The global porcelain tile market is experiencing robust growth, driven by rising demand in residential, commercial, and infrastructure sectors. According to Grand View Research, the global ceramic tiles market size was valued at USD 195.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030, with gres porcellanato tiles—a denser, more durable type of porcelain—gaining significant traction due to their low water absorption, high abrasion resistance, and design versatility. Factors such as urbanization, increasing renovation activities, and the growing preference for aesthetically versatile yet functional flooring solutions are accelerating this trend. As demand surges, manufacturers are investing heavily in innovation, large-format tiles, and sustainable production methods. In this evolving landscape, the following eight gres porcellanato tile manufacturers have distinguished themselves through scale, technological advancement, design leadership, and global reach—shaping the future of the industry.

Top 8 Gres Porcellanato Tile Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tile of Spain

Domain Est. 2011

Website: tileofspainusa.com

Key Highlights: Tile of Spain is the international brand representing 125 ceramic tile manufacturers belonging to the Spanish Ceramic Tile Manufacturers’ Association (ASCER)….

#2 Rosa Gres

Domain Est. 1997

Website: rosagres.com

Key Highlights: High-quality porcelain stoneware floors by Rosa Gres. The ideal ceramics for swimming pools, exteriors, interiors and terraces….

#3 Gres Aragón

Domain Est. 1997

Website: gresaragon.com

Key Highlights: At Gres Aragón we are experts in porcelain and extruded ceramic tiles. Quality and design in all our collections, come in and discover it!…

#4 Ceramica Fioranese

Domain Est. 1998

Website: fioranese.it

Key Highlights: A long tradition in the production of porcelain stoneware floor tiles: wood effect porcelain stoneware, marble effect porcelain stoneware, kitchen tiles….

#5 Porcelain stoneware

Domain Est. 1999

Website: caesarceramicsusa.com

Key Highlights: Caesar porcelain stoneware is obtained from natural raw materials, does not contain plastic and is easily and fully recyclable. It can be used anywhere….

#6 Italian Ceramic & Porcelain Tiles: Floors & Walls

Domain Est. 1999

Website: atlasconcorde.com

Key Highlights: Discover Atlas Concorde: Italian ceramic excellence in porcelain tiles, offering many solutions for both indoor and outdoor floors and walls….

#7 Iris Ceramica

Domain Est. 2000

#8 GIGACER S.p.A.

Domain Est. 2007

Website: gigacer.it

Key Highlights: Porcelain Stoneware Slabs Made in Italy. GIGACER produces large 120X250 ceramic slabs characterized by the high quality of the design and materials….

Expert Sourcing Insights for Gres Porcellanato Tile

H2: 2026 Market Trends for Gres Porcellanato Tile

The global market for Gres Porcellanato (porcelain tile) is poised for significant evolution by 2026, driven by technological advancements, shifting consumer preferences, and sustainability demands. As one of the most durable and versatile flooring and wall covering solutions, Gres Porcellanato is expected to maintain strong growth momentum across residential, commercial, and industrial sectors. Below are the key market trends shaping the Gres Porcellanato tile industry in 2026:

-

Increased Demand for Large-Format and Slim Tiles

By 2026, large-format and ultra-thin porcelain tiles (SlimTiles) will dominate design preferences. Architects and designers are favoring these formats for their seamless aesthetic, reduced grout lines, and lightweight properties, which lower transportation and installation costs. The trend is particularly strong in urban developments and high-end residential projects where minimalism and space optimization are priorities. -

Sustainability and Eco-Friendly Production

Environmental regulations and green building certifications (such as LEED and BREEAM) are pushing manufacturers to adopt sustainable practices. In 2026, expect widespread use of recycled raw materials, energy-efficient kilns, and closed-loop water systems in production. Consumers and developers are increasingly favoring tiles with Environmental Product Declarations (EPDs), contributing to a surge in eco-labeled Gres Porcellanato products. -

