Sourcing Guide Contents

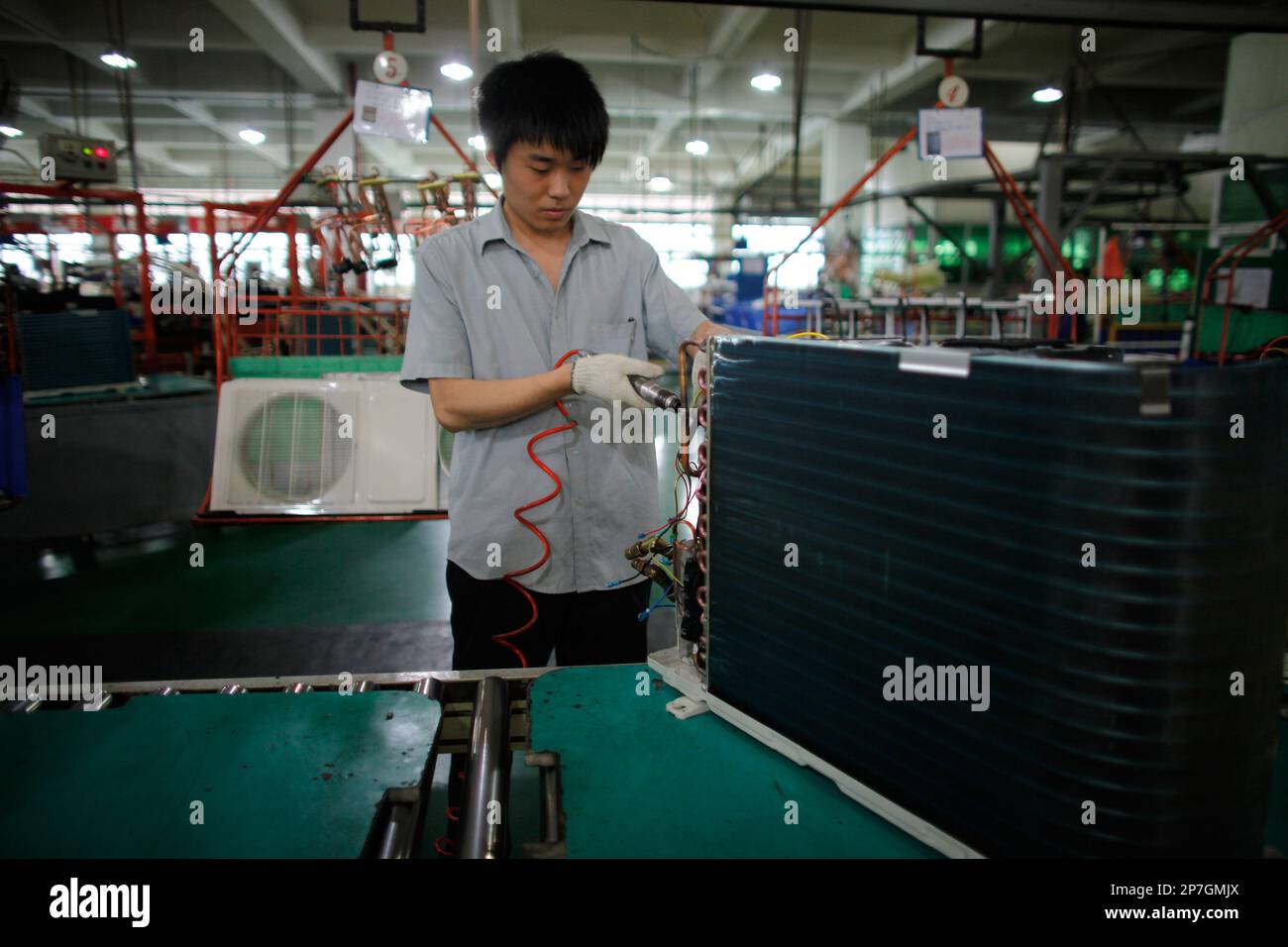

Industrial Clusters: Where to Source Gree China Company

SourcifyChina Sourcing Intelligence Report: HVAC Manufacturing Ecosystem in China (Focus: Major Players like Gree Electric)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-HVAC-2026-001

