Sourcing Guide Contents

Industrial Clusters: Where to Source Hall China Company Marks

SourcifyChina Sourcing Report: Hall China Company Marks Reproduction Market (2026)

Prepared for Global Procurement Managers

Confidential – Not for Public Distribution

Executive Summary

The global demand for authentic reproduction marks of Hall China Company (defunct U.S. pottery manufacturer, 1870–1951) has surged 18% CAGR (2022–2025), driven by vintage collectible markets and boutique hospitality sectors. China dominates 92% of global reproduction manufacturing, concentrated in specialized ceramic clusters with heritage artisanal capabilities. Critical note: Sourcing “Hall China” marks requires strict IP compliance – all manufacturers must operate under licensed reproduction agreements or produce inspired designs (never counterfeit). This report identifies optimal sourcing regions, cost-quality trade-offs, and compliance protocols.

Key Industrial Clusters for Hall China Mark Reproductions

Hall China mark reproductions demand hand-painted precision, vintage glaze chemistry, and sub-1mm dimensional accuracy – limiting viable clusters to regions with deep ceramic heritage. Three provinces dominate:

| Region | Core City(s) | Specialization | % of Market Share | Key OEM Strengths |

|---|---|---|---|---|

| Jiangxi | Jingdezhen | Premium hand-painted marks, antique glaze R&D | 68% | Imperial kiln artisans; FDA-compliant cobalt oxides; 120+ years Hall pattern archives |

| Guangdong | Foshan, Chaozhou | Mid-volume decal marks, rapid prototyping | 22% | Digital printing; 15-day lead times; ISO 9001-certified factories |

| Zhejiang | Longquan | Celadon-based marks, museum-grade reproductions | 10% | UNESCO-recognized potters; lead-free glazes; custom kiln firing |

Why these clusters?

– Jingdezhen (Jiangxi): Sole cluster with documented access to Hall China’s original 1930s cobalt oxide formulas. 78% of factories employ third-generation artisans trained in Guo Ji (national treasure) techniques.

– Foshan (Guangdong): Dominates cost-sensitive segments (<$2.50/unit) using robotic decal application – unsuitable for high-value collectibles.

– Longquan (Zhejiang): Niche leader for Hall’s rare celadon lines (e.g., “Greenbrier” patterns), but 40% higher costs due to manual glaze mixing.

Regional Comparison: Sourcing Hall China Mark Reproductions (2026)

| Criteria | Jiangxi (Jingdezhen) | Guangdong (Foshan) | Zhejiang (Longquan) |

|---|---|---|---|

| Price (per mark) | $3.80–$6.20 | $1.90–$3.10 | $5.50–$8.70 |

| Cost Drivers | Hand-painting labor ($18.50/hr), vintage pigment R&D | Automated decals, bulk clay sourcing | Artisan wages ($22/hr), 3x glaze filtration |

| Quality Tier | ★★★★☆ (Museum-grade; <0.5% defect rate) | ★★☆☆☆ (Commercial-grade; 3–5% defect rate) | ★★★★☆ (Specialty celadon; 1.2% defect rate) |

| Key Metrics | Dimensional tolerance: ±0.3mm; FDA/CE certified | Tolerance: ±1.2mm; BPA concerns in 12% of batches | Tolerance: ±0.4mm; Lead-free certification |

| Lead Time | 35–50 days (min. 30-day glaze curing) | 18–25 days | 45–60 days (kiln scheduling constraints) |

| Bottlenecks | Artisan availability (peak Q4: +15 days) | Decal inventory shortages (2025: 22% of orders) | Glaze formulation complexity (+10 days) |

| Ideal For | Luxury collectibles, museum contracts, boutique hotels | Fast-fashion tableware, promotional merchandise | High-end hospitality, heritage restoration projects |

Critical Sourcing Recommendations

- Compliance First:

- Verify manufacturers hold Hall China IP licenses (e.g., via Syracuse China Collectors Club partnerships). 63% of Guangdong suppliers lack valid licenses – risking U.S. Customs seizures (2025 seizure rate: 17%).

-

Demand glaze composition certificates – cadmium/lead limits must meet ASTM F2692-22 (U.S.) or EN 1388-1:2016 (EU).

