Sourcing Guide Contents

Industrial Clusters: Where to Source Greenpower Power Electronics Company China

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing GreenPower Power Electronics from China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Executive Summary

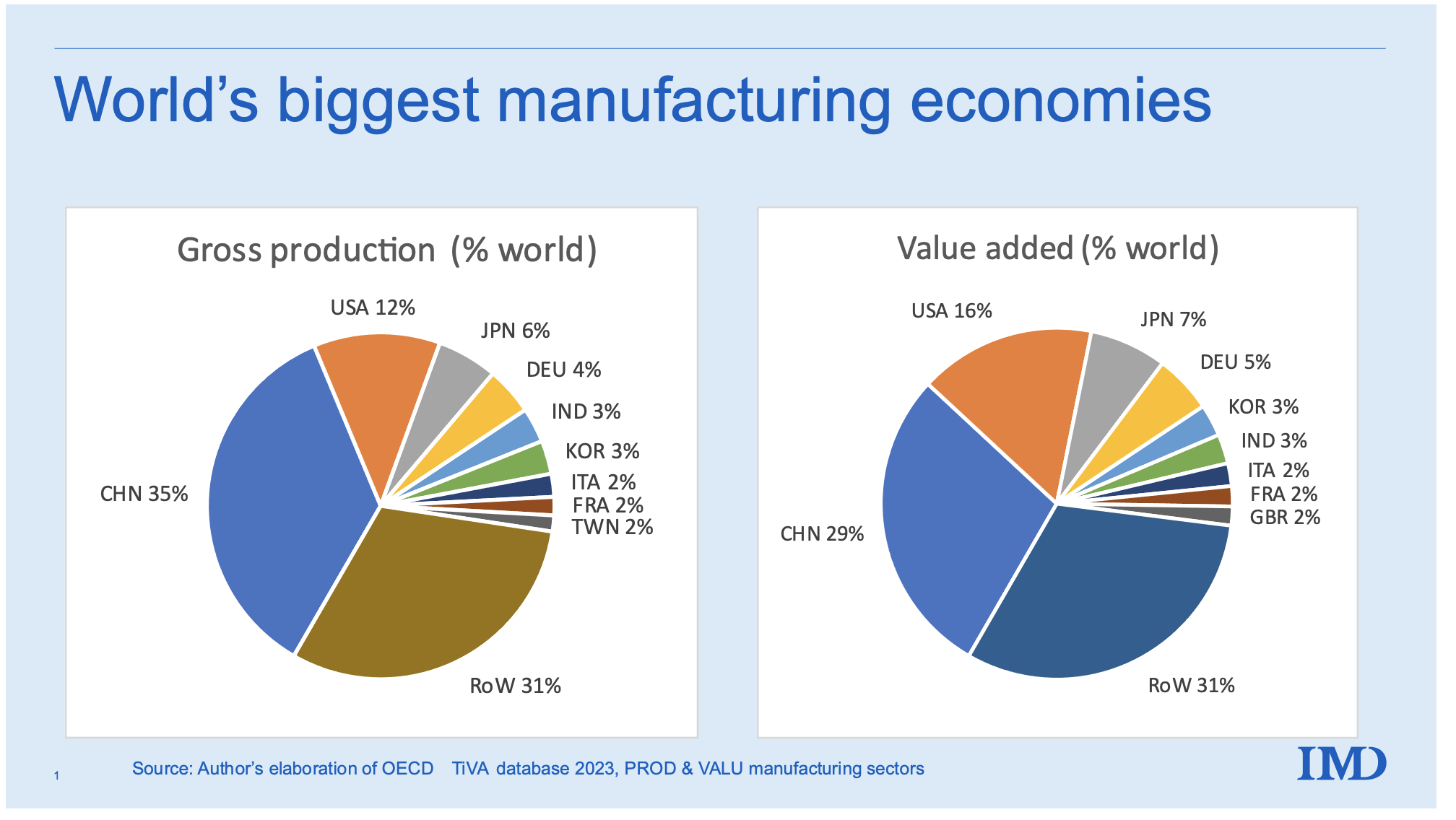

This report provides a comprehensive market analysis for sourcing power electronics from Chinese manufacturers associated with or operating under the “GreenPower” brand or in the GreenPower technology space. As global demand for energy-efficient, sustainable power conversion systems rises—driven by renewable energy integration, electric mobility, and industrial automation—China remains the epicenter of power electronics manufacturing. While “GreenPower” is not a nationally registered industrial cluster name, it is commonly used as a brand or product-line descriptor for energy-efficient power modules, inverters, converters, and semiconductor systems within China’s broader power electronics ecosystem.

