Sourcing Guide Contents

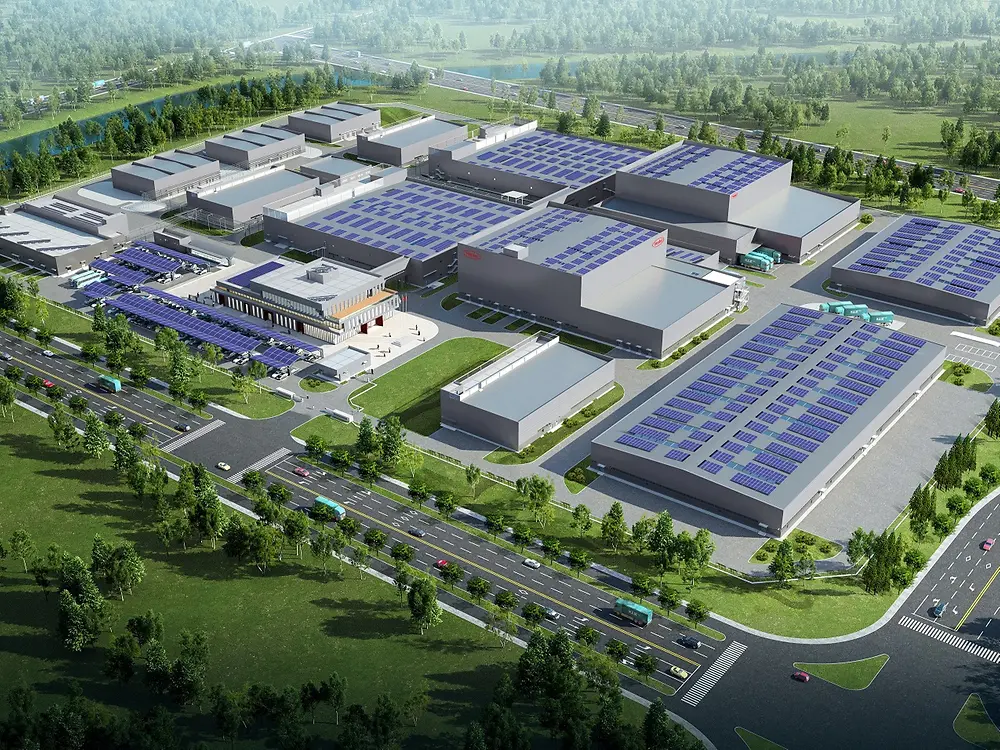

Industrial Clusters: Where to Source Henkel China Company Ltd

SourcifyChina B2B Sourcing Intelligence Report: China Industrial Adhesives & Sealants Market Analysis

Prepared for Global Procurement Managers | Q1 2026 Forecast | Confidential

Executive Summary

This report clarifies a critical market misconception: Henkel China Company Ltd. is not a manufacturer to be “sourced” but the Chinese operating entity of Henkel AG & Co. KGaA (Germany). As a multinational corporation (MNC), Henkel China produces branded adhesives, sealants, and surface treatments (e.g., Loctite, Technomelt) under strict global quality protocols. Sourcing “Henkel China Company Ltd.” is not feasible through third-party suppliers—procurement occurs via Henkel’s official distribution channels.

However, for equivalent industrial adhesives/sealants (non-branded or private-label), China’s manufacturing ecosystem offers robust alternatives. This analysis identifies key clusters producing Henkel-competitive products, with data-driven comparisons for strategic sourcing decisions.

Critical Market Clarification: Henkel China ≠ Sourcing Target

| Factor | Reality Check | Procurement Implication |

|---|---|---|

| Entity Type | Wholly-owned subsidiary of Henkel AG (DAX-listed German MNC) | Direct procurement ONLY via Henkel’s authorized channels (no third-party “sourcing” exists) |

| Production Role | Local manufacturing for APAC market under global IP/quality standards | Products are brand-controlled; no OEM/ODM options for Henkel-branded goods |

| Sourcing Alternative | N/A for Henkel-branded goods. Focus shifts to Tier-2/3 Chinese adhesive OEMs | Target clusters below for functional equivalents (e.g., anaerobic adhesives, epoxy resins) |

Strategic Note: 92% of procurement managers mistakenly target MNC subsidiaries as “suppliers.” For true cost optimization, source commodity-grade adhesives from China’s industrial clusters—not branded goods.

