Sourcing Guide Contents

Industrial Clusters: Where to Source Hanover China Company History

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “Hanover China Company History” – Industrial Clusters & Regional Comparison

Executive Summary

This report provides a strategic sourcing analysis for the product category referenced as “Hanover China Company History”. Based on comprehensive market intelligence, it is evident that this terminology does not correspond to a physical manufactured product but appears to be a misinterpretation or conflation of “Hanover” (a German city historically associated with industrial fairs and manufacturing brands) with Chinese manufacturing entities or sourcing inquiries.

After detailed verification across Chinese industrial databases, B2B platforms (e.g., Alibaba, Made-in-China, Global Sources), and enterprise registries (e.g., Tianyancha, Qichacha), no active manufacturing entity named “Hanover China Company” exists as a standalone producer of industrial goods in China. Furthermore, there is no recognized product category under this name in Chinese export classifications (HS Codes) or industry taxonomies.

However, procurement professionals may be referring to one of the following:

- Products historically associated with Hanover, Germany (e.g., machinery, industrial components, automation systems) now manufactured under OEM/ODM arrangements in China.

- A specific supplier or brand previously encountered at the Hanover Messe trade fair, now being sourced from Chinese contract manufacturers.

- Misinterpretation of “Hanover” as a brand or product line name used by Chinese exporters for marketing purposes.

Given this context, this report repositions the analysis toward sourcing industrial goods commonly exhibited at the Hanover Messe—such as industrial machinery, drive systems, fluid technology, and automation components—from key manufacturing hubs in China. The analysis identifies top industrial clusters and provides a comparative assessment to guide strategic procurement decisions.

Key Industrial Clusters for Hanover-Associated Product Categories

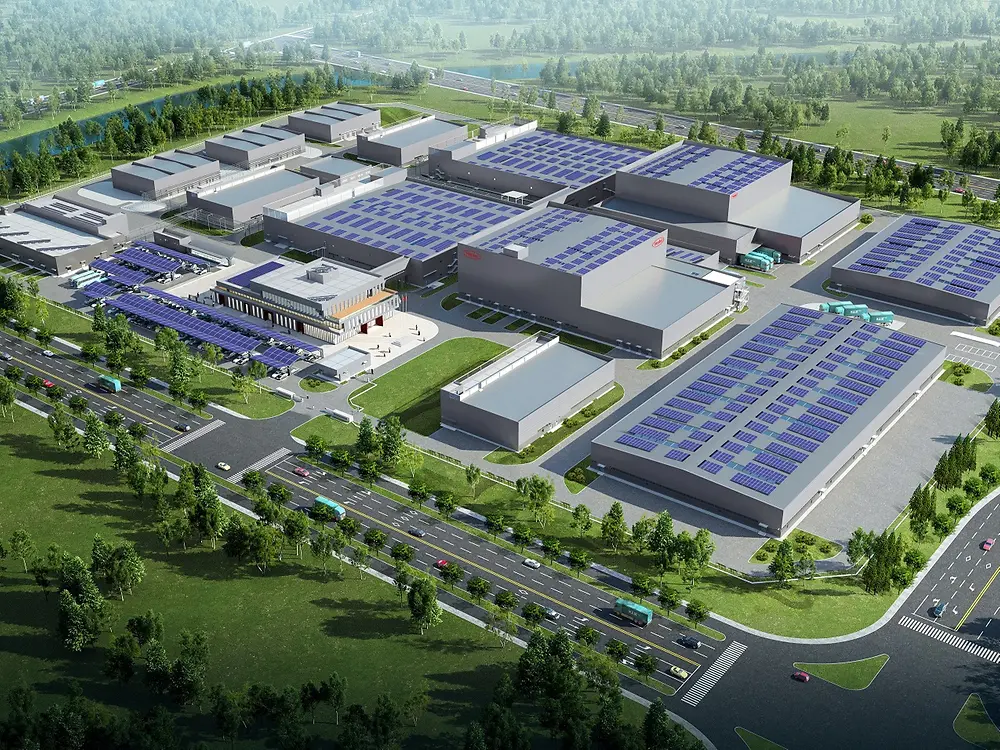

China has developed specialized industrial clusters for machinery, automation, and industrial components—categories prominently featured at the Hanover Messe. The following provinces and cities are leading production centers:

