The global hematology analyzers market is experiencing robust growth, driven by increasing demand for rapid and accurate blood diagnostics, rising prevalence of hematological disorders, and advancements in automation and digital pathology. According to Grand View Research, the market was valued at USD 3.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. Similarly, Mordor Intelligence forecasts steady expansion, attributing growth to enhanced healthcare infrastructure, rising geriatric populations, and the integration of artificial intelligence in diagnostic platforms. With laboratories and hospitals prioritizing efficiency and precision, leading manufacturers are innovating to capture market share across both developed and emerging economies. In this evolving landscape, eight key players stand out for their technological innovation, global reach, and comprehensive product portfolios—shaping the future of hematology diagnostics worldwide.

Top 8 Hematology Analyzer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High Technology, Inc.

Domain Est. 2011

Website: htidiagnostics.com

Key Highlights: Hematology Analyzer. 5-part hematology analyzer built for developing healthcare systems where reliable CBC results can’t wait for ideal conditions….

#2 Diatron

Domain Est. 2002

Website: diatron.com

Key Highlights: Diatron is a hematology and clinical chemistry analyzer and reagent manufacturer. Diatron develops, manufactures and markets hematology and clinical chemistry ……

#3 HORIBA Medical

Domain Est. 1994

Website: horiba.com

Key Highlights: HORIBA Medical designs, develops and distributes worldwide, in vitro diagnostic systems mainly destined for biological analysis in medical laboratories….

#4 Hematology Analyzers & Systems

Domain Est. 1996

Website: sysmex.com

Key Highlights: Our automated cell image analysis systems offer hematology labs of all sizes improved consistency of cell identification, efficient resource utilization….

#5 Hematology Analyzers, Instruments and Systems

Domain Est. 1997

Website: beckmancoulter.com

Key Highlights: Find the hematology analyzers, machines and instruments your lab needs. See how our innovation delivers superior efficiency and unparalleled results….

#6 Boule

Domain Est. 2003

Website: boule.com

Key Highlights: Boule Diagnostics is a global provider of diagnostics solutions, specialized in hematology, tailored for the decentralized human and veterinary markets….

#7 Hematology Analyzers, Testing Equipment and Solutions

Domain Est. 2016

Website: corelaboratory.abbott

Key Highlights: We offer a complete portfolio of hematology solutions, including automated analyzers, a slide maker stainer as well as reagents, calibrators and controls….

#8 Hematology Systems

Domain Est. 2016

Website: siemens-healthineers.com

Key Highlights: ADVIA 560 and 560 AL Systems. Compact and reliable mid-volume hematology analyzers with the ability to automate sample processing via an optional autoloader….

Expert Sourcing Insights for Hematology Analyzer

H2: 2026 Market Trends for Hematology Analyzers

The global hematology analyzer market is projected to experience substantial growth and transformation by 2026, driven by technological advancements, rising prevalence of blood disorders, and expanding healthcare infrastructure. Key trends shaping the market include increased automation, integration of artificial intelligence (AI), point-of-care (POC) expansion, and growing demand in emerging economies.

-

Automation and High-Throughput Systems

Hospitals and clinical laboratories are increasingly adopting fully automated hematology analyzers to improve efficiency, reduce human error, and handle higher sample volumes. By 2026, manufacturers are expected to focus on developing integrated platforms that offer comprehensive blood testing with minimal manual intervention, particularly in large diagnostic centers and tertiary care hospitals. -

Artificial Intelligence and Machine Learning Integration

AI-powered hematology analyzers are gaining traction for their ability to enhance diagnostic accuracy by identifying abnormal cell morphologies and flagging rare conditions. By 2026, AI integration will enable predictive analytics, real-time quality control, and remote monitoring, improving workflow efficiency and diagnostic confidence. -

Growth of Point-of-Care Testing

There is a rising demand for portable and desktop hematology analyzers in clinics, physician offices, and remote areas. The shift toward decentralized testing—accelerated by the need for rapid diagnostics during health emergencies—will drive innovation in compact, user-friendly devices with rapid turnaround times. -

Expansion in Emerging Markets

Asia-Pacific, Latin America, and parts of Africa are expected to register the highest growth rates by 2026 due to improving healthcare access, government investments in medical infrastructure, and increasing awareness of early disease detection. Local manufacturing and cost-effective analyzer models will play a crucial role in market penetration. -

