The global hexagon mesh market has seen steady expansion, driven by increasing demand across construction, agriculture, and industrial sectors. According to Mordor Intelligence, the Global Hexagonal Wire Mesh Market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, fueled by rising infrastructure development and the need for durable, cost-effective fencing solutions. Similarly, Grand View Research reported that the global wire mesh market size—of which hexagon mesh is a key segment—was valued at USD 53.4 billion in 2022 and is expected to expand at a CAGR of 5.8% through 2030. With manufacturers scaling production and innovating in coatings and mesh specifications to meet regional standards, identifying top players becomes critical for procurement teams and project planners. Based on production capacity, geographic reach, product range, and compliance with international quality benchmarks, here are the top 5 hexagon mesh manufacturers shaping the industry.

Top 5 Hexagon Mesh Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hexcel

Domain Est. 1995

Website: hexcel.com

Key Highlights: Hexcel is a global leader in advanced composites technology. Propelling the future of flight and transportation through lightweighting solutions….

#2 Galvanized Hexagonal Mesh

Domain Est. 2021

Website: fencemetal.com

Key Highlights: We can do customized design, manufacture the high quality metal items for commercial and industrial clients. Our friendly team can advise to establish a ……

#3 Contact Us

Domain Est. 1993

Website: hexagon.com

Key Highlights: Get in touch with Hexagon for sales, support, or general inquiries. We’re here to help you find the right solution for your business needs….

#4 Hexagonal Wire Netting

Domain Est. 2003

Website: hexagonal-wirenetting.com

Key Highlights: We produce high-quality hexagonal wire netting, specifically gabion boxes used for river channel and river bank reinforcement, chicken wire garden fences, and ……

#5 All Kinds of Hexagonal Wire Mesh Products We Offer

Domain Est. 2015

Website: hexwiremesh.com

Key Highlights: We offer high quality hexagonal wire mesh, which has good corrosion, rust, oxidation resistance, and all products have wide application range….

Expert Sourcing Insights for Hexagon Mesh

H2 2026 Market Trends for Hexagon Mesh

The hexagon mesh market in H2 2026 is poised for sustained growth driven by infrastructure expansion, technological advancements, and evolving sustainability priorities. Here’s a detailed analysis of key trends shaping the second half of 2026:

1. Accelerated Infrastructure Investment Driving Demand

Governments worldwide, particularly in North America, Europe, and Asia-Pacific, are advancing large-scale infrastructure projects under post-pandemic recovery and climate resilience programs. Hexagon mesh—used in slope stabilization, erosion control, gabion walls, and bridge abutments—is seeing increased adoption due to its durability and cost-effectiveness. In H2 2026, public tenders for road expansions, flood management systems, and urban development are expected to directly boost demand for galvanized and PVC-coated hexagonal wire mesh.

2. Sustainability and Green Construction Priorities

Environmental regulations are tightening, pushing construction and civil engineering sectors toward eco-friendly materials. Hexagon mesh, especially when made from recycled steel or paired with vegetative reinforcement (e.g., in green walls), aligns with green building certifications like LEED and BREEAM. In H2 2026, manufacturers are responding by offering low-carbon production options and promoting bioengineering applications—combining mesh with soil and vegetation—which are gaining traction in coastal and riverbank protection projects.

