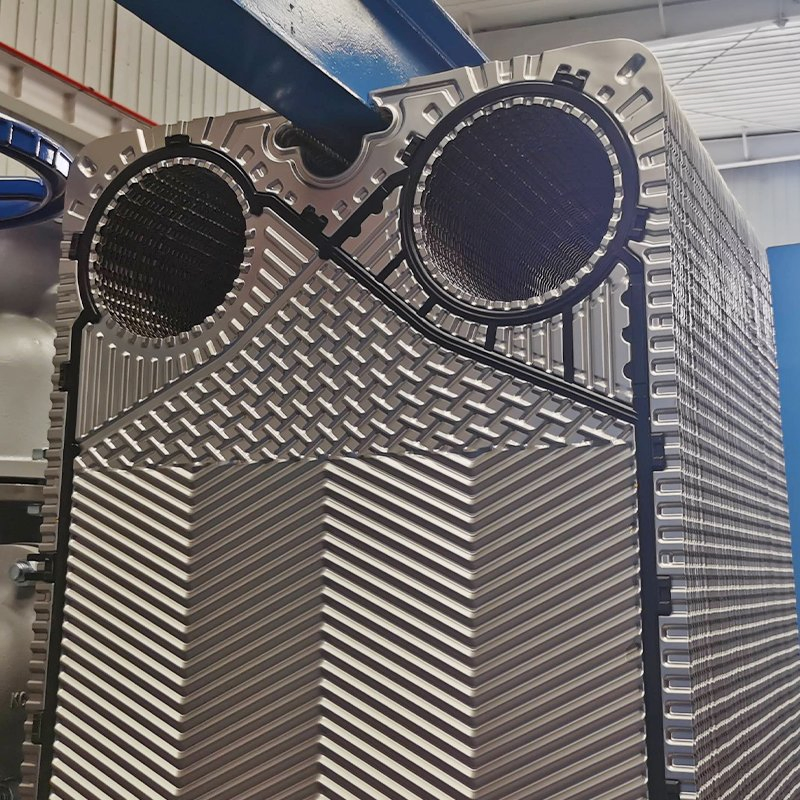

The global heat exchanger market is experiencing robust growth, driven by increasing demand for energy-efficient solutions across industries such as oil & gas, power generation, chemical processing, and HVAC. According to Mordor Intelligence, the market was valued at USD 23.3 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. A critical component within this ecosystem is the heat exchanger plate, particularly in plate heat exchangers (PHEs), which are favored for their compact design, high thermal efficiency, and ease of maintenance. With growing industrialization and a heightened focus on sustainable operations, the demand for high-quality, corrosion-resistant, and thermally optimized plates has surged. This increasing need has elevated the prominence of leading manufacturers who combine advanced materials, precision engineering, and scalability. Based on market presence, production capacity, innovation, and global reach, the following are the top 10 heat exchanger plate manufacturers shaping the industry’s future.

Top 10 Heat Exchanger Plate Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Heat Exchangers for Industrial & Mobile Applications

Domain Est. 1997

Website: thermaltransfer.com

Key Highlights: Leading US-based manufacturer of heat exchangers for industrial and mobile applications. Custom, pre-engineered and off-the-shelf solutions with fast lead ……

#2 SWEP

Domain Est. 2023

Website: swepgroup.com

Key Highlights: Together we can bring cutting-edge brazed plate heat exchanger technology to HVAC, refrigeration, and industrial heating and cooling markets around the globe….

