The global industrial steam boiler market, a critical enabler for power generation, manufacturing, and process industries, is experiencing robust growth driven by increasing energy demands and industrialization. According to Mordor Intelligence, the high-pressure boiler market was valued at USD 12.3 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. This expansion is fueled by rising investments in thermal power plants, stricter efficiency regulations, and the modernization of aging industrial infrastructure. As operational demands for higher efficiency and greater steam pressure intensify, manufacturers capable of delivering reliable, high-performance boilers are gaining strategic importance. Based on production capacity, technological innovation, global footprint, and project track record, the following ten manufacturers have emerged as leaders in the high steam pressure equipment space—setting benchmarks for performance, safety, and scalability in industrial energy systems.

Top 10 High Steam Pressure Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Clayton Industries

Domain Est. 1997

Website: claytonindustries.com

Key Highlights: Clayton Industries is proud to be a leading industrial steam boiler manufacturer at the forefront of steam technology delivering unparalleled efficiency, ……

#2 Watson McDaniel Manufacturer of High

Domain Est. 1996

Website: watsonmcdaniel.com

Key Highlights: Watson McDaniel has been proudly manufacturing high-quality steam and fluid specialty products for the industrial marketplace since 1878….

#3 Electric High Pressure Steam Boiler

Domain Est. 1994

Website: thermon.com

Key Highlights: The STH High Pressure Steam Boiler provides process steam above 200 psi in a compact footprint. Custom knock-down designs fit tight spaces, while optional ……

#4 Croll

Domain Est. 1995

Website: croll.com

Key Highlights: Croll-Reynolds specializes in process vacuum systems, ejectors, and heat transfer products. Leading vacuum manufacturers in the USA offering innovative ……

#5 Sioux Corporation

Domain Est. 1997

Website: sioux.com

Key Highlights: At Sioux Corporation, we specialize in manufacturing reliable industrial heating and cleaning equipment, including water heaters, steam generators, pressure ……

#6 First for steam solutions

Domain Est. 2000

Website: spiraxsarco.com

Key Highlights: Spirax Sarco US is the world leader in high quality products for the control & efficient use of steam & other industrial fluids. Find out more….

#7 A Steam Specialist Company

Domain Est. 1995

Website: tlv.com

Key Highlights: TLV delivers innovative products, services and solutions for steam and air systems, from steam traps, condensate recovery pumps, pressure reducing valves, ……

#8 Fulton: High

Domain Est. 1996

Website: fulton.com

Key Highlights: Trusted globally, Fulton engineers high-efficiency steam and hydronic boilers, thermal fluid heaters, and custom heat transfer systems….

#9 Triad High Pressure Steam

Domain Est. 1997

Website: superiorboiler.com

Key Highlights: The High Pressure Triad Steam Boiler is available with a wide range of inputs based on the chosen capacity. However, millions of BTU’s can be delivered….