Focus on Multi-Parameter Analysis and Advanced Parameters

Next-generation analyzers are moving beyond basic complete blood count (CBC) metrics to include advanced parameters such as reticulocyte count, nucleated red blood cells (NRBCs), and immature granulocyte counts. These features support early diagnosis of conditions like anemia, leukemia, and infections, enhancing clinical utility. -

Regulatory and Standardization Developments

With increasing globalization of diagnostic devices, harmonization of regulatory standards (e.g., FDA, CE, and NMPA) will influence product development and market entry strategies. Compliance with data security and interoperability standards (e.g., HL7, LIS integration) will become essential. -

Sustainability and Cost Efficiency

Environmental concerns and operational costs are prompting manufacturers to develop analyzers with reduced reagent consumption, longer-lasting components, and eco-friendly disposal mechanisms. These features will appeal to healthcare providers aiming to balance performance with sustainability.

In summary, the 2026 hematology analyzer market will be defined by smarter, faster, and more accessible technologies that cater to both centralized laboratories and decentralized care settings. Companies that prioritize innovation, affordability, and regulatory compliance will be best positioned to capture growing global demand.

H2. Common Pitfalls in Sourcing Hematology Analyzers: Quality and Intellectual Property Concerns

Sourcing hematology analyzers—especially from international or non-traditional suppliers—poses several risks that can compromise clinical accuracy, regulatory compliance, and long-term operational efficiency. Two of the most critical areas of concern are product quality and intellectual property (IP) integrity. Failing to address these aspects can lead to significant clinical, financial, and legal repercussions.

Quality-Related Pitfalls

-

Inconsistent Analytical Performance

A major risk when sourcing hematology analyzers is receiving devices that do not meet established performance standards. Low-cost or uncertified models may deliver inaccurate white blood cell (WBC), red blood cell (RBC), and platelet counts due to substandard sensors, reagents, or calibration protocols. This can result in misdiagnosis or delayed treatment. -

Lack of Regulatory Approvals

Many suppliers, particularly in emerging markets, offer analyzers without proper certification from recognized regulatory bodies (e.g., FDA, CE-IVDR, ISO 13485). Devices lacking such approvals may not adhere to international quality management systems, increasing the risk of device failure or non-compliance during audits. -

Poor After-Sales Support and Maintenance

Sourced analyzers may come from manufacturers with limited or no local service infrastructure. This leads to prolonged downtime, difficulty in obtaining replacement parts, and inadequate technical training—ultimately affecting test reliability and lab throughput. -

Use of Counterfeit or Refurbished Components

Some suppliers market refurbished or reconditioned units as new, sometimes using counterfeit parts that degrade performance and safety. Without thorough vetting, buyers may unknowingly acquire unreliable equipment with shortened lifespans.

