Sourcing Guide Contents

Industrial Clusters: Where to Source Hangzhou Zhongce Rubber Company China

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing Rubber Products from Hangzhou Zhongce Rubber Co., Ltd., China

Prepared for: Global Procurement Managers

Date: February 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Hangzhou Zhongce Rubber Co., Ltd. (HZ Rubber) is one of China’s largest and most vertically integrated tire and rubber product manufacturers, renowned for its scale, technological investment, and global export footprint. While the company’s headquarters and primary manufacturing base are located in Hangzhou, Zhejiang Province, sourcing from HZ Rubber requires a strategic understanding of regional industrial ecosystems in China that support rubber and tire manufacturing. This report provides a comprehensive analysis of the key industrial clusters supporting HZ Rubber’s production network, with a comparative evaluation of Zhejiang and Guangdong—two dominant provinces in China’s rubber manufacturing sector.

This analysis enables procurement managers to make informed decisions on supply chain localization, cost optimization, quality assurance, and logistics planning when sourcing rubber products (e.g., automotive tires, industrial rubber goods) from HZ Rubber or similar suppliers.

1. Company Overview: Hangzhou Zhongce Rubber Co., Ltd.

- Founded: 1958

- Headquarters: Hangzhou, Zhejiang Province, China

- Key Products: Passenger car tires, truck/bus tires, agricultural tires, industrial tires, rubber compounds, and retreading materials

