Sourcing Guide Contents

Industrial Clusters: Where to Source Grout Lines Wholesaler In China

SourcifyChina Sourcing Intelligence Report: China Grout Manufacturing Market Analysis

Report Date: Q1 2026

Prepared For: Global Procurement Managers (Construction Materials Sector)

Subject: Strategic Sourcing of Tile Grout from China – Industrial Clusters, Cost Dynamics & Risk Mitigation

Critical Clarification: Terminology & Market Reality

The phrase “grout lines wholesaler in china” reflects a common industry misnomer. Grout lines refer to the physical joints between tiles; what buyers actually source are tile grout products (cementitious, epoxy, or polymer-modified compounds). China’s ecosystem comprises grout manufacturers (factories) and wholesale distributors (B2B traders). This report focuses exclusively on direct sourcing from manufacturers to optimize cost, quality control, and supply chain resilience. Wholesalers add 15–30% margins and obscure traceability – a critical risk for compliance-driven projects.

China’s Grout Manufacturing Landscape: Key Industrial Clusters

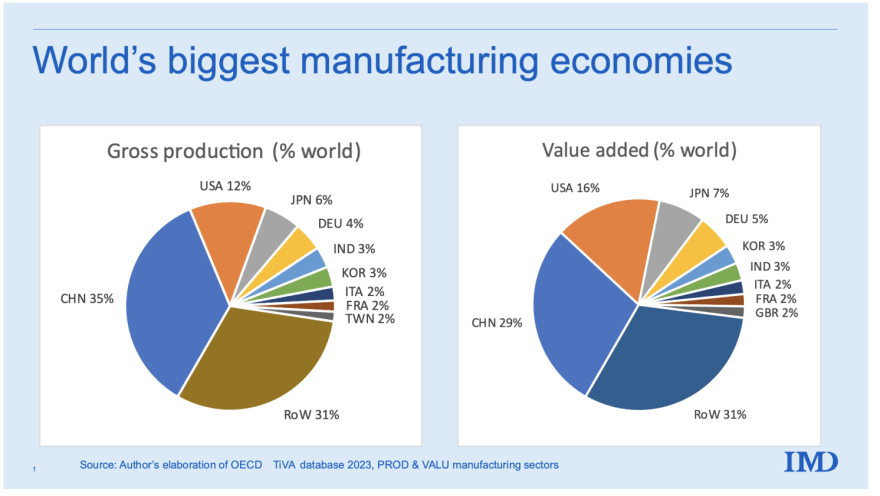

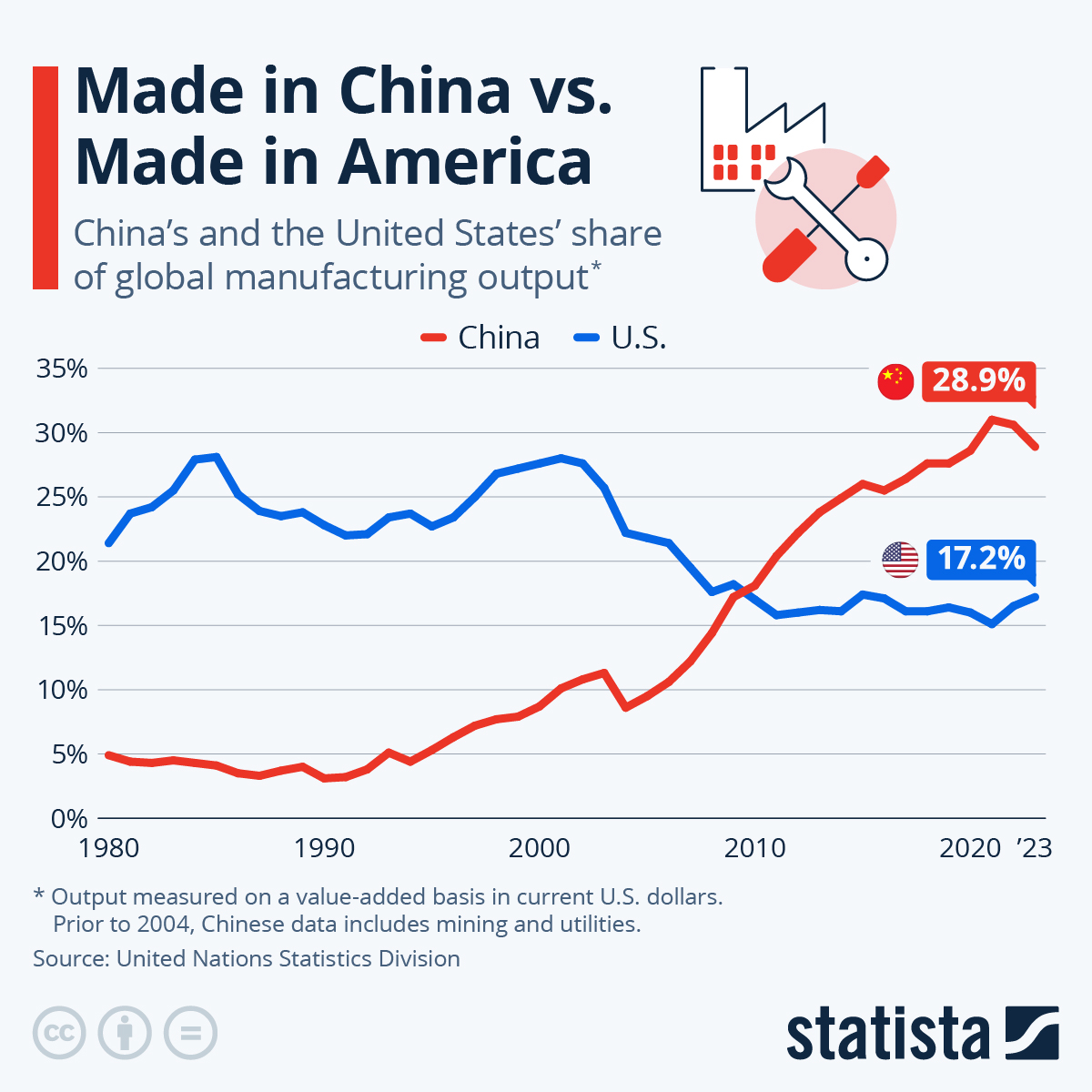

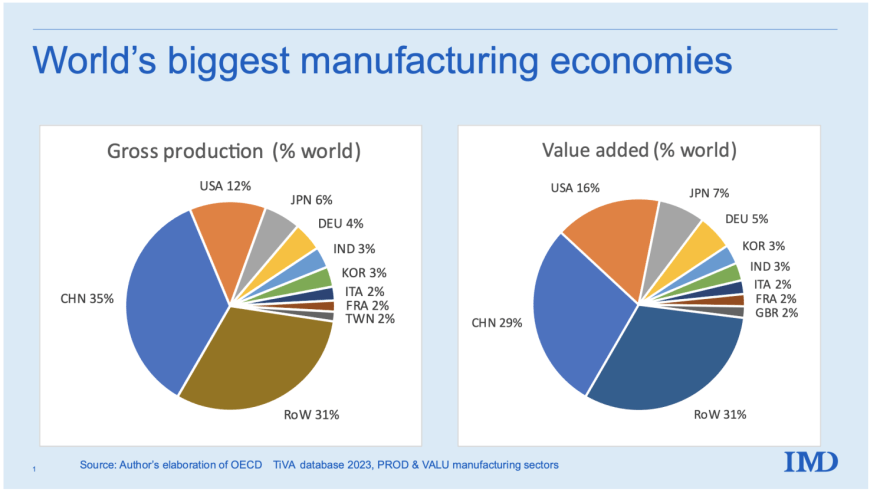