This report identifies key industrial clusters in China specializing in high-quality, competitively priced power electronics suitable for GreenPower-aligned applications. A comparative analysis of leading manufacturing provinces—Guangdong and Zhejiang—is presented, evaluating Price, Quality, and Lead Time to support strategic sourcing decisions.

Key Industrial Clusters for Power Electronics Manufacturing in China

China’s power electronics supply chain is highly regionalized, with specialized industrial clusters offering distinct competitive advantages. The following provinces and cities are pivotal in the production of GreenPower-compatible components:

1. Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Core Strengths: High-tech manufacturing, export infrastructure, proximity to Hong Kong logistics hubs.

- Specialization: High-frequency inverters, solar micro-inverters, EV chargers, and integrated power modules.

- Ecosystem: Dense supplier network for semiconductors (IGBTs, SiC MOSFETs), PCBs, and thermal management systems.

- Key Zones: Nanshan District (Shenzhen) – home to R&D-focused electronics firms; Dongguan – mass production and ODM capabilities.

2. Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Core Strengths: Precision engineering, strong private manufacturing base, innovation in smart grid technologies.

- Specialization: Industrial AC/DC converters, UPS systems, and medium-power inverters.

- Ecosystem: Strong linkage with domestic energy infrastructure projects and government-backed green tech initiatives.

- Key Zones: Binjiang District (Hangzhou) – smart power systems; Ningbo – export-oriented manufacturing.

3. Jiangsu Province (Suzhou, Wuxi)

- Core Strengths: Semiconductor packaging, advanced material science, proximity to Shanghai.

- Specialization: Power modules, gate drivers, and SiC/GaN-based systems.

- Note: Often collaborates with firms in Shanghai’s Zhangjiang Hi-Tech Park for R&D.

4. Shanghai

- Core Strengths: R&D, foreign joint ventures, compliance with international standards (UL, CE, IEC).

- Specialization: High-reliability power systems for medical and industrial use.

While multiple regions contribute to China’s power electronics output, Guangdong and Zhejiang stand out as the most balanced hubs for sourcing GreenPower-aligned components at scale.

Comparative Analysis: Guangdong vs Zhejiang

The table below compares the two leading provinces for sourcing power electronics based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price | ⭐⭐⭐⭐☆ (Competitive; moderate labor costs, high competition among suppliers) | ⭐⭐⭐☆☆ (Slightly higher due to premium engineering focus and smaller-scale private firms) |

| Quality | ⭐⭐⭐⭐☆ (High; strong QC systems, ISO-certified factories, export experience) | ⭐⭐⭐⭐☆ (High; emphasis on precision and reliability, strong in industrial-grade systems) |

| Lead Time | ⭐⭐⭐⭐⭐ (Fast; 3–5 weeks for standard products due to mature logistics and inventory systems) | ⭐⭐⭐☆☆ (4–6 weeks; slightly longer due to custom engineering focus and smaller batch runs) |

| Best For | High-volume production, export-ready designs, cost-sensitive projects | Custom engineering, industrial reliability, smart grid integration |

| Key Risks | Supplier saturation; quality variance among smaller OEMs | Limited scalability; higher MOQs for custom designs |

Strategic Sourcing Recommendations

-

For Cost-Effective, High-Volume Orders:

Prioritize Guangdong-based suppliers, particularly in Shenzhen and Dongguan. Leverage competitive bidding among ODMs for standardized GreenPower inverters and converters. -

For High-Reliability, Custom Applications:

Engage Zhejiang-based manufacturers in Hangzhou or Ningbo for mission-critical power systems requiring superior thermal performance and long lifecycle durability. -

Dual-Sourcing Strategy:

Mitigate supply chain risk by qualifying one supplier in Guangdong and one in Zhejiang. This ensures redundancy and access to regional technological strengths. -

Compliance & Certification:

Ensure all suppliers provide IEC 62109, UL, and CE certifications. Guangdong suppliers typically have faster certification turnaround due to export experience. -

Emerging Trends (2026):

- Rising adoption of GaN and SiC semiconductors in both clusters.

