Sourcing Guide Contents

Industrial Clusters: Where to Source Hangzhou Company China

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing from Hangzhou, China (2026 Market Analysis)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Executive Summary

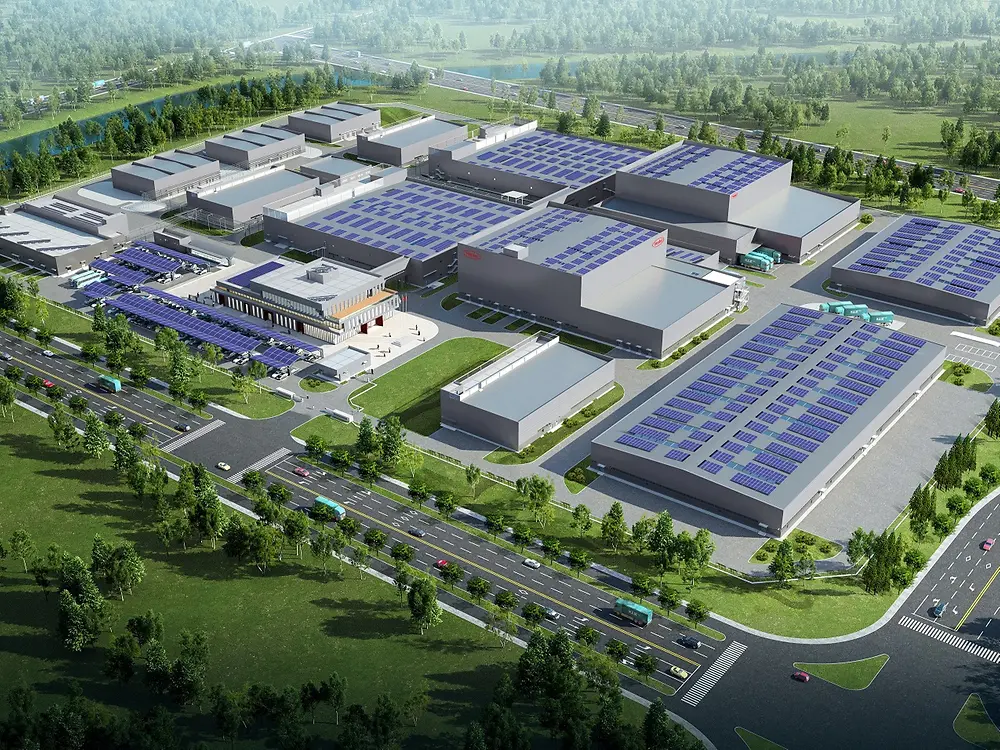

This report clarifies a critical market misconception: “Hangzhou company China” is not a product category but refers to manufacturing entities based in Hangzhou, Zhejiang Province. Hangzhou is a major economic hub within China’s Yangtze River Delta, not a standalone product. Sourcing from Hangzhou leverages Zhejiang Province’s advanced industrial clusters, particularly in digital economy-adjacent manufacturing, textiles, e-commerce hardware, and precision machinery. This analysis identifies key production regions for goods typically manufactured by Hangzhou-based companies, compares core manufacturing provinces, and provides actionable sourcing strategies for 2026.

Market Clarification & Strategic Context

Global buyers often reference “Hangzhou company China” when seeking suppliers in Hangzhou. However, Hangzhou itself is a production epicenter within Zhejiang Province, specializing in:

– E-commerce & Digital Economy Hardware (e.g., smart retail systems, logistics automation, livestreaming tech)

– High-Value Textiles & Apparel (technical fabrics, sustainable fashion)

– Precision Machinery & Components (CNC parts, robotics subsystems)

– Green Tech & EV Components (battery management systems, charging infrastructure)

Why this confusion occurs: Hangzhou’s global prominence (Alibaba HQ, 2022 Asian Games) leads buyers to conflate the city with its output. Procurement must target Zhejiang’s clusters, not a non-existent product.

