The global heat treating steel market is experiencing robust growth, driven by rising demand from automotive, aerospace, and industrial manufacturing sectors. According to Grand View Research, the global metal heat treating market size was valued at USD 98.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. This expansion is fueled by advancements in steel processing technologies, increasing emphasis on material durability, and the need for enhanced mechanical properties in high-performance applications. As industries continue to prioritize precision-engineered components, the role of specialized heat treating steel manufacturers becomes increasingly critical. Based on production scale, technological capabilities, geographic reach, and service innovation, the following ten companies have emerged as leaders shaping the future of the heat treating landscape.

Top 10 Heat Treating Steel Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

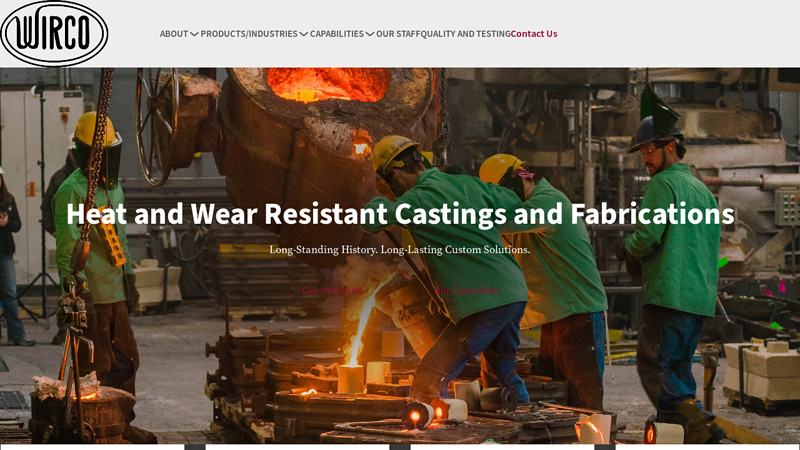

#1 Wirco Inc.

Domain Est. 1997 | Founded: 1978

Website: wirco.com

Key Highlights: Since 1978 Wirco, Inc. has been committed to providing high-temperature tooling and furnace replacement parts for our heat treating and steel manufacturing ……

#2 DELTA H

Domain Est. 1998

Website: delta-h.com

Key Highlights: DELTA H designs and manufactures industrial furnaces and ovens for aerospace, defense, and manufacturing. Explore our USA-made thermal processing solutions….

#3 Paulo

Domain Est. 1999

Website: paulo.com

Key Highlights: Paulo is the nation’s largest privately-held commercial thermal processing company advancing manufacturers in aerospace, automotive, and beyond….

#4 Queen City Steel Treating Co.

Domain Est. 2000 | Founded: 1922

Website: qcst.com

Key Highlights: Industrial Heat Treating Since 1922 · Automotive · Commercial Vehicles · Agricultural & Construction · Soft & Hard Mineral Mining · Appliance Parts · ITAR Compliant ……

#5 The leading provider of heat treatment and specialist thermal …

Domain Est. 1997

Website: bodycote.com

Key Highlights: We are the world’s largest and most respected provider of heat treatment services and specialist thermal processes, Hot Isostatic Pressing, Powdermet and ……

#6 Specialty Steel Treating: Heat Treating Services

Domain Est. 2000

Website: sst.net

Key Highlights: We provide a variety of services including: case hardening, tempering steel, carburizing, quenching heat treatment, vacuum heat treatments and more….

#7 American Steel Treating

Domain Est. 2001

Website: americansteeltreating.com

Key Highlights: American Steel Treating has four of the largest batch ferritic nitrocarburizing and nitriding furnaces in the world capable of processing up to 45 tons in a ……

#8 Advanced Heat Treat Corp

Domain Est. 2007

Website: ahtcorp.com

Key Highlights: Welcome to Advanced Heat Treat Corp. (AHT), a recognized leader in providing commercial heat treat services and metallurgical solutions….

#9 Phoenix Heat Treating

Domain Est. 2007

Website: phoenix-heat-treating.com

Key Highlights: Phoenix Heat Treating is especially known for its ability to resolve difficult heat treating problems that are beyond the capability of a typical application….

#10 Metal Treatments

Domain Est. 2022

Website: aalberts-ht.us

Key Highlights: Specializing in high-quality metal treatments, Aalberts surface technologies brings strength, durability, and precision to every project we undertake….

Expert Sourcing Insights for Heat Treating Steel

H2: Projected Market Trends in the Heat Treating Steel Industry for 2026

As the global manufacturing and industrial sectors continue to evolve, the heat treating steel market is expected to undergo significant transformation by 2026. Driven by technological advancements, shifting regulatory landscapes, and increasing demand from key end-use industries, the following trends are projected to shape the heat treating steel sector over the coming years.