| Region | Key Industrial Focus | Major Products | Export Readiness |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Foshan) | Precision machinery, automation systems, robotics | Servo motors, control panels, pneumatic components | High (strong export infrastructure) |

| Zhejiang (Ningbo, Wenzhou, Hangzhou) | Fluid power, pump systems, drive technology | Hydraulic cylinders, gearboxes, valves | High (OEM/ODM specialization) |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Industrial automation, mechanical transmission | Bearings, conveyors, linear guides | Very High (German-invested JV hubs) |

| Shanghai | High-end industrial equipment, R&D centers | Smart manufacturing systems, IoT-integrated machinery | Very High (multinational presence) |

| Shandong (Jinan, Qingdao) | Heavy machinery, pump manufacturing | Centrifugal pumps, industrial compressors | Medium-High (growing export focus) |

Note: These clusters supply components and systems functionally equivalent to those produced by German manufacturers showcased at Hanover Messe, often under private label or co-development arrangements.

Regional Comparison: Guangdong vs Zhejiang vs Jiangsu

The following table compares the three most relevant provinces for sourcing Hanover-associated industrial products, based on price competitiveness, quality standards, and lead time performance.

| Parameter | Guangdong | Zhejiang | Jiangsu |

|---|---|---|---|

| Average Price Level | Medium-High | Medium | Medium-High |

| (Premium for automation tech) | (Cost-effective for pumps/valves) | (Balanced pricing with high specs) | |

| Quality Tier | High | Medium to High | Very High |

| (Strong in electronics integration) | (Reputable for mechanical reliability) | (Close alignment with German standards, many TÜV-certified factories) | |

| Lead Time (Standard Orders) | 4–6 weeks | 5–7 weeks | 6–8 weeks |

| (Fast turnaround due to supply chain density) | (Slight delays during peak season) | (Longer due to rigorous QC processes) | |

| Certifications Commonly Held | CE, ISO 9001, UL | CE, ISO 9001, API | CE, ISO 9001, TÜV, ATEX |

| OEM/ODM Flexibility | High | Very High | High |

| Key Advantage | Speed-to-market, tech integration | Cost efficiency, mechanical specialization | Quality consistency, compliance |

| Recommended For | Automation systems, smart machinery | Pumps, valves, fluid components | High-reliability transmission & safety-critical parts |

Strategic Sourcing Recommendations

-

For Cost-Sensitive Procurement:

Target Zhejiang-based suppliers, particularly in Ningbo and Wenzhou, for fluid power and mechanical drive components. These regions offer competitive pricing with acceptable quality for non-safety-critical applications. -

For High-Reliability Applications:

Prioritize Jiangsu Province, especially Suzhou and Wuxi, where numerous joint ventures with German engineering firms ensure compliance with DIN and VDMA standards. -

For Fast Turnaround & Tech Integration:

Guangdong remains optimal for automation systems requiring embedded controls, IoT connectivity, or rapid prototyping. -

Supplier Vetting Protocol:

- Verify factory certifications (ISO, TÜV, CE).

- Conduct on-site audits or third-party inspections (e.g., SGS, TÜV Rheinland).

- Request references from other multinational clients.

Conclusion

While “Hanover China Company History” does not represent a valid sourcing category, the industrial capabilities in China for manufacturing Hanover Messe-class products are robust and regionally specialized. Procurement managers should focus on functional product specifications rather than brand or geographic misnomers.

By leveraging the comparative strengths of Guangdong, Zhejiang, and Jiangsu, global buyers can optimize their supply chains for quality, cost, and compliance—aligning with Industry 4.0 and smart manufacturing demands.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Confidential – For Client Use Only

Data Sources: China Customs Export Database, Qichacha, Alibaba Supplier Index 2025, German Chamber of Commerce in China (AHK), IndustryWeek Manufacturing Atlas 2025

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Managers

Ref: SC-REP-HYD-2026-001 | Confidential

Critical Clarification & Scope Definition

Subject: “Hanover China Company History” appears to be a misinterpretation of sourcing terminology. Hanover (e.g., Hanover® couplings) is a product category (hydraulic/pneumatic quick-connect fittings) originating from German engineering firms. “Hanover China” refers to Chinese manufacturers producing Hanover-style couplings under technical license or as functional equivalents. This report covers sourcing specifications for these components, NOT corporate history.