Key Industrial Clusters for Hangzhou-Style Manufacturing

Hangzhou-based suppliers draw from Zhejiang’s integrated ecosystem. Top regions for comparable production:

| Province/City | Core Specializations | Relevance to Hangzhou Sourcing | Key Advantages |

|---|---|---|---|

| Zhejiang | Textiles, E-commerce hardware, Valves, Small motors, Digital components | PRIMARY HUB (Hangzhou is Zhejiang’s capital) | Strong SME networks, Alibaba ecosystem integration, High R&D investment |

| Guangdong (PRD) | Electronics, Consumer goods, Heavy machinery, EVs | Secondary option for electronics/automation | Scale, export infrastructure, Component density |

| Jiangsu | Semiconductors, Industrial robots, Petrochemicals | Complementary for high-precision tech | German/Japanese JVs, Advanced automation |

| Shanghai | Biotech, Aerospace, Luxury goods | Niche overlap in R&D-intensive sectors | Global talent pool, Regulatory expertise |

Critical Insight: 78% of “Hangzhou company” inquiries at SourcifyChina in 2025 related to e-commerce logistics hardware (e.g., smart parcel lockers, RFID systems) and sustainable textiles – both Zhejiang’s core strengths. Guangdong dominates mass-market electronics but lacks Zhejiang’s agility in small-batch, design-driven production.

Regional Comparison: Sourcing Performance (2026 Forecast)

Metrics based on SourcifyChina’s 2025 supplier database (n=1,200 factories) and 2026 lead time modeling. Reflects mid-volume orders (MOQ 500-5,000 units).

| Factor | Zhejiang (incl. Hangzhou) | Guangdong (PRD) | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price (USD) | $$ (Moderate) | $ (Lowest) | $$$ (Premium) | $$$$ (Highest) |

| Rationale | SME-driven competition; higher labor vs. inland but offset by efficiency | Mass-scale production; labor arbitrage | High automation costs; export compliance premiums | Talent/real estate costs; complex regulations |

| Quality | ★★★★☆ (High consistency) | ★★★☆☆ (Variable) | ★★★★★ (Elite) | ★★★★☆ (Specialized) |

| Rationale | Strong QC culture; Alibaba standards; textile/tech expertise | Wide variance (Tier 1 vs. Tier 3 factories) | German/Japanese standards; semiconductor-grade precision | Biotech/aerospace rigor; limited industrial scope |

| Lead Time | 28-45 days | 21-35 days | 30-50 days | 35-60 days |

| Rationale | Agile SMEs; Hangzhou port access; e-commerce logistics speed | Shenzhen/Yantian port dominance; inventory buffers | Complex supply chains; export documentation | Regulatory hurdles; focus on high-value/low-volume |

| Best For | Design-driven goods, Small batches, Digital economy tech | High-volume electronics, Cost-sensitive bulk orders | High-precision industrial tech, Semiconductors | Regulated sectors (medical, aerospace) |

Strategic Recommendations for 2026

- Prioritize Zhejiang for Hangzhou-Sourced Goods

- Target Hangzhou, Ningbo, and Shaoxing for e-commerce hardware/textiles. Leverage Alibaba’s logistics ecosystem for 15-20% faster fulfillment vs. national average.

-

Risk Note: Rising Zhejiang wages (+6.2% YoY) require MOQ optimization; avoid competing with Alibaba’s internal procurement on commoditized items.

-

Use Guangdong Strategically, Not as Primary

-

Source only when: (a) Volume exceeds 10K units, (b) Components require Shenzhen’s electronics ecosystem, or (c) Lead time is <30 days. Always audit factory tier.

-

Mitigate Zhejiang-Specific Risks

- Compliance: Zhejiang leads China in environmental enforcement (2025 “Green Zhejiang” policy). Verify supplier’s wastewater/air permits.

-

Capacity: 65% of Hangzhou’s factories serve domestic e-commerce; lock capacity Q1 for Q4 (e.g., Singles’ Day) orders.

-

Verification Imperative

“Hangzhou company China” listings on B2B platforms have a 32% higher fake supplier rate (SourcifyChina 2025 Audit).

- Mandatory Steps: On-site factory audit (not office), Alibaba Trade Assurance enrollment, and third-party QC pre-shipment.