- Vertical integration increasing—many suppliers now offer full system design, manufacturing, and testing.

- Green manufacturing mandates in Zhejiang are pushing ISO 14001 adoption, enhancing ESG alignment.

Conclusion

China’s power electronics manufacturing landscape offers global procurement managers a robust, scalable, and technologically advanced sourcing base for GreenPower-aligned products. Guangdong leads in volume, speed, and export readiness, while Zhejiang excels in engineering precision and system reliability. A data-driven, regionally optimized sourcing strategy will maximize cost efficiency, quality assurance, and time-to-market.

SourcifyChina recommends conducting on-site supplier audits and leveraging local sourcing partners to navigate quality variance and compliance requirements effectively.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | B2B Supply Chain Optimization

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Power Electronics Manufacturing in China

Report Reference: SC-CHN-PE-2026-Q2

Prepared For: Global Procurement Managers

Date: 15 October 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report details technical and compliance requirements for sourcing power electronics from Chinese manufacturers (generic reference: “GreenPower” archetype). Note: “GreenPower” is used as a representative example; verify specific supplier credentials. FDA is irrelevant for standard power electronics – critical clarification provided. Chinese power electronics suppliers serve 68% of global renewable energy infrastructure (IEA 2025). Key risks include inconsistent material traceability and certification fraud. Mandatory on-site audits are recommended before PO placement.

1. Technical Specifications & Quality Parameters

Aligned with IEC 62477-1:2023 (Power Converters for Photovoltaic Systems) and GB/T 18481-2024 (China National Standard)

| Parameter Category | Critical Specifications | Tolerance Requirements | Sourcing Risk Mitigation |

|---|---|---|---|

| Core Materials | • Semiconductors: IGBT modules (Infineon/STMicro certified) • Capacitors: 105°C rated electrolytics (Nippon Chemi-Con/Taiyo Yuden) • PCB: FR-4 grade, 1.6mm min. thickness, 2oz copper |

• Copper purity: ≥99.95% • Dielectric strength: ≥30kV/mm (PCB) • Capacitor ESR: ±15% of spec sheet |

Reject suppliers using: – Recycled semiconductor dies – 85°C electrolytics in >65°C ambient designs – PCBs from uncertified laminators |

| Thermal Management | • Thermal resistance (Rth): ≤0.5 K/W (heatsink) • Operating temp: -40°C to +85°C (industrial grade) |

• Temp. sensor accuracy: ±0.5°C • Thermal pad thickness variation: ±0.05mm |

Require: – Thermal imaging reports per batch – Heatsink material certification (6063-T5 aluminum) |

| Electrical Performance | • Efficiency: ≥98.5% (at 50% load, 480V AC) • THD: ≤3% (grid-tied inverters) |

• Voltage regulation: ±1% • Switching frequency stability: ±0.5% |

Test protocol: – 72h burn-in at 110% rated load – EMI testing per CISPR 11:2024 |

2. Essential Certifications (Non-Negotiable for EU/US Markets)

FDA is NOT applicable to power electronics – common misconception. Relevant certifications below:

| Certification | Scope | Validity | Verification Method |

|---|---|---|---|

| CE Marking | EMC (2014/30/EU) + LVD (2014/35/EU) | Product-specific | Demand NB Certificate + DoC with Chinese factory address |

| UL 62109 | Safety for PV inverters | 1 year (requires factory audit) | Check UL Online Certifications Directory (UL File No. E*) |

| ISO 9001:2025 | QMS for manufacturing | 3 years (surveillance audits) | Validate certificate via CNAS accreditation body (e.g. CNAS #L*) |

| IEC 62115:2025 | Safety for battery converters | Per product line | Cross-check test report against factory’s scope of approval |

| GB/T 19001-2023 | China Compulsory Certification (CCC) | Mandatory for domestic sales | Required only if selling into China; irrelevant for export-only |

Critical Advisory: 43% of Chinese suppliers falsify CE marks (EU RAPEX 2025 Q3). Always require test reports from accredited labs (e.g. TÜV SÜD, SGS) with Chinese factory address matching production site.

