The global fasteners market, driven by robust demand from automotive, construction, and industrial equipment sectors, is projected to grow at a CAGR of 5.8% from 2023 to 2028, according to Mordor Intelligence. Within this expanding landscape, hardware nuts—a critical subset of threaded fasteners—play an indispensable role in structural integrity and assembly reliability across high-performance applications. With increasing industrial automation and infrastructure development, especially in Asia-Pacific and North America, the demand for precision-engineered, high-strength nuts has surged. This growth is further amplified by stringent quality standards in aerospace and defense, where material durability and compliance are non-negotiable. As supply chains prioritize reliability and scalability, identifying leading manufacturers who combine innovation, global reach, and consistent quality becomes essential. Based on production capacity, market presence, material expertise, and compliance certifications, the following list highlights the top 10 hardware nut manufacturers shaping the future of the fastening industry.

Top 10 Hardware Nut Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dayton Nut & Bolt

Domain Est. 2001

Website: daytonnutandbolt.com

Key Highlights: Dayton Nut and Bolt, a division of Forte Fasteners, Inc., is an industrial distributor of standard fasteners and made-to-print components to original equipment ……

#2 HARDLOCK Nut

Domain Est. 2023

Website: hardlock-nut.com

Key Highlights: HARDLOCK Industry Co., ltd. is the authentic manufacturer and distributor of loosening prevention measures such as HARDLOCK Nut with over 40 years of use….

#3 OEM Speciality Nuts & Bolts Made in USA

Domain Est. 1995

Website: wyandotte.com

Key Highlights: Choose American-made nuts and bolts for unmatched strength and precision. Specialty fasteners and CNC parts built in the USA. Get a quote today!…

#4 Airfasco – AN

Domain Est. 1997

Website: airfasco.com

Key Highlights: Over the years Airfasco has expanded and manufactures NAS, MS and NASM fasteners including pins, screws and nuts. Airfasco is now launching new FAA-PMA product ……

#5 Custom Fasteners Manufacturer

Domain Est. 1999

Website: nationalbolt.com

Key Highlights: National Bolt and Nut Corporation is a ISO Certified Nationwide custom fasteners manufacturer of nuts, washers, bolts and fasteners. Contact us today!…

#6 U

Domain Est. 1999

Website: uboltit.com

Key Highlights: At U-Bolt-It, we custom manufacture bolts and fasteners made to meet all your requirements and in all materials from stainless steel and exotic materials….

#7 Midwest Fastener

Domain Est. 2000

Website: fastenerconnection.com

Key Highlights: Midwest Fastener is a fastener supplier and fastener manufacturer offering construction fasteners, drywall screws, and much, much more….

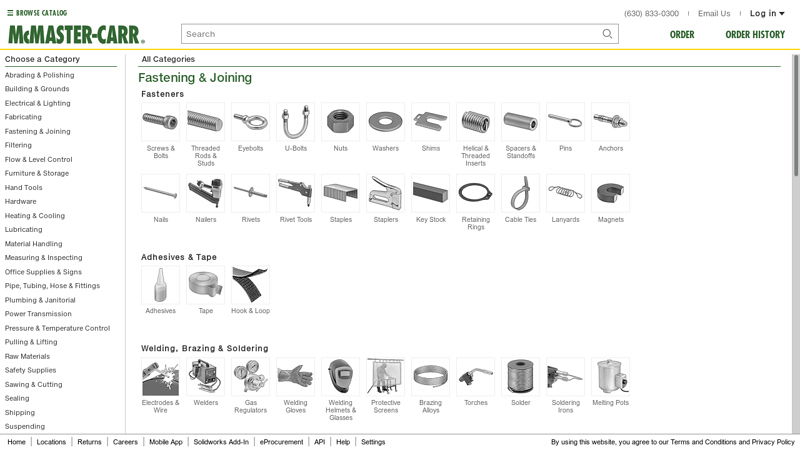

#8 McMaster

Domain Est. 1994

Website: mcmaster.com

Key Highlights: McMaster-Carr is the complete source for your plant with over 700000 products. 98% of products ordered ship from stock and deliver same or next day….

#9 PEM – PennEngineering

Domain Est. 1996

Website: pemnet.com

Key Highlights: PEM offers innovative fastening solutions for a variety of applications across industries like Automotive Electronics, Consumer Electronics, Datacom and more….