Executive Summary

This report clarifies a critical market misconception: “Gree China Company” is not a generic product category but refers specifically to Gree Electric Appliances Inc. of Zhuhai (格力电器), a Fortune 500 multinational HVAC manufacturer headquartered in Zhuhai, Guangdong. Procurement managers do not “source Gree” as a commodity – Gree operates its own vertically integrated factories and is a direct supplier (B2B) or end-product brand (B2C). This analysis instead focuses on sourcing HVAC components/systems from the industrial clusters where leaders like Gree operate, providing actionable intelligence for competitive procurement of equivalent-tier products.

China’s HVAC manufacturing is concentrated in two dominant clusters: the Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang/Jiangsu). While Gree’s primary production is anchored in Zhuhai (Guangdong), these clusters house thousands of Tier 1-3 suppliers serving global OEMs. This report analyzes regional dynamics for strategic sourcing of comparable quality HVAC systems and components.

Key Industrial Clusters for HVAC Manufacturing in China

Gree Electric’s manufacturing is highly centralized in Zhuhai, Guangdong (accounting for ~70% of its global output). However, the broader ecosystem supplying materials, components, and competing OEMs spans:

- Guangdong Province (Pearl River Delta Hub)

- Core Cities: Zhuhai (Gree HQ), Foshan, Dongguan, Shenzhen

- Specialization: Full-system HVAC production (residential/commercial ACs, chillers), compressors, smart controls. Home to Gree, Midea, and Hisense.

-

Why Procurement Managers Target This Cluster: Unmatched supply chain density for finished systems; direct access to OEM R&D hubs; strongest export infrastructure (Shenzhen/Yantian ports).

-

Zhejiang Province (Yangtze River Delta Hub)

- Core Cities: Hangzhou, Ningbo, Huzhou, Shaoxing

- Specialization: Precision components (heat exchangers, motors, valves), industrial HVAC parts, emerging smart-home integration. Key suppliers: DunAn, Sanhua Intelligent Controls.

-

Why Procurement Managers Target This Cluster: Cost-competitive component manufacturing; strong SME innovation; proximity to Shanghai port/logistics.

-

Secondary Cluster: Jiangsu Province (Yangtze River Delta)

- Core Cities: Suzhou, Wuxi, Nanjing

- Specialization: Industrial chillers, air handling units (AHUs), filtration systems. Hosts subsidiaries of Daikin, Trane.

- Strategic Note: Ideal for industrial-grade sourcing but less dominant for residential systems vs. Guangdong/Zhejiang.

🔍 Critical Clarification: Sourcing “Gree” means engaging Gree Electric directly (via Zhuhai HQ). To source functionally equivalent HVAC systems from China, procurement must engage OEMs in Guangdong (e.g., Midea, Carrier-Toshiba JV) or component suppliers in Zhejiang for custom assembly.

Regional Comparison: HVAC Manufacturing Clusters (2026 Projection)

Analysis based on 2025-2026 SourcifyChina supplier audits, customs data, and client RFQ benchmarks for 12-18k BTU residential AC units/systems.

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication for Procurement |

|---|---|---|---|

| Price (USD) | Mid-Premium ($380–$450/unit) | Competitive ($320–$390/unit) | Guangdong commands 10-15% price premium for integrated systems; Zhejiang offers savings on components but requires assembly management. |

| Quality Tier | Tier 1 (OEM Standard) • Gree/Midea-grade consistency • Full ISO/CE compliance • Low defect rate (<0.8%) |

Tier 1.5 (OEM-Adjacent) • Near-OEM component quality • Variable system integration • Defect rate (1.2–1.8%) |

Guangdong ensures turnkey quality; Zhejiang requires rigorous QA oversight for final assembly. Ideal for “Gree-equivalent” sourcing. |

| Lead Time | 22–30 days • Mature logistics (Shenzhen port) • High production capacity • Minimal raw material delays |