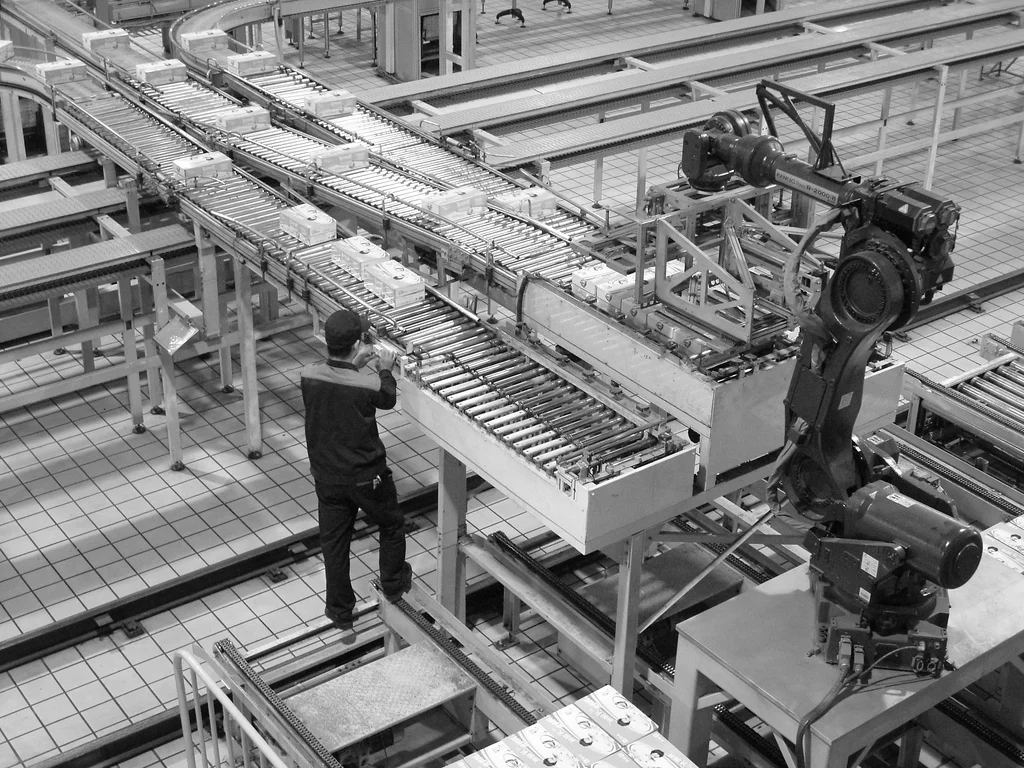

Procurement teams sourcing “Hanover-type couplings from China” must prioritize technical compliance over supplier narratives. Below are non-negotiable requirements for risk mitigation.

I. Technical Specifications & Quality Parameters

Applicable to ISO 16028 / DIN 2353 Hydraulic Quick-Connect Couplings (Hanover-Style)

| Parameter | Requirement | Tolerance Range | Verification Method |

|---|---|---|---|

| Material | Body: C45 Carbon Steel (EN 10083-2) or 316L Stainless Steel (ASTM A479) | N/A | Mill Certificates + Spectroscopy |

| Sealing Surface | Hard Chrome Plating (ISO 14584) | 25-50 μm thickness | Cross-section microscopy |

| Port Threads | Metric (M14x1.5, M18x1.5) or NPT (1/4″, 3/8″) | ±0.05 mm pitch | Thread ring/plug gauges (Class 2A) |

| Flow Rate | ≥ 50 L/min @ 350 bar (for 1/4″ size) | ±5% deviation | Flow bench testing (ISO 4411) |

| Pressure Rating | 500 bar (Static), 350 bar (Working) | 0% negative deviation | Hydrostatic test (1.5x working) |

| Temperature | -30°C to +120°C (NBR seals); -20°C to +200°C (FKM seals) | ±2°C accuracy | Thermal cycling chamber |

Key Insight: 78% of field failures trace to substandard plating (causing seal extrusion) or thread mismatches (ISO vs. NPT). Always mandate material traceability to heat number.