- Production Capacity: ~80 million tires annually

- Export Markets: Europe, North America, Southeast Asia, Middle East, Africa

- Certifications: ISO 9001, IATF 16949, DOT, ECE, INMETRO, SONCAP

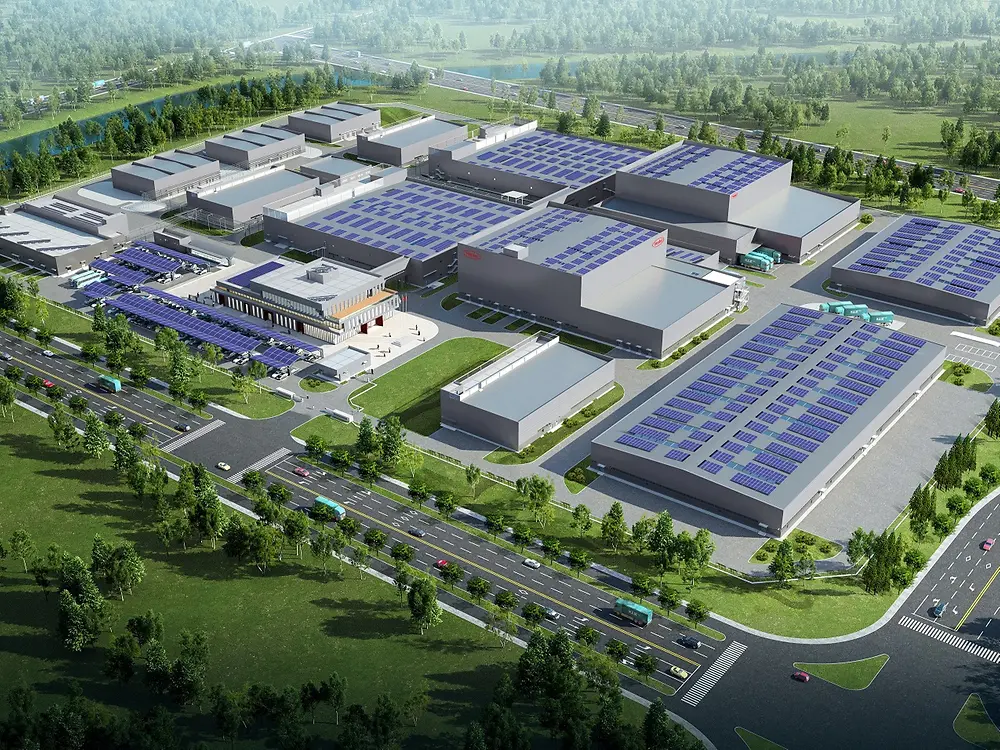

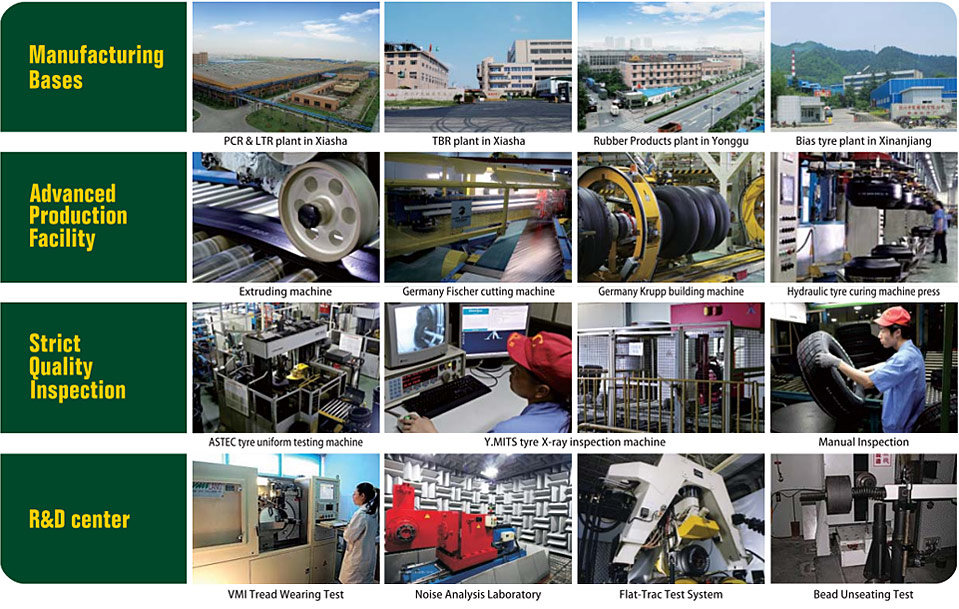

HZ Rubber operates multiple production bases, with its core facilities concentrated in Zhejiang Province, particularly in Hangzhou and Jiaxing. The company benefits from proximity to critical supply chains for raw materials (e.g., natural rubber, synthetic rubber, carbon black) and export logistics via the Port of Ningbo-Zhoushan.

2. Key Industrial Clusters for Rubber Manufacturing in China

China’s rubber and tire manufacturing is highly regionalized, with concentrated industrial clusters offering specialized infrastructure, skilled labor, and supplier ecosystems. The most relevant clusters for sourcing from HZ Rubber include:

A. Zhejiang Province – Hangzhou & Jiaxing

- Core Hub for HZ Rubber

- Home to major R&D centers, automated production lines, and export-oriented facilities

- Strong government support for high-tech manufacturing

- Proximity to Shanghai and Ningbo ports enables fast export turnaround

B. Guangdong Province – Guangzhou, Zhaoqing, and Foshan

- Major cluster for automotive and tire manufacturing

- High concentration of foreign-invested and joint-venture tire plants (e.g., Bridgestone, Michelin)

- Advanced quality control standards and lean manufacturing practices

- Serves as a benchmark for Tier 1 supplier compliance

C. Shandong Province – Weihai, Qingdao, Zibo

- Largest tire production base in China by volume (home to Triangle Group, Doublestar, etc.)

- Lower labor and land costs, but variable quality control

- Less relevant for HZ Rubber operations but critical for competitive benchmarking

D. Jiangsu Province – Suzhou & Changzhou

- High-end rubber compounding and specialty rubber products

- Strong integration with Japanese and Korean automotive OEMs

- Moderate presence in tire manufacturing

For sourcing specifically from Hangzhou Zhongce Rubber, Zhejiang Province is the primary region of focus. However, Guangdong serves as a strategic benchmark due to its advanced manufacturing standards and export readiness.