Intellectual Property (IP) Risks

-

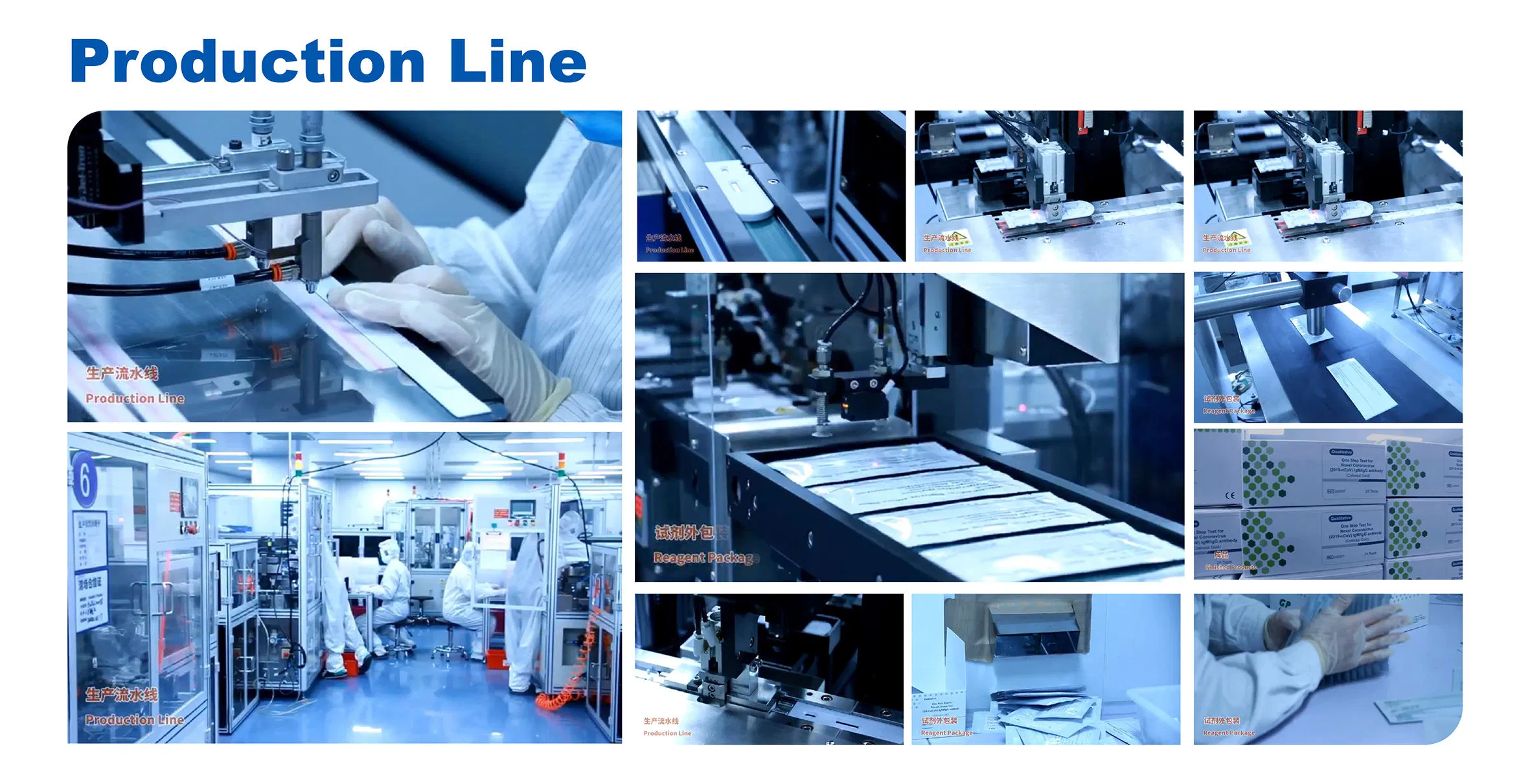

Clone or Copycat Devices

Certain manufacturers produce hematology analyzers that closely mimic the design and functionality of established brands without licensing the technology. These “clone” devices may infringe on patents related to fluidics systems, detection algorithms, or software interfaces, exposing the buyer to legal risks, especially in jurisdictions with strong IP enforcement. -

Embedded Software Violations

Many modern analyzers rely on proprietary software for data analysis and instrument control. Sourced devices may use pirated or reverse-engineered software, which not only violates IP laws but also introduces cybersecurity vulnerabilities and limits software updates or integration with hospital information systems. -

Supply Chain Liability

End users or distributors may face secondary liability if they import or use analyzers found to infringe on IP rights. In some countries, customs authorities can seize shipments, and healthcare institutions may face reputational damage or legal action from original equipment manufacturers (OEMs). -

Lack of Transparency in Manufacturing Origin

Opaque supply chains make it difficult to trace whether a device was developed legally or incorporates stolen designs. Suppliers may obscure the true manufacturer or mislabel the country of origin, complicating due diligence and increasing IP exposure.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Verify regulatory certifications and conduct third-party performance evaluations.

– Audit supplier credentials and manufacturing practices.

– Ensure software and hardware components are licensed and legally sourced.

– Include IP indemnification clauses in procurement contracts.

In summary, while cost-saving is a common driver in sourcing decisions, overlooking quality and IP concerns when acquiring hematology analyzers can lead to compromised patient care, legal disputes, and long-term financial losses. A due diligence-focused procurement strategy is essential to ensure safety, compliance, and reliability.

Logistics & Compliance Guide for Hematology Analyzer

Regulatory Compliance

Ensure all regulatory requirements are met prior to deployment and operation of the hematology analyzer. This includes adherence to international, national, and local regulations.

- FDA Clearance (U.S.): Verify the device is 510(k) cleared or granted De Novo classification by the U.S. Food and Drug Administration. Maintain records of FDA submission numbers and clearance letters.

