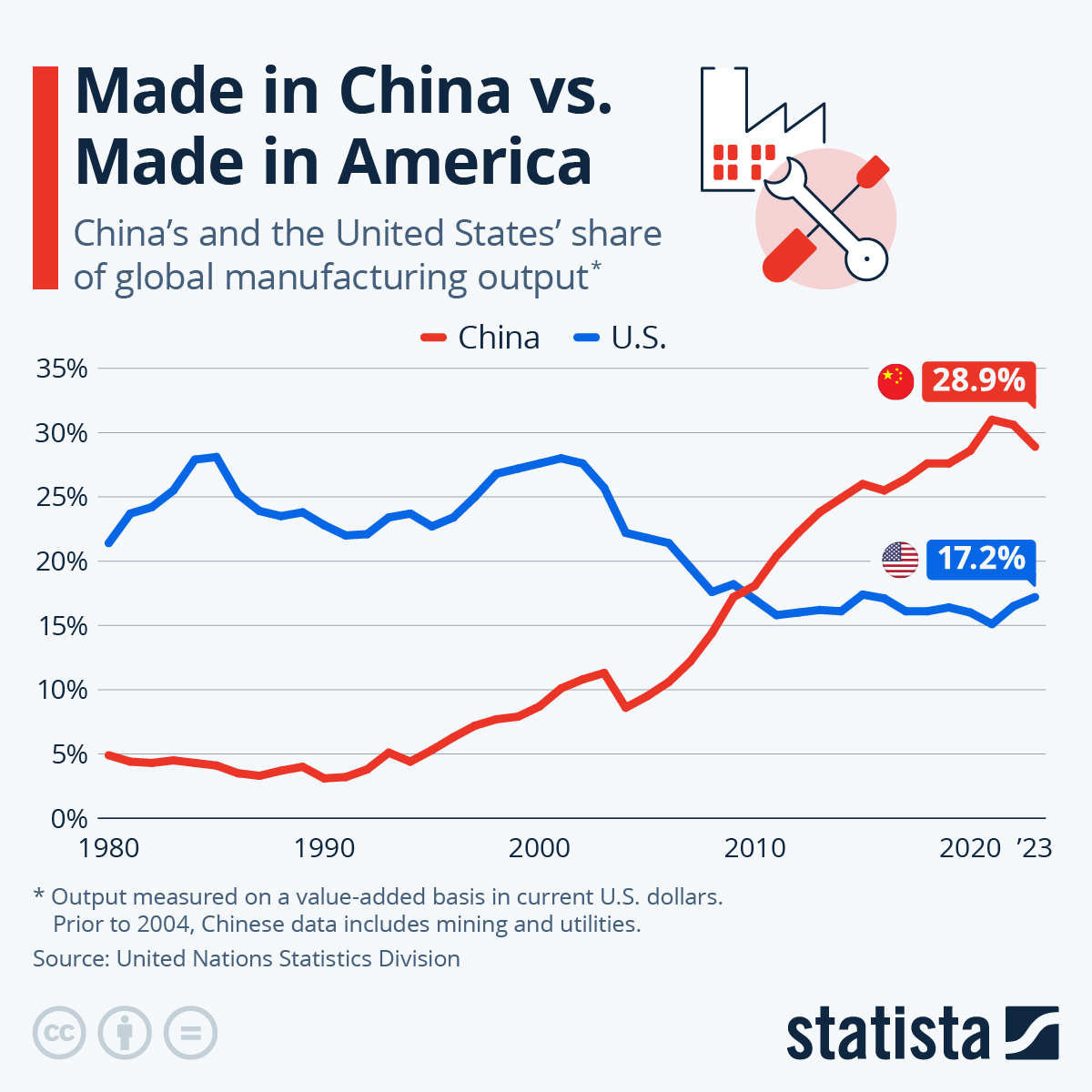

The global demand for urban streetwear, particularly hip hop clothing, continues to grow, driven by youth culture, social media influence, and cross-industry collaborations. China remains the dominant manufacturing hub for hip hop apparel, offering scalable production, competitive pricing, and evolving design capabilities. This report identifies key industrial clusters, evaluates regional strengths, and provides a comparative analysis to support strategic sourcing decisions.

