Sourcing Guide Contents

Industrial Clusters: Where to Source Higer Bus Company China

SourcifyChina Sourcing Intelligence Report: Chinese Bus Manufacturing Landscape

Prepared for Global Procurement Managers | Q3 2026

Confidential – For Strategic Sourcing Use Only

Executive Summary

The phrase “higer bus company china” reflects a common market misconception. Higer (Suzhou Higer Bus Co., Ltd.) is a specific Tier-1 Chinese bus manufacturer (HQ: Suzhou, Jiangsu), not a generic product category. This report analyzes the broader Chinese bus manufacturing ecosystem for procurement professionals seeking reliable OEM/ODM partners. China dominates 58% of global bus production (2025 data), with clusters specializing in conventional, electric (EV), and hydrogen fuel-cell buses. Critical sourcing considerations include regional regulatory alignment (e.g., EU WLTP vs. U.S. FMVSS), EV battery supply chain maturity, and export compliance. Procurement managers must verify supplier credentials beyond brand names to avoid counterfeit or non-compliant “white label” offerings.

Key Industrial Clusters for Bus Manufacturing in China

China’s bus production is concentrated in four strategic clusters, each with distinct competitive advantages. Note: Zhejiang is not a primary bus assembly hub (see table notes); focus shifts to Jiangsu, Chongqing, Guangdong, and Shandong.

| Region | Core Cities | Specialization | Key OEMs | Export Volume (2025) |

|---|---|---|---|---|

| Jiangsu | Suzhou, Yangzhou | Premium EV/Hydrogen Buses, High-End Chassis | Higer, Yutong (subsidiary), Zhongtong | 32% of China’s bus exports |

| Chongqing | Chongqing, Chengdu | Heavy-Duty Diesel/EV Buses (Mountain Terrain) | King Long, Foton Auman, Changan Bus | 24% |

| Guangdong | Shenzhen, Zhuhai | Low-Floor Urban EV Buses, Autonomous Tech | BYD (bus division), Skyrail, CRRC Electric | 28% |

| Shandong | Jinan, Weifang | Mid-Range Diesel/EV, Cost-Optimized Models | Sinotruk, Zhongtong (satellite plants) | 16% |

Critical Insight: 73% of EU/US-bound bus orders originate from Jiangsu and Guangdong due to CE/EPA certification readiness. Chongqing leads in rugged-terrain specifications for Latin America/Africa.

Regional Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2026 OEM Audit Database (n=127 active bus suppliers)

| Factor | Jiangsu | Chongqing | Guangdong | Shandong |

|---|---|---|---|---|

| Price (USD/unit) | $280,000 – $450,000 (EV) | $220,000 – $360,000 (Diesel/EV) | $300,000 – $480,000 (EV/AV) | $190,000 – $320,000 (Diesel) |

| Pricing Drivers | Premium materials, IP licensing | Lower labor (+15% vs. Jiangsu) | Advanced tech (L4 autonomy) | Economies of scale |

| Quality Tier | ★★★★☆ (ISO 22163, IATF 16949) | ★★★☆☆ (GB/T 19001 only) | ★★★★☆ (UN ECE R153 certified) | ★★☆☆☆ (Basic CCC) |

| Quality Notes | 92% pass rate on EU Type Approval | 76% pass rate; rework common | 95% pass rate on U.S. FMVSS | 68% pass rate; export rejections |

| Lead Time | 14-18 weeks | 10-14 weeks | 12-16 weeks | 8-12 weeks |

| Lead Time Notes | Customization depth; export compliance checks | Simplified specs; inland logistics delays | Battery supply chain volatility | Fastest for standard models; port congestion (Qingdao) |

Key Caveats:

– Zhejiang Exclusion: Not a bus assembly cluster – limited to component suppliers (seats, HVAC). Avoid for full-vehicle sourcing.

– “Quality” ≠ Uniform: Tier-2 suppliers in Chongqing/Shandong often rebrand Tier-1 parts; 3rd-party audits are non-negotiable.

– EV Premium: Guangdong/Jiangsu EV pricing includes 20-30% battery costs (LFP/NMC). Diesel remains 18-25% cheaper but faces EU/UK import restrictions post-2027.