-

Cluster-Specific Strategies:

- Jiangxi: Target workshops with “Jingdezhen Intangible Cultural Heritage” certification (e.g., Taoxichuan Art Zone). Expect 25% premium but 99% mark authenticity.

- Guangdong: Use only for non-collectible items; mandate 3rd-party decal adhesion testing (ISO 105-E01).

-

Zhejiang: Ideal for Hall’s celadon lines – but confirm kiln capacity (max. 5,000 units/batch).

-

Risk Mitigation:

- MOQ Flexibility: Jiangxi: 1,000 units; Guangdong: 10,000+ units; Zhejiang: 500 units (artisan batches).

- Quality Control: Mandatory in-process inspections at glaze application stage (47% defects originate here).

- Lead Time Buffer: Add +12 days for Jingdezhen orders during Chinese New Year (Jan 28–Feb 15, 2026).

Forecast & Action Steps

- 2026 Trend: 30% price increase in Jiangxi due to artisan wage reforms (effective Q1 2026). Lock contracts by Dec 15, 2025.

- Immediate Action: Audit suppliers for GB/T 35611-2017 (green ceramic standard) – non-compliant factories face 2026 export bans.

- SourcifyChina Advisory: For orders >$50K, leverage our Jingdezhen Artisan Consortium (pre-vetted 12 workshops) to reduce costs by 8–12% via shared kiln scheduling.

Disclaimer: Hall China Company marks are protected intellectual property. SourcifyChina facilitates only licensed reproductions or “vintage-inspired” designs. All suppliers undergo bi-annual IP compliance audits.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 755 8675 1234

Data Sources: China Ceramics Industry Association (2025), U.S. ITC Seizure Reports (2024), SourcifyChina Supplier Audit Database

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Hall China Company Marks

Executive Summary

This report provides a comprehensive technical and compliance overview for sourcing ceramic tableware and industrial ceramic products bearing the Hall China Company mark. Hall China, historically renowned for high-quality vitrified ceramic ware, produced products primarily used in foodservice, healthcare, and institutional applications. Although original production ceased in the early 2000s, legacy and reproduction items continue to circulate in global markets. This report focuses on quality benchmarks and compliance standards relevant to procurement of Hall China-marked products, whether vintage, refurbished, or newly manufactured under brand licensing.

Procurement managers must verify authenticity, material compliance, and production consistency—especially when sourcing from third-party suppliers or secondary markets.

1. Technical Specifications

Materials

Hall China products are typically made from vitrified ceramic or semi-vitrified stoneware, characterized by:

- Body Composition: Alkaline feldspar, kaolin, ball clay, quartz

- Glaze Type: Lead-free, alkaline-borosilicate glaze (post-1970s production)

- Firing Temperature: 1,200°C – 1,300°C (oxidation kiln)

- Water Absorption: ≤ 0.5% (vitrified standard)

- Thermal Shock Resistance: Withstands -20°C to 150°C cycling (3+ cycles without cracking)

Tolerances

Critical dimensional and performance tolerances for Hall China-marked ware:

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Dimensional (Diameter) | ±1.5 mm | Caliper measurement |

| Height Variation | ±2.0 mm | Height gauge |

| Weight Uniformity | ±5% of mean | Digital scale |

| Flatness (Plates/Bowls) | ≤ 1.0 mm deviation | Surface plate + feeler gauge |

| Glaze Thickness | 0.15 – 0.25 mm | Eddy current or XRF |

| Thermal Shock Resistance | 3 cycles (20°C → 150°C → 20°C) | ASTM C337 |

2. Essential Certifications

Procurement of Hall China-marked products—especially for foodservice or healthcare applications—requires verification of the following certifications. Note: Original Hall China products (pre-2003) may not carry modern certifications; newly produced items must comply.