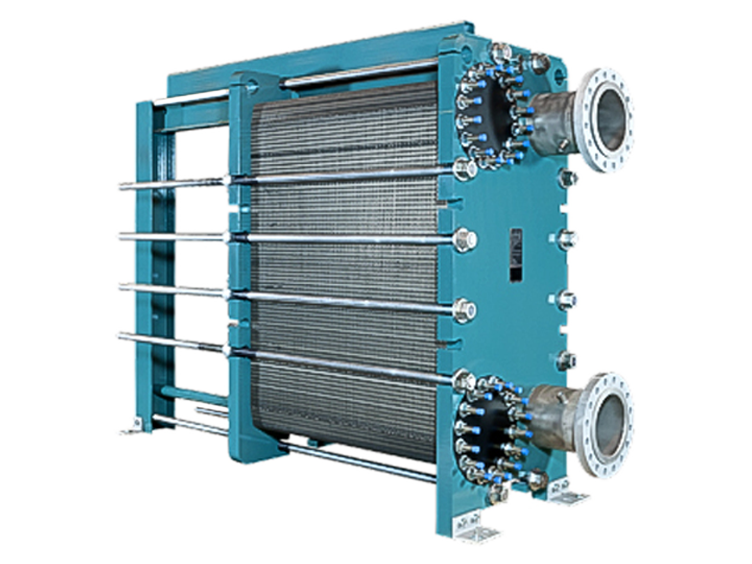

#3 Tranter: Responsive Heat Exchangers

Domain Est. 1995

Website: tranter.com

Key Highlights: At Tranter, we specialize in advanced gasketed and welded plate heat exchangers. As a global manufacturer, we are committed to precision and localized service….