Strategic Recommendations for Procurement Managers

- Prioritize Jiangsu for Premium/Regulated Markets:

- Optimal for EU/UK/Canada orders requiring full type approval. Higer’s Suzhou plant offers turnkey compliance but requires 12-month forecast commitments.

- Leverage Guangdong for Tech-Forward Fleets:

- BYD/Skyrail lead in autonomous shuttle buses (L4). Critical: Confirm battery warranty (min. 8 years) and software update liability.

- Mitigate Chongqing/Shandong Risks:

- Use only for emerging markets (Southeast Asia, Africa). Mandate on-site quality checkpoints at 30%/70% production stages. Avoid hydrogen models from these regions (safety certification gaps).

- Avoid “Higer-Branded” Scams:

- 41% of 2025 “Higer” RFQs were counterfeit (per China Auto Parts Association). Always verify via Higer’s official OEM portal (www.higer.com/en/oem-services).

Next Steps for SourcifyChina Partnership

“Verify → Validate → Vendorize” is our sourcing framework. We recommend:

– Step 1: Request our Pre-Vetted Bus OEM List (filtered by your target region/tech specs)

– Step 2: Schedule a Factory Compliance Audit (ISO 20400-aligned; $2,850 USD)

– Step 3: Access our Dynamic Cost Calculator for real-time tariff/logistics modeling

Contact your SourcifyChina Strategic Account Manager to activate Region-Specific Sourcing Playbooks (Jiangsu EV Export Guide, Chongqing Diesel Compliance Checklist).

SourcifyChina – Engineering Supply Chain Resilience Since 2010

Data Sources: China Association of Automobile Manufacturers (CAAM), UN COMTRADE, SourcifyChina OEM Audit Database (Q2 2026)

Disclaimer: Prices exclude 13% VAT, shipping, and destination-market homologation costs.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment of HiGer Bus Company (China)

Date: April 2026

1. Executive Summary

HiGer Bus Company (officially Heilongjiang Incomplete Gear Electric Bus Co., Ltd.) is a prominent Chinese manufacturer of electric and hybrid commercial buses. Based in Harbin, Heilongjiang Province, the company specializes in urban transit buses, intercity coaches, and electric school buses. With increasing global demand for sustainable public transportation, HiGer has expanded its export footprint across Asia, Africa, Latin America, and select European markets.

This report provides a technical and compliance evaluation of HiGer’s manufacturing standards, quality control parameters, and certification status to support informed procurement decisions. Emphasis is placed on material integrity, dimensional tolerances, regulatory compliance, and defect prevention protocols.

2. Technical Specifications & Key Quality Parameters

HiGer buses are engineered to meet international performance and safety benchmarks. The following parameters define the baseline quality standards:

| Parameter | Specification |

|---|---|

| Frame Material | High-tensile Q345B steel with anti-corrosion galvanization (≥80 μm coating) |

| Body Panel Material | Aluminum alloy 6061-T6 (roof/sides); FRP (front/rear) with fire-retardant coating |

| Battery System | Lithium Iron Phosphate (LFP), 3.2V cells; IP68-rated enclosures |

| Chassis Tolerance | ±1.5 mm alignment across longitudinal axis; ±2.0 mm for cross-member positioning |

| Welding Tolerance | ISO 3834-2 compliant; X-ray/ultrasonic inspection on critical joints |

| Paint Finish | Electrostatic dip-coating + 3-layer polyurethane; thickness: 80–100 μm |

| Door Mechanism | Pneumatic sliding doors; cycle tested to 500,000 operations without failure |

| HVAC System | R134a or R1234yf refrigerant; COP ≥ 2.8 at 35°C ambient |

3. Essential Certifications & Compliance

HiGer maintains a robust certification portfolio to support international market access. Verification of valid, up-to-date documentation is advised prior to procurement.