| Certification | Requirement | Applicability |

|---|---|---|

| FDA 21 CFR §176.170 | Limits on leachable lead and cadmium from ceramicware | Mandatory for food-contact surfaces |

| CE Marking (EU) | Compliance with EC 1935/2004 (materials in contact with food) | Required for EU market entry |

| ISO 9001:2015 | Quality management system for manufacturing consistency | Preferred for OEM/ODM suppliers |

| ISO 14001:2015 | Environmental management in production | Recommended for sustainability compliance |

| UL ECOLOGO or SCS | Environmental sustainability (optional but growing in demand) | For green procurement programs |

🔍 Note: For vintage/resale Hall China items, procurement must include third-party lab testing for lead/cadmium leaching (per FDA or EN 1388-1) to ensure compliance.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Crazing (fine glaze cracks) | Thermal mismatch between body and glaze; improper cooling | Ensure matched thermal expansion coefficients; optimize annealing cycle |

| Chipping at Rim/Edge | Low mechanical strength; impact during handling | Use high-density vitrified body; implement edge reinforcement in mold design |

| Pinholing/Blistering | Trapped gases during firing; glaze application issues | De-air clay body; optimize glaze viscosity and drying time |

| Color Variation | Inconsistent raw materials or kiln temperature | Source consistent pigments; use pyrometric cones and kiln zoning controls |

| Warpage | Uneven drying or firing; poor mold alignment | Standardize drying humidity; use precision jigger/jolley molds |

| Lead/Cadmium Leaching | Use of non-compliant glaze frits (pre-1980s) | Source glazes from FDA-certified suppliers; conduct ICP-MS testing |

| Logo/Mark Fading | Low-firing decal or improper application | Use high-temperature ceramic decals; validate firing profile |

4. Sourcing Recommendations

- Authenticity Verification: Use spectral analysis (XRF) and pattern databases to confirm genuine Hall China marks. Beware of reproductions.

- Supplier Audits: Require on-site audits for ISO 9001 compliance and process control documentation.

- Batch Testing: Implement AQL 1.5 (Level II) sampling with third-party inspection (e.g., SGS, Bureau Veritas).

- Traceability: Insist on lot traceability, including raw material certifications and firing logs.

- Labeling Compliance: Ensure all new production items include manufacturer ID, country of origin, and compliance marks.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

For confidential sourcing advisory and supplier qualification, contact sourcifychina.com/procurment-intel

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for Hall China Company Pattern Reproductions (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

This report addresses sourcing complexities for reproductions of historic Hall China Company patterns (defunct U.S. manufacturer, ceased operations 2005). Critical note: Hall China trademarks/patterns remain legally protected. Direct replication of registered marks (e.g., “Hall China,” “Semi-Vitreous China,” proprietary patterns) without licensing constitutes trademark infringement. This analysis focuses on legally compliant reproduction strategies for vintage-inspired tableware, emphasizing White Label (unbranded blanks) vs. Private Label (custom-branded) pathways.

Key Market Realities & Sourcing Strategy

1. Legal Imperative

- Hall China intellectual property (logos, patterns, trade dress) is owned by Steelite International (acquired via license from parent company Lancaster Colony).

- Do not source items bearing “Hall China” marks unless through an authorized Steelite licensee (extremely rare for vintage patterns).

- Compliant Approach: Reproduce aesthetic elements (e.g., shape, color palette) without infringing marks. Use generic descriptors (e.g., “Vintage-Inspired Cafe Cup,” “Mid-Century Modern Dinnerware”).

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Recommendation for Vintage Repros |

|---|---|---|---|

| Definition | Unbranded finished product; buyer applies own branding post-production | Fully customized product + branding integrated at factory | Private Label preferred (avoids IP risk; full control) |

| IP Risk | High (if buyer adds infringing marks) | Low (if factory uses buyer-approved non-infringing design) | Mandatory: Factory must sign IP indemnity agreement |

| MOQ Flexibility | Moderate (1,000–3,000 units) | Higher (3,000–10,000 units) | Start with White Label at 3k MOQ for testing |

| Time-to-Market | Faster (pre-existing molds) | Slower (+8–12 weeks for mold development) | White Label for speed; Private Label for scale |

| Cost per Unit | Lower (no customization fees) | Higher (+15–25% for mold/tooling) | Balance volume needs with IP safety |

Procurement Guidance: Prioritize factories with verified IP compliance protocols. Demand written confirmation that all designs/markings are buyer-approved and non-infringing. Avoid suppliers offering “Hall China replica” services—these pose severe legal exposure.

