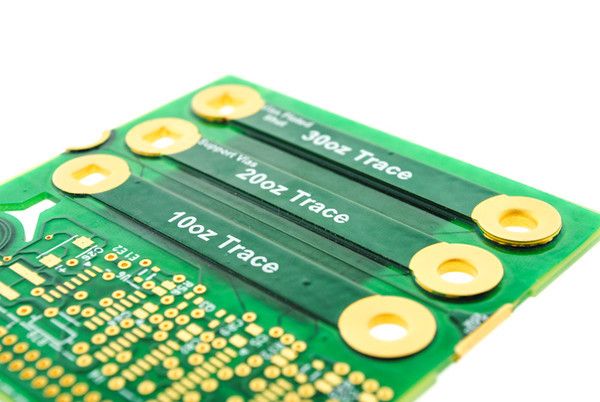

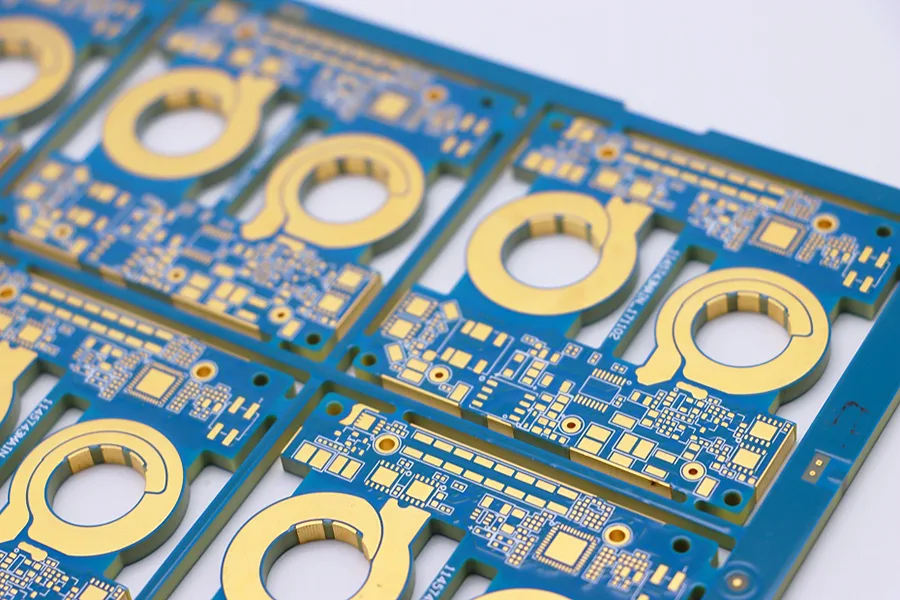

The global printed circuit board (PCB) market is experiencing robust growth, driven by rising demand in high-power applications such as electric vehicles, renewable energy systems, industrial machinery, and aerospace technologies. According to a 2023 report by Mordor Intelligence, the PCB market is projected to grow at a CAGR of over 6.2% from 2023 to 2028, with heavy copper PCBs emerging as a key segment due to their superior thermal conductivity, increased current-carrying capacity, and enhanced durability in extreme environments. As industries push the boundaries of power density and reliability, the need for advanced circuit solutions has elevated the importance of specialized manufacturers capable of producing high-quality heavy copper PCBs—typically defined as boards with copper thicknesses ranging from 3 oz/ft² to 20 oz/ft² or more. This increasing demand has led to a competitive landscape where technological expertise, precision manufacturing, and scalability differentiate market leaders. Below is a curated list of the top nine heavy copper PCB manufacturers shaping the future of power electronics through innovation and engineering excellence.