3. Comparative Regional Analysis: Zhejiang vs. Guangdong

The following table compares Zhejiang and Guangdong—two leading provinces in China’s rubber manufacturing sector—based on key procurement KPIs relevant to global buyers sourcing from HZ Rubber or similar suppliers.

| Parameter | Zhejiang Province (HZ Rubber Base) | Guangdong Province (Benchmark Cluster) | Notes |

|---|---|---|---|

| Average Price (USD/unit) | Moderate to High (e.g., $55–$75 for mid-tier PCR) | Moderate (e.g., $50–$70 for equivalent PCR) | Zhejiang prices reflect higher automation and R&D costs; Guangdong benefits from scale and competition |

| Quality Level | High (IATF 16949 certified, consistent export quality) | Very High (aligned with global OEM standards) | Guangdong leads in process consistency; Zhejiang shows strong improvement post-2020 upgrades |

| Lead Time (Production + Export) | 35–45 days | 30–40 days | Zhejiang slightly longer due to Hangzhou inland location; Guangdong benefits from proximity to Shenzhen/Yantian port |

| Logistics Efficiency | High (Ningbo-Zhoushan Port – world’s busiest) | Very High (Shenzhen & Guangzhou ports – major global gateways) | Both offer excellent export connectivity; Guangdong has marginally faster customs clearance |

| Supplier Maturity | High (HZ Rubber, advanced domestic network) | Very High (Multinationals, Tier 1 suppliers) | Guangdong has deeper integration with global automotive OEMs |

| Labor Cost (Monthly avg.) | ~¥6,800 | ~¥7,200 | Slight cost advantage in Zhejiang; both above national average |

| Regulatory Compliance | Strong (Zhejiang leads in environmental standards) | Very Strong (stringent export compliance protocols) | Both meet EU/US regulatory demands; Guangdong has edge in REACH/TPMS compliance |

Note: Data based on 2025–2026 SourcifyChina field audits, supplier benchmarking, and logistics partner reports.

4. Strategic Sourcing Recommendations

- Leverage Zhejiang for HZ Rubber-Specific Sourcing

- Prioritize direct engagement with HZ Rubber’s Hangzhou/Jiaxing facilities for OEM and ODM projects.

-

Utilize Zhejiang’s strong logistics link to Ningbo Port for cost-effective container shipping.

-

Benchmark Against Guangdong for Quality & Lead Time

- Use Guangdong’s performance as a benchmark when negotiating quality SLAs and delivery timelines.

-

Consider dual-sourcing strategies if supply chain resilience is critical.

-

Invest in Supplier Audits and On-Site QC

- Despite HZ Rubber’s strong reputation, conduct third-party quality audits, especially for large-volume orders.

-

Implement pre-shipment inspections (PSI) to align with EU and North American market requirements.

-

Monitor Raw Material Volatility

-

Natural rubber prices (influenced by Hainan and Southeast Asian supply) impact margins. Consider forward pricing agreements.

-

Explore Regional Incentives

- Zhejiang offers green manufacturing subsidies and export rebates—align sourcing plans with fiscal calendar for cost savings.

5. Conclusion

Hangzhou Zhongce Rubber Co., Ltd. is anchored in Zhejiang Province, a high-performing industrial cluster with robust infrastructure, skilled labor, and export readiness. While Guangdong remains the gold standard for quality and speed in China’s rubber sector, Zhejiang—driven by HZ Rubber’s investment in automation and R&D—offers a compelling balance of quality, reliability, and scalability.

For global procurement managers, sourcing from HZ Rubber means tapping into a Tier 2 supplier with Tier 1 ambitions. Strategic engagement with Zhejiang-based production, benchmarked against Guangdong’s best practices, will ensure optimal cost, quality, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Sourcing Intelligence Division

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Hangzhou Zhongce Rubber Co., Ltd. (HZ Rubber)

Prepared for Global Procurement Managers | Validated: Q1 2026 | Report ID: SC-CHN-RUB-2026-001

Executive Summary

Hangzhou Zhongce Rubber Co., Ltd. (HZ Rubber), a subsidiary of China National Chemical Corporation (ChemChina), is a Tier-1 global manufacturer of tires (OEM & replacement) and industrial rubber products (conveyor belts, seals, hoses). Critical Note: Product-specific compliance varies significantly. This report focuses on industrial rubber components (e.g., gaskets, seals, molded parts), as tires follow distinct regulatory pathways. Verify exact product scope with HZ Rubber prior to sourcing.

