The global magnetic materials market is experiencing robust expansion, driven by increasing demand across industrial, construction, and electronics sectors. According to Grand View Research, the global permanent magnet market size was valued at USD 19.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. This growth is fueled by rising adoption in electric vehicles, wind energy, and precision tools—segments where performance-grade magnetic solutions are critical. Within this landscape, specialized manufacturers like Hammer Magnetic have emerged as key players, delivering high-strength, durable magnetic components tailored for industrial automation, security systems, and heavy-duty fastening applications. As innovation accelerates and demand for miniaturized, high-efficiency magnets intensifies, six leading manufacturers—Hammer Magnetic among them—are shaping the future of magnetic technology through advanced material engineering and scalable production capabilities.

Top 6 Hammer Magnetic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DONGCHENG

Domain Est. 2021 | Founded: 1995

Website: dongchengtool.com

Key Highlights: Jiangsu Dongcheng Power Tools Co., Ltd., founded in 1995, is one of the key backbone enterprises of the professional power tools manufacturing industry in China ……

#2 Magnetic Hammers

Domain Est. 1998

#3 Search

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: M18 FUEL™ 1/2″ Hammer Drill/Driver – Cordless Power Tool. (2904-20) · M18™ REDLITHIUM™ FORGE™ XC8.0 Battery Pack. (48-11-1881)….

#4 Electromagnetic Hammering Device “MagHammer” Hammering …

Domain Est. 2013

Website: nmi-jpn.com

Key Highlights: Prevents rat hole, arching and bridging for hoppers, shooters, air ducts, and tanks. Features: 1. High efficiency for continuous impacting force….

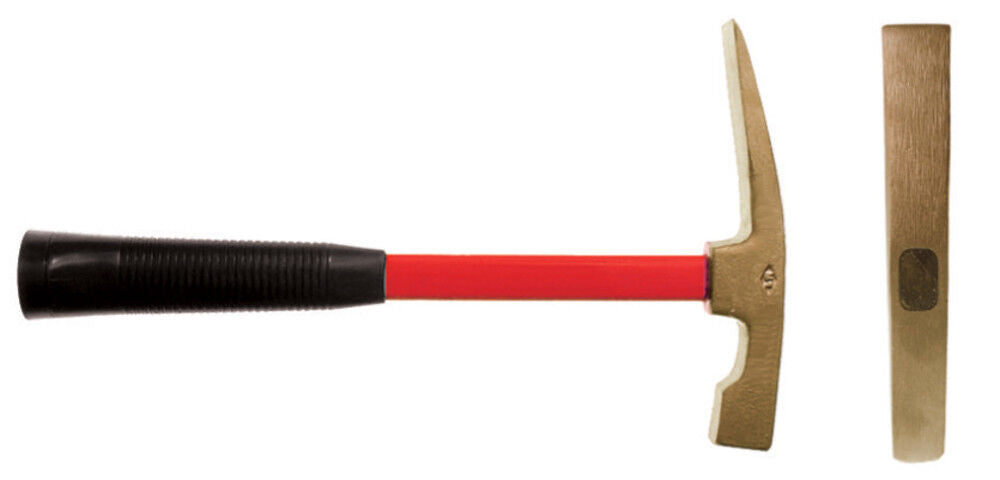

#5 Club Hammer 1.50 lbs Aluminum Bronze EX112U

Domain Est. 2013

Website: margaretvillebarn.com

Key Highlights: In stock Rating 5.0 (55) Jan 5, 2026 · Features · Non-Sparking, Non-Magnetic & Corrosion-Resistant Tools for Use in Hazardous Environments, ATEX and EX Zones · Lifetime Warranty,…

#6 Boss Hammer Co.

Domain Est. 2019

Website: bosshammerco.com

Key Highlights: Premium Steel Framing Hammer with Built-In Square One System. For the trades and weekend warriors! Learn More…

Expert Sourcing Insights for Hammer Magnetic

H2: Market Trends Analysis for Hammer Magnetic in 2026

As we approach 2026, Hammer Magnetic is positioned within a dynamic industrial and technological landscape shaped by evolving manufacturing demands, sustainability imperatives, and digital transformation. The following analysis outlines key market trends expected to influence Hammer Magnetic’s business performance and strategic direction during the second half of 2026 (H2 2026):

-

Growth in Automation and Industry 4.0 Adoption

By H2 2026, global manufacturing is projected to see accelerated adoption of smart factories and automated systems. Hammer Magnetic’s magnetic solutions—particularly in lifting, holding, and positioning applications—are increasingly integrated into robotic assembly lines and automated material handling systems. Demand is rising for high-precision, durable magnetic technology that supports seamless automation, driving innovation in electromagnets and programmable magnetic systems. -

