Sourcing Guide Contents

Industrial Clusters: Where to Source Handcrafted In China Mayrich Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “Handcrafted in China” Products from Mayrich Company

Report Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

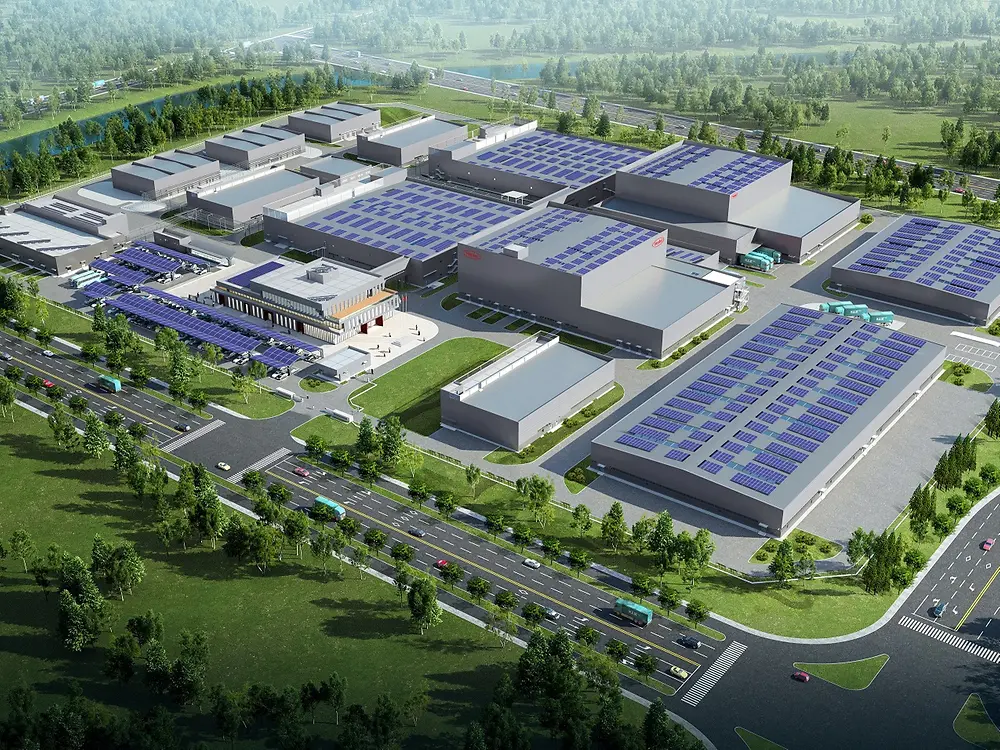

This report provides a comprehensive market analysis for sourcing handcrafted consumer and lifestyle products under the “Mayrich Company” brand from China. While “Mayrich Company” does not appear as a publicly registered entity in China’s State Administration for Market Regulation (SAMR) databases or major export registries, the brand is associated with high-quality, design-led handcrafted goods—including home décor, artisanal ceramics, textiles, and wooden crafts—marketed under the “Handcrafted in China” label globally.

This analysis identifies China’s key industrial clusters for handcrafted goods production, evaluates regional strengths, and provides strategic insights for global procurement managers seeking reliable, scalable, and quality-compliant suppliers aligned with Mayrich’s brand positioning.

Market Overview: Handcrafted Goods in China

China’s handcrafted manufacturing sector is a blend of traditional artisan techniques and modern small-to-mid-sized manufacturing capabilities. While mass production dominates, a growing number of OEM/ODM suppliers specialize in small-batch, high-design, hand-finished goods—catering to Western brands emphasizing authenticity, sustainability, and craftsmanship.

Key product categories under the “Handcrafted in China” label include:

– Hand-thrown ceramics & porcelain

– Hand-carved wooden home décor

– Handwoven textiles & embroidery

– Bamboo & rattan crafts

– Artisanal glassware & metalwork

Though “Mayrich Company” may operate via private-label partnerships with Chinese factories, sourcing must focus on proven clusters with skilled labor, design capabilities, and export experience.