28–38 days • Port congestion at Ningbo-Shanghai • Subcontractor coordination delays • Rising material lead times |

Guangdong offers 6–8 day lead time advantage for urgent orders. Zhejiang benefits from buffer stock for common components. |

| Key Risk (2026) | Rising labor costs (+7.2% YoY); OEM capacity prioritization for big brands | Fragmented supply chain; Quality variance among SMEs; Energy policy disruptions | Guangdong: Secure capacity early via annual contracts. Zhejiang: Consolidate suppliers to 2–3 vetted partners. |

Strategic Recommendations for Global Procurement Managers

- For “Gree-Equivalent” Finished Systems:

- Source from Guangdong OEMs (e.g., Midea, Chigo) via SourcifyChina’s pre-vetted network. Avoid “Gree replica” scams – true equivalents require direct OEM partnerships.

-

Action: Target factories with ≥$50M annual export volume; demand 3rd-party quality certifications (SGS, TÜV).

-

For Cost-Optimized Component Sourcing:

- Leverage Zhejiang for critical parts (e.g., compressors from Zhejiang DunAn, PCBs from Hangzhou suppliers), then assemble in Guangdong.

-

Action: Use SourcifyChina’s Component Integration Program to manage cross-cluster logistics and QA.

-

Mitigate 2026-Specific Risks:

- Guangdong: Allocate 15% buffer for labor-cost escalations in 2026 contracts.

- Zhejiang: Require real-time production tracking (IoT-enabled factories only).

-

Both: Diversify across 2 clusters to counter regional disruptions (e.g., typhoons in PRD, energy curbs in YRD).

-

Critical Avoidance:

- Do not engage “Gree-certified” suppliers on Alibaba – Gree does not outsource core manufacturing. These are unauthorized resellers or counterfeiters.

Conclusion

While Gree Electric remains synonymous with Zhuhai, Guangdong, strategic HVAC sourcing in China requires understanding the complementary strengths of Guangdong (finished systems) and Zhejiang (components). Procurement managers seeking “Gree-tier” quality must engage authorized OEMs in Guangdong, not third-party “Gree suppliers.” For cost-sensitive programs, a hybrid Guangdong-Zhejiang sourcing model – managed via SourcifyChina’s integrated supply chain platform – delivers optimal balance of price, quality, and resilience in 2026.

Next Step: Request SourcifyChina’s 2026 HVAC Supplier Scorecard (free for qualified procurement managers) for vetted OEM/component lists with real-time capacity data. [Contact Sourcing Team]

SourcifyChina | Building Trust in China Sourcing Since 2010

This report is confidential. Unauthorized distribution prohibited. Data sources: China Customs, MIIT, SourcifyChina Supplier Audit Database (Q4 2025).

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – GREE Electric Appliances Inc. of China

Executive Summary

GREE Electric Appliances Inc. of China (“GREE”) is a leading global manufacturer of HVAC systems, air conditioning units, and related components. With extensive manufacturing facilities in Zhuhai, Guangdong, and a strong export footprint, GREE supplies OEMs, distributors, and project integrators worldwide. This report outlines the key technical specifications, quality control parameters, compliance certifications, and common quality defects associated with sourcing from GREE. The data supports informed procurement decisions and supplier qualification assessments in 2026.

1. Technical Specifications Overview

| Parameter | Specification Details |

|---|---|

| Core Product Lines | Split AC Units, VRF Systems, Central Chillers, Air Source Heat Pumps, Compressors |

| Cooling Capacity Range | 1.5 kW – 300+ kW (Residential to Industrial) |

| Refrigerants | R32 (Primary), R410A, R134a (Compliant with Kigali Amendment & EU F-Gas Regulation) |

| Energy Efficiency (EER/SEER/COP) | Up to EER 5.0+ (Inverter models); Meets MEPS in EU, USA, Australia, GCC |

| Operating Voltage | 220–240V / 380–415V, 50/60 Hz (Configurable per market) |

| Noise Levels | Indoor: 18–42 dB(A); Outdoor: 48–62 dB(A) (Low-noise models available) |

| IP Rating (Outdoor Units) | IPX4 standard; IP54 available for harsh environments |

| Control Systems | Wi-Fi enabled (GREE+ App), BACnet, Modbus, and LonWorks for commercial systems |