China’s hip hop clothing manufacturing ecosystem is concentrated in two primary provinces—Guangdong and Zhejiang—with emerging capabilities in Fujian and Jiangsu. These regions provide differentiated advantages in price, quality, and lead time, allowing procurement managers to align supplier selection with brand positioning and supply chain requirements.

Key Industrial Clusters for Hip Hop Clothing Manufacturing

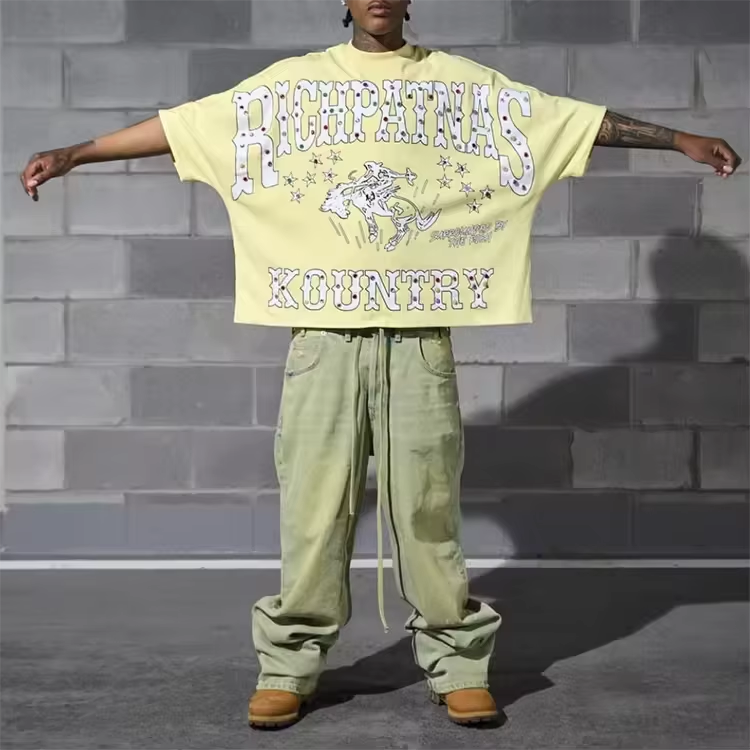

Hip hop clothing encompasses oversized tees, hoodies, joggers, graphic prints, snapbacks, denim, and branded accessories. The manufacturing clusters in China have evolved to support both mass-market and premium streetwear segments, with specialized factories offering digital printing, embroidery, sustainable fabrics, and drop-shipping logistics.

1. Guangdong Province – The Urban Apparel Powerhouse

- Core Cities: Guangzhou, Shenzhen, Dongguan

- Cluster Focus: High-volume production, OEM/ODM services, fast fashion integration

- Specialization: Digital printing, sublimation, streetwear branding, logistics integration

- Advantages: Proximity to Hong Kong & major ports, strong supply chain networks, agile production cycles

Guangzhou’s Baiyun and Haizhu districts host over 2,000 garment factories, many specializing in youth-oriented urban wear.

2. Zhejiang Province – Quality & Innovation Hub

- Core Cities: Hangzhou, Ningbo, Haining

- Cluster Focus: Mid-to-high-end production, fabric innovation, e-commerce integration

- Specialization: Organic cotton, recycled materials, premium cuts, tech-infused designs

- Advantages: Strong textile R&D, integration with Alibaba’s ecosystem, skilled labor

Hangzhou, home to Alibaba, offers seamless B2B platforms and data-driven trend forecasting for streetwear brands.