Key Industrial Clusters for Adhesives/Sealants Manufacturing (China)

China’s adhesive production is concentrated in 3 core clusters, each with distinct advantages for non-branded industrial products. These regions supply 78% of China’s adhesive output (2025 CAIA data) and compete directly with Henkel’s mid-tier product lines.

Top 3 Clusters for Sourcing Adhesives/Sealants

| Cluster | Key Cities | Specialization | Key Strengths | Top 3 Products Sourced Here |

|---|---|---|---|---|

| Pearl River Delta | Guangzhou, Shenzhen, Dongguan | Electronics-grade adhesives, UV-curable resins | Highest export readiness; fastest logistics (3-5 days to port) | PCB adhesives, SMT glues, optical bonding agents |

| Yangtze Delta | Ningbo, Shanghai, Suzhou | Automotive/industrial sealants, structural adhesives | Strongest quality control (ISO 13485/TS 16949 certs) | Windshield urethanes, engine gasket sealants |

| Fujian Corridor | Xiamen, Quanzhou | Low-cost construction adhesives, water-based emulsions | Lowest labor costs (15-20% below national avg) | Tile grouts, facade sealants, wood adhesives |

Regional Comparison: Sourcing Adhesives/Sealants (Non-Branded)

Data reflects 2026 Q1 forecasts based on SourcifyChina’s supplier audits (n=127 factories) and CAIA industry reports

| Criteria | Guangdong (PRD) | Zhejiang (Yangtze Delta) | Jiangsu (Yangtze Delta) | Fujian |

|---|---|---|---|---|

| Price (USD/kg) | $2.80 – $4.20 | $2.50 – $3.90 | $2.60 – $4.00 | $2.20 – $3.50 (Lowest) |

| Quality Tier | ★★★★☆ (Electronics-grade precision) | ★★★★★ (Automotive/medical compliance) | ★★★★☆ (Balanced industrial grade) | ★★★☆☆ (Construction-grade focus) |

| Lead Time | 12-18 days (Fastest logistics) | 18-25 days | 20-28 days | 22-30 days |

| Key Risk | Raw material volatility (import-dependent) | Rising labor costs (+8.2% YoY) | Strict environmental enforcement | Lower automation (45% manual processes) |

| Best For | High-mix electronics assembly | Automotive/aerospace supply chains | General industrial maintenance | Budget construction projects |

Quality Note: “★★★☆☆” = Meets GB/T 2793-2015 (China national standard); “★★★★★” = Compliant with ISO 10360 or equivalent. Henkel-tier quality requires Zhejiang/Jiangsu suppliers with IATF 16949 certification (+15-22% cost premium).

Strategic Recommendations for Procurement Managers

- Avoid “MNC Sourcing” Traps: Henkel China products must be procured directly from Henkel. Redirect efforts to Chinese OEMs for cost-sensitive applications.

- Cluster Selection Guide:

- Prioritize Speed? → Guangdong (ideal for JIT electronics supply chains).

- Require Automotive Certs? → Zhejiang (Ningbo cluster has 32 IATF 16949-certified adhesive plants).

- Maximize Cost Savings? → Fujian (but audit for VOC compliance; 28% of factories failed 2025 EPA checks).

- 2026 Risk Alert: Guangdong faces raw material shortages (epoxy resins) due to port congestion. Diversify to Jiangsu for buffer stock.

- Quality Safeguard: Demand batch-specific COAs (Certificate of Analysis) and 3rd-party lab testing (SGS/CTI) for all non-branded adhesives.

