The global HDMI to DVI adapter market is experiencing steady growth, driven by increasing demand for seamless digital connectivity across consumer electronics, enterprise computing, and display technologies. According to a report by Grand View Research, the global HDMI cable and adapter market was valued at USD 8.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. This growth is supported by the widespread adoption of high-resolution displays, continued use of legacy DVI-equipped systems in enterprise and industrial environments, and the need for reliable signal translation solutions. As organizations and end-users navigate hybrid display ecosystems, demand for high-quality, low-latency HDMI to DVI adapters has intensified. This has led to the emergence of several manufacturers specializing in precision-engineered connectivity solutions. Based on market presence, product reliability, customer reviews, and technical specifications, the following four companies have distinguished themselves as leading HDMI to DVI adapter manufacturers in a competitive and evolving landscape.

Top 4 Hdmi Dvi Adapter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HDMI to DVI Adapter

Domain Est. 1995

Website: aten.com

Key Highlights: The 2A-128G HDMI to DVI Converter is a bi-directional converter that allows you to connect an DVI display to a device with a HDMI display output….

#2 DVI Adapter, DVI

Domain Est. 1996

Website: l-com.com

Key Highlights: This fully molded adapter provides transition from a DVI to HDMI interfaces. Compact in size, this adapter is very useful in dealing with difficult ……

#3 HDMI to DVI Adapter Cable, 6

Domain Est. 1996

#4 HDMI to DVI

Domain Est. 1998

Website: startech.com

Key Highlights: In stock Rating 4.5 (102) Designed and constructed to provide a dependable HDMI to DVI connection, this high quality adapter is backed by StarTech.com’s Lifetime Warranty….

Expert Sourcing Insights for Hdmi Dvi Adapter

H2: HDMI to DVI Adapter Market Trends in 2026

As we approach 2026, the HDMI to DVI adapter market continues to reflect a niche yet enduring demand, shaped by legacy system integration, professional applications, and evolving digital connectivity standards. While newer technologies like DisplayPort, USB-C, and wireless display solutions dominate modern AV ecosystems, HDMI to DVI adapters maintain relevance in specific industrial, commercial, and educational environments.

-

Declining Consumer Demand, Steady Niche Use

Consumer demand for HDMI to DVI adapters is on a gradual decline due to the phasing out of DVI-equipped devices in favor of HDMI and DisplayPort in modern laptops, monitors, and gaming consoles. However, demand persists in legacy infrastructure settings—such as corporate offices, educational institutions, and medical imaging systems—where older DVI monitors or projectors remain in use. This ensures steady but limited market growth. -

Price Stabilization and Commoditization

By 2026, HDMI to DVI adapters have become highly commoditized. Most products are low-cost, often priced under $15, with minimal differentiation between brands. Manufacturers focus on cost efficiency, plug-and-play functionality, and durability rather than innovation. As a result, profit margins remain thin, and competition is primarily driven by distribution reach and online retail presence. -

Shift Toward Active and Bi-Directional Adapters

While passive HDMI to DVI adapters suffice for basic video transmission (since HDMI and DVI share the same TMDS signaling standard), there is a growing preference for active and bi-directional models, especially in professional AV setups. These adapters support signal conversion in both directions and ensure compatibility across mixed-device environments, enhancing their utility in hybrid workspaces. -

Integration with Multi-Port Docking Stations

Rather than being sold as standalone accessories, HDMI to DVI adapters are increasingly integrated into multi-function docking stations and video switchers. This bundling trend reflects user demand for consolidated connectivity solutions, especially in enterprise IT deployments managing hybrid setups with legacy and modern displays. -

Environmental and Regulatory Pressures

Sustainability regulations in regions like the EU and North America are pushing manufacturers to reduce e-waste. This has led to improved product longevity, recyclable packaging, and modular designs. Some vendors now offer repairable or upgradable adapters, aligning with circular economy principles. -

Regional Market Dynamics

Asia-Pacific, particularly China and India, remains a key manufacturing and consumption hub due to the abundance of legacy industrial equipment and cost-sensitive procurement practices. In contrast, North America and Western Europe see reduced adoption but maintain demand in specialized sectors such as healthcare, defense, and broadcast engineering. -

Threat from Wireless and Cloud-Based Display Solutions

The rise of wireless screen mirroring (e.g., Miracast, AirPlay, and Google Cast) poses a long-term challenge to physical adapters. While HDMI to DVI adapters are still preferred for low-latency, high-reliability applications, their role is increasingly supplemental rather than primary.