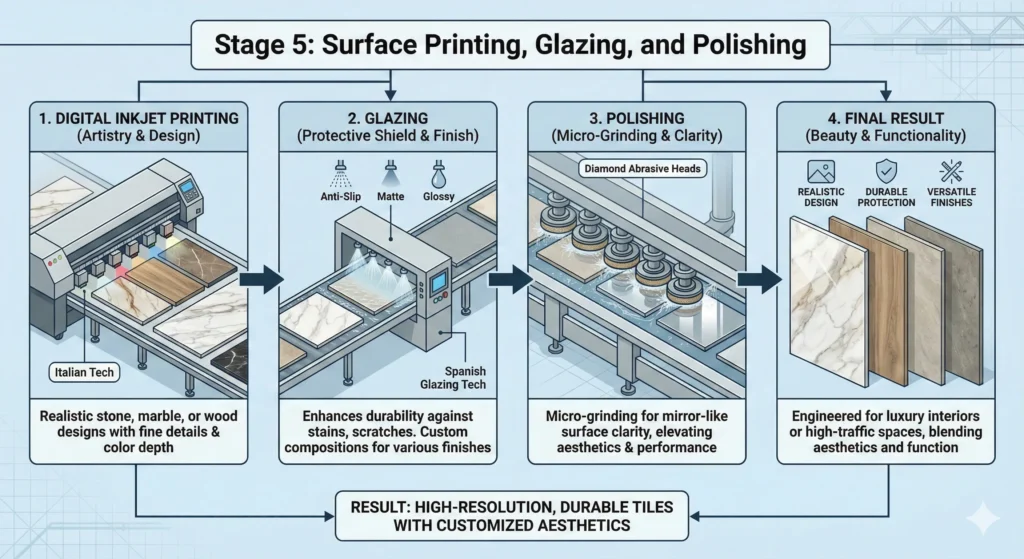

Digital Printing and Hyper-Realistic Designs

Advancements in digital inkjet technology enable porcelain tiles to mimic natural materials like marble, wood, concrete, and stone with unprecedented realism. By 2026, customization through digital printing will become more accessible, allowing for bespoke patterns and textures tailored to specific projects. This trend supports the growing desire for high-end aesthetics at lower costs and greater durability. -

Growth in Emerging Markets

Asia-Pacific, Latin America, and parts of Africa are emerging as high-growth regions due to rapid urbanization and infrastructure development. Countries like India, Vietnam, and Mexico are expanding their construction sectors, creating robust demand for cost-effective, durable, and stylish tile solutions. Local manufacturing hubs are also rising to reduce import dependence and cater to regional tastes. -

Smart Tiles and Functional Innovations

Innovation is extending beyond appearance. By 2026, smart porcelain tiles with embedded heating elements, antibacterial properties, or photovoltaic capabilities are gaining traction in luxury and healthcare applications. Additionally, anti-slip and self-cleaning surface treatments are becoming standard in high-traffic and outdoor installations. -

E-Commerce and Direct-to-Consumer Distribution

The tile industry is undergoing a digital transformation. Online platforms offering augmented reality (AR) visualization, sample delivery, and direct purchasing are gaining popularity. By 2026, a growing share of Gres Porcellanato sales will occur through e-commerce channels, especially among younger homeowners and DIY renovators. -

Consolidation and Brand Differentiation

Market consolidation is expected as major players acquire regional manufacturers to expand their global footprint. At the same time, brands will invest in storytelling, design innovation, and premium collections to differentiate themselves in a competitive landscape.

In conclusion, the 2026 Gres Porcellanato tile market will be defined by innovation, sustainability, and design versatility. With increasing demand across diverse geographies and applications, manufacturers who embrace digitalization, eco-conscious practices, and consumer-centric design will lead the industry forward.