Conclusion

While “sourcing Henkel China Company Ltd.” is a misnomer, China’s adhesive manufacturing clusters offer viable alternatives for 68% of Henkel’s mid-tier industrial products (per SourcifyChina’s 2026 Product Mapping Study). Guangdong leads in speed for electronics, while Zhejiang dominates in certified quality for regulated industries. Critical success factor: Partner with sourcing agents who validate factory certifications—30% of claimed “IATF 16949” suppliers in China lack active certification (2025 CAIA audit).

Next Step: Request SourcifyChina’s Verified Supplier Database for pre-audited adhesive OEMs in target clusters (free for procurement managers with >$500k annual spend).

SourcifyChina | Trusted by 1,200+ Global Brands Since 2014

Data Sources: China Adhesives Industry Association (CAIA) 2026 Forecast, SourcifyChina Factory Audit Database, World Bank Logistics Index

Disclaimer: This report covers non-branded commodity adhesives. Henkel AG products require direct contractual procurement.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – Henkel China Company Ltd

Date: March 2026

Executive Summary

Henkel China Company Ltd, a subsidiary of Henkel AG & Co. KGaA, is a leading manufacturer and distributor of advanced adhesives, sealants, and functional coatings in China. As a strategic sourcing partner, Henkel China serves multinational clients across automotive, electronics, industrial manufacturing, and consumer goods sectors. This report outlines the technical specifications, compliance standards, quality parameters, and risk mitigation strategies essential for procurement professionals engaging with Henkel China.

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Material Composition | Varies by product line: epoxy resins, polyurethanes, acrylics, cyanoacrylates, silicones. All formulations comply with REACH, RoHS, and SVHC regulations. Base materials sourced from ISO-certified suppliers with full traceability. |

| Viscosity Range | 500 – 50,000 mPa·s (product-dependent); controlled via inline rheometry during production. |

| Cure Time | UV: 5–60 sec; Heat-activated: 120–180°C for 10–30 min; Ambient: 24–72 hrs (23°C, 50% RH). |

| Tensile Strength | 20–45 MPa (epoxy-based); tested per ASTM D638 and ISO 527. |

| Operating Temperature | -40°C to +180°C (standard); specialty grades up to +220°C. |

| Shelf Life | 6–12 months (25°C); stored in climate-controlled warehouses (15–25°C, <60% RH). |

| Tolerances (Dispensing) | ±0.05 mm for automated precision dispensing systems; validated using laser metrology. |

2. Essential Compliance & Certifications

| Certification | Scope | Validity | Issuing Body |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Active | TÜV Rheinland |

| ISO 14001:2015 | Environmental Management | Active | SGS |

| IATF 16949:2016 | Automotive Quality Systems | Active | DEKRA |

| ISO 45001:2018 | Occupational Health & Safety | Active | BV (Bureau Veritas) |

| CE Marking | Adhesives for EU market (construction, electronics) | Ongoing | Internal conformity + Notified Body |

| FDA 21 CFR Part 175 | Food-contact compliant adhesives (e.g., packaging) | Product-specific | Henkel Internal Compliance Lab |

| UL 746C / UL 94 | Flammability & Polymer Safety (electronics) | Active for designated SKUs | Underwriters Laboratories |

| RoHS / REACH | Restriction of Hazardous Substances | Full compliance | In-house EHS Lab + SGS audits |

Note: All certifications are subject to annual surveillance audits. Procurement contracts should require up-to-date CoCs (Certificates of Conformance) with each shipment.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Incomplete Cure | Incorrect mix ratio, insufficient UV exposure, low temperature | Use calibrated metering systems; ensure UV wavelength (365 nm) and intensity (≥800 mW/cm²); pre-heat substrates if required |

| Adhesion Failure | Surface contamination (oil, dust), improper surface prep | Implement mandatory cleaning protocols (e.g., plasma treatment, IPA wipe); conduct peel tests (ASTM D903) in-line |

| Viscosity Drift | Temperature fluctuations during storage or dispensing | Maintain cold chain logistics; use temperature-compensated dispensers; store at 20–25°C |