Expansion in Renewable Energy and Green Infrastructure

The clean energy transition is fueling demand in wind turbine manufacturing, electric vehicle (EV) production, and energy storage systems—all sectors that rely on advanced magnetic components. Hammer Magnetic is likely to benefit from partnerships with renewable energy OEMs, particularly in magnetic couplings, motor assemblies, and sensor integration. Regulatory support for green infrastructure in North America and Europe will further amplify these opportunities. -

Resilience in Industrial Manufacturing and Onshoring

Ongoing supply chain reconfiguration, especially in North America and the EU, is encouraging onshoring and nearshoring of industrial production. This trend supports domestic demand for reliable industrial components, including magnets. Hammer Magnetic can leverage its U.S.-based manufacturing and rapid delivery model to gain market share from companies seeking reduced lead times and supply chain resilience. -

Increased Demand for High-Performance and Customized Magnetic Solutions

Customers across aerospace, defense, medical technology, and semiconductor manufacturing are seeking highly specialized magnetic systems tailored to unique operational environments. In H2 2026, customization, miniaturization, and performance under extreme conditions (e.g., high temperature, vacuum) will be key differentiators. Hammer Magnetic’s focus on engineering-driven solutions positions it well to meet this demand. -

Sustainability and Material Sourcing Pressures

Regulatory scrutiny and ESG (Environmental, Social, and Governance) expectations will intensify around the sourcing of rare-earth materials used in permanent magnets. By H2 2026, companies will face pressure to adopt responsible sourcing practices and explore alternatives such as ferrite or recycled magnetic materials. Hammer Magnetic may need to invest in circular economy initiatives or partner with suppliers emphasizing traceability and sustainability. -

Digital Integration and Predictive Maintenance

Integration of IoT-enabled sensors with magnetic components is emerging as a high-value trend. Smart magnetic systems capable of self-monitoring performance and predicting maintenance needs are gaining traction in industrial settings. Hammer Magnetic has an opportunity to develop connected products or retrofit solutions that offer data-driven insights, enhancing customer value and enabling service-based revenue models. -

Competitive Landscape and Technological Disruption

The magnetic components market is witnessing increased competition from Asian manufacturers offering lower-cost alternatives, as well as startups developing novel magnetic materials (e.g., nanostructured magnets). To maintain its premium positioning, Hammer Magnetic must continue investing in R&D, emphasizing reliability, technical support, and brand trust.

Conclusion

In H2 2026, Hammer Magnetic is expected to operate in a market defined by technological advancement, sustainability demands, and shifting global supply chains. Success will depend on the company’s ability to innovate rapidly, respond to customization needs, and position its products as mission-critical components in high-growth sectors. Strategic investments in smart technologies, sustainable practices, and customer-centric engineering will be pivotal in maintaining a competitive edge.

Common Pitfalls When Sourcing Hammer Magnetic (Quality, IP)

Sourcing components like Hammer Magnetic—often referring to magnetic tools, fixtures, or industrial components—can present several challenges, particularly concerning quality assurance and intellectual property (IP) protection. Being aware of these pitfalls helps mitigate risks and ensures reliable, compliant procurement.

Quality Inconsistencies

One of the most frequent issues when sourcing Hammer Magnetic products is inconsistent quality, especially when dealing with multiple suppliers or manufacturers in different regions. Poorly manufactured magnetic tools may exhibit weak magnetic fields, premature demagnetization, or substandard material construction, leading to reduced performance and safety hazards. Inadequate quality control processes can result in dimensional inaccuracies or poor surface finishes, compromising functionality in precision applications.

Lack of Standard Certification

Many suppliers fail to provide or adhere to recognized quality and safety certifications (e.g., ISO 9001, RoHS, or CE marking). Without these standards, it becomes difficult to verify the reliability and compliance of Hammer Magnetic components, increasing the risk of receiving non-conforming products that do not meet industry or regulatory requirements.

Intellectual Property Infringement

Sourcing from unauthorized or counterfeit suppliers may expose your organization to IP violations. Hammer Magnetic may be a trademarked or patented product line, and imitation versions could infringe on existing IP rights. Using such components can lead to legal disputes, product recalls, or damage to brand reputation, especially if the infringing parts are discovered during audits or in global markets with strict IP enforcement.