Top 9 Heavy Copper Pcb Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

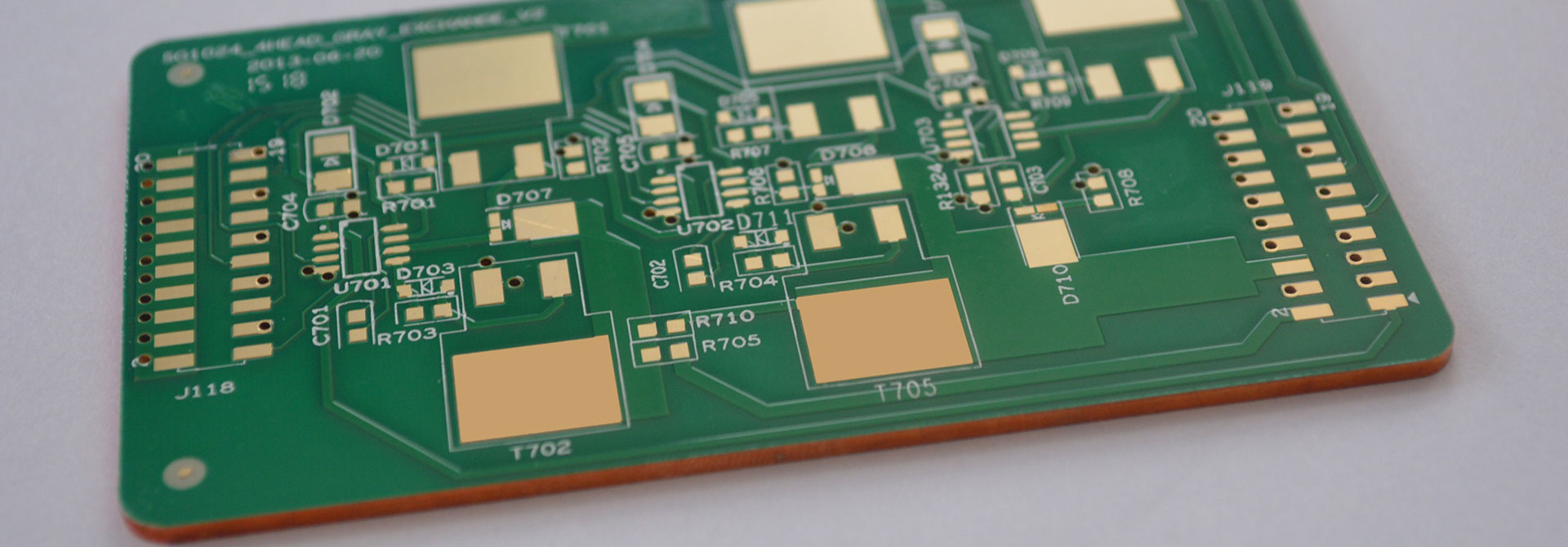

#1 Heavy Copper Printed Circuit Boards by Rigiflex Technology

Domain Est. 1997

Website: rigiflex.com

Key Highlights: Rigiflex Technology, Inc. provides performance-oriented, heavy copper PCBs, which ensure efficient thermal management and power distribution….

#2 Heavy Copper PCB – Amitron

Domain Est. 1995 | Founded: 1994

Website: amitron.com

Key Highlights: Amitron has been manufacturing PCBs with heavy copper plating since 1994 and we are capable of producing 20 plus ounces of finished copper….

#3 Heavy Copper PCB Boards Manufacturer & Fabricator

Domain Est. 2002

Website: htglobalcircuits.com

Key Highlights: Trusted heavy copper PCB manufacturer & fabricator delivering thick copper circuit boards for power, thermal management, and high current applications….

#4 Thick Copper PCB Manufacturer USA

Domain Est. 2004

Website: rushpcb.com

Key Highlights: Rush PCB manufacturers regular PCBs with copper thickness of 1-3 oz (35-105 um). We also make thick copper PCBs with finished copper weight of more than 4 oz….

#5 Heavy Copper PCB

Domain Est. 2005

Website: pcbcart.com

Key Highlights: PCBCart is a highly skilled thick copper PCB manufacturer that can develop and produce a superior thick copper PCB product of the highest quality….

#6 Heavy Copper PCB Manufacturing and Assembly Services

Domain Est. 2008

Website: greencircuits.com

Key Highlights: Green Circuits’ heavy copper PCBs are used by: Solar panel manufacturers; Power supplies; Power converters; Electrical power distribution; Automotive ……

#7 Heavy Copper PCBs

Domain Est. 1996

Website: cirexx.com

Key Highlights: With our innovative capabilities, we can fabricate a PCB with up to 6 ounces of copper for outer layers and up to 4 ounces for inner layers….

#8 Heavy Copper Printed Circuit Boards

Domain Est. 2009

Website: epectec.com

Key Highlights: Epec has been building heavy copper circuit boards with traces and copper planes of up to 6 ounces for more than 20 years….

#9 Thick

Website: multi-circuit-boards.eu

Key Highlights: Rating 4.7 (12,829) Order thick-copper PCBs online. E.g. for complex switches in limited space in combination with circuitry for high current levels….