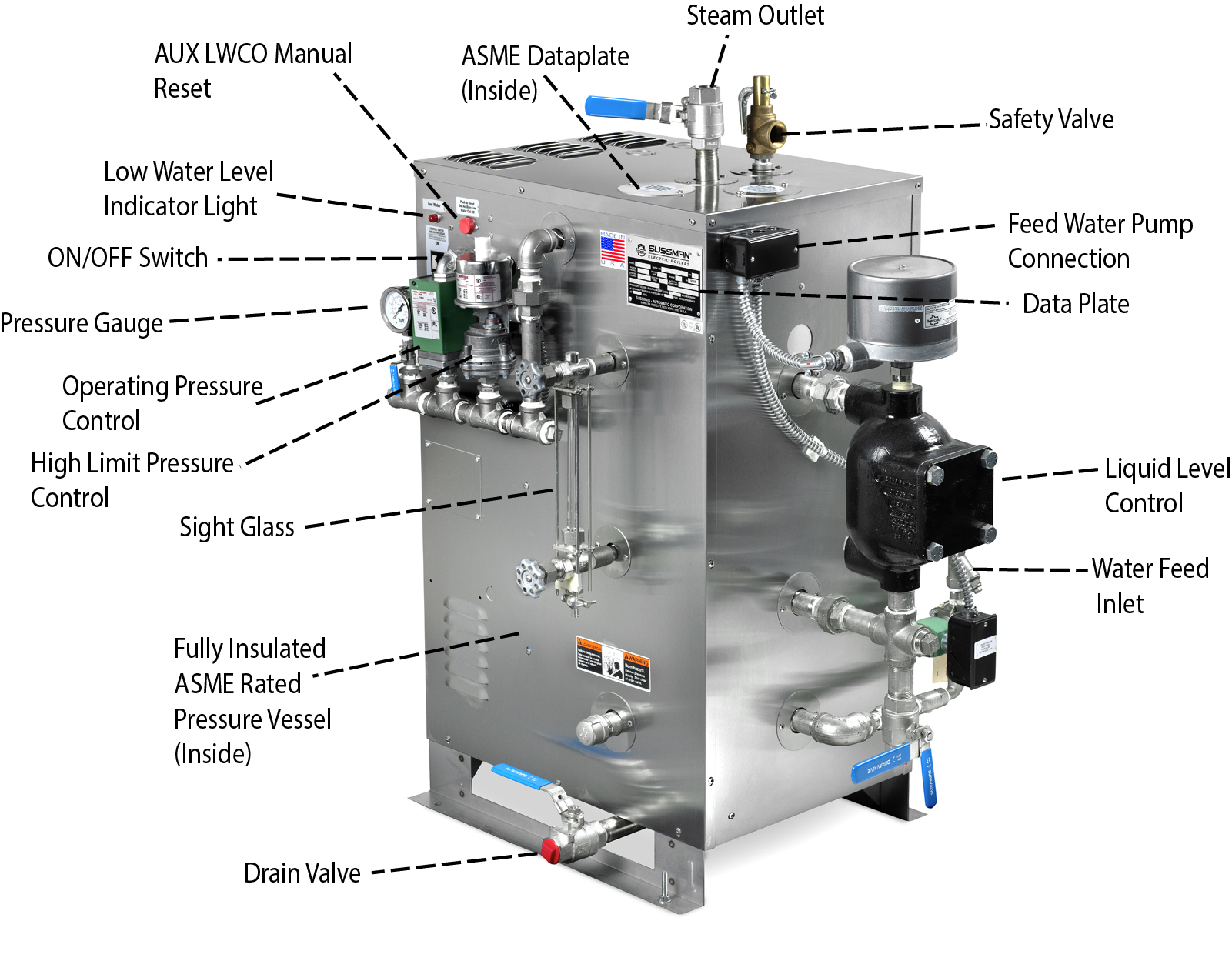

#10 SussmanBoilers

Domain Est. 2000

Website: sussmanboilers.com

Key Highlights: SSB – Stainless Steel Electric Steam Boilers · SVS – Electric Steam Boilers · SVW- Electric Hot Water Boiler · CSG – Steam to Clean Steam Exchangers · Options….

Expert Sourcing Insights for High Steam Pressure

As of now, projecting market trends for High Steam Pressure (HSP) systems in 2026 involves analyzing current industrial dynamics, energy transition pathways, technological innovation, and global policy frameworks—with hydrogen (H₂), particularly clean hydrogen, playing an increasingly influential role. Below is an analysis of the 2026 market trends for high steam pressure technologies, with a focus on how hydrogen (H₂) integration is shaping this sector.

Market Trends for High Steam Pressure Systems in 2026: The Role of Hydrogen (H₂)

1. Increased Demand for High Steam Pressure in Hydrogen Production

By 2026, high steam pressure systems are expected to experience strong demand driven by green and blue hydrogen production, especially via Steam Methane Reforming (SMR) and renewable-powered electrolysis with steam cycling.

- Steam Methane Reforming (SMR): Despite the push for green hydrogen, SMR remains dominant in 2026 for gray and blue hydrogen, requiring high-pressure steam (typically 20–100 bar). Carbon capture integration (CCS) in blue hydrogen plants further necessitates robust high-pressure steam infrastructure.