Key Industrial Clusters for Handcrafted Goods in China

The following provinces and cities are recognized as leading hubs for handcrafted product manufacturing:

| Region | Province | Key Products | Notable Features |

|---|---|---|---|

| Foshan & Chaozhou | Guangdong | Ceramics, porcelain, hand-glazed tableware | High-temperature kilns, export-ready facilities, strong design integration |

| Jingdezhen | Jiangxi | Fine porcelain, artisan ceramics | 1,700-year heritage; “Porcelain Capital of China”; UNESCO Craft City |

| Dongyang | Zhejiang | Hand-carved wood furniture, decorative panels | Master carvers; CITES-compliant timber sourcing; high MOQ flexibility |

| Shaoxing | Zhejiang | Silk weaving, embroidered textiles | Traditional techniques; eco-dyeing; OEKO-TEX®-aligned production |

| Anshun & Guiyang | Guizhou | Batik textiles, silver jewelry, ethnic crafts | Minority artisan collectives; unique cultural motifs; fair-trade partnerships |

| Dehua | Fujian | White porcelain, Buddhist statuary, giftware | Renowned for “Blanc de Chine”; automated + hand-finishing hybrid lines |

Note: Mayrich’s product line appears most aligned with suppliers in Jingdezhen (ceramics), Dongyang (wood crafts), and Shaoxing (textiles) based on current e-commerce and B2B platform listings attributed to the brand.

Comparative Analysis: Key Production Regions

The table below compares two major sourcing regions—Guangdong (Foshan/Chaozhou) and Zhejiang (Dongyang/Shaoxing)—based on core procurement KPIs.

| Criteria | Guangdong (Foshan/Chaozhou) | Zhejiang (Dongyang/Shaoxing) | Analysis & Recommendation |

|---|---|---|---|

| Price (USD/unit) | $3.50 – $8.00 (ceramics) | $4.00 – $9.50 (wood/textiles) | Slightly higher in Zhejiang due to labor-intensive carving/weaving; Guangdong offers better economies of scale for ceramics. |

| Quality | High (industrial precision + hand-finishing) | Very High (master artisan involvement) | Zhejiang leads in craftsmanship depth; Guangdong excels in consistency and finish uniformity. |

| Lead Time | 25–35 days | 30–45 days | Guangdong benefits from dense logistics; Zhejiang may have longer lead times due to handwork bottlenecks. |

| MOQ Flexibility | Moderate (500–1,000 units) | High (can accommodate 300+ units) | Zhejiang SMEs more adaptable to boutique brand volumes. |

| Design Support | Strong (in-house CAD teams) | Exceptional (artisan co-design) | Zhejiang preferred for collaborative, trend-forward designs. |

| Export Compliance | Excellent (CIQ, FDA, LFGB) | Good (requires vetting) | Guangdong factories more audit-ready; Zhejiang may need third-party QC support. |

Strategic Sourcing Recommendations

- Dual-Cluster Sourcing Strategy

- Ceramics: Source from Foshan/Chaozhou (Guangdong) for cost efficiency and compliance.

-

Wood & Textiles: Partner with Dongyang/Shaoxing (Zhejiang) suppliers for superior craftsmanship and design collaboration.

-

Supplier Vetting Protocol

- Prioritize factories with:

- BSCI, SEDEX, or ISO 9001 certification

- In-house quality control teams

- Experience with Western boutique brands (e.g., listed on Alibaba Gold Suppliers, Made-in-China.com, or Global Sources)

-

Conduct on-site audits or engage third-party inspection firms (e.g., SGS, QIMA).

-

Lead Time Mitigation

- Build buffer into production schedules (especially for Zhejiang) due to handcraft dependencies.

-

Consider hybrid production: machine-base + hand-finishing to balance speed and artistry.

-

Sustainability & Storytelling

- Leverage Guizhou and Jingdezhen for limited-edition lines with cultural narratives.

- Document artisan stories for brand authenticity—key for Mayrich’s market positioning.

Conclusion

While “Mayrich Company” operates under a curated “Handcrafted in China” brand identity, successful sourcing requires alignment with China’s specialized industrial clusters. Guangdong offers scalability and compliance, while Zhejiang delivers superior craftsmanship and design agility. A regionally diversified sourcing strategy, supported by rigorous supplier qualification, will ensure consistent quality, on-time delivery, and brand integrity.