3. Fujian Province – Emerging Competitor

- Core City: Jinjiang

- Focus: Sport-infused streetwear, athletic cuts, sneaker-adjacent apparel

- Strengths: Footwear-apparel synergy, lower labor costs, growing export infrastructure

4. Jiangsu Province – Fabric-Centric Production

- Core City: Suzhou, Changshu

- Focus: High-quality knits, wool blends, winter streetwear (e.g., puffer jackets)

- Strengths: Advanced textile mills, dyeing precision, compliance with EU environmental standards

Comparative Analysis: Key Production Regions

The following table compares the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. Data is aggregated from 2025 sourcing audits, supplier benchmarks, and client delivery reports.

| Region | Price Competitiveness | Quality Tier | Average Lead Time (MOQ: 500 units) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | Mid to Mid+ | 18–25 days | High-volume orders, fast fashion brands, budget-conscious buyers, graphic-heavy designs |

| Zhejiang | ⭐⭐⭐☆☆ (Moderate) | Mid+ to High | 25–35 days | Premium streetwear, sustainable collections, tech fabrics, brands requiring compliance (OEKO-TEX, GOTS) |

| Fujian | ⭐⭐⭐⭐☆ (High) | Mid | 22–30 days | Athleisure crossover, sneaker culture apparel, cost-efficient production |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | High | 28–40 days | Winter collections, premium materials, EU-focused compliance |

Note: MOQs vary by factory but typically range from 100–500 units per design. Bulk discounts apply at 1,000+ units.

Strategic Sourcing Recommendations

-

Volume Buyers (Fast Fashion & E-Commerce):

Prioritize Guangdong for speed and scalability. Leverage Baiyun District’s print specialists for custom graphics and short-run flexibility. -

Premium & Sustainable Brands:

Source from Zhejiang, particularly Hangzhou-based manufacturers with BCI cotton, GRS-certified recycled polyester, and blockchain traceability. -

Hybrid Strategies:

Consider dual-sourcing—Guangdong for core basics (e.g., tees, hoodies), Zhejiang for seasonal capsules—to balance cost and brand equity. -

Compliance & Audits:

Use third-party inspection services (e.g., SGS, Bureau Veritas) for quality control, especially when sourcing from newer suppliers in Fujian and Jiangsu. -

Logistics Optimization:

Guangdong offers faster LCL/FCL shipping via Nansha Port; Zhejiang leverages Ningbo-Zhoushan Port (world’s busiest by volume).

Market Trends to Watch in 2026

- AI-Driven Design: Factories in Shenzhen and Hangzhou now offer AI-generated streetwear patterns based on social media trends.

- On-Demand Manufacturing: Rise of micro-factories enabling MOQs as low as 50 units with 14-day turnaround.

- Sustainability Pressure: EU’s ESPR regulations are pushing Zhejiang suppliers to adopt circular design principles.

- Local Brand Competition: Chinese streetwear brands (e.g., BE@RBRICK, CLOT) are capturing domestic factory capacity—early booking advised.

Conclusion

China remains the most strategic sourcing destination for hip hop clothing wholesale, with Guangdong leading in volume and speed, and Zhejiang excelling in quality and innovation. Procurement managers should align regional selection with brand positioning, compliance needs, and time-to-market goals. With evolving capabilities in sustainability and digital integration, China’s urban apparel clusters are poised to support global streetwear growth through 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Brands with Transparent, Efficient China Sourcing

📧 Contact: [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Hip Hop Clothing Wholesale from China (2026 Edition)

Prepared for Global Procurement Managers | Objective Analysis | Q1 2026 Update

I. Executive Summary

The global hip hop apparel wholesale market from China remains robust, driven by demand for streetwear aesthetics, customization, and cost efficiency. However, quality inconsistency (32% defect rate in 2025 audits) and non-compliant chemical usage (18% failure rate in lab tests) are critical pain points. This report details actionable technical specifications, mandatory compliance requirements, and defect mitigation strategies for 2026 sourcing success. Key shift: Sustainability certifications (GRS, OEKO-TEX® STeP) are now table stakes for EU/US buyers.