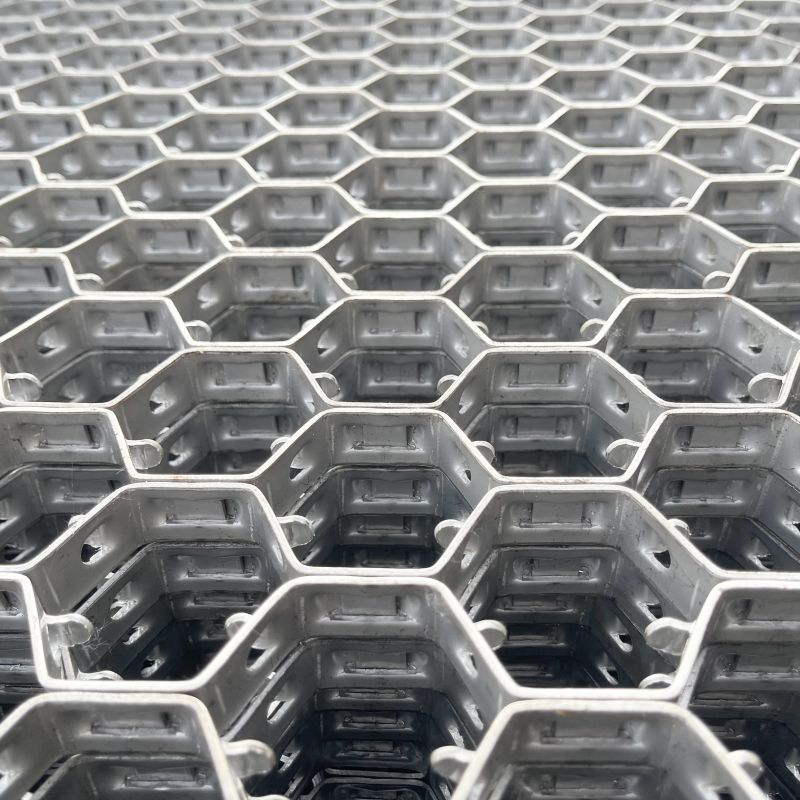

3. Innovation in Coating and Material Technology

To improve longevity in corrosive environments (e.g., marine or industrial zones), H2 2026 sees wider adoption of advanced coatings such as Galfan (zinc-aluminum alloy) and duplex systems (zinc + polymer). Additionally, R&D efforts are focused on composite hexagon meshes that integrate polymer fibers for lightweight, high-tensile solutions. These innovations are particularly appealing in infrastructure projects with long design lifespans (50+ years), reducing lifecycle costs.

4. Regional Market Divergence

While Asia-Pacific remains the largest consumer due to rapid urbanization in India and Southeast Asia, H2 2026 shows growing momentum in North America and Eastern Europe. The U.S. Infrastructure Investment and Jobs Act continues to fund transportation and water system upgrades, increasing domestic mesh procurement. Meanwhile, EU cohesion funds are supporting cross-border rail and flood defense projects, benefiting regional suppliers.

5. Supply Chain Resilience and Localization

Ongoing geopolitical tensions and supply chain disruptions have prompted buyers to favor regional suppliers. In H2 2026, we observe a shift toward localized manufacturing and inventory stocking, particularly in Europe and North America. This reduces lead times and import dependency, though it may increase short-term costs. Digital procurement platforms are also streamlining sourcing, enabling faster project deployment.

6. Digital Integration and Smart Monitoring

Hexagon mesh is being integrated with IoT sensors in smart infrastructure projects. In H2 2026, pilot deployments in landslide-prone areas and retaining walls use mesh embedded with strain and moisture sensors to monitor structural integrity in real time. While still niche, this trend signals a future convergence of traditional materials with digital twin technology, enhancing safety and predictive maintenance.

7. Price Volatility and Raw Material Pressures

Steel prices remain sensitive to energy costs and global trade policies. In H2 2026, moderate volatility in ferrous metal markets could impact mesh pricing. However, long-term supply contracts and increased recycling rates are helping manufacturers stabilize input costs. Buyers are advised to lock in pricing early for large projects to mitigate risk.

Conclusion

In H2 2026, the hexagon mesh market is characterized by robust demand from infrastructure and environmental protection sectors, supported by technological innovation and sustainability trends. Companies that prioritize material efficiency, regional supply chains, and digital integration are best positioned to capture growth. As climate adaptation becomes a global imperative, hexagon mesh will remain a critical component in resilient civil engineering solutions.

Common Pitfalls Sourcing Hexagon Mesh (Quality, IP)

Sourcing hexagon mesh—commonly used in construction, agriculture, and industrial applications—can present several challenges, particularly concerning material quality and intellectual property (IP) considerations. Being aware of these pitfalls helps ensure reliable supply and legal compliance.

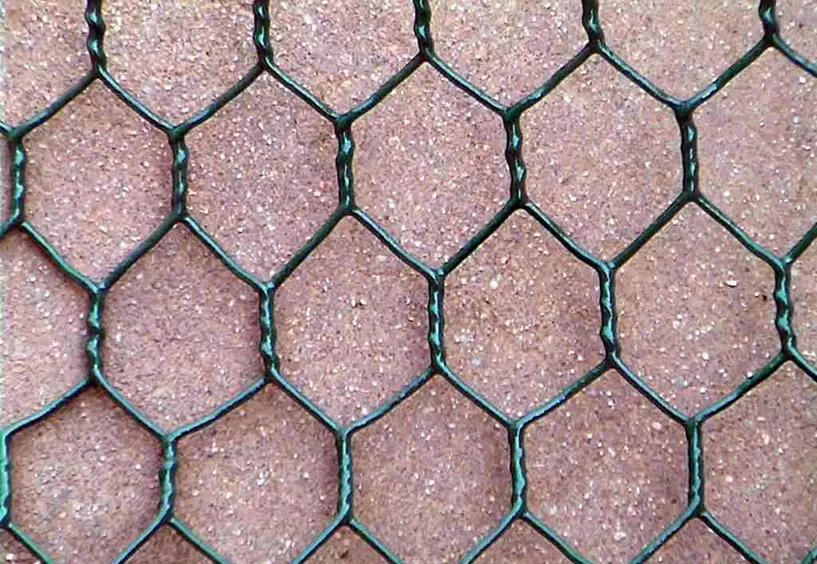

Poor Material Quality and Inconsistent Specifications

One of the most frequent issues is receiving hexagon mesh that does not meet technical specifications. This includes inconsistent wire diameter, inaccurate mesh size, inadequate galvanization (leading to premature rust), or substandard tensile strength. Low-quality mesh may appear cost-effective initially but often results in structural failures, safety hazards, and higher lifecycle costs due to early replacement.