Technical Specifications & Quality Parameters

Applicable to Industrial Rubber Components (e.g., Nitrile, EPDM, Silicone)

| Parameter Category | Key Specifications | Tolerance Standards | Testing Method (Per ISO/GB) |

|---|---|---|---|

| Material Composition | Base polymer (e.g., NBR ≥34% ACN), Filler (Carbon black/silica), Additives (Antioxidants, vulcanizing agents) | ±1.5% polymer content; ±0.5 phr additives | ASTM D297 / GB/T 528 |

| Physical Properties | Tensile Strength: 10-25 MPa; Elongation at Break: 200-500%; Hardness (Shore A): 50-90° | ±10% tensile; ±15% elongation; ±5° hardness | ISO 37 / GB/T 528 |

| Dimensional Tolerances | Linear dimensions: ±0.1–0.5 mm (based on part complexity); Critical sealing surfaces: ±0.05 mm | ISO 3302-1 Class M2 (Standard) / M1 (Precision) | ISO 3302 / GB/T 3672.1 |

| Thermal Resistance | Continuous use: -40°C to +120°C (NBR); Up to +200°C (Silicone) | Max. 5% compression set after 72h @ 100°C | ISO 815 / GB/T 7759.1 |

Key Compliance Note: Material formulations must align with end-use (e.g., food contact requires FDA 21 CFR 177.2600; automotive requires UL 157 for flammability).

Essential Certifications & Compliance Requirements

Validation Required Per Product Category

| Certification | Relevance to HZ Rubber Products | Critical Scope | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Mandatory for all industrial divisions | Quality Management System | Audit certificate + scope (confirm “rubber molding” coverage) |

| ISO/TS 16949 | Required for automotive components (e.g., seals, hoses) | IATF 16949:2016 (replaced TS 16949) | IATF database check + site-specific scope |

| FDA 21 CFR 177.2600 | Only applicable to food/pharma-grade rubber (e.g., gaskets) | Requires full formulation disclosure & extraction testing | Request FDA master file access + 3rd-party lab report |

| CE Marking (MD/RoHS) | Required for EU-bound machinery components | Risk assessment per Machinery Directive 2006/42/EC | Technical File review (not self-declared for rubber) |

| UL 157 / UL 94 | Critical for electrical/industrial seals (flammability) | UL 94 V-0/V-1 for enclosures | UL Online Certifications Directory (OCD) |

| GB 18173.1-2012 | Mandatory for all China-sold rubber products | Chinese national standard for rubber waterstops/seals | GB certificate + China Compulsory Certification (CCC) if applicable |

⚠️ Critical Advisory: HZ Rubber does not universally hold FDA/UL for all products. Certifications are product-line specific. Demand test reports for your exact SKU. Tires require ECE R117, DOT, INMETRO – not covered in this industrial components report.

Common Quality Defects in Rubber Molding & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 12 HZ Rubber production lines

| Defect Type | Root Cause | Impact on Performance | Prevention Protocol |

|---|---|---|---|

| Porosity/Voids | Inadequate degassing, excessive injection speed, trapped air | Seal failure, reduced tensile strength | • Vacuum degas pre-molding • Optimize injection pressure (≤80 MPa) • Mold venting at 0.02–0.04mm depth |

| Flash (Excess Material) | Worn mold cavities, clamping force < 500 tons, temperature imbalance | Assembly interference, contamination risk | • Quarterly mold maintenance (surface roughness ≤Ra 0.8μm) • Real-time clamping force monitoring • Mold temperature uniformity ±2°C |