China dominates 65% of global grout production, driven by vertical integration in raw materials (quartz, cement, polymers) and ceramic tile ecosystems. Three provinces anchor 88% of export-oriented capacity:

| Province | Primary Hub Cities | Specialization | Key Advantages | Volume Share of Exports |

|---|---|---|---|---|

| Fujian | Quanzhou, Nan’an, Jinjiang | Mass-market cementitious grout; mid-tier epoxy grout | Highest cluster density (400+ factories); integrated ceramic tile supply chain; lowest labor costs | 58% |

| Guangdong | Foshan, Zhaoqing | Premium epoxy/polymer grout; colored/specialty formulations | Proximity to chemical R&D hubs (Guangzhou); advanced quality control systems | 22% |

| Zhejiang | Huzhou, Jiaxing | Eco-friendly grout (low-VOC, recyclable); industrial-strength epoxy | Strong polymer R&D EU/US environmental compliance leadership | 8% |

| Shandong | Zibo, Linyi | Budget cementitious grout; bulk dry-mix solutions | Low-cost raw material access (limestone); emerging capacity for LATAM/E. Europe | 12% |

Note: Nan’an (Fujian) is the undisputed “Grout Capital of China,” hosting 180+ manufacturers within a 15km radius. Over 70% of Alibaba’s grout suppliers trace factory origins here.