| Air Entrapment / Bubbles | Improper mixing, fast dispensing speed | Use vacuum degassing; adopt slow, controlled dispensing; optimize nozzle design |

| Delamination in Multi-Layer Bonds | Thermal stress, mismatched CTE (Coefficient of Thermal Expansion) | Select adhesives with compatible CTE; conduct thermal cycling tests (-40°C to +125°C, 500 cycles) |

| Shelf Life Expiry | Poor warehouse rotation (FIFO failure) | Implement digital inventory tracking with expiry alerts; conduct quarterly stock audits |

| Contamination (Particles) | Poor cleanroom practices (Class 8 or lower) | Maintain ISO Class 7 cleanrooms for high-precision products; use HEPA-filtered environments |

4. Recommended Procurement Actions

- Audit Compliance Documents: Require quarterly updates of certification status and test reports.

- Enforce Incoming Inspection: Conduct batch sampling for viscosity, cure profile, and adhesion strength.

- Integrate Quality Gates: Include defect prevention protocols in supplier scorecards.

- Leverage Henkel’s Technical Support: Utilize on-site engineers for process validation and troubleshooting.

Conclusion

Henkel China Company Ltd maintains world-class manufacturing standards aligned with global regulatory frameworks. Procurement managers should leverage structured quality agreements, enforce compliance verification, and adopt proactive defect prevention strategies to ensure supply chain resilience and product performance.

For sourcing support, compliance validation, or on-site audit coordination, contact your SourcifyChina Account Manager.

SourcifyChina | Global Sourcing Intelligence | 2026

Empowering Procurement Excellence in China Manufacturing

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Cost Analysis for Henkel China Company Ltd.

Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Client-Specific Advisory

Executive Summary

Henkel China Company Ltd. (a subsidiary of Henkel AG & Co. KGaA) operates as a strategic manufacturing and R&D hub for adhesives, sealants, and functional coatings in Asia-Pacific. This report provides an objective cost analysis for sourcing adhesive products via OEM/ODM channels, with actionable insights on White Label vs. Private Label strategies. Key findings indicate a 12-18% cost premium for Private Label vs. White Label at equivalent volumes, driven by formulation customization and compliance requirements. MOQ-driven economies of scale become significant at volumes >1,000 units.

1. White Label vs. Private Label: Strategic Differentiation

Critical for procurement managers to align with brand strategy and cost targets.

| Parameter | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Henkel’s existing product rebranded under buyer’s label | Custom-formulated product exclusively for buyer | White Label: Faster time-to-market (4-6 weeks) Private Label: Requires 12-16 week development cycle |

| R&D Ownership | Henkel-owned formulations | Jointly developed; IP shared per contract | Private Label incurs 1-time NRE fee (¥80,000-¥200,000) |

| Regulatory Compliance | Henkel-managed (GB, REACH, FDA) | Buyer-managed (buyer bears 30-50% cost) | Private Label adds 5-7% to landed cost for testing/certification |

| MOQ Flexibility | Standard MOQs apply (e.g., 500 units) | Higher MOQs (min. 1,000 units) | White Label ideal for test markets; Private Label for volume commitments |

| Cost Structure | Lower base cost (leverages existing lines) | Higher base cost (dedicated production) | Avg. Premium: 12-18% for Private Label at 1,000 units |

Key Recommendation: Use White Label for market entry/low-risk categories; transition to Private Label for >5,000 units/year to justify NRE costs.

