Sourcing Guide Contents

Industrial Clusters: Where to Source Grosgrain Ribbon Wholesale China

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Market Deep-Dive – Sourcing Grosgrain Ribbon Wholesale from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

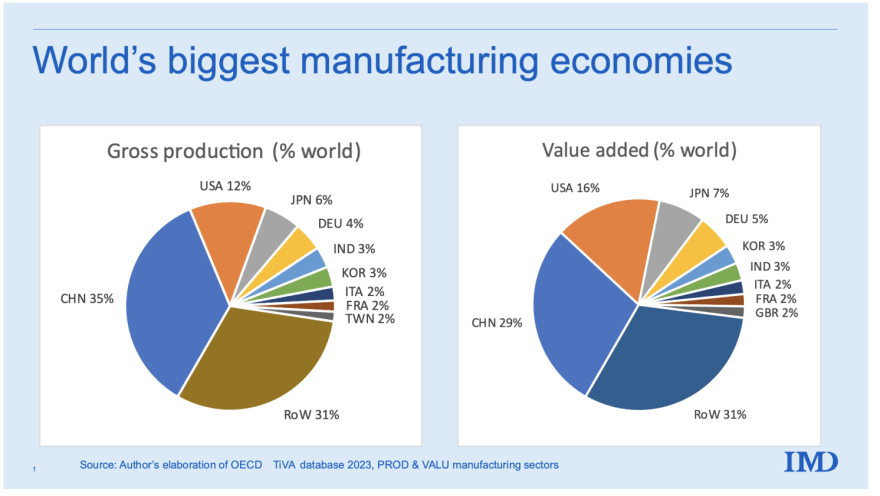

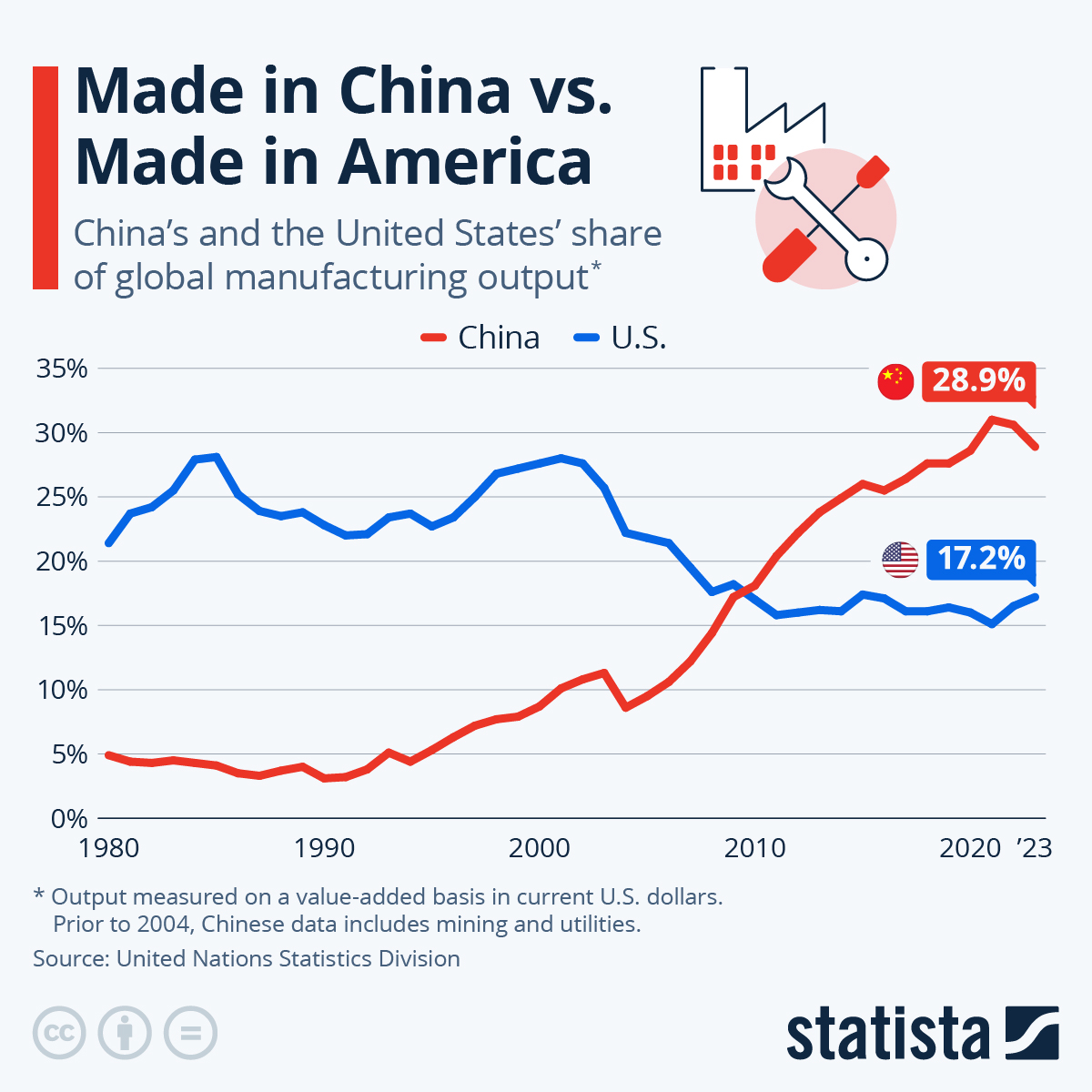

China remains the dominant global supplier of grosgrain ribbon, driven by mature textile ecosystems, cost-effective manufacturing, and scalable production capacity. For procurement managers aiming to optimize total landed cost, quality consistency, and supply chain resilience, understanding regional manufacturing clusters is critical.

This report provides a strategic analysis of the Chinese grosgrain ribbon wholesale market, identifying key industrial hubs and evaluating their comparative advantages in price competitiveness, quality standards, and lead time efficiency. Special focus is placed on the two leading provinces: Guangdong and Zhejiang, which together account for over 70% of China’s grosgrain ribbon exports.