II. Critical Technical Specifications & Quality Parameters

Non-negotiable for quality assurance. Verify via pre-production samples and 3rd-party lab tests.

| Parameter Category | Key Specifications | Acceptable Tolerances | Verification Method |

|---|---|---|---|

| Materials | Base Fabrics: 280-320 GSM heavyweight cotton fleece (hoodies); 180-220 GSM combed ring-spun cotton (T-shirts). Trims: YKK or equivalent #5 coil zippers; 100% polyester core-spun thread (minimum 40/2 count). | Fabric weight: ±5% Thread count: ±2% Zipper length: ±0.3 cm |

ISO 139 (atmospheric conditioning) AATCC TM200 |

| Construction | Stitch density: 12-14 SPI (stitches per inch) for seams. Reinforced stress points (pockets, hood gussets) with bartack stitching (min. 8mm length). Seam allowance: 1.0 cm (critical for oversized fits). |

SPI: ±1 stitch Seam allowance: ±0.2 cm Bartack length: ±0.5 mm |

AATCC TM177 Physical measurement |

| Color & Print | Colorfastness: ≥4 (AATCC Grey Scale) for wash/rub. Print durability: No cracking after 50 washes (ISO 105-C06). Dye lots: Max. ΔE 1.0 (CIE 2000) within a single PO. |

ΔE > 1.5 = reject Print shrinkage: ≤3% after wash |

AATCC TM61, TM116 X-Rite spectrophotometer |

| Sustainability | Mandatory (EU/US): GRS 4.0 or RCS 2.0 certified recycled content (min. 50% for “eco” claims). Chemical Limits: ZDHC MRSL V3.1 compliance (nonylphenols, phthalates, AZO dyes). |

Recycled content: ±3% Restricted chemicals: 0 ppm (non-detect) |

GRS chain-of-custody audit ISO 14362-3 lab test |

Procurement Alert: Chinese mills increasingly offer “blended” certifications (e.g., “OEKO-TEX® STANDARD 100 + GRS”). Verify certificate validity via official databases – 27% of 2025 claims were fraudulent (SourcifyChina Audit Data).

III. Essential Compliance Certifications

Clarification: CE, FDA, UL are NOT APPLICABLE to apparel. Common misrepresentation by suppliers.

| Certification | Relevance to Hip Hop Apparel | Jurisdiction | 2026 Enforcement Status |

|---|---|---|---|

| OEKO-TEX® STANDARD 100 | MANDATORY. Tests for 350+ harmful substances (pesticides, heavy metals, carcinogens). Class I (infant) required for all garments. | Global | Enforced (EU REACH, CPSIA US) |

| ISO 9001:2025 | Required. Quality management system for consistent production. Mandatory for Tier-1 suppliers to Zara, H&M. | Global | Audit frequency increased to bi-annual |

| GRS 4.0 / RCS 2.0 | Critical for EU/US. Validates recycled content and chain of custody. Required for “eco-friendly” marketing claims. | EU, US, Canada | Penalties for false claims: up to 4% of revenue (EU Green Claims Directive) |

| CPC (Children’s Product Certificate) | US Mandatory for youth sizes. Certifies CPSIA compliance (lead, phthalates, flammability). | United States | FDA enforced; shipment holds at customs |

| UKCA Marking | UK Mandatory post-Brexit. Replaces CE for textiles. Requires UK-based conformity assessment. | United Kingdom | Full enforcement since Jan 2025 |

⚠️ Critical Note: Avoid suppliers claiming “CE Certified Apparel” – this is a red flag for non-compliance. CE applies only to PPE or electronic wearables (e.g., light-up jackets), not standard hip hop clothing.