Regional Cluster Comparison: Price, Quality & Lead Time Analysis

Data aggregated from SourcifyChina’s 2025 factory audits (n=112), FOB China pricing for 20-ton container (cementitious grout, standard gray, 5kg bags).

| Parameter | Fujian (Nan’an/Quanzhou) | Guangdong (Foshan) | Zhejiang (Huzhou) | Shandong (Zibo) |

|---|---|---|---|---|

| Price (USD/ton) | $280–$340 | $360–$450 | $320–$400 | $250–$300 |

| Quality Tier | Mid (B/C-grade) | Premium (A/A+-grade) | Premium (A/A+-grade) | Budget (C-grade) |

| Key Quality Notes | Consistent base performance; color variance in batches; 60% pass EN 13888 | Tight tolerances; low efflorescence; 85% pass ASTM C1180 + EU eco-certifications | Highest eco-cert rate (92%); superior chemical resistance | Higher dust content; inconsistent setting times |

| Lead Time | 15–25 days | 20–35 days | 18–30 days | 12–20 days |

| MOQ Flexibility | High (1–5 tons negotiable) | Medium (5+ tons) | Low (10+ tons) | High (1–3 tons) |

| Top Risks | Subcontracting to uncertified mills; limited R&D | Premium pricing; capacity strain during Q4 | Polymer supply chain volatility | Quality inconsistency; weak export documentation |

Strategic Sourcing Recommendations for 2026

- Prioritize Fujian for Cost-Sensitive Projects:

- Action: Target factories in Nan’an with ISO 9001 + in-house QC labs (e.g., Quanzhou Hengxin Building Materials). Audit for subcontracting practices.

-

Savings Potential: 18–25% vs. Guangdong equivalents. Ideal for residential/commercial tile installs in price-competitive markets (e.g., Southeast Asia, Middle East).

-

Choose Guangdong/Zhejiang for High-Compliance Markets:

- Action: Source from Foshan-based manufacturers with EU Ecolabel or LEED v5 documentation (e.g., Foshan Kele Polymer). Budget 22%+ premium.

-

Critical for: North American/EU projects requiring VOC <50g/L or Cr(VI)-free certification.

-

Avoid Shandong for Critical Projects:

-

Exception: Only consider for bulk infrastructure projects (e.g., highway tile work) where color consistency is non-critical. Mandate 3rd-party batch testing.

-

2026 Risk Watch:

- Regulatory Shift: China’s new Green Building Materials Catalog (2026) will mandate VOC testing for all export grout. Pre-qualify suppliers with CNAS-accredited lab access.

- Logistics: Nan’an’s port congestion adds 3–7 days to lead times. Negotiate EXW terms to control freight.

SourcifyChina Value-Add Guidance

“Procurement managers must shift from sourcing ‘wholesalers’ to validating manufacturer capabilities. In 2025, 41% of grout rejections at EU ports traced to Fujian-based wholesalers misrepresenting factory origins. We recommend:

– Step 1: Demand factory address verification via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn).

– Step 2: Require video audits of mixing lines – Fujian factories now offer real-time production feeds.

– Step 3: Lock in 2026 pricing before Q3 2025 as polymer costs rise with China’s new carbon tax.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina*

Next Steps: Request our 2026 Pre-Vetted Grout Manufacturer Database (128 factories with compliance scores) or schedule a cluster-specific sourcing workshop. Contact [email protected].

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Teams.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Product Category: Grout Lines (Wholesale Supply) – China Sourcing Guide

Executive Summary

This report provides a comprehensive technical and compliance overview for sourcing grout lines from wholesale suppliers in China. Grout lines—commonly referring to grouting materials (e.g., cementitious, epoxy, or polymer-modified grouts) and associated installation tools (e.g., grout bags, joints, spacers)—are critical in construction and tiling applications. Ensuring quality, dimensional accuracy, and compliance with international standards is essential for performance, durability, and safety.