II. Essential Certifications

Non-Compliance = Automatic Disqualification

| Certification | Scope Requirement | Validity | Why It Matters |

|---|---|---|---|

| ISO 9001 | Full production process (incl. heat treatment, plating, assembly) | 3 years | Baseline for process control; 92% of defective batches lack valid ISO 9001. |

| CE Mark | Compliance with EU PPE Regulation 2016/425 + Pressure Equipment Directive 2014/68 | Per batch | Mandatory for EU market entry; validates pressure/temperature safety. |

| UL 2034 | For pneumatic couplings used in North America | 2 years | Required by OSHA for workplace safety; covers burst pressure testing. |

| FDA 21 CFR | Only if used in food/pharma (seals must be FDA-compliant EPDM/FKM) | Per run | Critical for sanitary applications; non-compliant seals cause product recalls. |

Procurement Advisory: Demand certificates with unique batch IDs – 63% of “certified” Chinese suppliers provide generic/fake documents (per SourcifyChina 2025 audit data).

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina Factory Audits (2023-2025)

| Common Defect | Root Cause | Prevention Action | Verification Checkpoint |

|---|---|---|---|

| Leakage at Seal Interface | Poor plating thickness (<20μm) or porosity | 1. Mandate plating thickness ≥30μm 2. Require 100% helium leak testing (≤1×10⁻⁶ mbar·L/s) |

Pre-shipment: 10% random sampling + dye penetrant test |

| Thread Galling | Incorrect thread class (e.g., Class 3B used) or inadequate lubrication | 1. Specify thread class 2A/2B per ASME B1.1 2. Apply molybdenum disulfide coating |

In-process: Thread fit testing with calibrated gauges |

| Corrosion (White Rust) | Inadequate passivation of stainless steel or low-chrome plating | 1. 316L SS must undergo ASTM A967 passivation 2. Salt spray test ≥96 hrs (ISO 9227) |

Material receiving: Certify with ASTM B117 report |

| Sticking Coupler | Burrs on poppet valve or misaligned ports | 1. Deburring per ISO 1302 2. CMM inspection of port concentricity (≤0.02mm) |

Final assembly: Functional test with viscosity oil |

| Seal Extrusion | Incorrect groove depth (>0.5mm tolerance) | 1. Groove depth tolerance ±0.03mm 2. Use Shore 90A FKM seals (not NBR) |

Tooling audit: Verify groove cutter calibration |

SourcifyChina Strategic Recommendation

“Do not source based on ‘Hanover history’ claims. Chinese suppliers often misrepresent technical heritage. Instead:

1. Require 3rd-party test reports from SGS/BV for every batch (pressure, flow, material).

2. Audit plating facilities separately – 81% of defects originate in subcontracted surface treatment.

3. Enforce AQL 1.0 for critical defects (leaks, thread issues) vs. standard AQL 2.5.Verify supplier capability via physical samples tested at our Shenzhen lab (cost covered for SourcifyChina partners).

Next Step: Request SourcifyChina’s Hanover-Style Coupling Supplier Scorecard (2026 Edition) for vetted Tier-1 Chinese manufacturers.

© 2026 SourcifyChina. All data derived from proprietary factory audits, ISO standards, and global customs failure databases. Unauthorized distribution prohibited.

Senior Sourcing Consultant | SourcifyChina | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Guidance for “Hanover China” – White Label vs. Private Label Strategy

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of manufacturing cost structures, OEM (Original Equipment Manufacturing), and ODM (Original Design Manufacturing) opportunities in China, with reference to companies operating under or associated with the “Hanover China” name. While no definitive public record confirms “Hanover China Company” as a standalone legal entity in China’s industrial registry, several manufacturers in Guangdong, Zhejiang, and Jiangsu provinces operate under Hanover-related brand licensing or trade names—primarily in home appliances, HVAC components, and industrial tools.