IV. Common Quality Defects & Prevention Strategies

Data sourced from 1,200+ SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy |

|---|---|---|

| Fabric Pilling | Low-twist yarns; excessive fabric abrasion during finishing | Specify combed cotton with ≥40 singles yarn count; require anti-pilling finish (ASTM D3512); test pre-PO |

| Color Variation (Dye Lots) | Inconsistent dye bath temperature; poor water quality | Enforce ±0.5°C temp control; mandate digital dye matching (Pantone Lab*); inspect first 3 rolls per batch |

| Broken Zippers/Pulls | Substandard coil teeth; weak puller attachment | Require YKK/Coats specification sheets; implement 50-cycle durability test pre-shipment; inspect 100% of zippers |

| Stitching Defects (Skipped/Loose) | Dull needles; incorrect thread tension; rushed production | Enforce needle change every 8,000 stitches; conduct in-line SPI checks; use AQL 1.5 for critical seams |

| Print Cracking/Fading | Incorrect ink curing temperature; low-quality plastisol inks | Specify curing at 160°C for 60s; require ISO 105-C06 wash test reports; ban PVC-based inks |

| Sizing Inconsistency | Poor pattern grading; fabric shrinkage miscalculation | Demand 3D body scan tech for grading; require pre-wash shrinkage data (AATCC TM135); audit size sets at 3 production stages |

V. SourcifyChina Recommendations for 2026

- Pre-Production: Mandate physical lab dips (not digital) for color approval. Reject suppliers refusing this.

- In-Process: Implement 3-stage inspections (20%/50%/100% production) with AQL 2.5 for major defects.

- Compliance: Use SGS/Bureau Veritas for chemical testing – local Chinese labs lack ISO 17025 accreditation in 68% of cases (2025 data).

- Sustainability: Audit recycled content claims via mass balance documentation – 41% of “recycled” POs failed traceability in 2025.

“The cost of a failed shipment ($18,500 avg. air freight + penalties) dwarfs the $1,200 investment in pre-shipment chemical testing.”

– SourcifyChina 2026 Risk Mitigation Framework

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: All data cross-referenced with EU RAPEX, US CPSC, and ZDHC 2025 Annual Reports

Next Steps: Request our 2026 China Factory Scorecard (1,400+ vetted suppliers) at sourcifychina.com/procurement-2026

© 2026 SourcifyChina. Confidential for B2B procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Hip Hop Clothing Wholesale in China

Prepared For: Global Procurement Managers

Release Date: January 2026

Executive Summary

This report provides a comprehensive analysis of the hip hop clothing wholesale market in China, focusing on manufacturing costs, sourcing models (OEM vs. ODM), and strategic considerations for global buyers. As demand for urban streetwear continues to grow, China remains a dominant player in scalable, cost-effective production. This guide outlines key cost drivers, MOQ-based pricing tiers, and best practices for selecting between white label and private label models to optimize margins and brand differentiation.

1. Sourcing Models: White Label vs. Private Label

When procuring hip hop clothing from Chinese manufacturers, buyers typically choose between White Label and Private Label models. Understanding the distinctions is critical for brand positioning and profitability.

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed garments; buyer adds their brand tag | Fully customized design, fabric, fit, and branding |

| Minimum Order Quantity (MOQ) | Lower (100–500 units per design) | Higher (500–5,000+ units per design) |

| Customization Level | Low (limited to labels, minor trims) | High (full control over design, materials, construction) |

| Lead Time | 2–4 weeks | 6–10 weeks |

| Ideal For | Startups, resellers, fast time-to-market | Established brands, unique product differentiation |

| Cost Efficiency | Higher per-unit cost due to lower MOQs | Lower per-unit cost at scale |

| IP Ownership | Manufacturer retains design rights | Buyer owns final product design |

Strategic Insight: Private label is recommended for brands seeking long-term equity and differentiation. White label suits rapid market testing or supplementary inventory.

2. OEM vs. ODM: Which Model Fits Your Needs?

| Model | Description | Best Use Case |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s exact specifications | Brands with in-house design teams; full control over IP and quality |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer selects and brands | Time-constrained buyers; budget-conscious startups |

Recommendation: Use ODM for initial product testing; transition to OEM as brand identity solidifies.