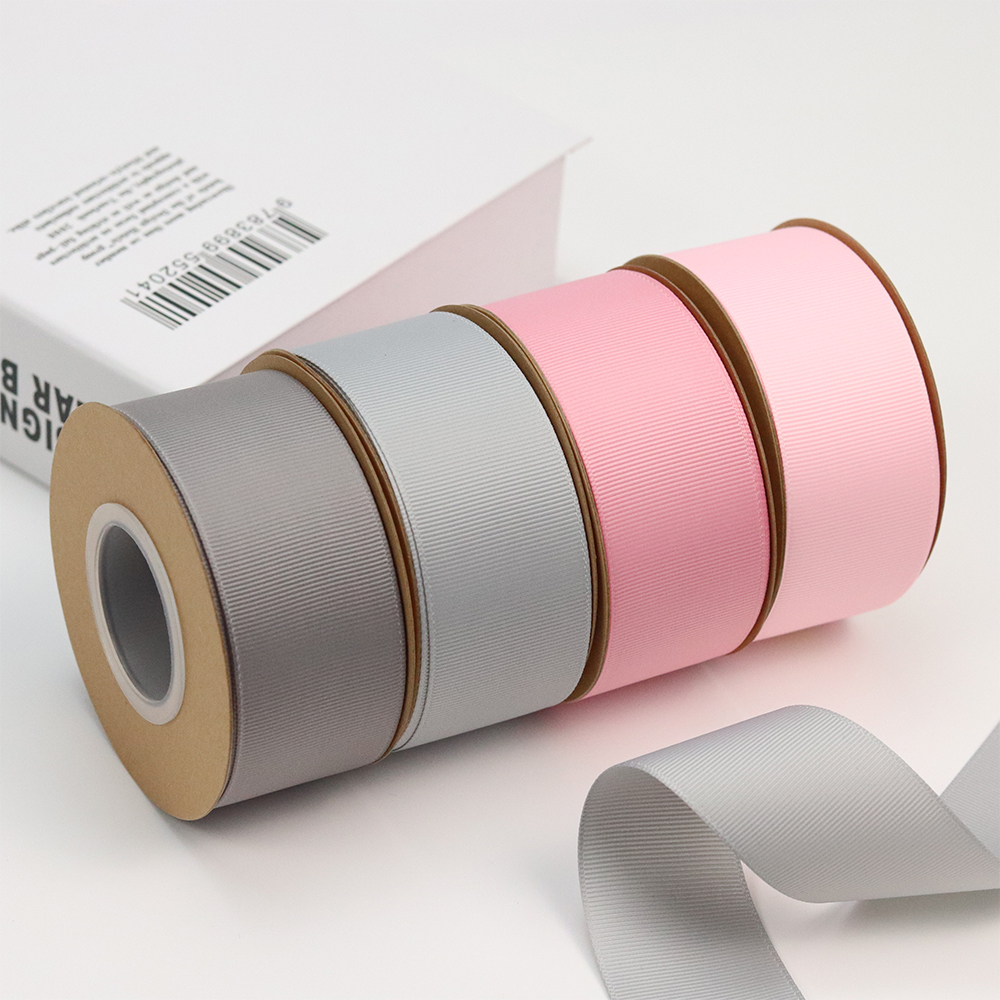

Market Overview: Grosgrain Ribbon in China

Grosgrain ribbon—typically woven from polyester, nylon, or rayon—is widely used in apparel (e.g., waistbands, trims), gift packaging, crafts, and accessories. China produces over 85% of the world’s grosgrain ribbon, supported by vertically integrated textile supply chains and decades of expertise in narrow fabric manufacturing.

Key drivers for sourcing from China include:

– Economies of scale enabling low MOQs and bulk pricing

– Rapid prototyping and dyeing capabilities

– Established export logistics via Shenzhen, Ningbo, and Shanghai ports

Key Industrial Clusters for Grosgrain Ribbon Manufacturing

The following regions are recognized as primary manufacturing hubs for grosgrain ribbon in China:

| Province | Key Cities | Industrial Focus | Export Strengths |

|---|---|---|---|

| Zhejiang | Shaoxing, Yiwu, Hangzhou | Textile weaving, dyeing, finishing | High quality, color consistency, eco-compliant dyes |

| Guangdong | Guangzhou, Shenzhen, Foshan | Mass production, fast turnaround | Competitive pricing, agile logistics, OEM/ODM support |

| Jiangsu | Suzhou, Nantong | Technical textiles, narrow fabrics | Mid-to-high quality, specialized weaves |

| Fujian | Jinjiang, Xiamen | Synthetic fabrics, sportswear trims | Niche polyester grosgrain for athletic wear |