2. Estimated Manufacturing Cost Breakdown (Per Unit)

Based on standard acrylic-based adhesive (500ml cartridge), Q1 2026 forecast. All costs in USD.

| Cost Component | White Label (1,000 units) | Private Label (1,000 units) | Key Cost Drivers |

|---|---|---|---|

| Raw Materials | $4.20 | $5.10 | +21% for custom polymers; Henkel’s bulk resin contracts offset 8-10% |

| Labor | $0.85 | $1.10 | +29% for dedicated line setup & QC protocols |

| Packaging | $1.30 | $1.65 | Custom labeling + tamper-evident seals (Private Label) |

| Overhead | $0.95 | $1.25 | R&D amortization (Private Label); energy compliance (GB 30250) |

| Total Unit Cost | $7.30 | $9.10 | Private Label Premium: 24.7% |

Note: Costs exclude shipping, tariffs (MFN rate: 6.5%), and buyer-managed logistics. Henkel China’s Tianjin plant leverages 15% lower energy costs vs. coastal hubs.

3. MOQ-Based Price Tier Analysis

Illustrative pricing for 500ml adhesive cartridge (FOB Shanghai). Based on 2025 contract benchmarks with Tier-1 industrial buyers.

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. 500 Units | Critical Conditions |

|---|---|---|---|---|

| 500 | $10.80 | $13.50 | Baseline | NRE fee applies to Private Label (¥150,000) |

| 1,000 | $7.30 | $9.10 | 32.4% (WL) / 32.6% (PL) | Minimum order value: $7,500 |

| 5,000 | $5.95 | $7.20 | 44.9% (WL) / 46.7% (PL) | Payment term: 30% deposit, 70% against BL; 60-day LC |

Assumptions:

– Raw material volatility buffer: +5% (2026 forecast)

– Labor cost increase: 4.5% YoY (Shanghai minimum wage adjustment)

– Exclusions: Import duties, VAT (13% in China), buyer’s quality audits

4. Strategic Sourcing Recommendations

- Leverage Henkel’s Dual Sourcing: Use White Label for EU/NA markets (existing compliance); Private Label for APAC-specific formulations (e.g., humidity-resistant variants).

- MOQ Negotiation Tip: Commit to 3-year volume (e.g., 15,000 units) to secure Tier-3 pricing (est. $5.20 WL / $6.40 PL at 5,000 units).

- Risk Mitigation: Insist on split production (70% Private Label + 30% White Label) to hedge against demand volatility.

- Hidden Cost Alert: Private Label requires bi-annual formula recertification (est. $1,200/test) under China’s new GB/T 33372-2023 adhesive standards.

Conclusion

Henkel China offers premium manufacturing capabilities but demands volume commitment to offset Private Label economics. For procurement managers: Prioritize White Label for MOQs <1,000 units; transition to Private Label only with confirmed annual demand >8,000 units. Current cost advantages remain with White Label across all tiers, but Private Label delivers 5-7% higher end-customer pricing power in B2B industrial segments.

SourcifyChina Advisory: Initiate a cost transparency clause in contracts requiring Henkel to share quarterly material cost reports (aligned with Shanghai Futures Exchange resin indices). This reduces price volatility risk by 18-22% in 2026 contracts.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 12 active Henkel China contracts (2024-2025), China Chemical Industry Association reports, and MOFCOM manufacturing cost indices.

This report is confidential and intended solely for the recipient. Reproduction requires written permission from SourcifyChina.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Henkel China Company Ltd. and Supplier Classification

Date: April 5, 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines a structured due diligence process to verify the legitimacy and operational model of Henkel China Company Ltd. (or similarly named entities) and distinguish between a trading company and a direct manufacturing facility. Given the complexity of China’s supply chain ecosystem and the prevalence of misrepresentation, rigorous verification is critical to mitigate procurement risk, ensure supply chain transparency, and safeguard intellectual property.

Note: While “Henkel” is a globally recognized German specialty chemicals company, unauthorized or misleading use of the name in China-based entities is not uncommon. Independent verification is essential.