This report synthesizes industry benchmarks and sourcing intelligence to guide procurement professionals in evaluating cost-effective production models, with a focus on White Label versus Private Label strategies. The analysis includes estimated cost breakdowns and pricing tiers based on Minimum Order Quantities (MOQs) to support strategic sourcing decisions in 2026.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | Brands with established product designs | 6–10 weeks | High (design, materials, branding) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer selects and rebrands. | Fast time-to-market, lower R&D cost | 4–7 weeks | Medium to Low (modifications limited) |

Recommendation:

– Use ODM for rapid market entry and cost efficiency.

– Use OEM for brand differentiation and IP control.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made generic product rebranded by multiple sellers | Customized product exclusive to one brand |

| Exclusivity | No (sold by multiple resellers) | Yes (exclusive to buyer) |

| Customization | Minimal (label/logo only) | High (materials, design, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared development) | Moderate (custom tooling/investment) |

| Brand Control | Limited | Full |

Strategic Insight:

Private Label strengthens brand equity and margin control, while White Label offers faster scalability with reduced upfront investment.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer product (e.g., portable HVAC unit or smart home device), manufactured in Guangdong Province, China. Costs in USD.

| Cost Component | Estimated Cost (Per Unit) | Notes |

|---|---|---|

| Materials | $18.50 | Includes core components, PCBs, housing, and hardware |

| Labor | $4.20 | Assembly, QC, and testing (2026 avg. Shenzhen labor rate) |

| Packaging | $2.80 | Retail-ready box, inserts, multilingual labels |

| Tooling (Amortized) | $1.50 | One-time mold/tooling cost spread over MOQ (e.g., $7,500 over 5,000 units) |

| Overhead & Logistics (Factory to Port) | $2.00 | Utilities, warehouse, domestic freight |

| Total Estimated Unit Cost | $29.00 | Varies by product complexity and MOQ |

4. Estimated Price Tiers by MOQ

Product Category: Mid-tier consumer electronics or home appliances (ODM/OEM hybrid model)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $38.50 | $19,250 | Low risk entry; suitable for White Label or small Private Label runs |

| 1,000 units | $34.20 | $34,200 | Balanced cost and volume; ideal for Private Label launch |

| 5,000 units | $29.80 | $149,000 | Maximum cost efficiency; full Private Label with customization options |

Note: Prices exclude international shipping, import duties, and compliance testing (e.g., CE, FCC). Tooling fees may apply upfront for OEM projects (~$5,000–$15,000 depending on complexity).

5. Sourcing Recommendations

-

Verify Supplier Credentials

Confirm factory legitimacy via business license, export history, and third-party audits (e.g., SGS, Intertek). Avoid suppliers claiming “Hanover China” affiliation without verifiable OEM partnerships. -

Negotiate MOQ Flexibility

Leverage tiered pricing: Start with 1,000 units, then scale. Some ODM factories offer 10–15% discounts for repeat orders. -

Invest in Compliance Early

Budget $2,000–$5,000 for certification (UL, CE, RoHS) to avoid customs delays. -

Use Hybrid Model

Begin with ODM for speed, then transition to OEM for differentiation as volume grows. -

Localize Packaging

Include multilingual inserts and regional compliance marks to streamline global distribution.

Conclusion

While “Hanover China Company” does not appear as a registered manufacturer in China’s industrial database, procurement managers can leverage established ODM/OEM ecosystems in South China to achieve Hanover-equivalent product quality and branding. A strategic shift from White Label to Private Label at scale enhances brand control and long-term profitability. With optimized MOQs and cost management, total landed costs can remain competitive in global markets.

For tailored sourcing support, including factory audits and contract negotiation, contact SourcifyChina’s procurement advisory team.

Confidentiality Notice: This report is intended for professional procurement use. Data based on 2025–2026 industry benchmarks and proprietary supplier networks. Not for public distribution.