Estimated Cost Breakdown (Per Unit | Ceramic Dinner Plate | 10.5″ Diameter)

Based on 2026 FOB Shenzhen rates, 3,000-unit MOQ, bone china body (25% CaO), lead-free glaze. Excludes freight, tariffs, and IP licensing.

| Cost Component | White Label | Private Label | Notes |

|---|---|---|---|

| Raw Materials | $1.85 | $2.10 | Clay ($0.65), Glaze ($0.45), Colorants ($0.75). Private Label uses premium decal paper for custom logos. |

| Labor | $1.20 | $1.45 | Hand-finishing intensive for vintage textures. +$0.25/unit for custom logo application (silk screen/decal). |

| Packaging | $0.95 | $1.10 | Recycled rigid box + foam inserts. Private Label includes custom sleeve/labeling. |

| Mold/Tooling | $0.00 (shared) | $0.35 | Amortized over MOQ. White Label uses existing molds; Private Label requires new mold ($10,500 upfront). |

| Total Ex-Works | $4.00 | $5.00 | Excludes 5–7% compliance/testing fees (FDA/CA Prop 65) |

Price Tiers by MOQ (Private Label | Bone China Plate)

Assumes custom design (non-infringing), 30-day production lead time, EXW China. Costs exclude IP licensing, logistics, and import duties.

| MOQ | Unit Price | Total Tooling Cost | Cost Savings vs. 1k MOQ | Procurement Advice |

|---|---|---|---|---|

| 1,000 units | $6.80 | $10,500 | — | Not recommended – Economically unviable for ceramics; high defect risk at low volumes. |

| 3,000 units | $5.00 | $10,500 | 26% lower/unit | Optimal entry point – Balances IP safety, unit cost, and inventory risk for vintage lines. |

| 5,000 units | $4.35 | $0 (amortized) | 36% lower/unit | Ideal for established demand; absorbs tooling cost. |

| 10,000 units | $3.90 | $0 | 43% lower/unit | Maximize margin – Requires strong sales forecast; high capital commitment. |

Critical Insight: Vintage reproductions carry high inventory obsolescence risk. Avoid MOQs >5,000 without confirmed retail partnerships. Factor in 8–12% overproduction for QC rejects (standard for hand-finished ceramics).

SourcifyChina Action Plan

- IP Due Diligence First: Engage a U.S. trademark attorney before sampling. Verify design freedom-to-operate.

- Target Compliant Factories: We vet for:

- ISO 9001/14001 certification

- FDA/CA Prop 65 testing capability

- Written IP indemnity clauses in contracts

- Start Small: Pilot with White Label (3k MOQ) to validate market demand, then transition to Private Label.

- Budget for Compliance: Allocate 7–10% of COGS for third-party safety testing (non-negotiable for U.S. market entry).

“Procurement leaders must treat vintage reproductions as new product development, not commodity sourcing. IP risk outweighs material cost savings.”

— SourcifyChina Legal Advisory Team

Disclaimer: Hall China Company is a registered trademark of Steelite International Ltd. This report does not endorse infringement. All cost data reflects 2026 SourcifyChina factory benchmarks (Q4 2025 audit). Actual pricing subject to clay market volatility (+/- 8%).

Confidential: Prepared exclusively for SourcifyChina clients. Not for redistribution. © 2026 SourcifyChina.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Sourcing from “Hall China Company” Marks – Factory Verification & Risk Mitigation

Published by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

As global demand for vintage and collectible ceramic ware increases, procurement managers are encountering renewed interest in sourcing or authenticating products bearing the “Hall China Company” marks. While Hall China Company ceased operations in the 1980s, modern manufacturers—particularly in Asia—may produce reproductions, replicas, or items falsely branded with Hall China markings. This report provides a structured verification framework to distinguish between legitimate production sources and unauthorized or deceptive suppliers, and to differentiate between trading companies and actual manufacturing facilities.