-

Growing Demand from Automotive and Aerospace Sectors

The automotive industry, particularly in the electric vehicle (EV) segment, is expected to fuel demand for high-performance, heat-treated steel components. Lightweight yet durable steel parts—such as gears, crankshafts, and suspension systems—require precise heat treatment to enhance strength and wear resistance. Similarly, the aerospace industry’s need for materials capable of withstanding extreme temperatures and stress will sustain demand for advanced heat-treated alloys. By 2026, original equipment manufacturers (OEMs) are likely to prioritize partnerships with heat treatment service providers to ensure compliance with stringent quality standards. -

Adoption of Digitalization and Industry 4.0 Technologies

The integration of smart manufacturing technologies is set to revolutionize heat treatment processes. In 2026, predictive analytics, Internet of Things (IoT)-enabled monitoring, and AI-driven quality control systems will become more prevalent in heat treating facilities. These technologies will improve process consistency, reduce energy consumption, and minimize defects through real-time data tracking. Digital twins for furnace operations and automated process optimization are expected to be mainstream, enhancing operational efficiency and reducing downtime. -

Emphasis on Energy Efficiency and Sustainability

Environmental regulations and corporate sustainability goals will drive innovation in energy-efficient heat treatment methods. Vacuum and controlled atmosphere furnaces, along with induction hardening technologies, are anticipated to gain traction due to their lower emissions and higher precision. Additionally, the industry is likely to see increased investment in waste heat recovery systems and the use of renewable energy sources to power heat treatment operations. By 2026, compliance with carbon reduction targets will be a key competitive advantage for service providers. -

Regional Market Shifts and Supply Chain Resilience

Asia-Pacific, particularly China and India, will remain dominant in both production and consumption of heat-treated steel, supported by rapid industrialization and infrastructure development. Meanwhile, nearshoring and reshoring trends in North America and Europe—motivated by supply chain disruptions and geopolitical factors—will bolster local heat treatment capacity. Regionalization of supply chains is expected to lead to a rise in decentralized heat treatment centers, improving lead times and customization capabilities. -

Advancements in Materials and Process Innovations

Research into new steel alloys and hybrid materials will expand the application scope of heat treatment. By 2026, ultra-high-strength steels (UHSS) and maraging steels treated with advanced techniques such as deep cryogenic treatment and laser-assisted hardening are likely to see broader adoption. These innovations will cater to high-performance needs in defense, energy, and medical device manufacturing. -

Consolidation and Service Diversification Among Providers

The competitive landscape will witness increased consolidation as larger players acquire specialized heat treatment firms to expand service portfolios. Companies offering integrated solutions—including surface engineering, metallurgical testing, and consulting—will gain market share. Customized, end-to-end thermal processing services will become a differentiator in attracting high-value clients.

In conclusion, the heat treating steel market in 2026 will be characterized by technological sophistication, sustainability focus, and responsiveness to evolving industrial demands. Companies that invest in innovation, digital transformation, and green technologies are well-positioned to lead in this dynamic environment.

Common Pitfalls in Sourcing Heat Treating Steel (Quality & Intellectual Property)

Sourcing heat treating steel requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to production delays, part failures, legal disputes, and reputational damage. Below are the most common pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Specification of Material Grades and Standards

Failing to clearly define the required steel grade (e.g., AISI 4140, 4340), applicable standards (e.g., ASTM A29, AMS 6260), and heat treatment parameters (quenching medium, tempering temperature) can result in receiving material that does not meet performance requirements. Vague or incomplete specifications open the door to supplier interpretation and non-compliance.

2. Insufficient Verification of Heat Treatment Documentation

Accepting mill test reports (MTRs) without verifying actual heat treatment records is a major risk. Some suppliers may provide untreated or improperly treated steel while falsifying documentation. Always require certified heat treatment reports that include furnace logs, soak times, cooling rates, and hardness validation.

3. Poor Control Over Traceability and Lot Management

Lack of clear lot traceability makes it difficult to investigate field failures or conduct recalls. Ensure suppliers maintain full traceability from raw material to finished heat-treated product, including batch numbers, heat numbers, and processing dates.

4. Overlooking Microstructure and Hardness Consistency

Heat-treated steel must achieve uniform hardness and desired microstructure (e.g., tempered martensite). Inconsistent quenching or improper tempering can lead to residual stresses, distortion, or cracking. Require hardness testing (e.g., Rockwell C) across multiple points and, where critical, microstructural analysis.