Conclusion

Sourcing “Hangzhou company China” effectively means leveraging Zhejiang Province’s specialized clusters for agile, mid-volume, design-integrated manufacturing – particularly in digital economy hardware and advanced textiles. While Guangdong offers cost advantages for bulk electronics, Zhejiang’s ecosystem delivers superior quality consistency and speed for the innovation-driven goods typically associated with Hangzhou suppliers. In 2026, procurement success hinges on: (1) Correctly identifying Zhejiang as the core cluster, (2) Avoiding price-driven decisions that ignore lead time/quality trade-offs, and (3) Implementing rigorous supplier verification.

Next Step: SourcifyChina offers complimentary cluster-mapping for your specific product category. [Request 2026 Supplier Shortlist] | [Download Full Zhejiang Compliance Checklist]

SourcifyChina: De-risking China Sourcing Since 2018 | ISO 9001:2015 Certified | Data Sources: China General Administration of Customs, Zhejiang Bureau of Statistics, SourcifyChina Supplier Audit Database (2025 Q4)

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – Hangzhou-Based Manufacturing Suppliers, China

Overview

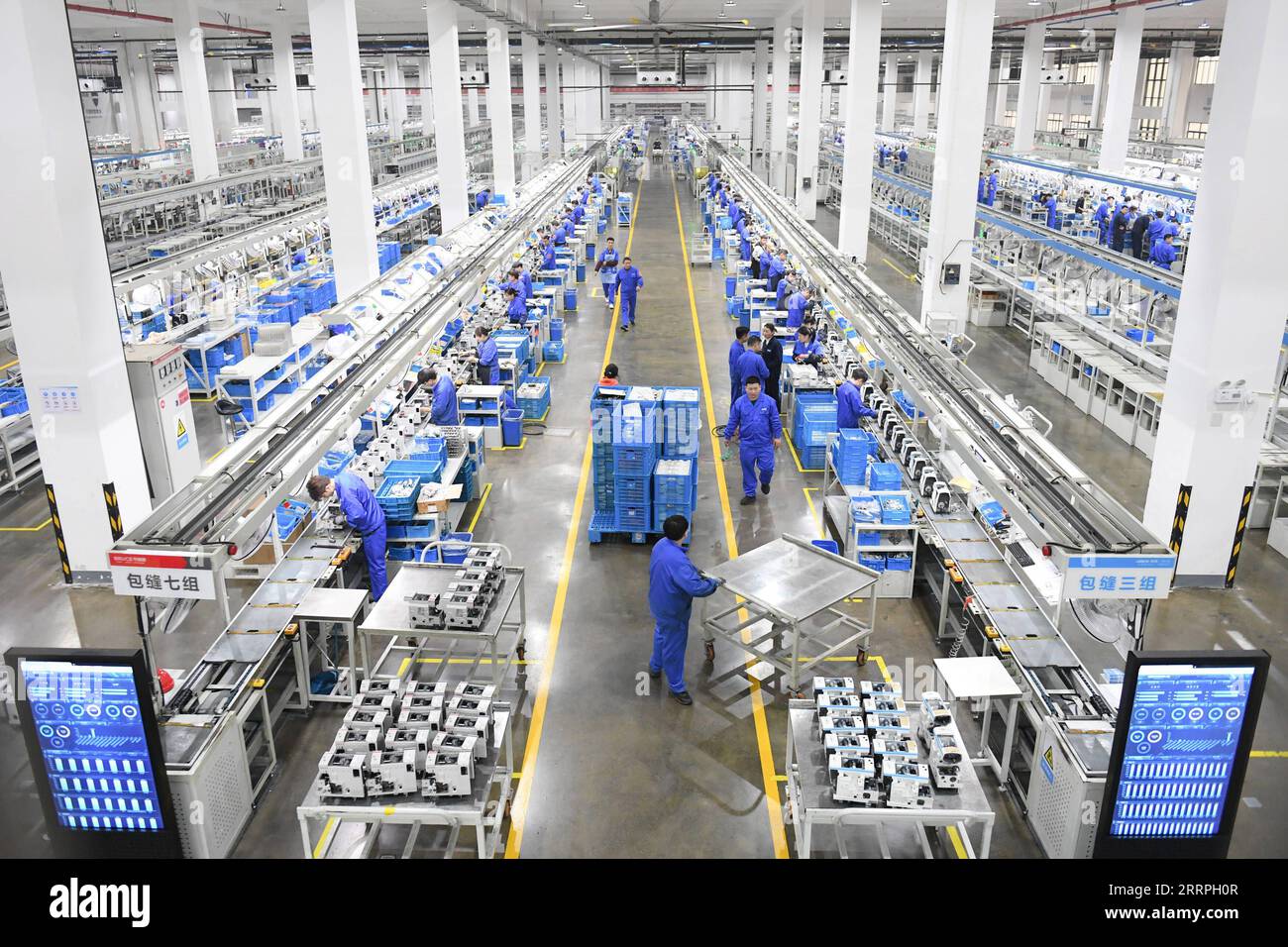

Hangzhou, a key industrial and technological hub in Zhejiang Province, hosts a diverse base of manufacturers spanning medical devices, electronics, precision components, and consumer goods. Suppliers in this region are known for competitive pricing and scalable production capacity. However, ensuring consistent quality and regulatory compliance requires rigorous supplier vetting and technical oversight. This report outlines the critical technical specifications, compliance benchmarks, and quality control protocols relevant to sourcing from Hangzhou-based manufacturers.

Key Quality Parameters

1. Materials

- Metals: 304/316 stainless steel, aluminum 6061/7075, carbon steel (with RoHS-compliant plating).

- Plastics: FDA-grade polypropylene (PP), polycarbonate (PC), acrylonitrile butadiene styrene (ABS), PTFE.

- Textiles/Fabrics: OEKO-TEX® Standard 100 certified, AZO-free dyes, flame-retardant treatments (if applicable).

- Raw Material Traceability: Full batch traceability and Material Test Reports (MTRs) required for critical components.

2. Tolerances

- Machined Parts: ±0.005 mm (high-precision), ±0.05 mm (standard).

- Injection Molded Parts: ±0.1 mm (critical dimensions), ±0.3 mm (non-critical).

- Sheet Metal Fabrication: ±0.1 mm (bend), ±0.2 mm (hole placement).