Common Pitfalls When Sourcing Gres Porcellanato Tile (Quality & IP)

Sourcing Gres Porcellanato (porcelain tile) can be complex, particularly when balancing quality expectations and intellectual property (IP) concerns. Here are key pitfalls to avoid:

Overlooking Technical Specifications and Certifications

Many buyers focus solely on appearance, neglecting critical technical aspects such as water absorption, breaking strength (EN 14411), abrasion resistance (PEI rating), and slip resistance. Failing to verify compliance with international standards (e.g., ISO 13006, CE marking) can result in tiles that underperform in intended applications, especially in high-traffic or wet areas.

Ignoring Manufacturing Consistency

Tiles from inconsistent production batches can vary in shade, size, or texture. This leads to visible mismatches during installation. Always request samples from the actual production batch and confirm the manufacturer’s quality control protocols to ensure uniformity.

Prioritizing Low Cost Over Durability

Unusually low prices may indicate substandard raw materials, inadequate firing processes, or lower density—compromising the tile’s durability and frost resistance. Cheap alternatives may chip, crack, or stain more easily, increasing long-term maintenance and replacement costs.

Failing to Verify Authenticity of Premium Brands

Counterfeit or imitation tiles mimicking high-end Italian or Spanish brands are widespread. These copies often lack the quality and design integrity of the originals. Verify supplier credentials, request authenticity documentation, and, if possible, source directly from authorized distributors.

Overlooking Intellectual Property (IP) Risks

Using tiles that replicate patented designs or copyrighted patterns (e.g., wood-look, marble-look, or designer finishes) without proper licensing exposes buyers to legal liability. Ensure suppliers can provide proof of design rights or confirm that patterns are original or in the public domain.

Inadequate Sampling and Testing

Relying only on digital images or small showroom samples can be misleading. Full-size physical samples should be evaluated under different lighting and in context with other materials. Conduct on-site mockups when possible to assess real-world appearance and performance.

Poor Communication with Suppliers

Misunderstandings about tile thickness, finish (polished, matte, textured), edge type (rectified vs. standard), and packaging can lead to costly delays or rework. Clearly define all specifications in writing and confirm understanding with the supplier before production.

Underestimating Logistics and Lead Times

Porcelain tiles are heavy and fragile. Inadequate packaging or poor logistics planning can result in breakage. Additionally, extended lead times from overseas manufacturers can disrupt project timelines. Confirm shipping methods, insurance, and delivery schedules early in the sourcing process.

By addressing these common pitfalls, buyers can ensure they source high-quality Gres Porcellanato tiles that meet both performance standards and legal requirements.

Logistics & Compliance Guide for Gres Porcellanato Tile

Gres Porcellanato tiles, also known as porcelain stoneware, are dense, durable ceramic tiles widely used in residential and commercial applications. Proper logistics and compliance measures are essential to ensure safe transport, regulatory adherence, and customer satisfaction. This guide outlines key considerations for handling, shipping, importing, and complying with standards related to Gres Porcellanato tiles.

Product Classification and HS Code

Gres Porcellanato tiles are classified under the Harmonized System (HS) Code 6907.90 or 6907.21, depending on size, finish, and intended use. Accurate classification is critical for international trade.

- HS 6907.90: Unglazed or glazed ceramic flagstones and paving blocks, including porcelain stoneware.

- HS 6907.21: Glazed ceramic tiles, whether or not rectified, with the largest surface area > 3600 cm².

- Verify the exact HS code with your supplier or customs broker to ensure correct tariff application and duty rates.

Packaging and Handling Requirements

Proper packaging protects tiles from breakage and moisture during transit:

- Standard Packaging: Tiles are typically packed in sturdy cardboard boxes on wooden pallets, shrink-wrapped for stability.

- Stacking Limits: Adhere to manufacturer-recommended stacking heights (usually 1.8–2.2 meters) to avoid crushing lower layers.

- Moisture Protection: Use moisture-resistant packaging and silica gel desiccants if shipping through humid climates or marine environments.

- Fragile Labeling: Mark all packages with “Fragile,” “This Side Up,” and “Do Not Stack” labels as needed.