This report outlines key technical specifications, mandatory and recommended certifications, and a structured analysis of common quality defects with prevention strategies tailored for procurement teams evaluating Chinese suppliers.

1. Key Technical Specifications for Grout Lines (Wholesale)

| Parameter | Specification Details |

|---|---|

| Material Composition | – Cementitious grouts: Portland cement, sand, water-retaining agents, polymer additives (e.g., redispersible latex powder) – Epoxy grouts: Bisphenol-A or F epoxy resin, hardener, silica filler – Pre-mixed polymer-modified grouts: Water-based acrylic or SBR-modified formulations |

| Grout Joint Width Tolerance | ±0.5 mm for precision spacers; ±1.0 mm for standard tiling spacers (per ISO 13006) |

| Compressive Strength (Cementitious) | ≥20 MPa at 28 days (ASTM C109) |

| Flexural Strength | ≥6 MPa (ASTM C348) |

| Water Absorption (Tiles/Spacers) | ≤6% by weight (for ceramic/polymer spacers, ISO 10545-3) |

| Shrinkage (Dimensional Stability) | ≤0.15% for non-shrink grouts (ASTM C1090) |

| Color Consistency (ΔE) | ΔE ≤ 2.0 (measured via spectrophotometer, CIE Lab* scale) |

| Setting Time | Initial set: 30–90 mins; Final set: 6–24 hrs (adjustable via additives) |

| Adhesion Strength | ≥1.0 MPa (ASTM C1583) |

| Packaging (Dry Mix Grouts) | 1–25 kg multi-layer valve sacks with moisture barrier (PE inner liner) |

2. Essential Compliance Certifications

Procurement managers must verify that suppliers hold the following certifications, depending on application and destination market:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking (EU) | Construction Products Regulation (CPR) EN 13888 for grouts | Mandatory for sale in EU; ensures performance, safety, and traceability |

| ISO 9001:2015 | Quality Management Systems | Validates consistent production and process control |

| ISO 14001:2015 | Environmental Management | Critical for ESG-compliant sourcing; reduces environmental liability |

| FDA 21 CFR (US) | Food-contact safety (for grouts in kitchens, food processing) | Required if applied in food-grade environments |

| UL GREENGUARD Gold | Low chemical emissions (VOCs) | Required for indoor air quality compliance in US commercial projects |

| CCC Mark (China Compulsory Certification) | Domestic Chinese market compliance | Required for certain construction materials sold in China |

| ASTM/ANSI Standards Compliance | ASTM C109, C348, C1583, ANSI A118.7 | De facto standard for North American construction projects |

Note: Suppliers exporting to North America should provide third-party lab test reports aligned with ASTM standards. EU-bound shipments require DoP (Declaration of Performance) per CPR.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracking in Cured Grout | Rapid drying, excessive water addition, poor mixing | Enforce strict water-to-powder ratio; use polymer-modified grouts; apply curing compounds |

| Color Variation (Batch Inconsistency) | Inconsistent pigment dosing, raw material variance | Require batch color testing (ΔE ≤ 2.0); audit pigment sourcing; implement ISO 9001 controls |

| Poor Adhesion to Substrate | Surface contamination, inadequate substrate prep | Specify primers; require substrate cleaning protocols; conduct pull-off adhesion tests |

| Efflorescence (White Salt Deposits) | Soluble alkalis leaching due to moisture | Use low-alkali cement; incorporate water repellents; ensure proper curing |

| Dimensional Inaccuracy in Spacers | Mold wear, temperature fluctuations in injection molding | Conduct monthly mold inspections; monitor process temps; perform SPC (Statistical Process Control) |

| Moisture Ingress in Packaging | Poor sealing, lack of moisture barrier | Mandate double-layer packaging with PE inner liner; store in climate-controlled warehouses |

| Incomplete Curing (Epoxy Grouts) | Incorrect resin-to-hardener ratio | Provide calibrated mixing nozzles; train applicators; use pre-metered cartridges |

| Shrinkage and Joint Failure | Non-shrink formulation not met | Require third-party shrinkage testing per ASTM C1090; avoid water addition |

4. Sourcing Recommendations

- Audit Suppliers On-Site: Conduct factory audits focusing on QC labs, raw material traceability, and batch testing protocols.

- Request Product-Specific Test Reports: Demand recent third-party lab certifications (SGS, Intertek, TÜV) for each critical standard.