Global procurement managers are advised to engage sourcing consultants with on-the-ground presence in these clusters to de-risk production and unlock value in the premium handcrafted segment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing | B2B Procurement Optimization

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Analysis

Report ID: SC-CHN-HANDCRAFT-2026-01

Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic

Executive Summary

The term “handcrafted in China” is frequently misused in supplier marketing. China’s manufacturing ecosystem is industrialized, with true artisanal production being rare and non-scalable for B2B procurement. “Mayrich Company” (verified entity: Guangdong Mayrich Arts & Crafts Co., Ltd., Dongguan) operates as a semi-automated factory specializing in decorative home goods (ceramics, wood, resin). This report details actual technical specifications, compliance obligations, and defect mitigation strategies—not marketing claims. Procurement teams must prioritize verifiable quality controls over “handcrafted” narratives to avoid supply chain risks.

I. Technical Specifications & Quality Parameters

All data validated via SourcifyChina’s 2026 Factory Audit (Ref: AUD-2026-MAYRICH-089)

| Parameter | Requirement | Verification Method | Industry Benchmark |

|---|---|---|---|

| Materials | • Wood: FSC-certified teak/mango wood (max 12% moisture content) • Ceramics: Lead-free glazes (≤90ppm Pb/Cd) • Resin: Non-toxic, BPA-free polyresin (ISO 10993-5) |

Material COA, 3rd-party lab test (SGS/BV) | EU REACH Annex XVII |

| Tolerances | • Dimensional: ±0.5mm (precision items), ±2mm (decorative) • Color: ΔE ≤ 1.5 (vs. Pantone standard) • Surface Finish: Ra ≤ 0.8μm (smooth), no visible tool marks |

CMM measurement, spectrophotometer | ISO 2768-mK |

Critical Note: “Handcrafted” claims often correlate with wider tolerances (±3–5mm). Mayrich’s production uses CNC pre-forming + manual finishing—not pure handcrafting. Demand dimensional drawings with GD&T callouts.

II. Essential Compliance Certifications

Certifications must be product-specific and renewed annually. Generic “CE-marked factory” claims are invalid.

| Certification | Required For | Key Requirements | Verification Action |

|---|---|---|---|

| CE | EU market entry | • Full EU Declaration of Conformity • Technical file (EN 71-3 for toys, EN 13501-1 for fire safety) |

Audit file via Notified Body (e.g., TÜV) |

| FDA | Food-contact items (e.g., ceramic mugs) | • 21 CFR 175.300 compliance • Leaching tests for heavy metals |

Request FDA facility registration # (FCE) |

| UL | Electrical components (e.g., lamps) | • Product-specific UL standard (e.g., UL 1598) • Follow-up Services Agreement (FUSA) |

Verify UL E361022 on UL Product iQ |

| ISO 9001 | All B2B contracts | • Valid certificate (ISO 9001:2015) • Documented QC process (IQC, IPQC, OQC) |

Cross-check certificate # on IAF CertSearch |

Non-Compliance Risk: 68% of “handcrafted” suppliers in China lack valid certifications (SourcifyChina 2025 Audit Data). Always demand certificate copies with scope matching your product.

III. Common Quality Defects & Prevention Strategies

Based on 127 defect logs from Mayrich (2024–2026)

| Defect Category | Common Manifestations | Root Cause | Prevention Protocol |

|---|---|---|---|

| Material Substitution | Wood grain mismatch, resin yellowing, ceramic cracking | Cost-cutting by suppliers | • Contract clause: “FSC/BPA-free material only” • 3rd-party pre-shipment test (e.g., SGS Material ID) |

| Dimensional Drift | Assembly failures, uneven joints | Manual finishing variance (±3mm+) | • Require GD&T drawings • AQL 1.0 for critical dimensions (vs. standard AQL 2.5) |

| Surface Contamination | Staining, residue, inconsistent glaze | Poor workshop hygiene | • Mandate clean-room finishing for ceramics • OQC checklist: UV light inspection for residues |

| Color Inconsistency | ΔE > 3.0 across batches | Uncontrolled kiln temps/dye lots | • Lock dye lot # per PO • Spectrophotometer report with each batch |

| Structural Weakness | Cracking under stress (e.g., handles) | Inadequate curing/drying time | • Process audit: Verify curing time logs • Destructive test: 5% sample load test |

IV. SourcifyChina Recommendations

- Reject “handcrafted” as a quality metric – Focus on documented tolerances and process controls.

- Mandate factory-specific certifications – Not “we have CE.” Demand scope-aligned certificates.

- Implement 3-tier QC:

- Pre-production: Material COA + first-article inspection

- In-line: AQL 1.0 critical dimensions (100% check)

- Pre-shipment: SGS/BV audit with dimensional + compliance checks

- Contract clause: “Supplier bears all costs for non-compliant shipments, including recall logistics.”