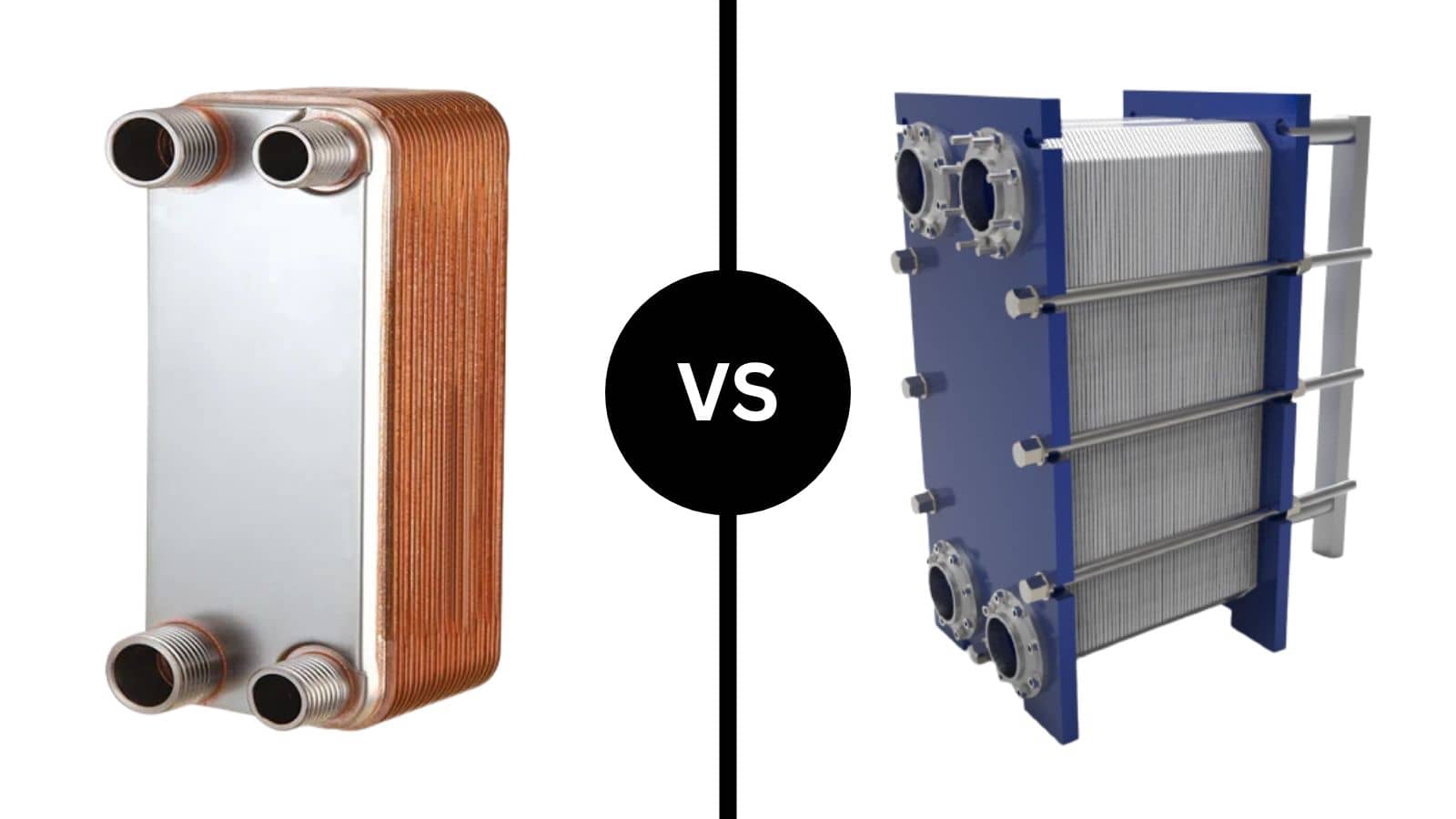

#4 Heat exchangers – brazed and gasketed

Domain Est. 1995

Website: danfoss.com

Key Highlights: Brazed and gasketed plate heat exchangers for heat transfer and refrigeration applications. New technology with micro plate and micro channel heat exchanger ……

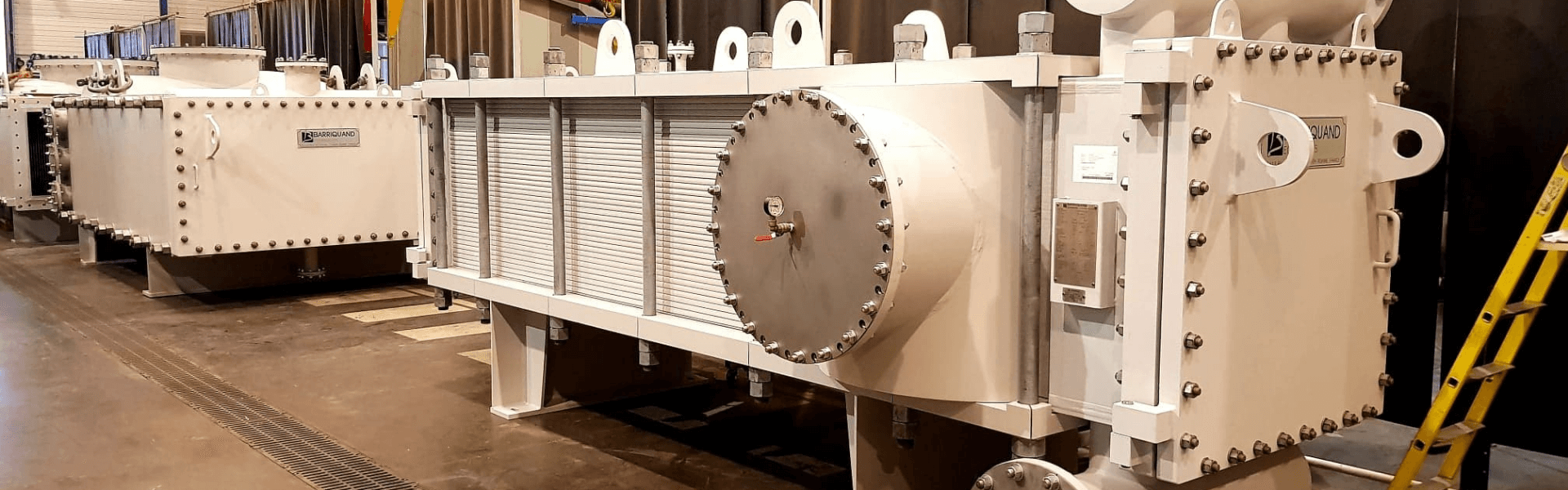

#5 Plate heat exchanger, shell tube heat exchangers ⇒ Barriquand

Domain Est. 1997

Website: barriquand.com

Key Highlights: Barriquand is a French designer and manufacturer of heat exchangers. Thanks to over 80 years of know-how, our company is able to supply exchangers and heat ……

#6 Global Manufacturer of Heat Exchangers

Domain Est. 1998

Website: heatex.com

Key Highlights: Heatex specializes in plate and rotary heat exchangers used in ventilation and thermal management applications worldwide….