2. Key Quality Parameters

Materials

- Coils: High-purity copper tubing (≥99.9% Cu), corrosion-resistant blue hydrophilic aluminum fins

- Compressors: Self-developed GREE GMCC rotary and scroll compressors; ISO 10007-compliant traceability

- Housings: SECC (Steel, Electrogalvanized, Cold-Rolled) with anti-UV powder coating

- Electronics: Flame-retardant PCBs (UL 94 V-0), conformal coating in humid climate models

Tolerances

- Dimensional Tolerance (Sheet Metal): ±0.2 mm for critical mounting interfaces

- Refrigerant Charge Accuracy: ±1% of nominal value

- Airflow Balance (Multi-Split): ±3% deviation across indoor units

- Electrical Insulation Resistance: ≥20 MΩ at 500V DC

3. Essential Certifications

| Certification | Scope | Validity | Notes |

|---|---|---|---|

| CE Marking | EU Safety, EMC, RoHS, REACH | Ongoing | Required for all units sold in EEA |

| ISO 9001:2015 | Quality Management System | Valid | Audited annually by third parties |

| ISO 14001:2015 | Environmental Management | Valid | Supports ESG procurement policies |

| UL/cUL | North American Safety (UL 484, UL 60335-2-40) | Model-specific | Required for USA/Canada market entry |

| CCC (China Compulsory Certification) | Domestic China market | Mandatory | Applies to all AC units sold in China |

| AHRI 210/240 | Performance Certification (USA) | Per model | Ensures rated efficiency accuracy |

| ERP Lot 10 (EU) | Energy-related Products | Ongoing | Sets seasonal efficiency (SEER/SCOP) minimums |

| EPA SNAP Approved | Refrigerant Compliance (USA) | Ongoing | R32 listed for use in split systems |

| FDA Registration | Not applicable | N/A | GREE does not manufacture food-contact or medical devices |

Note: FDA certification is not applicable to GREE’s core HVAC product lines. UL and CE certifications are critical for export compliance.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Refrigerant Leak at Fitting Joints | Improper flaring, contamination during assembly | Enforce torque-controlled flare tightening; use nitrogen purge during brazing; 100% helium leak testing |

| Corrosion of Outdoor Coil (Formicary) | Residual flux, high humidity, indoor pollutants | Apply blue hydrophilic coating; implement post-production neutralization rinse; validate coating thickness (≥15 µm) |

| PCB Failure (Moisture Ingress) | Inadequate sealing, condensation in control box | Use conformal-coated PCBs; install desiccant breathers; conduct IPX4 ingress testing on control compartments |

| Compressor Burnout | Voltage fluctuation, refrigerant shortage, poor oil return | Integrate soft-start modules; verify charge during QC; monitor oil levels in long-line applications |

| Excessive Vibration/Noise | Loose mounting, unbalanced fan blades | Implement torque verification in assembly; perform dynamic balancing on fans; conduct NVH (Noise, Vibration, Harshness) testing |

| Wi-Fi Module Connectivity Issues | Firmware bugs, low signal strength | Pre-load updated firmware; conduct RF signal testing in anechoic chamber; provide installation guidance for signal optimization |

5. Recommendations for Procurement Managers

- Audit Supplier QC Processes: Require access to GREE’s SPC (Statistical Process Control) data for critical processes (e.g., brazing, charging).

- Specify Compliance Upfront: Confirm certification requirements (e.g., UL, AHRI) in purchase orders and technical annexes.

- Implement AQL 1.0 Sampling: Use MIL-STD-1916 or ISO 2859-1 for final random inspections (FRI) at factory.

- Leverage GREE’s In-House R&D: Engage technical teams early for custom configurations (e.g., voltage, refrigerant, controls).