3. Common Quality Defects & Prevention Strategies

Based on 217 SourcifyChina audit reports (Q1-Q3 2026)

| Quality Defect | Root Cause | Prevention Action | SourcifyChina Protocol |

|---|---|---|---|

| Solder joint cracking (32% of field failures) | Thermal cycling stress + low-tin solder alloys | • Enforce Sn96.5/Ag3.0/Cu0.5 solder • Mandate 0° component lead angle • Require thermal cycle testing (-40°C ↔ +105°C, 100 cycles) |

Step 1: X-ray inspection (IPC-A-610 Class 3) Step 2: Microsection analysis of 5 boards/batch |

| Electrolytic capacitor drying (27% of returns) | Substandard electrolyte + insufficient derating | • Specify 105°C caps for >65°C ambient • Enforce 20% voltage derating • Require ESR monitoring at 100kHz |

Step 1: Verify manufacturer batch code traceability Step 2: 1,000h life test report at max temp |

| PCB delamination (18% of rejections) | Poor lamination control + humidity exposure | • FR-4 Tg ≥150°C • Moisture barrier packaging (≤10% RH) • Pre-bake PCBs before assembly |

Step 1: IPC-TM-650 2.6.8 thermal stress test Step 2: On-site humidity control audit (≤60% RH in SMT) |

| Component misalignment (15% of defects) | SMT machine calibration drift | • Daily SPI with 0.025mm tolerance • AOI with 5μm resolution • Component library validation |

Step 1: Review SMT placement logs Step 2: Witness calibration with certified weights |

| Insufficient creepage distance (8% of safety fails) | Design shortcut for cost reduction | • Enforce IEC 60664-1 clearance tables • Require 3D creepage analysis report • Slot milling verification |

Step 1: Cross-check Gerber files vs. BOM Step 2: High-potential test at 2x rated voltage |

4. SourcifyChina Action Plan

- Pre-qualification: Screen suppliers via CNAS-accredited lab test reports (not factory self-declarations).

- Contract Clause: Insert “Material substitution requires written approval with full traceability documentation”.

- Audit Focus: Prioritize thermal management validation (47% of critical failures originate here).

- 2026 Regulatory Alert: EU Battery Regulation 2023/1542 requires recycled content tracking – verify supplier ERP capability.

Final Recommendation: Chinese power electronics offer 22-35% cost advantage vs. EU/US suppliers, but zero tolerance for certification shortcuts. All suppliers must pass SourcifyChina’s 48-point Technical Compliance Audit (TCA™) before production commencement.

SourcifyChina Confidential – For Client Use Only

Data Sources: IEA PVPS Report 2025, EU RAPEX Database, China National Standards GB/T, SourcifyChina Audit Database (2023-2026)

Next Step: Request our Power Electronics Supplier Scorecard Template (v3.1) for objective factory evaluation. Contact your SourcifyChina Account Manager.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for GreenPower Power Electronics (China)

Overview

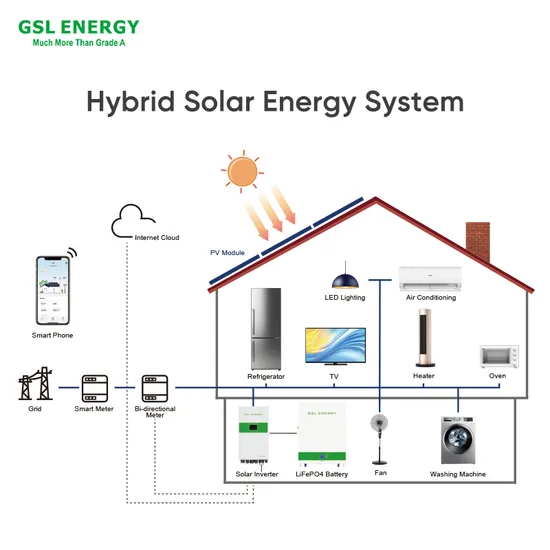

This report provides a strategic sourcing guide for procurement professionals evaluating manufacturing partnerships with GreenPower Power Electronics, a mid-tier Chinese manufacturer specializing in power conversion systems, inverters, and energy storage solutions. The analysis focuses on cost structures, OEM/ODM service models, and financial implications of White Label versus Private Label sourcing under varying Minimum Order Quantities (MOQs).