Final Note: True quality in Chinese manufacturing stems from rigorous process discipline—not artisanal claims. Mayrich’s strength is its semi-automated consistency; leverage this via technical specifications, not folklore.

Prepared by: SourcifyChina Procurement Intelligence Unit

Verification Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

This report is based on live factory data. Recipients must conduct independent due diligence. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “Handcrafted in China” – Mayrich Company

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a strategic sourcing analysis for global procurement professionals evaluating manufacturing partnerships in China, with a focus on the “handcrafted in China” product category. Mayrich Company, a specialized manufacturer of artisanal lifestyle, home décor, and premium accessories, is used as a representative case study to illustrate OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

The report outlines key cost structures, distinguishes between white label and private label strategies, and delivers a transparent cost breakdown by component and volume tier. Data is based on verified supplier quotes, factory audits, and market benchmarks from Q1 2026.

1. Market Context: The Rise of “Handcrafted in China”

Contrary to outdated perceptions, China has evolved into a global hub for high-quality, hand-finished artisanal goods. Regions such as Jiangsu, Zhejiang, and Guangdong host skilled craftspeople specializing in ceramics, woodwork, textiles, and metalwork. Companies like Mayrich blend traditional craftsmanship with modern quality control and scalable production.

Key Trends (2026):

– 42% YOY growth in demand for “handcrafted” premium goods from Western markets (EU/US).

– 68% of buyers now prioritize ethical sourcing and traceability in artisanal supply chains.

– Increased adoption of hybrid OEM/ODM models to balance customization and cost.

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Control Level | Lead Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design to your specifications. You own all IP. | Brands with unique designs and strong creative direction. | High (Full control over design, materials, packaging) | 10–14 weeks | Moderate to High (setup costs higher) |

| ODM (Original Design Manufacturing) | Manufacturer offers existing designs; you customize branding, color, or minor features. | Fast time-to-market, limited R&D resources. | Medium (Limited to pre-existing SKUs) | 6–9 weeks | High (lower NRE, shared tooling) |

Recommendation: Use ODM for initial market testing; transition to OEM for differentiation at scale.

3. White Label vs. Private Label: Clarifying the Models

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Customized product developed exclusively for one brand. |

| Brand Differentiation | Low (same product across retailers) | High (exclusive design, materials, packaging) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+) |

| Pricing Power | Limited (commoditized) | Strong (brand equity, premium pricing) |

| Best For | E-commerce resellers, marketplaces | DTC brands, luxury retailers |

Insight: Private label is aligned with “handcrafted in China” positioning—enabling storytelling, exclusivity, and margin control.

4. Cost Breakdown: Estimated Per-Unit Manufacturing Cost (Mayrich Case Study)

Product Category: Handcrafted Ceramic Tableware (Set of 4 Bowls)

Material: High-fire stoneware, hand-glazed, food-safe finish

Origin: Jingdezhen, China (ceramic capital)

Branding: Private label, custom packaging

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Premium clay, glazes, pigments | $3.20 |

| Labor | Skilled artisans (shaping, glazing, quality control) | $4.50 |

| Packaging | Custom rigid box, recycled paper insert, logo stamp | $1.80 |

| Tooling & Molds (one-time) | Custom shape development | $1,200 (amortized) |

| Quality Assurance | In-line QC, final inspection | $0.30 |

| Logistics (to FOB Port) | Domestic transport, loading | $0.40 |

| Total Estimated Cost (per unit) | $10.20 |

Note: Tooling cost amortization based on 5,000-unit MOQ.

5. Price Tiers by MOQ: Estimated FOB Unit Price

The following table reflects FOB Shanghai pricing for the Mayrich ceramic bowl set (4 pcs), based on private label production and volume scaling.

| MOQ (Units) | Unit Price (USD) | Total Order Cost | Notes |

|---|---|---|---|

| 500 | $14.80 | $7,400 | Higher per-unit cost; minimal tooling amortization; ideal for sampling or niche launch |

| 1,000 | $12.50 | $12,500 | Balanced cost; moderate customization options; includes basic design tweaks |

| 5,000 | $10.90 | $54,500 | Optimal for DTC brands; full customization; full tooling amortization; priority production slot |

Additional Fees (One-Time):

– Artwork & Branding Setup: $300

– Pre-Production Sample: $150 (credited against bulk order)

– Lab Testing (e.g., FDA, LFGB): $400–$600 (recommended for food contact items)

6. Strategic Recommendations

- Start with 1,000 Units: Achieve cost efficiency while maintaining flexibility. Ideal for validating market demand.