#7 WCRHX

Domain Est. 2013

Website: wcrhx.com

Key Highlights: WCR manufactures and stocks OEM-quality specified plates and gaskets for all makes and models of plate heat exchangers. Simply choose your heat exchanger name ……

#8 FUNKE

Website: funke.de

Key Highlights: FUNKE Wärmeaustauscher Apparatebau GmbH is a leading specialist in the development and production of heat exchangers for industrial use. Find out more now!…

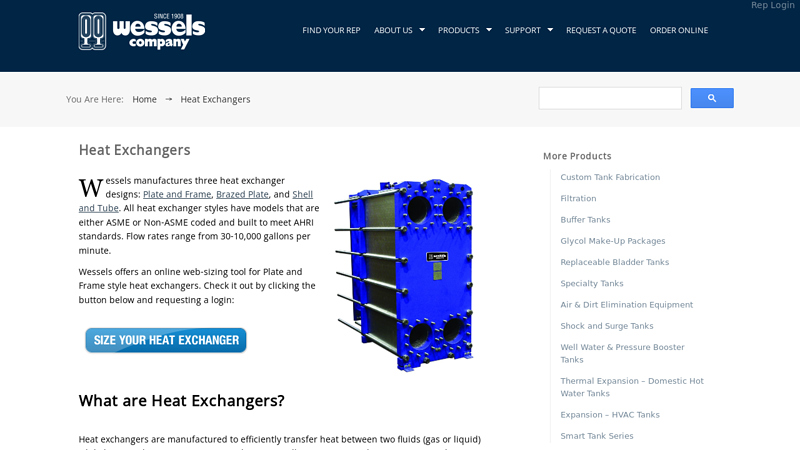

#9 Heat Exchangers

Domain Est. 1997

Website: westank.com

Key Highlights: Wessels manufactures three heat exchanger designs: Plate and Frame, Brazed Plate, and Shell and Tube. All heat exchanger styles have models that are either ……

#10 Comprehensive portfolio of plate heat exchangers

Domain Est. 2002

Website: alfalaval.us

Key Highlights: We offer the market’s most comprehensive portfolio of plate heat exchangers to cover the widest range of needs….

Expert Sourcing Insights for Heat Exchanger Plate

H2: Market Trends in Heat Exchanger Plates for 2026

The global heat exchanger plate market is poised for significant transformation by 2026, driven by technological innovation, regulatory shifts, and evolving industrial demands. Key trends shaping the market include the rising emphasis on energy efficiency, expansion in renewable energy infrastructure, advancements in materials science, and the growing adoption of compact heat exchangers across various sectors.

-

Increasing Demand for Energy Efficiency

With global energy costs rising and sustainability becoming a strategic priority, industries are increasingly adopting high-efficiency heat exchanger plates to optimize thermal performance. Regulatory mandates, particularly in the EU and North America, are pushing for reduced carbon emissions, prompting manufacturers in HVAC, power generation, and process industries to upgrade to more efficient plate heat exchangers (PHEs). This trend is expected to drive demand for advanced plate designs with improved heat transfer coefficients and lower pressure drops. -

Growth in Renewable Energy and District Heating

The expansion of renewable energy systems—such as geothermal, solar thermal, and heat pump technologies—is creating new applications for heat exchanger plates. In district heating networks, especially in urban and cold-climate regions, PHEs are critical for transferring heat efficiently between primary and secondary circuits. As cities invest in smart and sustainable heating solutions, the market for brazed and gasketed plate heat exchangers is projected to grow steadily through 2026. -

Material Innovation and Corrosion Resistance

Stainless steel remains dominant, but there is a growing shift toward high-performance alloys (e.g., titanium, super austenitic steels) and coated plates to handle aggressive media and extend service life. Manufacturers are investing in surface treatments and nano-coatings to enhance thermal conductivity and reduce fouling, which lowers maintenance costs and improves operational uptime—key selling points for end-users in chemical processing, food & beverage, and marine industries. -

Digitalization and Smart Monitoring Integration

By 2026, smart heat exchangers equipped with IoT sensors and predictive analytics are expected to gain traction. Real-time monitoring of temperature, pressure, flow rates, and fouling levels allows for proactive maintenance and optimization of performance. OEMs are partnering with digital solution providers to offer integrated platforms, enhancing the value proposition of plate heat exchangers in Industry 4.0 environments. -