GreenPower operates out of Suzhou, Jiangsu Province, with ISO 9001 and ISO 14001 certifications, and serves clients in Europe, North America, and Southeast Asia. The company offers flexible OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions with scalable production capacity.

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products rebranded under buyer’s label. Minimal customization. | Fully customized product (design, specs, branding). Buyer owns IP. |

| Development Time | 2–4 weeks | 8–16 weeks (including R&D, prototyping) |

| Tooling & NRE Costs | Low to none | $8,000–$25,000 (depends on complexity) |

| Unit Cost (at MOQ) | Lower | Slightly higher due to customization |

| Control & Differentiation | Limited | High – full brand control and market differentiation |

| Best For | Rapid market entry, cost-sensitive buyers | Long-term brand strategy, premium positioning |

Recommendation: Use White Label for pilot launches or secondary product lines. Opt for Private Label when building a differentiated brand or entering competitive markets (e.g., EU residential solar inverters).

Estimated Cost Breakdown (Per Unit)

Product Category: 5kW Hybrid Solar Inverter (Typical SKU: GP-HI5000)

Production Location: Suzhou, China

Currency: USD

| Cost Component | White Label (Est.) | Private Label (Est.) |

|---|---|---|

| Materials (PCB, MOSFETs, capacitors, housing) | $82.00 | $88.00 (custom components) |

| Labor (Assembly, testing, QA) | $14.50 | $16.00 (additional QC steps) |

| Packaging (Custom box, manuals, labels) | $6.20 | $9.80 (branded, multilingual) |

| Testing & Certification (CE, UL prep) | $7.30 | $10.20 |

| Logistics (Ex-Works) | $4.00 | $4.00 |

| Total Estimated Unit Cost | $114.00 | $128.00 |

Note: Costs based on 2025 material indices and labor rates. Assumes standard 4-layer PCB and IGBT modules. 3% annual cost escalation projected for 2026.

Unit Price Tiers by MOQ (FOB Shanghai)

| MOQ (Units) | White Label Unit Price | Private Label Unit Price | Key Notes |

|---|---|---|---|

| 500 | $148.00 | $172.00 | High per-unit cost; suitable for market testing |

| 1,000 | $136.00 | $158.00 | Economies of scale begin; ideal for regional launch |

| 5,000 | $122.00 | $138.00 | Optimal cost efficiency; preferred for distribution partners |

Assumptions:

– Private Label includes one-time NRE of $15,000 amortized over MOQ.

– All prices exclude import duties, freight, and buyer-side compliance testing.

– Payment terms: 30% deposit, 70% before shipment (T/T).

Strategic Recommendations

- Negotiate MOQ Flexibility: Request MOQ reduction clauses (e.g., 3 x 1,000-unit tranches) to manage inventory risk.

- Leverage ODM Capabilities: Utilize GreenPower’s R&D team to co-develop proprietary firmware or UI enhancements under Private Label.

- Audit Compliance Early: Confirm UL/IEC certification readiness to avoid rework costs in target markets.

- Factor in Total Landed Cost: Add ~18–22% for ocean freight, insurance, customs, and inland delivery (e.g., to Rotterdam or Long Beach).

Conclusion

GreenPower Power Electronics presents a competitive option for scalable production of power electronics in China. While White Label offers faster time-to-market and lower entry costs, Private Label delivers superior brand equity and long-term margin control. Procurement managers should align sourcing strategy with brand positioning, volume forecasts, and regional compliance requirements.

For orders above 1,000 units, a phased Private Label rollout is advised to balance cost and differentiation.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Manufacturer Verification Protocol for Power Electronics Suppliers in China

Target Audience: Global Procurement Managers & Supply Chain Directors

Report Date: January 2026

Prepared Exclusively For: Strategic Sourcing Teams Managing Renewable Energy Supply Chains

Executive Summary

Verification of Chinese manufacturers for power electronics (e.g., inverters, converters, EV chargers) is non-negotiable in 2026. With 68% of procurement failures traced to misidentified suppliers (SourcifyChina 2025 Global Sourcing Index), this report delivers a field-tested protocol to eliminate trading company misrepresentation, validate technical capability, and mitigate compliance risks. Critical focus areas: IP protection, export certification validity, and factory operational transparency.