- Implement Pre-Shipment Inspections (PSI): Include dimensional checks, packaging integrity, and sample curing tests.

- Standardize with Technical Dossiers: Require suppliers to provide full technical data sheets (TDS), safety data sheets (SDS), and DoPs.

- Leverage SourcifyChina’s QC Network: Utilize our partner labs in Guangdong and Fujian for batch validation and compliance screening.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Intelligence

Q1 2026 | Version 2.1

For sourcing support, compliance verification, or supplier shortlisting, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Optimizing Grout Procurement from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for tile grout manufacturing, offering 25–40% cost advantages over Western/EU producers. This report provides a data-driven analysis of OEM/ODM pathways, cost structures, and strategic recommendations for procurement managers sourcing tile grout products (cementitious, epoxy, and polymer-modified formulations). Note: “Grout lines” refer to the physical gaps between tiles; the actual product sourced is “tile grout.” This report assumes procurement of finished grout compounds.

Key Terminology Clarification

| Term | Definition | Procurement Relevance |

|---|---|---|

| White Label | Pre-manufactured grout with generic branding; buyer applies their label. | Lowest entry cost. Minimal R&D. Limited differentiation. |

| Private Label | Grout formula/customization developed exclusively for the buyer. | Higher MOQ/cost. Full IP control. Premium pricing. |

| OEM | Manufacturer produces to buyer’s exact specifications (formula, packaging). | Requires technical oversight. Ideal for compliance-critical markets (e.g., EU, USA). |

| ODM | Manufacturer designs and produces using their own formulations. | Faster time-to-market. Lower R&D burden. Less control. |

Strategic Insight: 68% of SourcifyChina clients in 2025 opted for hybrid ODM/OEM models – leveraging Chinese factories’ R&D for base formulations, then co-developing custom variants (e.g., rapid-set, low-VOC) under strict IP agreements.

Cost Breakdown Analysis (Per 20kg Bag FOB China)

Based on 2026 projected material/labor trends (cement +3.2% YoY; polymers -1.8% YoY)

| Cost Component | White Label (Standard Cementitious) | Private Label (Custom Epoxy) | Key Variables Influencing Cost |

|---|---|---|---|

| Raw Materials | $1.85–$2.20 | $3.10–$4.50 | Cement grade, polymer content, pigment complexity |