- CE Marking (Europe): Confirm the analyzer complies with the In Vitro Diagnostic Medical Devices Regulation (IVDR) (EU) 2017/746. Ensure Technical Documentation and EU Declaration of Conformity are available.

- Local Approvals: Obtain necessary certifications in target markets (e.g., Health Canada, TGA in Australia, NMPA in China). Validate registration status before shipment.

- ISO Standards: The device and its manufacturing process must comply with relevant ISO standards, including ISO 13485 (Quality Management) and ISO 15197 (in vitro diagnostic systems).

Import and Export Documentation

Prepare accurate documentation to facilitate smooth international shipping and customs clearance.

- Commercial Invoice: Include product description, value, country of origin, and Harmonized System (HS) code (typically 9018.19 for medical diagnostic instruments).

- Packing List: Detail contents, weights, dimensions, and serial numbers for each unit.

- Certificate of Conformity: Provide proof of compliance with destination country standards.

- Bill of Lading/Air Waybill: Legal document between shipper and carrier; ensure accuracy for tracking and delivery.

- Export License (if applicable): Required for certain countries or high-tech medical devices under dual-use regulations.

Transportation and Handling

Follow best practices to ensure the analyzer arrives undamaged and ready for installation.

- Packaging: Use original manufacturer packaging with shock-absorbing materials. Include humidity and temperature indicators if required.

- Environmental Controls: Maintain storage and transit temperatures within manufacturer-specified range (typically 10°C to 30°C). Avoid freezing or extreme heat.

- Fragile Labeling: Clearly mark packages as “Fragile,” “This Side Up,” and “Do Not Stack.”

- Shipping Method: Choose reliable freight carriers with experience in medical equipment logistics. Air freight is recommended for time-sensitive deliveries.

- Insurance: Secure comprehensive insurance covering damage, loss, and delays.

Installation and Validation

Post-delivery procedures to ensure operational readiness and regulatory compliance.

- Site Preparation: Confirm electrical supply, network connectivity, bench space, and environmental conditions (temperature, humidity) meet specifications.

- Installation Qualification (IQ): Perform documented installation per manufacturer guidelines, including calibration and software setup.

- Operational Qualification (OQ): Verify analyzer functions according to specifications using control materials.

- Performance Verification: Conduct testing with known samples to confirm accuracy, precision, and linearity.

- Training: Provide certified operator training on usage, maintenance, and safety protocols.

Post-Market Surveillance and Maintenance

Maintain compliance and device performance throughout its lifecycle.

- Adverse Event Reporting: Implement systems to report malfunctions or adverse events to regulatory bodies (e.g., FDA MAUDE, EUDAMED).

- Software Updates: Apply manufacturer-released updates and patches; validate after each update.

- Preventive Maintenance: Follow the manufacturer’s recommended service schedule. Keep logs of all maintenance activities.

- Calibration Records: Maintain traceable calibration records using certified reference materials.

- Audit Readiness: Retain all compliance, training, and service documentation for inspection by regulatory agencies.

Disposal and Decommissioning

Ensure environmentally responsible and compliant end-of-life handling.

- Waste Classification: Classify the analyzer as electronic medical waste (e-waste) per local regulations.

- Data Security: Remove or securely erase any stored patient or operational data before disposal.

- Recycling Compliance: Partner with certified e-waste recyclers compliant with WEEE (EU) or equivalent standards.

- Documentation: Record decommissioning details, including date, method, and certificate of destruction/recycling.

Conclusion for Sourcing a Hematology Analyzer

In conclusion, the selection and sourcing of a hematology analyzer require a comprehensive evaluation of clinical needs, analytical performance, automation capabilities, throughput requirements, cost-effectiveness, and long-term service support. The ideal instrument should provide accurate, reliable, and reproducible results while aligning with the laboratory’s workflow and volume demands. Key considerations such as ease of use, maintenance requirements, training availability, and vendor reputation play a crucial role in ensuring sustained operational efficiency.

After thorough assessment of available options, it is recommended to procure a hematology analyzer that balances advanced technology with practical functionality, supports future scalability, and offers strong technical support and warranty terms. Engaging stakeholders—including laboratory staff, clinicians, and procurement officers—ensures that the chosen system meets both current diagnostic needs and future growth objectives. Ultimately, investing in the right hematology analyzer enhances patient care, improves laboratory productivity, and supports the delivery of high-quality hematology testing services.