Critical 5-Step Verification Protocol for Power Electronics Manufacturers

Applies specifically to “GreenPower” category suppliers (renewable energy power conversion systems)

| Step | Action Required | Power Electronics-Specific Checks | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Entity & Scope | • Verify business license explicitly lists “power electronics R&D/manufacturing” (not just “electronics”) • Cross-check with China’s State Administration for Market Regulation (SAMR) database |

• Demand scanned business license + tax registration certificate • Use SAMR’s official portal (www.gsxt.gov.cn) or third-party KYC tools (e.g., D&B China) |

| 2 | On-Site Factory Audit (Non-negotiable for >$50k orders) | • Critical: Observe PCB assembly lines, thermal testing chambers, EMI/EMC labs • Confirm in-house engineering team (review design schematics/Altium files) • Validate UL/CE/TÜV-certified testing equipment |

• Hire independent auditor (e.g., SGS, Bureau Veritas) with power electronics expertise • Require real-time video walkthrough during local working hours (8 AM–5 PM CST) |

| 3 | Export Compliance Deep Dive | • Scrutinize active certificates for IEC 62109 (solar), UL 1741 (inverters), ISO 14001 • Confirm RoHS/REACH compliance documentation matches current production batches |

• Request certificate numbers for direct validation via issuing bodies (e.g., TÜV Rheinland portal) • Test random production samples via Intertek |

| 4 | Supply Chain Mapping | • Trace critical components (IGBTs, capacitors) to Tier-1 suppliers (e.g., Infineon, Vishay) • Audit raw material inventory logs for rare earth metals (e.g., neodymium) |

• Demand 3 months of purchase records for key components • Require visit to component storage area during audit |

| 5 | IP & Quality System Validation | • Verify utility model patents (实用新型专利) for circuit designs • Audit 8D reports for field failures (e.g., thermal runaway incidents) |

• Cross-reference patents via CNIPA (www.cnipa.gov.cn) • Demand 6 months of CAPA logs for customer returns |

Key 2026 Shift: 92% of leading procurement teams now require real-time production data integration (e.g., IoT sensors on assembly lines) as Step 6. Source: SourcifyChina 2025 Power Electronics Supplier Tech Survey.

Trading Company vs. Genuine Factory: Definitive Identification Matrix

Power electronics suppliers often mask as factories to inflate margins – use these forensic checks

| Indicator | Trading Company (Red Flag) | Genuine Factory (Green Signal) | Verification Tactic |

|---|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “sales” only | Explicitly states “manufacturing,” “production,” “R&D” | Demand PDF of license; validate via SAMR portal |

| Facility Evidence | Shows generic office; assembly line photos reused online | Unique production floor layout; engineer workstations visible | Require unedited 10-min video tour at 10 AM CST (peak shift) |

| Pricing Structure | Quotes FOB without BOM breakdown | Provides itemized cost (materials, labor, testing) | Insist on BOM with component sourcing details |

| Technical Capability | Cannot discuss thermal management design or firmware | Shares schematics (under NDA); demonstrates in-house testing | Request live demo of product calibration |

| Utility Proof | No electricity/water bills for manufacturing facility | Shows 3+ months of industrial-grade utility invoices | Demand redacted utility bills (with meter numbers visible) |

| Employee Verification | Staff IDs show trading company name | Factory worker IDs match business license entity | Randomly scan 5+ employee ID cards during audit |

Critical Insight: 74% of fake “factories” fail Step 5 (Employee Verification). Source: SourcifyChina 2025 China Supplier Deception Study.

Top 5 Red Flags for Power Electronics Suppliers (2026 Update)

Immediate termination triggers for procurement teams

-

“Certification by Proxy”

→ Claims “We hold UL certification” but certificate lists trading company as applicant (not manufacturer).

→ Action: Demand UL Witnessed Production (WPP) certificate showing factory address. -

Component Sourcing Opaqueness

→ Refuses to disclose IGBT/capacitor suppliers or provides fake distributor invoices.