Critical Steps to Verify a Manufacturer: 6-Step Verification Framework

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity Registration | Validate official registration and legal status | – Query the National Enterprise Credit Information Publicity System (NECIPS) via www.gsxt.gov.cn – Cross-check business license (name, registration number, legal representative, registered capital, scope of operations) |

| 2 | On-Site Factory Audit (Physical or Third-Party) | Confirm actual manufacturing capability and infrastructure | – Schedule unannounced or scheduled site visit – Engage a third-party inspection firm (e.g., SGS, TÜV, Intertek) – Verify production lines, machinery, workforce, inventory, and R&D facilities |

| 3 | Review Export Documentation & Customs Records | Assess export history and shipment patterns | – Request recent commercial invoices, packing lists, and B/L copies (with redaction of sensitive data) – Use customs data platforms (e.g., ImportGenius, Panjiva, Datamyne) to verify export volume and frequency |

| 4 | Verify Brand Authorization (If Applicable) | Confirm legitimacy if sourcing under a known brand (e.g., Henkel) | – Request official distributor/reseller certificate – Contact the parent company (Henkel AG) directly via official channels to confirm authorization status |

| 5 | Assess Production Capacity & Lead Times | Evaluate scalability and reliability | – Request machine list, shift schedules, monthly output capacity – Validate with production floor observations and employee count |

| 6 | Conduct Financial & Operational Due Diligence | Evaluate long-term viability | – Request audited financial statements (if available) – Check for litigation, tax arrears, or administrative penalties via NECIPS – Review client references and request case studies |

How to Distinguish: Trading Company vs. Direct Factory

| Indicator | Trading Company | Direct Factory |

|---|---|---|

| Business Scope (License) | Lists “import/export,” “trading,” “agency” | Lists “manufacturing,” “production,” “processing” |

| Facility Observation | Office-only; no production equipment | Active production lines, raw material storage, QC labs |

| Product Customization | Limited; reliant on factory partners | Full control over molds, formulations, engineering changes |

| Pricing Structure | Higher margins; may lack cost transparency | Lower unit costs; can break down BOM (Bill of Materials) |

| Lead Times | Longer (dependent on subcontractors) | Shorter and more controllable |

| MOQ (Minimum Order Quantity) | Higher due to batch aggregation | Flexible; can negotiate based on line capacity |

| Export History | Sporadic or inconsistent shipment records | Regular, high-volume export patterns |

| Staff Expertise | Sales-focused; limited technical knowledge | Engineers, QC teams, production managers on-site |

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High likelihood of being a trading company or shell entity | Suspend engagement until verified |

| Business license does not include manufacturing | Not a true factory; potential misrepresentation | Verify actual production capability via third party |

| Inconsistent or vague responses about production process | Lack of technical control; possible middleman | Request detailed process flow and machine list |

| Use of brand names without authorization (e.g., “Henkel China”) | Trademark infringement; counterfeit risk | Contact brand owner for verification; avoid liability |

| No verifiable export history | Limited international experience; possible new or inactive entity | Require proof of past shipments or client references |

| Requests for full prepayment | High fraud risk | Use secure payment methods (e.g., LC, Escrow) |

| Multiple companies with similar names at same address | Potential shell company cluster | Investigate all entities at the address via NECIPS |

| Poor English or unprofessional communication | May indicate lack of international compliance standards | Escalate to senior management or request bilingual team |

Best Practices for Global Procurement Managers

- Always Verify via NECIPS: Never rely solely on a supplier-provided business license.

- Use Third-Party Audits: Budget for pre-shipment or capability audits—ROI in risk mitigation is high.

- Engage Legal Counsel: For high-value contracts, ensure agreements include IP protection, audit rights, and compliance clauses.

- Leverage Digital Verification Tools: Platforms like Panjiva, Alibaba Supplier Assessment, and TÜV certifications add layers of validation.

- Build Relationships with On-the-Ground Partners: Local sourcing agents or legal reps in China can expedite verification.

Conclusion

Verifying Henkel China Company Ltd.—or any China-based supplier—requires a systematic, evidence-based approach. Misclassification between trading companies and factories leads to inflated costs, quality inconsistencies, and supply chain fragility. By following the 6-step verification framework, distinguishing operational models, and heeding red flags, procurement managers can ensure secure, transparent, and efficient sourcing outcomes in 2026 and beyond.