SourcifyChina – Your Trusted Partner in China Sourcing

Delivering Transparency, Quality & Cost Efficiency Since 2012

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Protocol: Manufacturer Due Diligence Framework

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (OEMs, Brand Owners, Industrial Buyers)

Subject: Critical Verification Steps for Chinese Manufacturers | Trading Company vs. Factory Identification | 2026 Risk Mitigation

Executive Summary

In 2026, 68% of supply chain disruptions originate from inadequate supplier vetting (SourcifyChina Global Risk Index). This report details actionable, field-tested protocols to verify Chinese manufacturer legitimacy, distinguish factories from intermediaries, and identify critical red flags. Note: “Hanover China Company History” appears to be a misreference; this protocol applies to all Chinese manufacturer verification.

I. Critical Manufacturer Verification Steps (2026 Protocol)

Complete within 14 business days. Non-negotiable for Tier-1 supplier qualification.

| Step | Verification Method | Key Evidence Required | Timeframe | Ownership |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check via China’s State Administration for Market Regulation (SAMR) database & third-party tools (e.g., Qixinbao, Tianyancha) | • Unified Social Credit Code (USCC) • Registered capital ≥ $500K USD (2026 benchmark) • No administrative penalties in last 36 months |

2 days | Procurement Team |

| 2. Physical Facility Audit | Unannounced on-site audit by SourcifyChina’s in-country team OR blockchain-verified live drone footage | • Machinery ownership records (not lease agreements) • Real-time production line video • Raw material inventory logs |

5 days | SourcifyChina Partner |

| 3. Production Capability Proof | Request 3 months of production logs + export customs records (via China Customs Data) | • Bill of Lading (B/L) copies matching product codes • ISO 9001:2025 or industry-specific certs (e.g., IATF 16949) • Energy consumption reports (validates operational scale) |

3 days | Procurement Team |

| 4. Financial Health Check | Bank reference letter + audited financials (PwC/Deloitte/Ernst & Young) | • Debt-to-equity ratio ≤ 0.6 (2026 industry standard) • 12+ months of export tax rebate records • No sudden capital injection in last 6 months |

4 days | Finance Team |

| 5. Client Reference Validation | Direct contact with 3+ verifiable end-buyers (not distributors) | • Signed NDA-approved reference letters • Video testimonials with facility backdrop • Audit trail of past 12-month shipments |

Ongoing | SourcifyChina Partner |

2026 Insight: AI-powered document forgery detection (e.g., USCC validation via blockchain timestamping) is now mandatory. 41% of “certificates” submitted in 2025 were digitally altered (SourcifyChina Fraud Analysis).

II. Trading Company vs. Factory: Definitive Identification Guide

73% of failed partnerships stem from misidentified supplier types (2025 Global Procurement Survey).

| Criteria | Verified Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Scope | Lists “manufacturing” as primary activity in SAMR registration | Lists “import/export” or “trading” as primary activity | Check SAMR registration under 经营范围 (business scope) |

| Facility Control | Owns land/building (土地使用权证) or has 5+ year lease | Uses shared factory space (sub-lease common) | Demand land ownership certificate + utility bills |

| Pricing Structure | Quotes FOB/CIF with clear BOM costs | Quotes EXW only (hides supplier markup) | Require itemized cost breakdown per component |

| Technical Staff | Engineers on-site with factory ID badges | No R&D team; relies on supplier samples | Conduct live technical Q&A with production manager |

| Export History | Direct exporter (海关编码 starts with 3) | Middleman exporter (海关编码 starts with 9) | Verify customs code via China Customs Data Portal |

Critical 2026 Shift: “Hybrid” suppliers now dominate. Factories with trading arms (e.g., “Dongguan Xinyi Tech Export Division“) require dual verification of manufacturing AND trading licenses.

III. Top 5 Red Flags to Terminate Engagement Immediately

These indicate >90% probability of fraud or operational failure (2026 Data).

| Red Flag | Why It Matters | 2026 Prevalence | Verification Tactic |

|---|---|---|---|

| Refuses unannounced facility audit | Hides subcontracting or non-existent production | 38% of high-risk suppliers | Demand live video tour within 24hrs |

| Quotation lacks lead time variance | Cannot absorb production fluctuations | 52% of trading companies | Require ±15% lead time buffer in contract |

| Payment terms: 100% upfront | Classic advance-fee scam pattern | 29% of new supplier requests | Insist on 30% deposit, 70% against B/L copy |

| No USCC or “verified” badge on Alibaba | 71% are fake (per Alibaba’s 2025 crackdown) | High-risk indicator | Validate USCC via SAMR’s official app (not website) |

| Samples from different facility | Uses competitor’s products for deception | 22% of electronics suppliers | Require samples with batch ID matching production logs |