- Hybrid Systems: Emerging hybrid models use high-pressure steam in conjunction with solid oxide electrolyzers (SOEC), which operate efficiently at elevated temperatures and pressures. SOEC adoption is rising by 2026 in industrial hubs (e.g., EU, Japan, South Korea), boosting demand for high-efficiency steam systems.

Trend: High steam pressure boilers and heat exchangers are being redesigned to integrate with H₂ production units, emphasizing efficiency, corrosion resistance, and dynamic load response.

2. Retrofitting Industrial Plants for Hydrogen-Ready Operations

Existing industrial facilities (chemical, refining, steel) are retrofitting high-pressure steam systems to accommodate hydrogen as a fuel or feedstock.

- Fuel Switching: Operators are blending hydrogen into fuel streams for high-pressure steam boilers. By 2026, H₂ blending (up to 20–30%) is becoming common in EU and UK industrial zones under decarbonization mandates.

- Material Upgrades: High steam pressure components are being upgraded to handle hydrogen embrittlement risks—requiring new alloys and monitoring systems.

- Regulatory Push: Policies like the EU’s Industrial Emissions Directive and U.S. Inflation Reduction Act (IRA) incentivize low-carbon steam generation, accelerating H₂-compatible retrofits.

Trend: The market for hydrogen-adapted high-pressure steam equipment (valves, turbines, boilers) is growing at ~12% CAGR (2022–2026), driven by compliance and long-term operational savings.

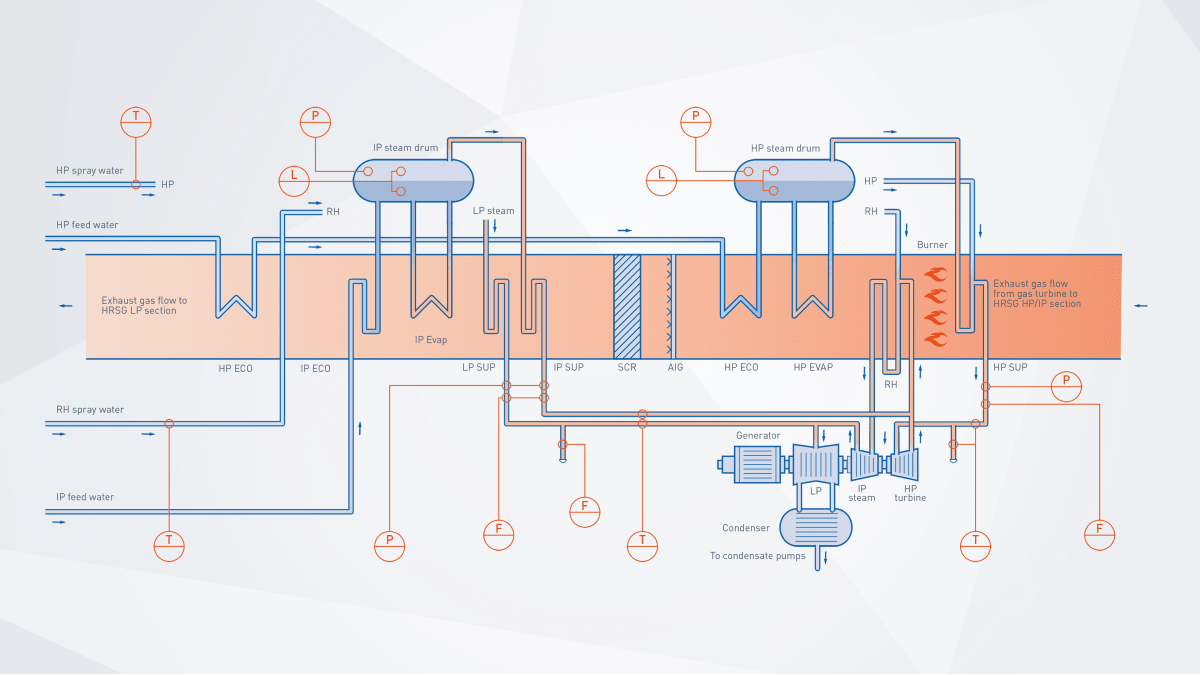

3. Synergies Between Hydrogen and High-Pressure Steam in Power and CHP

Combined Heat and Power (CHP) systems using hydrogen are increasingly relying on high-pressure steam cycles for efficiency.