Regional Market Dynamics

Asia-Pacific is anticipated to lead market growth, fueled by rapid industrialization, urbanization, and investments in infrastructure in countries like China, India, and Vietnam. Europe maintains a strong presence due to stringent energy efficiency regulations and the push for decarbonization. North America is seeing steady growth, particularly in the oil & gas sector’s transition to cleaner operations and in data center cooling applications. -

Sustainability and Circular Economy Practices

Recyclability of materials and modular design for easy disassembly are becoming important differentiators. Leading manufacturers are adopting eco-design principles and offering refurbishment services to support circular economy goals—aligning with ESG (Environmental, Social, and Governance) criteria increasingly demanded by corporate clients.

In summary, the 2026 heat exchanger plate market will be characterized by innovation in materials and design, digital integration, and strong alignment with global sustainability objectives. Companies that invest in R&D, energy-efficient solutions, and smart technologies are likely to gain competitive advantage in this evolving landscape.

H2: Common Pitfalls in Sourcing Heat Exchanger Plates (Quality & Intellectual Property)

Sourcing heat exchanger plates involves significant technical and legal considerations, particularly regarding quality consistency and intellectual property (IP) protection. Failing to address these can lead to performance failures, safety risks, and legal disputes. Here are key pitfalls to avoid:

1. Compromised Material Quality and Certification

- Pitfall: Accepting plates made from substandard or non-specified materials (e.g., incorrect stainless steel grade like 304 instead of 316L or titanium) without proper mill test certificates (MTCs) or material traceability.

- Risk: Reduced corrosion resistance, shorter lifespan, leaks, and system contamination.

- Best Practice: Require full material certifications (EN 10204 3.1 or 3.2), third-party material testing reports, and ensure alloy composition matches design specifications.