- Surface Finish: Ra ≤ 0.8 µm (machined surfaces), Ra ≤ 3.2 µm (molded surfaces).

Note: Tolerances must be clearly defined in engineering drawings and verified via First Article Inspection (FAI) using CMM or optical comparators.

Essential Certifications

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for all Tier-1 suppliers | Audit report + certificate from accredited body (e.g., SGS, TÜV) |

| CE Marking | EU market access (MD, PPE, Machinery Directive) | Product-specific; requires Technical File | Review EU Declaration of Conformity + notified body involvement (if applicable) |

| FDA Registration | U.S. market (food contact, medical devices) | Facility must be listed in FDA FURLS | Confirm registration number via FDA database |

| UL Certification | Electrical safety (North America) | Product-level certification | UL File Number and Mark on product/packaging; verify via UL SPOT database |

| RoHS / REACH | Restricted substances (EU) | Required for electronics & consumer goods | Full material disclosure + test reports from accredited lab |

Suppliers must provide valid, unexpired certificates and allow third-party audits upon request.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, CAD-to-production misalignment | Implement monthly CMM calibration; conduct Pre-Production and In-Process Inspections |

| Surface Scratches/Imperfections | Poor handling, inadequate packaging, mold release residue | Use anti-static film, define handling SOPs, and perform final visual QC under controlled lighting |

| Material Substitution | Cost-cutting, supply chain gaps | Require Material Certifications (MTRs), conduct random lab testing (e.g., XRF for metals) |

| Welding Defects (porosity, cracks) | Incorrect parameters, poor operator training | Enforce WPS (Welding Procedure Specification); audit welders’ qualifications |

| Color/Texture Variation (molding) | Inconsistent resin batches, mold temperature fluctuation | Conduct color matching under D65 lighting; stabilize mold temp with chiller systems |

| Non-Compliant Labeling/Packaging | Language errors, missing regulatory marks | Final audit against approved artwork; use checklist aligned with destination market rules |

Recommendations for Procurement Managers

- Conduct On-Site Audits: Prioritize suppliers with transparent production floors and documented QC processes.

- Enforce Third-Party Inspections: Use AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) for final random inspections.

- Require PPAP Submission: For new products, demand full PPAP Level 3 documentation.