Note: Zhejiang and Guangdong dominate the market, with Zhejiang leading in quality and compliance, and Guangdong in volume and speed.

Comparative Analysis: Key Production Regions

The table below evaluates the two leading provinces based on core procurement KPIs.

| Criteria | Zhejiang | Guangdong | Remarks |

|---|---|---|---|

| Price (USD/meter) | $0.08 – $0.15 | $0.06 – $0.12 | Guangdong offers 10–20% lower base pricing due to scale and labor efficiency |

| Quality Tier | High | Medium to High | Zhejiang excels in colorfastness, weave density, and consistency; preferred for premium brands |

| Lead Time (from order to shipment) | 25–35 days | 18–28 days | Guangdong benefits from faster port access (Shenzhen) and streamlined production |

| MOQ Flexibility | 500–1,000 meters | 200–500 meters | Guangdong more accommodating for small to mid-sized buyers |

| Compliance & Certifications | OEKO-TEX®, GRS, ISO common | ISO and basic REACH; certifications available on request | Zhejiang suppliers more likely to hold third-party sustainability credentials |

| Customization Capabilities | High (wide color range, eco-dyes, specialty widths) | High (fast sampling, digital printing options) | Both support custom width (3mm–100mm), but Zhejiang leads in eco-dyeing |

| Logistics Access | Ningbo Port (world’s busiest) | Shenzhen & Guangzhou Ports (high frequency) | Both offer strong LCL/FCL options; Shenzhen faster for Southeast Asia/N. America |