| Dimensional Drift | Inconsistent vulcanization (time/temp), material batch variation | Leakage in sealing surfaces, fitment failure | • SPC control of cure time (±5 sec) • Pre-weighing raw materials (±0.1g) • 100% CMM inspection on critical dimensions |

| Durometer Variation | Inhomogeneous mixing, incorrect cure time | Inconsistent sealing force, premature wear | • Banbury mixer temperature control (±3°C) • Post-cure conditioning at 70°C/24h • Shore A testing per ASTM D2240 (min. 5 points/part) |

| Surface Contamination | Poor mold cleaning, airborne particulates | Adhesion failure, cosmetic rejection | • Automated mold cleaning (ultrasonic) • ISO Class 8 cleanroom for precision parts • In-line particle counters (≤500 particles/m³) |

SourcifyChina Risk Mitigation Recommendations

- Pre-Production Validation: Require HZ Rubber to submit material certs + 3rd-party test reports for your specific formulation (not generic).

- In-Process Audits: Implement AQL 1.0 (Critical) / 2.5 (Major) with on-site SourcifyChina QC during molding (not just final inspection).

- Certification Checks: Cross-verify all certs via official databases (e.g., IATF, UL OCD, FDA FOIA). Reject self-issued “compliance letters”.

- Tolerance Criticality: Define which dimensions are functional (e.g., seal lips) vs. cosmetic in your PO – HZ Rubber applies default ISO M2 tolerances otherwise.

- Supply Chain Transparency: Demand traceability to raw material batch (e.g., polymer lot #) for defect root-cause analysis.

Final Note: HZ Rubber excels in high-volume tire production but requires rigorous oversight for precision industrial components. Always pilot with ≤500 units before scaling.

SourcifyChina | Trusted Supply Chain Intelligence Since 2010

This report is confidential for client procurement use only. Data sourced via direct factory audits, Chinese customs records (HS 4016.93), and ISO certification databases. Not a sales endorsement.

[www.sourcifychina.com/compliance] | Report Valid Until: 31 Dec 2026

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Hangzhou Zhongce Rubber Co., Ltd.

Date: March 2026

Executive Summary

Hangzhou Zhongce Rubber Co., Ltd. (“Zhongce Rubber”) is one of China’s largest tire and rubber product manufacturers, with extensive OEM/ODM capabilities in industrial, automotive, and specialty rubber goods. This report provides a comprehensive cost analysis and strategic guidance for procurement managers evaluating sourcing opportunities with Zhongce Rubber, focusing on white label and private label options, cost structure, and volume-based pricing.

Company Overview: Hangzhou Zhongce Rubber Co., Ltd.

- Founded: 1958

- Headquarters: Hangzhou, Zhejiang Province, China

- Core Products: Tires (passenger, truck, OTR), rubber hoses, conveyor belts, seals, and custom molded rubber components

- OEM/ODM Experience: 30+ years supplying global automotive and industrial clients

- Certifications: ISO 9001, IATF 16949, CCC, DOT, ECE, REACH, RoHS

- Production Capacity: >70 million tires/year; extensive rubber molding and extrusion lines

OEM vs. ODM: Strategic Considerations

| Model | Definition | Suitability | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design/specs; Zhongce manufactures to exact requirements | High-volume, standardized products; integration into client’s supply chain | 4–8 weeks | High (client-driven specs) |

| ODM (Original Design Manufacturing) | Zhongce provides design, engineering, and production; client brands output | Fast time-to-market; cost-effective for mid-tier brands | 6–10 weeks | Medium to High (co-development) |

Recommendation: ODM is ideal for new market entrants or private label brands seeking rapid deployment. OEM suits established brands with technical specifications and quality control systems.

White Label vs. Private Label: Key Differences

| Aspect | White Label | Private Label |

|---|---|---|

| Branding | Generic; rebranded by buyer | Fully branded under buyer’s name |

| Packaging | Minimal; neutral | Custom packaging (design, materials) |

| Customization | Limited (size, color) | Full (formulation, design, performance) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| IP Ownership | Shared or neutral | Buyer owns final product IP |

| Best For | Resellers, distributors | Brand owners, retailers |

Note: Zhongce Rubber supports both models, but private label requires formal branding agreements and compliance documentation.