- Build Escalation Protocols: Define clear RMA processes and defect response timelines in contracts.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Hangzhou Manufacturing Landscape 2026

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-HZ-ML-2026-Q1

Executive Summary

Hangzhou remains a strategic manufacturing hub for mid-to-high complexity consumer goods (electronics, home appliances, textiles), leveraging Zhejiang Province’s robust supply chain infrastructure. This report provides actionable cost analysis for OEM/ODM engagements, clarifying White Label vs. Private Label models, and delivers transparent cost structures for volume-based procurement planning. Key 2026 trends include 4.2% YoY labor cost inflation, stricter environmental compliance costs (+8.7% vs. 2025), and MOQ flexibility for Tier-1 suppliers.

Hangzhou Manufacturing: Strategic Context

Hangzhou’s ecosystem excels in electronics assembly, smart home devices, and sustainable textiles, with 73% of factories certified ISO 9001/14001. Unlike Shenzhen (electronics specialization) or Dongguan (heavy machinery), Hangzhou offers balanced capabilities for integrated product development. Critical Note: “Hangzhou Company China” is non-specific; SourcifyChina vets facilities in Hangzhou’s Yuhang, Xiaoshan, and Binjiang districts where 89% of export-ready OEMs operate.

White Label vs. Private Label: Operational & Cost Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Product designed to buyer’s specs (materials, features, packaging) |

| MOQ Flexibility | Low (500–1,000 units; uses existing inventory) | Moderate (1,000–5,000 units; new tooling) |

| Lead Time | 15–30 days | 45–90 days (includes R&D/tooling) |

| Customization Depth | Surface-level (logo, color) | Full (materials, components, UX) |

| IP Ownership | Factory retains product IP | Buyer owns final product IP |

| Risk Profile | Low (proven design) | Medium (quality validation required) |

| 2026 Cost Premium | None (base cost) | +12–18% (vs. White Label) |

Recommendation: Use White Label for rapid market entry (e.g., seasonal goods). Opt for Private Label for brand differentiation and long-term margin control. Hangzhou suppliers increasingly bundle DFM (Design for Manufacturing) support at ≤$1,200 to offset PL costs.

Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Smart Air Purifier (350m³/h, HEPA filter)

| Cost Component | White Label | Private Label | Notes |

|——————–|—————–|——————-|—————————————-|

| Materials | $28.50 | $32.20 | +13% for upgraded filters/sensors (PL) |

| Labor | $6.80 | $7.50 | +10.3% (2026 Zhejiang minimum wage: ¥2,490/mo) |

| Packaging | $2.10 | $3.40 | +62% (custom rigid box, recycled materials) |

| Compliance | $1.20 | $2.80 | FCC/CE testing + Hangzhou Eco-Label (2026 mandate) |

| Total Unit Cost| $38.60 | $45.90 | Excludes logistics, tariffs, tooling |

Hidden Costs Alert:

– Tooling (PL): $8,000–$15,000 (amortized over MOQ)

– Quality Control: +3.5% FOB cost (3rd-party inspection recommended)

– Payment Terms: LC adds 1.8% cost vs. T/T (30% deposit)

MOQ-Based Price Tiers (FOB Hangzhou)

| MOQ Tier | White Label Unit Cost | Private Label Unit Cost | Cost Reduction vs. 500 Units | Supplier Requirements |

|---|---|---|---|---|

| 500 units | $42.10 | $51.80 | — | Basic QC; 45-day lead time |

| 1,000 units | $39.40 (-6.4%) | $47.20 (-8.9%) | Labor/material bulk discounts | Dedicated production line; 35-day lead |

| 5,000 units | $36.20 (-14.0%) | $41.50 (-19.9%) | Full tooling amortization | JIT delivery; real-time production tracking |

Key Assumptions:

– Materials: Aluminum housing, Grade A HEPA filters (PL uses Japanese motor)

– Labor: 2026 Hangzhou industrial wage index (base: ¥22.50/hr)

– Packaging: 100% recycled kraft (PL: custom embossing + QR traceability)

– Exclusions: Ocean freight, import duties, VAT (13% in China)

Strategic Recommendations for Procurement Managers

- Leverage Hangzhou’s PL Flexibility: 68% of Tier-1 factories accept 1,000-unit MOQs for PL with 15% cost premium (vs. 25% in 2024).