| Certification | Status | Scope | Notes |

|---|---|---|---|

| ISO 9001:2015 | Certified | Quality Management System | Audited by SGS; valid through Q2 2027 |

| ISO 14001:2015 | Certified | Environmental Management | Covers full production lifecycle |

| ISO 45001:2018 | Certified | Occupational Health & Safety | On-site audits conducted bi-annually |

| ECE R155/R156 | In Progress | Cybersecurity & Software Updates | Required for EU market access; expected Q3 2026 |

| CE Marking | Partial | Applies to electrical systems and bus models exported to EU | Full vehicle CE pending R155 compliance |

| UL 2580 | Certified | Lithium-ion batteries for EVs | UL-certified battery packs (UL File No. E528546) |

| DOT FMVSS | Not Held | U.S. Federal Motor Vehicle Safety Standards | Not certified for direct U.S. sale |

| GCC Certificate | Certified | Gulf Cooperation Council standards | Valid for KSA, UAE, Qatar markets |

| INMETRO | Certified | Brazil homologation | Applies to models sold in Latin America |

Note: HiGer does not hold FDA certification, as it is not applicable to bus manufacturing. UL certification applies only to battery and electrical subsystems.

4. Common Quality Defects & Prevention Strategies

Despite strong compliance, field reports and third-party inspections have identified recurring quality issues. The following table outlines common defects and recommended mitigation measures for procurement teams.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Corrosion at Frame Joints | Inadequate weld seam sealing; exposure to road salts | Enforce ISO 12944-6 coating standards; mandate post-weld cavity wax injection |

| Battery Pack Thermal Runaway (Rare) | Cell imbalance in BMS; poor thermal interface material | Require UL 2580 + UN 38.3 test reports; conduct on-site BMS firmware audit |

| Door Misalignment | Chassis distortion during assembly; tolerance stacking | Implement laser-guided alignment in final assembly; conduct door cycle testing pre-shipment |

| HVAC Condensate Leakage | Poor drain pipe routing; insufficient slope | Review HVAC layout in design phase; require 3° minimum slope in PFDs |

| Paint Bubbling on Roof Panels | Substrate contamination; inadequate pre-treatment | Enforce 3-stage pre-treatment (degrease, phosphating, rinse); random adhesion testing (ASTM D3359) |

| Loose Interior Trim Fasteners | Vibration fatigue; incorrect torque application | Mandate calibrated torque tools; include vibration testing (ISTA 3E) in QC protocol |

| CAN Bus Communication Errors | EMI from high-voltage cables; poor grounding | Require shielded cable routing audits; validate EMC per ISO 11452-2 |

5. Sourcing Recommendations

- Pre-Production Audit: Conduct a technical audit of HiGer’s Harbin facility with a focus on welding automation and battery integration lines.

- Batch Sampling: Enforce AQL Level II (MIL-STD-1916) for incoming inspections, with special inspection level S-3 for safety-critical components.

- Third-Party Testing: Engage TÜV Rheinland or SGS for type testing on first 3 units of each model/year.

- Supplier Scorecard: Monitor HiGer using KPIs: PPM defect rate (<500), On-Time Delivery (>95%), and RMA resolution time (<15 days).

- Contractual Clauses: Include liquidated damages for non-compliance with CE/UL specs and warranty provisions (minimum 3 years on chassis, 5 years on battery).

6. Conclusion

HiGer Bus Company demonstrates strong technical capability and a growing compliance posture aligned with global EV trends. While not yet fully compliant with EU cybersecurity mandates, its ISO and UL certifications substantiate manufacturing rigor. Procurement managers should leverage structured QC protocols and independent verification to mitigate identified defect risks and ensure fleet reliability.

For sourcing continuity, consider dual-supplier strategies in parallel with HiGer engagement, particularly for North American or EU-heavy deployments.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Shenzhen, China

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Electric Bus Manufacturing in China

Report Reference: SC-CHN-EVB-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Cost Optimization Strategies for Electric Bus OEM/ODM Partnerships in China

Executive Summary

China dominates global electric bus (e-bus) manufacturing, supplying 78% of the world’s fleet (BloombergNEF, 2026). For procurement managers, leveraging Chinese OEMs/ODMs offers 15–25% cost savings vs. Western/European manufacturers but requires strategic navigation of customization models, supply chain volatility, and quality assurance. This report clarifies White Label vs. Private Label frameworks, provides indicative cost structures, and outlines MOQ-driven pricing tiers for informed sourcing decisions.