5. Selecting Unqualified or Non-Specialized Suppliers

Not all steel suppliers have the expertise or equipment for precision heat treatment. Using general-purpose vendors without proven experience in aerospace, automotive, or tooling applications can compromise material performance. Audit suppliers for certifications (e.g., Nadcap, ISO 17025) and technical capabilities.

Intellectual Property-Related Pitfalls

1. Unprotected or Poorly Defined IP in Technical Drawings and Specifications

Sharing detailed engineering drawings, material specs, or proprietary heat treatment cycles without proper confidentiality agreements (NDAs) or IP clauses exposes your designs to misuse. Always watermark documents and limit distribution to authorized personnel.

2. Failure to Secure Ownership of Custom-Developed Processes

If your organization develops a unique heat treatment process in collaboration with a supplier, failing to formalize IP ownership in contracts may allow the supplier to reuse or license the process to competitors. Clearly define IP rights in joint development agreements.

3. Inadequate Supplier Agreements Regarding Reverse Engineering

Some suppliers may reverse engineer your components to replicate or improve upon your design. Contractual clauses must explicitly prohibit reverse engineering, duplication, or third-party disclosure of supplied parts and processes.

4. Using Suppliers with a History of IP Infringement

Partnering with suppliers who have previously been involved in IP disputes increases legal and operational risk. Conduct due diligence on suppliers’ compliance history and enforce strict contractual penalties for IP violations.

5. Lack of Export Control and Regulatory Compliance

Certain high-performance heat-treated steels may be subject to export controls (e.g., ITAR, EAR). Sourcing from or shipping to unauthorized regions without compliance can result in severe penalties. Ensure suppliers are aware of and adhere to relevant regulations.

Best Practices to Mitigate Risks

- Use detailed, unambiguous material and process specifications.

- Require third-party certification and independent testing when feasible.

- Conduct regular supplier audits for quality systems and IP controls.

- Implement robust NDAs and IP clauses in all supplier contracts.

- Maintain internal records of all technical specifications and supplier communications.

By proactively addressing both quality and IP concerns, organizations can ensure reliable performance of heat-treated components while protecting their competitive advantage.

H2: Logistics & Compliance Guide for Heat Treating Steel

Heat treating steel is a critical industrial process that enhances mechanical properties such as hardness, strength, and toughness. Due to the high temperatures, energy usage, chemical treatments (e.g., quenching media), and potential environmental and safety hazards involved, both logistics and regulatory compliance are crucial for safe, efficient, and legally sound operations.

1. Regulatory Compliance

1.1 Environmental Regulations

- Air Emissions Control

- Heat treating furnaces emit combustion byproducts (NOx, CO, VOCs) and particulate matter.

-

Compliance Requirements:

- Install and maintain air pollution control devices (e.g., thermal oxidizers, scrubbers).

- Comply with EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP) Subpart GGGGGG (Area Sources) or applicable MACT standards.

- Conduct regular stack testing and keep records for inspections.

-

Wastewater and Spill Management

- Quenching oils, coolants, and cleaning solvents can contaminate water if not managed properly.

-

Compliance Requirements:

- Implement oil-water separators and secondary containment for storage tanks.

- Follow EPA’s Clean Water Act and local discharge permits.

- Prevent stormwater contamination per the Stormwater Pollution Prevention Plan (SWPPP).

-

Hazardous Waste Handling

- Spent quenching oils, used filters, and cleaning sludge may be classified as hazardous waste.

- Compliance Requirements:

- Classify waste using EPA’s RCRA (Resource Conservation and Recovery Act) guidelines.

- Store waste in labeled, leak-proof containers with proper accumulation time limits.

- Use licensed hazardous waste transporters and maintain manifests.

1.2 Occupational Safety and Health (OSHA)

- Heat and Burn Hazards

- Workers are exposed to high-temperature furnaces, molten materials, and hot metal.

-

Compliance Requirements:

- Provide heat-resistant PPE (gloves, aprons, face shields).

- Implement lockout/tagout (LOTO) procedures during maintenance.

- Train employees on burn prevention and emergency response.

-

Chemical Exposure

- Exposure to quenching oils, cyanide salts (in salt bath furnaces), and degreasers.

-

Compliance Requirements:

- Maintain Safety Data Sheets (SDS) for all chemicals.

- Install local exhaust ventilation (LEV) systems.

- Conduct air monitoring and enforce PPE use (respirators, gloves).

-

Machine Safety

- Automated handling systems and conveyors pose mechanical risks.

- Compliance Requirements:

- Install machine guards, emergency stops, and interlocks.