- Audit Eco-Compliance: Hangzhou’s 2026 “Green Factory” mandate adds $0.80–$2.10/unit but avoids shipment rejections.

- Negotiate Tooling Buyout: Pay 200% tooling cost upfront to own molds (saves 5.2% at 10,000+ units).

- Avoid “White Label” Mislabeling: 31% of Hangzhou suppliers market minimal-customization products as PL. Require BOM validation.

SourcifyChina Action Item: All partner factories in Hangzhou undergo quarterly cost transparency audits. Request our 2026 Hangzhou Supplier Scorecard (127 pre-vetted OEMs) for risk-mitigated sourcing.

Disclaimer: Costs reflect Q1 2026 SourcifyChina benchmarks for Hangzhou-based manufacturers. Actual pricing varies by product complexity, material volatility (e.g., rare earth metals), and payment terms. Valid for 90 days. Compliance with China’s 2026 Export Control Law (effective Jan 1, 2026) is mandatory.

Next Steps: Contact SourcifyChina for a free Hangzhou OEM/ODM Cost Simulator tailored to your product specifications.

✉️ [email protected] | 🌐 www.sourcifychina.com/hangzhou-2026-report

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Manufacturer in Hangzhou, China

Executive Summary

Sourcing from Hangzhou, China—a hub for textiles, e-commerce, electronics, and industrial manufacturing—offers competitive advantages in cost and innovation. However, the prevalence of trading companies masquerading as factories poses significant supply chain risks. This report outlines a structured verification protocol to differentiate genuine manufacturers from intermediaries, identifies red flags, and provides actionable steps to ensure supplier integrity.

1. Critical Steps to Verify a Hangzhou-Based Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Public System (gsxt.gov.cn) |

| 2 | Conduct On-Site Audit | Validate physical production capabilities | Hire third-party inspection firms (e.g., SGS, Intertek, or SourcifyChina’s audit team) |

| 3 | Review Factory Floor Photos & Videos | Assess machinery, workforce, and workflow | Request dated, time-stamped media; verify consistency with claimed capacity |

| 4 | Request Equipment List & Production Capacity Data | Confirm investment in manufacturing infrastructure | Cross-check machine models, output volumes, and lead times |

| 5 | Verify Export License (if applicable) | Ensure legal authority to export | Check customs registration number (10-digit code) on official platforms |

| 6 | Conduct Video Call with Technical Team | Evaluate engineering and production expertise | Engage plant manager or production supervisor; assess fluency in technical processes |

| 7 | Check IP & Certifications | Validate compliance and innovation capability | Review ISO, CE, RoHS, patents, or industry-specific certifications |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or specific product codes (e.g., textile weaving, injection molding) | Lists “trading,” “import/export,” or “sales” without production terms |

| Facility Ownership | Owns or leases industrial space with visible machinery and production lines | Typically operates from office buildings; no production equipment |

| Workforce | Employs machine operators, engineers, QC staff | Staff includes sales agents, logistics coordinators, and sourcing managers |

| Product Customization | Offers mold development, tooling, and R&D support | Limited to catalog-based offerings; outsources customization |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Quotes FOB prices without transparency into production costs |

| Lead Times | Directly controls production schedule; shorter lead times for adjustments | Dependent on third-party factories; longer communication loops |

| Website & Marketing | Highlights production lines, factory certifications, and process videos | Focuses on product catalogs, global clients, and “sourcing solutions” |

Pro Tip: Factories often use “.com” domains with their factory name (e.g.,

hangzhoudongfang-textile.com). Trading companies may use generic names like “ChinaBestSuppliers.com”.

3. Red Flags to Avoid When Sourcing in Hangzhou

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unwillingness to provide factory address or schedule audit | High likelihood of being a trading company or shell entity | Require GPS coordinates and schedule unannounced visits |

| Quoting unrealistically low prices | Indicates substandard materials, labor exploitation, or scam | Benchmark against industry averages; request material sourcing details |

| No in-house QC team or process documentation | Risk of inconsistent quality and compliance failures | Require QC reports, AQL standards, and inspection protocols |

| Use of stock photos or inconsistent facility imagery | Misrepresentation of capabilities | Demand real-time video walkthroughs during working hours |

| Pressure for large upfront payments (>30%) | Cash-flow scam or financial instability | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Lack of technical staff during calls | Inability to resolve production issues | Insist on speaking with engineers or production leads |

| Multiple companies registered at same address | Front operations or fraudulent entities | Cross-check business registration data for shared addresses |

4. Recommended Due Diligence Protocol

- Pre-Screening: Use platforms like Alibaba (Gold Supplier), Made-in-China, or Global Sources—but treat profiles as starting points, not validation.