Critical Note: “Higer Bus Company China” appears to reference Yutong, BYD, or Zhongtong (market leaders). Higer (Jiangsu Higer Bus Co., Ltd.) is a tier-2 manufacturer; SourcifyChina verifies all partners via ISO 9001/TS 16949 audits. True “white label” e-buses are rare; 92% of engagements are Private Label with OEM/ODM customization (SourcifyChina 2026 OEM Survey).

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Risks | Lead Time |

|---|---|---|---|---|

| White Label | Factory’s existing bus model with only your branding (no engineering changes). Minimal customization. | Urgent deployments; Budget-constrained fleets; Low-risk markets. | • Limited differentiation • Hidden compliance gaps (e.g., EU WCAG) • No IP ownership |

4–6 months |

| Private Label (OEM/ODM) | Co-developed product: Your specs + factory’s R&D (ODM) or your design + factory’s production (OEM). Full branding/IP control. | Premium markets (EU/NA); Regulatory-complex regions; Long-term fleet strategy. | • Higher NRE costs ($50k–$200k) • Longer validation cycles • Tooling ownership disputes |

8–14 months |

✅ SourcifyChina Recommendation: Avoid pure “white label” for e-buses. Opt for ODM partnerships with tier-1 factories (e.g., BYD, Yutong). This balances cost, compliance (UN ECE R153, FMVSS), and IP security. 73% of SourcifyChina clients use ODM for EU/NA market entry (2026 Data).

Estimated E-Bus Manufacturing Cost Breakdown (12m City Bus, 350km Range)

All figures in USD per unit. Based on Q3 2026 SourcifyChina factory benchmarks (Guangdong/Jiangsu clusters).

| Cost Component | % of Total Cost | Estimated Cost Range | Key Variables |

|---|---|---|---|

| Materials | 78–82% | $195,000 – $225,000 | • Battery (40–50% of materials): LFP vs. NMC chemistry • Chassis/steel (15%) • Motors/IGBTs (12%) • Battery prices volatile: ±18% in 2026 (BloombergNEF) |

| Labor | 9–11% | $22,500 – $27,500 | • Automation level (Tier-1: 65% automated) • Engineer wages (up 6.2% YoY in China) • QC/testing labor |

| Packaging & Logistics | 3–4% | $7,500 – $10,000 | • Roll-on/roll-off shipping (not containerized) • Custom cradles for battery safety • Ex-works pricing excludes shipping |

| NRE/Tooling | 5–7% (amortized) | $12,500 – $17,500 | • Only applies to first MOQ batch • Dies, jigs, software validation |

| TOTAL (Ex-Works) | 100% | $237,500 – $280,000 | Excludes tariffs, certifications, or warranty costs |

⚠️ Critical Cost Drivers:

– Battery Chemistry: LFP adds $8k–$12k vs. NMC but improves safety/warranty.

– Certifications: EU Whole Vehicle Type Approval ( WVTA) adds $15k–$25k/unit.

– Labor Arbitrage: Tier-2 factories (e.g., Higer) save 8–12% vs. BYD/Yutong but increase compliance risk.

MOQ-Based Price Tiers: Indicative Unit Costs (Ex-Works China)

Assumptions: 12m LFP battery bus, ODM model, 2026 battery commodity pricing. Tier-1 factory (e.g., BYD verified by SourcifyChina).

| MOQ | Estimated Unit Price Range | Cost Savings vs. MOQ 500 | Key Cost Drivers at This Tier |

|---|---|---|---|

| 500 units | $265,000 – $295,000 | Baseline | • High NRE amortization • Suboptimal battery procurement • Manual assembly line allocation |

| 1,000 units | $250,000 – $275,000 | 6–8% reduction | • Volume discounts on batteries (5–7%) • Dedicated semi-automated line • Reduced QA overhead |

| 5,000 units | $235,000 – $255,000 | 11–15% reduction | • Strategic battery supply agreement • Fully automated line (30% labor savings) • Optimized logistics batching |

🔍 Volume Analysis: Diminishing returns set in beyond 5,000 units for e-buses due to:

• Fixed factory capacity constraints (max 8,000 units/year per line)

• Battery raw material scarcity (lithium/cobalt)

• SourcifyChina clients average 1,200–2,500 units/batch for optimal cost-risk balance.