Conclusion

By 2026, the HDMI to DVI adapter market is characterized by maturity, commoditization, and sustained but limited demand. While innovation in this segment is minimal, the adapter remains a critical bridge for organizations managing technology transitions. The future of the market lies not in growth but in adaptation—supporting legacy systems while gradually giving way to next-generation digital interfaces.

H2. Common Pitfalls When Sourcing HDMI to DVI Adapters (Quality and Intellectual Property)

-

Compromised Build Quality

Many low-cost HDMI to DVI adapters suffer from poor construction, including flimsy connectors, thin shielding, and substandard internal circuitry. This can lead to intermittent signal loss, flickering displays, or complete failure over time. Sourcing from unverified suppliers increases the risk of receiving adapters with inadequate materials or poor soldering. -

Signal Integrity Issues

Not all adapters properly handle signal conversion or pass-through. HDMI and DVI share similar digital video standards (especially DVI-D), but improper impedance matching or lack of signal buffering in cheap adapters can degrade video quality—resulting in artifacts, color distortion, or resolution limitations. -

Misleading Product Descriptions

Some suppliers advertise adapters as “HDMI to DVI” without specifying whether they support DVI-D (digital), DVI-A (analog), or DVI-I (integrated). This can lead to incompatibility, especially if the source or display requires analog signals. Additionally, claims of “4K support” may not be accurate if the adapter lacks the necessary bandwidth. -

Lack of Electromagnetic Interference (EMI) Shielding

Low-quality adapters often omit proper shielding, making them susceptible to electromagnetic interference. This can disrupt video output and affect nearby devices, especially in environments with multiple electronic systems. -

Intellectual Property (IP) Concerns

Some manufacturers may incorporate HDMI or DVI interface designs that infringe on licensed technologies. HDMI Licensing Administrator, Inc. requires certification and royalties for compliant products. Unlicensed adapters may avoid these fees by cloning designs, exposing buyers—especially businesses—to potential IP risks or compliance violations. -

Missing or Fake HDMI Certification

Authentic HDMI adapters should carry HDMI certification, ensuring compliance with interoperability and performance standards. Counterfeit or uncertified adapters may mimic logos and packaging but fail to meet specifications, leading to reliability issues and lack of support. -

Inadequate Supplier Vetting

Purchasing from unknown or third-party marketplaces increases exposure to counterfeit products. Reliable sourcing requires due diligence, including checking supplier reputation, certifications, and customer feedback. -

No Warranty or Technical Support

Many low-quality adapters come without warranty or manufacturer support. If issues arise, replacements or troubleshooting assistance may not be available, increasing long-term costs and downtime.

To mitigate these risks, buyers should source HDMI to DVI adapters from reputable, certified suppliers and verify product specifications, certifications, and compliance with HDMI licensing standards.

Logistics & Compliance Guide for HDMI to DVI Adapter

Product Overview

The HDMI to DVI Adapter is a passive device that facilitates video signal transmission between HDMI and DVI interfaces. It supports digital video signals up to 1080p and is commonly used to connect devices such as laptops, gaming consoles, and media players to monitors or projectors. This guide outlines essential logistics and compliance considerations for manufacturers, distributors, and retailers.

Regulatory Compliance Requirements

Electromagnetic Compatibility (EMC)

The adapter must comply with EMC regulations to prevent interference with other electronic devices. Key standards include:

– FCC Part 15 (USA): Must meet Class B limits for unintentional radiators.

– CE Marking (EU): Compliance with the EMC Directive 2014/30/EU and RoHS Directive 2011/65/EU is mandatory.