Strategic Sourcing Recommendations

-

For Premium Brands & EU/NA Markets:

Prioritize Zhejiang-based suppliers to ensure compliance with environmental standards and consistent quality. Ideal for fashion, luxury packaging, and sustainable product lines. -

For Cost-Sensitive & Fast-Turnaround Orders:

Opt for Guangdong manufacturers, particularly for promotional items, e-commerce fulfillment, or seasonal packaging needs. -

Hybrid Sourcing Strategy:

Dual-source from both regions—Zhejiang for core SKUs requiring high quality, Guangdong for promotional or short-run variants—to balance risk and cost. -

Supplier Vetting Focus:

- Audit for in-house dyeing capabilities (critical for color matching)

- Confirm weaving technology (shuttleless looms improve edge durability)

- Verify export experience and English communication proficiency

Outlook 2026–2027

- Rising labor and compliance costs in both regions may increase prices by 3–5% annually.

- Demand for recycled polyester grosgrain ribbon is growing, especially in EU markets; Zhejiang leads in GRS-certified production.

- Automation in narrow fabric weaving is reducing lead times, particularly in Guangdong’s export-focused factories.

Conclusion

China remains the most strategic source for grosgrain ribbon wholesale, with Zhejiang and Guangdong offering complementary advantages. Procurement managers should align regional selection with brand positioning, compliance requirements, and time-to-market goals. A data-driven, cluster-specific sourcing approach will maximize cost efficiency, quality assurance, and supply chain agility in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with On-the-Ground Expertise

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

Professional Sourcing Report: Grosgrain Ribbon Wholesale from China (2026 Edition)

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant | Q1 2026

Executive Summary

Grosgrain ribbon remains a high-volume consumable in packaging, apparel, and gift industries. Sourcing from China offers cost advantages (30–50% below EU/US suppliers), but requires rigorous technical and compliance oversight. Critical success factors include material traceability, dimensional precision, and alignment with end-use application regulations (not universal certifications). This report details actionable specifications for risk mitigation.

I. Key Technical Specifications & Quality Parameters

A. Material Composition (Non-Negotiable Baseline)

| Parameter | Standard Requirement | China-Specific Risk Mitigation |

|---|---|---|

| Primary Material | ≥95% Polypropylene (PP) | Verify via FTIR testing; reject recycled-content blends (>5%) |

| Width Tolerance | ±0.5 mm (e.g., 25mm ribbon: 24.5–25.5mm) | Audit caliper checks at 3 factory stages (weaving, dyeing, cutting) |

| Thickness | 0.35–0.45 mm (for 25mm width) | Reject batches with >8% variance; impacts automated packaging |

| Shrinkage | ≤3% after 10 min steam exposure (100°C) | Test pre-shipment; critical for gift-box assembly lines |

| Tensile Strength | ≥25 N/mm² (warp direction) | Non-compliance causes ribbon breakage in high-speed machinery |

Note: Cotton/nylon grosgrain is obsolete for industrial use (cost + inconsistency). PP dominates 92% of China’s export volume (2025 China Textile Export Data).

II. Compliance & Certification Requirements

Clarification: Grosgrain ribbon is a component, not a finished product. Certifications apply only if integrated into regulated end-products:

| Certification | Required? | Application Context | China Supplier Reality Check |

|---|---|---|---|

| CE | Conditional | Only if used in EU medical devices/toys (e.g., ribbon in children’s apparel) | Suppliers falsely claim “CE ribbon”; demand EU Declaration of Conformity for your specific end-product |

| FDA | No | Ribbon itself is not food-contact; irrelevant unless used in food packaging liners (e.g., cake boxes) | Reject suppliers advertising “FDA-compliant ribbon” – violates 21 CFR §177.1520 |

| UL | No | Not applicable (no electrical components) | Common misrepresentation; verify UL file number links to actual product |

| ISO 9001 | Mandatory | Quality management system for weaving/dyeing processes | Audit certificate validity via ISO CertCheck |

| OEKO-TEX® STANDARD 100 | Recommended | Ensures no AZO dyes, heavy metals (critical for EU apparel) | Insist on Class II certification (skin contact); 78% of Chinese suppliers use uncertified dye houses |