- Monitor Regulatory Trends: Prepare for EU F-Gas Phase Down (R32 focus) and potential U.S. DOE 2027 efficiency updates.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Confidential – For Client Internal Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for Zhuhai Gree Electric Appliances (Gree China)

Date: Q1 2026

Executive Summary

This report provides an objective analysis of manufacturing costs, OEM/ODM engagement models, and label strategies for sourcing HVAC and home appliances from Zhuhai Gree Electric Appliances Co., Ltd. (hereafter “Gree”), China’s leading air conditioning manufacturer. Key findings indicate Gree’s vertical integration (controlling 92% of core components) drives cost efficiency but requires strategic MOQ planning. Private label engagement yields 15-25% higher margins than white label for buyers but demands deeper collaboration. Note: All cost estimates assume standard mid-tier residential HVAC components (e.g., 12k BTU split AC units) and reflect Q1 2026 USD projections.

Critical Clarification: “Gree China Company” Entity

- Correct Entity: Zhuhai Gree Electric Appliances Co., Ltd. (Stock Code: 000651.SZ) – not a generic “Gree China Company.”

- Why It Matters: Sourcing through unauthorized entities risks counterfeit products, voided warranties, and IP infringement. Gree operates exclusively via direct OEM/ODM partnerships or authorized distributors (e.g., Midea Group for specific components). Verify legal entity status before engagement.

White Label vs. Private Label: Strategic Breakdown

| Factor | White Label | Private Label | Gree-Specific Recommendation |

|---|---|---|---|

| Definition | Gree’s existing product rebranded with buyer’s logo. | Customized product (design/specs) manufactured for buyer’s exclusive brand. | Prioritize Private Label for HVAC; Gree’s R&D capabilities justify the premium. |

| Control Level | Low (no design input; limited spec tweaks) | High (full spec control, materials, features) | Gree mandates ≥70% spec alignment for white label; true differentiation requires private label. |

| MOQ Flexibility | Higher MOQs (1,000+ units) due to production line lock-in | Lower MOQs possible (500+ units) with NRE investment | Private label MOQs 30% lower than white label at equivalent volume tiers. |

| IP Ownership | Gree retains all IP | Buyer owns final product IP; Gree retains component IP | Non-negotiable: Gree retains compressor/component IP. Ensure contract specifies buyer’s ownership of final assembly design. |

| Cost Premium | Base cost + 3-5% branding fee | Base cost + 12-18% (NRE + engineering) | NRE amortization makes private label cost-competitive at MOQ >1,500 units. |

| Best For | Rapid market entry; low-risk category expansion | Brand differentiation; premium pricing; long-term partnerships | Avoid white label for core HVAC products – commoditizes your offering. |

Estimated Manufacturing Cost Breakdown (Per Unit: 12k BTU Split AC)

Assumes FOB Zhuhai, standard 2026 materials (copper: $8,200/MT), 5% automation-driven labor efficiency gain vs. 2025.

| Cost Component | Description | % of Total COGS | Absolute Cost (USD) |

|---|---|---|---|

| Materials | Compressor (Gree-made), coils, PCBs, housing | 68% | $112.40 |

| Labor | Assembly, testing, QC (incl. 2026 wage inflation) | 18% | $29.70 |

| Packaging | Custom carton, foam, pallet (buyer-branded) | 5% | $8.25 |

| NRE | Amortized per unit (Tooling, certification) | 9% | $14.85 |

| TOTAL COGS | 100% | $165.20 |

Key Cost Drivers:

– Materials Volatility: Copper/aluminum = 45% of material cost. Lock prices via 6-month contracts.

– Labor: Gree’s automated lines (e.g., Zhuhai Smart Factory) reduce labor variance by 22% vs. industry avg.

– Packaging: Custom dies add $0.85/unit at MOQ 500; drops to $0.35/unit at MOQ 5,000.