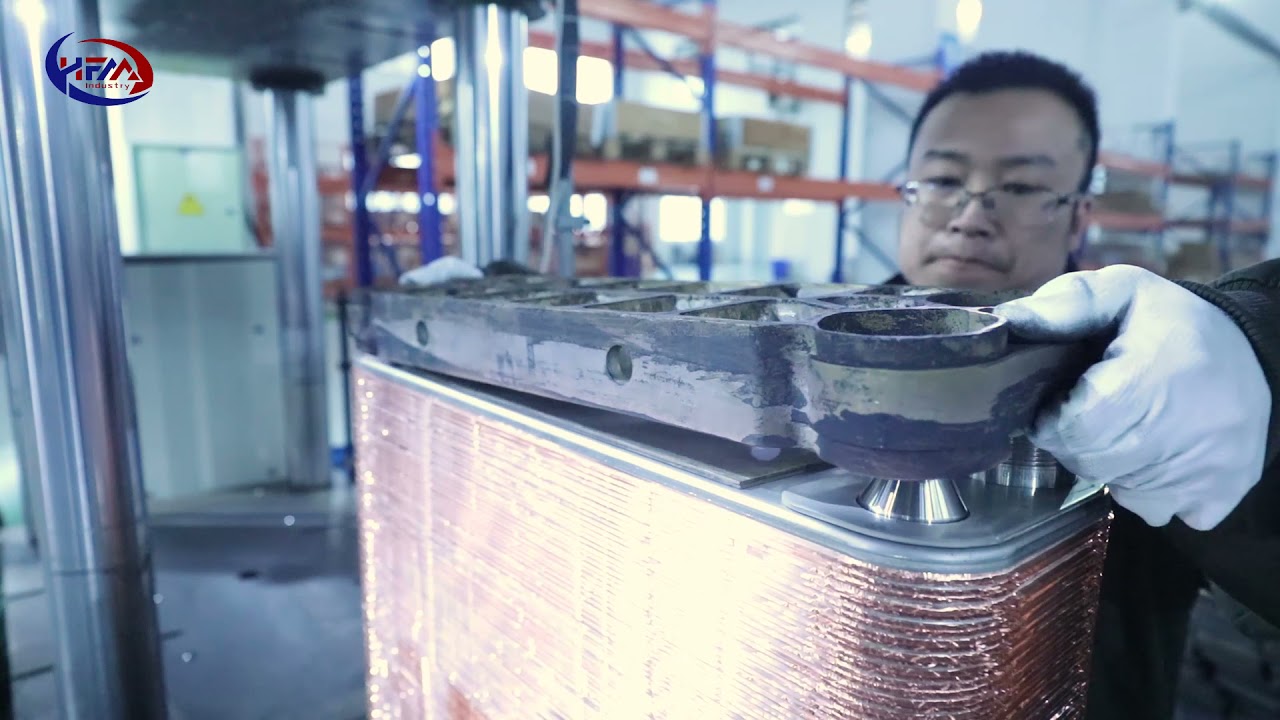

2. Inconsistent Plate Geometry and Surface Finish

- Pitfall: Tolerances in embossing depth, plate thickness, or gasket groove dimensions exceeding acceptable limits due to poor tooling or manufacturing controls.

- Risk: Poor thermal efficiency, flow maldistribution, increased pressure drop, and gasket leakage.

- Best Practice: Enforce strict dimensional tolerances (per EN 13779 or supplier-specific standards), conduct first-article inspections, and verify surface roughness (Ra value) for optimal heat transfer.

3. Unauthorized Reverse Engineering and IP Infringement

- Pitfall: Sourcing “compatible” or “generic” plates that replicate patented plate designs (e.g., chevron angles, port configurations) without licensing.

- Risk: Legal action for patent or design infringement, voided warranties, and potential liability for end-user equipment failure.

- Best Practice: Verify supplier IP rights; source from OEMs or licensed partners. Avoid suppliers offering “exact matches” for proprietary designs unless legally authorized.

4. Lack of Traceability and Documentation

- Pitfall: Inadequate batch/lot traceability, missing heat numbers, or incomplete quality control records.

- Risk: Inability to perform root cause analysis during failures, non-compliance with regulatory standards (e.g., ASME, PED), and supply chain opacity.

- Best Practice: Require full documentation with each shipment, including heat numbers, inspection reports, and compliance certificates.

5. Gasket Compatibility and Bonding Issues

- Pitfall: Using incorrect gasket materials (e.g., NBR instead of EPDM or FKM) or poor bonding techniques (glue vs. clip-in).

- Risk: Premature gasket failure, chemical incompatibility, leaks, and downtime.

- Best Practice: Specify gasket material per fluid compatibility charts, verify bonding method, and ensure gasket geometry matches plate grooves.

6. Insufficient Testing and Quality Assurance

- Pitfall: Relying solely on supplier claims without independent verification of pressure, leakage, or dimensional testing.

- Risk: Undetected manufacturing defects leading to in-field failures.

- Best Practice: Include mandatory factory acceptance tests (FAT), hydrostatic pressure testing (e.g., 1.5x operating pressure), and random sampling for quality audits.

7. OEM Warranty and Support Limitations

- Pitfall: Using non-OEM plates voids equipment manufacturer warranties and limits technical support.

- Risk: Costly repairs or replacements not covered; lack of performance guarantees.

- Best Practice: Clarify warranty terms with both equipment OEM and plate supplier; consider total cost of ownership, not just upfront price.

By proactively addressing these quality and IP-related pitfalls, buyers can ensure reliable performance, regulatory compliance, and legal safety in their heat exchanger plate sourcing strategy.

Logistics & Compliance Guide for Heat Exchanger Plates

Overview and Importance

Heat exchanger plates are critical components in thermal systems across industries such as HVAC, refrigeration, power generation, and chemical processing. Due to their material composition, sensitivity to handling, and international usage, proper logistics and regulatory compliance are essential to ensure product integrity, safety, and adherence to trade laws.

Packaging and Handling Requirements

Heat exchanger plates are typically made from stainless steel, titanium, or specialty alloys and are prone to surface damage, corrosion, and deformation. Proper packaging and handling are crucial:

– Protective Packaging: Use anti-corrosion VCI (Vapor Corrosion Inhibitor) paper or film, and place plates in rigid wooden or metal crates with internal padding (foam or cardboard dividers) to prevent contact and scratching.

– Moisture Control: Include desiccants in packaging to prevent moisture accumulation during transit, especially for ocean shipments.