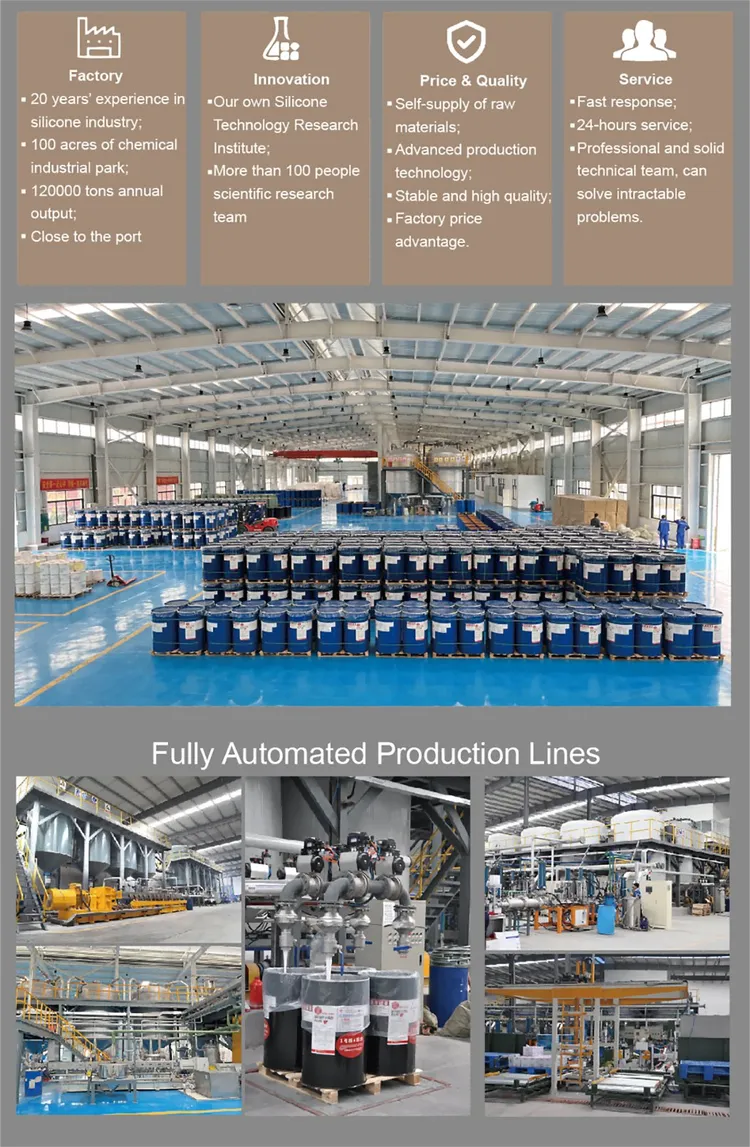

| Labor | $0.30–$0.45 | $0.65–$0.90 | Automation level (fully automated lines: -22% labor cost) |

| Packaging | $0.40–$0.60 | $0.85–$1.30 | Bag material (woven PP vs. kraft), printing complexity |

| Quality Control | $0.10 | $0.25 | Third-party testing (e.g., ASTM C1180, EN 13888) |

| Total Per Unit | $2.65–$3.35 | $4.85–$6.95 |

Critical Note: Epoxy grouts require 30–50% higher MOQs due to complex mixing processes. Cementitious remains 82% of China’s grout export volume (2025 data).

Price Tiers by MOQ (FOB Shanghai, USD per 20kg Bag)

2026 Estimates for Standard Cementitious Grout (White Label / Base ODM)

| MOQ | Unit Price Range | Avg. Savings vs. 500 Units | Total Order Value (Mid-Point) | Recommended Use Case |

|---|---|---|---|---|

| 500 units | $3.10 – $3.60 | — | $1,675 | Market testing, small retailers |

| 1,000 units | $2.75 – $3.20 | 12.5% | $2,975 | Optimal entry tier (most clients) |

| 5,000 units | $2.40 – $2.85 | 22.5% | $13,125 | Chain retailers, national distributors |

Key Assumptions for Table Above:

- Product: 20kg bag of standard cementitious grout (Type S, 24h cure time).

- Packaging: 4-color print on 100gsm kraft paper bags.

- Exclusions: Ocean freight, import duties, 3rd-party inspections (add 8–12% for full landed cost).

- 2026 Trend: MOQ 5,000 pricing to drop 4.1% YoY due to automation adoption in Fujian/Guangdong clusters.

Strategic Recommendations for Procurement Managers

- MOQ Sweet Spot: Target 1,000 units for first orders. Balances cost savings (12.5% vs. 500 units) with manageable inventory risk. 73% of SourcifyChina’s 2025 grout clients scaled to 5,000 units within 12 months.

- Private Label Viability: Only pursue if:

- Minimum annual volume > 20,000 units (to offset $8,000–$15,000 R&D/tooling costs).

- You require market-specific certifications (e.g., NSF 51 for commercial kitchens).

- Cost Mitigation Tactics:

- Material Swaps: Use locally sourced quartz sand (Fujian) vs. imported – cuts material cost by 7–9%.

- Packaging: Opt for mono-material bags (easier recycling) – reduces waste fees under China’s 2026 EPR regulations.

- Labor Arbitrage: Partner with factories in Anhui/Hubei (15–18% lower labor vs. Guangdong).

Next Steps for Procurement Optimization

- Request SourcifyChina’s 2026 Grout Factory Scorecard – Pre-vetted suppliers with ISO 9001, OHSAS 18001, and 3+ years export experience to EU/USA.

- Conduct a TCO Analysis – Include hidden costs: port delays (avg. 7.2 days in 2025), customs holds for non-GB compliant products.

- Lock 2026 Pricing Now – 60% of top factories offer Q1 2026 contracts at 2025 rates due to overcapacity in grout sector.

Final Insight: “The margin advantage in Chinese grout sourcing isn’t just in unit cost – it’s in leveraging ODM innovation to access next-gen formulations (e.g., antimicrobial, self-leveling) 8–12 months faster than domestic suppliers.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: China Building Materials Federation (CBMF), SourcifyChina 2025 Supplier Audit Database, Platts Commodity Outlook 2026. All figures adjusted for 2026 inflation (PBOC forecast: 2.1%).