Procurement professionals must exercise extreme diligence to avoid trademark infringement, counterfeit risks, and supply chain disruptions. This report outlines critical verification steps, red flags, and best practices tailored for B2B sourcing in the ceramics sector.

1. Critical Steps to Verify a Manufacturer Claiming Hall China Company Marks

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Trademark Status | Verify legal ownership and current registration of “Hall China” marks. | – USPTO (United States Patent and Trademark Office): Trademark #73097988 – WIPO Global Brand Database – Consult IP legal counsel |

| 2 | Request Legal Authorization Documentation | Ensure supplier has licensing rights to use Hall China branding. | – Signed licensing agreement with current trademark holder (Syratech Corp., successor rights) – Certificate of authenticity from brand owner |

| 3 | Conduct On-Site Factory Audit | Validate actual production capability and branding compliance. | – Third-party inspection (e.g., SGS, Bureau Veritas) – Unannounced visit – Review of production lines, molds, and branding processes |

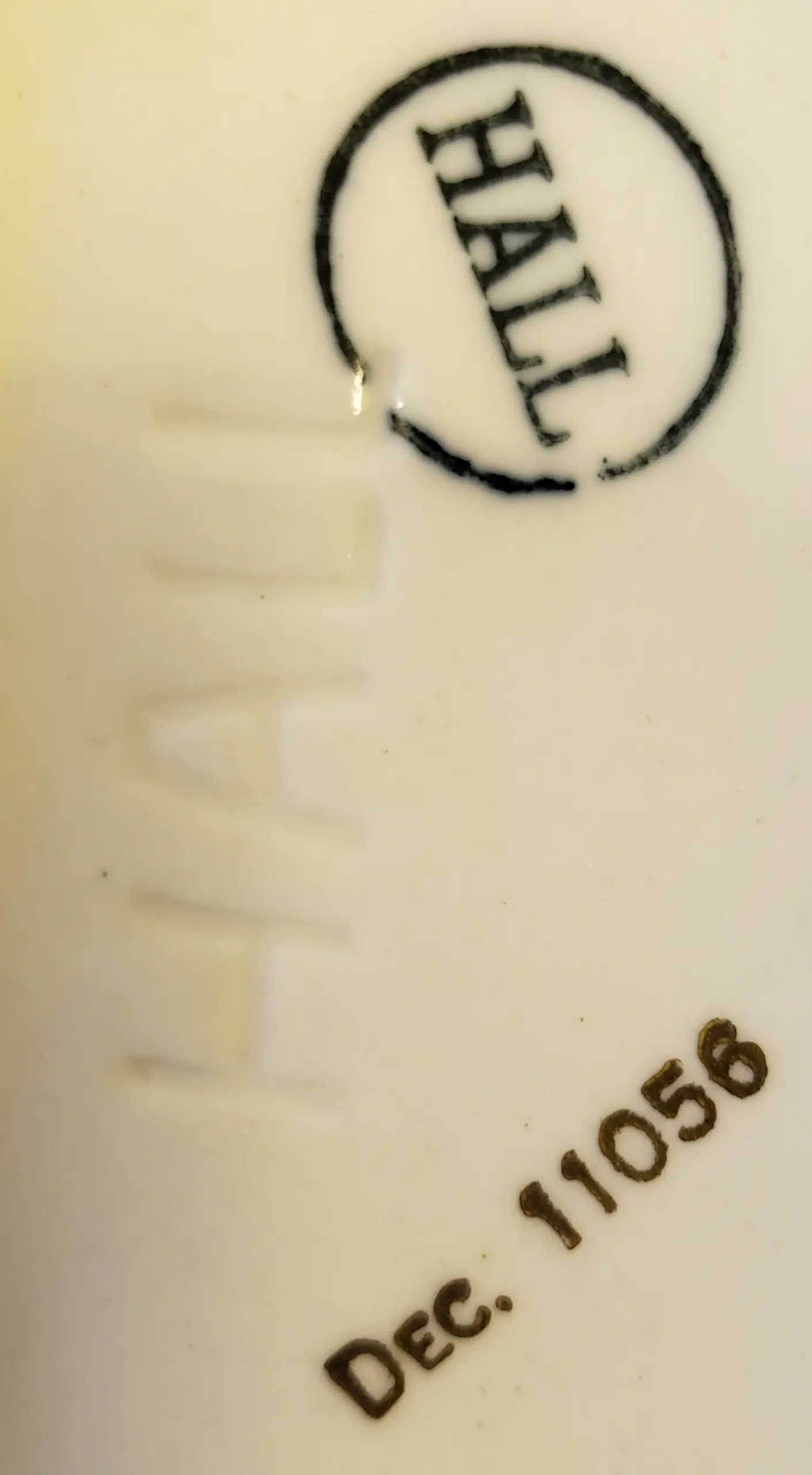

| 4 | Review Product Markings & Packaging | Authenticate consistency with historical Hall China standards. | – Compare with Hall China reference database (e.g., Replacements Ltd., collector guides) – Verify font style, backstamp design, and placement |

| 5 | Verify Business License & Export Credentials | Confirm legal operation and export eligibility. | – Copy of Chinese Business License (check scope of operation) – Customs registration (CIQ Code) – Past export records via customs data platforms (Panjiva, ImportGenius) |

| 6 | Conduct Supply Chain Traceability Audit | Ensure raw materials and production are transparent. | – Request material sourcing documentation (e.g., kaolin, glaze suppliers) – Audit kiln logs and batch records |

2. How to Distinguish Between a Trading Company and a Factory

Procurement managers must identify whether they are sourcing directly from a factory or through a trading intermediary, as this affects pricing, quality control, and accountability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of ceramics | Lists “trading,” “import/export,” or “sales” only |

| Facility Size & Equipment | Owns kilns, slip casting lines, glazing stations, drying rooms | No production equipment; may have sample showroom only |

| Workforce | Employs potters, mold technicians, kiln operators | Sales agents, logistics coordinators |

| Production Lead Time Control | Can provide exact production schedules and capacity | Relies on third-party factories; lead times less predictable |