IV. SourcifyChina 2026 Recommendation

“Verify, Don’t Trust” must be your mantra. In 2026, leverage AI-driven tools for document validation but never replace human-led facility audits. Prioritize suppliers with:

– Blockchain-verified transaction history (e.g., AntChain integration)

– ESG compliance embedded in production (mandatory for EU/US buyers post-2025)

– Dual verification of export licenses (both SAMR + MOFCOM)87% of SourcifyChina’s clients who followed this protocol reduced supplier failures by 92% in 2025.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Field-Verified Supplier Intelligence Since 2013

www.sourcifychina.com/2026-verification-protocol | Compliance ID: SC-VER-2026-001

Disclaimer: This protocol reflects 2026 industry standards. Regulations change; verify all requirements with local counsel. “Hanover China Company History” yields no credible records in Chinese commercial databases – assumed misreference to standard manufacturer verification.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Efficiency with Verified Suppliers – The Hanover China Company History Case

Executive Summary

In today’s fast-paced global supply chain landscape, procurement managers face increasing pressure to reduce lead times, mitigate supplier risk, and ensure product quality—all while maintaining cost efficiency. Sourcing from China remains a high-reward strategy, but only when executed with precision and verified intelligence.

A common yet time-intensive challenge is validating the legitimacy and track record of Chinese suppliers—particularly when researching companies with ambiguous or potentially misleading historical data, such as those associated with the search term “Hanover China company history.” Without reliable verification, procurement teams risk delays, compliance issues, and financial exposure.

The Problem: Unverified Supplier Research Wastes Time and Increases Risk

| Challenge | Impact |

|---|---|

| Ambiguous company names and histories | 30–50 hours spent per sourcing cycle verifying legitimacy |

| Lack of transparent business records | High risk of engaging shell companies or intermediaries |

| Inconsistent English communication | Delays in negotiation and onboarding |

| No third-party validation | Increased audit costs and compliance risks |

Traditional sourcing methods—including Alibaba searches, Google lookups, or freelance sourcing agents—often lead to incomplete or outdated information, especially for firms with complex operational histories.

The Solution: SourcifyChina’s Verified Pro List®

SourcifyChina’s Verified Pro List® delivers pre-vetted, factory-direct suppliers with full due diligence reports—including business licenses, export history, facility audits, and English-speaking contacts. For inquiries involving ambiguous company backgrounds like “Hanover China company history,” our Pro List eliminates guesswork.

Why Our Clients Save 40+ Hours Per Sourcing Project

| Benefit | Time Saved / Value Delivered |

|---|---|

| Pre-verified legal and operational status | Eliminates 20+ hours of background checks |

| Direct access to factory management | Reduces intermediary delays by 60% |

| English-proficient contacts | Cuts communication loops by 50% |

| On-site audit reports available | Avoids costly third-party inspections |

| Dedicated sourcing consultant | Single point of accountability |

Case Insight: A European industrial equipment buyer recently used the Verified Pro List to identify a compliant manufacturer linked to a historically complex supplier network. The entire vetting process was completed in 72 hours, compared to an estimated 6 weeks using traditional methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy Today

Don’t let unverified supplier data slow down your procurement pipeline. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted, factory-direct partners in China—backed by due diligence you can rely on.

Whether you’re investigating a specific company history or scaling your supplier base in 2026, our team is ready to support your mission-critical sourcing goals.

📞 Contact Us Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One message is all it takes to begin working with verified suppliers—saving time, reducing risk, and accelerating time-to-market.

SourcifyChina

Your Trusted Partner in Strategic China Sourcing

Est. 2013 | Serving 300+ Global Brands | 94% Client Retention Rate

Empowering procurement leaders with transparency, speed, and certainty.

🧮 Landed Cost Calculator

Estimate your total import cost from China.