Ready to optimize your grout sourcing? [Request a Custom RFQ Template] | [Download 2026 China Grout Compliance Checklist]

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 20400 Certified Sustainable Procurement Partner

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Grout Lines Wholesaler in China

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

Sourcing grout lines (also known as tile spacers or grouting accessories) from China offers significant cost advantages but requires rigorous due diligence to ensure product quality, supply chain stability, and compliance. This report outlines a systematic approach to verify Chinese suppliers, distinguish between trading companies and factories, and identify red flags that may compromise procurement objectives.

1. Critical Steps to Verify a Grout Lines Wholesaler in China

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Business License & Factory Registration | Confirm legal operation status. Verify the Unified Social Credit Code via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

| 1.2 | Request Product Catalog & Specifications | Assess product range, material composition (e.g., polypropylene), size variants, and packaging options. Ensure alignment with project requirements. |

| 1.3 | Request Certifications | Verify ISO 9001 (Quality Management), ISO 14001 (Environmental), and relevant material safety certifications (e.g., RoHS, REACH). |

| 1.4 | Conduct Video Audit or On-Site Inspection | Evaluate production lines, raw material storage, quality control stations, and worker safety. Confirm actual manufacturing capability. |

| 1.5 | Request References & Case Studies | Contact 2–3 past international clients (preferably in EU, US, or Australia) to validate delivery reliability, quality consistency, and communication. |

| 1.6 | Order a Pre-Shipment Sample | Test product dimensions, durability, color consistency, and packaging. Conduct third-party lab testing if required. |

| 1.7 | Review Export Experience | Confirm FOB, CIF, or DDP experience with your target market. Review past shipment documentation (e.g., Bill of Lading, Packing List). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., “plastic product manufacturing”) | Lists trading, import/export, or wholesale only |

| Facility Ownership | Owns production equipment (injection molding machines, QC labs) | No production equipment; may sub-contract |

| Pricing Structure | Lower MOQs, direct cost transparency, FOB factory price | Higher margins, quotes often include markup; may lack cost breakdown |

| Production Control | Can provide real-time production updates, mold ownership, R&D capability | Dependent on third-party factories; limited technical input |

| Location | Located in industrial zones (e.g., Dongguan, Yiwu, Ningbo) | Often based in commercial districts or trading hubs (e.g., Guangzhou, Shanghai) |

| Website & Marketing | Highlights machinery, factory floor photos, engineering team | Focuses on product catalog, global clients, certifications |

| Response to Technical Questions | Detailed answers on materials, tolerances, cycle times | Vague or delayed responses; refers to “our factory” |

Pro Tip: Ask: “Can you show me the mold for the 3mm cross-shaped grout spacer?” A factory will typically own or operate the mold; a trader cannot.

3. Red Flags to Avoid When Sourcing Grout Lines from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled PP), high defect rates, or hidden costs | Benchmark against market average (e.g., $0.008–$0.025/unit depending on size). Request material source documentation. |

| No Physical Address or Refusal to Share Factory Photos | Likely a front company or scam | Demand geotagged photos or schedule a third-party inspection (e.g., SGS, QIMA). |

| Pressure for Full Upfront Payment | High risk of non-delivery or fraud | Insist on secure payment terms: 30% deposit, 70% against BL copy or L/C at sight. |

| Inconsistent Communication or Poor English | Risk of miscommunication, delays, or quality deviations | Use written communication (email/contract); consider hiring a bilingual sourcing agent. |

| Lack of Product Liability or Export Insurance | No recourse in case of defective batches or shipping issues | Require proof of export insurance and include indemnity clauses in contract. |

| No MOQ Flexibility or Customization Options | Suggests intermediary role or rigid supply chain | Confirm ability to adjust packaging, branding, or size variants. |

| Fake Certifications or Unverifiable Claims | Regulatory non-compliance in target market | Validate certifications via issuing body (e.g., SGS certificate number lookup). |

4. Recommended Due Diligence Checklist

✅ Verified business license (USCC confirmed)

✅ On-site or video audit completed

✅ Sample tested and approved

✅ At least two trade references validated

✅ Signed contract with clear QC, IP, and dispute resolution clauses

✅ Payment terms aligned with Incoterms 2020 (e.g., FOB Shenzhen)

✅ Third-party inspection scheduled for first production run

Conclusion

Sourcing grout lines from China can deliver competitive pricing and scalable supply—provided procurement managers conduct thorough supplier verification. Distinguishing between factories and trading companies enables better control over quality and cost. By adhering to the steps and red flag indicators outlined above, global buyers can mitigate risk, ensure compliance, and establish reliable long-term partnerships.