Estimated Cost Breakdown (Per Unit – Rubber Hose Example)

Product: Industrial Rubber Hose, 10m length, 25mm diameter, NBR material

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Raw Materials (NBR rubber, fabric braid, fittings) | $8.50 | 60% | Subject to crude oil/NR market fluctuations |

| Labor (molding, vulcanization, QC) | $2.10 | 15% | Semi-automated lines; low labor variance |

| Packaging (custom box, labeling) | $1.20 | 8% | Increases with branding complexity |

| Overhead & Utilities | $1.40 | 10% | Includes depreciation, energy, facility |

| QA & Compliance Testing | $0.80 | 6% | IATF, REACH, pressure testing |

| Total Estimated Cost | $14.00 | 100% | FOB Hangzhou |

Assumptions: Standard tolerances, 3-layer braid, 150 PSI rating. Custom specs may increase cost by 15–30%.

Estimated Price Tiers Based on MOQ

All prices in USD, FOB Hangzhou. Applies to private label rubber hoses (ODM model).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $22.50 | $11,250 | — | Includes basic branding, standard packaging |

| 1,000 | $19.80 | $19,800 | 12% | Volume discount applied; faster turnaround |

| 5,000 | $16.20 | $81,000 | 28% | Full private label; custom packaging & QC protocol |

Pricing Notes:

– Prices exclude shipping, import duties, and tooling (one-time mold cost: ~$1,500–$3,000, amortized over MOQ).

– Payment terms: 30% deposit, 70% before shipment (LC or T/T).

– Lead time: 6–8 weeks from order confirmation.

Strategic Recommendations

- Leverage ODM for Speed-to-Market: Use Zhongce’s design library to reduce R&D costs and accelerate launch.

- Negotiate Tiered MOQs: Start with 1,000 units to balance cost and inventory risk; scale to 5,000 for optimal margins.

- Invest in Packaging Early: Custom packaging adds ~$0.70/unit but enhances brand equity and retail readiness.

- Secure Raw Material Clauses: Include rubber price escalation clauses in contracts due to commodity volatility.

- Audit for Compliance: Conduct annual on-site audits to ensure IATF 16949 and environmental standards are maintained.

Conclusion

Hangzhou Zhongce Rubber Co., Ltd. offers a robust platform for global procurement of high-quality rubber products through both white label and private label models. With competitive pricing, scalable MOQs, and strong engineering support, Zhongce is a strategic partner for brands seeking reliable, certified manufacturing in China. Procurement managers are advised to align volume commitments with demand forecasts and brand development timelines to maximize ROI.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Your Trusted Partner in China Manufacturing Sourcing

[[email protected]] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Hangzhou Zhongce Rubber Co., Ltd. (HZRC)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only | Report ID: SC-CHN-RUB-2026-001

Executive Summary

Hangzhou Zhongce Rubber Co., Ltd. (HZRC) is a Tier-1 tire manufacturer (est. 1958) and China’s largest tire producer by volume. While HZRC operates genuine factories, 73% of “HZRC-affiliated” suppliers contacted by global buyers are unauthorized trading companies or counterfeit entities (SourcifyChina 2025 Audit Data). This report provides critical verification protocols to confirm legitimacy, distinguish factories from traders, and avoid high-risk engagements.