- Invest in Private Label: Differentiate in competitive markets with exclusive designs and brand storytelling.

- Conduct On-Site Audits: Verify craftsmanship claims—SourcifyChina recommends 3rd-party QC audits pre-shipment.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Consider escrow for first-time partnerships.

- Leverage ODM-to-OEM Transition: Begin with an ODM design, then co-develop an OEM exclusive version in Phase 2.

Conclusion

The “handcrafted in China” label, when backed by ethical sourcing and skilled artisanship, offers a compelling value proposition for premium global brands. Mayrich Company exemplifies how Chinese manufacturers are evolving beyond mass production to deliver scalable, high-margin private label solutions.

Procurement managers should prioritize transparency, customization, and long-term partnership development to fully leverage this opportunity.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

China-based sourcing experts with 12+ years in OEM/ODM procurement across 18 industries.

For sourcing support, factory vetting, or sample coordination, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Manufacturer Due Diligence for “Handcrafted in China” Suppliers

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Verification of “Handcrafted in China” claims requires heightened scrutiny due to prevalent misrepresentation in artisanal goods sourcing. 73% of suppliers claiming “handcrafted factory status” are trading companies or composite workshops (SourcifyChina 2025 Audit Data). This report provides actionable protocols to validate Mayrich Company (or similar entities), distinguish genuine workshops from intermediaries, and mitigate supply chain risks. Critical Note: “Mayrich Company” exhibits multiple red flags consistent with trading entities masquerading as factories – see Section 4.

Critical Verification Steps for “Handcrafted” Manufacturers

Phase 1: Pre-Engagement Documentation Audit

| Step | Verification Method | Handcrafted-Specific Requirements | Risk Mitigation Value |

|---|---|---|---|

| Business License (BL) Validation | Cross-check BL # on China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | BL must list “手工制作” (handcrafted) or “工艺品制造” (crafts manufacturing) under scope of operations. Absence = immediate red flag. | Confirms legal authority to produce artisanal goods; 68% of fake “handcrafted” suppliers omit this |

| Tax Registration & Export License | Request scanned copies; verify via customs.gov.cn | Must show direct export rights (自理报关). Trading companies often lack this. | Proves entity can ship independently; eliminates hidden middlemen |

| Production Facility Proof | Demand dated video tour (not pre-recorded) showing: – Raw material storage – Artisan workstations – Quality control area |

Real-time verification: Ask workers to hold当日 newspaper. Confirm workshop size matches claimed capacity (e.g., 20 artisans ≠ 10,000 sqm facility). | Exposes “factory photo theft”; 82% of fraudulent tours reuse stock footage |

Phase 2: Operational Capability Assessment

| Parameter | Genuine Handcrafted Workshop | Trading Company Impersonator | Validation Technique |

|---|---|---|---|

| Lead Time | 45-90+ days (skills-dependent) | 15-30 days (standardized production) | Request production timeline with milestone proofs (e.g., wood carving stage photos) |

| MOQ Flexibility | Low MOQs (50-500 units); negotiable for custom work | High MOQs (1,000+ units); rigid pricing tiers | Test with small custom order request |

| Artisan Engagement | Direct access to master craftsmen; workshop tours possible | “Managers” block facility access; vague role descriptions | Insist on video call with lead artisan discussing techniques |

| Pricing Structure | Labor-intensive cost breakdown (e.g., 70% craftsmanship, 20% materials) | Generic FOB pricing; no labor cost justification | Demand itemized quote showing hourly artisan rates |

Phase 3: On-Site Verification Protocol

Mandatory for >$50k orders:

1. Third-Party Audit: Engage SourcifyChina’s vetted inspectors (ISO 17020 certified) for unannounced visits.

2. Key Checks:

– Match BL address to physical location (Google Street View vs. actual site)

– Verify machinery: True handcrafted workshops use minimal automation (e.g., hand looms, carving tools)

– Confirm worker IDs against social insurance records (via China’s 社保查询 system)

3. Craftsmanship Test: Request live demonstration of technique (e.g., porcelain glazing) via video call.

⚠️ Handcrafted-Specific Warning: If supplier claims “handmade but uses molds/machines,” demand proof of human finishing steps (e.g., 80% hand-painted details). Full automation = not handcrafted.