#10 Copper State

Domain Est. 1996

Website: copperstate.com

Key Highlights: Our ISO 9001:2015 by TUV Rheinland of North America certified manufacturing facility specializes in large diameter bolts and custom fasteners. If you have ……

Expert Sourcing Insights for Hardware Nut

H2 2026 Market Trends Analysis for Hardware Nuts

As the global industrial and manufacturing sectors continue to evolve, the hardware nut market is poised for significant transformation in the second half of 2026. Driven by advancements in materials science, automation, sustainability mandates, and shifting supply chain dynamics, several key trends are shaping the demand, production, and innovation landscape for hardware nuts.

1. Increased Demand from Electric Vehicles (EVs) and Renewable Energy Sectors

The rapid expansion of the electric vehicle (EV) market and renewable energy infrastructure (particularly wind and solar power) is a major growth driver. Lightweight, high-strength nuts made from advanced alloys—such as aerospace-grade aluminum, titanium, and stainless steel—are in rising demand for EV battery enclosures, motor assemblies, and turbine installations. OEMs are increasingly specifying corrosion-resistant and high-tolerance fasteners, pushing nut manufacturers to adopt precision engineering and tighter quality controls.

2. Adoption of Smart Fasteners and IoT Integration

A notable innovation trend is the emergence of “smart nuts” embedded with sensors to monitor torque, tension, temperature, and structural stress in real time. These intelligent fasteners are gaining traction in aerospace, construction, and industrial machinery applications. By H2 2026, major infrastructure and transportation projects are expected to integrate IoT-connected nuts for predictive maintenance and structural health monitoring, improving safety and reducing downtime.

3. Sustainability and Circular Economy Pressures

Environmental regulations and corporate ESG (Environmental, Social, Governance) commitments are pushing manufacturers toward sustainable practices. Recyclable materials, reduced carbon footprint in production (e.g., using green steel), and optimized logistics are becoming competitive differentiators. Additionally, modular and reusable nut designs are being adopted in temporary construction and event infrastructure to support circular economy models.

4. Reshoring and Supply Chain Diversification

Geopolitical instability and trade tensions continue to influence supply chain strategies. In H2 2026, many manufacturers in North America and Europe are shifting toward regional sourcing and nearshoring to reduce dependency on single-supply markets, particularly from Asia. This is creating opportunities for local nut producers to expand capacity and invest in automation to remain cost-competitive.

5. Automation and Digital Manufacturing

The integration of AI-driven quality inspection, robotic assembly lines, and digital twin technologies is transforming nut production. By mid-2026, leading hardware manufacturers are leveraging Industry 4.0 tools to enhance precision, reduce waste, and scale custom orders efficiently. Digital platforms are also enabling B2B customers to configure and order specialized nuts online with real-time pricing and delivery tracking.

6. Growth in Customization and High-Performance Applications

As engineering requirements become more complex, demand for customized nuts—such as flange nuts, serrated flange nuts, and specialty thread forms—is increasing. Sectors like robotics, medical devices, and defense are driving innovation in miniaturized and ultra-high-strength fasteners. Coatings such as PTFE, Dacromet, and ceramic are being used to enhance performance under extreme conditions.

Conclusion:

In H2 2026, the hardware nut market is transitioning from a commodity-based industry to a high-value, technology-driven segment. Success will depend on agility in responding to sector-specific demands, investment in smart and sustainable manufacturing, and strategic positioning within resilient supply chains. Companies that embrace innovation and digital transformation are likely to capture significant market share amid growing demand across advanced industries.

Common Pitfalls Sourcing Hardware Nuts (Quality, IP)

Sourcing hardware nuts may seem straightforward, but overlooking key quality and intellectual property (IP) considerations can lead to significant risks, including product failures, recalls, legal disputes, and reputational damage. Here are common pitfalls to avoid:

Poor Material and Manufacturing Quality

Using substandard materials or inadequate manufacturing processes can compromise the structural integrity of nuts. Common issues include incorrect alloy composition, insufficient heat treatment, or poor thread accuracy. These flaws can lead to stripping, galling, or failure under load, especially in critical applications like automotive or aerospace.

Non-Compliance with Industry Standards

Sourcing nuts that don’t meet recognized standards (e.g., ISO, ASTM, DIN, SAE) is a frequent oversight. Nuts that appear visually identical may differ in mechanical properties, thread pitch, or tolerances. Always verify that suppliers provide certification (e.g., mill test reports) confirming compliance with required specifications.