- Hydrogen-Fueled Turbines: Companies like Siemens Energy and GE are deploying H₂-capable gas turbines (up to 100% H₂ by 2030), which exhaust high-temperature gases used to generate high-pressure steam for secondary power or industrial use.

- Thermal Storage Integration: High-pressure steam systems are being paired with molten salt or thermochemical storage, using surplus renewable energy to produce hydrogen and later generate steam on demand.

Trend: By 2026, hybrid H₂–steam CHP systems are gaining traction in data centers, district heating, and heavy industry for resilience and decarbonization.

4. Technological Innovation: Advanced Materials and Digitalization

To meet the demands of H₂-integrated steam systems, the market is seeing rapid innovation:

- Materials Science: Development of nickel-based alloys and ceramic coatings to resist H₂-induced degradation under high pressure and temperature.

- Digital Twins and AI: Predictive maintenance platforms monitor steam pressure systems in real time, optimizing performance when burning H₂ blends.

- Modular Steam Generators: Compact, high-pressure steam modules designed for hydrogen-ready industrial parks are entering the market.

Trend: The integration of AI-driven control systems with H₂-fueled steam plants improves ramp rates and reduces thermal stress—key for grid balancing.

5. Regional Market Drivers

- Europe: Leading in H₂-ready steam infrastructure due to REPowerEU and carbon pricing. High-pressure steam systems in refineries are being converted for 100% H₂ co-firing by 2026.

- Asia-Pacific: China and Japan are investing heavily in hydrogen-based steelmaking (e.g., HYBRIT-style processes), requiring high-pressure steam for reduction reactors.

- North America: IRA tax credits ($3/kg for clean H₂) are spurring blue and green hydrogen projects, many involving high-pressure steam cycles.

Conclusion: H₂ as a Catalyst for High Steam Pressure Evolution

By 2026, the high steam pressure market is undergoing a transformation, driven by hydrogen’s growing role in decarbonizing industry and power. Key trends include:

- Rising integration of H₂ in steam generation for hydrogen production and industrial heating.

- Retrofitting of steam systems for hydrogen compatibility.

- Growth in hybrid H₂–steam CHP and power plants.

- Innovation in materials, controls, and modular design.

- Strong regional policy support accelerating adoption.

Outlook: The convergence of clean hydrogen and high-efficiency steam systems positions high-pressure steam technology not as a legacy system, but as a critical enabler of the hydrogen economy.

Note: This analysis is forward-looking based on 2023–2025 trends, policy roadmaps, and industry announcements projected to 2026. Actual market outcomes may vary with technological breakthroughs, policy shifts, or energy price volatility.

Common Pitfalls When Sourcing High Steam Pressure Equipment (Focus on Quality and Intellectual Property)

Sourcing high steam pressure equipment—such as boilers, turbines, valves, and piping systems—requires meticulous attention to technical specifications, safety standards, and legal considerations. Two critical areas where companies often encounter challenges are quality assurance and intellectual property (IP) protection. Below are the common pitfalls in each domain:

1. Quality-Related Pitfalls

- Inadequate Material Certification: Suppliers may provide equipment made from substandard materials that do not meet ASME, ASTM, or ISO standards. Without proper material test reports (MTRs), equipment may fail under high pressure and temperature, leading to safety hazards and costly downtime.

- Insufficient Third-Party Inspections: Skipping independent inspections (e.g., by authorized inspectors or classification societies like TÜV or Lloyd’s Register) increases the risk of receiving non-compliant equipment. This is especially critical for pressure vessels governed by ASME BPVC Section VIII.