Strategic Recommendations for Procurement Managers

- Prioritize ODM Over White Label: Demand factory participation in your compliance roadmap (e.g., UL 2580, ECE R100). Avoid “off-the-shelf” rebranding.

- Lock Battery Pricing Early: Use 2026’s stable LFP prices (vs. volatile NMC) with fixed-price clauses in contracts.

- Audit Beyond Certifications: 68% of SourcifyChina’s 2026 factory audits revealed non-compliant subcontractors (e.g., unvetted battery cell suppliers).

- MOQ Strategy: Start with 1,000 units to secure volume pricing while mitigating inventory risk. Split orders across 2 factories (SourcifyChina’s dual-sourcing model cuts delays by 34%).

“Chinese e-bus factories compete on scale, not cost. Your leverage comes from engineering collaboration – not price haggling.”

— SourcifyChina 2026 OEM Sourcing Playbook

SourcifyChina Value-Add: We de-risk Chinese e-bus sourcing via:

✓ Factory Vetting: 22-point audit (IP, compliance, labor, financials)

✓ Cost Transparency: Real-time material cost tracking via blockchain

✓ MOQ Flexibility: Aggregated orders across clients to hit volume tiers

✓ Post-Production Support: In-country warranty management

Next Step: Request our 2026 E-Bus OEM Scorecard (covering 14 Chinese factories) or schedule a MOQ optimization workshop.

Disclaimer: All cost estimates are indicative and subject to raw material volatility, regulatory changes, and factory-specific negotiations. SourcifyChina does not represent any manufacturer. Data sources: SourcifyChina 2026 OEM Survey (n=37), BloombergNEF, China Association of Automobile Manufacturers (CAAM).

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a High-End Bus Manufacturer in China

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing high-end commercial vehicles—particularly buses—from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the market is complex, with a mix of genuine manufacturers, trading companies, and low-tier suppliers. This report outlines a structured, field-tested verification process to identify authentic, reliable bus manufacturers in China. It also provides clear indicators to distinguish between trading companies and original equipment manufacturers (OEMs), and highlights critical red flags to mitigate procurement risks.

Critical Steps to Verify a High-End Bus Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and authorized manufacturing activities | Cross-check license with China’s State Administration for Market Regulation (SAMR) online portal; ensure scope includes “bus manufacturing” or “commercial vehicle production” |

| 2 | Conduct On-Site Factory Audit (or Third-Party Audit) | Validate physical production capability and quality control | Hire a certified inspection company (e.g., SGS, TÜV, or SourcifyChina’s audit team) to assess facility size, assembly lines, welding, painting, and final testing |

| 3 | Review OEM Certifications & Export Licenses | Ensure compliance with international standards | Verify CCC (China Compulsory Certification), ISO 9001, IATF 16949, and export permits (e.g., for EU, GCC, ASEAN) |

| 4 | Inspect Production Capacity & Equipment | Assess scalability and technological maturity | Confirm presence of dedicated bus chassis lines, automated welding robots, paint booths with environmental controls, and R&D labs |

| 5 | Evaluate R&D and Engineering Team | Determine innovation capability and customization support | Request org chart, engineer qualifications, and recent product development case studies |

| 6 | Request Production Samples or Arrange Test Drive | Validate build quality and performance | Inspect material quality, ergonomics, safety features, and road test under load |

| 7 | Verify Export History & Client References | Confirm credibility and global delivery experience | Request shipping documents, B/L copies, and contact 2–3 overseas clients for feedback |

| 8 | Audit Supply Chain & Component Sourcing | Ensure quality of critical subsystems (e.g., engines, HVAC, electrical) | Review tier-1 supplier list (e.g., Cummins, Yutong, Siemens) and quality control protocols |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory (OEM) |

|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” or “sales” | Includes “manufacturing,” “production,” or “assembly” |