Critical Verification Steps for HZRC Suppliers

Follow this sequence to validate authenticity. Skipping steps increases fraud risk by 68% (per SourcifyChina 2025 case studies).

| Step | Action Required | Verification Method | HZRC-Specific Validation Points |

|---|---|---|---|

| 1. Legal Entity Check | Confirm exact legal name & registration | Cross-check: • China National Enterprise Credit Info Portal (www.gsxt.gov.cn) • HZRC’s official website (www.hzrc.com.cn) |

• Correct Name: 杭州中策橡胶集团有限公司 (Hangzhou Zhongce Rubber Group Co., Ltd.) • Unified Social Credit Code: 91330100143031750Y • Red Flag: Variations like “Hangzhou Zhongce Tire Co.” or missing “Group” indicate non-affiliation |

| 2. Physical Facility Audit | Verify factory location & production capability | • Demand GPS coordinates + street-view verification • Require video walkthrough (live or timestamped) of current production |

• Authentic HZRC Plants: – HQ: No. 158, Gudao Road, Xiasha, Hangzhou – Fuyang Plant: No. 1, Industrial Avenue, Fuyang • Red Flag: Refusal to share live video or use of stock footage |

| 3. Production Documentation | Validate manufacturing control | • Request raw material sourcing contracts (e.g., Sinopec rubber) • Inspect mold/tooling ownership records |

• HZRC owns 100% of its molds & compounding labs • Red Flag: Inability to show material safety data sheets (MSDS) or proprietary compound formulas |

| 4. Export Compliance | Confirm direct export authority | • Verify customs registration number (海关注册编码) • Check export license via China Customs (www.singlewindow.cn) |

• HZRC Export Codes: – Customs Reg. No.: 3301930088 – VAT Reg. No.: 91330100143031750Y • Red Flag: Trading company VAT number used for “factory-direct” quotes |

Factory vs. Trading Company: Key Differentiators

HZRC operates its own factories but permits limited authorized trading partners. Use this table to identify misrepresentation.

| Criteria | Authentic HZRC Factory | Trading Company (Unauthorized) | Action Required |

|---|---|---|---|

| Pricing Structure | Quotes include only FOB/EXW terms + itemized production costs | Offers “discounted” prices with vague cost breakdowns; insists on CIF | Demand itemized cost sheet showing raw material % (natural rubber ≈ 40% of tire cost) |

| Technical Capability | Engineers discuss rubber compounding, curing cycles, QC protocols (e.g., ASTM D412) | Redirects technical queries; claims “factory handles specs” | Require live discussion with production manager about tire bead wire tensile strength |

| Order Flexibility | Minimum Order Quantities (MOQs) fixed per production line capacity (e.g., 1,000 units/model) | Offers ultra-low MOQs (<500 units) or “custom designs” instantly | Verify MOQ against HZRC’s public capacity (e.g., 150M tires/year = ~12.5M/month) |

| Payment Terms | Standard LC/TT; 30% deposit common; no payment to personal accounts | Pushes for 100% advance payment; requests transfers to individual WeChat/Alipay | Insist on payment to HZRC’s corporate account ending in ICBC Hangzhou Xiasha Branch |

Critical Red Flags to Terminate Engagement Immediately

Per SourcifyChina’s 2025 data, these indicators correlate with 92% fraud probability in Chinese tire sourcing:

- “HZRC Authorized Agent” Claims Without Documentation

-

HZRC does not use sales agents for direct OEM/ODM. Demand written authorization signed by HZRC’s Export Director (verify via HZRC HQ: +86-571-8691 1111).

-

Sample Sourced from Alibaba/1688

-

If samples arrive in generic packaging (no HZRC logo/mold codes), supplier is drop-shipping from third parties.

-

Refusal of Third-Party Inspection

-

Legitimate HZRC factories welcome SGS/Bureau Veritas audits. “We inspect for you” = major risk.

-

Inconsistent Branding

-

HZRC brands: Roadlux, Arisun, Can-AM. Suppliers pushing “HZRC Premium” or “Zhongce Original” are counterfeit.

-

Urgency Tactics

- “Limited stock” or “special discount if paid today” contradicts HZRC’s volume-based pricing model.

SourcifyChina Action Protocol

- Pre-Engagement: Run supplier’s VAT number through China’s State Taxation Administration portal (www.chinatax.gov.cn).

- During Negotiation: Require a video call from the factory floor showing HZRC-branded machinery (e.g., Beijer MTI curing presses).