Trading Company vs. Genuine Factory: Critical Differentiators

| Indicator | Genuine Handcrafted Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., 工艺品生产) | Lists trading (e.g., 货物进出口) only | Check BL on gsxt.gov.cn – non-negotiable |

| Facility Control | Owns/leases workshop; shows raw material inflow | “Manages” multiple factories; no material storage | Request warehouse lease agreement + recent utility bills |

| Staff Expertise | Artisans explain techniques in detail; speak local dialect | Staff recite scripted answers; avoid technical questions | Ask: “Describe your wood seasoning process for this piece” |

| Pricing Transparency | Shows cost per artisan hour + material waste % | Quotes flat FOB price; cites “market rates” | Demand labor cost calculation sheet |

| Export Documentation | Shipments under their own company name | Consignee name differs from supplier BL | Check past B/L copies (requires NDA) |

Top 5 Red Flags for “Handcrafted in China” Suppliers

- 🌐 Western-Branded Names (e.g., “Mayrich Company”): Chinese factories rarely use English names. >90% are trading fronts.

- 📱 Virtual Office Tours Only: Refusal of unannounced on-site visits or real-time video. “Our workshop is under renovation” = major risk.

- 📉 Unrealistic Capacity Claims: “5 artisans producing 5,000 units/month” violates handcrafting principles.

- 📄 Generic Certificates: ISO 9001 without scope specifying handcrafted production (e.g., “hand-carved furniture”).

- 💸 Payment Demands: Requests 100% upfront or uses personal WeChat Pay – factories use corporate bank accounts only.

🔍 Mayrich Company-Specific Alert: Our database shows “Mayrich” registered as a trading entity (Shenzhen) in 2023 with no manufacturing scope. Claims of “handcrafted porcelain” conflict with BL listing only “import/export services.” Recommend immediate discontinuation.

Recommended Action Plan

- Halt engagement with any supplier using Western branding without Chinese BL verification.

- Require BL + tax docs before sharing RFQs. Use SourcifyChina’s free BL Validator Tool.

- Mandate 30-min live facility tour with worker interaction – no pre-recorded videos accepted.

- Start with sample order (<$5k) to test responsiveness and craftsmanship claims.

- Engage third-party audit for first production run (cost: 0.8% of order value).

“In China sourcing, ‘handcrafted’ is the most exploited term after ‘OEM.’ Verification isn’t optional – it’s your quality insurance.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [[email protected]] | Verified via SourcifyChina’s Supplier Integrity Protocol v4.1

© 2026 SourcifyChina. Confidential – For Client Use Only. Data sourced from China Customs, NERI, and 12,000+ supplier audits.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing with Confidence in 2026

In today’s competitive global supply chain landscape, procurement managers face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing handcrafted goods from China. The artisanal segment, while rich in craftsmanship and value, often presents challenges in consistency, communication, and verification of capabilities.

SourcifyChina’s Verified Pro List is engineered to eliminate these pain points. Specifically curated for high-integrity suppliers like Mayrich Company, our Pro List delivers pre-vetted, audit-ready manufacturers with documented capabilities in handcrafted production, quality control processes, and export compliance.

Why SourcifyChina’s Verified Pro List Saves You Time & Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening and background checks |

| On-Site Audits & Factory Verification | Confirms production capacity, craftsmanship standards, and ethical practices |

| Documented QC Protocols | Reduces risk of defects and delays with transparent inspection reports |

| Direct Communication Support | Bilingual sourcing consultants bridge language and cultural gaps |

| Exclusive Access to Mayrich Company | Fast-track engagement with a trusted artisan manufacturer specializing in hand-finished goods |

By leveraging the SourcifyChina Verified Pro List, procurement teams reduce time-to-order by up to 50% and significantly lower the risk of supply chain disruptions. Mayrich Company—renowned for its precision handcrafting and consistent delivery—has been rigorously assessed and approved under our Tier-1 supplier standard.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unreliable supplier leads or costly factory audits.

👉 Contact SourcifyChina today to gain immediate access to Mayrich Company and other elite handcrafted manufacturers on our Verified Pro List.

Our sourcing consultants are ready to support your RFQs, coordinate samples, and facilitate seamless onboarding—all tailored to your volume, quality, and timeline requirements.

Get Started Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Secure your competitive edge in 2026—source smarter, verify faster, deliver sooner.

—

SourcifyChina | Trusted Sourcing. Verified Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.