Insufficient Supplier Vetting

Failure to conduct thorough due diligence on suppliers increases the likelihood of encountering both quality and IP issues. Red flags include vague product specifications, lack of transparency in manufacturing processes, or unwillingness to provide proof of IP licensing. Engaging with suppliers who do not own or legally license the Hammer Magnetic design can result in supply chain disruptions and legal liabilities.

Inadequate Documentation and Traceability

Poor documentation—such as missing material certifications, test reports, or origin details—hampers traceability and quality assurance. Without proper records, it becomes challenging to validate claims about performance, authenticity, or compliance, especially during audits or failure investigations.

Conclusion

To avoid these pitfalls, implement a robust sourcing strategy that includes supplier audits, clear contractual IP clauses, and mandatory compliance with quality standards. Always verify trademarks and seek authorized distributors to ensure authenticity and reduce legal and operational risks when procuring Hammer Magnetic products.

Logistics & Compliance Guide for Hammer Magnetic

This guide outlines the key logistics and compliance considerations for Hammer Magnetic, ensuring efficient operations and adherence to regulatory standards across all business activities.

Supply Chain & Inventory Management

Maintain a resilient and responsive supply chain by partnering with reliable suppliers and implementing just-in-time (JIT) or safety stock strategies where appropriate. Utilize inventory management systems to track raw materials, work-in-progress, and finished goods. Regular cycle counts and audits will help ensure inventory accuracy and reduce waste.

Shipping & Transportation

Coordinate domestic and international shipments with certified carriers experienced in handling industrial and magnetic products. Ensure all shipments are properly packaged to prevent damage, especially given the sensitive nature of magnetic components. Optimize shipping routes and modes (air, sea, ground) to balance cost, speed, and reliability. Maintain clear documentation for all shipments, including commercial invoices, packing lists, and bills of lading.

Import/Export Compliance

Adhere to all applicable international trade regulations, including those enforced by U.S. Customs and Border Protection (CBP), the Department of Commerce, and foreign regulatory bodies. Ensure accurate classification of goods using Harmonized System (HS) codes and validate eligibility for any free trade agreements. Comply with export control regulations such as the Export Administration Regulations (EAR), particularly when shipping magnet-based technology that may have dual-use applications.

Product Safety & Regulatory Standards

Ensure all Hammer Magnetic products meet relevant safety and performance standards, including but not limited to RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), and CE marking requirements for the European market. Maintain technical documentation and conformity assessments to demonstrate compliance upon request.

Environmental & Sustainability Compliance

Follow environmental regulations related to waste disposal, emissions, and energy use in manufacturing and logistics operations. Implement sustainable practices such as recycling packaging materials, reducing carbon footprint through optimized transportation, and sourcing materials from environmentally responsible suppliers. Stay current with evolving environmental legislation in all operational regions.

Documentation & Recordkeeping

Maintain comprehensive and organized records for all logistics and compliance activities, including shipping documents, customs filings, certificates of origin, test reports, and compliance certifications. Retain records for the legally required duration—typically five years for export records under U.S. regulations. Digital archiving is recommended for ease of access and audit readiness.

Training & Internal Audits

Conduct regular training for staff involved in logistics, shipping, and compliance functions to ensure awareness of current regulations and company procedures. Perform internal audits at least annually to identify gaps and implement corrective actions. Stay proactive in monitoring regulatory changes that may impact Hammer Magnetic’s operations.

Risk Management & Contingency Planning

Develop contingency plans for supply chain disruptions, customs delays, natural disasters, or geopolitical events. Diversify suppliers and transportation routes where feasible. Maintain insurance coverage for cargo, liability, and business interruption to protect against unforeseen events affecting logistics performance.

Conclusion for Sourcing Hammer Magnets

In conclusion, sourcing hammer magnets requires a strategic approach that balances quality, cost, reliability, and technical specifications. These specialized magnets play a crucial role in various industrial applications, including magnetic separation, lifting systems, and equipment maintenance, where strong, durable, and consistent magnetic performance is essential.