Counterfeit or Gray Market Components

The hardware supply chain is vulnerable to counterfeit or gray market goods. These may be misrepresented as high-grade or certified products but fail to meet performance requirements. Relying on unauthorized distributors or failing to validate supplier authenticity increases this risk.

Inadequate Quality Control and Traceability

Suppliers without robust quality management systems (e.g., ISO 9001) may lack consistent inspection processes or traceability. Without lot traceability, identifying and containing defective batches becomes nearly impossible, complicating root cause analysis and recalls.

Intellectual Property Infringement

Sourcing proprietary nut designs—such as specialized locking mechanisms or patented thread geometries—without proper licensing can lead to IP violations. Even if the nut appears generic, unique features may be protected. Always conduct IP due diligence, especially when reverse engineering or sourcing from low-cost manufacturers.

Misrepresentation of Origin and Certification

Some suppliers may falsify country-of-origin labels or certifications to meet contractual requirements or bypass import restrictions. This not only affects quality assurance but may also violate trade regulations and customer contracts.

Lack of Long-Term Supplier Reliability

Choosing suppliers based solely on price without assessing financial stability, production capacity, or long-term reliability can result in supply disruptions. A reliable supplier should offer consistent quality, scalability, and responsiveness to quality issues.

Avoiding these pitfalls requires due diligence, clear specifications, third-party audits, and strong supplier qualification processes—ensuring both the mechanical performance and legal integrity of sourced hardware nuts.

Logistics & Compliance Guide for Hardware Nut

This guide outlines the essential logistics and compliance practices for Hardware Nut to ensure efficient operations, regulatory adherence, and customer satisfaction across the hardware supply chain.

Supply Chain Management

Establish a reliable network of suppliers, manufacturers, and distributors. Conduct due diligence on all partners to verify product quality, ethical sourcing, and compliance with international trade regulations. Maintain inventory transparency through real-time tracking systems to prevent stockouts and overstocking.

Inventory & Warehouse Operations

Implement a robust warehouse management system (WMS) to track inventory levels, monitor product rotation, and optimize storage. Label all hardware items clearly with SKU numbers, safety classifications, and handling instructions. Conduct regular audits and cycle counts to ensure data accuracy and minimize shrinkage.

Transportation & Distribution

Partner with certified logistics providers experienced in handling industrial and hardware goods. Use appropriate packaging to protect items during transit and comply with carrier-specific requirements. Optimize shipping routes to reduce delivery times and transportation costs while maintaining on-time delivery performance.

Import/Export Compliance

Adhere to all relevant customs regulations when shipping internationally. Ensure accurate classification of hardware products under the Harmonized System (HS) codes. Prepare complete and correct documentation, including commercial invoices, packing lists, and certificates of origin. Stay updated on trade restrictions, tariffs, and sanctions affecting hardware components.

Product Safety & Regulatory Standards

Verify that all hardware products meet applicable safety standards such as ISO, ANSI, CE, or UL, depending on the target market. Maintain records of product testing and certifications. Clearly label products with required safety warnings, usage instructions, and compliance marks.

Environmental & Sustainability Compliance

Comply with environmental regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) for applicable hardware items. Implement recycling programs for packaging and obsolete inventory. Minimize carbon footprint through efficient logistics planning and eco-friendly packaging solutions.

Recordkeeping & Audit Preparedness

Maintain comprehensive records of all logistics and compliance activities for a minimum of seven years. This includes shipping logs, customs documentation, safety certifications, and supplier agreements. Conduct internal audits annually to identify gaps and ensure ongoing compliance.

Training & Continuous Improvement

Provide regular training for staff on compliance updates, safety protocols, and logistics best practices. Establish a feedback loop with customers and partners to identify areas for improvement. Continuously refine processes to adapt to regulatory changes and evolving industry standards.

Conclusion for Sourcing Hardware Nuts:

In conclusion, the successful sourcing of hardware nuts requires a strategic approach that balances quality, cost, supply chain reliability, and compliance with industry standards. Selecting the right material, size, grade, and finish based on the application ensures performance and durability. Evaluating suppliers on certifications, production capabilities, and track record helps mitigate risks related to quality and delivery. Additionally, considering total cost of ownership—rather than just unit price—leads to more sustainable and efficient procurement decisions. By leveraging strong supplier relationships, implementing effective quality control measures, and staying informed about market trends, organizations can ensure a consistent supply of reliable fasteners that support the integrity and longevity of their end products.