- Poor Welding and Fabrication Standards: Inconsistent welding practices or lack of certified welders can compromise structural integrity. Radiographic or ultrasonic testing should be mandatory, but are often overlooked to cut costs.

- Incorrect Design for Operating Conditions: Equipment may be rated for high pressure but not designed for thermal cycling, corrosion, or fatigue. Failure to validate design calculations (e.g., wall thickness, stress analysis) against actual site conditions leads to premature failure.

- Lack of Traceability and Documentation: Incomplete documentation (e.g., design drawings, test records, compliance certificates) makes it difficult to verify quality or perform root cause analysis during failures.

2. Intellectual Property (IP)-Related Pitfalls

- Unauthorized Use of Proprietary Designs: Some suppliers may replicate patented or copyrighted designs without licensing. Using such equipment can expose the buyer to legal liability, especially in litigious jurisdictions.

- Gray Market Equipment and Reverse Engineering: Sourcing from unauthorized distributors or suppliers who reverse-engineer OEM parts may result in IP infringement claims, even if the buyer is unaware.

- Unclear IP Ownership in Custom Designs: When commissioning custom high-pressure components, failure to define IP ownership in contracts may result in disputes. Suppliers might retain rights to design improvements, limiting future modifications or sourcing flexibility.

- Insufficient IP Due Diligence: Buyers often fail to vet suppliers for prior IP violations or patent litigation history. This increases the risk of purchasing infringing technology.

- Export Control and Licensing Issues: High-performance steam systems may incorporate technology subject to export controls (e.g., ITAR, EAR). Unauthorized transfer or use can lead to sanctions or IP-related legal actions.

Mitigation Strategies

- Require full compliance with international standards (ASME, PED, ISO) and third-party certification.

- Conduct factory acceptance tests (FAT) and on-site inspections before equipment release.

- Include clear IP clauses in procurement contracts specifying ownership, permitted use, and indemnification.

- Perform supplier audits and IP risk assessments, especially for custom or proprietary systems.

- Maintain a documented chain of custody and certification for all critical components.

By proactively addressing quality and IP concerns, organizations can reduce operational risks, ensure regulatory compliance, and protect themselves from legal and financial exposure when sourcing high steam pressure equipment.

H2: Logistics & Compliance Guide for High Steam Pressure Systems

Introduction

High steam pressure systems are critical components in various industrial operations, including power generation, chemical processing, and manufacturing. Due to the inherent risks associated with high-pressure steam—such as explosions, scalding, and equipment failure—strict logistics planning and regulatory compliance are essential. This guide outlines key considerations for the safe transportation, handling, installation, operation, and regulatory adherence for high steam pressure systems.

H2: Regulatory and Safety Compliance

- Adherence to Industry Standards

Ensure compliance with recognized codes and standards, including: - ASME Boiler and Pressure Vessel Code (BPVC), Section I (Power Boilers) and Section VIII (Pressure Vessels)

- OSHA 29 CFR 1910.168 – Occupational exposure to high-pressure boilers

- National Board Inspection Code (NBIC) for inspection, repair, and alteration

-

Local and national building and fire codes

-

Certification and Inspection

- All pressure vessels and boilers must be certified by an authorized inspector and stamped with the ASME “U” or “S” symbol.

- Regular inspections (internal, external, and non-destructive testing) must be conducted per NBIC guidelines.

-

Maintain a documented inspection and maintenance log accessible for audits.

-

Personnel Training and Qualification

- Operators must be trained and certified per OSHA and company safety protocols.

- Training should cover emergency shutdown procedures, hazard recognition, and PPE usage.

- Only qualified personnel should operate or maintain high-pressure steam systems.

H2: Transportation and Logistics

- Equipment Transport

- Use certified carriers experienced in handling heavy, high-pressure industrial equipment.

- Secure components on flatbeds using proper bracing; protect valves, gauges, and connections.

-

Comply with Department of Transportation (DOT) regulations for oversized or heavy loads if applicable.