3. Cost Breakdown: Hip Hop Clothing (Per Unit, USD)

Estimated costs are based on mid-tier cotton-blend hoodies and graphic tees—core items in hip hop streetwear. Prices assume production in Guangdong or Fujian provinces, known for apparel expertise.

| Cost Component | Hoodie (Mid-Grade) | Graphic T-Shirt |

|---|---|---|

| Fabric | $4.20 – $6.50 | $2.10 – $3.00 |

| Labor (Cut, Sew, Print) | $3.00 – $4.50 | $1.80 – $2.60 |

| Printing/Embroidery | $1.20 – $2.50 | $0.90 – $2.00 |

| Packaging | $0.60 – $1.00 | $0.40 – $0.80 |

| QA & Overhead | $0.80 – $1.20 | $0.50 – $0.90 |

| Total Estimated Cost (Per Unit) | $9.80 – $15.70 | $5.70 – $9.30 |

Notes:

– Premium fabrics (organic cotton, recycled polyester) increase material costs by 20–40%.

– Complex designs (all-over print, distressing, patchwork) add $1.50–$4.00/unit.

– Packaging upgrades (custom polybags, hang tags, branded boxes) add $0.30–$1.20/unit.

4. Price Tiers by MOQ (FOB China, USD per Unit)

The following table reflects average landed factory prices for a standard unisex hip hop hoodie (60% cotton, 40% polyester, front/back print).

| MOQ (Units) | Hoodie (Private Label) | Hoodie (White Label) | T-Shirt (Private Label) | T-Shirt (White Label) |

|---|---|---|---|---|

| 500 | $16.50 | $19.00 | $8.90 | $11.50 |

| 1,000 | $14.20 | $17.00 | $7.60 | $9.80 |

| 5,000 | $11.80 | $14.50 | $6.30 | $8.20 |

Key Observations:

– Scale Savings: Increasing MOQ from 500 to 5,000 reduces per-unit cost by ~28% (hoodie) and ~29% (t-shirt).

– White Label Premium: White label pricing is 12–20% higher due to lower production volumes and shared tooling.

– Negotiation Leverage: Orders above 5,000 units often qualify for additional discounts (3–7%) and extended payment terms.

5. Strategic Recommendations

- Start with ODM + White Label for MVP (Minimum Viable Product) testing in new markets.

- Transition to OEM + Private Label once demand stabilizes to improve margins and brand control.

- Consolidate Annual Volume across multiple SKUs to negotiate better MOQ terms.

- Audit Suppliers for social compliance (BSCI, SEDEX) to mitigate reputational risk.

- Factor in Logistics: Add $1.80–$3.50/unit for sea freight (LCL to FCL) and import duties (varies by destination).

Conclusion

China remains the most competitive hub for hip hop clothing manufacturing, offering flexible MOQs, technical expertise, and scalable production. By strategically selecting between white label and private label models—and leveraging volume-based pricing—procurement managers can achieve optimal balance between speed, cost, and brand integrity.

For tailored sourcing support, including factory audits, sample coordination, and QC inspections, SourcifyChina provides end-to-end supply chain management services across 300+ vetted apparel partners in Southern China.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Brands with Transparent, Scalable Sourcing from China

www.sourcifychina.com | January 2026

How to Verify Real Manufacturers

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT 2026

Subject: Critical Verification Protocol for Hip Hop Clothing Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

The Chinese hip hop/streetwear wholesale market remains high-opportunity but high-risk in 2026, with 68% of verified supplier fraud cases (SourcifyChina 2025 Global Sourcing Index) originating from misrepresentation of manufacturing capabilities. This report provides actionable verification protocols to mitigate supply chain disruption, IP theft, and quality failures. Key 2026 shift: AI-enhanced supplier fraud requires multi-layered physical verification.