– Labeling: Clearly label packages with “Fragile,” “This Side Up,” and material specifications (e.g., “AISI 316L Stainless Steel”). Include handling instructions and batch/lot numbers for traceability.

– Stacking and Palletizing: Secure plates on pallets using stretch wrap and corner boards. Avoid stacking excessive weight on top of packaged plates.

Transportation and Shipping

Transportation methods must ensure product safety and compliance with carrier regulations:

– Mode of Transport: Air freight is preferred for urgent or high-value shipments; sea freight is cost-effective for bulk orders. Road transport is common for regional deliveries.

– Environmental Conditions: Avoid exposure to extreme temperatures, humidity, or corrosive environments. Use climate-controlled containers for sensitive alloys.

– Customs Documentation: Provide accurate commercial invoices, packing lists, and bills of lading. Include HS (Harmonized System) code 8419.89 (parts of heat exchangers) for international shipments.

– Insurance: Ensure full cargo insurance is in place, covering damage, loss, and delays.

Regulatory and Compliance Standards

Compliance with international and regional regulations is mandatory:

– Material Compliance: Confirm plates meet material standards such as ASTM, EN, or ISO specifications (e.g., ASTM A240 for stainless steel). Provide Material Test Certificates (MTCs) upon request.

– REACH and RoHS (EU): Verify that materials do not contain restricted substances. Provide declarations of compliance for shipments to the European Union.

– PED (Pressure Equipment Directive 2014/68/EU): If plates are part of pressure-bearing equipment, ensure compliance with CE marking requirements and involve a Notified Body if applicable.

– ASME Certification (USA): For use in pressure systems in North America, plates may require ASME certification or traceability to certified materials (e.g., U Stamp).

– Export Controls: Check if plates or their materials are subject to export restrictions (e.g., EAR for dual-use items). Titanium and certain nickel alloys may require export licenses.

Import and Customs Clearance

Smooth customs clearance depends on accurate documentation and classification:

– HS Code Classification: Use correct tariff codes—typically 8419.89.00 for plate heat exchanger parts. Confirm with local customs authorities.

– Country-Specific Requirements: Some countries require pre-shipment inspections (e.g., SONCAP for Nigeria, CoC for Saudi Arabia).

– Duties and Taxes: Calculate import duties, VAT, or GST based on the destination country’s tariff schedule. Leverage free trade agreements where applicable.

– Customs Broker: Engage a licensed customs broker to handle documentation and ensure compliance with import regulations.

Storage and Inventory Management

Proper storage maintains plate quality before installation:

– Indoor Storage: Store in a dry, temperature-controlled environment away from direct sunlight and corrosive agents.

– Horizontal Positioning: Keep plates flat on racks to prevent warping. Avoid leaning or vertical stacking without support.

– Inventory Tracking: Use a traceability system (e.g., barcode or RFID) linked to batch numbers, material certifications, and compliance documents.

Environmental and Safety Considerations

- Hazardous Materials: While most plates are inert, cleaning residues or protective coatings may require proper disposal per local environmental regulations.

- Handling Safety: Provide PPE (gloves, safety glasses) during handling due to sharp edges. Train personnel on safe lifting procedures to prevent injuries.

Summary

Effective logistics and compliance for heat exchanger plates require attention to packaging, transportation, regulatory standards, and documentation. By adhering to this guide, manufacturers and distributors can minimize risks, ensure product quality, and achieve seamless global delivery.

Conclusion for Sourcing Heat Exchanger Plates

In conclusion, the successful sourcing of heat exchanger plates requires a comprehensive evaluation of technical specifications, material compatibility, supplier reliability, cost-effectiveness, and long-term performance requirements. Selecting the appropriate plate material—such as stainless steel, titanium, or alloys—based on the operating environment, fluid types, temperature, and pressure ensures durability and optimal heat transfer efficiency. Partnering with reputable suppliers who adhere to international quality standards (e.g., ASME, ISO, or PED) enhances product reliability and traceability. Additionally, considering total cost of ownership—not just initial procurement cost—helps in making a sustainable and economically sound decision. By balancing performance, quality, and supply chain consistency, organizations can secure heat exchanger plates that support efficient, safe, and long-lasting thermal systems.