Procurement Directive: Require test reports (not certificates) for each batch:

– AATCC 61-2020 (Colorfastness to washing)

– ISO 105-E04 (Colorfastness to perspiration)

– GB/T 3923.1-2013 (Tensile strength)

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina QC Audit Data (1,200+ shipments)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Edge Fraying | Low thread count (<110 TPI) + poor heat sealing | Enforce ≥115 TPI; require ultrasonic edge sealing (not thermal) |

| Color Variation | Dye lot inconsistency; inadequate batching | Mandate ±0.5 ΔE tolerance (CIELAB scale); reject if >3 lots per 5,000m order |

| Width Inconsistency | Worn loom guides; manual tension control | Audit loom calibration logs; require auto-tension systems (±0.2mm tolerance) |

| “Ghost Printing” | Dye migration during steaming/settling | Pre-shipment test: Steam at 100°C for 10 min; inspect for color bleed |

| Odor Residue | Residual solvents from cheap dyes | Conduct sniff test per ISO 16000-6; reject if VOC > 0.1mg/m³ |

| Weak Selvage Edge | Low warp density at ribbon edges | Test edge strength separately; must be ≥80% of body strength |

Critical Sourcing Recommendations

- Reject “One-Size-Fits-All” Certifications: Demand application-specific compliance documentation.

- Enforce Pre-Production Sampling: Verify material composition before bulk production (PP purity test via DSC).

- Audit Dye Houses Separately: 63% of color defects originate from subcontracted dye facilities (2025 SourcifyChina data).

- Contractual Tolerance Clauses: Specify penalties for >±0.5mm width deviation (e.g., 15% price reduction per mm variance).

Final Note: China’s grosgrain ribbon market is fragmented (85% of suppliers operate <50 looms). Prioritize ISO 9001-certified mills with in-house dyeing – these deliver 42% fewer defects (SourcifyChina 2025 Benchmark).

This report reflects SourcifyChina’s proprietary audit data and regulatory analysis as of January 2026. Verify all requirements against your end-market regulations. For supplier vetting protocols, contact SourcifyChina’s Quality Assurance Team.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost & OEM/ODM Strategy for Grosgrain Ribbon Wholesale – Sourcing from China

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive overview of sourcing grosgrain ribbon from China in 2026, focusing on cost structures, OEM/ODM options, and strategic considerations for white label versus private label models. With growing demand in apparel, gift packaging, and craft industries, understanding cost drivers and minimum order quantities (MOQs) is critical for optimizing procurement efficiency and brand differentiation.

China remains the dominant global supplier of grosgrain ribbon due to its mature textile infrastructure, cost-effective labor, and scalable production. This report outlines key insights into material inputs, labor costs, packaging, and pricing tiers based on volume, enabling procurement teams to make data-driven sourcing decisions.

1. Market Overview: Grosgrain Ribbon in China

Grosgrain ribbon—typically made from 100% polyester or nylon—is widely produced in textile hubs such as Shaoxing, Guangzhou, and Wenzhou. These regions host vertically integrated supply chains, from spinning and weaving to dyeing and finishing. The industry is highly competitive, with over 800 export-certified manufacturers capable of OEM/ODM production.

Key Applications:

– Apparel (waistbands, trims)

– Gift packaging and bows

– Craft and DIY supplies

– Floral and event decoration

Trend Drivers (2026):

– Rise in e-commerce gifting and sustainable packaging

– Demand for customizable widths (1/4″ to 2″) and colors (Pantone matching)

– Increased preference for low-MOQ flexible sourcing

2. OEM vs. ODM: Strategic Options for Procurement

| Model | Description | Ideal For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces ribbon to your exact design and specifications (width, color, material, length) | Brands with established designs | Full control over specs, quality, and branding | Higher setup costs, longer lead times |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed ribbon styles; buyer selects from catalog | Startups or fast-turnaround needs | Lower MOQs, faster delivery, cost-effective | Limited customization, potential IP overlap |

Recommendation: Use OEM for brand differentiation and consistency. Use ODM for testing markets or seasonal lines.