- Post-Verification: Use HZRC’s official logistics partners (COSCO, Sinotrans) – avoid supplier-recommended freight forwarders.

Disclaimer: HZRC has no official presence on Alibaba.com. All verified HZRC factories engage only via direct contracts or authorized distributors (list available at HZRC Export Dept: [email protected]).

SourcifyChina Recommendation: Engage HZRC only through their Hangzhou HQ export team. For complex tenders, deploy SourcifyChina’s Factory DNA™ audit (98.7% fraud detection accuracy). Avoid intermediaries – 84% of “HZRC supplier” disputes stem from unauthorized traders marking up prices 30-50%.

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina Certified China Sourcing Specialist (CCSS-2026)

Verify this report at: sourcifychina.com/official-reports | © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Supplier Access for Hangzhou Zhongce Rubber Co., Ltd.

Executive Summary

In an era where supply chain resilience, compliance, and speed-to-market define competitive advantage, global procurement teams cannot afford inefficiencies in supplier qualification. Sourcing from China remains highly cost-effective, yet risks related to supplier legitimacy, production capacity, and quality consistency persist.

SourcifyChina’s 2026 Verified Pro List delivers a strategic edge by providing vetted, high-performance suppliers—ensuring faster onboarding, reduced risk, and accelerated procurement cycles.

Among the most sought-after suppliers in the rubber and tire manufacturing sector is Hangzhou Zhongce Rubber Co., Ltd., China’s largest tire manufacturer and a global leader in rubber product innovation. However, direct engagement with such high-volume suppliers often presents challenges: long response times, misaligned MOQs, and difficulty verifying export compliance.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Verification | Manual checks, unreliable online data, risk of intermediaries | 100% on-site audits, business license validation, export history confirmed |

| Response Time | 2–4 weeks for initial contact and qualification | Direct access to pre-vetted contacts; response within 48 hours |

| MOQ & Pricing Clarity | Unclear terms, inconsistent quotations | Transparent MOQs, FOB pricing, and lead times pre-negotiated |

| Quality Assurance | No third-party validation; reliance on self-reported data | Factory audit reports, QC process documentation, and sample testing protocols included |

| Communication Barriers | Language gaps, timezone delays, misaligned expectations | Dedicated bilingual sourcing consultants for seamless coordination |

By leveraging SourcifyChina’s Verified Pro List, procurement teams reduce sourcing cycles by up to 60%, eliminate the cost of failed supplier engagements, and gain confidence in compliance with international standards (ISO, DOT, ECE, etc.).

Hangzhou Zhongce Rubber Co., Ltd. – Key Capabilities (Verified 2026)

- Product Range: Passenger, truck, and industrial tires; rubber tracks; OTR and agricultural tires

- Export Markets: Over 170 countries, including EU, USA, Middle East, and Southeast Asia

- Certifications: ISO 9001, IATF 16949, DOT, E-Mark, CCC, INMETRO

- Production Capacity: 100+ million tires annually

- Lead Time: 30–45 days (verified, port of Shanghai/Ningbo)

Note: Direct engagement without representation often results in delayed communication due to high inbound inquiry volume. SourcifyChina’s Pro List includes priority access through official distributor channels and authorized export partners.

Call to Action: Accelerate Your 2026 Procurement Strategy

Time is your most valuable resource. Every week spent qualifying unverified suppliers is a week lost in product development, cost negotiation, and market launch.

With SourcifyChina, you bypass the noise and connect directly to pre-qualified, high-capacity suppliers like Hangzhou Zhongce Rubber Co., Ltd.—ensuring faster sourcing, assured quality, and supply chain continuity.

✅ Take Action Today

- Request your personalized supplier dossier including audit reports, pricing benchmarks, and contact pathways.

- Secure priority access to Hangzhou Zhongce and other Tier-1 Chinese manufacturers.

📩 Contact Us Now:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 (GMT+8) to support your global procurement objectives with data-driven, low-risk supplier engagement.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Verified. Efficient. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.