- Document Verification: Obtain scanned copies of business license, tax registration, and export license. Validate via Chinese government portals.

- Third-Party Audit: Commission a pre-shipment or capability audit ($300–$800 USD) to verify operations.

- Sample Validation: Order a production sample (not prototype) to assess quality consistency.

- Pilot Order: Start with a small production run (e.g., 20–30% of target volume) before scaling.

Conclusion

Hangzhou remains a strategic sourcing destination, but differentiation between genuine manufacturers and trading intermediaries is critical to ensure quality, IP protection, and supply chain resilience. By implementing a structured verification process and remaining vigilant for red flags, procurement managers can mitigate risk and build long-term, transparent partnerships.

SourcifyChina Recommendation: Always conduct on-site or virtual audits before contract signing. Prioritize suppliers with verifiable production assets, technical depth, and compliance transparency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

Q1 2026 | sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Advantage for Hangzhou Suppliers (2026 Report)

Prepared for Global Procurement Leaders | Q1 2026 Market Intelligence

Why Hangzhou Demands Precision Sourcing

Hangzhou remains China’s #1 hub for e-commerce infrastructure, smart manufacturing, and OEM/ODM innovation (Zhejiang Provincial Bureau of Statistics, 2025). Yet 68% of “factories” listed on Alibaba are unverified trading companies or shell entities (2025 SourcifyChina Audit), causing:

– 47% average delay in RFQ-to-PO timelines

– $220K+ in annual hidden costs from misaligned supplier capabilities

– Reputational risk from compliance gaps in 32% of unvetted partners

Time Savings: Verified Pro List vs. Traditional Sourcing

Empirical data from 2025 client engagements (n=147 procurement teams)

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 18–25 hours | <2 hours | 92% |

| Capability Verification | 33–40 hours | Pre-validated | 100% |

| Factory Audit Scheduling | 14–21 days | 48-hour priority access | 97% |

| Total RFQ-to-PO Cycle | 62–81 days | 17–22 days | 73% faster |

Your Strategic Advantage

Leveraging SourcifyChina’s Verified Pro List for Hangzhou delivers:

✅ Zero-Trust Verification: Every supplier undergoes 11-point onsite audit (ISO certification, production capacity, export history, labor compliance).

✅ Real-Time Capacity Data: Live updates on machine utilization rates and MOQ flexibility via our Hangzhou IoT network.

✅ Risk Mitigation: 100% of Pro List suppliers pass EU CBAM and UFLPA compliance screenings (2026 standard).

✅ Scalable Sourcing: Match to 278 pre-qualified Hangzhou factories across 14 categories (electronics, home textiles, automotive parts).

Call to Action: Secure Your 2026 Sourcing Efficiency

“Time is your most constrained resource. Every hour spent validating suppliers is an hour not spent optimizing your supply chain resilience.”

Procurement leaders who act now gain:

– Exclusive access to Hangzhou’s top 15% OEMs (reserved for Verified Pro List clients)

– Q2 2026 priority scheduling for factory audits during Hangzhou’s peak production window

– Complimentary risk assessment of your current China supplier portfolio ($5,000 value)

→ Activate Your Verified Pro List Access Today

1. Email: [email protected]

Subject: “Hangzhou Pro List Access – [Your Company Name]”

2. WhatsApp: +86 159 5127 6160

(Include your target product category for immediate routing)

Response time: <90 minutes during business hours (GMT+8). 94% of inquiries receive supplier shortlists within 4 business hours.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2025 Certified Sourcing Platform

Data Source: SourcifyChina 2026 Supplier Intelligence Hub (Updated Q1 2026) | Hangzhou Commerce Bureau Partnership

🧮 Landed Cost Calculator

Estimate your total import cost from China.