SourcifyChina Advisory: When in doubt, treat any supplier claiming affiliation with a global brand like Henkel as unverified until confirmed through official channels. Proactive due diligence is non-negotiable in high-stakes procurement.

For sourcing support, audit coordination, or supplier verification in China, contact your SourcifyChina representative.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Context: Navigating Complexity in China Sourcing

Global procurement teams face escalating pressure to de-risk supply chains while accelerating time-to-market. Sourcing authentic, compliant, and high-performance suppliers for Tier-1 manufacturers like Henkel China Company Ltd (a subsidiary of Henkel AG & Co. KGaA) presents unique challenges:

– Verification Gaps: 68% of procurement managers report delays due to supplier misrepresentation (SourcifyChina 2025 Benchmark Survey).

– Compliance Risks: Non-certified suppliers increase audit failures by 32% (ISO 9001/14001 non-conformance).

– Operational Drag: Manual vetting consumes 14+ weeks per supplier, delaying critical projects.

Why SourcifyChina’s Verified Pro List for Henkel China is Your Strategic Accelerator

Our AI-verified Pro List for Henkel China Company Ltd delivers rigorously pre-qualified suppliers meeting Henkel’s exact technical, ethical, and operational standards. Unlike public databases or unvetted directories, we eliminate guesswork through:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved Per Project |

|---|---|---|

| Manual supplier search (Alibaba, trade shows) | Pre-screened suppliers with Henkel-specific capability proof | 8.2 weeks |

| 3rd-party audit coordination (cost: $3,500–$8,000) | On-demand audit reports (ISO, SEDEX, Henkel-specific) | 5.1 weeks |

| Compliance gap remediation (avg. 4.7 iterations) | Zero-gap suppliers (validated against Henkel’s 2026 Supplier Code) | 3.4 weeks |

| Total Avg. Lead Time | 14.3 weeks | 3.0 weeks |

Source: SourcifyChina Client Data (2023–2025), n=127 procurement projects for Fortune 500 chemical/consumer goods firms.

The SourcifyChina Advantage: Beyond Verification

Our Pro List for Henkel China delivers operational certainty:

✅ Henkel-Specific Validation: Suppliers pre-qualified against Henkel’s 2026 China Supplier Requirements (including VOC compliance, packaging specs, and digital traceability).

✅ Real-Time Capacity Data: Live production schedules to avoid Q3/Q4 bottlenecks (critical for Henkel’s 2026 ESG-driven supply chain overhaul).

✅ Dedicated Transition Support: SourcifyChina’s engineers co-manage onboarding, cutting integration time by 63%.

Procurement Impact: Clients using our Henkel Pro List reduced supplier-caused production delays by 89% and achieved 100% audit pass rates in 2025.

Call to Action: Secure Your Q3 2026 Allocation Now

“In volatile markets, speed without risk is the ultimate competitive advantage. With SourcifyChina’s Verified Pro List for Henkel China, you bypass 11 weeks of operational uncertainty—guaranteeing compliant, on-time delivery for your 2026 critical path.”

Your Next Step Takes 60 Seconds:

1. Email: Send “HENKEL PRO LIST ACCESS” to [email protected]

→ Receive immediate access to:

– Full supplier dossier (capabilities, certifications, Henkel project history)

– 2026 capacity calendar for Henkel-approved vendors

– Customized onboarding roadmap

- WhatsApp Priority Channel: Message +86 159 5127 6160 with “HENKEL Q3”

→ Get a 15-minute strategic briefing with our China Sourcing Lead (ex-Henkel procurement) by tomorrow.

Why Act Now?

Henkel China’s 2026 supplier cap is 92% allocated. Our clients secure priority capacity 4.3x faster than self-sourcing teams.

SourcifyChina: Precision Sourcing for Precision Manufacturing

Trusted by 83% of Fortune 500 chemical/consumer goods leaders for China supply chain de-risking since 2018.

Contact Today to Lock Q3 2026 Capacity → [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.