-

Site Delivery and Handling

- Conduct site surveys to ensure access routes, crane availability, and foundation readiness.

- Use lifting equipment rated for the weight and center of gravity of steam components.

-

Protect insulation and piping during unloading to prevent moisture ingress or damage.

-

Storage Prior to Installation

- Store components in a dry, covered area to prevent corrosion.

- Seal open flanges and ports with protective caps.

- Follow manufacturer’s guidelines for storage duration and environmental conditions.

H2: Installation and Commissioning

- Installation Best Practices

- Follow engineered drawings and manufacturer specifications.

- Ensure proper alignment, support, and anchoring of piping and vessels.

-

Use qualified welders certified to ASME Section IX for all pressure-retaining welds.

-

Pressure Testing

- Conduct hydrostatic testing at 1.5 times the maximum allowable working pressure (MAWP).

- Perform steam leak tests at operating pressure after system warm-up.

-

Document all test results and retain for compliance records.

-

Commissioning and Start-Up

- Conduct pre-start safety reviews (PSSR).

- Verify operation of safety valves, pressure controls, and interlocks.

- Gradually bring the system online to avoid thermal shock.

H2: Operational Safety and Maintenance

- Operational Controls

- Monitor steam pressure, temperature, and water levels continuously using calibrated instruments.

- Install high-pressure cut-offs and redundant safety relief valves.

-

Implement lockout/tagout (LOTO) procedures for maintenance.

-

Preventive Maintenance

- Schedule routine checks of safety valves, gauges, and water treatment systems.

- Inspect for corrosion, erosion, and insulation damage.

-

Maintain water quality to prevent scaling and corrosion (per ASME Guidelines for Boiler Water).

-

Emergency Preparedness

- Develop and post emergency response procedures for steam leaks, overpressure, or explosions.

- Provide accessible emergency shutoff valves and PPE (face shields, heat-resistant gloves).

- Conduct regular drills and review incident reports.

H2: Documentation and Auditing

- Recordkeeping

- Maintain logs for:

- Equipment specifications and certifications

- Inspection and testing results

- Maintenance and repair history

-

Operator training records

-

Regulatory Reporting

- Report any incidents involving injury, release, or equipment failure to relevant authorities (e.g., OSHA, local fire department).

-

Submit required compliance documentation during audits or inspections.

-

Continuous Improvement

- Conduct periodic safety audits and risk assessments.

- Update procedures based on incident learnings and technological advances.

Conclusion

Managing high steam pressure systems requires rigorous attention to logistics, safety, and compliance. By adhering to established standards, investing in training, and maintaining meticulous records, organizations can ensure the safe and reliable operation of these high-risk systems. Always consult with qualified engineers and regulatory experts when designing, installing, or operating high-pressure steam equipment.

Conclusion on Sourcing High Steam Pressure

Sourcing high steam pressure requires a comprehensive approach that balances technical requirements, safety considerations, energy efficiency, and cost-effectiveness. High-pressure steam systems are critical in various industrial applications such as power generation, chemical processing, and manufacturing, where they offer improved thermal efficiency and process effectiveness. However, achieving and maintaining high steam pressure demands robust system design, high-quality materials, and reliable equipment—including boilers, pressure regulators, piping, and safety controls.

Key considerations include selecting suitably rated components capable of withstanding high stresses and temperatures, ensuring compliance with industry standards and regulations (such as ASME BPVC), and implementing rigorous maintenance and monitoring protocols to prevent failures. Additionally, energy sourcing—whether through natural gas, biomass, waste heat recovery, or electric boilers—must align with sustainability goals and operational needs.

Ultimately, successfully sourcing high steam pressure involves not only technical expertise but also strategic planning to ensure long-term reliability, safety, and efficiency. Investing in advanced control systems, proper insulation, and trained personnel can further enhance performance and reduce operational risks. As industries continue to seek higher efficiencies and lower emissions, the ability to generate and manage high-pressure steam safely and sustainably will remain a vital capability.