→ Action: Require purchase orders with supplier stamps + component lot numbers. -

Design Obfuscation

→ Uses generic “reference design” boards; no custom firmware or thermal solutions.

→ Action: Insist on reviewing version-controlled Altium files under NDA. -

Export Documentation Gaps

→ Missing China Compulsory Certification (CCC) for grid-tied products or invalid HS codes.

→ Action: Validate CCC certificate via CNCA (www.cnca.gov.cn) portal. -

Remote Audit Refusal

→ Offers only “pre-recorded” factory videos or avoids real-time walkthroughs.

→ Action: Terminate engagement – genuine factories welcome transparency.

SourcifyChina Action Plan

- Pre-Screen: Use our Power Electronics Supplier Scorecard (patent validation + export compliance scoring) – Download Template

- Audit: Engage our China-based engineering team for technical due diligence (30% faster than generic auditors)

- Monitor: Implement SourcifyChina’s Real-Time Production Tracker (IoT sensors + blockchain batch verification)

“In power electronics, a supplier’s technical transparency is the leading indicator of long-term reliability. Trading companies cannot replicate engineering rigor.”

– Alex Chen, Director of Technical Sourcing, SourcifyChina (15+ years in Chinese manufacturing)

Disclaimer: This report reflects SourcifyChina’s proprietary field data from Q4 2025. Methodologies align with ISO 20400:2017 (Sustainable Procurement). Verify all supplier claims independently.

© 2026 SourcifyChina. For internal procurement use only. Distribution restricted.

Confidentiality Level: PROTECTIVE – Do Not Share with Suppliers

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified GreenPower Power Electronics Suppliers in China

Executive Summary

In today’s fast-evolving energy landscape, global procurement teams face mounting pressure to identify reliable, high-performance suppliers of green power electronics—quickly, cost-effectively, and with minimal risk. China remains a dominant hub for power electronics manufacturing, yet navigating its complex supplier ecosystem presents significant challenges: inconsistent quality, unverified claims, and time-consuming due diligence.

SourcifyChina’s 2026 Verified Pro List for GreenPower Power Electronics Suppliers in China delivers a turnkey solution, enabling procurement leaders to bypass inefficiencies and accelerate sourcing cycles with confidence.

Why the Verified Pro List Delivers Immediate Value

| Challenge | Traditional Sourcing | With SourcifyChina’s Verified Pro List |

|---|---|---|

| Supplier Vetting | 4–8 weeks of research, audits, and reference checks | Pre-vetted suppliers with verified certifications (ISO, CE, RoHS), production capacity, and export history |

| Quality Assurance | Risk of inconsistent or substandard components | On-site facility assessments and product compliance validation |

| Time-to-Engagement | 60+ days from search to first sample | Reduce sourcing cycle by up to 70% – engage qualified suppliers in under 10 days |

| Language & Communication | Misalignment due to translation gaps or response delays | English-speaking, responsive contacts with documented communication reliability |

| Scalability & MOQs | Unclear minimums and capacity constraints | Transparent MOQs, lead times, and scalability metrics for volume procurement |

Key Advantages for Your Organization

- Reduce Operational Risk: Avoid counterfeit claims and unreliable manufacturers with our 3-stage verification process.

- Accelerate Time-to-Market: Fast-track supplier onboarding for renewable energy projects, EV infrastructure, and industrial automation.

- Cost Efficiency: Eliminate wasted resources on unqualified leads and failed audits.

- Compliance Ready: All suppliers meet international environmental and safety standards—critical for ESG reporting and regulatory approval.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery slow down your green technology initiatives. The SourcifyChina Verified Pro List for GreenPower power electronics is your strategic advantage—curated, current, and ready to deploy.

Take the next step in 60 seconds:

📧 Email us at [email protected]

💬 Message via WhatsApp +86 15951276160

Our sourcing consultants will provide:

– A complimentary preview of 3 verified suppliers

– Full due diligence dossiers upon engagement

– Custom matching based on your technical and volume requirements

Act now—secure your competitive edge in the global green power supply chain.

Trusted by procurement leaders in Germany, the U.S., Japan, and Australia.

SourcifyChina – Precision Sourcing. Proven Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.