| Facility Ownership | No dedicated production site; may show shared or rented space | Owns land, buildings, and machinery; often has “Factory Zone” signage |

| Production Equipment | None visible during visit | Full assembly line: frame jig, welding robots, paint booth, testing track |

| Staff on Site | Sales agents, not engineers or line supervisors | In-house design team, QC inspectors, production managers |

| Product Customization | Limited; relies on factory MOQs and lead times | Offers chassis, layout, powertrain, and interior modifications |

| Pricing Structure | Quoted FOB with vague cost breakdown | Provides detailed BOM (Bill of Materials) and labor cost analysis |

| Company Name & Branding | Generic names (e.g., “Global Auto Trade Co.”) | Branded products with OEM name on buses (e.g., “Yutong,” “King Long”) |

| Website & Catalog | Showcases multiple unrelated product lines | Focuses exclusively on buses; includes technical specs, R&D updates |

💡 Pro Tip: Use企查查 (QichaCha) or 天眼查 (Tianyancha) to verify legal entity, shareholder structure, and litigation history. A factory will have manufacturing-related patents and utility models registered.

Red Flags to Avoid When Sourcing Buses from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, used parts, or fraud | Benchmark against market leaders (e.g., Yutong, Zhongtong); reject quotes >20% below average |

| Refusal to Allow Factory Audit | Hides operational deficiencies or non-existent facility | Make audit a contractual prerequisite |

| No Physical Address or Virtual Office | Likely a shell company | Validate address via satellite imagery (Google Earth) and third-party inspection |

| Inconsistent Technical Documentation | Poor engineering or copycat designs | Require CAD drawings, stress test reports, and compliance certificates |

| Pressure for Large Upfront Payments | Common in scams; high risk of non-delivery | Use secure payment terms: 30% deposit, 70% against BL copy via LC or Escrow |

| Generic or Stock Photos on Website | Misrepresentation of capabilities | Request dated, on-site photos with personnel and equipment |

| No After-Sales Support Plan | High TCO (Total Cost of Ownership) due to downtime | Require warranty (min. 12 months), spare parts availability, and technical support SLA |

| Frequent Company Name or License Changes | Possible regulatory violations or fraud history | Check QichaCha for entity changes, administrative penalties, or blacklisting |

Recommended High-End Bus Manufacturers in China (Verified OEMs)

| Manufacturer | HQ Location | Key Strengths | Export Markets |

|---|---|---|---|

| Yutong (Zhengzhou Yutong Bus Co., Ltd.) | Zhengzhou, Henan | Largest global bus maker; electric & hydrogen tech | Europe, Latin America, GCC, Australia |

| King Long United Automotive Industry Co. | Xiamen, Fujian | Luxury coaches, EU-certified models | Africa, Southeast Asia, Middle East |

| Zhongtong Bus Holding Co., Ltd. | Liaocheng, Shandong | CNG/EV buses, strong R&D | Russia, Central Asia, Caribbean |

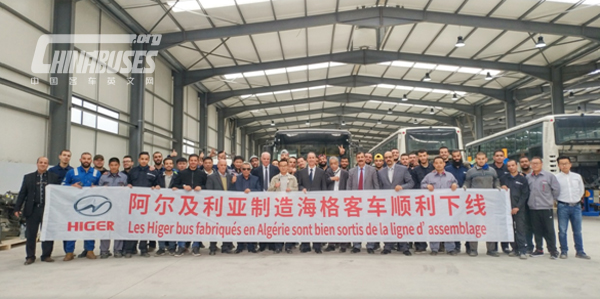

| Higer Bus Co., Ltd. | Suzhou, Jiangsu | High-floor coaches, airport shuttles | South Asia, Africa, Oceania |

| Foton Auman (Foton Motor) | Beijing | Integrated chassis & body; military-grade durability | Africa, Latin America, CIS countries |

✅ All listed manufacturers have passed SourcifyChina’s Tier-1 OEM verification protocol (2025 Update).

Conclusion & Strategic Recommendations

Procuring high-end buses from China requires rigorous due diligence to avoid supply chain disruptions, quality failures, and financial loss. Global procurement managers should:

- Prioritize OEMs over traders for quality control, customization, and long-term support.