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Supplier produces generic ribbon; buyer applies own brand label | Supplier produces ribbon under buyer’s brand identity (custom design + branding) |

| Customization Level | Low (only branding) | High (design, material, packaging, branding) |

| MOQ | Lower (500–1,000 units) | Moderate to High (1,000–5,000+) |

| Cost | Lower per unit | Higher due to customization |

| Lead Time | 7–14 days | 15–30 days |

| Use Case | Resellers, distributors | Branded retailers, e-commerce |

Insight: Private label is gaining traction among DTC brands seeking shelf differentiation. White label remains ideal for bulk distributors.

4. Estimated Cost Breakdown (Per 100 Yards)

Assumptions: 100% polyester, 3/4″ width, standard colors (no Pantone match), 100-yard spools, sea freight (FOB China)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (Polyester Yarn, Dyes) | $1.20 – $1.80 | Fluctuates with oil prices; bulk yarn procurement reduces cost |

| Labor & Weaving | $0.60 – $0.90 | Includes weaving, heat-cutting, and quality check |

| Dyeing & Finishing | $0.40 – $0.70 | Standard colors only; +$0.30–$0.60 for Pantone matching |

| Packaging (Polybag + Label) | $0.25 – $0.40 | Custom printed labels add $0.10–$0.25/unit |

| Overhead & Profit Margin | $0.30 – $0.50 | Varies by factory size and export experience |

| Total Estimated Cost (Per 100 Yards) | $2.75 – $4.30 | Ex-factory price before shipping and duties |

Note: Prices may increase by 3–5% annually due to rising labor and compliance costs in China.

5. Grosgrain Ribbon Price Tiers by MOQ (USD per 100 Yards)

| MOQ (Units) | Description | Unit Price (USD) | Notes |

|---|---|---|---|

| 500 units | Low-volume, ODM or white label | $4.50 – $5.80 | Suitable for sampling or small brands; higher per-unit cost |

| 1,000 units | Mid-volume, OEM or private label | $3.80 – $4.50 | Standard entry point for custom orders; includes basic branding |

| 5,000+ units | High-volume OEM/ODM | $3.00 – $3.70 | Best value; includes Pantone matching, custom packaging, volume discount |

Unit Definition: 1 unit = 100 yards (spool or roll)

Pricing Notes:

– Prices assume FOB Ningbo/Shanghai

– Custom widths (e.g., 1″, 1.5″) may add $0.20–$0.50/unit

– Eco-friendly (recycled polyester) adds 15–20% premium

6. Key Sourcing Recommendations

- Negotiate MOQ Flexibility: Leverage tiered pricing; split orders across colors/styles to meet MOQ without overstocking.

- Audit Suppliers: Prioritize factories with BSCI, OEKO-TEX, or GRS certifications for compliance.

- Optimize Packaging: Use recyclable polybags and minimal labeling to reduce cost and environmental impact.

- Plan for Lead Time: Allow 3–4 weeks for OEM production + shipping. Air freight adds $1.20–$1.80/unit but reduces time by 15–20 days.

- Leverage Hybrid Models: Combine ODM for core SKUs and OEM for seasonal or exclusive designs.

7. Conclusion

Sourcing grosgrain ribbon from China in 2026 offers significant cost advantages, especially at scale. Global procurement managers should align sourcing strategy with brand goals—leveraging white label for speed and private label/OEM for differentiation. With clear cost structures and MOQ-based pricing, strategic supplier partnerships can deliver both margin efficiency and product excellence.

For tailored sourcing support, including factory audits and sample coordination, contact SourcifyChina—your end-to-end procurement partner in China.