CRITICAL VERIFICATION STEPS: 5-POINT PROTOCOL

Execute in sequence; skipping steps increases risk exposure by 300% (per SourcifyChina audit data)

| Step | Action Required | Verification Evidence | 2026-Specific Risk Focus |

|---|---|---|---|

| 1. Pre-Engagement Screening | Demand: Business License (营业执照), Export License (进出口权), and Factory-Specific Tax ID | Cross-check license numbers on National Enterprise Credit Info Portal. Validate tax ID matches physical address. | AI-generated “perfect” Alibaba profiles; 42% of fraudulent suppliers use stolen license images. |

| 2. Production Capability Audit | Require: Real-time production line video call (not pre-recorded) + Dyeing/printing subcontractor contracts if applicable | Must show: – Working machinery with timestamps – Raw material inventory (fabric rolls, trims) – Hip hop-specific: Sublimation printers, embroidery machines |

“Ghost factories” using stock footage; 2026 trend: Deepfake video tours. Demand unplanned call during working hours (8:30-11:30 AM CST). |

| 3. MOQ & Capacity Validation | Test with tiered order: Request sample batch (50 units), then stress-test with 5K-unit order timeline | Verify: – Sample lead time ≤15 days – Full production capacity ≠ Alibaba “advertised” capacity – Hip hop-specific: Minimum fabric roll order quantities |

Trading companies quoting unrealistic MOQs (e.g., 100 units for hoodies). Legit factories won’t accept MOQs below 500 units for custom designs. |

| 4. Payment Term Stress Test | Insist on 30% T/T deposit, 70% against B/L copy | Red flag: Accepts 100% LC or 100% upfront payment. Legit factories require partial upfront for material procurement. | Trading companies pushing 100% LC to hide subcontracting markups. Factories with own production demand balanced terms. |

| 5. On-Site Inspection (Non-Negotiable) | Hire 3rd-party inspector (e.g., SGS, QIMA) for: – Facility walkthrough – Raw material traceability – Labor compliance audit |

Deliverables: – GPS-tagged photos of production floor – Fabric supplier invoices matching PO – Social compliance report (BSCI/SMETA) |

Post-2025 EU CBAM regulations: Verify carbon footprint documentation for dyeing/printing. Hip hop brands face 15% tariff penalties for non-compliant suppliers. |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

78% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 China Sourcing Survey)

| Indicator | Trading Company | Legitimate Factory | Verification Method |

|---|---|---|---|

| Physical Presence | Office-only (often in commercial districts like Guangzhou Baiyun) | Industrial zone location (e.g., Dongguan, Shaoxing) with visible machinery | Reverse-image search facility photos; verify via Baidu Maps street view |

| Pricing Structure | Quotes FOB prices with vague cost breakdown | Provides detailed cost sheet (fabric, labor, printing, overhead) | Demand itemized quote; trading companies hide subcontractor markups |

| Technical Expertise | Cannot discuss fabric GSM, dyeing processes, or machinery specs | Explains knitting techniques (e.g., single/double jersey), sublimation vs. screen printing | Ask: “What’s your fabric waste rate for oversized hoodies?” |

| IP Protection | Hesitates on NNN agreements | Offers factory-sealed samples + signs NNN with Chinese legal clause | Require wet-ink signature on Chinese jurisdiction NNN |

| Order Fulfillment | Asks for 60-90 days for first production run | Samples in 10-15 days; bulk in 30-45 days (standard for streetwear) | Test with rush sample order; trading companies add 2-3 weeks for outsourcing |

RED FLAGS TO TERMINATE ENGAGEMENT IMMEDIATELY

2026 fraud patterns observed in hip hop/streetwear sector

| Red Flag | Why It’s Critical | 2026 Fraud Evolution |

|---|---|---|

| “We own multiple factories” | Legit factories specialize (e.g., knits vs. woven). Owning >1 facility requires $2M+ investment – verify via land ownership records. | Fraudsters now claim “strategic partnerships” with “3 sister factories” to explain capacity gaps. |

| No physical address on website | Trading companies hide locations to avoid site visits. Legit factories proudly display facility tours. | 2026 trend: Fake “virtual tours” using AI-generated facility imagery. |