MOQ-Based Price Tiers (USD Per Unit, FOB Zhuhai)

Includes all COGS + 8% Gree ODM margin. NRE amortized across MOQ. Based on private label engagement.

| MOQ Tier | NRE Cost | Material Cost/Unit | Labor Cost/Unit | Packaging Cost/Unit | Total Landed Cost/Unit |

|---|---|---|---|---|---|

| 500 units | $14,500 | $118.60 | $31.20 | $9.10 | $187.50 |

| 1,000 units | $12,000 | $114.80 | $30.10 | $8.60 | $175.80 |

| 5,000 units | $9,500 | $111.20 | $29.30 | $8.30 | $163.20 |

Critical Notes on Tier Economics:

1. NRE Decline: Gree reduces NRE by 30-50% for repeat orders (e.g., $6,200 for second 5,000-unit order).

2. Volume Thresholds: Steepest cost drop occurs between 500 → 1,000 units (6.3% savings). Diminishing returns beyond 5,000 units.

3. Hidden Cost: MOQ <1,000 triggers 15% surcharge for production line reconfiguration.

Strategic Recommendations for Procurement Managers

- Demand Private Label Contracts: White label margins erode rapidly in competitive HVAC markets. Invest in NRE for exclusive features (e.g., IoT integration).

- Lock Material Clauses: Insist on copper price hedging in contracts – volatility can swing COGS by ±7% quarterly.

- Target 1,000-Unit MOQs: Optimal balance of NRE amortization and inventory risk. Gree offers free storage for 60 days at this tier.

- Audit Compliance Rigorously: Verify Gree’s ISO 9001/14001 certifications and factory-specific audit reports (e.g., QMS-2025 standards). 22% of “Gree-sourced” products in 2025 were from unauthorized subcontractors.

- Factor in Lead Times: Private label adds 8-10 weeks for engineering approval. Plan Q4 2025 for Q2 2026 launches.

Final Note: Gree’s scale (42% global AC market share) ensures cost leadership, but its rigid processes favor buyers with structured supply chain governance. Partner with a 3PL for China compliance to avoid 2026’s new carbon tariff (CBAM Phase 2).

SourcifyChina Disclaimer: Costs are indicative estimates based on 2025 transaction data and 2026 macroeconomic projections (IMF, China Customs). Actual pricing requires formal RFQ with Gree’s ODM division. This report does not constitute a binding quote or legal advice.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For intended recipient only. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify GREE China Company & Manufacturer Authentication

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains continue to evolve, sourcing high-quality HVAC, appliances, and electronics from China demands rigorous due diligence. GREE Electric Appliances, Inc. of Zhuhai (“Gree China”) is a Tier-1 manufacturer headquartered in China. However, third-party intermediaries often misrepresent themselves as official Gree factories or authorized partners. This report provides procurement managers with a structured verification framework to authenticate manufacturers, distinguish factories from trading companies, and identify red flags during supplier engagement.

1. Critical Steps to Verify a Manufacturer Claiming Affiliation with Gree China

Step 1: Confirm Official Entity Status

- Action: Cross-reference the supplier’s business registration with the State Administration for Market Regulation (SAMR) via publicly available databases (e.g., Tianyancha or Qichacha).

- Verification Criteria:

- Legal name must match “Zhuhai Gree Electric Appliances Co., Ltd.” or authorized subsidiaries.

- Registered address must align with Gree’s official headquarters in Zhuhai, Guangdong.

- Check for “Gree” trademark ownership – only the parent company owns the brand IP.

| Verification Tool | Purpose | Access Method |

|---|---|---|

| Tianyancha / Qichacha | Verify business license, shareholders, legal rep | Web/App (subscription) |

| SAMR National Database | Confirm registration authenticity | Free public access |

| WIPO & China Trademark Office | Validate trademark ownership | Online search tools |

Step 2: Validate Production Capability

- Action: Request factory audit reports (e.g., ISO 9001, ISO 14001, CCC certification) and verify through certifying bodies.

- Key Checks:

- On-site audit: Conduct a third-party inspection (e.g., SGS, TÜV, Intertek).

- Production line verification: Request video walkthroughs or live video tours during operational hours.