Expert Sourcing Insights for Heavy Copper Pcb

H2: Market Trends for Heavy Copper PCBs in 2026

As the electronics and industrial sectors evolve toward higher power efficiency, durability, and thermal management, the Heavy Copper Printed Circuit Board (PCB) market is positioned for significant transformation by 2026. Driven by advancements in technology and increasing demand across key industries, several prominent trends are expected to shape the Heavy Copper PCB landscape during this period.

1. Rising Demand from Power Electronics and Renewable Energy

One of the most influential drivers of Heavy Copper PCB adoption in 2026 will be the continued expansion of power electronics, particularly in renewable energy systems such as solar inverters, wind turbine converters, and energy storage solutions. Heavy Copper PCBs, capable of handling currents exceeding 100A and offering superior thermal dissipation, are essential in high-power applications. As global investments in clean energy accelerate, the need for robust, reliable circuit boards will elevate demand for Heavy Copper PCBs.

2. Growth in Electric Vehicles (EVs) and Charging Infrastructure

The automotive sector, especially electric vehicles (EVs) and high-power charging stations, will be a major growth vector. Heavy Copper PCBs are increasingly used in EV motor drives, battery management systems (BMS), and onboard chargers due to their ability to withstand high current loads and dissipate heat efficiently. With EV adoption projected to surge by 2026, manufacturers will prioritize components that enhance performance and safety—making Heavy Copper PCBs a critical enabler.

3. Adoption in Industrial and Military Applications

Industrial automation, robotics, and defense systems are also adopting Heavy Copper PCBs for their ruggedness and reliability under extreme conditions. In military and aerospace applications, where systems operate under high stress and temperature variations, these PCBs provide essential durability. By 2026, increased defense spending and the modernization of industrial equipment are expected to further accelerate demand.

4. Technological Advancements and Miniaturization

Manufacturers are investing in advanced fabrication techniques such as step plating, laser drilling, and embedded copper technology to produce thinner, more complex Heavy Copper PCBs without sacrificing performance. These innovations allow for miniaturization while maintaining high current capacity—meeting the needs of compact yet powerful electronic systems in telecommunications, medical devices, and high-performance computing.

5. Regional Market Shifts and Supply Chain Dynamics

Asia-Pacific, particularly China, Japan, and South Korea, will remain the dominant hub for Heavy Copper PCB production due to established manufacturing infrastructure and proximity to key end-users. However, supply chain diversification efforts—driven by geopolitical tensions and pandemic-era disruptions—are prompting investment in North American and European fabrication capabilities. By 2026, localized production is expected to grow, reducing lead times and enhancing supply chain resilience.

6. Sustainability and Material Innovation

Environmental regulations and corporate sustainability goals are pushing manufacturers to develop eco-friendly Heavy Copper PCBs. This includes reducing hazardous chemicals in plating processes and improving recyclability. Additionally, research into alternative conductive materials and hybrid PCB designs may begin to influence market offerings, though copper will remain the dominant conductor due to its unmatched electrical and thermal properties.

7. Price Volatility and Raw Material Challenges

Copper prices are subject to fluctuation based on global mining output, geopolitical factors, and demand from other industries (e.g., construction, EVs). By 2026, manufacturers may face margin pressures, prompting greater emphasis on design efficiency, material utilization, and value-added services to maintain competitiveness.

Conclusion:

By 2026, the Heavy Copper PCB market will be shaped by strong demand from high-power industries, technological innovation, and a strategic shift toward resilient, sustainable manufacturing. Companies that invest in advanced production capabilities, vertical integration, and application-specific designs will be best positioned to capitalize on these evolving trends. As power density and reliability become paramount across sectors, Heavy Copper PCBs will transition from niche components to essential building blocks of next-generation electronic systems.

Common Pitfalls in Sourcing Heavy Copper PCBs: Quality and Intellectual Property Risks

Quality-Related Pitfalls

Inadequate Copper Thickness Control

One of the most frequent quality issues is inconsistent or inaccurate copper plating. Heavy copper PCBs require precise control over copper thickness (often 3 oz/ft² and above), and suppliers with subpar plating processes may deliver boards that fall short of specifications. This can lead to reduced current-carrying capacity, overheating, and premature failure in high-power applications.