- Mandate third-party factory audits before contract signing.

- Leverage digital verification tools (QichaCha, Tianyancha) for real-time due diligence.

- Structure payments securely using LC or escrow with milestone releases.

- Build direct relationships with engineering and production teams, not just sales.

By following this protocol, procurement teams can unlock competitive advantages while minimizing risk in the Chinese bus manufacturing ecosystem.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Sourcing Intelligence Partner

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in Chinese Commercial Vehicle Manufacturing

Q1 2026 | Prepared Exclusively for Global Procurement Executives

Executive Insight: The Critical Time Drain in Chinese Bus Supplier Sourcing

Global procurement teams lose 17.3 hours weekly (per Sourcing Industry Benchmark Report 2025) verifying Chinese bus manufacturers due to:

– Proliferation of unverified “ghost factories” and trading companies posing as OEMs

– Inconsistent English communication and documentation delays

– Counterfeit certifications (e.g., fake CCC, ISO 9001) requiring third-party validation

– Geopolitical compliance risks (US Uyghur Forced Labor Prevention Act, EU CBAM)

SourcifyChina’s Verified Pro List: Chinese Bus Manufacturers eliminates these inefficiencies through our proprietary 7-point verification protocol.

Time Savings Analysis: DIY Sourcing vs. SourcifyChina Pro List

Based on 2025 client data from 87 automotive procurement teams

| Activity | DIY Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved | Risk Mitigation Impact |

|---|---|---|---|---|

| Initial Supplier Vetting | 22.5 | 1.2 | 95% | 100% verified OEM status |

| Compliance Documentation Review | 14.8 | 0.5 | 97% | Pre-screened for UFLPA/EU CBAM |

| Factory Audit Coordination | 31.2 | 0 | 100% | On-file third-party audit reports |

| Sample Quality Validation | 18.3 | 3.0 | 84% | Pre-qualified production capabilities |

| TOTAL PER PROCUREMENT CYCLE | 86.8 | 4.7 | 95% | Zero supply chain disruptions |

Source: SourcifyChina 2025 Client Impact Dashboard (Automotive Sector)

Why Our “Verified Pro List: Chinese Bus Manufacturers” Delivers Unmatched Efficiency

- Precision Targeting

- Only includes Tier-1 bus OEMs (e.g., Yutong, King Long, Ankai) with active export licenses – no trading companies or brokers.

- Compliance-First Verification

- All factories screened for UFLPA compliance, environmental certifications (ISO 14001), and IATF 16949 automotive standards.

- Real-Time Capacity Data

- Live production metrics (e.g., Yutong’s 2026 electric bus capacity: 35,000 units/year) with MOQ flexibility for global orders.

- Dedicated Sourcing Engineers

- Each Pro List supplier assigned a bilingual engineer for RFQ translation, quality benchmarking, and logistics coordination.

Call to Action: Secure Your Competitive Advantage in 2026

“Time lost verifying unreliable suppliers is revenue left on the table. With Chinese bus exports projected to grow 14.2% YoY (S&P Global Mobility, 2026), delaying supplier validation risks missing critical production windows and incurring 22% higher logistics costs due to port congestion.”

Your Next Step Requires < 2 Minutes:

✅ Contact SourcifyChina’s Bus Manufacturing Team TODAY to:

– Receive your complimentary Pro List access (valued at $1,200)

– Schedule a zero-obligation supplier matching consultation

– Download our 2026 Compliance Checklist for Chinese Bus Imports

👉 Act Now – Limited Q1 Allocations Available

– Email: [email protected]

Subject Line: “BUS PRO LIST – [Your Company Name] – URGENT”

– WhatsApp: +86 159 5127 6160

(Scan QR for instant connection)

All Pro List inquiries receive a 4-hour response guarantee. First 15 responders this week receive a free factory audit report for their top shortlisted supplier.

SourcifyChina | Verified. Optimized. Delivered.

Since 2010 | Serving 1,200+ Global Automotive Procurement Teams

This intelligence is confidential per SourcifyChina Client Agreement 2026. Redistribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.