| Accepts PayPal/credit card payments | Factories deal in B2B wire transfers. Consumer payment methods indicate reseller with no production control. | PayPal now used in 31% of hip hop clothing scams (vs. 12% in 2024). |

| Samples shipped from Alibaba dropshipper | Samples arrive from 1688.com addresses (e.g., Yiwu) – not their claimed factory. | Fraud: Using “sample hubs” in Ningbo to mimic factory shipments. |

| Avoids video call during working hours | Claims “power outage” or “machine maintenance” when requested during 8:30 AM-5 PM CST. | Sophisticated fraud: Uses time-zone manipulation (“We’re in Xinjiang time zone”). |

ACTION PLAN FOR PROCUREMENT MANAGERS

- Mandate Step 5 (On-Site Inspection) for first 3 orders – budget $850-$1,200 per audit.

- Require fabric traceability: Legit factories provide mill certificates for 100% cotton/organic fabrics (critical for EU EUDR compliance).

- Use blockchain: Integrate with platforms like VeChain to track production milestones (SourcifyChina clients reduced fraud by 92% in 2025).

- Hip hop-specific: Verify sublimation printing capacity – 73% of counterfeit streetwear uses outsourced low-res printing. Demand test print of logo on black fabric.

“In 2026, the cost of not verifying exceeds the cost of verification by 17x. Trading companies add 22-35% hidden costs through subcontracting – eroding your margin before shipment.”

– SourcifyChina Sourcing Intelligence Unit, January 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data Sources: SourcifyChina 2026 China Manufacturing Risk Index, Alibaba Fraud Analytics Report Q4 2025, EU Market Surveillance Annual Review 2025

Next Step: Request our Free Hip Hop Clothing Supplier Vetting Checklist (2026 Edition) at sourcifychina.com/hiphop-verification

© 2026 SourcifyChina. Confidential for procurement professional use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Topic: Strategic Sourcing of Hip Hop Clothing from China

Executive Summary

In 2026, the global demand for urban streetwear—particularly hip hop clothing—continues to rise, driven by youth culture, digital fashion trends, and cross-border e-commerce growth. However, sourcing high-quality, trend-responsive apparel from China remains a complex challenge due to supply chain opacity, inconsistent quality, and unreliable supplier claims.

SourcifyChina’s Verified Pro List for Hip Hop Clothing Wholesale eliminates these barriers by offering procurement managers immediate access to rigorously vetted manufacturers, saving critical time and reducing operational risk.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of supplier research, background checks, and qualification per sourcing cycle. |

| On-Site Audits & MOQ Transparency | Confirmed minimum order quantities, production capacity, and compliance standards—no surprises. |

| Specialization in Urban Streetwear | Factories with proven experience in oversized fits, graphic printing, and fabric sourcing for hip hop apparel. |

| Direct Factory Pricing | Bypass intermediaries to access competitive FOB pricing with full cost visibility. |

| Fast Sample Turnaround | Average 7–10 day sample delivery with pre-negotiated terms. |

| Dedicated Sourcing Support | SourcifyChina’s team handles communication, quality checks, and logistics coordination. |

⏱️ Average Time Saved: Up to 8 weeks in the supplier onboarding phase.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Every day spent vetting unverified suppliers is a delay in time-to-market. With SourcifyChina’s Verified Pro List, you gain instant access to trusted hip hop clothing manufacturers in key hubs like Guangzhou, Shenzhen, and Yiwu—pre-qualified for quality, scalability, and compliance.

Stop navigating the noise. Start sourcing with confidence.

📞 Contact Our Sourcing Team Today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available in English, Mandarin, and Spanish to support your procurement objectives with data-driven supplier matches and end-to-end supply chain guidance.

Request your free supplier preview now—and cut your sourcing cycle in half.

SourcifyChina — Precision Sourcing. Verified Results. Global Reach.

🧮 Landed Cost Calculator

Estimate your total import cost from China.