Poor Thermal Management and Delamination

Heavy copper PCBs are often used in high-temperature environments. A common pitfall is poor adhesion between copper layers and the substrate, leading to delamination under thermal cycling. Suppliers lacking experience with heavy copper may use inappropriate materials or lamination processes, compromising long-term reliability.

Insufficient Etching Precision

Thick copper layers are harder to etch with precision. Inexperienced manufacturers may struggle to maintain tight tolerances, resulting in undercutting, uneven trace widths, or short circuits. This is particularly problematic in densely routed designs or when impedance control is critical.

Inadequate Testing and Quality Assurance

Some suppliers may skip or skimp on essential testing procedures such as high-potential (hi-pot) testing, thermal stress testing, or cross-sectional analysis. Without rigorous QA, defects like micro-cracks, voids in vias, or poor through-hole plating may go undetected until field failure.

Intellectual Property (IP) Protection Pitfalls

Lack of IP Agreements and NDAs

A major risk when sourcing heavy copper PCBs—especially from overseas—is the absence of enforceable non-disclosure agreements (NDAs) or IP ownership clauses. Without clear contracts, your design files, layer stack-ups, and proprietary features may be vulnerable to unauthorized use or replication.

Unsecured Data Transfer and Storage

Transmitting Gerber files, schematics, or stack-up details over unencrypted channels or to suppliers with weak cybersecurity practices increases the risk of IP theft. Some manufacturers may store design data on unsecured servers, making them targets for hackers or industrial espionage.

Third-Party Subcontracting Without Consent

Some PCB suppliers outsource production to subcontractors without informing the customer. This not only reduces traceability but also increases IP exposure, as additional parties gain access to sensitive design information—often in jurisdictions with lax IP enforcement.

Reverse Engineering and Clone Production

In extreme cases, unscrupulous manufacturers may reverse-engineer your PCBs to produce clones or sell designs to competitors. This is especially likely if there are no legal safeguards or audit rights in place to monitor production and ensure exclusivity.

Mitigation Strategies

To avoid these pitfalls, vet suppliers thoroughly by reviewing certifications (e.g., ISO, IPC), requesting sample testing, and conducting on-site audits when possible. Always sign comprehensive IP protection agreements, use encrypted file transfer, and limit design data access to only what’s necessary. Prioritize suppliers with proven experience in heavy copper technology and a transparent supply chain.

Logistics & Compliance Guide for Heavy Copper PCBs

Heavy copper PCBs, defined as printed circuit boards with copper thicknesses typically exceeding 3 oz/ft² (approximately 105 µm), are essential in high-power, high-current, and high-temperature applications such as power supplies, automotive systems, and industrial equipment. Due to their specialized nature and increased material and handling requirements, shipping and compliance procedures differ significantly from standard PCBs. This guide outlines key logistics and regulatory considerations to ensure safe, efficient, and compliant transportation of heavy copper PCBs.

Regulatory Compliance and Documentation

Ensuring compliance with international and regional regulations is critical when shipping heavy copper PCBs. These boards may incorporate materials subject to environmental, safety, and export controls.

RoHS and REACH Compliance

Heavy copper PCBs must comply with the Restriction of Hazardous Substances (RoHS) directive if destined for the European Union or other RoHS-regulated markets. Confirm that all components, finishes (e.g., ENIG, HASL), and base materials (e.g., FR-4, metal-core substrates) are RoHS-compliant. Additionally, evaluate compliance with REACH regulations regarding the registration, evaluation, and restriction of chemical substances, especially if brominated flame retardants or other SVHCs (Substances of Very High Concern) are present.

Export Control Regulations (ITAR/EAR)

Depending on the application, heavy copper PCBs used in defense, aerospace, or high-power electronics may be subject to export control regulations such as the International Traffic in Arms Regulations (ITAR) or the Export Administration Regulations (EAR). Verify the ECCN (Export Control Classification Number) for your PCBs. If classified under controlled categories, obtain necessary export licenses before shipment.

Material Safety Data Sheets (MSDS/SDS)

Although PCBs are generally not classified as hazardous, some substrates or metal-core materials (e.g., aluminum-backed boards) may require Safety Data Sheets (SDS) for customs clearance, especially when shipping in bulk. Maintain up-to-date SDS documentation for all constituent materials.

Packaging and Handling Requirements

Due to their weight and susceptibility to mechanical stress, heavy copper PCBs require robust packaging to prevent damage during transit.