- Comply with OSHA 29 CFR 1910 Subparts O (Machinery) and Q (Welding, Cutting, and Brazing).

1.3 Process-Specific Standards

- AMS and ASTM Standards

- Aerospace (AMS 2750) and industrial (ASTM A887) standards govern temperature uniformity, instrumentation, and process control.

- Compliance Requirements:

- Perform regular furnace temperature uniformity surveys (TUS).

- Calibrate thermocouples and controllers per specified intervals.

- Maintain detailed process records for traceability.

2. Logistics Management

2.1 Incoming Material Handling

- Receiving & Inspection

- Verify steel grade, dimensions, and condition against purchase orders.

-

Use non-destructive testing (e.g., PMI – Positive Material Identification) for critical applications.

-

Storage

- Store materials off the ground, segregated by alloy type and heat lot.

- Protect from moisture and contamination to prevent scaling or rust before treatment.

2.2 In-Process Flow

- Scheduling & Batch Control

- Optimize furnace loading to improve energy efficiency and throughput.

-

Track batch numbers, process parameters (time, temperature, atmosphere), and operator logs.

-

Quenching & Cooling

- Select appropriate quenching media (oil, water, polymer, gas) based on steel grade and desired properties.

-

Monitor quench tank temperature and agitation to prevent distortion or cracking.

-

Post-Treatment Handling

- Allow adequate cooling before handling; use automated systems where possible.

- Clean parts (e.g., shot blasting, washing) to remove scale or residual quenchants.

2.3 Outbound Logistics

- Quality Verification

- Conduct hardness testing (Rockwell, Brinell), microstructure analysis, and dimensional checks.

-

Generate compliance certificates (e.g., Material Test Reports, NADCAP audit compliance).

-

Packaging & Shipping

- Protect treated parts from corrosion during transit (VCI bags, rust inhibitors).

- Label packages with heat lot, material grade, and handling instructions.

- Use carriers experienced in handling heavy or precision metal components.

3. Documentation & Recordkeeping

- Maintain records for:

- Temperature charts and furnace calibration logs.

- Batch processing records (time, temperature, atmosphere).

- Inspection and test results.

- Waste manifests and disposal certificates.

-

Employee training logs and safety drills.

-

Retention Period: Minimum 5–10 years depending on industry (longer for aerospace or nuclear applications).

4. Best Practices for Compliance & Efficiency

- Automation & Monitoring

- Use SCADA systems to monitor furnace conditions in real time.

-

Automate data logging to reduce human error and support audits.

-

Training Programs

-

Conduct regular training on safety, environmental compliance, and quality procedures.

-

Audits & Continuous Improvement

- Perform internal audits against ISO 9001, IATF 16949, or NADCAP standards.

- Implement corrective actions for non-conformances.

5. Key Regulatory Agencies & Standards

| Agency/Standard | Scope |

|—————–|——-|

| EPA (Environmental Protection Agency) | Air, water, and waste regulations |

| OSHA (Occupational Safety and Health Administration) | Worker safety and chemical exposure |

| NADCAP (National Aerospace and Defense Contractors Accreditation Program) | Aerospace heat treat accreditation |

| AMS 2750 | Pyrometry and thermal processing standards |

| ISO 14001 | Environmental management systems |

| ISO 45001 | Occupational health and safety |

Conclusion

Effective logistics and strict compliance in steel heat treating ensure product quality, worker safety, and environmental protection. A proactive approach—combining standardized procedures, employee training, and robust documentation—is essential for meeting regulatory requirements and maintaining operational excellence in the heat treating industry.

Conclusion on Sourcing Heat-Treating Steel:

Sourcing the right steel for heat treatment is a critical step that directly impacts the performance, durability, and reliability of the final component. It requires a thorough understanding of material specifications, including alloy composition, hardenability, grain structure, and response to thermal processing. When selecting a supplier, factors such as material traceability, quality certifications (e.g., ISO, ASTM), consistency in production, and technical support are essential to ensure the steel meets required standards.

Domestic versus international sourcing involves trade-offs in cost, lead times, and quality control. While overseas suppliers may offer competitive pricing, domestic sources often provide better communication, faster delivery, and more rigorous quality assurance—especially critical for mission-critical applications in industries like aerospace, automotive, and tooling.

Ultimately, successful sourcing of heat-treating steel combines material expertise, strong supplier relationships, and rigorous quality validation. Investing time in selecting the right material and supplier not only enhances the effectiveness of the heat treatment process but also reduces the risk of part failure, rework, and costly downtime—delivering long-term value and performance.