– ISED Canada (formerly IC): Must adhere to ICES-003 for digital devices.

Electrical Safety

While low-voltage adapters typically do not require full safety certification, they should align with general safety principles:

– Follow relevant clauses in IEC/UL 62368-1 (Audio/Video, Information and Communication Technology Equipment).

– Avoid designs that could overheat or pose electrical hazards.

Restriction of Hazardous Substances (RoHS)

– Comply with EU RoHS, restricting lead, mercury, cadmium, hexavalent chromium, PBB, and PBDE.

– Provide a Declaration of Conformity and maintain material disclosure records.

Reach & Chemical Compliance

– Ensure compliance with REACH (EC 1907/2006), particularly SVHC (Substances of Very High Concern) disclosure.

– Avoid restricted phthalates and other harmful substances in plastic housing.

Labeling and Packaging Requirements

Mandatory Markings

– CE mark (for EU), FCC ID or statement (for USA), IC ID (for Canada) if applicable.

– Manufacturer or importer name and address.

– Model number and batch/lot identification.

– RoHS compliance symbol (e.g., “RoHS compliant” or “Lead-Free”).

User Documentation

– Include multilingual quick-start guide with safety warnings and compatibility information.

– Specify supported resolutions (e.g., 1080p@60Hz) and limitations (audio not supported).

Import & Customs Considerations

HS Code Classification

– Typical HS Code: 8544.42 (Electrical conductors for wired telecommunications, including adapters).

– Confirm local classification; some jurisdictions may use 8517.62 (connectors for electronic devices).

Duty and Tariff Implications

– Duty rates vary by country; verify under Free Trade Agreements (e.g., USMCA, RCEP).

– Maintain accurate commercial invoices and packing lists for customs clearance.

Country-Specific Regulations

– UK: UKCA marking required for Great Britain; Northern Ireland follows CE rules.

– China: CCC certification generally not required for passive adapters, but verify with local authorities.

– Australia/New Zealand: Must comply with EMC Framework (C-Tick/RCM mark).

Logistics & Supply Chain Best Practices

Packaging Standards

– Use anti-static packaging to protect sensitive components.

– Ensure packaging is durable for shipping and complies with environmental regulations (e.g., recyclable materials).

Storage Conditions

– Store in a dry, temperature-controlled environment (10°C to 30°C recommended).

– Avoid exposure to direct sunlight and high humidity.

Shipping & Handling

– Classify as “non-hazardous” for air and ground freight (IATA/ADR not applicable).

– Label cartons with handling instructions (e.g., “Fragile,” “Do Not Stack”).

Quality Assurance & Documentation

Certification & Testing

– Conduct pre-compliance EMC and signal integrity testing.

– Retain test reports from accredited labs (e.g., TÜV, SGS, Intertek).

Technical Files & DoC

– Maintain a full technical construction file per EU requirements.

– Issue a Declaration of Conformity for each market (EU, UK, USA, etc.).

Post-Market Surveillance

– Monitor for customer complaints and field failures.

– Implement a corrective action process for non-conforming products.

By adhering to this guide, stakeholders can ensure that HDMI to DVI adapters meet global logistics and compliance standards, minimizing regulatory risks and facilitating smooth market access.

Conclusion:

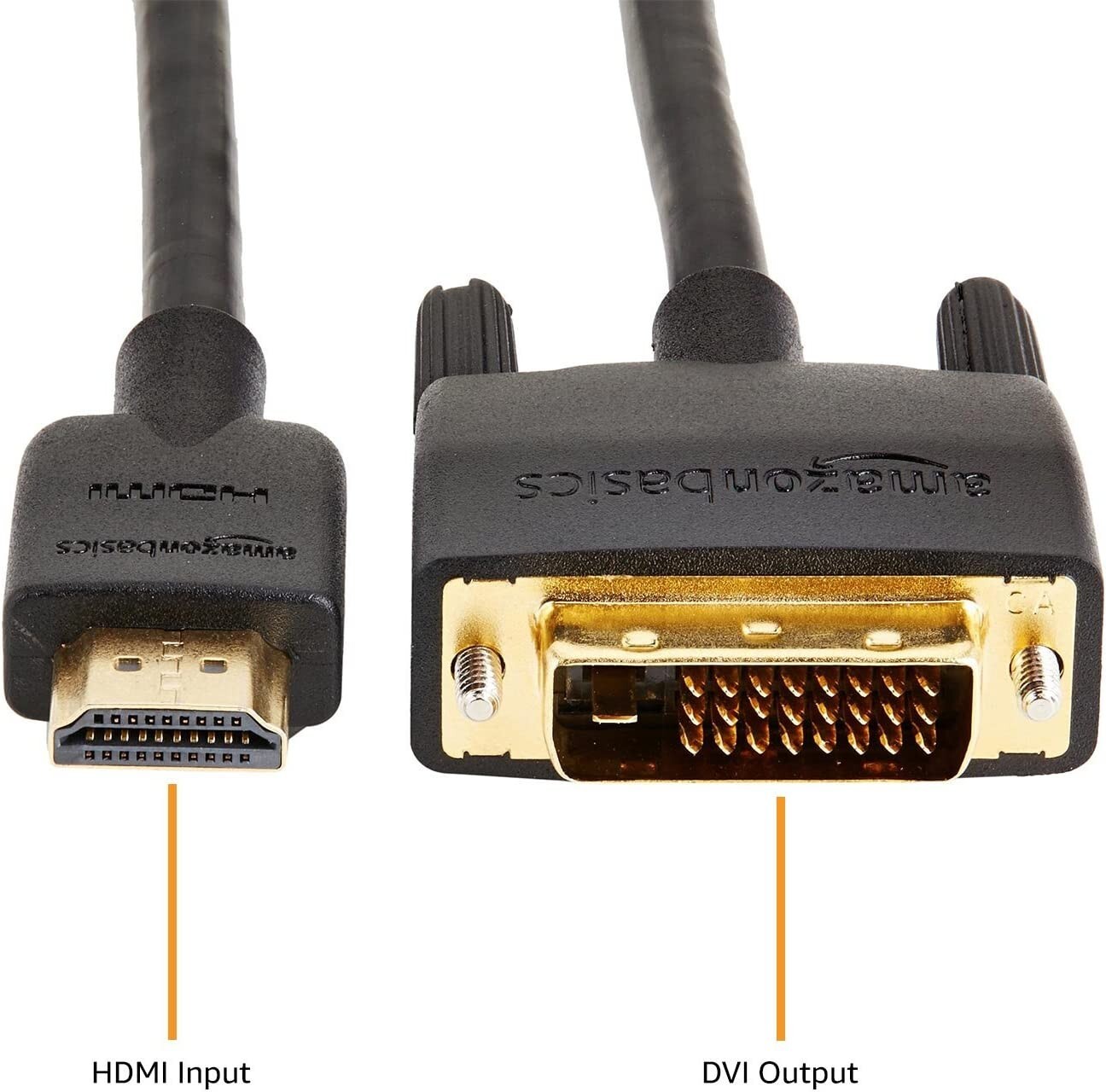

After evaluating various options for sourcing an HDMI to DVI adapter, it is clear that compatibility, build quality, and seller reliability are key factors in making a successful purchase. These adapters are widely available through online retailers such as Amazon, eBay, and specialized electronics suppliers, often at competitive prices. When selecting an adapter, it is essential to confirm whether the HDMI source device supports dual-link output (for higher resolutions) and whether the adapter is HDMI to DVI-D (digital only) or supports DVI-I (digital and analog). Passive adapters are usually sufficient since HDMI and DVI share the same digital video standard (TMDS), but signal integrity can vary based on cable quality and adapter construction.

Purchasing from reputable brands or sellers with positive customer reviews helps ensure reliability and longevity. Additionally, considering return policies and warranty options provides added assurance. Overall, sourcing an HDMI to DVI adapter is a straightforward process, and with careful attention to specifications and vendor credibility, users can achieve seamless connectivity between devices without significant cost or technical difficulty.