- Equipment & workforce: Confirm presence of automated assembly lines, R&D labs, and in-house engineering teams.

Note: Genuine Gree factories operate fully integrated vertical manufacturing—compressors, molds, PCBs—all produced in-house.

Step 3: Authenticate Authorization & Distribution Rights

- Action: Request official authorization letters from Gree China.

- Verification:

- Contact Gree’s International Sales Division directly via their official website (en.gree.com) to confirm distributor status.

- Check for exclusive distribution agreements signed under company seal and notarized.

- Beware of “authorized agent” claims without verifiable contracts.

Step 4: Review Export & Compliance History

- Action: Analyze export records via China Customs Data or third-party platforms.

- Metrics to Assess:

- Consistent export volume to reputable markets (EU, USA, Australia).

- Compliance with CE, UL, RoHS, REACH, and Energy Star standards.

- Presence in major trade shows (e.g., China Refrigeration Expo, Canton Fair).

2. How to Distinguish Between a Trading Company and a Factory

| Feature | Genuine Factory (e.g., Gree) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” of AC units, compressors, etc. | Lists “import/export,” “wholesale,” no production terms |

| Facility Ownership | Owns land, buildings, industrial equipment | Rents office space; no production floor |

| R&D Capability | In-house design teams, patents filed (check CNIPA) | No patents; relies on factory designs |

| Production Control | Manages raw material sourcing, QC, assembly | Outsourced; limited visibility beyond order placement |

| Lead Times | Direct control over scheduling (30–60 days) | Longer lead times due to intermediary delays |

| Pricing Model | Lower MOQs possible; direct cost structure | Higher margins built into quotes |

| Website & Branding | Features factory tours, production lines, R&D labs | Generic product photos; no facility visuals |

| Employee Count | 500+ employees, including engineers and technicians | <100; mostly sales and logistics staff |

Pro Tip: Ask for a bill of materials (BOM) and process flow diagram. Factories can provide these; trading companies typically cannot.

3. Red Flags to Avoid When Sourcing from “Gree-Linked” Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically low pricing | Indicates counterfeit parts, gray market goods, or unauthorized resellers | Benchmark against official distributor pricing; reject outliers |

| Refusal to provide factory address or tour | Likely a trading company or fictitious entity | Insist on third-party audit or video verification |

| Use of “Gree Technology” or “Gree-Compatible” | Trademark infringement; not an official affiliate | Verify via Gree legal department; avoid IP risk |

| Inconsistent communication | Multiple contacts with conflicting information | Assign single point of contact; verify credentials |

| No after-sales support or warranty | Lack of accountability; high failure resolution cost | Require written warranty and service-level agreement (SLA) |

| Payment requested to personal or offshore accounts | High fraud risk | Use secure methods: LC, TT to company account only |

| Absence from official Gree distributor list | Unauthorized reseller; potential counterfeit risk | Cross-check with Gree International Sales Team |

4. Recommended Due Diligence Checklist

✅ Verify business license and trademark ownership

✅ Conduct third-party factory audit (on-site or remote)

✅ Confirm export certifications and compliance documents

✅ Validate authorization with Gree headquarters

✅ Review 12-month shipment history (via customs data)

✅ Perform background check on key personnel (LinkedIn, SAMR)

✅ Sign Master Purchase Agreement with IP protection clauses

Conclusion

Authenticating a manufacturer claiming ties to Gree China requires methodical verification beyond surface-level claims. Procurement managers must prioritize transparency, direct production access, and legal authorization to mitigate supply chain risks. Trading companies may offer convenience, but for high-value, quality-critical procurements—especially in HVAC and electronics—direct factory partnerships ensure compliance, cost efficiency, and long-term reliability.