Reinforced Packaging Materials

Use double-wall or triple-wall corrugated cardboard boxes with high edge crush test (ECT) ratings to support the weight of heavy copper PCBs. Avoid standard single-wall boxes, which may collapse under load.

Internal Protection and Spacing

Separate individual boards using anti-static foam, corrugated dividers, or bubble wrap to prevent scratching and edge chipping. For stacked boards, use rigid interlayer supports or plastic rails to avoid warping or short-circuiting due to contact between conductive surfaces.

Moisture and ESD Protection

Seal PCBs in static-shielding bags (e.g., metallic or pink poly) to protect against electrostatic discharge (ESD). Include desiccant packs and humidity indicator cards inside moisture barrier bags (MBBs), especially if the boards have surface finishes sensitive to oxidation (e.g., immersion silver or OSP).

Shipping and Transportation Considerations

Transporting heavy copper PCBs involves considerations related to weight, dimensional stability, and carrier-specific restrictions.

Weight and Dimensional Constraints

Heavy copper PCBs are significantly heavier than standard PCBs. Ensure packages do not exceed carrier weight limits (e.g., 70 lbs for many express couriers). For oversized or heavy shipments, use freight services (LTL or FTL) and palletize loads with proper strapping and corner boards.

Carrier Selection and Labeling

Choose carriers experienced in handling electronics and industrial goods. Clearly label packages with “Fragile,” “This Side Up,” and “Static Sensitive” indicators. Include correct HS codes (e.g., 8534.00 for printed circuits) and detailed commercial invoices indicating value, quantity, and technical specifications.

Environmental Exposure

Avoid exposing heavy copper PCBs to extreme temperatures or high humidity during transit. Use climate-controlled transport where necessary, particularly for boards with moisture-sensitive laminates or metal-core substrates prone to thermal expansion.

Customs Clearance and Import Regulations

Smooth customs clearance requires accurate documentation and awareness of destination-country regulations.

Accurate Commercial Invoicing

Provide detailed commercial invoices listing:

– Full product description (e.g., “Printed Circuit Board with 6 oz Copper, FR-4 Substrate”)

– Quantity, unit value, and total value

– HS code (typically 8534.00.0000 in the U.S.)

– Country of origin

– Incoterms (e.g., FOB, DDP)

Import Duties and Tariffs

Research import duties for electronic components in the destination country. Some regions offer duty exemptions for electronic assemblies under specific conditions (e.g., bonded warehouses or special economic zones).

Certifications and Conformity Marks

Include compliance certificates (e.g., CE, UL, IPC) if required by the importing country. For industrial or automotive applications, customer-specific certifications may also be needed for customs or end-use validation.

Best Practices Summary

- Verify compliance with RoHS, REACH, and export controls before shipment.

- Use reinforced, ESD-safe packaging with moisture protection.

- Label clearly and provide accurate shipping documentation.

- Choose appropriate carriers based on weight, urgency, and destination.

- Maintain traceability with batch numbers, date codes, and compliance labels on packaging.

Adhering to these logistics and compliance guidelines ensures the secure and lawful delivery of heavy copper PCBs, minimizing delays, damage, and regulatory risks.

Conclusion for Sourcing Heavy Copper PCBs

Sourcing heavy copper PCBs requires careful consideration of both technical specifications and supplier capabilities. These specialized printed circuit boards, known for their ability to conduct higher currents, dissipate heat efficiently, and enhance product durability, are essential in demanding applications such as power electronics, military systems, automotive, and industrial equipment.

To ensure reliability, performance, and cost-efficiency, it is crucial to partner with experienced and certified PCB manufacturers who possess advanced fabrication technologies—such as high-speed plating, laser drilling, and precise etching controls—necessary to handle thick copper layers (typically 3 oz/ft² and above). Factors such as material selection, impedance control, thermal management, and adherence to industry standards (e.g., IPC-6012, UL) must be rigorously evaluated during the sourcing process.

Additionally, clear communication of design requirements, prototyping support, quality assurance protocols, and lead time management play a vital role in successful procurement. Sourcing from reputable suppliers, whether domestic or international, should balance cost savings with consistent quality and technical support.

In conclusion, a strategic approach to sourcing heavy copper PCBs—emphasizing technical expertise, manufacturing quality, and supply chain reliability—ensures optimal performance and longevity of high-power electronic systems. Investing time in selecting the right manufacturing partner ultimately leads to improved product reliability and reduced long-term production risks.