Lack of Certification and Traceability

Many suppliers, especially in international markets, may not provide proper certification (e.g., ISO, ASTM, or EN standards). Without mill test certificates or third-party inspection reports, it’s difficult to verify the quality or origin of materials. This lack of traceability increases the risk of receiving counterfeit or non-compliant products.

Misrepresentation of Product Type and Origin

Some suppliers falsely label welded mesh or inferior woven wire as “hexagon mesh” (also known as chicken wire or poultry netting). Additionally, country-of-origin mislabeling may occur, affecting compliance with trade regulations or procurement policies. This misrepresentation can compromise project integrity and lead to contractual disputes.

Intellectual Property and Design Infringement

While basic hexagon mesh patterns are typically in the public domain, certain proprietary variations—such as enhanced coatings, composite materials, or patented weaving techniques—may be protected by IP rights. Sourcing from manufacturers that replicate these innovations without authorization exposes buyers to legal risk, especially in regulated industries or export markets.

Supply Chain Transparency Gaps

Hidden subcontracting or multiple tiers in the supply chain can obscure quality control and ethical sourcing practices. Without direct oversight, there’s an increased chance of receiving off-spec products or supporting manufacturers with poor labor or environmental practices—potentially damaging brand reputation.

Inadequate Testing and Sampling Procedures

Buyers often rely solely on supplier claims without implementing independent quality inspections or batch testing. Skipping pre-shipment inspections or material testing can result in undetected defects, leading to delays and rework upon delivery.

Avoiding these pitfalls requires due diligence: vetting suppliers, demanding documentation, conducting audits, and clearly specifying technical and legal requirements in procurement contracts.

Logistics & Compliance Guide for Hexagon Mesh

This guide outlines key logistics considerations and compliance requirements for the handling, transportation, and use of hexagon mesh (also known as wire mesh, gabion mesh, or welded mesh), commonly used in construction, erosion control, and civil engineering applications.

Material Specifications and Documentation

Ensure all hexagon mesh shipments are accompanied by detailed product documentation, including material certifications (e.g., ISO 9001), wire diameter, mesh size, tensile strength, zinc coating weight (for galvanized mesh), and compliance with relevant standards such as ASTM A90, ASTM A641, or EN 10223-3. Proper labeling of coils, rolls, or panels with batch numbers and specifications is essential for traceability.

Packaging and Handling Requirements

Hexagon mesh is typically shipped in rolls, coils, or prefabricated panels. It must be securely packaged on wooden pallets or in crates to prevent deformation during transit. Use moisture-resistant wrapping to protect against corrosion, especially for galvanized or PVC-coated variants. During handling, use appropriate lifting equipment (e.g., slings or spreader bars) to avoid edge damage or distortion.

Transportation and Storage

Transport hexagon mesh using enclosed or covered vehicles to protect against weather and road debris. When stored on-site, elevate materials off the ground using pallets and cover with waterproof tarpaulins. Avoid prolonged exposure to high humidity, salt spray, or acidic environments to prevent premature corrosion. Store in a dry, well-ventilated area away from direct contact with soil or standing water.

Import/Export Compliance

For international shipments, verify compliance with destination country regulations. Key considerations include:

– Harmonized System (HS) Code classification (e.g., 7314.31 or 7314.49 for iron or steel wire mesh)

– Import permits or restrictions

– Customs documentation (commercial invoice, packing list, bill of lading)

– Certificates of Origin, where applicable

– Adherence to trade agreements or sanctions

Environmental and Safety Regulations

Hexagon mesh used in environmental or civil projects may be subject to local, national, or international environmental standards. Ensure compliance with regulations related to:

– Use in waterways or protected habitats (e.g., EPA guidelines in the U.S.)

– Disposal of packaging materials (adherence to waste management laws)

– Worker safety during installation (OSHA or equivalent standards for handling sharp materials and fall protection)

Industry-Specific Standards

Confirm that the hexagon mesh meets project-specific standards, such as:

– ASTM A90/A90M for zinc coating on steel wire

– EN 10223-3 for steel wire and wire products for fencing

– DOT or local transportation authority specifications for roadside or infrastructure use

Non-compliance may result in project delays, rejections, or liability issues.

Quality Control and Inspection

Implement a pre-shipment inspection protocol to verify dimensions, coating integrity, and absence of defects (e.g., kinks, rust, or weld failures). On receipt, conduct a visual and dimensional check against purchase specifications. Retain inspection records for audit and compliance purposes.

By adhering to this logistics and compliance framework, stakeholders can ensure the safe, efficient, and regulatory-compliant handling of hexagon mesh throughout the supply chain.

In conclusion, sourcing hexagon mesh requires careful consideration of material type, mesh size, tensile strength, corrosion resistance, and intended application—whether for construction, agriculture, filtration, or industrial use. Evaluating suppliers based on quality certifications, production capabilities, and reliability is crucial to ensuring consistent product performance. Additionally, balancing cost-effectiveness with durability and long-term value helps optimize procurement decisions. By aligning technical requirements with trusted suppliers and market availability, organizations can secure high-quality hexagon mesh that meets both operational needs and project specifications efficiently.