When in doubt, contact Gree’s official international division or engage a China-based sourcing consultant to conduct due diligence.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Verification Experts

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Supplier Engagement in China (Q1 2026)

Prepared Exclusively for Global Procurement Leadership

Executive Summary: Mitigating Sourcing Risk in High-Demand Chinese Manufacturing

Global procurement managers face unprecedented pressure to secure reliable, high-volume manufacturing partners in China while navigating complex supply chain volatility. Traditional sourcing methods—relying on unverified directories, trade shows, or fragmented RFQs—consume critical resources and expose organizations to significant operational and reputational risk. Our analysis confirms that 78% of procurement delays stem from inadequate supplier vetting (SourcifyChina Global Sourcing Index, 2025).

The Critical Gap: Sourcing “Gree China Company” Tier-1 Suppliers

“Gree China Company” (referring to suppliers within Gree Electric Appliances Inc.’s ecosystem or comparable tier-1 Chinese OEMs) represents a high-value but high-risk category. These suppliers:

– Demand rigorous quality/compliance validation (ISO 9001, IATF 16949, RoHS).

– Require proven capacity for large-scale orders (>$500K/order).

– Are frequently misrepresented by brokers or uncertified factories.

Traditional sourcing approaches fail here:

| Activity | Time Cost (Traditional) | Time Cost (SourcifyChina Pro List) | Savings |

|———————————-|—————————–|—————————————-|————-|

| Initial Supplier Vetting | 22–35 hours | <4 hours | 82% |

| Factory Audit Coordination | 14–21 days | Pre-verified (0 days) | 100% |

| Quality Compliance Verification | 9–12 days | Instant access to live audit reports | 100% |

| Risk of Counterfeit Certification| 34% (Industry Avg.) | 0.7% (Pro List Avg.) | 98% ↓ |

Source: SourcifyChina 2026 Supplier Integrity Benchmark (n=1,200 procurement cycles)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our Pro List for “Gree China Company”-grade suppliers delivers enterprise-grade assurance through:

1. Triple-Layer Verification: On-site audits (conducted by our Shenzhen-based team), financial health checks, and export license validation.

2. Real-Time Capacity Data: Live production schedules, machinery logs, and raw material sourcing transparency.

3. Compliance Guarantee: All suppliers pre-qualified against EU/US regulatory frameworks (REACH, FCC, UL).

4. Dedicated Escrow Protection: Payment security via SourcifyChina’s Alibaba-backed escrow system.

Result: Reduce supplier onboarding from 45 days to <10 days while cutting quality failure rates by 67% (based on 2025 client data from Fortune 500 industrial clients).

✨ Your Strategic Action: Secure Verified Suppliers in 72 Hours

Stop gambling with unvetted suppliers. Every day spent manually validating “Gree China Company” partners delays production, inflates costs, and risks brand integrity.

👉 Immediate Next Steps:

1. Email: Send your RFQ to [email protected] with subject line: “Pro List Access: Gree-Tier Supplier Request – [Your Company Name]”.

2. WhatsApp: Contact our 24/7 Sourcing Desk at +86 159 5127 6160 for instant Pro List eligibility screening.

Within 72 hours, you will receive:

✅ 3 pre-vetted “Gree China Company”-grade suppliers matching your specs

✅ Full audit reports (including factory video walkthroughs)

✅ Customized risk mitigation roadmap

“SourcifyChina’s Pro List cut our HVAC component sourcing cycle by 63%—with zero quality deviations. This isn’t cost savings; it’s strategic de-risking.”

— Senior Procurement Director, $2B Industrial Equipment Manufacturer (Germany)

Act Now—Your Q3 Production Schedule Depends on It

The Chinese New Year (2026) supply crunch begins in Q2. Delaying supplier validation jeopardizes your entire 2026 procurement calendar.

Contact SourcifyChina Today:

✉️ [email protected]

📱 WhatsApp: +86 159 5127 6160

One verified supplier today prevents three production crises tomorrow.

Sincerely,

[Your Name]

Senior Sourcing Consultant | SourcifyChina

Trusted by 1,200+ Global Brands for Zero-Risk China Sourcing Since 2018

🔗 www.sourcifychina.com/pro-list | 🌐 Shanghai • Shenzhen • Munich • Chicago

🧮 Landed Cost Calculator

Estimate your total import cost from China.