Transportation and Shipping

Transport logistics must account for the weight and fragility of porcelain tiles:

- Weight Considerations: Porcelain tiles are heavy (approximately 20–30 kg/m²). Ensure vehicles and containers are rated for the load.

- Container Load: 20’ or 40’ dry containers are standard. Optimize space with proper pallet stacking and dunnage to prevent shifting.

- Loading/Unloading: Use forklifts or pallet jacks. Avoid manual handling of full pallets. Ensure warehouse floors can support concentrated loads.

- Temperature & Humidity: Avoid extreme temperatures and high humidity, which may affect adhesives or packaging integrity.

Import/Export Compliance

Ensure adherence to destination country regulations:

- Documentation: Prepare commercial invoice, packing list, bill of lading/airway bill, and certificate of origin.

- Customs Clearance: Provide accurate product description, HS code, value, and country of manufacture (e.g., Italy, Spain, China).

- Duties and Taxes: Research applicable import duties, VAT, and anti-dumping measures. Some countries impose additional tariffs on Chinese-made ceramics.

- Restricted Substances: Confirm compliance with REACH (EU), Prop 65 (California), and other chemical safety regulations.

Quality and Safety Standards

Gres Porcellanato tiles must meet international and regional performance standards:

- ISO 13006: International standard for ceramic tiles – covers dimensions, strength, water absorption (< 0.5% for porcelain), and durability.

- EN 14411: European standard equivalent to ISO 13006, required for CE marking.

- ASTM C373 / C1027: U.S. standards for water absorption and abrasion resistance.

- CE Marking: Mandatory for tiles sold in the European Economic Area (EEA), indicating conformity with health, safety, and environmental standards.

- LEED & Sustainability: For green building projects, verify if tiles contribute to LEED credits through recycled content or low-emission manufacturing.

Labeling and Traceability

Proper labeling ensures regulatory compliance and end-user safety:

- Product Label: Include tile type, size, color, batch/lot number, manufacturer name, country of origin, and compliance marks (e.g., CE, ANSI).

- Batch Tracing: Maintain batch records to enable recalls or quality investigations if defects arise.

- User Instructions: Provide installation and maintenance guidelines, especially for slip resistance (R9, R10, R11 ratings) and outdoor use.

Environmental and Sustainability Compliance

Environmental regulations increasingly affect tile manufacturing and distribution:

- Carbon Footprint: Some markets require carbon declarations or EPDs (Environmental Product Declarations).

- Waste Management: Follow local regulations for disposal of packaging materials (cardboard, wood, plastic).

- Sustainable Sourcing: Verify that raw materials are sourced responsibly, with minimal environmental impact.

Risk Mitigation and Insurance

Protect against common logistical risks:

- Transit Insurance: Cover breakage, theft, water damage, and delays. Specify all-risk coverage for fragile goods.

- Quality Inspection: Conduct pre-shipment inspections (PSI) to verify quantity, packaging, and quality.

- Incident Response Plan: Establish procedures for handling damaged shipments, including documentation and claims filing.

Conclusion

Successfully managing the logistics and compliance of Gres Porcellanato tiles requires attention to classification, packaging, transport safety, regulatory standards, and sustainability. By following this guide, importers, distributors, and contractors can ensure efficient delivery, regulatory compliance, and product integrity throughout the supply chain.

In conclusion, sourcing gres porcellanato (porcelain tile) requires careful consideration of quality, supplier reliability, cost-efficiency, and logistical factors. By identifying reputable manufacturers or suppliers—whether local, regional, or international—businesses can secure durable, aesthetically versatile tiles that meet technical and design specifications. Evaluating samples, verifying certifications (such as ISO standards or eco-labels), and assessing lead times and shipping costs are essential steps in making an informed decision. Building strong relationships with trusted suppliers, combined with strategic procurement planning, ensures a consistent supply of high-quality porcelain tile, supporting successful project execution in residential, commercial, or large-scale construction applications. Ultimately, effective sourcing balances performance, aesthetics, and value, contributing to long-term satisfaction and project excellence.