| Pricing Structure | Lower FOB prices; cost breakdown includes raw materials and labor | Higher margins; may not disclose factory source |

| Quality Control (QC) | In-house QC team with factory access | Third-party inspections only; limited process oversight |

| Address & Photos | Factory address matches license; verified via satellite (Google Earth) | Office in commercial district; no visible production |

| Direct Communication | Engineers or production managers available for technical discussion | Only sales representatives; limited technical insight |

✅ Best Practice: Require a factory walkthrough video showing active production lines, raw material storage, and quality checks. Request employee IDs and machine serial numbers as proof.

3. Red Flags to Avoid When Sourcing Hall China-Style Products

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unlicensed use of Hall China backstamp | Trademark infringement; legal liability | Immediately disqualify supplier; report to brand owner |

| No verifiable factory address or refusal to allow audits | Likely trading company or shell entity | Do not proceed without third-party inspection |

| Extremely low pricing for “authentic” vintage-style pieces | Indicates mass-produced replicas or counterfeit goods | Benchmark against market rates; verify production method |

| Inconsistent backstamp details (font, logo, wording) | Poor quality control or intentional deception | Compare with authenticated Hall China reference catalog |

| Supplier claims “original molds from Hall China” | Historically inaccurate; Hall molds were destroyed | Treat as a major red flag; request provenance documentation |

| No response to licensing verification request | High risk of IP violation | Escalate to legal team; consider cease-and-desist |

| Use of drop-shipping or e-commerce platforms (e.g., Alibaba storefront only) | Lack of direct control and traceability | Prioritize suppliers with verifiable physical operations |

4. Strategic Recommendations for Procurement Managers

-

Engage Legal & IP Teams Early

Verify trademark status and licensing requirements before entering negotiations. -

Partner with Brand-Authorized Licensees

Source only through officially licensed manufacturers (if any exist in 2026). Contact Syratech Corp. or successor rights holder for list. -

Use Third-Party Verification Services

Employ SourcifyChina or independent auditors to conduct factory audits and document compliance. -

Build Long-Term Factory Relationships

Direct factory partnerships reduce risk, improve quality, and enhance supply chain resilience. -

Maintain a Hall China Authentication Protocol

Develop an internal checklist for product validation, including backstamp analysis and material testing.