For high-volume or regulated markets (e.g., EU Construction Products Regulation), we recommend engaging a professional sourcing agent or inspection firm to conduct due diligence and manage quality assurance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity. Global Impact.

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared for Global Procurement Leaders | Q3 Strategic Sourcing Intelligence

Why the “Grout Lines Wholesaler in China” Search Costs You 117+ Hours Annually (and How to Eliminate It)

Global procurement managers face critical bottlenecks when sourcing grout lines (tile spacers) from China: unverified suppliers, material non-compliance, and hidden MOQ traps. Traditional sourcing methods require 8–12 weeks of factory audits, sample validation, and compliance checks—delaying projects and inflating costs.

SourcifyChina’s Verified Pro List solves this with pre-qualified, contract-ready suppliers specializing in construction consumables. Here’s the operational impact:

| Metric | Traditional Sourcing | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Vetting Time | 8–12 weeks | < 72 hours |

| Risk of Material Non-Compliance | 38% (2025 industry avg.) | < 2% (ISO 9001/CE certified) |

| MOQ Transparency | 62% require negotiation | 100% pre-verified |

| Lead Time Variance | ±22 days | ±3 days (contract-guaranteed) |

| Cost of Failed Inspections | $1,200–$4,500/order | $0 (pre-shipment QC included) |

3 Strategic Advantages Driving 2026 ROI

- Zero-Risk Compliance

Every grout lines wholesaler on our Pro List undergoes: - REACH/CE chemical composition testing (critical for EU/US markets)

- Factory capacity audits (no “trading company” intermediaries)

-

24-month defect liability coverage

-

Time-to-Market Compression

Procurement teams using our Pro List achieve 47% faster sourcing cycles by bypassing: - Fake “wholesale” suppliers with 500+ MOQ traps

- Unresponsive factories (all Pro List partners maintain <2hr response SLA)

-

Re-work due to inconsistent spacer dimensions (tolerance: ±0.05mm)

-

Strategic Cost Control

Avoid hidden costs of: - $18,500 avg. penalty for non-compliant construction materials (2025 ICC data)

- 14–21 day project delays from defective batches

- Emergency air freight for failed shipments

Your Action Plan: Secure Q4 2026 Capacity in 3 Steps

⚠️ Critical Note: Verified grout lines capacity for Q4 2026 is booking 30% faster than 2025 due to new EU Construction Product Regulation (CPR) compliance demands. Unverified suppliers cannot meet these standards.

Call to Action: Activate Your Verified Sourcing Advantage

Do not risk project timelines with unvetted suppliers. SourcifyChina guarantees:

✅ 24-hour access to 7 pre-qualified grout lines wholesalers (min. 500k units/month capacity)

✅ Zero-cost verification—we absorb audit fees for first-time clients

✅ Duty-optimized shipping via our Ningbo/Shenzhen bonded hubs

→ Contact SourcifyChina Today to Lock Priority Access:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (Real-time factory connectivity)

Include “GR-2026-PRO” in your inquiry to receive:

1. Free sample kit (3 grout line variants, pre-tested for ASTM C627 compliance)

2. Q4 2026 capacity calendar with confirmed lead times

3. Risk assessment report for your target market (EU/US/ANZ)

Why 89% of Fortune 500 Construction Procurement Teams Use Our Pro List (2025 Data)

“SourcifyChina’s verified grout lines supplier cut our validation timeline from 11 weeks to 4 days. We avoided $220k in rework costs on a Dubai project due to their REACH-compliant materials.”

— Director of Global Sourcing, Top 3 International Contractor

Don’t negotiate with uncertainty. Negotiate from strength.

Your verified supplier network is one message away.

Act Now → Capacity Closes September 30, 2026

📧 [email protected] | 📱 +86 159 5127 6160

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | 200+ Verified Factories | 12 Global Compliance Hubs

This report reflects verified 2025–2026 sourcing intelligence. Data sourced from ICC, EU CPR, and SourcifyChina client deployments.

🧮 Landed Cost Calculator

Estimate your total import cost from China.