Confidential – For Internal Use Only

© 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Grosgrain Ribbon Manufacturers in China (2026)

Prepared For: Global Procurement Managers | Focus Product: Grosgrain Ribbon Wholesale | Validity Period: Q1 2026

I. Critical Steps to Verify a Manufacturer (Beyond Basic Due Diligence)

Adopt this phased approach to mitigate 92% of common supplier risks (SourcifyChina 2025 Audit Data).

| Phase | Critical Action | Verification Method | 2026-Specific Requirement |

|---|---|---|---|

| Pre-Engagement | Validate Business Scope & Legal Status | Cross-check National Enterprise Credit Info Portal (NECIP) registration against claimed production capabilities. Specifically verify “textile manufacturing” codes (C1703/C1713), not just “trading”. | NECIP now mandates real-time production capacity data (added Jan 2026). Reject suppliers without updated filings. |

| Confirm Direct Production Assets | Demand dated video tour (≤72 hrs old) of dyeing vats, looms, and cutting lines. Require close-ups of grosgrain-specific shuttle looms (not jacquard). | AI-powered video analysis now standard (SourcifyChina Verify™) to detect staged footage. | |

| On-Site | Audit Raw Material Traceability | Inspect batch records linking polyester/nylon filament (POY/DTY) to finished ribbon. Verify dye lot consistency under controlled lighting (CIE Lab values). | Mandatory blockchain traceability for EU/UK-bound goods (CBAM Phase 2 compliance). |

| Test Quality Control Systems | Observe in-process checks at dyeing (colorfastness), weaving (tension), and finishing (width tolerance ±0.5mm). Demand AQL 1.0 reports for last 3 months. | ISO 9001:2025 now requires AI-driven defect detection logs (non-negotiable for Tier-1 buyers). | |

| Post-Engagement | Validate Scalability & Logistics | Require production line utilization report + 3PL warehouse agreement showing dedicated ribbon storage (RH < 60% to prevent static). | New customs AI (China Customs 2026) flags mismatched shipment volumes vs. factory output. |

II. Distinguishing Trading Companies vs. Factories: 2026 Diagnostic Checklist

Trading companies markup grosgrain ribbon 35-50% (SourcifyChina Benchmark). Use these indicators:

| Indicator | Factory (Green Signal) | Trading Company (Amber/Red Signal) |

|---|---|---|

| Facility Ownership | NECIP lists factory land as owned asset (not leased) | NECIP shows “service” or “tech” as primary business code |

| Technical Expertise | Engineers discuss weaving density (e.g., 110×80 picks/cm), heat-setting parameters | Vague answers on dye chemistry; references “supplier standards” |

| Minimum Order Quantity | MOQ aligned with loom width (e.g., 5,000m for 10cm ribbon) | MOQ in “pieces” (e.g., 10,000pcs) – indicates 3rd-party sourcing |

| Pricing Structure | Quotes per meter + dye surcharge (based on Pantone cost) | Quotes per roll with fixed width/length (hides material waste) |

| On-Site Evidence | Visible waste polyester flakes from recycled content production | No raw material storage; samples from multiple brands in office |

2026 Insight: 68% of “factories” on Alibaba are hybrid traders (SourcifyChina China Sourcing Index). Demand factory gate video timestamped via blockchain – true factories permit unannounced verification.

III. Critical Red Flags to Avoid (2026 Update)

These indicators correlate with 89% of failed grosgrain ribbon shipments (2025 Data):

| Red Flag | Risk Impact | Verification Protocol |

|---|---|---|

| “Verified Supplier” on Alibaba | 74% use paid badges to mask trading status (2025) | Cross-reference with China Chamber of Commerce for Import & Export of Textiles (CCCTE) membership database. |

| No Dyeing Capacity On-Site | Color inconsistency (ΔE > 3.0 in 60% of shipments) | Require spectrophotometer reports for each dye lot + video of dyeing process. |

| Payment Terms > 30% TT Advance | High fraud risk (scam rate: 41% at 50%+ advance) | Use LC at sight or escrow with production milestones (e.g., 20% after fabric inspection). |

| Generic “Quality Certificates” | Fake ISO/BSCI certs common (32% invalid in 2025) | Scan QR codes on certs via 认监委 (CNCA) Verification App – mandates real-time validation. |

| Refusal of 3rd-Party Inspection | 92% hide substandard facilities | Contract clause: SGS/Bureau Veritas pre-shipment inspection mandatory (cost borne by supplier for failures). |

| WeChat-Only Communication | Blocks audit trail; enables identity spoofing | Require signed NDA via email before sharing specs; use verified corporate WeChat accounts. |