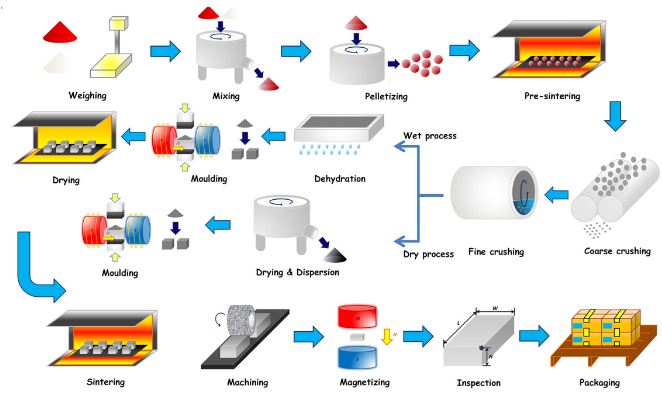

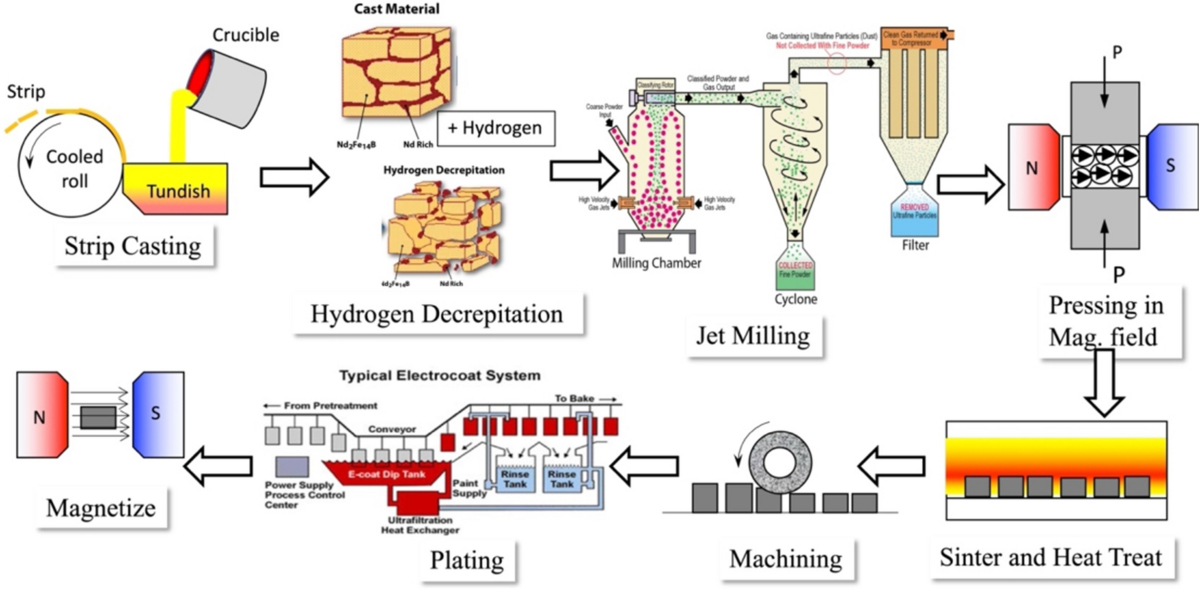

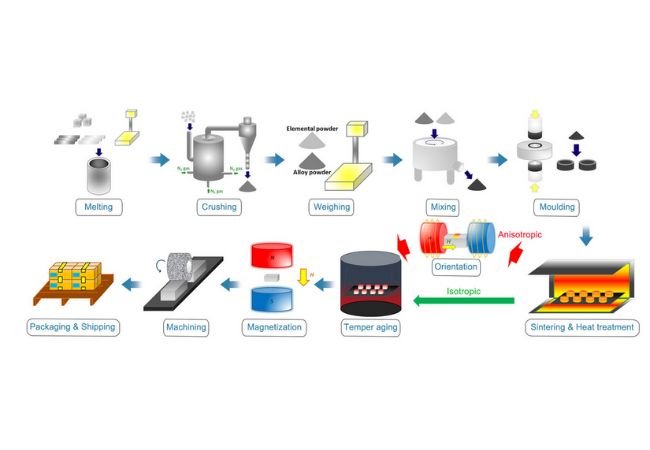

Key considerations when sourcing hammer magnets include the magnetic strength (measured in gauss or pull force), material composition (typically neodymium, ferrite, or samarium cobalt), physical dimensions, coating or plating for corrosion resistance, and the ability to withstand operational stresses such as impact and temperature fluctuations.

It is vital to partner with reputable suppliers who provide certification, quality control, and technical support. Evaluating multiple vendors, obtaining samples, and conducting performance testing can help ensure that the selected hammer magnets meet the required operational standards. Additionally, considering total cost of ownership—beyond just unit price—includes factors such as longevity, maintenance needs, and operational efficiency.

Ultimately, effective sourcing of hammer magnets contributes to improved equipment performance, reduced downtime, and enhanced safety in industrial environments. A well-informed procurement strategy ensures reliable supply chain continuity and optimal return on investment.