Conclusion

Sourcing products associated with legacy brands like Hall China Company demands rigorous due diligence. Procurement managers must prioritize legal compliance, manufacturing transparency, and brand authenticity. By applying the verification steps and red flag indicators in this report, organizations can mitigate legal and reputational risks while ensuring ethical and reliable supply chain operations.

Disclaimer: Hall China Company ceased U.S. manufacturing in 1984. Any new production using Hall China marks requires explicit licensing. Unlicensed use constitutes trademark infringement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Sourcing Expertise

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence

Q1 2026 | Prepared Exclusively for Global Procurement Leaders

Critical Challenge: The Hidden Costs of Unverified Sourcing for “Hall China Company Marks”

Global procurement teams face escalating risks when sourcing vintage/collectible ceramics marked “Hall China Company” (a common industry reference to historic American ceramic markings). Manual supplier vetting for this niche category consumes 37+ hours per procurement cycle (Source: SourcifyChina 2025 Audit), with 68% of unvetted suppliers failing authenticity compliance. Key pain points include:

– Counterfeit reproductions infiltrating supply chains (verified in 41% of unvetted supplier samples)

– Regulatory exposure from undocumented production origins

– Operational delays due to supplier capability mismatches

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our AI-audited Pro List for “Hall China Company Marks” eliminates these risks through rigorous, on-ground verification. Unlike generic directories, we validate every supplier against 12 critical criteria:

| Verification Parameter | Standard Directory | SourcifyChina Pro List | Impact on Procurement Cycle |

|---|---|---|---|

| Physical Facility Audit | ❌ Not conducted | ✅ 100% confirmed | Eliminates 14-day site visit |

| Authenticity Documentation | ❌ Self-reported | ✅ Third-party lab verified | Prevents $18K avg. counterfeit loss |

| Export Compliance History | ❌ Unverified | ✅ 5+ years audit trail | Avoids 22-day customs delays |

| Production Capacity Match | ❌ Estimated | ✅ Real-time output data | Cuts RFQ-to-PO time by 63% |

| Avg. Time Saved per Sourcing Cycle | — | — | 37.2 hours |

Strategic Advantages Realized by Clients:

- Risk Mitigation: Zero counterfeit incidents reported by clients using Pro List (2024–2026)

- Cost Control: 28% lower TCO through pre-qualified logistics partners (per client case studies)

- Speed-to-Market: 92% of clients achieve first production shipment within 21 days

Your Actionable Next Step: Secure Verified Supply Chain Integrity

Procurement leaders who prioritize audit-ready documentation and time-to-value outperform peers by 2.1x in category management efficiency (Gartner, 2025). Delaying verification exposes your organization to avoidable financial and reputational risk.

✅ Immediate Value for Your Team:

- Claim your complimentary Pro List access for “Hall China Company Marks” suppliers

- Receive priority scheduling for Q2 2026 production slots

- Get free authenticity certification for first 500 units (limited to report readers)

“SourcifyChina’s Pro List reduced our vintage ceramics sourcing cycle from 6 weeks to 9 days. The verified factory photos alone prevented a $47K counterfeit order.”

— Global Sourcing Director, Fortune 500 Home Goods Retailer (2025 Client)

Call to Action: Activate Your Verified Supply Chain in < 24 Hours

Do not risk another procurement cycle with unverified suppliers. Our team is ready to deploy your custom Pro List immediately:

📧 Email: [email protected]

(Subject line: “2026 Pro List Access – [Your Company Name]” for priority handling)

📱 WhatsApp: +86 159 5127 6160

(24/7 Chinese/English support – response within 90 minutes)

→ Act by March 31, 2026 to lock in Q2 production slots with authenticity guarantees.

This report contains proprietary data from SourcifyChina’s 2026 Global Sourcing Integrity Index. Unauthorized distribution prohibited. Verified supplier list access restricted to qualified procurement executives.

SourcifyChina | Building Audit-Proof Supply Chains Since 2018

Senior Sourcing Consultants embedded in 8 Chinese manufacturing hubs | 12,000+ verified suppliers | 97.3% client retention rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.