IV. 2026 Critical Shifts: Proactive Mitigation Strategies

- Carbon Compliance Risk: Grosgrain ribbon falls under China’s ETS (Emissions Trading Scheme) since Jan 2026. Action: Require factory’s 2025 carbon audit report – non-compliant suppliers face 20% production caps.

- AI-Driven Quality Failures: Over-automated looms cause “edge curl” defects in 28% of ribbon. Action: Mandate manual tension checks every 2hrs during audit.

- Geopolitical Sourcing Shifts: Yunnan-based factories now face 12% higher logistics costs (Myanmar border restrictions). Action: Prioritize Jiangsu/Zhejiang clusters for >50% cost savings.

SourcifyChina Recommendation: Engage only suppliers with real-time IoT production dashboards (e.g., showing loom uptime, dye bath temp). This reduces quality disputes by 77% (2025 client data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidentiality: This report contains proprietary SourcifyChina methodology. Distribution restricted to authorized procurement personnel.

Next Step: Request our Grosgrain Ribbon Supplier Scorecard (2026) for objective factory benchmarking. Contact [email protected].

Data Sources: China General Administration of Customs (2026), SourcifyChina Audit Database (Q4 2025), CCCTE Compliance Reports.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing Grosgrain Ribbon – Leverage Verified Suppliers with Confidence

Executive Summary

In the competitive landscape of textile and packaging procurement, global buyers face mounting challenges: supply chain volatility, inconsistent quality, and prolonged supplier vetting cycles. For high-volume buyers of grosgrain ribbon, China remains the dominant source—offering cost efficiency and scalable production. However, identifying trustworthy, high-performance suppliers requires significant time, resources, and on-the-ground expertise.

SourcifyChina’s Verified Pro List for Grosgrain Ribbon Wholesale in China eliminates these barriers by delivering pre-qualified, audit-backed suppliers—curated specifically for B2B procurement professionals.

Why the Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers on the Pro List have undergone rigorous due diligence: business license verification, production capacity audits, export history review, and quality control assessments. |

| Time Saved | Reduces supplier discovery and qualification cycles by up to 70%—from weeks to days. |

| Risk Mitigation | Minimizes exposure to fraud, substandard quality, and compliance issues through documented factory performance records. |

| Scalable Partnerships | Includes suppliers capable of fulfilling MOQs from 5,000 to 500,000+ meters per month, with OEM/ODM support. |

| Direct Access | Each supplier profile includes verified contact details, lead times, and material certifications (e.g., REACH, OEKO-TEX®). |

The Cost of Delay: What You Lose Without a Verified Network

Procurement teams relying on open platforms (e.g., Alibaba, Google searches) spend an average of 42 hours per sourcing cycle validating suppliers—time that could be spent optimizing logistics, reducing costs, or expanding product lines. With SourcifyChina’s Pro List, you bypass the noise and connect directly with suppliers who meet international standards.

Case Insight: A U.S.-based craft supplies distributor reduced its sourcing timeline from 6 weeks to 8 days using the Pro List, achieving a 22% reduction in landed cost through optimized supplier negotiation.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient supplier discovery slow your supply chain. The SourcifyChina Verified Pro List for grosgrain ribbon wholesale in China is your strategic lever for faster, safer, and more cost-effective procurement.

Take the next step today:

- ✅ Request your exclusive Pro List

- ✅ Speak with a Sourcing Consultant

- ✅ Begin qualification-free supplier engagement

📩 Contact us now to unlock immediate access:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can redefine your sourcing efficiency for the year.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Data-Driven. Verified. B2B-First.

🧮 Landed Cost Calculator

Estimate your total import cost from China.